Bigger second bite for early super withdrawals: APRA

Second applications by those withdrawing savings in the early super offer are higher than in the first round, new figures show.

Australians taking full advantage of the early super offer are withdrawing more on their second bite than the first, new figures show.

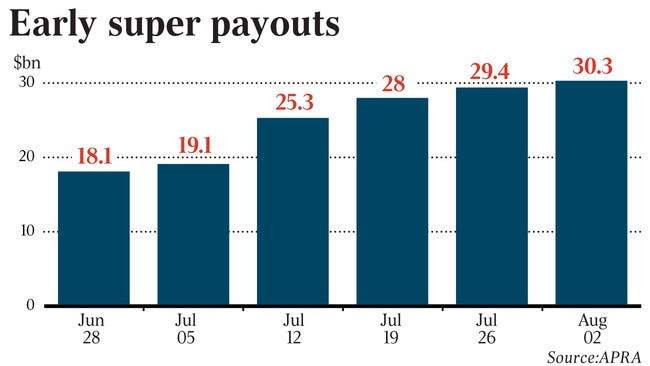

The rise in the average withdrawal by people accessing their super early for a second time came as the total amount cleared from saving accounts during the COVID-19 crisis topped $30bn.

The number of first-time applications has also topped three million, according to the latest data from the prudential regulator, APRA.

More than one million workers have double dipped into their nest eggs in the past month, withdrawing up to an additional $10,000, tax free, since the second tranche of the government’s early super access scheme kicked off on July 1, the APRA figures show.

Despite warnings from some about the consequences of clearing out super accounts, double-dippers don’t appear to be holding back on the amount they are withdrawing.

Second applications on average are more than $1000 higher than initial withdrawal requests.

The early super access scheme, in place since April, allowed workers hit by the coronavirus pandemic to access up to $10,000 of their retirement savings, tax free, last financial year.

Since July 1, eligible workers have been able to tap into their nest egg for up to a further $10,000. The scheme was due to finish on September 24 before the government last month extended it “to increase the scope for individuals who may still be financially impacted by COVID-19 to access early release in the coming months”.

Treasury originally estimated $27bn would be sucked out of super funds by under-pressure workers but last week lifted its forecast to $42bn.

As at August 2, $30.3bn had been siphoned off from super accounts across the nation, with the average withdrawal coming in at $7,695. More than 100,000 applications were received by funds in the week to August 2, of which 48,000 were initial applications and 55,000 were repeat applications.

But the average withdrawal amount is higher for workers accessing the second tranche of their savings, the APRA figures show.

For initial applications, the average amount withdrawn per worker sits at $7403. This jumps to $8511 among those who have gone back a second time.

It is taking super funds on average 3.3 business days to process applications once received from the tax office, with 95 per cent of applications processed within the five-day deadline.

AustralianSuper has borne the brunt of the withdrawal requests, with close to 20 per cent of its 2.2 million members accessing the scheme to wipe out more than $4.2bn in super savings. Of the more than 400,000 AustralianSuper members who took a lump sum from their nest eggs, 37 per cent went back a second time.

Among the other funds, Sunsuper, REST, Hostplus and CBUS have been the hardest hit.

Sunsuper has paid $2.97bn on 428,000 applications, REST has handed over $2.7bn following more than 388,000 requests and Hostplus has forked out $2.6bn on a little over 371,000 applications.

CBUS, meanwhile, has so far paid out $1.87bn on more than 230,000 withdrawal requests.

More than half a million Australians are believed to have completely wiped out their super savings since the scheme began, according to Industry Super Australia, with the vast majority under the age of 35.

Former prime minister Paul Keating last week lashed the government’s early access scheme, arguing that the COVID-19 crisis required a national response that did not place the burden on workers raiding their retirement savings.

“Instead of JobSeeker and JobKeeper carrying the main burden of income support from the get go, (it is being carried by) people ratting their own savings to the (extent) where 600,000 people — broadly young people — have no super accounts at all,” he said at an Industry Super event.

“It’s a national hardship requiring a national response. And the national response should have been a fiscal policy response, not the burden of the income support and maintenance of living standards coming from people’s long-term retirement savings.”

But Financial Services Minister Jane Hume soon hit back at Mr Keating’s comments, saying he was out of touch with ordinary Australia.

“This is not welfare that people are accessing, it is their own savings. And it isn‘t compulsory, it is just one suite of the government’s response to the COVID-19 crisis,” she argued.

“For thousands of Australians, the government support through JobKeeper, and Jobseeker has been what‘s kept them afloat. But it’s been their ability to access a limited amount of their own savings that has allowed them to pay down debt, to pay bills, to give them peace of mind at a really distressing time.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout