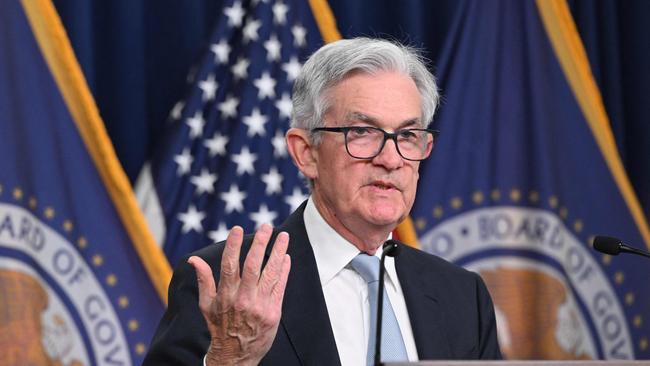

US Fed lifts rates by 75bp; chair Jerome Powell says talk of pause ‘premature’

The fourth big consecutive interest rate rise to curb stubborn inflation came as US Fed Reserve chair Jerome Powell said he doesn’t ‘see the case for real softening just yet’.

The US Federal Reserve has lifted interest rates by 0.75 percentage points to combat inflation and signalled plans to keep raising them, though possibly in smaller increments.

The latest three-quarter percentage point increase takes the benchmark lending rate to 3.75-4.0 per cent, the highest since January 2008.

Fed officials in a policy statement acknowledged it could take time for rapid increases this year to be reflected in the economy.

“The committee will take into account the cumulative tightening of monetary policy, the Ñ with which monetary policy affects economic activity and inflation, and economic and financial developments,” they said at the conclusion of a two-day meeting.

The statement said continued rate rises were needed “to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 per cent over time.”

Officials are boosting interest rates at the fastest pace since the early 1980s to reduce inflation that is running near a 40-year high.

They have raised rates by 75 basis points at four consecutive meetings, with the latest one taking the central bank’s benchmark federal-funds rate to a range between 3.75 per cent and 4 per cent.

During the post-meeting press conference, Fed chair Jerome Powell emphasised that interest rates would climb to higher levels than officials thought at the September meeting, disappointing investors banking on more accommodative policy.

“I don’t see the case for real softening just yet,” he told reporters.

Job growth has slowed in recent months and some measures of wage growth have also showed early signs of cooling, but Mr Powell said he wanted to see more evidence.

“Maybe that’s there but it’s not obvious to me,” he said.

Before June, the central bank hadn’t raised rates by 75 basis points at a policy meeting since 1994.

Mr Powell said after the June meeting he didn’t anticipate such increases to be common and called the move “an unusually large one.”

Officials had expected inflation to decline this year, but in vain so far.

They responded by targeting a higher destination for the fed-funds rate than they projected earlier in the year, resulting in the longer-than-anticipated string of 0.75-point rate rises.

Some officials have begun signalling their desire both to slow down the pace of increases soon and to potentially stop raising rates early next year – to see how their moves this year slow the economy.

They want to reduce the risk of causing an unnecessarily sharp slowdown.

Other officials have said it is too soon for those discussions because high inflation is proving to be so persistent and broad.

Debate over how much more to raise rates could intensify as they reach levels likely to restrain spending, hiring and investment.

The fed-funds rate influences other borrowing costs throughout the economy, including rates on credit cards, mortgages and car loans.

Some analysts believe the Fed would prefer to step down the pace of increases by making a smaller, half-point increase at its December meeting.

“You can’t go 75 basis points every time the data doesn’t go your way,” said Neil Dutta, an economist at research firm Renaissance Macro.

“Fifty basis points is still a pretty aggressive pace of tightening after you’ve taken the funds rate over 4 per cent.”

But other economists say it will be difficult for the Fed to dial back the pace of rate increases in December because they expect inflation to continue to run hotter than other analysts forecast.

The Fed combats inflation by slowing the economy through tighter financial conditions – such as higher borrowing costs, lower stock prices and a stronger dollar – that curb demand. Changes to the anticipated trajectory of rates, and not just what the Fed does at any meeting, can influence broader financial conditions.

Many investors this year have been eager to interpret signs that the Fed might shift to a less aggressive rate-rise pace as an indication that a pause in rate increases isn’t far off, but a sustained market rally fuelled by such anticipation would risk undermining the Fed’s attempts to slow the economy.

Most officials at their September meeting projected that they would need to raise the fed-funds rate to 4.4 per cent by December and by at least an additional quarter-percentage point next year.

That would imply a step down to a 50 basis point rate rise at the Fed’s December 13-14 policy meeting if officials don’t revise their outlook.

The debate over the speed of increases could obscure a more important one around how high rates ultimately rise.

– The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout