Why Elon Musk went cold on Tesla privatisation

As days passed, Elon Musk’s misgivings about taking Tesla private grew.

When the Tesla board convened last week at the company’s factory in Fremont, California, in a conference room where Elon Musk often spent the night, his sleeping bag was still on the floor.

The agenda was Mr Musk’s audacious plan to take Tesla private, which he had sprung on the investment world 16 days earlier via tweets. He was joined in the room by board members, lawyers, bankers and advisers, members of a Wall Street transaction machine put into motion by the entrepreneur’s idea.

Mr Musk’s plan turned out more shaky than his tweets suggested. He had told the world he had funding “secured,” and one tweet elaborated that the deal was so certain it needed only a shareholder vote.

As the team hustled to put form to his idea, lining up investors willing to put up the tens of billions of dollars required for the deal, Mr Musk was having doubts.

A buyout, even if accomplished, would force some of the technology mutual funds that had been ardent supporters to trim their stakes. It might mean allowing competitors inside his tent — one of the investors his bankers had lined up was Volkswagen.

Taking Tesla private also would displace legions of small-fry stockholders — a merry band of electric-car fanatics willing to look past Tesla’s rickety finances and its struggle to master the skill of mass-producing cars.

Taking their place would be more sophisticated investors tugging on a tighter leash.

Then there was the photo emailed to him last week from an elderly couple, dressed in Tesla T-shirts and baseball caps. The couple held up a handwritten sign congratulating Mr Musk for producing 7000 electric cars in seven days. Their message: “Thanks, Elon! Two happy stockholders!”

Mr Musk forwarded the email to a friend. “Made my day,” he wrote. It also nagged at him.

In the conference room, bankers from Goldman Sachs Group and executives at Silver Lake, the private-equity firm brought in to try to facilitate a deal, made their presentation. Then Mr Musk rose to speak.

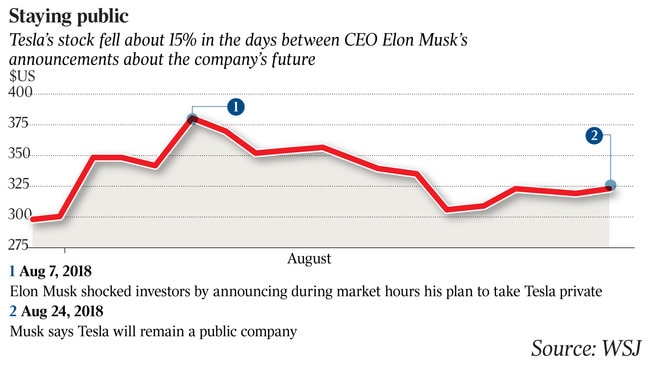

Taking Tesla private was an idea he considered for years, and Wall Street was offering him the chance to try. Despite a meteoric stock-price rise — up 78 per cent since the end of 2016 — Mr Musk was obsessed with short-selling investors who bet on Tesla’s price declining.

He complained about the scrutiny aimed at public companies, once chiding Wall Street analysts for asking “boring, bonehead” questions. Ever the optimist, he viewed Tesla as a revolutionary business with its best days ahead.

Then on Thursday, he told the board he wouldn’t be pursuing the deal.

The Securities and Exchange Commission is now investigating his tweets about the deal, including the one saying he had “funding secured”, putting Mr Musk and the company in jeopardy.

Mr Musk’s task ahead is to try to bury his private-transaction dalliance and focus instead on mass-marketing the Model 3 sedan — a bet-the-company product — at a scale and cost that could make it a mainstream car.

The company has significant debt obligations coming due over the next year, and some of its suppliers are nervous about Tesla’s ability to pay.

“In my opinion, the value of Tesla will rise considerably in the coming months and years, possibly putting any take-private beyond the reach of any investors,” Mr Musk said on Saturday in an email to The Wall Street Journal. “It was now or perhaps never.”

Tesla’s board recently added independent directors James Murdoch and Linda Johnson Rice, but it is still dominated by Mr Musk’s longtime supporters, including his brother, Kimbal Musk, a close confidant.

Mr Musk had spoken in recent years to Michael Dell, the founder of Dell, who had taken his own company public, then private a quarter-century later and then public again, according to a person familiar with the discussion.

Once Mr Musk raised the idea of a transaction, he expanded his advisers beyond his West Coast loyalists. He hired Egon Durban of Silver Lake Partners, who had brokered and helped bankroll the Dell buyout.

Gregg Lemkau and Dan Dees of Goldman came on board, too, to advise Mr Musk and tap the firm’s connections to wealthy investors around the world.

Board members remained supportive of Mr Musk, but some were whipsawed by the tweets. He told the board he understood that his tweets had been rash and promised to exercise more self-control.

Mr Musk seemed to view such a complex corporate transaction as an engineering problem he could solve — much as he had spent time pursuing the idea of a submarine to rescue a soccer team trapped in the waters of a Thai cave.

Finally, the deal team advised him the money would likely come with strings attached. The new investors would want a lot of say in the company, and each would likely want to hammer out terms of their own.

The following day, Thursday, the board meeting was convened at the Tesla factory conference room. Mr Musk had told some board members earlier in the day that he had doubts about the proposal, according to people familiar with the matter.

The advisers said they were confident it could be done, and then left.

Then Mr Musk spoke. “Based on the latest information I have,” he said, “I’m withdrawing the proposal.”

“Woo-hoo,” one board member let out.