Alternative assets offer good returns, but beware of performance fees

If that eventuates, analysing which growth investments held up the best during the carnage of March should give investors wanting downside protection a headstart on to how to strengthen their portfolio for the potential storms on the horizon.

Whether you have a super account with a retail or industry fund, you are likely to be invested in at least one of over 2000 managed funds available. On one end of the spectrum there are fund managers who have generated positive returns of up to 18 per cent this month, while others are down as much as 45 per cent.

Morningstar data compares all of the 2077 retail managed funds and reveals that seven out of the 10 best performing funds are in the alternative asset space.

Unlike a bond fund where you expect the underlying assets to be bonds, an alternative managed fund can employ a wide range of investments and strategies including short selling, high frequency trading, currency and interest rate trading, derivatives and futures.

You need to be careful when investing in an alternatives fund manager as the fees can be high, they tend not to track any particular benchmark, they often charge performance fees, and the underlying fund strategy can be difficult to interpret and sometimes opaque with limited fund updates.

The top performer is Odey International Fund, which has returned 18.3 per cent in of March. It holds a portfolio of stocks with a European bias, and can either hold stocks or take short positions. It charges a performance fee of 20 per cent above its performance hurdle (0 per cent) and an ongoing management fee of 1.36 per cent.

Looking under the hood of the fund, it has been holding some interesting investments. As at the end of December it held short positions against 10-year Japanese and Australian bonds, short positions against Netflix and Tesla, and 7 per cent of the fund was invested in Banco Marco, Argentina’s sixth-largest bank. The fund has returned 4.4 per cent over the past three years and -10.8 per cent over the past five years.

The second best performer was the Alpha Alternatives Fund, which returned a strong 16.3 per cent. It is a “manager of managers” which means that it invests in other managed funds, and acts as the manager by choosing which ones to hold in its own fund. The fee is 2.53 per cent along with a 20.5 per cent performance fee above the cash rate plus 1 per cent. Although it has had a strong March, its three-year return has been 0.71 per cent and its five-year return -1.62 per cent.

Looking a little further down the list, unlisted property funds make an appearance four times in the top 25 with Newmark Hardware Trust returning strong numbers. It is a portfolio of directly owned retail property, with Bunnings occupying 87 per cent of the four properties worth $197m inside this fund. It produces a 5.9 per cent yield, paid quarterly, and has limited monthly redemptions.

In contrast to unlisted property funds, Newmark’s listed competitor, BWP Trust, is Australia’s largest owner of Bunnings sites, having 68 sites with a total fund value of $2.5bn. BWP Trust started March with a share price of $3.79 and slid to a low of $2.73 before rebounding to $3.41, offering a 5.3 per cent dividend.

With uncertainty in markets, the tide washes out all investment, both good and bad. We’ve seen this across the board, with indiscriminate sell-offs on the ASX, and the listed property sector has been no exception. The good news is that listed property stocks are trading at close to fair value now, as opposed to trading at lofty premiums like they were pre-crash.

Hamish Wehl at Cromwell Funds Management says: “Unlisted property funds are not traded on the sharemarket and therefore typically have lower volatility relative to listed asset classes. This is not only a strong attraction for investors but one of the main reasons why the sector has outperformed listed property funds and equities.”

Looking beyond COVID-19, equities in general tend to be more volatile, and with interest rates hitting a historic low of 0.25 per cent, income-generating products like term deposits and bonds are also unlikely to deliver adequate returns for investors.”

However, if there is a crunch and properties in the fund need to be sold, that’s where there can be significant issues if the sale prices fall short of expectation, resulting in investors wearing huge losses or otherwise seeing redemptions frozen and becoming unable to access their capital.

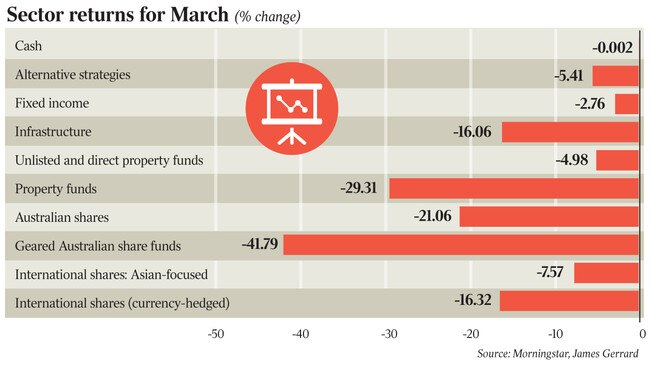

Some of the better performers have been Asian managed funds. Of the 22 Asia-focused managed funds available in Australia, the average return has been -7.57 per cent, largely due to the early containment of the coronavirus in Asia and the early return to normality while the rest of the world continues to fight the battle of “flattening the curve”.

It appears the age-old adage “safe as bricks and mortar” rings true even in turbulent times, with unlisted property managed funds being the top of the pops for stability and income, but be aware of differences in valuations versus sales prices if things get tough.

James Gerrard is the principal and director of financial planning firm FinancialAdvisor.com.au

Australian and global sharemarkets recently fell by over 30 per cent and have just staged a bounce-back. But some equity investors are not convinced that we are over the worst and are preparing for another round of falls.