Chinese investment in Israel raises security concerns

Security officials are raising alarms over Chinese investment in Israeli technology companies.

Security officials are raising alarms over Chinese investment in Israeli technology companies, prompting the Israeli government to scrutinise the money flows and urge businesses to reconsider accepting Chinese funds.

Israel is moving to create an interagency government body to oversee sensitive commercial deals involving foreign companies, US and Israeli officials said, akin to the US’s Committee on Foreign Investment, or Cfius.

The effort has been under way in recent months but has taken on added urgency amid recent complaints about Chinese investment from American and Israeli security officials, including US National Security Adviser John Bolton and Israel’s domestic spy chief.

US and Israeli officials said they were concerned about stepped-up Chinese investments in Israeli companies whose products are dual use, meaning they have both military and commercial applications, such as drones and artificial intelligence.

They also worry about China using Israeli companies as a way to uncover US secrets and about Beijing transferring Israeli technological know-how to its ally, Iran, an arch foe of Israel.

Officials said they worry that Chinese government entities could gain access to sensitive information by gaining control over and insight into companies that are in the dual-use space.

Mr Bolton and other American officials have warned that the investments in Israeli technology could hinder intelligence ties. US officials said they had offered to help set up the regulatory body.

Several business executives and security officials said the Trump administration’s renewed focus on China had made such scrutiny a higher priority in Israel.

“We are all concerned about theft of intellectual property and Chinese telecoms companies that are being used for intelligence gathering purposes,” a Trump administration official said.

The Israeli prime minister’s office, which is overseeing the creation of the body, declined to comment.

With few deep-pocketed investment partners outside of the US and Europe, Israel has for years welcomed Chinese money as Beijing embarked on a long-term plan of cementing its global influence with loans and business partnerships.

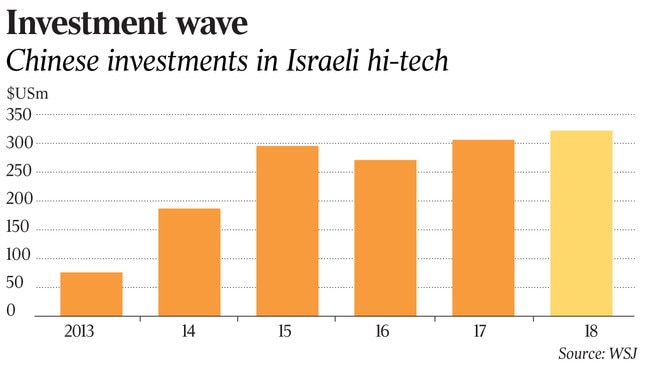

Concerns about Chinese investments flared in 2015, when state-controlled Shanghai International Port Group won a government contract to build and operate Haifa’s port for 25 years. The worries have accelerated with the global rise of telecoms giant Huawei Technologies — which the US government accuses of spying for Beijing — and a blitz of Chinese investment in Israel’s tech industry.

Chinese investors participated in 12 per cent of deals in the first three quarters of 2018 with Israeli tech companies, reflecting an increase over the past three years, according to a report by the IVC Research Centre, which tracks the Israeli tech industry. US and Israeli investors account for a much larger share, generally about one-third of deals each annually.

In the first three quarters of 2018, according to IVC, Chinese investors were involved in all 17 financing rounds for Israeli start-ups of $US20 million ($28m) or more.

Efraim Halevy, a former director of Israel’s spy agency, Mossad, said the country had been slow to recognise the security threat that Chinese investment represents, and said it was especially worrisome in dual-use products.

“That is a very dangerous area,” said Mr Halevy, who supports continued Chinese investment in Israel but wants it vetted for national security.

American officials have pressed allies in Europe and elsewhere not to let Huawei monopolise telecoms infrastructure, portraying the company as a serial violator of US laws and global business practices. Huawei doesn’t have a major presence in Israel, but Washington is worried about the firm’s interest in the country.

Huawei has developed technologies, some potentially sensitive, through a locally registered company called Toga Networks.

Israel is already home to 12 Chinese trade offices from 11 cities across the country. They aim to foster investments that go both ways, including funding Israeli companies that in turn set up offices or share technology in China.

Weijan Chen, director of the city of Dongguan’s Economic and Trade Office, said his city was seeking to invest in automation, biomedicine and telecoms in Israel. Mr Chen’s office in Tel Aviv is just one of two investment offices worldwide for Dongguan, one of China’s most important manufacturing cities. The other is in San Francisco.

“We don’t have any problems due to US pressure,” Mr Chen said, calling Israeli companies and government officials “very friendly”. “Israel is also very interested in the Chinese and the Dongguan market and want to work with us.”

Israeli executives said their government and US investors have stepped up pressure to steer clear of Chinese investment in dual use companies. Others say China is too big to turn down, and that concerns can be mitigated.