Trading Day: live markets coverage; Correction tantrum, sob or sniffle?; plus analysis and opinion

Colour returns to the faces of ASX investors after last week’s hiding, but was it a correction to stand the test of time?

And that’s the Trading Day blog for Tuesday, February 13.

5.11pm: BHP faces $2.3bn US tax reform hit

BHP says it expects to recognise an income tax expense of $US1.8bn ($2.3bn) as a result of changes to the US tax system including a reduction in corporate income tax rate from 35 per cent to 21 per cent.

The expense is to be comprised of two components: a $US898m non-cash remeasurement of deferred taxes and a $US834m non-cash impairment of foreign tax credits.

BHP maintains the US tax reform will have a “positive impact on its US profits in the long term, mainly due to the lower corporate tax rate.

BHP last $29.90

James Kirby 4.48pm: Bitcoin a digital fool’s gold

Bitcoin’s claim to be “digital gold” — a store of value when the wider investment market turns sour — has been shot to pieces in the latest share market correction.

In a much-anticipated stress test for all cryptocurrencies, the sharp reversal on sharemarkets in recent weeks has revealed bitcoin and its crypto cousins simply don’t hold up when the market tanks.

Bitcoin, the largest cryptocurrency, failed miserably as a “defensive asset” in the sharemarket rout — falling more than 20 per cent as gold prices remained broadly steady since January 26.

Samantha Bailey 4.34pm: Stocks harness US, commodity strength

The local share market finished the session higher off the back of a recovery in US markets and commodity market support.

At the close of trade, the benchmark S & P/ASX200 had jumped 35.2 points or 0.6 per cent at 5855.898 points. The broader All Ordinaries index had lifted 37.3 points or 0.63 per cent, at 5957 points.

CMC Markets chief market analyst Ric Spooner said the despite the bounce back into the green, markets remain volatile.

“We’re continuing to see relatively large moves, even though there’s not a lot of fresh news at an index level,” he said.

“Buyers are getting a bit more energetic as they see other people doing the same thing and a fear of missing out factor comes into play.

“But I think the market will remain fairly circumspect prior to the release of US inflation data on Wednesday night.”

Trading volumes in the day’s session were relatively light and in line with the 20 day average, while regional markets appeared cautious, Japan’s Nikkei turning negative as the local market closed.

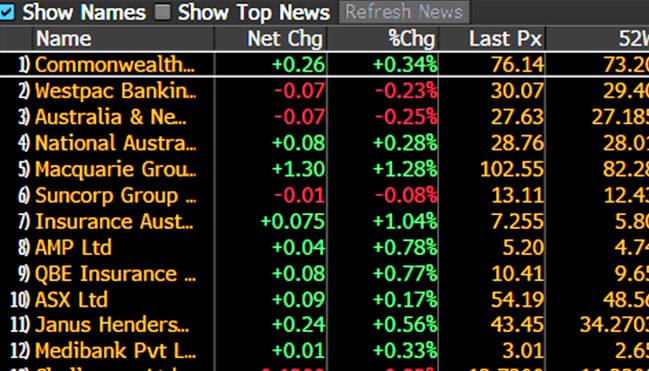

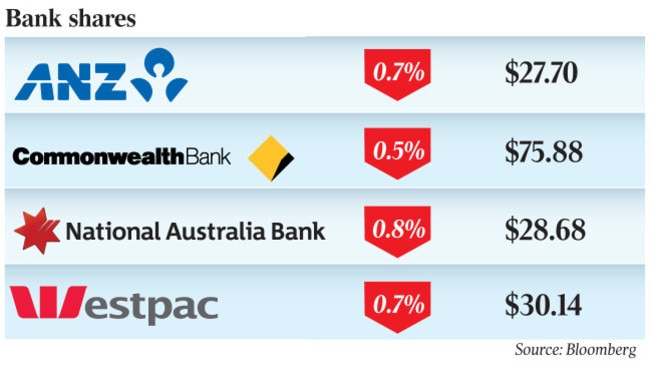

In financials, Commonwealth Bank stepped up 0.55 per cent to $76.30 while NAB made 0.38 per cent to $28.79. Westpac strengthened 0.23 per cent to $30.21 while ANZ inched up 0.07 per cent to $27.72.

BHP turned up 1.15 per cent to $29.90 while Rio Tinto grew 1.12 per cent to $78.87.

Stephen Bartholomeusz 4.28pm: Beware Trump’s pump-priming

The Trump administration’s budget “request’’, issued overnight, points to soaring US government deficits and debt. That should be sounding an alert for overly-indebted corporates and households around the world.

While the proposals will probably be reshaped by Congress, the overall direction of economic policy in the US is clear.

Trump is pursuing a supercharged growth strategy (he sees no reason, reportedly, why the US economy can’t grow at 6 per cent) that will see the US produce a deficit of close to $US1 trillion this year and more than $US1 trillion in 2019. US government debt, now just above $US20 trillion, is expected to reach $US30 trillion within a decade.

With the US economy growing quite strongly and unemployment at 4.1 per cent, the Trump tax cuts and infrastructure and defence spending agendas represent the priming of a pump that was already functioning at full capacity.

4.11pm: Local stocks seal firm recovery

The benchmark S & P/ASX200 index closes up 0.6 per cent on 5855 after early hesitation gave way to a bullish run throughout the session alongside strength in regional markets and a strong lead from Wall Street.

More to come.

4.03pm: Inflation blow may yet be thrown: FIIG

US CPI data on Wednesday now loom as an important test for global markets after last week’s sell-off, according to FIIG Securities.

“The threat of inflation is real, as any pick-up in CPI could increase uncertainty in the markets, encouraging a bond sell-off and further volatility in equities as a result,” says FIIG Head of Credit Strategy & Research, Mark Bayley.

“There has been a lot of commentary recently that this is the ‘correction’ or ‘adjustment’ the market had to have, but past experience shows us that P/E ratios will typically drop further than current levels following a market adjustment.”

He recommends investors position cautiously migrating to more highly-rated and shorter-dated corporate bonds. For higher yields, he recommends shorter-dated, lower-rated corporate bonds rather than longer-dated but more highly-rated bonds.

“If stronger US data continued, starting with a higher CPI print on Wednesday, we would expect 10 year US yields to trade at 3.00 per cent before the end of March,” he says.

“Consequently we continue to recommend that investors shorten their maturities and duration in US bonds.”

Samantha Bailey 3.51pm: Gains and pains: ASX confessors

Shares in hearing implant maker Cochlear recover to trade just 0.1 per cent lower on $171.62 after falling over 4 per cent in early trade after its first half results fell below analyst expectations. The company reported that its half-year net profit was one per cent lower to $110.8 million, telling investors it still expects to deliver a reported net profit in the range of $240m to $250m.

Toll road owner Transurban ebbs 0.2 per cent to $11.33 after earlier adding over 1.6 per cent following a first-half profit more than triple that of the same period last year.

Boral shares shrink losses to 1.9 per cent, buying $7.29 in late trade after earliery threatening its worst fall in over a year despite the company posting a 13 per cent lift in first-half profit and declaring a 12.5 cent interim dividend, up from 12c in the same period last year.

Shares in annuities provider Challenger crop just 0.6 per cent to $12.80 after falling nearly 7 per cent following its half-year result including a 3 per cent dip in profit compared to the same period last year, despite a jump in sales.

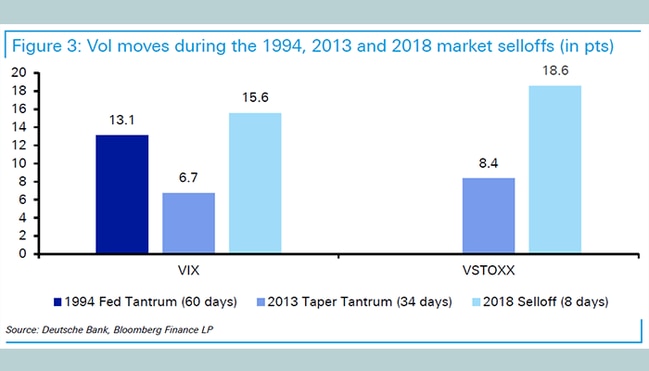

3.38pm: Correction tantrum, sob or sniffle?

The wooden spoon of financial markets, expectations of central bank tightening served investors a swift slap on the backside last week in the form of a correction on Wall Street — but just how bad was the hiding?

Deutsche Bank analysts have since flicked through the annals to compare last week’s mayhem with shocks of the past led by the spectre of monetary tightening: the classic surprise February Fed hike of 1994 and 2013’s taper tantrum.

Damage to the 10-year

“In 1994, US 10yr yields climbed from as low as 5.57pc in mid-January … to as high as 7.14pc by April after an Alan Greenspan-led Fed surprised markets by raising the Fed Funds rate.”

“We saw the taper tantrum of 2013 when … the Fed’s Ben Bernanke told Congress that the Federal Reserve might consider cutting the pace of bond purchases at the next few meetings.

“Treasury yields, which had already climbed around 40 bps in the few weeks leading into Bernanke’s speech, proceeded to sell-off over 60 bps in less than 5 weeks.”

“So far in 2018’s version, government yields are fairly flat.”

Equity fallout

“It’s fair to say that so far in 2018 developed market equities are already rivalling the moves in 1994 and 2013 but that emerging market equities … still have a long way to go if history is to repeat itself.”

“The S & P500 has already tumbled 7.2pc which is a little less than the fall in 1994 and more than that seen in 2013.”

“Emerging market equities have already fallen -8.5pc in this current sell-off but fell around -16pc in the full 1994 and 2013 experience.”

Volatility

“After a period of consistently low volatility, and the fact that the epicentre was inverse VIX ETPs, it is no surprise to see the spike in equity vol. in 2018 far eclipse that seen in 1994 and 2013.”

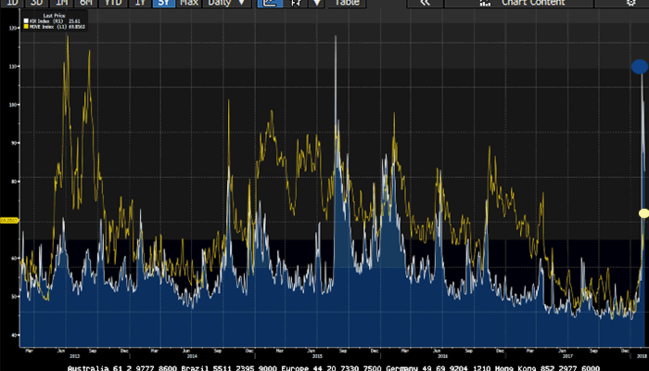

An indication of recent volatility containment to within the equity market, see also the graph below of its read on implied volatility, the CBOE’s VIX, against Bank of America Merrill Lynch’s Option Volatility Estimate of similarly implied volatility in the US treasury market.

3.25pm: IOOF flags $28m impairment

IOOF says it expects to realise a $28.3 million non-cash impalement related to the carrying value of goodwill allocated to its Perennial Investment Partners arm in its half-year results slated for release Friday.

IFL last up 1.4pc on $10.31

Samantha Woodhill 3.18pm: Sweden whips up whiskey float

The world’s first regulated and publicly listed single malt whisky fund has been approved to launch on the Nordic Growth Market in Sweden, giving whisky enthusiasts the opportunity to indirectly own a small part of a large collection of rare whiskies.

“The fund has been launched on the back of soaring demand for rare whisky from investors, connoisseurs and collectors across the world,” the Single Malt Fund said in a statement.

Figures from rare whisky analysts show that returns on rare whisky have outstripped those of many alternative traditional asset classes, the average bottle of rare whisky now fetching around £299.36 at auction, up from an average of £223.60 in 2013.

“With auction prices on the rise, whisky enthusiasts from across the work are increasingly turning to liquid gold as an investment,” the fund said.

The fund, which offers a target return rate of 10 per cent per annum, boasts five internationally acclaimed portfolio managers selecting its whiskies. It is scheduled to liquidate after six years.

“Knowing how much my own limited rare whiskies have appreciated in value, I spotted an opportunity to take a more professional approach to the whisky investor market,” said Christian Svantesson, the founder of the Single Malt Fund.

“As an entrepreneur, I couldn’t resist the temptation to combine my passion for whisky with my entrepreneurial drive.”

Ben Butler 3.12pm: ATO outs franking rort

The taxman is set to crack down on big-end-of-town investors rorting share ownership by holding stocks for a short period of time to tap into franking credits.

The scheme that is under ATO scrutiny involves an investor lending their existing shares in a listed company to a securities dealer and using the cash generated to buy additional shares in the same company.

At the same time, the investor enters into a repurchase deal where the securities dealer agrees to buy back the new shares after the dividend date.

After aggregating the new shares with the old, the investor claims to satisfy tax laws dictating that in order to claim the benefit of franking credits, 70 per cent of shares must be held “at risk” for at least 45 days.

The new shares are typically held for about 55 days, the ATO said.

Matt Chambers 3.03pm: S & P upgrades Rio, leaves M & A room

Ratings agency Standard & Poor’s has upgraded Rio Tinto’s debt to an “A” rating after a strong 2017 result, while UBS analysts predict the big miner will be able to return $US8 billion a year to shareholders for the next three years.

S & P said Rio’s debt-slashing in recent years, thanks to cost-cutting and strong commodities prices, has left the company able to pursue bigger acquisitions if it wanted to without putting its new A rating in danger — read more

RIO last up 1.6pc on $79.24

2.47pm: Boral positions for Trump spend

Preshant Mehra writes:

Boral has flagged growth in its full-year earnings on the back of a wave of infrastructure projects in Australia and market growth in its US operations.

The building materials supplier’s profit rose 13 per cent in the first half of the financial year to $173 million, but growth was capped by significant items, including $41 million in costs of integrating the Headwaters business it bought in the US.

Chief executive Mike Kane said the company had made a good start to the financial year and expects further growth in its three divisions — Boral Australia, Boral North America and the USG Boral joint venture.

He said the company will also “strongly see the benefits of infrastructure spending, particularly in the fly-ash business.”

Boral supplies concrete, asphalt, cement and timber products to the construction industry, as well as fly-ash, which is used in concrete.

Boral increased its exposure to the US market with a $US2.6 billion buyout of building products supplier Headwaters in mid-2017, just as the housing market recovers and US President Trump’s administration looks to boost infrastructure spending — AAP

BLD last down 0.5pc on $7.39

2.28pm: ASX gathers pace, hits new session highs

Local shares are on a tear in late trade as investors pile back into the Aussie sharemarket with a refined eye for choice buys after early hesitation.

The benchmark S & P/ASX200 index last traded 0.6 per cent higher on 5856.7, the biggest gains confined to select stocks Telstra (+1.6pc), Rio Tinto (+1.5pc), CSL (+1.5pc), Macquarie (+1.5pc) and BHP (+1.1pc).

1.43pm: Specialty retail backs GPT growth

Petrina Berry writes:

International specialty retailers, including Sephora and consumer electronic players JB Hi-Fi and Apple are offsetting department stores’ sales declines, shopping centre owner GPT Group says.

GPT Group, which owns Australia Square in Sydney and Melbourne Central and Highpoint Shopping Centre in Melbourne, has posted a 10 per cent lift in full- year profit to $1.27 billion.

Revenue for the 12 months to December 31 has risen 6.4 per cent to $1.65 billion with all segments — retail, offices and warehouse — contributing. Chief financial officer Anastasia Clarke says the mini majors specialty retailers’ 12.3 per cent sales growth had underpinned GPT’s shopping precincts result.

“The mini majors category continues to outperform and this is due to the ongoing inclusion of international retailers into the mix such as Sephora and JD Sports, ... and to the expansion of domestic groups like Cotton On and Mecca,” Ms Clarke said on Tuesday.

“We have seen outperformance in homewares with strong results across the portfolio for JB Hi-Fi and Apple,” she added.

But, sales were down at department and discount stores, Ms Clarke said, and while menswear sales had improved, women’s fashion had mixed results across different brands — AAP

GPT last down 0.2pc on $4.84

Sarah-Jane Tasker 1.24pm: Health insurer’s prudential retort

Australia’s private health insurers have used the latest prudential data to debunk opposition leader Bill Shorten’s claim the big funds were pocketing a return of more than 20 per cent.

The Australian Prudential Regulation Authority’s latest quarterly report on private health insurers has revealed the net margin for the sector was 5.16 per cent in the 12 months to December 2017.

Rachel David, chief executive of Private Healthcare Australia, said health fund profits had remained stable over the last decade running between 4.5 and 6 per cent. She argued that figure was significantly below the returns made by private hospital groups and medical specialist practices.

“This report by private health insurance industry regulator APRA should leave no doubt that there is no pot of gold hidden in health funds,” Dr David said.

1.13pm: ASX ramp-up winners & losers

12.53pm: ASX200 extends gains at lunch

The benchmark S & P/ASX200 index extends a run into the afternoon session, last up 0.4 per cent 5844.3 as gains spread evenly across the ASX10 — the Big Four banks now all in the green after early hesitation.

12.49pm: Heng Seng on strong footing early

Hong Kong stocks surged more than one per cent in the first few minutes of trade Tuesday as dealers took a strong lead from Europe and New York, following last week’s painful losses.

The Hang Seng index added 1.41 per cent, or 415.50 points, to 29,875.13. And the benchmark Shanghai Composite Index rose 0.70 per cent, or 21.98 points, to 3,176.11 while the Shenzhen Composite Index, which tracks stocks on China’s second exchange, climbed 0.54 per cent, or 9.32 points, to 1,733.05

AFP

12.27pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Andrew Wielandt — Dornbusch Partners

12.30pm: Nigel Littlewood — Harness Asset Management

12.45pm: Janu Chan — Senior Economist, St. George

1.30pm: Su-Lin Ong — Chief Economist, RBC Capital Markets

1.40pm: Mike Kane — CEO, Boral

(All times in AEDT)

12.09pm: Nufarm oil given regulatory tick

Nufarm’s proprietary omega-3 canola oil has been given regulatory approval for production and use in animal feed and human consumption by the Australian Office of Gene Technology regulator.

A land-based crop derivation, the oil through its new means of supply can “help relieve pressure on wild fish stocks” according to Nufarm. The company anticipates one hectare of its Nuseed omega-3 canola has the potential to provide the omega-3 yield from 10,000 kilograms of wild caught fish.

NUF last $7.86

12.04pm: Respite for bank investors royal pain?

Nope, nothing definitive — shares in the Big Four trade mixed as investors digest yesterday’s opening bell of the banking royal commission, heavyweights scrambling to meet a deadline today for full disclosure of misconduct over the last five years.

11.53am: Wage growth shock unlikely: RBA

James Glynn writes:

Australian wages growth is some way away from gaining upward momentum, and even then, the rise will be slow, says Luci Ellis, the Reserve Bank of Australia’s chief economist.

“Our forecasts are for wage growth to pick up from here, but not immediately and then only gradually,” she told a business audience.

While there are some pockets of wage pressures, firms are so far resisting paying broadbased wage increases, she said — read more

Note: Surprise US January payrolls data, including a sharp rise in average hourly earnings, preceded the first of Wall Street’s plunges into last week’s correction as traders positioned for expedited Fed tightening in response to the inflation pressure.

11.43am: Nikkei books solid opening gains

Tokyo stocks opened higher on Tuesday following two days of gains on Wall Street.

The benchmark Nikkei 225 index gained 0.98 per cent or 209.91 points to 21,592.53 in early trade, playing catch-up after a market holiday in Japan on Monday.

The broader Topix index was up 0.64 per cent or 11.10 points to 1,743.07 — AFP

Read: Miners lead ASX recovery

Samantha Bailey 11.30am: Business conditions, confidence up: NAB

Both business conditions and confidence made gains in January pointing to a “robust business sector”, according to the NAB Monthly Business Survey.

The business conditions index jumped 6 points to +19 points, well above the long-run average of +5 points.

Conditions remained solid across all major industry groups with the exception of retail, with the construction industry performing particularly well.

“The improvement in construction conditions over the last 12 months is due to improved trading conditions, profitability and employment, and probably reflects the still elevated residential construction pipeline, infrastructure construction and the gains in non-residential building approvals last year,” said NAB group chief economist Alan Oster.

11.07am: Materials lead ASX recovery

Local investors shake-off yesterday’s false start, albeit in slightly unconvincing manner as the sharemarket remains in the black after briefly dipping into negative territory in early trade.

The benchmark S & P/ASX200 index remains 0.1 per cent higher on 5827 in late morning trade.

Global markets left a dust-covered ASX by yesterday’s close, making up ground after the local bourse managed to curb losses the week prior that heralded a correction and return to volatility on Wall St.

Big miners BHP and Rio Tinto lead gains, the latter up over 2 per cent, strength in commodity markets overnight supporting sentiment toward the session’s best-performing sector: materials.

“Metals led the complex, with both base and precious recording strong gains,” said ANZ’s Daniel Gradwell, “energy was also boosted by better fundamentals, while agriculture pushed higher.”

“The release of President Trump’s infrastructure plan failed to ignite much interest from investors, despite its potential for boosting raw material demand in the US.”

Read: Gains and pains: ASX confessors

10.32am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Michael McCarthy from CMC Markets guest hosts

10.45am: Tom Kennedy — Economist, JPMorgan

11.00am: Live cross — Morgans

11.15am: Rudi Filapek Vandyck — Editor, FNArena

11.30am: Kara Ordway — FX Strategis

11.45am: Live cross — Shaw and Partners

(All times in AEDT)

10.22am: ASX opening winners and losers

10.09am: Stocks latch onto global rebound

The S & P/ASX200 index leaps up 0.3 per cent at the open to 5850.6, playing catch up after underperforming markets around the globe in yesterday’s session in a recovery from extended losses last week curbed by the local bourse.

Shares in AGL leap up over 3 per cent at the open to $21.55.

BHP and Rio Tinto have each come online over 1.5 per cent.

9.52am: Cochlear result leaves analyst sour

Cochlear’s first-half results were below market expectations and earnings will have to accelerate to meet full-year guidance, according to analysts.

“The key variation relative to our forecasts was lower-than-expected Cochlear Implant (CI) unit sales ex-China tender — 15,972, up 5.5pc versus our forecasts at 16,950 or +12pc — and hence, CI revenue $393m, up 4pc but about ~6pc below our forecasts,” Macquarie says. “While growth in developed economies remained strong, growth in emerging markets fell, impacted by tender timing.”

Macquarie adds that the midpoint of management guidance, at $245m, implies 2H18 underlying NPAT of $134m, up 20pc on year.

“This implies strong 2H18 growth within CI and/or Services revenue,” Macquarie says.

The implant manufacturer currently trades on 35.6 times 12-month forward consensus EPS.

Investment house Citi was similarly cautious over the result:

“Overall a reasonable result driven by solid performance in DM but weaker in EM due to timing of Chinese market tender. EBIT slightly lower than Citi due to investment for future growth. Citi expects the stock to trade “flat to down”.

COH last $171.79

9.42am: Woodside penal risk rising: Macquarie

Macquarie says Woodside faces rising penal risk following media reports that KOGA has initiated court arbitration over the price of a midterm supply contract pertaining to the NWS joint-venture.

“As we have long flagged, arbitration within LNG has been rapidly rising as the power has shifted from seller to buyer,” the broker says.

“Publicly available arbitration decisions over the past few years have all been in favour of the buyer, and we note there are 43 metric-tonnes-per-annum (Mtpa) of expiring long-term contracts and 187Mtpa that will come up for repricing before 2020.

“The high risk of arbitration and its risk to WPL’s earnings has the primary reason behind our downgrade and negative view, which has now materialised.”

WPL last $31.30

9.32am: Analyst rating changes

AWE raised to Equalweight — Morgan Stanley

Ansell cut to Underperform — Credit Suisse

Monadelphous started at Underperform; $15 target price — Credit Suisse

JB Hi-Fi cut to Sell — Bell Potter

Praemium cut to Hold — Morgans

Praemium raised to Buy — Baillieu Holst

Myer cut to Sell — Deutsche Bank

Samantha Bailey 9.28am: Cochlear sees currency relief

Hearing implant maker Cochlear has delivered a flat first-half result as it reaffirmed its full-year guidance, expecting currency headwinds to moderate strong underlying business growth for the remainder of the financial year.

The company said it still expects to deliver a reported net profit within the range of $240 and $250 million for the 2018 fiscal year, as the market for the Cochlear hearing implants continues to grow worldwide.

But for the half, net profit attributable to members edged 1 per cent lower to $110.8 million for the six months to December 31.

Meanwhile total revenue for the period hiked up 7 per cent to $649.6 million, up from $609.2m in the first half last year — read more

COH last $171.79

Ben Wilmot 9.23am: Fire breaks out in Sydney CBD

Fire! A fire has broken out in the Sydney CBD on a major building site.

Flames could be seen rising from the Circular Quay building project.

The fire is believed to be on the former Gold Fields House site where are a major hotel and apartment project is planned.

The site recently changed hands and was bought by Chinese backed company Yuhu from a unit of the under pressure Dalian Wanda Group which also sold a project on the Gold Coast as part of a larger $1.1 billion deal.

Details of

Luxury apartments and a hotel tower have been planned and the new owners would like to create tourist destination but it is not known how much damage the fire has caused.

9.12am: Metro, retail growth firms GPT result

Diversified property group GPT booked double digit profit growth in its full fiscal year backed by performance in its retail assets and healthy returns from capital city investments.

The company grew funds-from-operations (FFO) by 3 per cent per security to $554.2m, achieving 15.2 per cent total return alongside 10.1 per cent growth in net-profit-after-tax (NPAT) to $1.3bn.

Bloomberg’s consensus analyst collation forecast total net income in GAAP terms of $554.8m.

Strong valuation gains and effective growth in rental yield from it Sydney and Melbourne assets drove the result, as did pleasing performance of its retail portfolio, according to chief executive Bob Johnston.

“[The portfolio] demonstrates both the quality of the portfolio and the successful outcomes achieved by the Group in continuing to evolve its retail offer in response to changing trends,”

said Mr Johnston.

The Group continued to make good progress on its development pipeline, which includes the proposed Parramatta office development in Sydney, the expansion of Sunshine Plaza, and new logistics opportunities in western Sydney.”

Alongside results, GPT announced a 12.3c per share final dividend contributing to total distribution per security growth of 5.1 per cent over the fiscal year.

Chair Rob Ferguson yesterday revealed he will retire from the board after the group’s annual general meeting in May, with veteran investment banker Vickki McFadden slated as his successor effective March this year.

GPT last $4.85

Michael Roddan 8.49am: Challenger profit falls in sales boom

Australia’s largest annuities provider Challenger has recorded a slight dip in interim profit despite a substantial lift in sales.

Challenger today announced a profit of $195 million for the six months through December, a 3 per cent fall on year-on-year, mainly due to decreased income from investment returns. The group said it had a “negative” investment experience of $13 million.

The slip in statutory profit came despite a 21 per cent increase in life insurance sales, which included a 69 per cent expansion in the annuity portfolio.

Annuities, a form of longevity insurance that helps to provide savers with income in retirement beyond average life expectancy, have been a key focus for the group amid Australia’s burgeoning population of retirees. The government currently has plans to encourage the take up of annuities and other retirement income products in a bid to help pensions better consume their savings — read more

CGF last $12.84

8.42am: Transurban holds outlook steady

Transurban booked $338m in first-half net income and has maintained its full-year distribution guidance in its interim results released this morning.

The infrastructure operator announced a 28c per share interim dividend, reiterating its expectation for a total fiscal year distribution of 56c per share.

TCL last $11.35

8.31am: Boral seals $173m in first-half

Boral brought home $173m in net income over the first-half and says it is on track to post low double digit EBIT growth by FY18 close.

Alongside its interim results released this morning, the building materials company announced a 12.5cps interim dividend.

BLD last $7.43

8.20am: Wall St powers higher

US stocks roared for a second consecutive session as commodity prices stabilised, a potential sign the clouds over the market are beginning to part after two bruising weeks that pushed indexes from New York to Hong Kong into correction territory.

The overnight gains were broad, with increases seen in oil companies, regional banks and utilities firms. The trading session lacked the volatility that characterised last week’s stumble. The S & P 500 and Dow Jones Industrial Average climbed out of the gate, marched steadily higher and never reversed course. The indexes closed up 1.7 per cent and 1.4 per cent, respectively. The Nasdaq advanced 1.5 per cent.

The moves marked a sharp departure from the past two weeks, when concerns over rising bond yields and collapsing bets on low volatility led investors to pull a record amount of money from equity funds in the week ended Wednesday and dump other assets, like oil and gold. In total last week, the blue-chip index changed direction 53 times, including 29 times in a single session.

The wild swings in share prices led many traders to express uncertainty over when the downturn would end.

Yet overnight, markets showed signs of bouncing back — giving some investors hope that the turbulence that had gripped markets around the world was starting to fade.

The S & P 500 notched its biggest two-day percentage gain since June 2016, shortly after markets rebounded from UK’s surprise vote to leave the European Union. Commodities that had slid the past two weeks reversed course, with US crude oil ending the day higher following its largest one-week percentage decline in more than two years. And a measure of expected swings in the U.S. stock market, the Cboe Volatility Index, headed lower again, after rocketing higher in its biggest weekly advance since August 2015.

Dow Jones Newswires

8.13am: Bank shares in royal commission wake

Ben Butler 8.09am: Banks miss first down payment

Commonwealth Bank and National Australia Bank earned the wrath of financial services royal commissioner Kenneth Hayne on the inquiry’s opening day by telling him they cannot meet a deadline of 4pm today to provide full details about misconduct over the past five years.

Both banks intend to file as much as they can by today’s deadline but expect to have to file additional material later.

Opening the commission yesterday, Mr Hayne complained that financial services institutions had told him they needed more time to compile information about their misconduct, even though they had already made 50-page submissions about both misconduct and behaviour that did not meet “community expectations” stretching back to 2008.

7.40am: Wall St set to lead ASX higher

The Australian share market looks set to open higher, taking its lead from Wall Street which has lifted for its second consecutive session.

At 7am (AEDT), the share price futures index was up 34 points, or 0.59 per cent, at 5,775.

Worldwide, investors brushed aside fears of rising inflation and tried to put last week’s worst rout in two years past them, but some volatility still lingered.

Volatility picked up, with the major indexes on Wall Street climbing more than one per cent shortly after the open, then pared about half that advance before rebounding further.

In late US afternoon trading, the Dow Jones Industrial Average was up 2.27 per cent, at 24,740.28 and the S & P 500 was up 1.73 per cent, at 2,664.97. The Nasdaq Composite was back above 7,000 points, up 2.10 per cent at 7,018.87.

Locally, in economic news today, Reserve Bank of Australia assistant governor (Economics) Luci Ellis is slated to speak at the ABE Forecasting conference.

The federal government’s financial statements for the last six months of 2017 are due to be released, as is the Australian Bureau of Statistics’ lending finance data for December.

The Anz-Roy Morgan Consumer Confidence weekly survey is also due out as is the National Australia Bank’s January business confidence and conditions survey.

In equities news, GPT Group is expected to release its full-year results while Boral, Cochlear, Challenger and Transurban are slated to release half-year results.

The Australian market yesterday closed lower but did claw back some earlier losses as the Dow Jones futures index pointed to a possible positive session on US markets tonight.

The benchmark S & P/ASX200 index fell 17.3 points, or 0.3 per cent, to 5,820.7 points.

The broader All Ordinaries index was down 17.8 points, or 0.3 per cent, to 5,919.7 points.

AAP

7.00am: Dollar gains

The Australian dollar is back above US78 cents as the US dollar’s rise falters and it slips amid an equity rebound.

At 6.35am (AEDT), the Australian dollar was worth US78.44 cents, up from US78.35 cents yesterday.

Appetite for risk-taking crept back into currency markets to the detriment of the US currency and helped higher-yielding emerging market currencies as well as commodity-linked currencies like the Australian and Canadian dollars, Reuters reported.

“The index that tracks the US dollar against a basket of currencies was down 0.2 per cent at 90.291, erasing some of the gains last week,” the agency said.

Westpac’s Imre Speizer later said the US dollar had slipped a little further. “The USD index is 0.3 per cent lower on the day ... (while the) AUD rose from 0.7810 to 0.7847,” he said in a morning note.

The main event risk for the local currency today would be Reserve Bank of Australia assistant governor (Economics) Luci Ellis’s speech at the ABE forecasting conference in Sydney around 0850 AEDT.

Also, the National Australia Bank’s business survey for January, which was steady in 2017, may have an impact, he said.

Mr Speizer thinks the Australian dollar could even extend its latest gains and reach above US79 cents.

“(There’s) potential for this rebound to extend to 0.7900 if the USD remains stalled and/or equities recover further.” The Aussie dollar is also higher against the yen and the euro.

AAP

6.45am: Wall St on the rise

US stocks bounced higher overnight following two bruising weeks, lifted by a rally in shares of oil-and-gas companies.

In US afternoon trade the Dow Jones Industrial Average had jumped 519.60 points, or 2.2 per cent, to 24,710.50, following its largest one-week percentage decline in more than two years. The S & P 500 rose 1.8 per cent and the Nasdaq Composite added 1.9 per cent.

Australian stocks looks set for a strong rise at the open. At 6.45am the SPI futures index was up 37 points.

The overnight gains on Wall Street were broad, lifting 10 of the S & P 500’s 11 sectors higher for the day. Still, major stock indexes remain sharply lower for the month, following a heavy bout of selling that analysts and investors have attributed to failed bets on low stock market volatility, rising bond yields and concerns about a possible pick-up in inflation.

Investors have been questioning whether the declines, which have erased the S & P 500 and Dow industrials’ gains for the year, reflect a short-term technical correction or the start of a more profound reassessment of the financial climate in light of less support from central banks.

“I think this is a healthy squeezing out of some overoptimism,” said James Norman, head of equity strategy at QS Investors. Still, if inflation rises faster than expected, the Federal Reserve will need to pick up the pace on interest-rate increases, which would also lift government bond yields. That could hurt growth and reduce the appeal of companies that have taken on a lot of debt, he added.

Shares of energy companies rose with oil prices, giving major indexes a boost.

The S & P 500 energy sector rose 1.8 per cent, among the biggest gains of the broad index’s 11 sectors, while US crude oil rose 1.1 per cent to $US59.87 a barrel after sliding last week on worries about rising US production.

Meanwhile, government bonds weakened, with the yield on the benchmark 10-year US Treasury note — which rises as bond prices fall — recently at 2.862 per cent, compared with 2.829 per cent on Friday. Rising bond yields had spooked some equity investors last week, raising concerns about the possibility of central banks increasing interest rates faster than expected.

Earlier, stocks across Europe rallied, lifting the Stoxx Europe 600 up 1.7 per cent.

Dow Jones Newswires

6.40am: Stocks bounce back

US and European stock markets rebounded overnight, but the danger of ever more volatility kept investors’ nerves under strain.

Wild price swings accompanied last week’s heavy stock market losses, the worst weekly equity slump in years, making it hard for investors to read the market with any degree of confidence from one moment to the next.

“Investors are breathing a sigh of relief after the torrid times last week,” said Rebecca O’Keeffe, head of investment at Interactive Investor.

“Buying the dip (bargain hunting) has been a very difficult call in recent days, with every attempt at engagement punished in subsequent market moves, so investors will be hoping that this is a genuine buying opportunity.” But such hopes may well be premature, some analysts cautioned.

“Investors will be aware the calm probably won’t last,” said Jasper Lawler, head of research at LCG.

Michael Hewson at CMC Markets, meanwhile, said that there is “a whole new breed of equity investors and traders who have never experienced the type of volatility that we’ve gone through over the last few days”, making their “untried reaction” another factor of market uncertainty.

At the heart of market worries lies the rapidly rising likelihood of monetary policy tightening by key central banks, notably the Federal Reserve, but also the European Central Bank and the Bank of England, as inflationary pressures build up.

Analysts are now predicting that Thursday morning’s (AEDT) US inflation report for January, coupled with fresh retail sales data, may well spark another rollercoaster ride for equities if they confirm inflationary fears.

A weak reading, however, may give US monetary policymakers a reason to hold off on raising rates at a faster clip.

London closed up 1.2 per cent, Frankfurt ended 1.5 per cent higher and Paris finished up 1.2 per cent.

Yesterday got off to a calm start across Asia but while some exchanges managed to stay in positive territory, the afternoon saw gains eroded or wiped out.

Hong Kong, which sank more than nine per cent last week, closed slightly lower, while Shanghai and Singapore both posted modest gains.

Tokyo, a benchmark for Asian market trends, was closed for a public holiday.

AFP