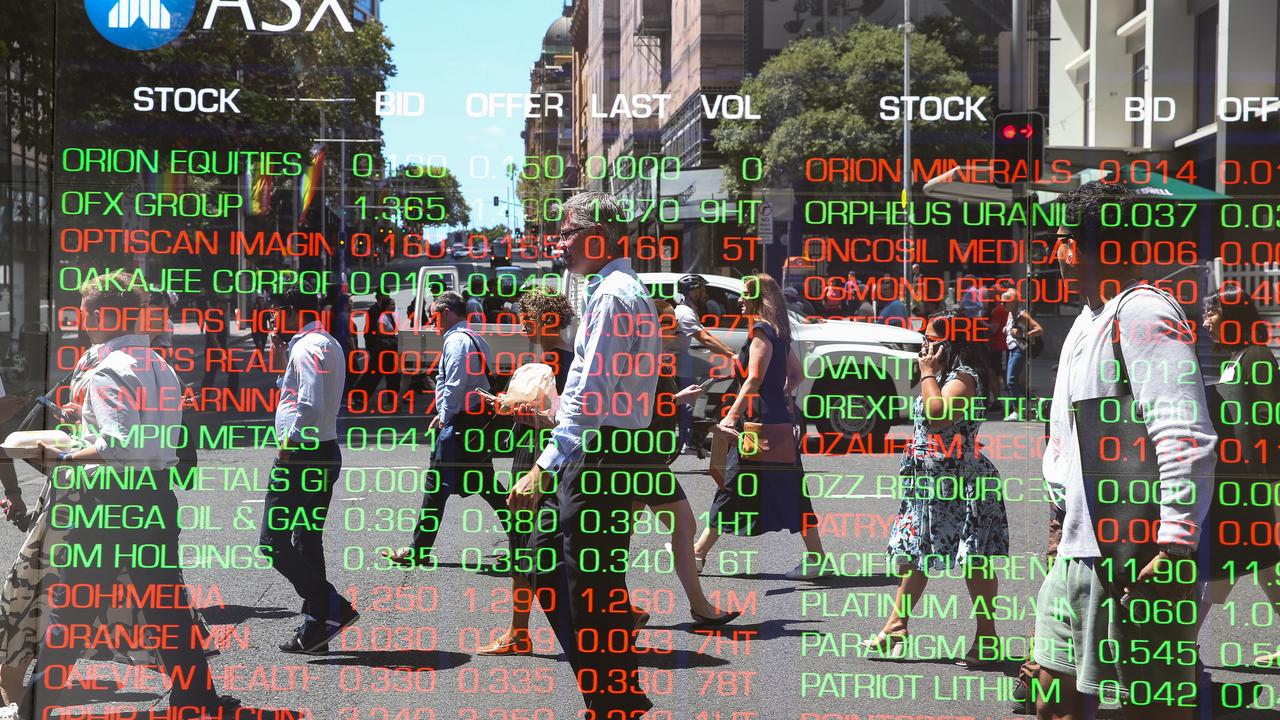

Trading Day: live markets coverage; Local market in $60bn meltdown; plus analysis and opinion

The FTSE 100 is down 1.9 per cent, while French and German markets opened down 3 per cent as market carnage continues.

That’s it for the Trading Day blog for Tuesday, February 6.

10.49pm: British shares hit 13-month low

Britain’s major share index has sunk to a 13-month low as a violent global sell-off in stock markets and spike in volatility shook investors. London’s FTSE 100 was down 1.9 per cent at 7,197 points by 2100 AEDT, having sunk to its lowest level since December 2016 in early deals. It was set for its worst daily fall in 10 months as investors rushed out of equities, which have surged since the start of the year.

“There’s a sense of relief that we finally have a meaningful correction, it’s long overdue. We have been positioned for it for a while, so we can actually breathe again,” said Christopher Peel, chief investment officer at Tavistock Wealth.

“This type of price action, where you have a correction as severe as it has been, is a great reminder to investors, traders and regulators that it’s not all a one way bet,” he added.

The stars of the past months’ rally were the worst fallers on Tuesday. Financials led the slide, taking 33 points off the index. HSBC, Prudential, Lloyds and Standard Chartered fell 2.0 to 2.6 per cent.

Asset managers also featured prominently among the worst-performing stocks as the global markets ‘melt-up’ reversed.

Investment trust Scottish Mortgage tumbled 4.8 per cent as the sell-off in US tech stocks took its toll on the fund, whose top holdings include Amazon and Tesla.

Asset managers Standard Life Aberdeen and Schroders and retail investment platform Hargreaves Lansdown fell 2.7 to 3 per cent.

Hedge fund firm Man Group was the biggest weight on the FTSE 250, its shares tumbling 4.7 per cent.

Oil majors BP and Royal Dutch Shell also took a sizeable chunk out of the index as the rout in equities sent crude prices tumbling.

Europe’s main bourses — Germany’s Dax and the Cac 40 in France — started down by as much as three per cent in early trading, leaving investors with little option but to seek the traditional refuges of gold.

Samantha Bailey 7.53pm: Global rout claims local shares

The local share market plunged more than three per cent Tuesday, wiping $60 billion off the sharemarket in one of the biggest falls in more than two years.

At the close of trade, the benchmark S & P/ASX200 was down 192 points or 3.2 per cent at 5833.3 points. The broader All Ordinaries index was down 198.2 points or 3.2 per cent, at 5930.2 points.

Falls in markets across the region continued following Friday’s sell off in the US bond market and accelerated after US futures came online, trading lower with those in the Dow down 2.5 per cent in late Asia trade.

The local volatility index soared 7 points to 22 per cent.

The Nikkei 225 was down 6.4 per cent while the Shanghai Composite was down 2.8 per cent at 4.15pm (AEDT).

“What we know from studies is that once volatility begins, it’s likely to continue so Australian investors haven’t seen the end of this by any means and those US futures pointing for further significant falls to come over the days and weeks ahead,” said CMC Markets chief market strategist Michael McCarthy.

Mr McCarthy said that while markets in the Asia-Pacific region have plummeted in-line with global markets, he expects the region to outperform in the sessions ahead, due to strong global growth prospects and the fact that the local bourse was not exhibiting the same exuberance on display in US markets.

7.52pm: Hong Kong closes down 5pc

Hong Kong stocks crumbled more than five per cent on Tuesday, making it one of the worst performers on a painful day for Asian markets after a record-breaking collapse on Wall Street fuelled by concerns over rising US interest rates.

The Hang Seng index dived 5.12 per cent, or 1,649.80 points, to end 30,595.42 — its biggest close since the China-fuelled sell-off in August 2015.

AFP

7.15pm: European stocks slump at open

Europe’s stock markets have tumbled by more than 3 per cent in opening deals on Tuesday, as a fierce global sell-off — rooted in fears of rising US interest rates — showed no sign of abating.

London’s FTSE 100 index sank 3.5 per cent to 7,080.61 points, compared with the closing level on Monday. Elsewhere, the Paris CAC 40 dived 3.4 per cent to 5,104.28 and Frankfurt’s DAX 30 lost 3.6 per cent to 12,232 points.

AFP

6.40pm: Bitcoin dives below $US6,000

Bitcoin fell below $US6,000 on Tuesday, extending a steep slide that has wiped out over $US200 billion of its market value in nearly two months.

The digital currency’s price slid as low as $US5,995.58, according to research site CoinDesk. It has fallen 70 per cent since reaching a record high of near $US20,000 in December, a drop that’s intensified in recent weeks following a global regulatory crackdown on the cryptocurrency market.

Dow Jones — Read more

6.31pm: Malaysia, Singapore to link markets

Malaysian and Singaporean regulators said Tuesday the two countries will establish a link to connect their stockmarkets by the end of the year to cut trading costs and woo cross-border investments. The ‘Malaysia-Singapore Connect’ will allow investors to trade and settle shares listed on each other’s stock market in a more convenient and cost efficient way, benefiting retail investors, the Monetary Authority of Singapore and the Securities Commission Malaysia said in a joint statement.

The initiative might be expanded later to include other stock markets in the region, the statement said.

AP

6.16pm: Oil lift buoys BP’s book

British energy major BP said Tuesday that 2017 net profits rocketed to almost $US3.4 billion, boosted mostly by a recovery in the crude oil market.

Earnings after taxation for the full year compared with $115m in 2016, BP said in a statement, adding that “the results primarily reflected higher oil prices”.

AFP

6.05pm: Chinese markets take 3.4-5.3pc hit

Major Chinese stockmarkets have closed down between 3.4 per cent and 4.4 per cent lower after sharp falls on Wall Street spread to Asian markets on Tuesday. The Shenzhen Composite

Index closed down 4.4 per cent, while the ChiNext Index finished the session 5.3 per cent in the red and the main Shanghai Composite Index ended the day down 3.4 per cent at 3370.65

5.57pm: Stock rout speads to Asia

Asian stock markets fell sharply Tuesday, building on the heavy selling in the US a day earlier but the picture brightened a little with late-session trading.

Japan’s Nikkei Stock Average for a time was on pace for its biggest one-day point drop since 1990. Instead, it merely logged its largest such decline since the UK voted to leave the European Union in June 2016 with a 4.7 per cent loss.

Meanwhile, S & P 500 futures rose nearly 60 points in an hour, pulling off their lows. They were recently down just 1.1 per cent, compared with a loss of almost 3 per cent earlier.

Taiwan’s Taiex slumped 5 per cent, the most in six-and-a-half years, while other indexes in the region were down 3 per cent to 4 per cent. Korea’s Kospi held up, falling just 1.5 per cent with heavyweight Samsung shedding 1 per cent following the release of the company’s de facto leader from prison.

Oil futures fell 1 per cent in Asian trading, putting Brent futures below $US67 a barrel. Bitcoin briefly slumped below $US6,000, after sitting at $US10,000 on Thursday.

Dow Jones — Read more

5.38pm: Tokyo’s Nikkei slides 4.7pc

Tokyo’s benchmark index lost nearly five per cent Tuesday as investors took their lead from a sell-off on Wall Street, while a surging yen hit exporters.

The benchmark Nikkei 225 index closed down 4.73 per cent or 1,071.84 points at 21,610.24, after diving more than seven per cent earlier.

It was the worst single-day fall in percentage points since the November 2016 election of US President Donald Trump.

The broader Topix index slumped 4.40 per cent, or 80.33 points, to 1,743.41.

AFP

5.15pm: Wall St on track for more sharp falls

US stock futures are pointing to more sharp losses when Wall Street opens in the early hours of Wednesday (AEDT), on the heels of a more than 1,100-point plunge for the Dow Jones Industrial Average, its worst one-day point drop in history. In extremely volatile trading, Dow futures plunged 447 points, or 1.9 per cent, to 23,486. S & P 500 futures dropped 17.95 points, or 0.7 per cent, to 2,588.50. Nasdaq-100 futures eased 12.5 points, or 0.2 per cent, to 6,406.50.

Dow Jones

4.12pm: Investors hit $60bn in market meltdown

The S & P/ASX200 index closes down 3.2pc, or 192 points on 5833.3, erasing $60bn from the sharemarket in its biggest fall since September 2015.

The broader All Ordinaries index closes down 3.2pc, or 198.2 points on 5930.2.

Read: Local stocks lumber to finish line

4.08pm: FTSE futures tip 6pc slide

London shares are likely to spiral Tuesday, with futures for the FTSE 100 down 378 points or nearly 6pc.

Dow Jones Newswires

4.04pm: Investors enter into damage control

Capital preservation is now the number one priority in global financial markets, according to Saxo Bank chief economist Steen Jakobsen.

After the market meltdown in equities and explosion volatility last night he recommends long JPY, gold and US Treasury bonds.

“All of it comes down to a simple rule of thumb — as long as the market is not down more than 5-6 per cent over two-three days, the market will be fine and volatility will tail-off,” he says.

“However should the market be down more than 6-7 per cent on consecutive closes it will mean everyone needs to start hedging.”

In his view risk has been allocated relative to volatility, with less volatility increasing risk taking in recent years, but “now the opposite is occurring”.

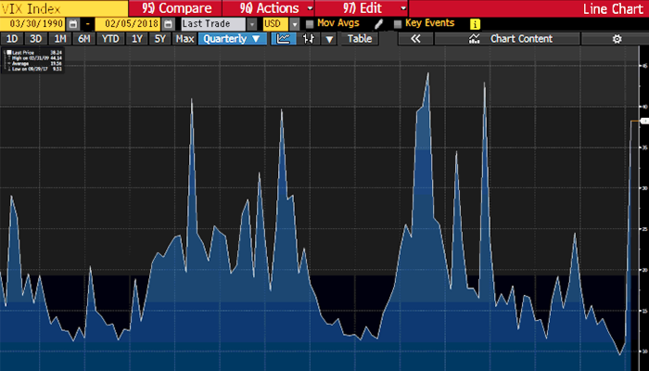

Surging volatility — the VIX jumped from 17pc to a 2.5-year high of 37pc — will force risk-parity funds to hedge their risk and therefore sell shares.

The next “event risk” in his view is the reaction from central banks who last week falsely “believed they were moving to Nirvana with higher inflation and growth, reality is now testing this.”

“Overall remember China is slowing dramatically, the US business cycle is peaking in 1Q 2018, Europe’s business cycle will peak in Q2, and Japan has just started its upside cycle lagging all of the above by 9-12 months.

“Hence valuation risk is mainly in the US and China, while Europe and Japan offer relative value.”

3.44pm: Nikkei extends losses to post-1990 record

Nikkei extends losses to 6.7pc, or 1,500 points, its biggest point drop since 1990.

Dow Jones Newswires

3.36pm: Local stocks lumber to finish line

The S & P/ASX200 hits a new daily low in late trade, last down 3.5 per cent at 5815.4 heading for its worst one-day performance in over 2 years (Brexit inclusive) and erasing $62bn in value from the sharemarket.

A horror Wall Street session overnight saw the Dow’s close down over 1,179 points, its worst ever points fall on record following on from a pullback last week, US wage data raising the spectre of overheating in the world’s largest economy.

US futures tips yet another fall in the coming overnight session, Asia trade sees those in the Dow down another 3.4pc.

Investors in peer regional markets take shelter: the Heng Seng down 4.9 per cent, Shanghai Composite down 2.2 per cent and the Nikkei in a 5.6 per cent slump as investors serve the export-driven economy a double dose by scooping up safehaven yen.

Blanket losses plague the local bourse, however property, gold and peer defensive stocks contain losses as yield on fixed-income alternatives drop, cash steaming toward the asset class.

Meanwhile the Aussie dollar trades 0.5 per cent lower on US78.43 after December retail sales data disappointed and traders saw a dovish line to RBA rhetoric in statement accompanying a February hold to its cash rate at 1.5 per cent.

Adam Creighton 3.11pm: Fall may be blessing in disguise

If ever there was a time to breathe a sigh of relief following a stock market mini-crash, this must be it.

Share prices, especially in the US, had got entirely out of whack with economic reality. And they still are. Even following the recent downward correction over the past couple of days, the US S & P500 is still an extraordinary 37 per cent higher than it was just two years ago.

Now, what in your life has gone up 37 per cent over the past two years? Perhaps you power or child care bills, but that’s about it. Americans wages have practically gone sideways too. Even in Australia, by the end of today’s “bloodbath’’, share prices, represented by the benchmark ASX200 index, are on track to be almost 20 per cent higher than they were in February 2016.

2.49pm: Bitcoin slumps 13pc below 200 DMA

Bitcoin has slumped over 12 per cent to $US6,265, below its 200 day moving average in a bearish move to chart watchers.

Crypto peer Ethereum similarly slumped 14pc to $US614, while Ripple is down 11 per cent to US61.6c.

2.30pm: RBA leaves cash rate on hold

The Reserve Bank of Australia has left interest rates unchanged at a record low of 1.5 per cent. The widely-expected decision comes after mixed signals on the domestic economy over recent weeks.

Business confidence and conditions remained solid along with employment growth but inflation stayed below target, unemployment rose from a five-year low, retail sales dived after a surprising jump, building approvals fell sharply and home prices in Sydney and Melbourne dipped.

2.21pm: ASX meltdown: the victims and heroes

Stephen Bartholomeusz 2.14pm: Markets’ multi-trillion dollar question

As the turmoil in US equity markets intensifies there’s an obvious multi-trillion-dollar question as to whether we’re watching a correction in markets that have been on a remarkable tear since Donald Trump’s election success, or something more structural.

While the sell-off of stocks that started in the US last Friday accelerated overnight, with the 4.6 per cent fall in the Dow Jones index and 4.1 per cent drop in the S & P 500 index wiping out all of the gains that had been made in a euphoric start to this year, the US market is still more than 15 per cent ahead of where it was a year ago.

Annabel Hepworth 1.55pm: Market serves Qantas air pocket

Qantas Airways shares have been caught in the downward plunge on the sharemarket today,

Shares in the national carrier opened at $5.14, after closing at $5.31 yesterday.

Shares had reached $6.45 in October, but since then the airline has faced rising oil prices and has been taken off the MSCI Australia index.

Of course it’s nowhere near the lows of $1.06 in late 2013.

QAN last down 2.5pc on $5.18

Matt Chambers 1.34pm: Gold stocks shine glimmer of hope

Resources stocks are getting hammered, along with the rest of the market. With the exception of gold miners of course, who are holding firm because of the precious metal’s safe-haven status.

Investors had been piling into mining and energy stocks this year, sending stock prices soaring. So the sectors are exposed to any market correction, with investors inclined to lock their recent gains. And if global growth looks at risk, even more so.

BHP is off 2.6 per cent, Rio Tinto off 0.2 per cent and Fortescue off 0.3 per cent.

South 32 is down 2.7 per cent, Whitehaven Coal is off 3.1 per cent and Yancoal is down 6.3 per cent.

In the energy stocks, Woodside is off 3.4 per cent, Santos down 3.9 per cent, Origin Energy off 5.2 per cent and Beach Petroleum is down 6.6pc.

It looks like a bloodbath, but only in comparison to last week. Most resources stocks were trading near multi-year gains and despite this week’s losses are so far much higher than they were six months ago.

In the gold miners, Newcrest is off 0.4 per cent, Northern Star is up 1.2 per cent, Resolute is up 1 per cent and Evolution is up 0.4 per cent.

1.19pm: Risk aversion, safehaven plays spike

Risk aversion has ramped up dramatically in afternoon trading.

US stock index futures dived more than 2pc after rising more than 1pc this morning.

Gold spiked along with JPY and US bond yields dropped as money flows to safe havens.

Australia’s S & P/ASX 200 share index fell as much as 3.4pc and AUD/USD hit a new 3-week low of 0.7855.

There have been no new developments here apart from the US meltdown spilling over to Asia.

The Hang Seng is down 3.6pc, China’s Shanghai Composite is down 2.1pc and Japan’s Nikkei 225 is down 5.5pc on track for its worst fall in four years — a higher currency tends to hurt demand for equities in the export-driven nation.

Scott Murdoch 1.07pm: Rate hikes Macquarie’s silver lining

Macquarie chief executive Nicholas Moore believes the US bond rate rises and the associated financial market volatility are unlikely to create major problems for the investment bank

Macquarie today said its full year profit should be up to 10 per cent higher for the 2018 full year, which finishes at the end of March, compared to the $2.2 billion profit recorded last year.

Mr Moore said higher interest rates around the world could be a positive for Macquarie.

“If you look at what is driving interest rates ... and that is synchronised economic growth that is generally a positive story for Macquarie overall,” he said.

The bank also revealed today its US effective tax rate would fall by 25 per cent once the Trump administration’s tax cuts come into effect.

12.56pm: New ASX lows as US futures slump

Australia’s S & P/ASX 200 has fallen down 3.3pc to a new 4-month low of 5827.5 in early afternoon trading, on track for its worst fall in over two years and wiping off more than $58bn in value from the sharemarket.

US futures have turned sharply negative, those in the Dow Jones Industrial Average down 2.3pc.

BHP is doing most of the additional damage this afternoon as it falls 3.5pc to a new 6-week low of $29.09.

The miner has decisively broken its 50-DMA at $29.34 and should now test its 100-DMA at $28.07.

12.43pm: Hong Kong shares sink 4pc

Hong Kong shares plunged almost four per cent in the opening minutes of trade on Tuesday as global markets are routed following months of strong gains.

The Hang Seng index dived 3.77 per cent, or 1,216.54 points, to 31,028.68. And the benchmark Shanghai Composite Index fell 1.99 per cent, or 69.49 points, to 3,418.01, while the Shenzhen Composite Index, which tracks stocks on China’s second exchange, dropped 1.95 per cent, or 35.22 points, to 1,771.08.

David Swan 12.32pm: Atlassian erases $US330m after-hours

Australian companies haven’t been spared from the US market rout, with about $US330 million wiped off the valuation of Sydney software giant Atlassian in Wall Street’s after-hours trading.

Atlassian, which has a larger market capitalisation than Qantas, is listed on the tech-heavy NASDAQ and closed the day at $US51.23, before dropping over 3 per cent to $US49.50 in after hours trading.

The NASDAQ is down 0.39 per cent overall in after hours trading.

Atlassian is still way up on its 1-year low of $US27.68, and is widely rated as a ‘buy’ stock. In January the company sharply widened its second-quarter loss as it took a hit from US tax reform, but delivered better-than-expected revenue growth.

And, as The Australian reported today, Atlassian co-founder Scott Farquhar has called on the federal government to introduce a visa for highly skilled foreign workers who can help generate jobs in Australia.

“We should make a new category of people from overseas who could help generate jobs of the future here,” he said yesterday.

12.11pm: Asia-Pacific bears meltdown selling

Australia’s S & P/ASX 200 share index is down 2.6 per cent at 5872 after surging volatility triggered a near meltdown on Wall Street.

In regional markets, Japan’s benchmark Nikkei 225 is down 4.7pc on 21617 and South Korea’s Kospi remains down 2.5pc on 2428. China markets are due to open at 12.30pm (AEDT).

US futures in Asia trade remain lofty, all three of Wall Street’s benchmark indices up near 0.3 per cent indicative of a recovery.

While yesterday’s 1.6 per cent fall was relatively calm by comparison there are definite signs of panic today.

Yesterday it was mostly last year’s hot stocks that were getting creamed, as well as Wesfarmers after its writedown.

But today the majors are also suffering outsized falls, with Macquarie, Computershare and Origin more than 5pc and CSL and Boral down more than 4pc.

The panic is also spreading to the major banks and resources, with Westpac down 3.3pc and BHP down as much as 3.1pc.

The index earlier neared a major technical support from its 200-day moving average at 5847.

A common technical strategy is to buy dips to the 200-day moving average when the major trend is up, hence the support at this level.

At this rate the market could set lows today that hold for the rest of the year.

Elizabeth Redman 12.01pm: Property trusts contain losses

Australia’s largest listed property trusts have dropped amid a broader market sell-off this morning.

Real estate does, however, remain the second best performing sector on the local market after a fall in US bond yields overnight, as nervous investors sought the safety of bonds. The safe haven buying alleviated the selling of bond proxy stocks such as real estate investment trusts, for now.

Shares in shopping mall owner Westfield Corporation fell 2 per cent to $8.92 in midmorning trade, while development giant Lendlease lost 2.2 per cent to $15.41 and the nation’s largest residential developer Stockland fell 1.5 per cent to $4.02.

Office landlord Dexus fell 1.9 per cent to $9.17, retail landlord Scentre dropped 1.7 per cent to $3.99 and diversified property group Mirvac lost 1.7 per cent to $2.04.

The sell-off on Australian and global markets comes in the wake of rising bond yields, which make bond proxy stocks such as real estate investment trusts less attractive for investors.

Sarah-Jane Tasker 11.46am: Market fever claims healthcare

Australia’s healthcare stocks joined the carnage on the market today with health insurers, private hospitals and biotechs all feeling the pain.

In the private healthcare sector Nib is down 3.97 per cent to $6.28, while Medibank is 2.69 per cent lower at $3.07. Hospital group Ramsay Health Care is off 2.5 per cent at $66.60 and rival Healthscope is down 2.59 per cent to $1.88.

The market hit comes as the sector is under wide scrutiny around rising costs and affordability concerns, prompting a series of reviews from the Turnbull government and a pledge this week from Labor leader Bill Shorten to cap health insurance premium increases at 2 per cent for two years if he wins office.

The country’s biggest biotechs and international success stories are also not immune to the market jitters and CSL is down 3.7 per cent at $141.01 and ResMed has taken a 4 per cent hit and is sitting around $11.69.

Bridget Carter 11.43am: ASX arbitrates in rout

Technology stocks appear to be hardest hit and those already fully priced.

Stocks that are highly defensive are performing strongly.

11.32am: Retail miss hits Aussie at 3w low

AUD/USD hit a new 3-week low of US78.66c after retail sales and international trade data missed estimates.

December retail sales fell 0.5pc vs. a 0.2pc fall expected by economists.

December quarter retail sales volume rose 0.9pc vs. 1.0pc expected.

December international trade balance fell to a $1.358 billion deficit vs. an expected $200m surplus.

AUD/USD is now likely to test US79.19c — the 50pc retracement of the Dec-Jan rise.

Samantha Bailey 11.23am: Selloff continuation likely: Tribeca

At the stock exchange’s Sydney headquarters, Tribeca deputy portfolio manager Jun Bei Liu told The Australian the sell-off will likely continue in the days ahead, as voliatiliy increases in US markets

“We’re seeing a sell off across all sectors following the very weak lead from the US market, which was all triggered on Friday when the US bond yield was sold off,” she said.

She said the US market was in the green overnight until a sell off of ETF and systematic funds in late trade, which could mean more volatility but when that settles in a few days time, it could be a time to buy.

“Global growth is picking up, inflation is picking up so it’s all good in terms of the economic environment,” she said.

Ms Liu said she doesn’t expect the sell off to continue long term.

Supratim Adhikari 11.11am: Telcos hit in rout fallout

The listed telco sector has been caught up in the market rout, with Telstra, Vocus and TPG Telecom all opening weaker on Tuesday.

Telstra (TLS) was down 2 per cent to $3.54; Vocus (VOC) slumped over 6 per cent to $2.92 and TPG Telecom (TPM) sliding over 4 per cent to $6.07.

11.04am: Tokyo stocks plunge 3pc

Japan’s benchmark Nikkei 225 is down 3pc at 5847.7 in early trade, it too staging its worst fall since Brexit in June 2016.

This level is below its 200 day-moving-average level at 5848, a bearish signal for chart watchers.

Eli Greenblat 10.57am: Contagion extends Wesfarmers loss to $5bn

Wesfarmers took another tumble this morning, slumping off the back of the $1.3 billion in writedowns against Bunnings UK and Target announced on Monday as well as falling in sentiment with the ructions on Wall Street.

Shares in Wesfarmers were down more than 3 per cent in early trade, following a similar fall on Monday, with around $5 billion in value stripped from the Perth-based conglomerate’s market valuation in the last 24 hours.

Analysts this morning began slashing their valuations and earnings outlooks for Wesfarmers as they also begin to calculate the cost of the company deciding to sell or close down its struggling Bunnings UK chain.

WES last down 3.2pc on $40.80

10.43am: Seller flood as trading volume surges

S & P/ASX 200 shares trading volume is 78pc above average with the meltdown in the index today.

Bloomberg’s end-of-day volume projection is $9.3 billion vs. $5.1 billion for the 20 day average.

10.34am: Entire ASX200 in the red

Not one single S & P/ASX200 stock trades in positive territory now the sharemarket is fully open, the benchmark index extends losses to 2.8 per cent on 5856.9 and will book its worst fall in over two years should it close at this level.

After successive records over the last 12 months,

Transurban, Scentre and Rio Tinto book contain losses to just under 2 per cent, while Macquarie suffers the steepest fall in the bluechips by 4.5 per cent and Wesfarmers extends a two-day losing streak to 8 per cent.

Meanwhile in greater Asia trade, US futures stage a recovery with those in the Dow up 1 per cet, S & P500 futures are up 0.9 per cent and the tech-heavy Nasdaq index it tipped for a 0.8 per cent rise in the coming Wall Street session overnight.

10.23am: US futures bounce in Asia trade

US stock index futures are bouncing in the Asian time zone after the meltdown overnight.

S & P 500 futures, DJIA and Nasdaq futures are up 0.5pc.

This is an encouraging sign after the DJIA and S & P 500 held their 10-DMA’s.

Also, note that the DJIA has now had a 10pc correction, while the S & P 500 has done 8.2pc.

10.04am: ASX rout winners & losers

The S & P/ASX200 index falls 2.6pc to at the open to 5871 after Wall St extended an equity rout overnight with the Dow plunging 4.6pc.

BHP is down 2.6pc

CBA is down 1.8pc

ANZ is down 1.7pc

Brambles is down 1.6pc

GMA Group is up 0.8pc

The market continues to come online with stocks sequentially opening for trade in alphabetical order.

9.52am: Wall St rout turns nightmare

The closing bell didn’t stop Monday’s U.S. stock rout.

Dow Jones Industrial Average futures contracts continued to slide in after-hours trading Monday, extending a fall that sent the blue-chip index down 1,100 in regular trading to its biggest ever daily point decline.

Dow futures shed more than 1pc from their level at 8.00am (AEDT), according to FactSet data. They were recently down 0.8pc.

S & P futures also continued to decline, falling about 1.3pc after-hours. In regular trading, the S & P declined 4.1pc.

The VelocityShares Daily Inverse VIX Short-Term exchange-traded note, which typically falls when volatility rises, was down about 58pc in after-hours trade.

The iPath S & P 500 VIX Short-Term Futures ETF, which rises along with volatility, was up more than 27pc after-hours.

The stock rout comes after a period of market calm and economic optimism that helped U.S. indexes notch steady gains over the past year.

But in recent trading sessions, investors have grown increasingly concerned about the impact of rising bond yields and inflation. Higher yields can make it more expensive for companies to borrow, while stronger inflation could encourage the Federal Reserve to raise interest rates more quickly, which can hurt the relative attractiveness of stocks.

Dow Jones Newswires

9.23am: Wall St rout’s winners & losers

Wells Fargo & Co., down $5.91 to $58.16: the Federal Reserve froze the bank’s growth in response to a scandal over phony consumer accounts.

Broadcom Corp., down $7.38 to $228.10: the chipmaker raised its offer for competitor Qualcomm to $121 billion in cash and stock.

Bunge Ltd., up $2.29 to $80.89: Bloomberg reported that Archer-Daniels-Midland is close to a deal to buy the agribusiness and food company.

Arconic Inc., down $2.59 to $26.52: the engineered products company forecast a smaller-than-expected profit in 2018.

Church & Dwight Co., up $1.09 to $47.42: the consumer products company had a stronger fourth quarter than analysts had expected.

Corcept Therapeutics Inc., down $6.20 to $17.26: the company said Teva Pharmaceutical Industries filed for approval of a generic version of its drug Korlym.

Kirby Corp., up $2.05 to $77.75: the barge operator said it will buy Higman Marine Inc. for $419 million.

Exxon Mobil Corp., down $4.81 to $79.72: shares in energy companies fell as the price of crude oil slipped.

AP

9.19am: Behind the market plunge

Ben Eisen writes:

Stock and bond markets have convulsed in recent days, reflecting a rocky adjustment among investors to the prospect that the US economy may be reaching the later stages of its cycle.

The unemployment rate has been falling steadily for years, yet wage growth remained benign, leading many to conclude that the economic expansion had no end in sight.

That shifted a bit on Friday when data showed a pick-up in wage growth to its highest year-over-year rate since the great recession, according to Tim Duy, an economics professor at the University of Oregon.

Wage growth is typically a good thing for workers. But it’s also a sign the economy is reaching full steam. That’s when investors begin to fear that the Federal Reserve will lift rates too quickly, causing a recession — read more

Dow Jones Newswires

9.13am: Macquarie tips double-digit growth

Macquarie Group expects to lift full-year profit by about 10 per cent on last year’s record $2.2 billion.

Macquarie says trading conditions were satisfactory in the December quarter, with the net profit contribution from annuity-style businesses rising following strong performance fees from Macquarie Asset Management and growth in banking and financial services.

Chief executive Nicholas Moore says Macquarie continues to benefit from its “ability to adapt the portfolio mix to changing market conditions” — AAP

MQG last $103.36

9.02am: Wall St enters correction territory

Accelerating a global share rout, on the closing bell Wall Street’s Dow Jones Industrial Average finished down 4.62 per cent or 1,179 points at 24,342 points.

Earlier, the Dow had dropped nearly 1,600 points, marking its biggest single day points loss. In Europe, the benchmark Eurostoxx 50 was down 1.3 per cent and London’s FTSE 100 was down 1.5 per cent.

Implied volatility has hit a seven-year high, according the Chicago Board of Options Exchange’s VIX index.

Local futures trade now tips an opening 2.3pc fall on the benchmark S & P/ASX200 index after a 1.6pc fall to 6026.2 yesterday.

8.54am: Magellan swoops on Airlie, Frontier

Fund manager Magellan has acquired Australian equity house Airlie and its North American distribution partner Frontier Partners Group for a total consideration of $19 million and 4.5 million Magellan shares.

Airlie and Magellan now intend to launch an active ETF quoted on ASX named the “Airlie Industrial Share Fund”

“The partnership with Frontier and Bill Forsyth has been a real success story for Magellan, representing A$12.8 billion of funds under management,” said Magellan boss and founder Hamish Douglass,

“Bill has played a pivotal role in the development of our relationships with key institutional clients and asset consultants in North America.”

MFG last $26.92

8.51am: Analyst rating changes

Seven West raised to Buy — Morningstar

Pact Group raised to Buy — Morningstar

Sandfire cut to Neutral — Hartleys

NextDC cut to Hold — Canaccord

AGL cut to Neutral — Macquarie

Matt Chambers 8.41am: BHP pivot to save $28bn: Elliot

BHP Billiton could add $28 billion of value by getting rid of its dual-listed structure in favour of an Australian listing, according to New York activist fund Elliott, which has commissioned a report on dissolving the dual-listing by FTI consulting.

The move has the potential to raise Australian retail and institutional ownership of the nation’s biggest company from about 41 per cent now to 60 per cent, the report claims.

The report is the first substantial volley fired by Elliott — which has successfully pushed BHP into selling its US shale assets — since Ken MacKenzie became BHP chairman in October.

It has been timed two week’s before BHP’s interim results on February 20, when chief executive Andrew Mackenzie faces investors and the media — more to come.

BHP last $20.15

8.32am: Worst 1-day Dow point loss ever

The final 1175 point loss marks the worst one day fall in history. https://t.co/OzFbOndrsG

— Sky News Business (@SkyBusiness) February 5, 2018

8.21am: Volatility hits 7-year high

The Chicago Board of Optinons Exchange’s measure of volatility the VIX index has closed at its highest level in seven years at a representative 38.80pc after more than doubling throughout the overnight session.

The VIX has only closed at or above this level only once since the GFC on September 30, 2011 amid the European debt crisis.

The index measures a market estimate of future volatility based on a weighted averages of the variance implied by option contract strike prices.

7.45am: ASX to join global tumble

Australian shares look set to open sharply lower after key markets around the globe tumble, with the worst falls on Wall Street.

At 7.55am (AEDT) on Tuesday, the share price futures index was down 98 points, or 1.7 per cent, following losses yesterday on the benchmark S & P/ASX 200 index of 1.6 per cent.

Key equity markets in the US, Europe, Britain and Asia — bar China — have all declined sharply, with Wall Street the worst performer.

US stocks’ losses accelerated in afternoon trading, pushing the S & P 500 down more than 5 per cent from its January 26 record high and the Dow below 25,000 for the first time since January 4.

The Dow and S & P 500 also fell below their 50-day moving averages, while the Cboe Volatility index was on pace for its largest one-day jump since August 2015.

In late trading, the Dow Jones Industrial Average was down 806.76 points, or 3.16 per cent, at 24,714.20, the S & P 500 had lost 82.90 points, or 3.00 per cent, to 2,679.23 and the Nasdaq Composite had dropped 146.55 points, or 2.02 per cent, to 7,094.40.

Locally, in economic news today, the Reserve Bank of Australia holds its monthly board meeting and announces its interest rate decision.

The Australian Bureau of Statistics releases December retail trade figures, plus international trade in goods and services data, also for December. Meanwhile, the ANZ-Roy Morgan Consumer Confidence weekly survey is due out. No major equities news is expected.

The Australian market yesterday lost around $33 billion after a sharp fall in US markets last Friday sent local investors running for the exits. The benchmark S & P/ASX200 index fell 95.2 points, or 1.56 per cent, to 6,026.2 points while the broader All Ordinaries index tumbled 101.4 points, or 1.63 per cent, to 6,128.4 points.

AAP

7.30am: US stocks plunge further

The sell-off on Wall Street accelerated sharply, with the Dow plummeting about 1500 points, giving back much of the gains scored with last year’s US tax cut.

With under an hour of trader to go, the Dow Jones Industrial Average was down 1,481 points, or 5.8 per cent to 24,040.29, losing more than 1000 points in about an hour.

The broadbased S & P 500 dropped 4.2 per cent to 2,647.18, while the tech-rich Nasdaq Composite Index tumbled 3.6 per cent to 6,980.28.

AFP

7.15am: Dollar slides

The Australian dollar has continued to gently slide against a stronger US counterpart despite the latter pausing from its US jobs data and wages growth inspired lift.

At 6.35am (AEDT), the Australian dollar was worth US79.06 cents, down from US79.36c yesterday.

The US dollar paused after rebounding at the end of last week, when a strong jobs report suggested the currency’s weakness might have gone too far, too fast.

The US dollar index against a basket of six major currencies stood little changed at US89.175 after gaining 0.6 per cent on Friday, Reuters reported. Overnight the Australian dollar touched US78.91 cents, its lowest in three weeks following a 1.5 per cent fall on Friday. The Aussie had advanced to 81.36 late in January, its highest in more than two years.

AAP

6.45am: US sell-off deepens

US stocks continued sliding overnight as fears about rising inflation and higher government bond yields interrupted the long-running market rally.

In US afternoon trade the Dow Jones Industrial Average fell 505 points, or 2 per cent, to 25017. The S & P 500 lost 1.8 per cent and the Nasdaq Composite fell 1.3 per cent — with both indexes heading toward their first three-day declines since December.

Australian stocks are set for more steep falls, after almost $30bn was wiped off Australian shares yesterday. At 7.15am (AEDT) the SPI futures index was down 74 points.

With the recent losses, the Dow industrials are still up about 1.5 per cent for 2018 but have fallen more than 5 per cent from their all-time closing high on January 26.

After a strong start to 2018, the US stock market has stumbled as strong wage figures in the monthly US jobs report added to concerns about a pick-up in inflation and subsequent tightening of monetary policy.

On Friday, Wall Street tumbled 2.5 per cent, sparking a sell-off in Australia and Asia yesterday.

Higher yields and rising interest rates typically mean higher borrowing costs for companies and can reduce the relative attractiveness of stocks. Longer term, tighter monetary policy can crimp economic growth, which has underpinned much of the climb in stock prices over the past year. Rising inflation and a crash in the bond market were cited as the greatest tail risk for markets in Bank of America Merrill Lynch’s January fund manager survey.

“The markets are just taking a bit of a breather, which I’d argue is somewhat healthy,” said Joseph Tanious, senior investment strategist for Bessemer Trust. Data still suggest that economic growth around the world is solid and corporate profits in the US are strong, two factors that should help US stocks keep climbing, he added.

Bank shares slid, with the KBW Nasdaq Bank Index of large US lenders down 2.2 per cent and extending declines after posting its steepest loss of the year Friday.

Declines in shares of oil-and-gas companies also dragged on major indexes. The S & P 500 energy sector shed 3.2 per cent, while US crude oil declined 2.7 per cent to $US63.67 a barrel.

Meanwhile, a measure of expected swings in the S & P 500, the Cboe Volatility Index, shot higher, recently trading up 27 per cent after closing at the highest level since November 2016 on Friday.

Even with the recent rise in bond yields, many investors are confident stocks will continue to do well in 2018. Interest rates and government bond yields globally remain low by historical standards, and stocks often have risen alongside them as the economy strengthens.

Elsewhere, the Stoxx Europe 600 fell 1.6 per cent, erasing its year-to-date gains, as shares of oil-and-gas companies and real-estate firms slid.

Dow Jones

6.40am: Growth hopes buoy copper

Copper prices rose, lifted by investors’ hopes for stronger global economic growth.

Front-month copper for February delivery added 1.1 per cent to $US3.2105 a pound on the Comex division of the New York Mercantile Exchange. Prices are slightly below nearly four-year highs hit in late December, but some analysts expect the industrial metal to continue rising as the year progresses.

Base metals like copper are considered an economic indicator because they are used to construct everything from aeroplanes to smartphone. Many analysts and agencies have recently revised upward their forecasts for global economic growth this year, with some expecting commodity demand to rise as a result. Some investors have stayed long copper despite a roughly 30 per cent increase in prices since early May.

AFP

6.35am: Global markets slump

Stock markets around the world slumped overnight on growing worries over the prospect of fast-rising interest rates in the United States, dealers said.

European stock markets closed the day more than a per cent lower, although Frankfurt fared somewhat better.

Wall Street had tumbled 2.5 per cent on Friday after the release of a healthy January jobs report that showed the biggest increase in wages in nine years. That catapulted 10-year Treasury yields — a key global interest rates indicator — to fresh four-year highs.

American turmoil in turn triggered fresh losses in Asia yesterday, with traders fretting that a resurgent US economy will lead to rapid interest rate rises by the Federal Reserve.

The selling was fuelled also by profit-taking after a blistering January that saw several indexes strike record or multi-year highs, while energy firms were hit by a drop in oil prices.

“Europe is catching the virus and is aggressively lower,” said AxiTrader analyst James Hughes. “The issue with this kind of fall is that it becomes a snowball effect, and after such astronomical gains since election day 2016 the falls can be equally as aggressive, but nobody could say that a correction has not been due.”

Londonclosed down 1.4 per cent, Frankfurt ended down 0.8 per cent and Paris was 1.5 per cent lower.

AFP