US at real risk of recession: Chalmers

Treasurer Jim Chalmers has raised the spectre of a global recession that could last for years, caused by the ‘blunt and brutal’ monetary policy of the US.

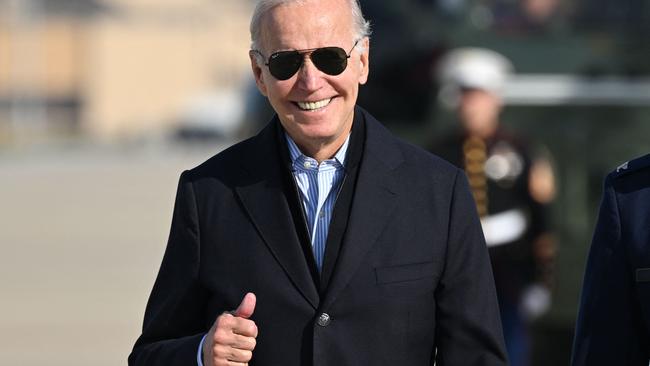

Treasurer Jim Chalmers has tipped cold water on US President Joe Biden’s relatively upbeat outlook for the US economy, raising the spectre of a global recession that could last “years”, caused by its “blunt and brutal” monetary policy.

On a two-day trip to Washington for IMF and World Bank meetings, Dr Chalmers told reporters outside the White House on Wednesday (Thursday AEDT) that it was the “broad expectation of most ministers here … that the US is at real risk of a recession”.

“There’s a pretty broad expectation around the world that there’s a big risk of recession here in the US, as there is the UK and Europe,” he added, stressing he didn’t want to appear to be “second guessing” the US president.

In a rare one-on-one interview broadcast on CNN a day earlier, Mr Biden said he “didn’t think” there would be a recession in the US.

“If it is, it will be a very slight recession,” Mr Biden added, amid mounting concern sharp increases in US interest rates by the Federal Reserve, meant to curb the highest inflation in 40 years, would drag the world’s biggest economy into its second recession in two years, taking the global economy with it.

“Look, it’s possible. I don’t anticipate it,” the president said.

The US economy shrank for two consecutive quarters in the first half of the year, meeting a traditional measure of recession, but the jobless rate remained at record lows, falling to 3.5 per cent in September, the lowest level since the 1960s.

Dr Chalmers said he would discuss the implications of rising US interest rates on Thursday (Friday AEDT) with Federal Reserve Chairman Jerome Powell, who has lifted the US benchmark interest rates from zero to 3.25 per cent so far this year, causing steep declines in sharemarket values and a more than doubling of the average home loan interest rate.

“The risk here is a hard landing brought about by the blunt and brutal application of tighter monetary policy, and that is a central part of the conversation I’ll be having with colleagues,” Dr Chalmers said.

“We’re seeing the sharpest synchronised tightening in modern era, having obvious consequences,” he explained, pointing to the inevitable upward pressure a weaker Australian dollar had for inflation.

Rising US interest rates have drastically increased the value of the US currency dollar against others, including the Australian dollar, which has plunged almost 15 per cent over the last year to just above US62c as of this week, as global investors flock to the global reserve currency.

“Australia is in better nick than most other countries but we need to be in better nick still,” Dr Chalmers said, pointing to Australia’s relative low unemployment rate, economic growth and high terms of trade.

“But we won’t be immune from another global downturn,” he added, maintaining the same cautious tone he has kept since Labor came to office in May.

The minister’s visit came in the same week the IMF released its latest World Economic Outlook, which forecast a “global cost-of-living crisis” that would trigger a sharp downturn centred in the developed world in 2023.

A third of the world was headed for recession, it estimated, and Australia’s growth would halve next year to 1.9 per cent, thereby avoiding a recession.

Dr Chalmers, who will present his first budget on October 25, ruled out any changes to the previous government’s legislated ‘stage three’ tax cuts, but said the government was prepared to make tweaks and “update the budget in real time”.

“The best way to build buffers against global turbulence is a responsible budget,” he said, adding the Labor government’s economic plan it took to the election had proved “bang on”.

Asked about rising gas prices in Australia, he said rising fossil fuel costs made the government’s plan to shift to renewable and cheaper energy “more urgent”

During his fleeting visit, the Treasurer will, in addition to Mr Powell, meet with treasurers and finance ministers of the US, UK, Canada, Korea and India, the heads of the IMF and World Bank, Mark Carney, the US council of Economic Advisers and the Coalition of Climate Change Action.

Reserve Bank governor Philip Lowe is also in Washington for a series of meetings with central banking colleagues from around the world.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout