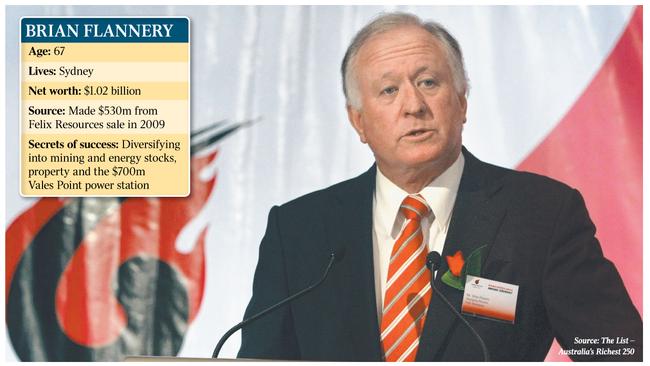

Brian Flannery thinks small as he builds a diversified portfolio

An eye for small cap stocks has paid off for billionaire Brian Flannery.

Billionaire Brian Flannery would have to rank among the most prolific — and successful — investors in small-cap companies among the country’s wealthy elite.

Flannery has shares in several small but strongly performing gold stocks, a range of other mining investments as well as property and aged-care holdings that make up one of the more diversified portfolios on The List — Australia’s Richest 250, published by The Australian.

He made his first fortune from the sale of Felix Resources to Yanzhou Coal in 2009, from which he made about $530 million, and has since had a range of resources and property investments, the latter including the KTQ Developments business owned with wife Peggy. KTQ manages hotels and resorts and builds apartment projects.

The duo also own the $100m Elements of Byron Report and Spa, north of Byron Bay.

Flannery also spent another $4m building the first solar-powered heritage diesel train to take their guests into town.

But Flannery clearly still devotes considerable time to his listed equities portfolio, judging by the sheer amount of companies in which his private investment vehicle Ilwella appears as a top 20 shareholder.

Flannery has about 25 stocks in his portfolio, mostly small and emerging mining companies, though his biggest holding is aged-care company Aveo.

Aveo has risen in value by 12 per cent since January 1, but that performance comes after plunging more than 10 per cent yesterday after it revealed it had received a confidential takeover offer but flagged a slump in full-year profit due to subdued property market conditions.

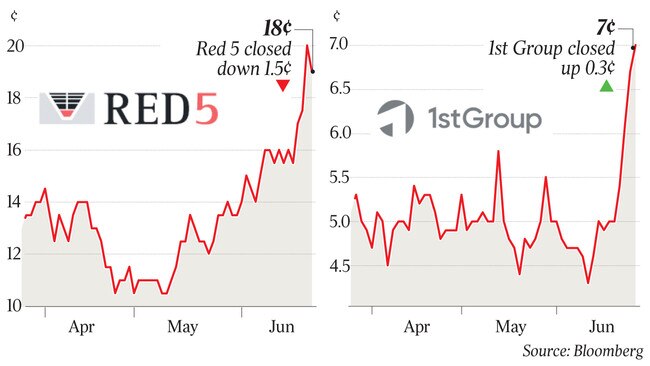

Several of Flannery’s other stocks have recently hit 12-month trading highs, including gold producer Red 5 and healthcare technology company 1st Group.

Red 5 shares have more than doubled in value since the beginning of the year. The company operates the Darlot and King of the Hill gold mines in Western Australia’s goldfields region, and has high hopes to extend operations at both.

1st Group shares, meanwhile, have risen by more than 100 per cent since January 1. The company raised $2.6m from investors earlier this year

Flannery is also a shareholder in a recent ASX float, Mont Royal Resources. It listed in May at 20c and rose to its highest level on Monday, 26c. Mont Royal is another WA gold mining company.

The share price of White Energy, of which Flannery is managing director (his Felix Resources partner Travers Duncan is chairman), has also performed well this year, rising 66 per cent.

White Energy has a tumultuous history, having been embroiled in a NSW Independent Commission Against Corruption investigation into the granting of a coal licence at Mount Penny and the involvement of former NSW state MP Eddie Obeid.

The company is now developing a technology it claims will producer clear and more efficient coal.

Other strong performers in the Flannery portfolio include Jupiter Mines, a manganese and iron ore miner that is up 38 per cent this year, and Orion Minerals, an explorer with several projects in South Africa that is up 40 per cent since January 1.

On the other hand, Flannery also holds stocks in companies that have fallen in value. Zinc explorer Superior Lake Resources is down 13 per cent, oil and gas company Sundance Energy Australia is down 25 per cent and Lucapa Diamond has fallen 17 per cent.

But Flannery’s best deal may be NSW coal-fired power station Vales Point, which he owns with fellow member of The List, Trevor St Baker. They paid $1m to the state government for the asset three years ago, as well as taking on its liabilities. With coal demand once again surging, the asset has been valued at about $700m. Flannery has previously considered selling his share to St Baker, though they have yet to strike a deal and have since flagged pouring more funds into the asset to extend its operating life.

St Baker and Flannery are also investors in private car battery charging network company Tritium. It lost almost $13m after recording revenue of about $34m in the 2018 financial year.

The last available financial report for Flannery’s Ilwella, for 2017, reveal it made a $213m net profit — $135m of that was a profit share of an asset that probably is Vales Point — and had net assets of $640m on its balance sheet.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout