Trump tariffs hurt US producers

Some small and mid-size US companies say the latest tariffs are hurting, not helping, their business.

The Trump administration says tariffs on Chinese imports will shift manufacturing back to US factories, but some small and mid-size companies that have done just that say the tariffs are hurting, not helping, their business.

Kent International, a bicycle company, opened a factory in Manning, South Carolina, in 2014 to start assembling some of the bicycles it sells to Walmart and other retailers. It currently employs about 167 people.

Kent planned to expand the facility next year by importing steel tubes cut in China for painting and welding. It planned to hire another 30 to 40 workers at the plant, which assembles about 300,000 of the roughly 3 million bicycles the company sells worldwide each year.

“When we started getting wind of tariffs and were confident cut tubes would be subject to the tariffs, we stopped,” said Arnold Kamler, majority owner of the company and its chief executive for more than 30 years. Instead, he is travelling to Thailand, Vietnam, Cambodia, The Philippines and Taiwan to find new suppliers for Chinese products hit by tariffs.

“We are not bringing jobs back to America with this thing,” Mr Kamler said. “We are bringing jobs to different countries in Southeast Asia.”

The Trump administration says the tariffs are designed to counter what it sees as unfair trade practices that give Chinese firms an advantage over their US counterparts. Some US manufacturers are reporting increased revenue as tariffs force customers to rethink supply chains.

At Allied Technologies International, a contract manufacturer in Tualatin, Oregan with 57 employees, orders are up overall by 30 per cent from last year. “There is a price shock because of tariffs and, more importantly, there is a supply chain risk,” said Allied CEO Thomas Biju Isaac.

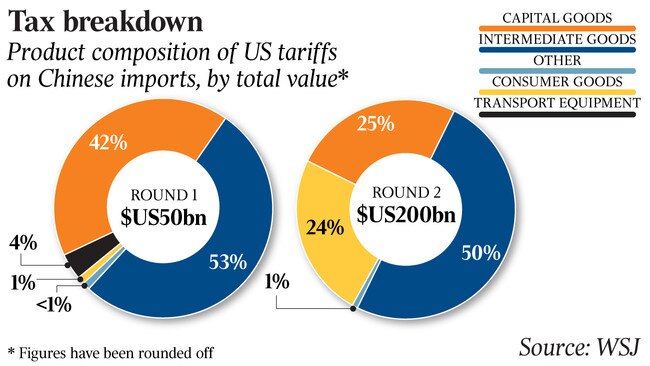

The latest tariffs, a 10 per cent levy on $US200 billion ($281.5bn) of Chinese imports, including bicycles and bicycle parts, took effect in September and are slated to rise to 25 per cent at year end. In all, the US has levied tariffs on $US250bn of Chinese imports, from steel and aluminium to bamboo furniture and luggage. China has responded with tariffs on $US110bn of US exports.

Companies that have brought manufacturing back to the US say tariffs are raising their costs and making them less competitive.

“It’s hard to build things here,” said Manville Smith, a vice-president at JL Audio. “It would be nice if our government would help us, not hurt us.”

Mr Smith and other smaller manufacturers said they were disadvantaged under the current tariff rules. Chinese-made finished goods that use the same components often can enter the US from China without paying these duties. So, a Chinese loudspeaker avoids the tariffs, but one assembled at JL Audio’s facility in Florida faces a 25 per cent duty on key parts next year. A European loudspeaker would also avoid the tariffs, even if it used Chinese components.

Intermediate goods, or parts and materials used to make a finished product, account for about half of the $US250bn in Chinese imports subject to tariffs, according to the Peterson Institute for International Economics.

Finished goods from China could lose their advantage over US-made goods with Chinese components if the White House follows through on its threat to place tariffs on another $US267bn of Chinese imports, a move it has so far avoided to limit the impact on US consumers.

The office of the US Trade Representative declined to comment for this article.

Companies hit by the tariffs aren’t simply raising prices to offset the added costs. Some business owners say they are delaying plans to expand their US footprint, looking at dropping product lines or shifting production offshore.

“Overall, manufacturing in the short-term in the US is worse off because of the tariffs,” said Harry Moser, founder of the Reshoring Initiative, a non-profit that helps manufacturers make decisions about relocating production.

President Trump “is 100 per cent right in working to reduce the trade deficit and bring manufacturing jobs back to the US”, Mr Moser said, but “we feel he has not chosen the optimal tool to achieve that objective”.

Kent had closed its Kearny, New Jersey, manufacturing plant in 1991 and, to cut costs, shifted production to China, which was already producing about half of the company’s bicycles. It opened the South Carolina factory after Mr Kamler attended an event sponsored by Walmart, its largest customer, promoting US manufacturing.

In a letter to the USTR, Walmart said tariffs on Chinese components “have the potential to undermine” the retailer’s reshoring efforts.

“Tariffs on intermediate goods make little sense.”