Washington H Soul Pattison not worried by blacklisting

Washington H Soul Pattinson chief executive Todd Barlow has shrugged off its placement on Norge Bank’s exclusion list.

Washington H Soul Pattinson chief executive Todd Barlow has shrugged off the company’s placement on Norge Bank’s investment exclusion list and said Australia’s economic slowdown will throw up opportunities for the value investment house.

Mr Barlow yesterday unveiled a 22.6 per cent lift in statutory net profit to $179.2 million for the six months ended January 31, underpinned by its portfolio investments benefiting from higher coal prices and property earnings.

WHSP’s results were buoyed by investments in sister company Brickworks and New Hope Corporation, the latter seeing strength in thermal coal prices and increased production volumes.

Mr Barlow said despite global demand for coal being “relatively static”, there was growing demand in the Asian region.

“We think the outlook for coal is extremely positive,” he added.

Earlier this year Norway’s central bank Norges added WHSP to a broader investment exclusion list for its sovereign wealth fund due to its coal-related exposures, reigniting debate about environmental activism.

Mr Barlow and his chairman Robert Millner said the decision didn’t faze WHSP.

“They are ill informed,” Mr Millner said, emphasising the need for energy in the developing Asian region. “There is 14 per cent of the world that still don’t have power.”

Mr Barlow concurred.

“It won’t change the fundamentals of the performance of our company, and in my opinion they will miss out,” he said.

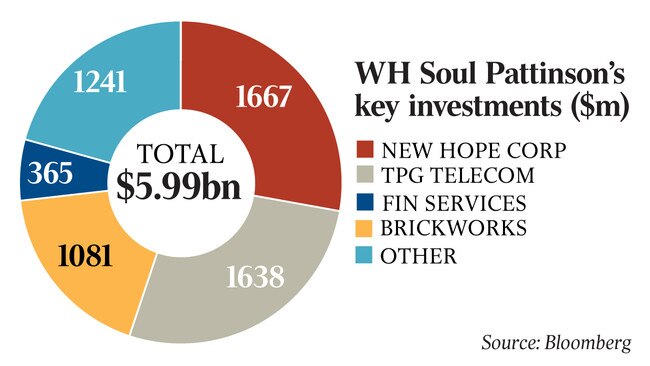

WHSP’s “regular profit”, which represents income from continuing operations, rose 12.2 per cent to $186.7 million, while the company’s pre-tax net asset value was up 10.2 per cent to $6 billion.

The company’s share price traded lower before rallying to close 0.7 per cent higher at $28.83. Year-to-date gains in the stock are 15.8 per cent.

WHSP’s interim revenue from continuing operations rose 31.6 per cent.

But the results were weighed on by start-up costs and expenses relating to the group’s investment in mining and exploration company Round Oak Minerals.

Mr Barlow cautioned that there were “early warning signs” emerging in the Australian economy as growth slowed and consumer sentiment soured.

“Australian households are far too over-leveraged,” he said. “There are a lot of indicators slowing and things are getting a bit tougher.”

Mr Barlow added that tempering growth also presented buying opportunities for the company in areas including the property and credit markets and in the financial services industry, hit by disruption from the Hayne royal commission.

WHSP has made a bigger push into financial services in the past five years. Its investments in the sector include a large holding in fund manager Pengana Capital and a stake in Ironbark Asset Management.

Valuations in many of its financial services portfolio companies were lower in the six months ended January 31, but the division’s contribution to profit edged up to $8.7m.

The company’s large holdings in listed companies also include Australian Pharmaceutical Industries and TPG Telecom.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout