Most IPOs lose money. B that’s not the case right now, when the average IPO gain is close to 40 per cent so far this year.

Tales of spectacular returns in highly anticipated new floats spread like wildfire under such conditions.

But it’s a market characterised by “heightened volatility and stretched valuations” as fund manager Perennial Investment puts it.

In the US, it’s the same story as the volume of new listings test records last set in another pre-Christmas frenzy, back in 1999.

Just in case you don’t know, the late 1999 dot.com IPO rush ended with the dot.com crash which began in earnest three months later in March 2000.

This week’s list of Wall Street hopefuls includes the accommodation rental site, Airbnb, which just had its final IPO price raised higher than forecast - another classic sign of a peak.

“This time round it’s different,” say stockbrokers and that’s true, as far as it goes.

Some of the companies listing on the exchange in recent weeks are considerably more impressive than the OneTels of a long forgotten dot.com era on the ASX.

Among the stars to date are software group Nuix, up around 70 per cent since its float earlier this month and now worth around $3 billion. Maas group, a construction player is up 36 per cent since its float and is now worth more than $700m.

More typically, the huge profits are made on small floats with even smaller shareholder lists. In turn, that means the vast majority of investors never get a look in. Gold miner Kaiser Reef is up around 105 per cent since its IPO but it is still only worth $11m.

Similarly, among the dozens of IPOs trying to list on the ASX before the end of the year many are raising fractional amounts, like Akora Resources ($5m) and BPM minerals ($4.5m).

What’s more, even in this market, where it looks like you can float just about anything, there are still potential flops. Online lending company Plenti (formerly Ratesetter) listed at $1.66 a share and is now closer to $1.02, tradie platform Hipages listed at $2.45 and is now at $2.20.

Who’s buying in this frenzy? As the vast majority of new floats don’t actually raise much and the new generation of investors that have flooded the online brokers since lockdowns began mid year are unlikely to be in the action.

More likely it is retail clients at the mid-tier brokers which offer full service functions and also raise capital.

Gemma Dale, the director of investor behaviour at NAB, says Nabtrade clients are not rushing into the IPO market. “We don’t go into the market very often and our investors would be aware of the wide variability of quality among new listings,” she explains.

Even so, Dale says new investors are still pouring into the market with new applications at Nabtrade running at up to twice the rate of last year.

This week’s big flop - the $1 billion float of the Dalrymple Bay coal terminal facility - had much more retail investors than usual for a float of that size - up to one third of all stock was taken up by mum and dad investors, and they got burnt. The stock floated earlier this week at $2.57 it was down at $2.17 by Wednesday.

So, one thing has not changed: Getting a slice of the action in the best floats looks to be as hard as ever, while getting invited into the ones that sink on debut remains altogether easier.

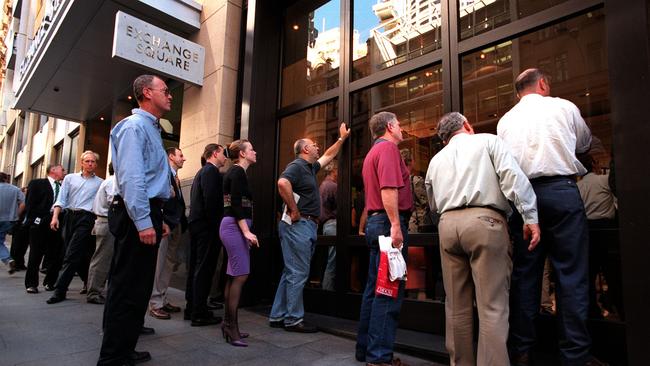

Australian sharemarket floats are going ballistic. A hot market and an artificial urgency created by the rush to float before Christmas are creating a frenzy.