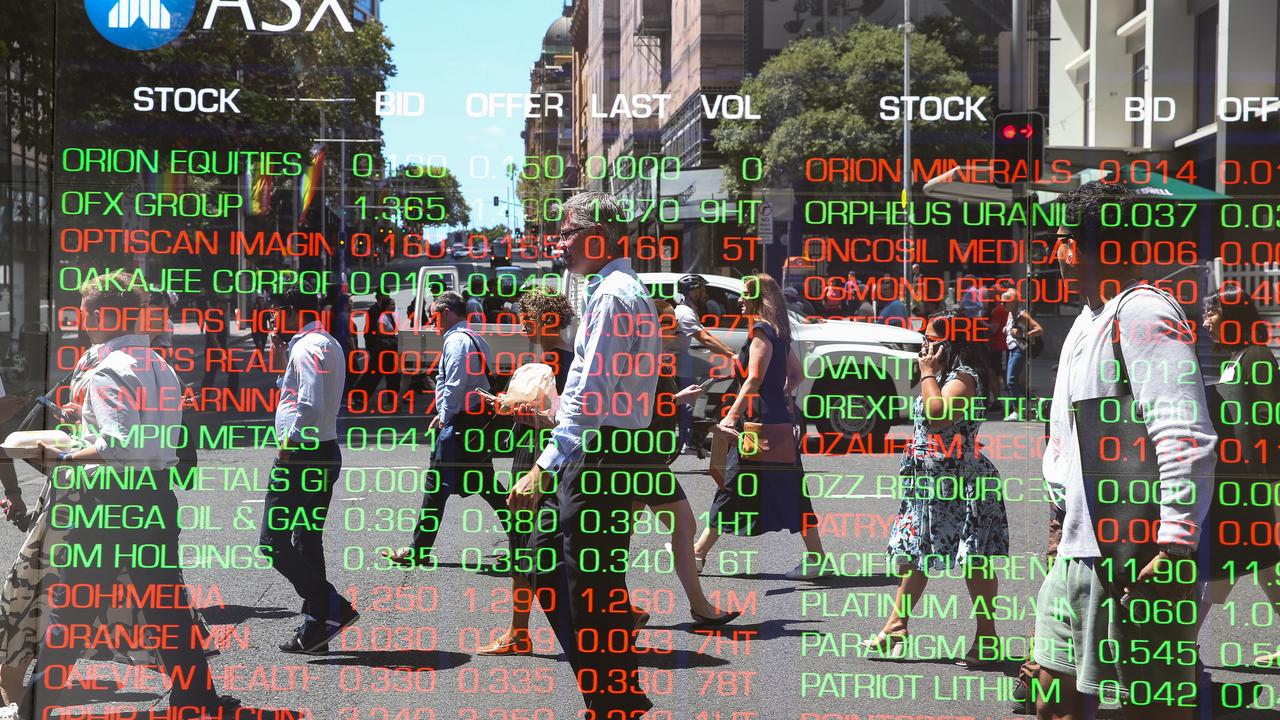

Trading Day: live markets coverage; Stocks fall as ex-div banks weigh; plus analysis and opinion

The local sharemarket lumbers along in the red as investors turn their backs to select heavyweight bank stocks.

Welcome to the Trading Day blog for Monday, November 13.

Samantha Woodhill 4.45pm: Investors take a breather

The local share market finished the session slightly lower as investors await news to propel the market higher and as banks traded ex-dividend.

The benchmark S&P/ASX200 was down 7.572 points, or 0.13 per cent, at 6021.8 points, while the broader All Ordinaries index was down 7.071 points, or 0.12 per cent, to 6097.2 points at the close.

Trading volumes were slightly below the 20-day average for the session.

“There’s no real new news to fuel the beast,” IG chief market strategist Chris Weston said.

“We’ve seen a bit of selling in financials, materials are holding in the market at the moment, some buying in staples but the moves are very light indeed and there’s no real conviction from the sellers to increase cash allocation.”

Mr Weston said that amid light trading volumes, investors will be looking to international markets overnight for cues on where the local bourse goes from this point.

“We’ve been trying to work out where this market goes from here we’ve been focusing on all these red flags which suggest a pull back on global equities but that doesn’t seem to be sort of transcending into any sort of worry in Australia at the moment,” he said.

In the financial sector, the big four banks were mixed at the close. NAB ticked up 0.43 per cent to $30.57 and Commonwealth Bank edged up 0.83 per cent to $81.52, but Westpac slumped 2.38 per cent to $32.45 and ANZ lost 2.70 per cent to $29.51 as they traded ex-dividend.

In resources, BHP Billiton put on 0.75 per cent to $28.28 and Rio Tinto added 1.10 per cent to $73.75.

Richard Gluyas 3.45pm: An unlikely successor for Narev

An unusual feature of the selection process for the next Commonwealth Bank chief executive is that one of the suggested candidates is a member of the nominations committee that will play a key role in choosing Ian Narev’s successor.

When Rob Whitfield, the ex-head of Westpac’s institutional division, joined the CBA board on September 4, it made sense to reserve him a spot on the nominations committee.

Ian Narev’s succession had been announced on August 14, and Whitfield’s long experience was going to make him a valuable source of advice to Catherine Livingstone on the board’s key function — the choice of a new chief executive.

But if Whitfield is now a candidate himself, as has often been suggested in the media, there is a clear conflict of interest that would have to be resolved.

2.42pm: Shaw spotted in Telstra cannibal camp

Telstra’s new “fighter” brand Belong is set to eat away at the telco’s average revenue per user, according to Shaw and Partner’s analyst David Spotswood, who welcomes the new entrant with an underhanded greeting: “let the cannibalisation begin.”

Data aside, Mr. Spotswood says he is saving $700 a year by making the switch from his $95/month Telstra mobile contract to a $30/month Belong deal while remaining on the Telstra network.

“If you don’t need a new iPhone, and you want to keep using the Telstra network, why wouldn’t you switch to Belong?”, asks Mr. Spotswood.

“My wife is saving $300 a year and getting five times the data allowance.”

Shaw and Partners keeps its “sell” rating on Telstra shares with a 12-month target price of $3.18.

Bloomberg consensus analyst rating currently shows 6 buys, 6 holds and 7 sells.

TLS last down 0.3pc on $3.45

2.19pm: Rio run done its dash: JPMorgan

A true blue-chip, Rio Tinto’s shares price has risen 25 per cent since the beginning of the year.

Too hot, says JPMorgan, analysts pulling the plug on their “buy” recommendation and downgrading to “neutral” with a 12-month price target bang on $75.

“We continue to view the company in a positive light,” says JPMorgan, “however, we believe the shares are now fairly valued.”

The analysts gawk at the bull run over the period in which the all-important price of iron ore has simultaneously fallen 20 per cent and stock in rival BHP a tame 14 per cent dearer.

“BHP has been elevated as our relative preference, based on more compelling spot metrics, and likelihood of positive strategic changes driven by the new chairman,” say the analysts.

However, the investment bank’s sector pick remains Fortescue, its only “accumulate” recommendation of the three based on strong operational performance and that a “significant” part of a widening discount between iron ore grades currently weighing on the miner is cyclical.

“Our base case shows Fortescue is now a value play.”

FMG last down 0.2pc on $4.85, BHP last up 0.7pc on $28.27, RIO last up 1.4pc on $73.94

2.12pm: ASX shy of ‘extreme’ valuation: Macquarie

The current valuation of the Australian share market isn’t extreme unless economic growth and earnings disappoint, or interest rates rise more sharply than expected, according to Macquarie equity strategists.

“Both are possible, but neither is likely as we close out the year and look into the first half of 2018 despite recognising that the momentum behind leading growth indicators is already topping out,” they say.

They note that the S&P/ASX 200 has risen 6.7 per cent since bottoming on October 5, and 83 per cent of this increase can be accounted for by PE expansion from 15.2 to 16.3 times 12-month forward earnings.

“We take a somewhat counterintuitive view on the valuation backdrop [in] believing multiples can go higher, particularly for growth stocks, and won’t go sustainably lower until we begin to see a broader and more powerful domestic growth pulse, which then gets the RBA to move on rates,” they say.

They note that PEs have risen unevenly and in a fashion that suggests stock and sector-selection is “genuinely becoming more risk-loving.”

They also note that there’s been no contraction in the valuation dispersion of the market, with the most expensive area of the market rising disproportionately while the cheapest end has gone sideways.

“This does not reflect a market which is becoming more comfortable about growth to a level that would drive a rotation into the value end of the market.”

And small caps have stepped up their relative rerating versus large caps in recent months, with absolute valuations for small caps now at all-time highs.

“It is possible to argue that this reflects a risk-on trade, but the composition or earnings doesn’t support this idea and nor does continued underperformance of large cap banks and retail.”

“Instead, we see this as just another confirmation of the lack of growth trade.”

But while an improving global growth backdrop is a “nice tailwind” for the local market, in combination with continued low rates, there are a number of limiting factors.

“First, Australia’s economic cycle is somewhat de-synchronised with the US, second, the improvement in growth is a first-world, tradeable goods recovery while our strongest economic leverage is via a second-world, commodity recovery, and third, Australia’s earnings backdrop is modest relative to the US which is driving equity markets with 12-month forward earnings growth at a paltry 5.4 per cent versus 10.8 per cent for the latter,” they say.

“In addition, while positive revisions are driving US equities, the same cannot be said for Australia.”

In Macquarie’s view it’s too early to expect improving global sentiment to drive the value end of the market — where most earnings risks lie.

The broker sticks to its growth — often at any price — and earnings momentum skew.

Key overweights are ABC, ALL, BLD, CCL, CSL, DOW, IPL, MIN, OML, STO, TWE and WOR.

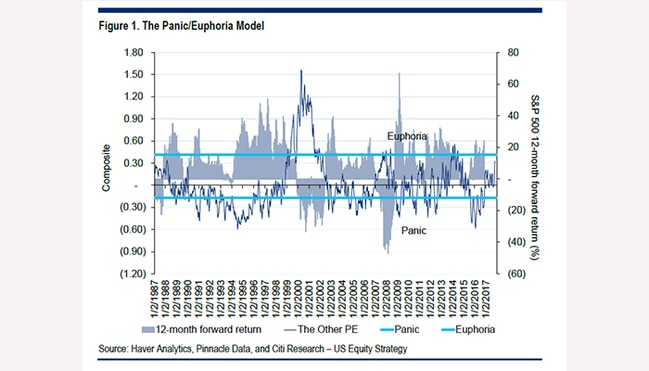

2.03pm: Citi sentiment model ‘flashing caution’

Citi’s “Panic/Euphoria Model” is “flashing caution”, according to the firm’s chief US equity strategist Tobias Levkovich.

“The model, comprised of nine factors correlated with future stock price performance, has reached a level that historically has implied a higher probability of a down market in the subsequent 12 months than higher levels for the S&P 500,” Mr Levkovich says. “This, combined with extremely low intra-stock correlation, is worrisome.”

Mr Levkovish adds that, at more than 20 times trailing 12-month earnings, US stocks traditionally have struggled.

“Notably, we have been a bit worried that the strength in the market was borrowing from 2018 returns given our 2,675 target for the end of next year.”

1.16pm: Local shares attempt recovery

The local sharemarket struggles to regain lost ground after a sharp fall as much as 0.3 per cent at the open, heavyweights ANZ and Westapc both trade ex-dividend while investors draw breath as Wall Street stalls its run of record highs.

The S&P/ASX200 index remains down 0.1 per cent on 6021.8.

SWING STOCKS

+ Syrah Resources (9.5pc), a2 Milk (4pc), Western Areas (2.8pc), Sandfire Resource (2.7pc), Santos (2.2pc)

— Iress (3.4pc), Speedcast International (2.2pc), Infigen Energy (1.8pc)

Elizabeth Redman 1.02pm: Lenders cut rates as property slows

Some 30 lenders have cut their home loan rate for owner occupiers since the start of October as banks and financiers compete more fiercely in the slowing property market.

And 70 lenders are offering a headline rate of less than 4 per cent for owner occupiers paying off principal and interest.

The competition comes after bank regulator APRA moved to direct lending away from investors, riskier borrowers and interest-only loans.

The crackdown on investment lending has helped take some heat out of spiralling price growth in the east coast capitals, with Sydney housing prices dropping 0.6 per cent over the three months to October after soaring 74 per cent in five years.

Chris Griffith 12.52pm: We’re close: Amazon local boss

Amazon’s country manager for Australia has revealed that the online behemoth is on the verge of a local launch.

Rocco Braeuniger, a 43-year-old German who has experience running Amazon’s consumer business in five European countries before arriving in Australia in August, told a crowd of 600 at a seller summit in Sydney earlier today that “we are getting really close” when asked about a launch date.

Many businesses have already registered with the company to sell goods either directly or through its fulfilment scheme where it handles warehousing and mailing on behalf of sellers.

Head of Amazon Marketplace in Australia Fabio Bertola, an Italian by birth, worked on Amazon’s Italian launch. Mr Bertola noted Australia would be the 13th country that Amazon had entered following its Brazilian launch.

More to come

12.46pm: WATCH: Labour MPs’ High Court referral looms

.@samanthamaiden: The government will refer four Labor MPs to the High Court when Parliament resumes on November 27. https://t.co/Eq59EbQHb2 pic.twitter.com/i7ECY3ysVv

— Sky News Australia (@SkyNewsAust) November 13, 2017

12.32pm: Vocus director Holman resigns

Vocus non-executive director Christine Holman has resigned effective immediately.

VOC last $2.97

Bridget Carter 11.54am: Bay-based Credible eyes $300m float

Credible Labs has priced its initial public offering at $1.21 per share, taking its overall market value to $306.2 million.

The San Francisco-based financial technology company was founded five years ago by former JP Morgan banker Stephen Dash and is an online consumer finance marketplace that allows shoppers to compare financial products.

It plans to sell 13.1 million shares by way of Chess Depositary Interests (CDIs) for the offer, raising $67.8 million.

Proceeds will be used to pay out shareholders and for technology and platform development.

Credible Labs began its roadshow on Friday and it will wind up by the end of the week.

More to come from DataRoom

11.05am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

11.15am: Daniel Hynes — Senior Commodity Strategist, ANZ

11.45am Live cross — Shaw and Partners

12.00pm: Tony Davidson from Henderson Maxwell guest hosts

12.00pm: Joe Mayger — Lakehouse Capital

12.15pm: James King — AFEX Australia

(All times in AEST)

Ben Wilmot 10.58am: Property in motion on bank HQ shift

Australia’s top banks are shifting their headquarters into glittering new skyscrapers along the eastern seaboard, setting commercial property markets alight at a time when they are also dramatically overhauling their workforces.

Moves by the big four — National Australia Bank, Commonwealth, ANZ and Westpac — and lesser lights including Suncorp are also driving the construction of major new towers in Sydney, Melbourne and Brisbane.

10.48am: Adelaide Brighton warns of $14m underpayments

Adelaide Brighton says it is investigating potential deliberate underpayments by customers over a sustained period to which the company attributes a $14m negative impact on FY17 earnings (EBIT).

Adelaide Brighton has reported this matter to its auditors and has pledged to co-operate with relevant authorities as the investigation proceeds.

Excluding the one-off impact, the company has confirmed it expects FY17 EBIT to fall between $188 million and $198 million.

ABC last up 0.5pc on $6.38.

10.38am: Great Boulder hits copper, nickel, cobalt

Shares in Great Boulder surge to an all-time high of 27.5 cents after the minnow miner hit broad zones of shallow copper-nickel-cobalt mineralisation at its Mt Venn project.

Initial assay results from its first nine holes drilled reveal mineralisation comprised of 4.3 per cent copper and 0.1 per cent cobalt, the miner yet to receive results from its remaining 12 holes drilled.

GBR last up 19.6pc at 27.5 cents

10.25am: ASX falls as ex-div banks weigh

The S&P/ASX 200 index falls 0.2 per cent at the open to 6015.6 as losses in heavyweight banks ANZ and Westpac trading ex-dividend weigh on the local bourse amid a broader slowdown in global markets.

SWING STOCKS

+ Syrah Resource (3pc), Asaleo Care (3pc), a2 Milk (2.8pc), Nine Entertainment (1.7pc)

— Iress (5.5pc), REA Group (2.1pc), Incitec Pivot (1.6pc), Altium (1.5pc)

10.18am: Westpac shuffles exec deck

Westpac chief risk officer Alexandra Holcomb will retire in 2018 after a 21-year tenure at the bank.

Royal Bank of Scotland chief risk officer David Stephen has been appointed as Ms. Holcomb’s replacement.

WBC last $33.24

10.08am: Nine sees earnings in top tier

At its annual general meeting currently underway, Nine Entertainment says it expects its FY18 earnings (EBITDA) in the upper end of the $186m-$207m consensus analyst forecast range.

NEC last $1.50

10.06am: WATCH: Nine turns eyes to ad market

10.00am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: John Milroy from Ord Minnett and Mathan Somasundaram from Blue Ocean Equities guest host

10.00am Alex Leyland — Leyland Private Asset Management

10.30pm: Tano Peiosi — Antares Capital

11.00pm: Ben Le Brun — OptionsExpress

(All times in AEST)

David Crowe 9.56am: Turnbull in horror poll slump

Malcolm Turnbull has suffered a horror slump in support as the citizenship crisis engulfs parliament, with voters slashing his lead as preferred prime minister at the same time as he faces new threats to his authority and signs of cabinet division over his leadership.

Voters have delivered a damaging blow to Mr Turnbull’s standing as preferred prime minister, cutting his rating from 41 to a new low of 36 per cent and narrowing his lead over Bill Shorten to just two percentage points.

9.47am: ASX limbo as global markets cool

Local shares eye a steady open, ASX200 futures tip a 1 point fall at the open to 6,031 after Wall Street’s run of record highs wavered in its first weekly loss since September.

The S&P500 index closed down 0.2 per cent for the week.

“The macro backdrop is that we are at an elevated risk of a pullback,” says IG chief market strategist Chris Weston, “emerging markets have started to underperform a touch.”

“The poster child of everything to do with US tax reform, the Russel index, has been falling, as has the Dow Industrial.”

“There have been a few red flags that tactically we can start looking at a bit of pullback. But of course we have to wait for the price action to respond.”

In a seasonally weak month for Australian shares, ANZ and Westpac are poised as the next heavyweight banks to trade ex-dividend at the open.

Local investors remain tuned in to RBA Deputy Governor Guy Debelle’s speech currently underway at a UBS conference this morning, while monthly China activity data from China due tomorrow will give a leading market indicator of demand from our largest trading partner.

Index last 6029.4

Michael Roddan 9.23am: Fund pushes for CBA board spill

The $3 billion superannuation fund First Super is running a backroom campaign to convince the $500bn union-and-employer-backed industry fund sector to spill the board of Commonwealth Bank at its shareholder meeting this week.

The bank, which holds its annual general meeting on Thursday, faces the threat of a “second strike” against its proposed salary packages for its more senior executives and board members this year, after 51 per cent of shareholders voted against the previous year’s remuneration report. A letter obtained by The Australian, sent by First Super chief Bill Watson to Stephen Rowe, chief executive of the $9 billion Vision Super fund, urges him to use his shares to vote against CBA’s “opaque” remuneration structure and send a message to the lender over its “egregious” mismanagement, which has led to allegations it breached anti-money-laundering legislation more than 53,000 times, the CommInsure life insurance scandal and the CBA Financial Planning debacle — read more

CBA last $80.85

9.12am: Data misses the point: RBA’s Debelle

James Glynn writes:

The outlook for business investment is looking up in Australia, with the full extent of expansion in the booming services sector not being fully captured in official data, said Guy Debelle, Deputy Governor at the Reserve Bank of Australia.

The environment for investment has also improved after estimates of activity in mining in recent years were recently revised higher, Mr Debelle said in a speech to a business conference.

“There have been signs of life in investment spending outside the resources sector. It now appears that there has been a solid upward trajectory in non-mining business investment over the past couple of years,” he said — read more

Dow Jones Newwires

9.05am: Aurizon confirms Wiggen coal port interest

Aurizon has confirmed speculation that it is in talks with a number of parties in relation to a potential acquisition of Wiggins Island Coal Export Terminal.

Aurizon says it “sees strategic alignment with the acquisition” given its rail infrastructure and train haulage services for coal customers in Queensland’s Bowen Basin — read more

AZJ last $5.22

8.53am: Lindsay Tanner joins Suncorp board

Former Labour finance minister Lindsay Tanner has joined the Suncorp board as a non-executive director.

Before his tenure in Rudd and Gillard administrations, Mr. Tanner’s career began as a personal injuries lawyer and has since assumed roles in mergers and acquisitions advisory, fintech, life insurance and cyber security businesses after his time in government.

“Lindsay brings a wide range of relevant public and private sector experience in financial services with an acute appreciation of the technological, regulatory and political changes shaping the industry”, said Suncorp chairman Dr Ziggy Switkowski.

Sun last $14.05

8.51am: Analyst rating changes

REA Group cut to Sell — UBS

Coca-Cola Amatil raised to Neutral — JPMorgans

Suncorp cut to Hold — Bell Potter

Integrated Research cut to Sell — Bell Potter

Johns Lyng Group initiated at Buy — Bell Potter

BWX initiated at Buy; $7.61 price target — Shaw & Partners

Motorcycle Holdings cut to Hold — Morgans Financial

Bridget Carter 8.43am: Tandem float sets course

Tandem Group Holdings has set the price range for its initial public offering at between $2 and $2.17 per share.

The subcontractor workforce manager will raise between $155m-$168m based on a 60 per cent sell down by owner IFM and other founders and shareholders.

Read more from DataRoom

Eli Greenblat 8.35am: Lew’s Myer spat dealt second blow

Solomon Lew has been dealt a second blow in his bid to eject three Myer directors at the annual general meeting, after another proxy adviser recommended supporting the re-election of all directors.

Proxy advisory service CGI Glass Lewis also said the close relationship between Mr Lew and his nominees for the Myer board was “troubling” — read more

MYR last 72 cents

Scott Murdoch 8.30am: ‘Nation must remain open’

Australia’s top deal-makers have encouraged Australia to remain open to foreign investment and avoid protectionist policies to drive the country’s growth prospects and help companies deliver earnings growth.

In a roundtable interview hosted by The Australian, bankers and lawyers said Australia must not follow the emerging anti-globalisation trend that could put inbound capital flows at risk.

The group said international investors were asking about Australia’s ongoing political uncertainty, driven by the citizenship dramas and the bank tax, but were confident it had not yet damaged the country’s reputation.

8.25am: Tax doubts cushion gold

Renita D. Young and Peter Hobson write:

Gold prices have turned lower as US Treasury bond yields rose, but losses were limited by weaker stock markets and the US dollar, which fell due to uncertainty over US tax reform.

A rise in US bond yields pressures gold by reducing the attractiveness of non- yielding bullion, while a weaker dollar makes bullion cheaper for holders of other currencies.

“A higher yield tends to increase the cost to carry gold, and we had a little uptick in the yield curve slope,” said Bart Melek, head of commodity strategy at TD Securities in Toronto.

Two-year yields were at a nine-year high as traders closed out curve-flattener positions and dealers reduced their holdings of longer-date debt following this weeks auctions.

Spot gold was down 0.7 per cent at $US1,275.60 an ounce by 1.55pm Friday EST (0555 Saturday AEDT). It touched $US1,288.34 on Thursday, its highest since October 20 and was on track for a 0.5 per cent weekly rise.

Reuters

7.35am: Flat start tipped for local bourse

The Australian sharemarket looks set to open flat following a mainly negative mood across international markets with investors concerned about US tax reform. At 7am (AEDT), the share price futures index was down one point, or 0.02 per cent, at 6,031.

In the US, Europe, Asia equity markets were down, with the exception of China’s major bourses, as investors became worried about the future of promised US tax reform including slated corporate tax cuts.

US Senate Republicans released a tax plan on Thursday that differed from a version put forth by the House of Representatives on several key fronts, including putting off corporate tax cuts for a year.

The Dow Jones Industrial Average on Friday fell 0.17 per cent and the S&P 500 slipped 0.09 per cent.

Locally, in economic news on Monday, Reserve Bank of Australia deputy governor Guy Debelle is slated to speak at the UBS Australasia Conference in Sydney. The Australian Bureau of Statistics is due to release September lending finance data, and the CoreLogic capital city house prices survey for the week just ended is due out.

In equities news, Elders is expected to release its full-year results while Nine Entertainment, Medibank Private, and Breville Group hold their annual general meetings.

The Australian market on Friday closed lower after losses concentrated in mining and energy stocks ended the market’s run of recent gains.

The benchmark S&P/ASX200 index fell 20 points, or 0.33 per cent, to 6,029.4 points The broader All Ordinaries index lost 18.1 points, or 0.3 per cent, to 6,104.3 points.

Meanwhile, the Australian dollar is lower against a US dollar that has weakened on investor concern that pledged US tax cuts may be delayed. The local currency was trading at US76.61 cent at 7am (AEDT), from US76.87c on Friday.

AAP

6.45am: Dollar dips against greenback

The Australian dollar is lower against its US counterpart which itself has slipped, along with equities, amid concern over President Donald Trump’s planned tax reform.

At 6.35am (AEDT), the Australian dollar was worth US76.61 cents, down from US76.87c on Friday.

Westpac’s Imre Speizer says US bond yields rose, and equities and the US dollar weakened slightly amid continuing uncertainty about the content and timing of US tax reforms.

“The US dollar index closed down 0.1 per cent on the day, (while the) AUD slipped from 0.7695 to 0.7654,” he said in a Monday morning note. “US consumer sentiment (Michigan Univ.) fell from 100.7 to 97.8 (vs. 100.8 expected). Inflation expectations for one year ahead rose from 2.4 per cent to 2.6 per cent, while five-year to 10-year expectations were unchanged at 2.5 per cent,” he added.

The main local event risk for the Australian dollar would be Reserve Bank of Australia deputy governor Debelle speech on Business Investment in Australia, in Sydney on Monday morning.

He expected the local currency to remain “stuck in a two-week old range between 0.7625 and 0.7730”.

The Aussie dollar is also lower against the yen and the euro.

AAP

6.32am: Wall Street ends week broadly flat

Wall Street closed marginally lower on Saturday, with investors worried about the future of promised corporate tax cuts following duelling plans unveiled by Republican politicians.

The S&P 500 and the Dow Jones Industrial Average ended the week lower for the first time in nine weeks.

US Senate Republicans released a tax plan on Thursday that differed from a version put forth by the House of Representatives on several key fronts, including putting off corporate tax cuts for a year.

Expectations of lower taxes, one of President Donald Trump’s key campaign promises, have helped drive the S&P 500 up 20 per cent since the 2016 presidential election.

Failure to cut corporate taxes would increase concerns about Trump’s ability to pass legislation and could shake markets that have been banking on lower tax rates to boost company earnings.

The Dow fell 0.17 per cent to end at 23,422.21, and the S&P 500 slipped 0.09 per cent to 2,582.30 but the Nasdaq Composite edged up 0.01 per cent to 6,750.94.

6.24am: European markets turn south

British shares could not shake a downbeat mood on Friday and suffered their biggest weekly drop in two months as retail stocks continued to weigh, with Burberry and Bunzl leading losses.

Britain’s FTSE 100 was down 0.68 per cent at 7,432.99, sliding for the second day alongside broad weakness in European trading. It ended the week with its heaviest loss in two months.

Industrials and construction stocks piled pressure on the index, tracking a slide in these sectors across Europe. They have been among the strongest drivers of stock market gains in the past months.

European shares suffered their worst week in three months, as a slowdown in earnings growth and jitters in bond markets spurred profit-taking in a market that remains close to two-year highs.

The STOXX 600 fell 0.4 per cent, weighed down by weaker industrials, one day after suffering its biggest one-day loss since the end of June. The pan-European index ended the week down 1.9 per cent, its biggest weekly loss since mid-August, but remains up 7.5 per cent for the year to date. Germany’s DAX fell 0.42 per cent to 13,127.47.

AAP

6.14am: Citizenship drama may weigh on stocks

The citizenship saga engulfing the federal parliament may drag the local share market lower at Monday’s open, despite a flat lead from Wall Street. The US market was barely changed on Friday, with the S&P 500 closing 0.1 per cent down, suggesting a flat start to Australian trade this week. However, AMP Capital chief economist Shane Oliver says citizenship developments on the weekend — such as the resignation of Liberal MP John Alexander due to dual-citizenship — may mean local shares fall slightly instead. “You can’t rule out a bit more of a fall because of the increase in political uncertainties in Canberra,” he told AAP.

“It’s probably the main risk at the open tomorrow, because we’re now getting close to the point where the government might lose its majority in parliament.” The Australian Bureau of Statistics (ABS) will release the wage price index for the September quarter on Wednesday, and October jobs data on Thursday. There could be good news on the wages front, Dr Oliver said, with 0.7 per cent growth expected for the quarter — bringing year-on-year growth to 2.2 per cent — after the national minimum wage rose by 3.3 per cent from July 1. On the jobs front, Dr Oliver said the consensus forecast is for jobs to have risen by 18,000 in October, with the unemployment rate remaining at 5.5 per cent.

Local investors are also anticipating the release of monthly business confidence data on Tuesday and consumer confidence data on Wednesday.

Internationally, US retail sales figures and inflation data will come out on Wednesday and Chinese economic activity data on Tuesday.

The Australian share market closed lower on Friday, with the benchmark S&P/ASX200 index down 0.33 per cent to 6,029.4 points.

However that index, which passed through the 6,000 point market on Tuesday, finished 1.2 per cent higher for the week.

AAP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout