Trading Day: live markets coverage; Investors rally behind 6000 pace; plus analysis and opinion

The local sharemarket continues a run of fresh decade highs as gains are shared across most major sectors.

Welcome to the Trading Day blog for Thursday, November 9.

Samantha Woodhill 4.35pm: Materials, CBA drive fresh ASX highs

Local shares rose after rallying commodities prices and an extended run by CBA pushed the market higher.

The benchmark S&P/ASX200 was up 33.135 points, or 0.55 per cent, at 6049.4 points. The broader All Ordinaries index was up 33.252 points, or 0.55 per cent, to 6122.4 points at the close.

“New nine-to-ten year highs confirm the sustainability of the two year uptrend — pending long term momentum confirmation,” said National Australia Bank technical analyst David Coloretti.

“While the immediate outlook is positive, we need to see some specific triggers in terms of both price and long term momentum to ensure that the uptrend is sustainable on a multi-month basis.”

The materials sector was led by the industrials while gains in the miners eased. Building materials supplier James Hardie shot up 7.6 to $20.39 after saying it anticipates steady growth in the US housing market and despite posting a first half loss.

Nufarm hiked up 5.28 per cent to $9.17 and Fletcher Building added 1.59 per cent to $6.40.

BHP edged up 0.49 per cent to $28.63 and Rio Tinto ticked 0.54 per cent higher to $74.64.

Financials weakened overall, led by National Australia Bank after it traded ex-dividend. NAB dropped 3.38 per cent to $30.58. Commonwealth Bank gained 0.83 per cent to $80.94. Westpac put on 1.31 per cent to $30.34 and ANZ lifted 0.80 per cent to $30.34.

4.25pm: Spheria sails past $100m float

Spheria’s small-cap fund IPO has exceeded its $100m minimum target just two weeks after opening.

The Spheria Emerging Companies LIC gives investors access to an actively-managed portfolio of Australian and New Zealand small-and micro-cap companies that are highly cash-generative.

The portfolio will be managed by Spheria’s small cap experts Marcus Burns and Matthew Booker and has a “highly recommended” rating from Lonsec.

Spheria Emerging Companies LIC will employ the same investment strategy as the Spheria Australian Smaller Companies Fund, which generated a 11.7 per cent per-annum return net of fees since inception in July 2016 to 30 September 2017, beating the benchmark S&P/ASX Small Ordinaries Accumulation Index (Benchmark) by 6.5 per cent per-annum net of fees in the same period.

“This illustrates strong demand from investors seeking diversification from highly concentrated portfolios by allocating to a quality small-cap product,” says Spheria Emerging Companies chairman Jonathan Trollip.

The IPO intends to raise a maximum of $250 million by issuing 125,000,000 fully paid ordinary shares at $2.00 a share. The Broker Firm Offer is due to close on 17 November 2017 and the General Offer period is expected to close on 24 November 2017. Trading on the ASX is due to start on December 5.

3 .35pm: Flight Centre short holiday hope: Macquarie

Flight Centre’s earnings recovery from a forecasted domestic slowdown would be at risk from sluggish domestic consumption, even as the travel agency doubles down on growth in its offshore portfolio according to Macquarie.

“Management has flagged that first-half fiscal 2018 profits in Australia — roughly 85pc of EBIT — will be slightly below that in the prior corresponding period after being disrupted by system changes,” says Macquarie.

“Management will close unprofitable stores, consistent with prior commentary, as part of the overall network planning.”

Macquarie sees a weaker consumer backdrop as a key risk to its earnings recovery in the wake of the flagged profit decline.

“We expect difficult trading conditions will persist as slow income growth, a softening housing market and rising living expenses continue to weigh on consumer spending.”

The investment bank does, however, forecast easing airfare deflation and a FY18 pre-tax, underlying earnings of $349.7m, within the company’s existing guidance, albeit at the lower end.

“Coupled with the recent price rally (stock is up roughly 49pc year-to-date) and a peak PE multiple of 21x, we maintain our ‘underperform’ recommendation.”

