Tesla shares plummet as SEC targets Musk

US securities regulators sought to force Tesla chief executive Elon Musk out of the company he established as tweet comes back to bite.

US securities regulators on Thursday sought to force Tesla chief executive Elon Musk out of the company he helped get off the ground about 15 years ago, alleging he misled shareholders when he tweeted he had funding for what would have been the largest-ever corporate buyout.

The suit, filed by the Securities and Exchange Commission in federal court in Manhattan, threatens to deal a severe blow to the electric-car maker. Its brand and Mr Musk are closely intertwined, and analysts have said the company’s roughly $US50 billion ($69.3bn) market value is driven by Wall Street’s appreciation for Mr Musk’s vision and his skill as an innovator.

Tesla wasn’t named in the suit as a defendant, but the SEC is seeking to bar Mr Musk, Tesla’s largest shareholder and its top executive, from serving as an officer or director of any US public company.

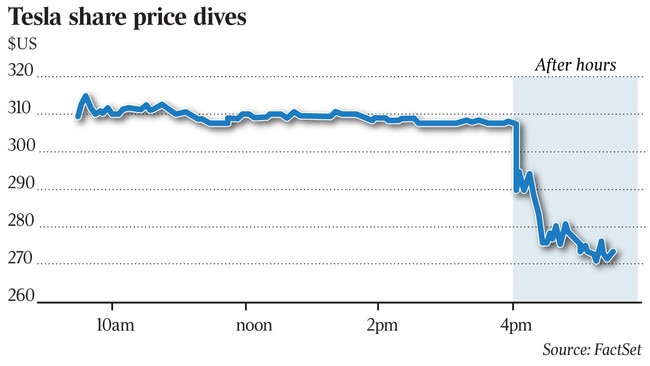

Tesla shares, which have been under intense pressure amid questions about the firm’s financial strength and Mr Musk’s behaviour, tumbled 9.9 per cent to $US277 in after-hours trading on Thursday on Nasdaq.

“This unjustified action by the SEC leaves me deeply saddened and disappointed,” Mr Musk said.

“I have always taken action in the best interests of truth, transparency and investors. Integrity is the most important value in my life and the facts will show I never compromised this in any way.”

The case ranks as one of the highest-profile civil securities-fraud cases in years. Its filing less than two months after the August 7 tweets by Mr Musk also marks an unusually rapid turnaround by an agency that has been under fire for its perceived failure to promptly bring significant cases in the financial crisis and other episodes.

“It means there was not that much investigation they needed to do to get comfortable that it was a case they should bring, but also a case they can win,” Michael Liftik, a former SEC enforcement lawyer, said.

The SEC said contrary to the statements he made in several Twitter messages on August 7, Mr Musk “knew that he had never discussed a going-private transaction at $US420 per share with any potential funding source”.

The agency said the statements and omissions of fact caused disruption to the market for Tesla shares — which rose more than 10 per cent the day of the tweets — and harm to investors.

“It’s an easy case,” Charles Elson, director of the John L. Weinberg Centre for Corporate Governance at the University of Delaware, said. “He said in the tweet he had financing, and apparently he didn’t … it’s about as straightforward as you can get.”

The claims against Mr Musk cap a year of turmoil for the carmaker, whose market value rivals that of much-larger General Motors despite the fact that Tesla has not turned an annual profit.

As Tesla has struggled since starting production of its mass-market Model 3 sedan in July last year, its limited cash supply has taken a hit, placing the company under increased scrutiny about whether Mr Musk would need to raise additional funds.

He has said Tesla won’t need to do so, and promised he could keep the rate of Model 3 production at a pace that would help the company become cashflow positive this quarter and profitable.

Despite his assurance, many analysts say Tesla will need to raise more money, in part because the company has debt coming due next year and because much of the growth projected by the electric car pioneer would require large investments.

A Tesla without Mr Musk could have a tougher time raising funds, according to David Whiston, an analyst for Morningstar Research Services.

“Without Musk, Tesla is just an automaker burning too much cash and holding too much debt,” he said.

Additional reporting: Tim Higgins, Michael Rapoport