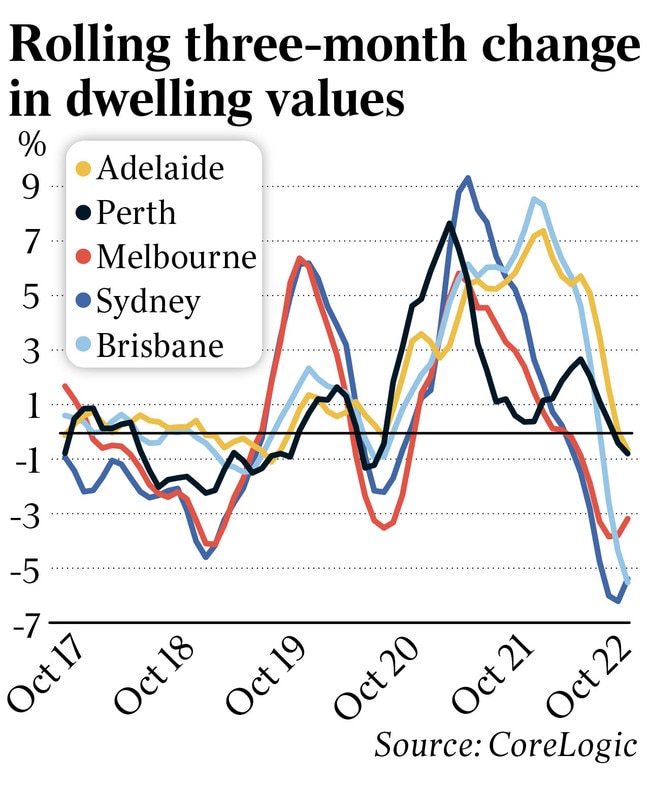

Figures from analysts at CoreLogic suggest the price pattern over the year remains mixed, but on a quarterly basis it is clear that declines are kicking in most sharply in the larger capitals.

Meanwhile, the black spot in the national market has moved to Brisbane, where house prices are now falling faster than Sydney which had led the way in recent months. Brisbane prices fell 5.4 per cent over the past three months, Sydney fell 5.3 per cent and Melbourne 3.1 per cent.

The most recent figures for Melbourne suggest some resilience. But they are only for a short period. As National Australia Bank suggests, for the first time since early May, Melbourne house prices didn’t fall this past weekend.

“Neither did they rise, but flatlined,” it said. “Of course, we wouldn’t wish to overreach with this. It is very high-frequency data but worth a notation nevertheless and hints at a little more steadiness and comes after some weeks when declines have been moderating.”

Another rate hike pencilled in for Melbourne Cup day from the Reserve Bank may also trigger a “re-acceleration” in overall market declines, analysts warn.

Moreover, despite some slight evidence of moderation in overall price declines, the volume of houses put up for sale is well below normal standards. According to CoreLogic’s Tim Lawless: “There is a below-average flow of new listings that is keeping overall inventory levels contained.”

Clearance rates – even at these reduced levels of stock volume – just went below the crucial 60 per cent market again last weekend.

Figures from inside the banking industry also point to the depth and scale of the slowdown, with housing credit showing clear signs of weakening even as business lending remains strong

As NAB reports: “Housing credit growth remained at 0.5 per cent month on month, though is slowing with the three-month annualised now running at 5.8 per cent from 8.6 per cent in early 2022.”

This downturn is falling most heavily on house prices – unit prices are not falling as much.

In fact, unit price declines are only about half the declines coming through for house prices.

The reality of the slowdown to date is orderly, and by no means as dramatic as the forecast declines across the market.

As Eleanor Creagh of PropTrack points out, “we are seeing a range of factors that could ultimately offset some of the negatives now, such as tight rental markets and a looming rebound in immigration.” On PropTrack numbers, the decline in October was “the smallest fall since national home prices peaked in March 2022”.

Senior figures in the banking industry have suggested the housing market could fall as much as 20 per cent peak to trough – that forecast has been gaining support after an RBA internal assessment suggested a 20 per cent drop was possible over the next two years.

The RBA’s base case is an 11 per cent drop finishing late in 2023, suggesting prices may keep falling by around 1.5 per cent a month.

As the downturn plays out, serious regional variations continue to emerge. In Adelaide and Perth, for example, the downturn has yet to fully register.

Taken city-by-city for the quarter, Sydney and Melbourne are showing declines, Adelaide and Perth are flat with falls of around half a per cent over the period.

On an annual basis, returns remains very strong outside the major cities. Adelaide showing a 16 per cent lift compared to a figure of 10.9 per cent figure nationwide.

Most analysts remain cautious around any suggestion the worst of the fall is over due to ongoing rate hikes and the specific risk in the fixed mortgage market.

Mortgage borrowers who fixed at exceptionally low levels in 2019 and 2020 will roll off into much higher rates in the months ahead, regardless of whether they choose to take fixed or variable products.

After six months of sliding prices it looks like the worst of the house price declines may be yet to come.