Californian utility PG&E’s shares sink on bankruptcy fears

PG&E shares plunged 22pc on concerns California’s largest utility might be forced to seek bankruptcy protection due to rising debt.

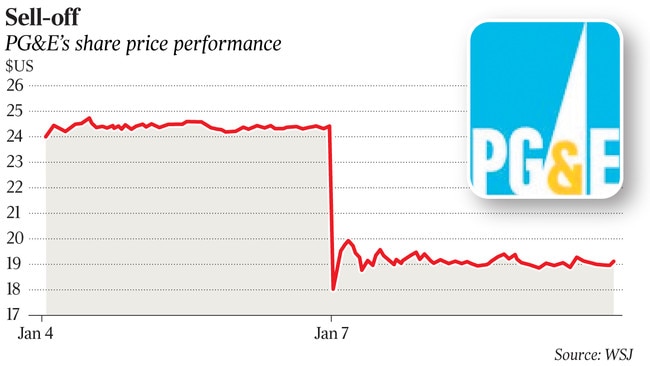

PG&E shares plunged 22 per cent at the start of trading this week as concerns mounted that California’s largest utility might be forced to seek bankruptcy protection because of billions of dollars in liabilities tied to the state’s recent wildfires.

Shares in the company closed at $US18.95 on Monday in New York, falling below $US20 for the first time since mid-November and continuing what has been a rollercoaster ride for investors since the Camp Fire that month killed 86 people and destroyed about 14,000 homes in the northern part of the state.

The sell-off began after-hours Friday evening, when Reuters reported that the utility was considering seeking bankruptcy protection for some or all of its businesses. PG&E said earlier that day that it planned to shake up its board by hiring a search firm to either replace or add to its 12 existing directors. The company said it was interviewing candidates and will review “structural options” to implement the changes, though it didn’t specify what those options might entail.

PG&E declined to comment yesterday. The stock fall on Monday erased more than $US2.8 billion ($3.9bn) of the company’s market value.

Some analysts said a PG&E bankruptcy is unlikely for the moment, noting that the company is pushing California politicians to let it pass on liability costs from more of the fires to its customers.

Morgan Stanley analyst Stephen Byrd said in a note that PG&E might have three broad options to preserve value for shareholders: a bankruptcy filing, legislative or regulatory support to boost investor confidence, or state intervention to ensure the company can raise capital.

Mr Byrd said he considered the possibility of bankruptcy “relatively unlikely”, but added that it was challenging to determine which approach would satisfy the company, regulators and politicians.

PG&E’s safety practices and corporate culture have come under intense scrutiny after November’s Camp Fire, the deadliest in California history. State investigators haven’t yet determined whether PG&E equipment played a role in the fire, but the company disclosed that some of it malfunctioned in that area around the time the fire started.

Last month, the California Public Utilities Commission said it would consider, among other things, a proposal to replace part or all of PG&E’s board with directors with a “stronger background and focus on safety”. It is also considering whether PG&E’s gas and electric businesses should be separated. The commission’s top regulator has announced plans to intensify a continuing investigation into the company’s safety practices. Investigators have linked PG&E’s gear to 17 wildfires during 2017.

The company last year took a $US2.5bn charge in its second quarter in relation to those fires.

The company warned in a securities filing last year that it had exhausted its revolving lines of credit and said that its $US1.4bn of insurance coverage for fires occurring since August might not be enough to cover potential liability claims.

Pacific Gas & Electric bond prices also fell on Monday, with some debt issues tumbling to near-distressed levels on the reports of the potential bankruptcy filing. PG&E’s 3.75 per cent bonds due 2024 were down more than 3 points, to US86c on the dollar.