Chemist Warehouse the winner as billionaires shared in $1.5bn dividend bonanza during Covid

Some of the biggest names among the ranks of the Richest 250 made big profits in 2021, surfing the Covid boom that many industries enjoyed.

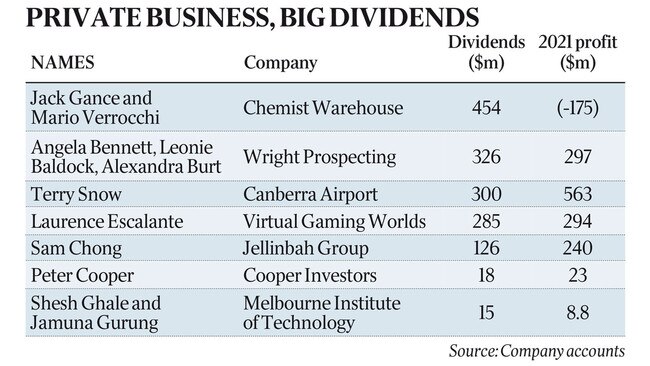

Some of the biggest names in Australian business paid themselves more than $1.5bn in dividends this year as their companies boomed during Covid.

Retailers such as Chemist Warehouse, which stayed open during the pandemic and increased e-commerce sales, have thrived along with fund managers who have surfed the stockmarket surge.

Commercial property magnates have also enjoyed big increases in the value of their real estate portfolios, though coal companies saw their profits plunge in line with commodity price falls earlier this year.

Chemist Warehouse co-founders Jack Gance and Mario Verrocchi’s respective families led the way in sharing $454m of dividends for the 2021 financial year, according to documents lodged with the corporate regulator over the weekend and obtained by The Australian.

Mr Gance and Mr Verrocchi, both members of The List – Australia’s Richest 250, oversee a business that has been one of the nation’s greatest entrepreneurial success stories in recent years.

Chemist Warehouse’s parent company CW Group Holdings had revenue of $2.46bn in the year to June 30, making it one of the largest private businesses in Australia.

In notes in its financial accounts, Chemist Warehouse’s directors say the group “had proven highly resilient to the impact of Covid” and that while there had been softer retail conditions that affected wholesale sales revenue growth, online sales accelerated and “sales to government … increased due to high demand for personal protective equipment”.

CW Group recorded a statutory net loss of $176m after a $227m profit last year, but attributed that result to changes to its business model resulting in a new wholesale supply agreement and changes to leasing and other fee arrangements with franchisees that led to a $450m increase in administration and general expenses.

The business model change may be a precursor to a future stockmarket float for Chemist Warehouse, a move that has long been rumoured. CW Group directors said they had consulted with state and territory pharmacy regulators about the changes to the business model, and were still negotiating with the Pharmacy Council of NSW for approval.

It declared $454m to the Gance and Verrocchi families after a $350m dividend in 2020.

Other big payers included Wright Prospecting, the company owned by billionaires Angela Bennett and sisters Leonie Baldock and Alexandra Burt, which paid out $320m, and Laurence Escalante’s Virtual Gaming Worlds, which shared a $285m dividend among its shareholders.

Canberra Airport, owned by billionaire Terry Snow and his family, declared a $300m unfranked dividend, according to its annual report.

While the airport’s operating results were hit by a lack of travel during various Covid lockdowns throughout the year, the business was boosted by a huge $585m upwards revaluation of its commercial property holdings.

Snow has built the huge Brindabella Business Park adjacent to the airport, the major reason for the group having $3.98bn in investment properties sitting on its balance sheet.

Stock picker Peter Cooper declared $18m in dividends for his boutique Cooper Investors funds management business, while Geoff Wilson’s private group paid about $9.6m in dividends after doubling profits to $22m.

Meanwhile, coal mining magnate Sam Chong saw profits and revenue fall at his Jellinbah Group. He shares the ownership of Jellinbah, which owns majority stakes in the Jellinbah Mine in Queensland’s Bowen Basin and the Lake Vermont Mine 240km northwest of Rockhampton, with subsidiaries of Japanese group Marubeni and global mining giant Anglo-American.

Jellinbah paid $126m in dividends, but that was $200m less than last year, and net profit fell by a similar amount to $240m.

Shesh Ghale and Jamuna Gurung’s Melbourne Institute of Technology also saw its profit decline by half, with international students still mostly kept out of Australia due to Covid restrictions. They received a $15m dividend.

More Coverage

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout