Trading Day: live markets coverage; Lithium deficit death date posed; plus analysis and opinion

The ASX posts healthy gains, while risk hungry investors wean off lithium stocks as Morgan Stanley hazards a line in the sand.

And that’s the Trading Day blog for Tuesday, February 27.

James Kirby 5.21pm: The inconvenient truth of interest-only

The first item on the agenda at the banking royal commission is going to be home loans and how they have been sold in the local market.

Hopefully, Commissioner Kenneth Hayne QC also puts WHAT mortgages have been sold as high on his agenda as HOW they were sold … because the elephant in the room in our home loan market is interest-only loans.

If you are offered an interest -only loan you can borrow more and in turn pay more for a property. The bigger the loan the more money everyone in the finance system from mortgage brokers to bank executives gets to make.

In 2011 interest only loans were restricted to business owners and richer clients among the banks — they were about 30 per cent of the home loan market. Six years later in 2017 they had mushroomed on the books of the banks to become closer to 45 per cent of new loans going out the door: Roughly one in five owner occupier mortgages and perhaps 60 per cent of all investor loans were on the arrangement.

Remarkably, despite a string of Senate Inquiries into bank practices, interest- only loans in Australia had become commonplace in a very short period.

Samantha Bailey 4.27pm: Stocks share in global uplift

The local share market ended the session slightly higher amid increasing investor confidence and following strong offshore leads overnight.

At the close of trade, the benchmark S&P/ASX200 had ticked up 14.722 points or 0.24 per cent at 6056.9 points. The broader All Ordinaries index had added 13.156 points or 0.21 per cent, at 6159.3 points.

CMC Markets chief market strategist Michael McCarthy said strong leads from Wall Street and Europe pushed the market higher as well as strong support for commodity prices.

“It does look like after a period of nervousness, investor confidence is returning,” he said, “earnings reports have been very influential for the past 17 sessions and that remains the case today.”

“The local volatility index slipped again and it’s now below 13 per cent, it was a break above 12 per cent that flagged that we were potentially getting nervous on the way up, we peaked around 25 so that fall back towards 12 per cent points to that idea that confidence is on the rise.”

4.19pm: Lithium wean, deficit death date posed

Lithium prices could fall 45pc by 2021 according to Morgan Stanley, the investment banks’ analysts predicting Electric Vehicle penetration will be insufficient to offset new low-cost supply from Chile.

A host of lithium projects and expansion plans threaten to add about 500ktpa to global lithium supply by 2025, according to their estimates.

“Increased production by low-cost Chilean brine operators SQM and Albermarle [add] about 200ktpa by 2025, increasing Chile’s share to a third of global supply from 24 per cent in 2017, driving down the cost curve and challenging higher-cost operators in China and Australia,” the broker says.

“We expect these supply additions to swamp forecast demand growth (and) as a result, we forecast 2018 to be the last year of global lithium market deficit, followed by significant surpluses emerging from 2019 onwards.

“It would take much higher EV penetration rates — from about 1.6pc in 2018, to 13.7pc in 2025 versus Morgan Stanley’s forecast 9 per cent penetration for 2025 — to offset these surpluses and balance the market, in our opinion.”

Accordingly, the broker downgrades Australia’s Galaxy Resources (GXY) and Orocobre (ORE) today, shares of which are down around 5 and 6 per cent respectively.

4.11pm: Stocks buoyed amid late fade

The benchmark S&P/ASX200 index closes down 0.2 per cent at 6056.9, fading in late trade after earlier posting gains up to 0.6 per cent as investors keenly await new Fed chair Jerome Powell’s first testimony to Congress overnight.

More to come

David Swan 4.09pm: Wright Nakamoto’s alleged wrongdoing

The Australian self-proclaimed ‘inventor’ of bitcoin, Dr Craig Wright, has been accused of stealing more than $US5bn ($6.37bn) of the digital currency from a former business partner.

A suit filed in Florida’s District court earlier this month alleges Dr Wright, who claimed in 2016 he created bitcoin using the pseudonym Satoshi Nakamoto, used forged signatures and backdated documents to lay claim to bitcoins owned by the now-deceased IT consultant Dave Kleiman.

Mr Kleiman’s family say they own the rights to those bitcoins, and blockchain technologies developed by Mr Kleiman, with the value exceeding $US5bn.

“Craig forged a series of contracts that purported to transfer Dave’s assets to Craig and/or companies controlled by him,’’ lawyers for Mr Kleiman’s estate said in the complaint. “Craig backdated these contracts and forged Dave’s signature on them.’’

In an email exchange as quoted in the complaint, Dr Wright said he was holding more than 300,000 bitcoins on behalf of Mr Kleiman.

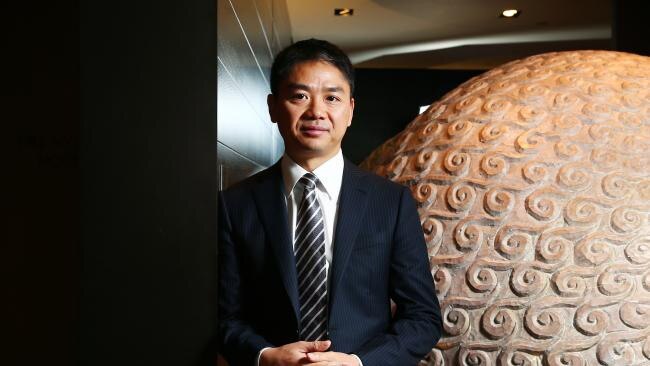

David Swan 3.52 pm: JD.com’s postcard from the future

Australian retailers need to rethink delivery times and get them up to scratch, according to the global CTO of Chinese online retailing titan JD.com, which opened its first Australian office on Tuesday.

The Beijing-based company which sells Australian food, dairy products, vitamins and cosmetics to millions of Chinese consumers, offers delivery times of around an hour in China, while delivery times for Australian online stores are often days if not a week or longer.

3.41pm: Pre-Fed speak jitters as stocks pare gains

Australia’s S&P/ASX 200 has pared more than half of its intraday rise on what looks like profit taking before Fed Chair Jerome Powell’s testimony later today.

The index is up 0.3pc at 6060 after rising as much as 0.7pc to a 3-week high of 6083 today to be more than 5pc above the 5786.8 trough it hit this month.

Given the strong rise in anticipation of an abstinence from hints of faster rate hikes within the testimony, some profit taking is possible overnight but it won’t last long if he keeps the status quo.

3.27pm: Buyback no margin call buffer: Domino’s

Domino’s says that its current buyback programme has not been misused for price support to avoid a margin call being made in relation to shares held by managing director Don Meij, nor “for the purpose of benefiting Mr. Meij or to manipulate the market”.

Mr. Meij has sold roughly 16 per cent of his total Domino’s shareholding in the last week following a steady 50 per cent decline the company’s share price since its peak in September 2016, Fairfax Media reportedly uncovering five margin lending facilities in Mr. Meij’s name.

“The company will review and adjust its buyback protocols to address this perceived conflict,” says Domino’s.

“Based on the information that the Company has been provided, it considers that there is a prudent buffer between the Company’s current share price and the margin call trigger price and there is alternative collateral to rely on in the unlikely event of a trigger occurring.”

DMP last $40.37

3.14pm: NEXTDC boss live on Sky Biz

$NXT CEO Craig Scroggie Joins me live shortly @SkyBusiness #ausbiz we'll talk rising costs & potential takeover

— Nadine Blayney (@NadineBlayney) February 27, 2018

3.00pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Live cross — Shaw and Partners

3.30pm: Diana Mousina — Senior Economist, AMP Capital

3.45pm: Fiona Wood — Prime Value

4.00pm: Adam Dawes from Shaw and Partners and Henry Jennings from Marcus Today guest host

4.00pm: Andrew Weilandt — Dornbusch Partners

4.30pm: Stephen Innes — Head of Trading Asia, OANDA

(All times in AEDT)

2.27pm: ASX swing stocks in PM trade

Eli Greenblat 2.19pm: Lew’s Myer angle ‘valid’: Bernie Brooks

Former Myer chief executive Bernie Brookes has given voice to the frustration felt by shareholders in the struggling department store owner over the time it is taking to turn around its poor financial performance and deal with the modern challenges of the retail sector.

Speaking to ABC Radio, Mr Brookes also described recent comments and criticisms by Myer’s biggest shareholder, billionaire Solomon Lew, as “valid”, as the businessman wages a war against the current Myer board and seeks to tip out all directors at a shareholders meeting in the next few months — read more

MYR last 49 cents

1.57pm: Costa’s guide to making friends with salad

Costa Group shares have ripped as much as 13 per cent to a record high of $7.09 after posting its latest results ahead of the open.

Costa’s underlying 1H8 NEAT rose 14.5pc to $28.6m and beat Macquarie’s forecast by 10pc, while the interim dividend of 5cps also beat its 4.1cps forecast. Sales of $489m beat its estimate by 13pc.

Costa raised its NPAT growth guidance to 25 per cent from “at least” 20 per cent and pinned strong revenue growth — particularly in its citrus and tomato categories — on demand from key export markets Japan, US and China.

“[Guidance] is in-line with our forecast as we currently forecast 27pc for the year — broadly in-line with consensus — with the international projects and domestic expansions being key contributors,” Macquarie says.

CGC last up 10 per cent on $6.85

Stephen Bartholomeusz 1.39pm: Caltex’s inevitable overhaul

For the past two years Julian Segal has presided over a rigorous evaluation of the potential for Caltex to launch a radically different strategy for its retail petrol network, a full-scale and innovative convenience store network. It’s been increasingly clear, as the evaluation and pilot program deepened, that the result was a foregone conclusion.

In announcing the group’s full-year results today (a typically solid performance, with replacement cost earnings up 18 per cent), Segal formally committed Caltex to a convenience store rollout that will see Caltex take control of the near-500 outlets now operated by franchisees at a cost of $100 million to $120 million over the next three years to give it the ability to deliver a consistent consumer offer and experience.

It is typical of Caltex in the Segal era that the announcement will come as no surprise to anyone who follows the company. It has been well-flagged and well-tested, with an accelerating and expanding pilot program over the past two years that has seen its “Foodary’’ concept rolled out to 26 stores — read more

CTX last up 4.8 per cent to $36.68

Read: Caltex shares hit 2-year high

1.28pm: Hang Seng channels global rebound

The rebound from a sell-off at the start of February continued in Hong Kong Tuesday morning with stocks extending gains following another rally on Wall Street.

The Hang Seng index climbed 0.5 per cent to 31,650 in early trade.

But the benchmark Shanghai Composite Index was slightly lower, dipping 0.8 points to 3,303.82, while the Shenzhen Composite Index, which tracks stocks on China’s second exchange, was up 0.1 per cent on 1,816.06.

AFP

1.12pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

1.30pm: Ben Wilson — RBC Capital Markets

1.50pm: Live cross to Bloomberg Asia

2.00pm: Winston Cheng — JD.com President of International, Group VP

2.20pm: Jessica Rusit — FIIG Securities

2.30pm: Chris Conway — Australian Stock Report

(All times in AEDT)

12.54pm: ASX200 hits fresh 3-week high

Australia’s S&P/ASX 200 share index has risen 40 points or 0.7pc to a fresh 3-week high fo 6081.7.

Costa Group, Caltex, Iluka and BlueScope are surging after their results this week, but investors are also favouring the largest stocks as Wall Street continues to lead a stunning rebound.

BHP, CSL, CBA, ANZ, Westpac, NAB, Macquarie, South32, Woolworths and Rio Tinto are all outperforming the index today.

Focus now turns to potential resistance from a downtrend line drawn from the decade high of 6150 achieved last month.

That line comes in today around 6090 and should be tough resistance before Fed chair Jerome Powell’s Congressional testimony tonight.

BHP is already testing an equivalent resistance line at $31.41.

12.48pm: BlueScope guidance conservative: Citi

BlueScope’s earnings guidance is too conservative according to Citi analyst Simon Thackray.

Management have guided sequential 2H18 spreads improving US$40/tonne to US$325/t compared to the US$77/t improvement in average spreads already observed with about 14 weeks still at risk based on observable lags,” he says.

“At the current rate there is about US$40m upside to the 2H18 EXIT guidance of A$606m with current spot spreads of US$415/tonne well beyond the average to date for 2H18.”

Mr Thackray has kept his “buy” rating and upgraded its target price by 20 per cent to $18.60 on BlueScope.

BSL last up 3.4 per cent on $16.38

Robert Gottliebsen 12.23pm: Eye twinkle in rare earth war

It’s taken a long time but suddenly the United States under Donald Trump has woken up that it has a potential “rare earths” crisis and is calling on Australia to help.

Indeed, one of the most dramatic features of the discussions between President Trump and our Prime Minister was the Trump plan to link with Australian enterprises to help the US break Chinese domination of rare earths.

The US president went further and set out a vision for a new era of trade and joint ventures between the US and Australia, which included infrastructure development in the region. But then he added high technology.

12.06pm: Stocks hold gains in midday trade

The S&P/ASX200 index was last 0.6 per cent higher on 6076.7 with serious buying at the top-end of town, the entire ASX10 in positive territory bar Telstra and Woodside.

Investment sentiment across the globe improves alongside bond market signals renewed expectations of increased global growth and associated inflation — those that preceded a sharp correction of Wall Street earlier this month — have been priced in.

“Markets have a watching brief on [the Fed’s] Jerome Powell’s testimony before Congress [overnight],” says CMC chief markets analyst Ric Spooner.

“However, the chances are, that like the markets, he will signal an evidence based strategy. This will involve plans to maintain a gradual approach to rate increases in the absence of further evidence that growth in wages and inflation is picking up steam.”

11.24am: Pilbara Minerals signs align: Macquarie

The fact that Pilbara Minerals is on track for Pilgangoora commissioning and first shipments by June is good sign for the company according to Macquarie.

“Remaining on schedule is important for PLS at the tail end of stage 1 development with wet commissioning to commence early in 4QFY18,” the broker says.

“Early cash flows are expected from the imminent sale of DSO, which is set to see PLS take advantage of currently buoyant lithium prices.”

Macquarie has an “outperform” rating and $1.20 target price on Pilbara Minerals.

Bloomberg’s analyst ratings compilation shows 6 buys, 2 holds and 0 sells.

The share price is about 33 per cent off the peak after surging 123pc last year.

PLS last down 2.7pc at 83 cents.

10.50am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Michael McCarthy from CMC Markets guest hosts

11.00am: Live cross — Morgans

11.15am: Rudi Filapek-Vandyck — FNArena

11.45am: Live cross — Shaw and Parnters

12.00pm: David Singleton — CEO, Austal

(All times in AEDT)

10.45am: Speedcast profit misses estimate

Speedcast booked $24.1m in full-year underlying profit, below a more optimistic consensus estimate by Bloomberg’s analyst survey of $44.6m.

SDA swung down 10.4 per cent on the release of results after the open, since recovering near half the ground after bargain hunters stepped in.

10.32am: Caltex shares hit 2-year high

Caltex shares jumped 5.8pc to a 2-year high of $37.02 after an updated convenience rollout and asset review announcement — the results were pre-released so there were no great surprises there.

Macquarie says the announcements today are “pleasing” with “quantified convenience uplift a meaningful earnings tailwind”.

Given the scale of assets owned, “we suggest valuation upside from the asset review is also likely”, the broker says.

“That said, alternative growth sources are required to offset headwinds in the business, primarily a subdued volume outlook and reducing premium fuel mix-shift benefits, while the cost-savings are likely required to offset price inflation and growth requirements in the business.”

Macquarie has a “neutral” rating and $35.40 target price.

CTX last up 4.1pc at $36.40

10.19am: Local stocks leap higher early

The S&P/ASX200 index jumps 0.6 per cent higher in early trade to 6078 as the final corporate earnings season confessors emerge and investors place bets toward a near V-shaped recovery from a sharp correction on Wall Street earlier this month.

“US bond markets appear to have arrived at a point where evidence of improved wage growth and inflation will be required to push yields significantly higher,” says CMC chief markets analyst Ric Spooner.

“This has given licence to investors to push stock indices higher in response to good reporting seasons in the US and Australia plus the outlook for solid profit growth.”

10.04am: Ferocious Costa pickings at the open

Costa Group shares leap 12 per cent higher at the open to $6.96 after its results released earlier this morning.

CGC last $6.23

9.59am: Santos in PNG quake shutdown

Santos has shut down its PNG LNG Hides plant and the Kutubu gas facilities as a precautionary measure following a major earthquake and a series of aftershocks in the Papua New Guinea highlands.

The company has been advised by PNG LNG operator ExxonMobil PNG that no staff or contractors have been injured as a result of these seismic events, and all personnel are safe and accounted for.

Production will remain shutdown while a full assessment of the impact of the earthquake is made.

STO last $5.07

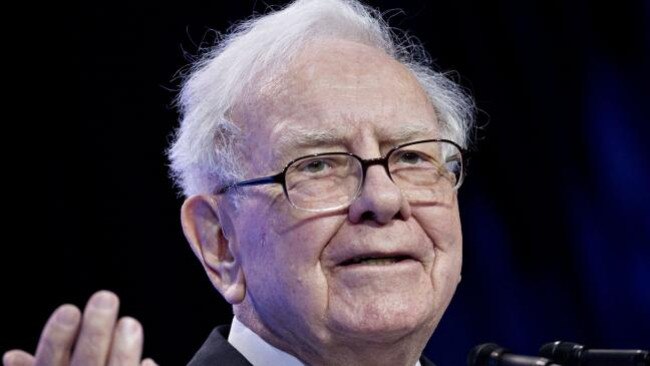

9.51am: A $US29bn tax break the Berkshire way

Billionaire Warren Buffett says American businesses are getting a significant boost from the tax overhaul, but health care costs remain a drag so he hopes a new initiative his company started with Amazon and JP Morgan Chase will deliver significant savings.

Mr Buffett appeared on CNBC after releasing his annual letter to Berkshire Hathaway shareholders over the weekend. Buffett’s Omaha, Nebraska, conglomerate reported a $US29 billion paper gain on far-reaching changes to the US tax code, and the conglomerate will benefit from a lower tax rate going forward.

“It’s a huge tail wind,” Mr Buffett said.

9.41am: Markets extend halcyon days

Global stocks struck a triumphant note on Monday, rising solidly ahead of an event-packed trading week.

The wave of higher results began in Asia, where Tokyo’s main stocks closed up more than one per cent, followed by solid gains in Europe and even stronger advances in New York.

The gains helped take another bite out of the big losses suffered at the start of February, when fears of US inflation sparked a global sell-off.

Those worries were eased somewhat on Friday when the US Federal Reserve, in its semi-annual report to Congress, tempered speculation that it could hike benchmark interest rates four times this year and said inflation remained subdued globally.

However, analysts still warn equity valuations remain elevated and volatility could still return.

Tech stocks returned to pre-correction levels while Cisco and 3M both gained more than three per cent. This helped send the Dow Jones Industrial Average 1.6 per cent higher while the broader S&P 500 added 1.2 per cent.

London’s benchmark FTSE 100 index finished the day with a gain of 0.6 per cent. In the eurozone, Frankfurt’s DAX 30 rose 0.4 per cent and in Paris the CAC 40 was up 0.5 per cent.

AFP

John Durie 9.32am: Ex-Suisse Stock Jefferies’ Aussie lead

US based investment bank Jefferies & Co has hired former Credit Suisse banker Michael Stock as its Sydney based head to establish its operation in Australia.

Stock who has filled senior roles also with UBS and Deutsche will be responsible for hiring a full service investment banking team in Australia.

The move comes as Jeffries expands its operation in the Asia Pacific region including a recent venture with the Bank of China.

9.30am: ASX200 tipped up 0.5pc

Australia’s S&P/ASX 200 share index is expected to open up 0.5pc near 6072 points today after strong gains on Wall Street.

Despite a lack of new information the DJIA surged 1.6pc and the S&P 500 rose 1.2pc ahead of Jerome Powell’s Congressional testimony tonight.

After bouncing about 10-12pc in the past two weeks, the major US indexes are only 1-3pc below their record highs.

While US the 10-year bond yield fell almost 4 basis points intraday it close almost flat at 2.86pc.

Tech was strong with Apple up 2pc on plans to launch 3 new iPhones this year.

But financials, telcos and industrials were also strong, with Berkshire Hathaway up 3.9pc, Qualcomm up 5.8pc and 3M up 3pc.

Commodities were also firm with China rear steel up 6.9pc and coking coal up 1.2pc.

On the charts the S&P/ASX 200 may find resistance at 6090 today from a potential downtrend line drawn from the January peak.

Any dips toward 6000 should be well supported while Wall Street is so strong.

Index last 6042.2

9.22am: Carlyle, TPG circling Steinhoff

Bridget Carter and Scott Murdoch write:

The Carlyle Group and TPG Capital are believed to be scrutinising the Australian arm of Steinhoff in preparation for an anticipated sale of the company that owns Freedom Furniture, Fantastic Furniture and Best and Less.

It comes as Blackstone and Kohlberg Kravis Roberts are also positioning themselves for a highly anticipated divestment.

With the strong level of private equity interest, some sources say that the prospect of a mooted management buyout by those in charge of the Asia Pacific operations is now looking increasingly slim.

9.14am: The Trading Day ahead

Big few hrs coming up @SkyBusiness from 10AM incl/ @IlukaResources CEO, @Austal_USA CEO & the latest predictions from @HarryDentjr #ausbiz

— Ingrid Willinge (@IngridWillinge) February 26, 2018

8.59am: Caltex profit beats, seizes franchisee stores

Caltex booked 1.5 per cent full-year after-tax net profit growth to $619 million, above more a conservative estimate by Bloomberg’s analyst survey of $616 million.

The company says it aims to take back control of all franchisee stores by mid-2020 based on the findings of a two-year operational review, the process underway with 314 of its 810 retail sites now company operated compared to 152 a year ago.

Alongside results, Caltex declared a 17 per cent increase in its final dividend to 61c per share, contributing to a 19 per cent increase in its total full-year distribution to $1.21 — read more

CTX last $35.00

8.52am: Analyst rating changes

Galaxy Resources cut to Equalweight — Morgan Stanley

Spark Infrastructure raised to Overweight — JPMorgan

Spark Infrastructure raised to Neutral — Credit Suisse

MYOB raised to Outperform — Credit Suisse

QBE raised to Neutral — Credit Suisse

ZIP Co cut to Hold — Bell Potter

Senetas cut to Hold — Bell Potter

Monash IVF cut to Hold — Morgans

Adairs cut to Hold — Morgans

Adairs cut to Neutral — Goldman Sachs

Ardent Leisure raised to Outperform — CLSA

Pact Group cut to Hold — Morningstar

Monadelphous raised to Hold — Morningstar

8.41am: Sweet kick to Costa profit

Costa Group has lifted underlying first-half profit 14.5 per cent to $28.6 million after a near 10 per cent rise in revenue for the fruit and vegetable grower.

Revenue for the six months to December 31 rose 9.8 per cent to $489.4 million, with citrus and tomato the stand out categories for the ASX-listed firm.

Net profit jumped more than fourfold to $66.2 million on a $40.1 million non-cash gain in the revaluation of Costa Group’s interest in berry grower African Blue, and the company raised its interim dividend by a cent to five cents, fully franked — AAP

CGC last $6.23

8.34am: Bondcano no thought bubble

If Warren Buffet thought US Treasury bonds were a bubble in 2008, what must he think now?

At the time he said: “the US Treasury bond bubble of late 2008 may be regarded as almost equally extraordinary” to the internet bubble of the late 1990s and the housing bubble of the early 2000s.

Thanks to a decade of record low interest rates and quantitative easing that’s now being withdrawn, the US 10-year yield set a record-low of 1.32 per cent in 2016 and is only just threatening to break above the 3 per cent level that prevailed at the time of Mr Buffett’s famous warning in early 2009.

8.27am: Iluka shrinks loss, US hits home

Mineral sands miner Illuka resources shrunk a full-year loss to $172m in its most recent fiscal year, provisions from the rehabilitation of closed US sites ultimately dragging it into the red.

Annual underlying group earnings (EBITDA) excluding the provisions rose 140 per cent to $361m, while mineral sands revenue rose 40 per cent to $1bn on the same basis.

The company booked $127m in provisions relating to rehabilitation for its closed operations after increasing those for sites in Virginia and Florida by US$90 million in December last year.

“Our reported loss is disappointing; but the underlying financial performance is encouraging,” said managing director Tom O’Leary.

The increases in our operating and free cash flow were a highlight of the year and have enabled a significant reduction in net debt and a return to moderate gearing levels following the Sierra Rutile acquisition.”

Perth-based Iluka is the world’s largest producer of zircon, a mineral sand used by the ceramics industry to make household products such as bathroom tiles and kitchenware. It also produces rutile, a mineral used to create the pigments in paints and plastics.

The company, which has for years been grappling with a deep, multiyear downturn in mineral sands markets, said demand for its commodities was improving and that it expects its markets “to remain positive in 2018.” Prices for zircon rose about 40% in 2017, while rutile prices also increased.

“We expect [mineral sand market] supply to remain tight in 2018.”

Alongside results, Illuka revived its year-end dividend with a 25c per share distribution, brining its total annual distribution to 31c compared to 3c the year prior.

With Rhiannon Hoyle

ILU last $10.18

Ben Butler 8.16am: Loan fraud, brokers in the spotlight

Home loan fraud at National Australia Bank and Commonwealth Bank-owned mortgage broker Aussie Home Loans, together with CBA’s dealings with its network of mortgage brokers, are among issues to be examined by the royal commission into the banks at its first public hearing in a fortnight.

The commission, headed by former High Court judge Kenneth Hayne, is to turn its blowtorch on to all four big banks over consumer lending issues including home loans, car finance, credit cards and insurance add-ons.

8.12am: Wall St eyes summit

Wall Street finished sharply higher on Monday for the second day in a row as stocks continued to move back toward January’s peak levels.

The benchmark Dow Jones Industrial Average gained nearly 400 points or 1.6 per cent, to close at 25,709.00, while the broader S&P 500 rose 1.2 per cent to finish at 2,779.60 — putting both indexes at their highest level this month.

The tech-heavy Nasdaq also added 1.2 per cent to close at 7,421.46, its highest level since late January.

AFP

7.40am: Rio gets offer for aluminium assets

Resources giant Rio Tinto says it has received a binding $345 million offer from Hydro to acquire its aluminium assets.

The bid is for Rio’s ISAL smelter in Iceland, its 53.3 per cent share in the Aluchemie anode plant in the Netherlands and its 50 per cent interest in the Aluminium fluoride plant in Sweden.

Rio says that, subject to consultation with stakeholders and employees, and certain other conditions, it expects to conclude the sale in the second quarter of 2018.

AAP

7.25am: ASX set to share in global updraft

Australian shares look set to open almost half a per cent higher after Wall Street rallied strongly and risk appetite returned to global equity markets.

The benchmark local share price futures index was last up 0.5 per cent.

All major international equity markets have climbed decisively in the offshore session, with Asian indexes up more than one per cent, London up more than half a per cent and the US following the trend with one per cent-plus gains.

US stocks have risen amid expectations that new Federal Reserve chair Jerome Powell will stick to a planned gradual series of interest rate rises. The Fed boss faces questions from both houses of the US Congress in a semi- annual testimony starting on Tuesday (US time), his first major set piece since he took over from Janet Yellen earlier in February.

In equities news, Cabcharge, Costa Group Holdings, and Caltex Australia announce results.

Also, the hearing into the Seven Network and Amber Harrison contempt of court case is expected to be heard in Sydney.

AAP

7.10am: Dollar slips

The Australian dollar is lower against its US counterpart, which has been unable to sustain a rise in the US session.

At 6.35am (AEDT), the Australian dollar was worth US78.52 cents, down from US78.78c yesterday.

The greenback dipped early in the European trading session, then edged higher as investors bet the new head of the US Federal Reserve would steer a steady course on monetary policy when he addresses lawmakers this week.

But it came off its highs to be little changed toward the end of the US session.

Westpac’s Imre Speizer says risk appetite had returned to US equities markets, but not to the US dollar.

“The USD index is unchanged on the day, after dipping during the European morning,” he said in a Tuesday morning note.

“(While the) AUD made a round-trip from 0.7830 to 0.7893 and back.” Domestically, there are no major event risks for the local currency on Tuesday, with Mr Speizer expecting the Australian dollar to remain moving between 78 and 79 US cents.

The Aussie dollar is also lower against the euro but up slightly against the yen.

AAP

6.50am: US stocks start week strongly

Financial and technology shares rallied overnight, putting the S & P 500 and Dow Jones Industrial Average on track to notch their third straight day of gains.

Major stock indexes have recouped a big chunk of their February losses, as corporate earnings suggest that US firms remain on strong footing.

A record 78 per cent of S & P 500 companies have beaten analysts’ revenue estimates so far for the fourth quarter of 2017, and overall earnings growth is nearly 15 per cent, which would make it the best quarter since 2011, according to FactSet.

“If interest rates are going up because inflation is a little higher, because the economy is stronger, because earnings are better ... these are all positive things,” said Dan Miller, director of equities at GW & K Investment Management.

The Dow industrials rose 341 points, or 1.4 per cent, to 25654. The S & P 500 added 0.9 per cent, and the Nasdaq Composite advanced 0.9 per cent.

Australian stocks are set to follow suit and make a positive start. At 6.50am (AEDT) the SPI futures index was up 28 points.

Technology stocks, among the best-performing sectors in the S & P 500 this year, led gains in the broad index Monday. HP shares rose 5.8 per cent after JPMorgan raised its rating for the stock to overweight from neutral, while Qualcomm added 5.1 per cent after the chip giant said it was getting closer to negotiating a takeover deal by Broadcom.

Financial shares rallied, with Class B shares of Berkshire Hathaway — which posted a nearly $US45 billion annual profit, thanks in part to the new tax legislation — jumping 3.6 per cent.

Government bonds strengthened Monday, with the yield on the benchmark 10-year US Treasury note recently at 2.857 per cent, according to Tradeweb, compared with 2.871 per cent Friday. Yields fall as bond prices rise.

Meanwhile, stocks elsewhere around the world also rose, with the Stoxx Europe 600 closing up 0.5 per cent, led by advances in shares of basic resources and technology companies.

The Shanghai Composite Index added 1.2 per cent in its sixth straight day of gains, while Hong Kong’s Hang Seng rose 0.7 per cent, with shares of Chinese car maker Geely rallying after the firm accumulated a stake in Germany’s Daimler.

Dow Jones Newswires

6.40am: Global markets post solid gains

World stock markets rose solidly overnight at the start of an event-packed trading week.

The advances helped take another bite out of the big losses suffered at the start of February, which were sparked by concerns that rising US inflation could lead to faster-than-expected interest rate rises in the world’s biggest economy.

Those worries were eased somewhat Friday when the Federal Reserve, in its semi-annual report to Congress, said inflation remains subdued globally and it expects to raise borrowing costs three times this year — tempering speculation of four increases.

However, analysts warn that equity valuations remain elevated and volatility could still return.

After Tokyo’s main stocks index closed up more than one per cent, Europe’s leading indices pushed higher albeit with lesser gains.

London’s benchmark FTSE 100 index finished the day with a gain of 0.6 per cent. In the eurozone, Frankfurt’s DAX 30 added 0.4 per cent and in Paris the CAC 40 rose 0.5 per cent.

“The recovery in European equity markets is still being played out. Investors are becoming more content to buy back into the market, and the memory of the sharp sell-off at the start of the month is continuing to fade,” said market analyst David Madden at CMC Markets UK.

“Dealers are coming around to the idea that the positive market momentum is here to stay,” he added.

Monday’s positivity meanwhile kicks off a busy week, with the release of key US data including economic growth, jobs creation and wages.

Also, new Fed boss Jerome Powell will speak before key finance committees on Wednesday (AEDT) and Friday (AEDT). Markets will pore over his comments for clues about plans for monetary policy — though many predict he will stick to the path of his predecessor Janet Yellen.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout