Trading Day: live markets coverage; Bank shareholders risk Royal pain; plus analysis and opinion

Local shares reverse early gains, while JPMorgan does the heavy lifting for its ‘Super 7’ picks and upgrade on the ASX.

And that’s the Trading Day blog for Friday January 19.

Samantha Woodhill 4.45pm: Stocks extend losing streak

The local share market a sluggish week down at a month-low, investors attention elsewhere as offshore markets built on recent strength.

At the close of trade, the benchmark S & P/ASX200 was down 8.766 points or 0.15 per cent at 5008.8 points. The broader All Ordinaries index was down 11.072 points or 0.18 per cent, at 6119.3 points.

It comes despite the Dow Jones Industrial Average closing above 26000 for the first time earlier this week.

Moody’s economist Katrina Ell said the local slump isn’t driven by any news or economic data in particular.

“The ASX has had a tough week and today has been a continuation of that trend,” Ms. Ell said.

“I think what we’re seeing is a little bit of mean reversion. The ASX started 2018 on a really strong note as did other markets and now we’re seeing a bit of a pull back.”

She said the ongoing Bitcoin dialogue could be causing investors some anxiety too.

In financials, NAB inched 0.24 per cent lower to $29.16. Commonwealth Bank edged up 0.26 per cent to $79.83 while Westpac lowered 0.06 per cent to $30.93. ANZ made 0.11 per cent to $28.56.

4.08pm: Bond market reveals hike bets

The week looks set to end on the sound of a thrown gauntlet, investors fleshing out the 3-year Aussie government bond yield and RBA cash rate spread to 75 basis points — its widest margin since 2010 according to Bloomberg.

The RBA indeed decided on a rate hike in its May 2010 meeting and subsequently did so again in November. The central bank is yet to lift rates since.

A hike in the RBA’s overnight cash rate tends to lift expected rates of return on investment and an increased probability gives less incentive to invest in fixed-income today. ‘Risk free’ government debt tends to be first cab off the rank once the would-be deed be done.

Given an investor need local currency to buy said securities, the Australian dollar makes interesting watching alongside the treasury yield — last holding well above the US80c milestone it broke overnight.

However it’s all been a US dollar story in FX markets, with the session’s jitters around a potential White House shutdown the latest hit to the reserve currency following moves by central banks around the world to follow a hawkish lead set by the Fed.

3.53pm: Banks face native growth drain: UBS

Australian banks are facing a regulation trap, something that is going against the trend around the rest of the world, notes UBS.

With banks facing 15 major inquiries, reviews and legal proceedings in Australia, this it is a material drag on the banks’ resources which will inevitably lead to lower returns for shareholders, says UBS bank analyst Jon Mott.

His comments come as the banking royal commission is expected to ramp up in coming weeks.

“Around the world the regulatory pendulum is swinging back, with most regions enjoying a lighter touch as governments focus on growth. Unfortunately this is not the case in Australia,” Mr. Mott says.

“At a minimum these inquiries will lead to ongoing volatility in share prices as the market prices in potential negative outcomes into their releases. This is consistent with experiences around the announcement of the FSI, the Bank Levy and APRA’s interpretation of ‘unquestionably strong’.

UBS has a “neutral” rating on ANZ, CBA and Westpac (WBC) and a “sell” rating on NAB.

3.28pm: #1-7: JPMorgan’s 2018 ‘overweights’

JPMorgan has gone full bull on local stocks this year, upgrading its year-end forecast for the benchmark index to 6450 from the moderate 6300 it stood before.

“We expect the earnings gap between Australia and the globe to narrow in 2018, with our analysts collectively forecasting growth of 8.3pc,” says Australian head of equity strategy Jason Steed.

Mr. Steed notes the market’s consensus forecasts for earnings currently sits at 7.0 per cent while his forecast still undershoots the 10.3 per cent aggregate developed market rate.

The figures are exclusive of Australia’s reputably generous dividend payments.

“The relative weakness in materials and financials has been a factor in Australia lagging the global earnings upswing,” says Mr. Steed.

“With the financials and faterials sectors accounting for over half of the ASX200’s capitalisation, we believe it’s no surprise that the overall index lagged so far behind most other markets.”

This year, however, major lender earnings growth looks promising based on likely improvement in funding costs and the repricing of mortgages and small business loans, according to Mr Steed, while miners look to be in “great shape” on future cash flow, leverage and capital management terms.

Alongside the forecast revision, the investment bank has issued its “Super 7” picks across sectors for investors looking to spread risk over the next 12 month:

Pharma: CSL

Materials: AMC

Utilities: AGL

Infrastructure: WOR

Real Estate: SCG

Agriculture: HUO

Finance: IFL

3.18pm: The Money Cafe returns for 2018

Listen in as Wealth Editor James Kirby and The Constant Investor’s Alan Kohler make their return for the first podcast of the year.

The duo take in bitcoin’s wild ride and offer their take on what it all means, mull what the ASX might hold in store for investors this year and look at how Amazon has helped put a rocket under Kogan’s share price.

Don’t forget to send you own questions to James and Alan via hello@theconstantinvestor.com.

Find all episodes of The Money Cafe and subscription links here.

3.03pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Live cross — Shaw and Partners

3.15pm: James Cahill — Melbourne School of Government

3.30pm:Vic Edwards — UNSW

4.00pm: Andrew Wielandt — Dornbusch Parnters

4.15pm: Winston Sammut — Folkestone Maxim Asset Management

4.30pm: Shane Oliver — Chief Economist and Head of Investment Startegy, AMP Capital

(All times in AEDT)

2.49pm: Crypto ETF push suffers setback

Dave Michaels and Asjylyn Loder write:

Wall Street’s top regulator on Thursday all but shut the door to approving exchange-traded funds that hold bitcoin and other cryptocurrencies, questioning whether the products could comply with rules meant to protect mom-and-pop investors.

The Securities and Exchange Commission outlined its views in a letter to two Wall Street trade groups whose members envision the profits that could flow from selling exposure to bitcoin through popular investment vehicles such as ETFs and mutual funds. The SEC questioned how bitcoin’s volatility and potential illiquidity would fit with funds that must calculate a fair market price for their portfolio at the end of every trading day and allow investors to easily cash out their shares.

“Until the questions identified above can be addressed satisfactorily, we do not believe that it is appropriate for fund sponsors to initiate registration of funds that intend to invest substantially in cryptocurrency and related products,” the SEC’s director of investment management, Dalia Blass, wrote in the letter made public Thursday.

Several ETF issuers have been racing to launch the first bitcoin fund amid a speculative frenzy for digital currencies, but the SEC has so far been sceptical. The agency has also expressed reservations about initial coin offerings, saying that many ICOs, in which a firm raises money from investors in exchange for a new coin, are securities sales that should comply with its investor protection rules.

Last year, the SEC rejected two proposed ETFs that would directly own bitcoin, including one from Cameron and Tyler Winklevoss, arguing that the global market for the digital currency wasn’t transparent enough to support sufficient oversight.

Dow Jones Newswires

2.32pm: Unease as stocks hint syndrome

Local shares are stuck in a narrow range just below flat after giving up early gains, investors choosing to sit on the sideline as the possibility of a US government shutdown remains at large.

The S & P/ASX200 index last traded dow 0.1 per cent at 6007.3.

In terms of hard line growth prospects, recent offshore indicators have painted an increasingly brighter economic backdrop for Australia, the contradictory sharemarket price action in the meantime thus all the more concerning for investors, according to CMC chief market strategist Michael McCarthy.

“It’s been the story of 2018 so far, when global sharemarkets move up the Australian sharemarkets have lagged them, and when markets falter or take a backward step, the falls here have been magnified,” says CMC chief market strategist Michael McCarthy.

“If this underperformance continues ... we might crack through very important support at 5950 ... it’s hard to see what the circuit breaker will be.”

SWING STOCKS:

+ Flight Centre (4.9pc), Infigen Energy (3.5pc), CYBG (3.2pc), A2 Milk (3pc), Qantas (2.7pc)

— Orocobre (9.5pc), Galaxy Resources (8.6pc), Minerals Resources (6.2pc), Retail Food Group (5.7pc), Pilbara Minerals (4pc)

Read: Lithium stocks sweat supply threat

Paul Garvey 2.02pm: Lithium stocks sweat supply threat

Lithium stocks are copping a drubbing today as the market responds to news that one of the sector’s biggest players is set to more than quadruple its output.

The big locally listed lithium stocks are all down more than 6 per cent in early afternoon trade. Kidman Resources (KDR) has been the hardest hit, falling 10.15 per cent.

Many stocks in the sector were trading at our near record highs earlier this week, only for Chilean lithium heavyweight SQM to spoil the party.

SQM — the world’s lowest cost producer of lithium, a key ingredient in the batteries that power electric vehicles — announced overnight that it had resolved a dispute with the Chilean authorities that clears the way for a big expansion of its operations.

SQM produced around 52,000 tonnes of lithium carbonate last year but is now expected to lift that to 216,000 tonnes by 2025.

Analysts at Morgan Stanley said SQM would also be permitted to ultimately expand to as much as 350,000 tonnes a year, with the news a negative for global lithium equities.

“We expect SQM to aggressively recover market share from 2020 and see downside risk to the lithium price,” Morgan Stanley said.

Kidman’s fall is particularly eye-catching, given SQM is the joint venture partner in Kidman’s Earl Grey lithium project in Western Australia.

1.47pm: Asia trade keeps watchful eye

Asian markets mostly rose Friday after another positive week across trading floors but investors’ desire for more buying was being tested by profit-taking and worries about a possible US government shutdown.

Hong Kong, which has broken to record levels this week, was 0.1 per cent lower, however Shanghai added 0.5 per cent a day after data showed China’s economy grew a forecast-busting 6.9 per cent last year, which was much better than the government’s target and the first annual increase since 2010.

Tokyo ended the morning 0.3 per cent higher, while Singapore and Seoul were each 0.1 per cent up. There were also gains in Taipei, Wellington and Manila.

Wall Street came off record highs to end lower as Washington politicians bicker over a federal funding deal, which must be passed by midnight on Friday US time.

The House of Representatives passed a bill on Thursday but there are increasing concerns the Republicans do not have enough votes in the Senate to send the budget to Donald Trump’s desk.

AFP

1.19pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

1.40pm: Andrew Wielandt — Dornbusch Partners

2.00pm: Michael McCarthy — Chief Market Strategist, CMC Markets

2.15pm: Tom Revy — Managing Director, Black Earth

2.30: Angus Armour — MD & CEO, AICD

2.45pm: Tim Lea — CEO, Veredictum

(All times in AEDT)

12.32pm: US faces government ‘shutdown’

President Trump was at odds with his chief of staff and Republican leaders yesterday as the US careered towards a potential government shutdown.

Much of the federal government was set to grind to a halt at midnight unless Congress passed a new spending bill.

Yesterday morning, however, Mr Trump undermined a stopgap solution, pushed by Republicans in the House of Representatives, that would keep the lights on for a further 30 days.

Robert Gottliebsen 12.27pm: Rate fate as bond bulls cool

Despite a few interruptions, US bond interest rates have been falling since the early 1980s as US bond prices rose, forcing yields lower.

That bond boom is over.

American interest rates in 2018 are now set to rise sending shockwaves around the world. Here in Australia the US directional change will edge our interest rates higher. As I will explain below, we have our own set of forces pushing rates higher, although our interest rate fate is not as clear as the US because of the dangers of the apartment glut and our high leverage.

11.43am: HSBC in $102m fraud claims settlement

HSBC to pay $101.5 million to resolve Federal fraud charges — more to come.

11.30am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ivan Colhoun — Chief Economist, NAB

11.40: Foad Fodahi — Managing Director, Telsyte

12.00pm: Geoff Horth — CEO, Vocus

12.15am: Gerard Burg — Senior Economist, NAB

12.15pm: Janu Chan — Senior Economist, St George

12.30pm: Greg McKenna — AxiTrader

(All times in AEDT)

11.11am: Williams eyes Fed vice-chair

Nick Timiraos writes:

The White House is considering John Williams, the president of the Federal Reserve Bank of San Francisco, as a candidate to serve as the vice chairman of Federal Reserve Board in Washington, according to people familiar with the matter.

Mr Williams succeeded Fed Chairwoman Janet Yellen as the San Francisco Fed leader in 2011, after Ms Yellen was tapped by President Barack Obama to serve as the Fed’s vice chairwoman in 2010 — read more

Dow Jones Newswires

10.35am: Stocks stage swift reversal

Australia’s S & P/ASX 200 turned slightly negative after rising 0.2pc to 6028.7 in early trading.

Healthcare and consumer staples are leading gains in a majority of sectors, but BHP is struggling to stay positive and bond proxies (e.g. SCG, TCL, SYD) are down after a further rise in bond yields.

BHP has copped a few downgrades from analysts in recent days and disappointing coal production and guidance hasn’t helped.

10-year bond yields rose as much as 3.5 bps to 2.845 per cent after US 10-years rose 3.5 bps to a 10-month high of 2.625 per cent amid US government shutdown risks.

Temporary US Government funding expires at midnight US time and the House and Senate must pass a temporary extension to avoid a partial shutdown.

But negotiations are stuck on a Democrat demand to include a provision to shield 690,000 undocumented immigrants brought to the US as children from deportation.

Plus there’s upward pressure on bond yields in any case from improving US economic data, quantitative tightening and rate hikes.

SWING STOCKS

+ Flight Centre (5.5pc), Infigen Energy (3.9pc), Qantas (2.9pc), CYBG (2.2pc), Nanosonics (1.9pc)

— Galaxy Resources (9.7pc), Pilbara Minerals (6pc), Mineral Resources (5.8pc), Retail Food Group (3.7pc)

10.15am: Whitehaven bears win out

Whitehaven Coal shares (WHC) hit a four-week low in early of $4.27 with a 3 per cent fall after receiving a mixed review from the analyst community in the wake of its quarterly update yesterday.

10.09am: Investors board Flight Centre on upgrade

Flight Centre sits top performer on the S & P/ASX200 index early after an upgrade from UBS to “buy”.

“In our view, the market is underappreciating Flight Centre’s ability to continue growing share ... its online business and achieve productivity gains over the next three-to-five years,” says the investment bank.

FLT last up 3.8pc on $48.60

10.04am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Ric Spooner from CMC Markets and Martin Lakos from Macquarie Wealth Management guest host

10.30am: James King — AFEX Australia

11.15am: Chris Gosselin — CEO, Australian Fund Monitors

11.30am: Ivan Colhoun — Chief Economist, NAB

(All times in AEDT)

9.48am: Atlassian extends loss, revenue grows

Software giant Atlassian has widened its second-quarter net loss, but has boosted revenue compared to a year ago.

Net loss for the three months to December 31 was $US65.2 million ($91.3m), compared to $US1.7m in the same quarter the previous year, due to a $US47.3m writedown of Atlassian’s deferred tax assets. Total revenue for second quarter was $US212.6m, up 43 per cent from $US148.9m a year ago, and is expected to be grow to between $US217m and $US219m in the third quarter — AAP

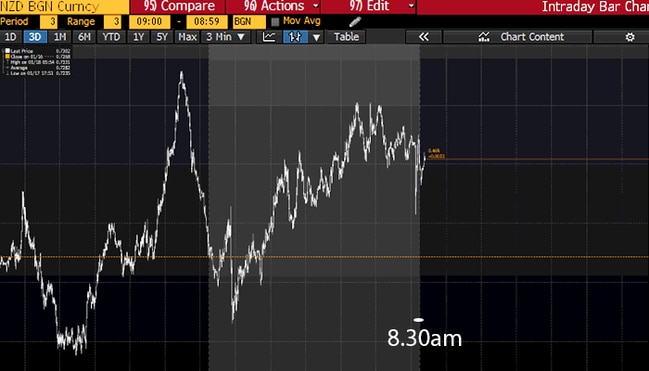

9.42am: NZD steady on PM Arden news

The Kiwi dollar registered a reaction at 8.30am (AEDT) as the news of Prime Minister Jacinda Ardern’s pregnancy landed and has since tracked sideways, last buying US73.03 cents.

Ms. Arden is due to have the baby in June, with coalition member Winston Peters slated as acting Prime Minister for the subsequent six weeks.

9.38am: Analyst rating changes

Whitehaven cut to Neutral — JPMorgan

Whitehaven cut to Sell — Citi

Whitehaven raised to Outperform — Credit Suisse

P2P Transport initiated at Buy; $1.68 target price — Shaw & Partners

National Tyre & Wheel initiated at Add — Morgans

Galaxy Resources raised to Speculative Buy — Harleys

Flight Centre raised to Buy — UBS

Beach Energy raised to Hold — Morningstar

BHP cut to Hold — SGB Securities

Healthscope cut to Sell — Citi

NextDC cut to Neutral — Macquarie

John Durie 9.34am: Aurizon rail sale call delayed

Aurizon and Pacific National are still haggling with the ACCC over the planned Acacia Ridge purchase with the date for the decision extended from February 1 to mid February.

The ACCC said the delay was to give the parties time to furnish more information — read more

AZJ last $4.60

9.13am: Aussie dollar skirts US80c

The Australian dollar remains within two points of the US80c mark after it briefly lofted over the milestone overnight, the greenback under heavy selling pressure throughout the last month.

“The imminent focus is whether or not the US can avoid a government shutdown,” says ANZ senior economist Daniel Hynes, “such an event is certainly not unprecedented by any stretch, but would likely lead to some increased volatility.”

AUD/USD last US79.99 cents.

8.51am: Wall St hauls in reins

Wall Street stocks pulled back from records Thursday as concerns about a possible US government shutdown and lofty equity valuations dented sentiment.

The Dow Jones Industrial Average fell 0.4 per cent to finish the session at 26,017.81.

The broadbased S & P 500 lost 0.2 per cent at 2,798.03, while the tech-rich Nasdaq Composite Index slipped less than 0.1 per cent to 7,296.05.

General Electric had another bad day, falling 3.3 per cent following the news Tuesday that it was taking a $6.2 billion charge linked to the insurance business. The conglomerate already was under heavy pressure due to weak performance in key industrial divisions.

Walmart advanced 1.6 per cent following an upgrade from Goldman Sachs, which praised the retail giant’s strategy and said it was likely to grant a “meaningful” dividend hike due to US tax reform.

Morgan Stanley rose 0.9 per cent after reporting that fourth-quarter earnings of 84 cents per share, seven cents above expectations.

AFP

8.47am: Builders hit by demand squeeze

Lisa Allen and Robyn Ironside write:

Builders across Australia’s east coast are starting to feel the squeeze as demand for apartment construction weakens amid a fall-off in foreign buyers and the threat of interest rate rises.

It adds fresh concern for a sector that is cooling, with analysts warning the Reserve Bank needs to carefully manage the path to rising interest rates as the economy recovers.

8.39am: Rio said to halt Oyu shipments

Rio Tinto (RIO) has halted shipments of copper concentrate from its Oyu Tolgoi copper mine in Mongolia after a week-long dispute at a border crossing to China and a new tax bill from the Mongolian government, reports the Financial Times.

8.24am: Roll with it: Credit Suisse goes cyclical

As the bull market in equities rolls on amid synchronised global economic growth, low interest rates and fiscal policy expansion, investors should ensure they have enough exposure to cyclical companies, according to Credit Suisse Australia equity strategist Hasan Tevfik.

While stable earnings, high yields and low volatility have been coveted by investors since the global financial crisis, Tevfik says they should no longer be paying up for expensive “bond proxies” in the property trusts, infrastructure and utilities sectors.

Rather, as low volatility becomes near universal and central banks start reducing their monetary stimulus, investors should look at some of the most cyclical exposures among the commodities, industrial cyclicals and financial companies.

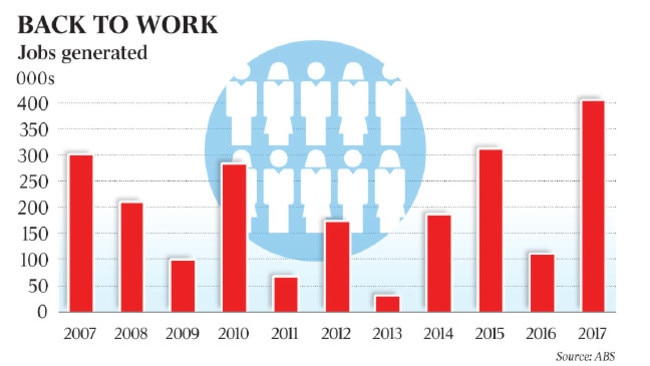

David Uren 8.14am: Employment at post-crisis prime

Almost 75 per cent of the working-age population now has a job, exceeding the levels reached during the peak of the resources boom, after strong demand from employers generated 400,000 new positions over the past year.

Employment growth in 2017 was the best in a decade as business cast off the caution left by the global financial crisis and started lifting investment.

The jobs growth last year was almost four times the 109,000 positions generated in 2016.

7.52am: Stocks tipped to buck weak Wall St lead

The Australian sharemarket looks set to open higher despite an uninspiring Wall Street session.

At 7am (AEDT) on Friday, the share price futures index was up 17 points, or 0.29 per cent, at 5,969 points.

The US market’s strong rally ran out of steam on Thursday — a day after the Dow Jones Industrial Average closed above 26,000 points for the first time. After being in the red most of the day, Wall Street has begun to pare losses but with little conviction.

In late afternoon trading 7.52am (AEDT), the Dow Jones Industrial Average was down 0.34 per cent, but still above the landmark 26,000 points at 26,024.44. The S & P 500 was down 0.18 per cent, and the Nasdaq Composite was down 0.04 per cent. Locally, in economic news on Friday, the Australian Bureau of Statistics releases November’s lending finance data.

In equities news, Australian-originated tech company Atlassian is slated to release its financial results for the second quarter after the close of the markets in the US.

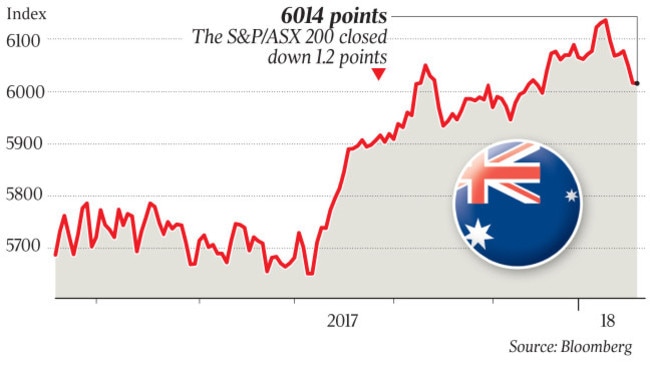

The Australian market on Thursday closed barely lower, with banks and consumer stocks among the few sectors to record gains as energy and mining stock weakness weighed on the market.

The benchmark S & P/ASX200 index fell 1.2 points, or 0.02 per cent, to 6,014.6 points.

The broader All Ordinaries index lost 3.9 points, or 0.06 per cent, to 6,130.4 points Meanwhile, the Australian dollar is a hair’s breadth off of US80 cents as the US dollar weakens amid fears of a government shutdown.

AAP

7.48am: US bond market breaches milestone

A continued slide in US government bond prices pushed the yield on the 10-year Treasury note above 2.6 per cent Thursday, a fresh milestone spurred by investors’ growing confidence in the global economy.

In recent trading, the yield on the benchmark 10-year Treasury note was 2.609 per cent, according to Tradeweb, up from 2.579 per cent Wednesday and exactly matching its 52-week closing high set last March.

Yields, which rise when bond prices fall, have been climbing steadily this year after being held in check for much of 2017 by a variety of factors, including soft US inflation and a series of alarming geopolitical headlines. So far this year, investors have focused instead on improving economic data around the globe and signs that major central banks could be stepping back from postcrisis stimulus policies.

Dow Jones

7.11am: Dollar teeters on edge of US80c

The Australian dollar is fractionally shy of US80 cents, with the US dollar weakening overnight amid fears of a possible federal government shutdown. At 7.20am (AEDT) on Friday, the Australian dollar was worth US79.94c, up from US79.70c on Thursday.

The US dollar fell on Thursday as traders piled into the euro, yen, sterling and other major currencies amid concerns over a possible US government shutdown as politicians struggle to cobble together a federal budget deal. If an agreement to fund government operations, even a temporary one, is not reached by Friday (US time) deadline, it could compound an already-negative climate for the greenback, analysts say.

The Aussie dollar is also higher against the yen and hardly changed against the euro.

AAP

6.53am: Wall Street mixed as Dow pares gains

US stocks edged lower Thursday, as weakening bond prices pulled down yield-sensitive sectors such as real-estate companies and utilities.

At 7.15am (AEDT) the Dow Jones Industrial Average was 50 points, or 0.2 per cent, in the red at 26,031 points, while the S & P 500 was flat and the Nasdaq Composite was up 0.15 per cent.

The rally that sent stocks to a series of fresh records this year took a pause a day after the Dow industrials closed above 26,000 points for the first time. Falling U.S. government bond prices contributed to a pullback among shares of real-estate companies and utilities, which are considered alternatives to traditional bonds because of the steady dividends they tend to generate.

Dow Jones

6.42am: European markets mixed

Most of Europe’s stock markets ran into profit-taking Thursday as the continent’s main currencies posted fresh gains against the dollar, weighing on export-heavy stocks, as the Wall Street rally also stalled.

The underlying mood remained confident, however, traders said, buoyed by bullish Chinese data, strong corporate earnings and New York’s record close the previous day amid optimism over the impact of US President Donald Trump’s tax cuts.

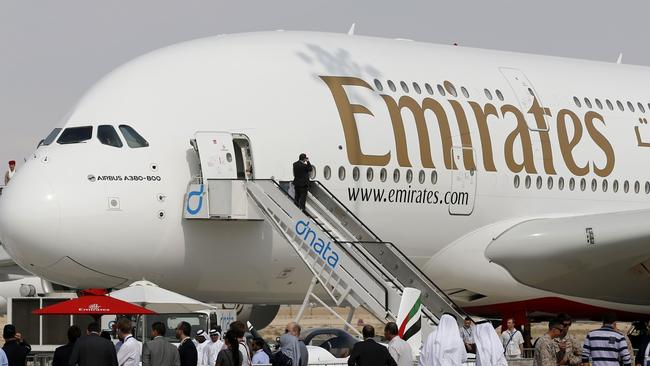

Paris ended the day flat despite Airbus shares rising 0.7 per cent after Emirates Airlines struck a $16-billion deal to buy 36 Airbus A-380 superjumbos, having traded as much as three per cent up on the day during the morning session.

London also lapsed into the red as market participants eyed the strong pound, which weighs on the performance of multinational companies. The FTSE 100 closed down 0.3 per cent.

Frankfurt was the European standout, with the DAX 30 gaining 0.7 per cent as German semiconductor giant Infineon’s shares surged a day after stellar annual results from Dutch computer chip maker ASML.

AFP

6.15am: Hong Kong bourse shines

Once again, Hong Kong was the star performer in Asia, notching up a historic record as investors tracked another milestone on Wall Street.

Hong Kong rose 0.4 per cent, holding above the 32,000 mark it broke in the morning for the first time in its history. The market has fallen only once in the past 17 trading days.

Shanghai ended up 0.9 per cent. After the market closed, data showed the Chinese economy grew a forecast-beating 6.9 per cent in 2017, the first annual improvement in the growth rate since 2010.

The GDP reading follows strong trade data last week, which showed the humming global economy had propelled China’s export machine.

AFP

5.55am: Airbus lifts on Emirates’ A380 order

Emirates Airlines said Thursday it has struck a $16 billion deal to buy 36 Airbus A380 superjumbos just days after the European manufacturer said it would have to halt production without new orders.

The company said it had placed firm orders for 20 of the double-decker aircraft with options for a further 16. Deliveries are scheduled to start in 2020.

Emirates is already the world’s biggest customer for the A380 with 101 in its fleet and 41 more firm orders previously placed.

Airbus shares closed the day with a gain of 0.7 per cent to 90.40 euros in Paris. Calling the deal “a relief for Airbus”, independent commercial aviation expert John Strickland said it probably saved the A-380 program.

AFP