FLT last up 1.9 per cent at $47.34

3.52pm: Trump, Xi strike trade deals worth $207bn

China and the United States have signed additional business agreements valued at $206.5 billion during President Donald Trump’s visit to Beijing, though some were less than binding commercial contracts. The agreements signed Thursday at a ceremony attended by Trump and his Chinese counterpart, Xi Jinping, included sales of U.S.-made chipsets, jet engines and auto parts.

Such contract signings are a fixture of visits to Beijing by foreign leaders and are intended to defuse foreign complaints about China’s trade policies. Many of the contracts signed Thursday appeared to represent purchases Chinese mobile phone makers, airlines and other customers would have made anyway that were saved for signing during Trump’s visit.

Others included a co-operation framework on shale gas and a memorandum of understanding on industrial development.

AP

3.48pm: Early election bank share risk: UBS

Australian banks 2H17 results were “mixed with subdued growth the key theme”, according to UBS, the risk of a “more likely” early election also weighing into its decision to withhold ‘outperform’ ratings on any of the Big Four bank shares.

“Entering reporting season we had suspected earnings could surprise positively given mortgage repricing and lending tailwinds,” UBS analyst Jonathan Mott says.

“However, Non-Interest Income was even weaker than anticipated. Overall Sector EPS was up just 1.2 per cent sequential, with Pre-Provision Profits going backwards.”

Mott says the banks “may continue to perform well through the remainder of 2017 benefiting from the rally in global banks and yield appeal”, but he remains cautious.

“The outlook into 2018 remains challenging as the housing market slows, NIM comes under pressure from competition and switching from Interest Only to Principal & Interest, offsetting improved funding,” Mott says.

“Mortgage mis-selling and responsible lending risks are a growing concern. With an early Federal election looking more likely, we believe it will be difficult for the banks to outperform during 2018.”

His order of preference is: Macquarie (his only “buy” rated stock), followed by WBC, CBA, ANZ and NAB.

Paul Garvey 3.32pm: Half-life lease on uranium mine closure

Shares in Australia’s long-suffering uranium stocks have soared after the news that world’s biggest high-grade uranium mine would be suspended due to weak prices.

Canadian uranium giant Cameco announced overnight that it will suspend operations at its Macarthur River mine in Saskatchewan for ten months, with the news driving the likes of Deep Yellow, Bannerman Resources and Toro Energy significantly higher today.

Deep Yellow (DYL) — which is now led by former Paladin Energy boss John Borshoff — was up almost 30 per cent to 26.5 cents, Toro (TOE) was up 20.7 per cent to 3.5c and Bannerman (BMN) jumped 19.5 per cent to 4.9c. Energy Resources of Australia (ERA), which is processing stockpiles from the ageing Ranger mine in the Northern Territory, had gained 11 per cent and the Andrew Forrest-backed Vimy Resources was up 8 per cent.

Cameco said that the Macarthur River suspension would last for ten months, with the company to meet its supply contracts with material from its existing stockpiles. While that means that overall market supply is unlikely to change significantly as a result of the Macarthur River closure, the move has nevertheless had a positive impact on investor sentiment towards the sector.

The spot price of uranium is currently at just $US19.95 a pound, and has been in the doldrums since the 2011 Fukushima disaster in Japan. Most of the world’s uranium mines are running at a loss at current spot prices, and a price of around $US70 a pound is generally seen as needed to inspire new developments.

Eli Greenblat 3.25pm: Coopers profit growth loses fizz

Coopers Brewery, Australia’s largest locally owned brewer, has notched up its 24th consecutive year of growth in beer volumes despite some of the worst trading conditions in decades for the beer sector, with sales for 2017 up 2.9 per cent to a record 83.8 million litres.

However, profit for the year at Coopers Brewery has shrunk after writedowns and impairments linked to its US-based Mr Beer home brew business.

Managing director of the family owned Coopers Brewery, Tim Cooper, said Coopers now held almost 5 per cent market share in the national beer market where industry figures showed a decline in sales volume of 1.9 per cent during 2016-17.

Ben Butler 2.53pm: Forrest launches Reuters defamation suit

Mining magnate Andrew Forrest has launched legal action denying he is a hypocrite for using native title laws to shut rival prospectors out of his Pilbara cattle station, Minderoo.

The Fortescue Metals founder is suing wire service Reuters and the deputy head of its Australian bureau, Jonathan Barrett, for defamation over an article, published in May this year, headlined “Australian billionaire uses indigenous land laws to keep prospectors off farm”.

Minderoo, a 2,400 sq km spread straddling the Ashburton River, sits within an area over which the Federal Court recognised the native title of the Thalanyji people in 2008.

Under Western Australian and federal laws, prospectors need permission from native title holders to enter properties over which they have jurisdiction.

The Reuters story dealt in part with a February ruling of the WA Mining Warden in which one of Mr Forrest’s companies, Red Sky Stations, successfully overturned two prospecting licenses because the applicants lacked permission from the Thalanyji people.

In August, Mr Forrest won a separate High Court case keeping sand miners off Minderoo on different grounds.

Mr Forrest’s Federal Court defamation lawsuit alleges the Reuters piece paints him as someone who, “while parading as a friend of indigenous people, undermined the very laws passed for their protection in order to advance his own selfish ends” and had “no respect” for indigenous people on Minderoo “by depriving them of water sources essential to their spiritual beliefs in order to enrich himself” — read more

2.21pm : The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

2.30pm: Adam Dawes — Wealth Manager, Shaw and Partners

3.00pm: Andrew Tyrell — Senior Investment Advisor, Shaw and Partners

3.05pm: David Lennox — Resource Analyst, Fat Prophets

3.15pm: Live Politics Panel

3.45pm: Nick Bishop — Head of Australian Fixed Income, Aberdeen Asset Management

3.50pm: Michael McCarthy — Chief Market Strategist, CMC Markets

(All times in AEST)

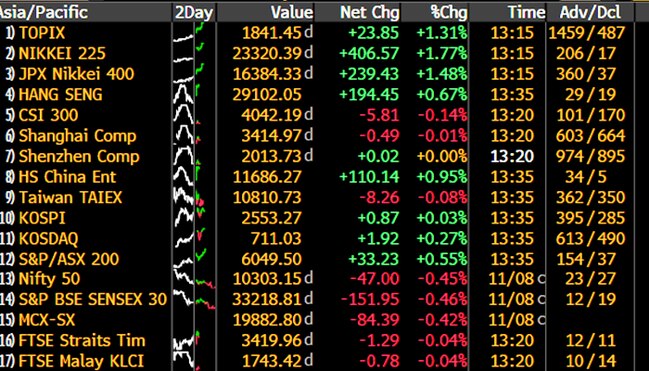

2.05pm: ASX, Nikkei steer APAC toward 10y high

Australia’s S&P/ASX 200 share index jumps 0.6 per cent to a fresh decade high of 6052.1 amid surging Asian markets.

Gains are broadbased, with banks and resources strong despite the ex-dividend fall in NAB.

Japan’s Nikkei 225 index earlier rose as much as 2 per cent to a 25-year high of 23382.15.

The Hang Seng index is up 0.8pc and US stock index futures 0.1pc higher.

The MSCI Asia Pacfic index is up about 0.5pc, putting it on track for its best close in a decade.

In commodity markets, Dalian iron ore futures are up about 0.2pc.

David Uren 1.38pm: Our company tax to top world

US company tax cuts will accelerate the slide in global business tax rates, leaving Australia stranded with the highest company rate in the advanced world and losing foreign investment.

France and Belgium are the only other advanced countries with higher company rates than Australia and both have announced major tax cuts.

With Labor and crossbenchers blocking the government’s plan to cut Australia’s rate to 25 per cent in a decade, the current 30 per cent rate would be exceeded only by Argentina and Brazil.

The average company tax rate in advanced countries has fallen from 32 per cent in 2000 to 24 per cent today, and Treasury’s analysis shows it will fall significantly further if the US federal company tax rate is slashed as planned.

1.28pm: Hardie buoyed by ‘cracking’ margins: CLSA

CLSA suggests weak US volume growth for James Hardie may point to customer attrition, however analyst Andrew Johnston describes the building material supplier’s second-quarter result as nevertheless revealing “cracking margins and continued manufacturing improvement.”

He notes a continued fall in manufacturing costs, together with strong price, EBIT and margin performance were reflected in North America margins of 24.5pc compared to a 21pc consensus forecast.

But a 2pc fall in US volume growth — attributed to FY17 capacity constraints dampening FY18 demand — “will raise concerns about Hardie having difficulty getting customers to return” after using competitors like FC or SmartSide when Hardie was short capacity in FY17.

Still, he says an improvement on unit costs in North America was pleasing.

JHX last up 5.8 per cent on $20.04

1.11pm: WATCH: Domino’s Meij on tech, Japan push

Samantha Woodhill 12.55pm: Westfield spurs online pivot

Global shopping centre landlord Westfield has reported stronger growth in leisure and food category sales, as retail landlords remix their properties towards eateries and experiences that can’t be bought online.

In its third quarter results, Westfield said that leisure sales in flagship stores grew 6.2 per cent year on year in the last quarter, globally. But leisure category sales in regional areas only increased 0.7 per cent compared to the same quarter last year.

Flagship food retail sales went rose 3.6 per cent for the quarter and 1.5 per cent in regional sales, compared to the previous corresponding period — read more

WFD last up 1.1 per cent $8.01

Stephen Bartholomeusz 12.38pm: BHP verging on capital recompense

When BHP’s new chairman addressed his UK shareholders last month his comments and plans appeared to reflect the views presented to him by the hundreds of institutional investors he spoke to prior to taking up the role, as well as the urgings of US activist investor Elliott management.

In a speech that no doubt will be echoed in a week’s time week when Ken MacKenzie fronts BHP’s Australian annual meeting, there was a heavy emphasis on capital allocation, with Mackenzie conceding that it hadn’t been perfect in the past and pledging to improve it.

12.17pm: ASX builds on gains over 6000

The local sharemarket firms gains over its heralded post-GFC high of 6000 as broadbased buying lifts the top 200 index to highs unseen in over a decade — last 0.3 per cent higher at 6032.5.

Heavyweight bank and mining stocks all find themselves in favour aside from NAB trading ex-dividend.

SWING STOCKS

+ Nufarm (5.9pc), Sims Metal (4.5pc), James Hardie (4.2pc), Premier Investments (4pc), Nib Holdings (2.9pc), Primary Healthcare (2.9pc)

— Domino’s (3.6pc), Santos (2.7pc), Myer (2.4pc), Sigma (1.9pc), Costa (1.2pc), Cochlea (1pc)

11.53am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

12.00pm: Adam Dawes from Shaw and Partners and Rudi Filapek Van Dyck from FNArena guest host

12.00pm: Chris Conway — Australian Stock Report

12.15pm: Tony Boyadjian — Senior Vice President, Compass Global Markets

12.45pm: David De Garis — Director of Economics, NAB

(All times in AEST)

11.35am: DATA: Investor loans fall in September

Investment lending fell in September by 6.2 per cent on the month prior, while the total number of home loans approved — owner-occupied inclusive — fell by 2.3 per cent on the same basis, slightly further than a 2 per cent fall expected by economists.

The Australian dollar fell slightly, by 10 points to US76.68 cents on this latest ABS data release.

Supratim Adhikari 11.23am: Optus books strong customer growth

Optus has posted a jump in its half-yearly earnings with the telco buoyed by strong growth in its mobile customer base.

However, the growth hasn’t translated into a net profit for the period as Optus continues to absorb the cost of investing heavily into its network and capabilities.

10.45am: Xero sees greener pastures on ASX

Xero has narrowed its first-half loss and posted positive pretax earnings for the first time as it announced it will delist from the NZX in favour of the ASX in February next year.

The cloud-based accounting software firm said it will keep its headquarters in Wellington but shift its listing across the Tasman to encourage a broader range of analyst and broker coverage and increase its relevance “to a more diverse range of large investors”.

The move was in the best interests of the company and its shareholders, it said on Thursday — AAP

10.25am: ASX hits fresh decade high early

Australia’s S&P/ASX 200 share index rose 0.4pc to a fresh decade high of 6042.7 in early trade.

Accelerating gains above 6000 could reflect some “fear of missing out” by under-invested fund managers.

Gains were broad based, with major banks and resources performing strongly, apart from NAB which is ex-dividend.

James Hardie is strongest in the S&P/ASX 200, rising as much as 5.1pc on impressive US margins.

Nufarm is up 4pc in a good reaction to its German acquisition yesterday.

Lithium plays Orocobre and Galaxy Resources also doing well.

Laggards include Santos, Domino’s, A2 Milk, Cochlear and Ardent.

Index last 0.2pc at 6030.8

9.58am: ASX to wrestle bank grip

Australia’s S&P/ASX 200 share index is expected to open up 0.1pc based on overnight futures.

That follows slight gains on Wall Street and mixed trading in commodities.

Brent crude fell 0.3pc to $US63.49 and spot iron ore fell 0.6pc to $US62.26.

However, coking coal rose 2.2pc to US$186.75 and LME copper rose 0.3pc.

CBA rating upgrades from Citi and Bell Potter may sustain the rise in CBA, though Morgans downgraded.

NAB is ex-dividend 99 cents today and ANZ and Westpac trade ex-dividend on Monday.

With banks normally falling in November, the index will need further gains in offshore markets to avoid a dip.

Index last 6016.3

9.41am: ASX ‘wont mind’ James Hardie result: Citi

James Hardie’s second-quarter result was “solid overall” according to Citi.

While volumes fell 2 per cent compared to Citi’s expected 8pc rise on capacity constraints, prices rose 6pc vs. 4pc expected, backed US EBIT margins up 420 basis points to 24.5pc vs. 22pc expected.

James Hardie also tightened its FY18 guidance range from $US240-$US280m to $US245-$US275m compared to a $US251-$US279m consensus range, and Citi forecast at $272m.

“The market won’t mind the result,” Citi says, “focus will be on further detail on the European acquisition of Fermacell and what this means for margins.”

JHX last $18.95

9.32am: Flight Centre bullish on global growth

Flight Centre says it sees 6-19 per cent growth in first-half pre-tax underlying profit to $113.2m in FY18, performance in offshore business unit set to carry this business over an expected decline in profitability from its Australian arm during the period.

At the company’s annual general meeting, managing director Graham Turner said international business arms “currently shape as key growth drivers”, while first-half profit from its domestic operations is expected to fall during system changes within the business.

“These changes, which we have spoken about previously, will inevitably lead to some

distraction and disruption for our people in-store while the upgrades are underway,” said Mr Turner.

FLT last $46.53

9.26am: Citibank refunds customers $4.3m

Citibank has refunded around 4,000 customers $1 million for misstating the bank’s obligations around unauthorised transactions on customers’ accounts, and another 39,500 customer $3.3 million for failing to refund customers when credit card accounts were closed with an outstanding credit balance.

9.11am: Analyst rating changes

Eclipx raised to Buy — Citi

Ansell target price raised 14pc to $24; Neutral rating kept — Citi

Cochlear cut to Sell — Citi

CBA raised to Neutral — Citi

CBA raised to Buy — Bell Potter

CBA cut to Hold — Morgans Financial

Macquarie Atlas cut to Hold — Morgans Financial

Virgin Australia raised to Outperform — Credit Suisse

Seven West Media raised to Buy — Morningstar

AMP cut to Hold — Morningstar

8.55am: Rio joins battle for lithium stake

Bridget Carter and Scott Murdoch write:

Rio Tinto is reportedly running the ruler over a major share in SQM, the world’s largest lithium producer, as the Anglo-Australian miner ramps up its exposure to this sector.

The news was reported yesterday by Chilean publication El Mostrador and would see Rio Tinto go up against some of its biggest global rivals.

The 32 per cent stake being sold by Potash Corporation could be worth about $US4 billion ($5.2bn) — read more from DataRoom here

RIO last $74.24

Sue Neals 8.54am: ACCC to scour Murray Goulburn deal

The Australian Competition & Consumer Commission has confirmed it will require the proposed $1.3 billion sale of Australia’s troubled major milk processor Murray Goulburn to Canadian dairy giant Saputo to be subject to a public review.

The need for a formal ACCC review of potential competition issues if Saputo — Australia’s fourth-largest milk processor through its ownership of Warrnambool Cheese & Butter — takes over Murray Goulburn, Australia’s second-largest dairy processor, could delay the planned quick fire sale of the financially crippled co-operative by as much as 24 weeks — read more

MGC last 80 cents.

8.51am: James Hardie profit slips

Robb M. Stewart writes:

Building materials supplier James Hardie Industries PLC anticipates steady growth in the US housing market through the rest of its fiscal year, but cautioned market conditions are uncertain and some costs remain volatile.

The company’s earnings fell over the first half of the fiscal year, affected by capacity constraints that dampened its demand and production costs that remain above historical levels.

Net profit fell by 14 per cent to $US123.8 million in the six months through September from US$144.1m in the same period last year, the company said Thursday.

JHX last $18.95

Pamela Williams 8.45am: Medcraft’s parting shot at APRA ‘plumbing’

Greg Medcraft might be about to leave for Paris, leaving behind six-plus years as head of Australia’s securities regulator and a reputation for plain speaking that has never endeared him to government, but he still has something more to say.

Medcraft’s “unfinished business” list includes a proposal to have the heads of the Australian Securities & Investments Commission and the Australian Prudential Regulation Authority sit on each other’s top boards in the interest of information sharing. It is a proposal that seems benign on one level, but it also suggests strains in the relationship between two powerful Australian regulators.

Richard Gluyas 8.42am: Mutual to gain capital muscle

Member-owned banks will be unshackled to lend an extra $18 billion and compete more effectively with the majors as a result of the Turnbull government’s move to accept the advice the Hammond review and remove capital constraints on the sector.

The government announced yesterday it would accept all of the review’s 11 recommendations on regulatory or legislative reforms to improve access to capital for co-operative and mutual enterprises, which are estimated to account for 8 per cent of the economy.

8.35am: WATCH: HSBC’s Neumann on China growth

.@FredericNeumann: Australia is 'very well placed' to benefit from China in sectors other than mining. MORE: https://t.co/fK5Z8zppbm #ticky pic.twitter.com/KDAvziriJ2

— Sky News Business (@SkyBusiness) November 8, 2017

8.28am: iSentia appoints new chairman

iSentia has named Doug Snedden as its new chairman after incumbent Doug Flynn announced his retirement at the end of the company’s annual general meeting on November 23 earlier this year.

ISD last $1.06

8.19am: Santos targets top range of forecasts

Santos says it now expects production and sales volumes to be towards the upper end of the 58-60 mmboe and 79-82 mmboe guidance ranges respectively.

In a statement released ahead of today’s investor briefing, Santos revealed since 2016 it has cut upstream unit production costs 22 per cent, reduced Cooper Basin and GLNG average costs by 42 per cent and 72 per cent respectively and reduced net debt by 40 per cent to $US2.8 billion.

“We have simplified the business to focus on five core, long-life natural gas assets, Cooper Basin, Queensland (including GLNG), PNG, Northern Australia and Western Australia Gas,” said

Santos chief executive Kevin Gallagher.

“This core portfolio is positioned to provide stable base production for the next decade and positive free cash flow in an oil price range of US$35-40/bbl, pre-major growth opportunities” — read more

STO last $4.78

7.50am: RBNZ flags earlier rate hike

Acting Reserve Bank governor Grant Spencer has kept the official cash rate unchanged at 1.75 per cent but brought forward a potential rate hike to June 2019 from September that year and lifted its inflation forecast.

While the forecasts were rejigged, Mr Spencer reiterated “monetary policy will remain accommodative for a considerable period. Numerous uncertainties remain and policy may need to adjust accordingly,” he said in a statement on Thursday morning.

Mr Spencer said the bank incorporated preliminary estimates of the impact of new government policies in four areas: new government spending; the KiwiBuild programme; tighter visa requirements; and increases in the minimum wage.

“The impact of these policies remains very uncertain,” he said.

AAP

7.40am: Local market set for positive open

The Australian share market looks set to open modestly higher after US equities found support amid elevated risk sentiment with the S&P 500 approaching its highest ever level.

At 7.00am (AEDT) on Thursday, the share price futures index was up 12 points, or 0.20 per cent, at 6,010.

In the US, the S&P 500 has approached its highest ever close as a rally in video game makers help offset doubts about an ambitious Republican plan to cut corporate taxes and weakness in banks.

Apple rose 0.65 per cent, putting it on track to end the day with a market value above $US900 billion for the first time.

In afternoon trading, the Dow Jones Industrial Average was up 0.05 per cent, while the S&P 500 had gained 0.13 per cent, and the Nasdaq had lifted 0.28 per cent.

Locally, in economic news on Thursday, the Australian Bureau of Statistics is due to release September’s housing finance figures.

In equities news, James Hardy Industries has released its half-year results while Optus is expected to post second quarter results, Janus Henderson its third quarter results and Goodman Group its first quarter update. Flight Centre holds its annual general meeting in Brisbane.

7.30am: Aussie higher against greenback

The Australian dollar is higher against its US counterpart as risk sentiment remains positive with no major news to give direction.

At 6.35am (AEDT) on Thursday, the Australian dollar was worth US76.77 cents, up from US76.53 cents on Wednesday.

Westpac’s Imre Speizer says risk sentiment has remained elevated overnight enabling bond yields, equities and the Australian dollar to nudge higher. “There was little fresh news of note for markets overnight,” he said in a Thursday morning note.

“The US dollar index is unchanged on the day. (The) EUR was locked in a narrow 1.1580-1.1610 range. USD/JPY made a round trip from 113.80 to 113.40 and back. “(The AUD extended the day’s rally from 0.7660 to 0.7685.” The main local event risk on Thursday was September housing finance data from the Australian Bureau of Statistics.

“(It) is expected to show the number of owner occupier loans up by 2.0 per cent. “September’s result for investors will be interesting with the value of loans surprisingly rising by 4.3 per cent in August, but this is likely related to refinancing activity.” Mr Speizer said he expected to see the local currency “remain stuck in a two- week old range between 0.7625 and 0.7730”.

The Aussie dollar is also higher against the yen and the euro.

7.15am: Wall St edges higher

US stocks inched higher Wednesday, as investors parsed the latest batch of corporate earnings.

The S&P 500 rose 0.1 per cent after snapping a five-session winning streak Tuesday. The Dow Jones Industrial Average advanced 14 points, or less than 0.1 per cent, to 23571, and the Nasdaq Composite was recently up 0.2 per cent, after swinging between small gains and losses earlier in the session.

Although some analysts caution that expectations for continued increases in corporate profits could limit gains moving forward, many investors say they expect major indexes to continue rising.

More than 85 per cent of S&P 500 companies have reported third-quarter results as of Wednesday morning, with roughly three-quarters of them beating earnings expectations, according to FactSet. Per-share earnings at the firms have grown about 6.4 per cent in the third quarter from the year-earlier period.

Dow Jones

Read more

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout