Trading Day: live markets coverage; ASX rise stalls as Newcrest weighs; plus analysis and opinion

Despite trading above 6000 throughout the session, the local bourse pared gains to close 0.5 per cent higher.

Welcome to the Trading Day blog for Monday, March 12.

Samantha Bailey 4.30pm: Stocks finish higher, pare gains

The local share market finished the session firmly higher on the back of positive US employment data on Friday.

At the close of trade, the benchmark S & P/ASX200 had gained 32.869 points or 0.55 per cent at 5996.102 points. The broader All Ordinaries index had lifted 32.25 points or 0.53 per cent, 6101.398 points.

It came after US president Donald Trump promised Australia would be exempt from the new tariffs on steel and aluminium, expected to come into effect in the coming weeks.

CMC Markets chief market strategist Michael McCarthy said that US data on Friday night showing strong growth in employment, but contained wages, gave investors’ confidence in the economy’s growth prospects.

“The economy’s growing but there are no signs of inflation on the radar,” he said.

“We do need to be a little cautious, it was the lack of inflation accompanied by good growth that really drove the market today.

“On Tuesday night we do have a CPI read in the US and on Wednesday night the PPI read and although these are not the central reads that the central bank focuses on, if they tell a different story on inflation we could see these gains quickly evaporate.”

4.00pm: Asian stocks push higher

Asian stocks are higher despite US-Chinese trade tension following solid Wall Street gains on strong U.S. employment data.

Keeping score The Shanghai Composite Index rose 0.8 per cent to 3,332.59, Tokyo’s Nikkei 225 surged 1.7 per cent to 21,837.46, Hong Kong’s Hang Seng added 1.5 per cent to 31,464.59 and Seoul’s Kospi advanced 1 per cent to 2,486.11.

Benchmarks in Taiwan, New Zealand and Southeast Asia are also higher.

3.45pm: ASX 200 rise stalls, ignores US futures strength

The Australian share market has stalled after rising 1.1pc to a 2-week high of 6026.1 this morning.

The index is up just 0.7pc at 6002 this afternoon despite Friday’s surge in offshore equities and commodities and further gains in S & P 500 futures today.

S & P 500 futures rose as much as 0.5pc this afternoon indicating expectations of another positive night on Wall Street.

The resources sector is still leading broadbased gains, but falls in Newcrest and Woolworths are detracting a few points from the index.

3.30pm: Liveris steps down from DowDuPont

Longtime Dow Chemical Co. leader Andrew Liveris plans to step down next month, ending a nearly 14-year tenure that culminated with the chemical giant’s combination last year with rival DuPont Co.

Mr Liveris will relinquish the role of executive chairman of the combined company April 1, it will announce Monday. Co-lead director Jeff Fettig will assume that role at the company, now known as DowDuPont Inc. and soon to be broken apart.

Liveris lieutenant Jim Fitterling will be chief executive of the materials-science company, to be known as Dow, that is expected to be created when the breakup takes place next year.

Mr Liveris, 63 years old, had said he would likely depart this year, but he had already delayed the move once and the advisory board of the materials-science company hadn’t yet named a successor.

Dow’s board and Mr. Liveris had gone through a search process that involved Mr. Fitterling, who is chief operating officer for the materials business, and Howard Ungerleider, DowDuPont’s chief financial officer, according to people familiar with the matter. The candidates, both of whom have spent their entire careers at Dow and held several roles, met with directors and made presentations in recent months, the people said.

Mr. Fitterling, 56, won the job in recent weeks, they said. Mr. Ungerleider, 50, will be named president on top of his CFO role.

In an interview, Mr. Liveris said he decided the timing was right with the stock hitting all-time highs this year and the company completing two projects he bet his legacy on: the combination with DuPont and a gigantic petrochemical plant in Saudi Arabia, the people said. He said he made up his mind while on Christmas holidays with his family in his native Australia, feeling the transformation he had wanted was done.

A 40-year veteran of the company, Mr. Liveris will remain a director on the combined board until July 1.

“This is a very, very good time; the Andrew Liveris era should end and the Jim Fitterling and Howard Ungerleider era should begin,” Mr. Liveris said. “I’ve achieved my goals.”

The hand-off marks the retirement of one of the most recognisable figures in American industry. The chemical and materials giant is a household name, and Mr. Liveris became a common sight in Washington and at global gatherings, like Davos, Switzerland, discussing everything from science to economic policy.

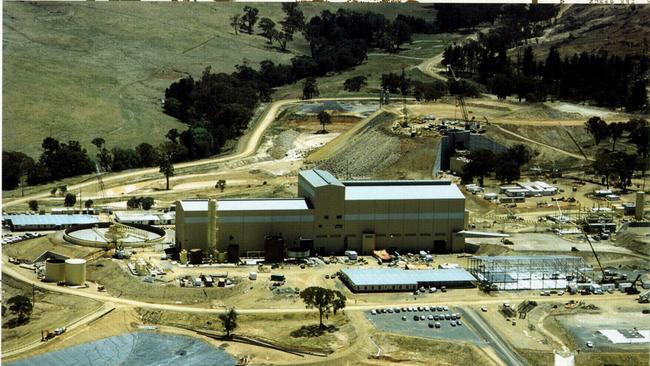

3.10pm: Newcrest to downgrade Cadia production

Newcrest expects to downgrade full-year production and cost guidance after its Cadia goldmine was shut down for the second time in less than a year. Production at Newcrest’s largest and lowest cost mine was halted at the weekend following a breach at a tailings dam, but the ASX-listed firm said it cannot yet estimate how much the closure and clean up will cost.

Newcrest’s first-half profit — announced last month — already dropped by half as a result of an earthquake that halted production in Central West NSW for three months last year.

The company did not say whether the latest disruption was because of a quake, but the government’s Geoscience Australia Earthquakes site reported a 2.7-magnitude seismic event southwest of Cadia late on Thursday evening. “While it is too early in the evaluation and recovery process for Newcrest to provide an indication of the extent to which FY18 production, capital and cost guidance will be impacted, this event will adversely impact guidance,” Newcrest said in a statement.

Shares in Newcrest dropped 86 cents, or 4.0 per cent, to $20.73 by 1500 AEDT on Monday.

AAP

Matt Chambers 2.40pm: Analysts split on OZ Min power plan

OZ Minerals’ South Australian power transmission solution has drawn a mixed reaction from analysts, with Deutsche Bank giving it the thumbs up but Credit Suisse saying it fails to address where its extra power supply will come from.

On Friday, OZ (OZL) released a power strategy to provide reliable and affordable power for its operations after 2020, when the new Carrrapateena mine starts and current access to BHP’s Olympic Dam transmission line expires.

The first phase is 400km of transmission lines to connect to the South Australian grid.

The second is to contract extra generation being built, including SolarReserve’s solar thermal generation and storage near Port Augusta, other renewable sources and “traditional sources”.

2.10pm: Westfield plans May vote on takeover

Retail landlord Westfield plans to hold a key shareholder vote on May 24 that will determine whether its takeover by European mall giant Unibail-Rodamco will go ahead.

Westfield plans to hold the vote on the same day as its annual general meeting, although local and offshore regulators could still cause delays.

The suitor lobbed a bid worth $10.01 per security for Westfield in December although the value of the proposal has since dropped due to a fall in Unibail’s share price and currency movements.

The takeover bid has the support of the founding Lowy family and Westfield’s board but requires the approval of 75 per cent of Westfield shareholders and two-thirds of Unibail shareholders.

1.30pm: Monadelphous raised to Neutral by CS

Monadelphous has today been raised to Neutral from Underperform by Credit Suisse, with a $15.10 target price, according to Bloomberg.

The share price bounced off a seven-month low of $14.34 last week. Last up 2.4pc at $15.16.

John Durie 1.15pm: Banks keep crossing the line

The ACCC is due to hand its report on bank interest rate setting to Treasurer Scott “cry me a river” Morrison today ahead of tomorrow’s launch of the royal commission hearings into the industry.

The ACCC report, which should be released to the public later this week, will focus in part on how rates are set and what impact that has on competition.

It will also look at whether the banks have passed on the costs of last year’s bank levy onto consumers.

The ACCC report is expected to back last month’s report by the Productivity Commission which basically said the banks play follow the leader and act to ensure net interest margins are held up.

Tomorrow’s royal commission hearing will focus on consumer lending and CBA has already moved to cut two insurance products on car loans ahead of the review.

12.50pm: S & G mulls bank class action

The big banks could face a class action over the sale of millions of dollars of “worthless” credit card insurance.

Commonwealth Bank has already admitted selling loan and credit card insurance to customers who were not eligible to make claims, and law firm Slater and Gordon is now investigating potential class actions on behalf of short-changed consumers.

Slater and Gordon (SGH) class actions senior associate Andrew Paull said consumer credit insurance — which is often sold alongside financial products to provide coverage if a person is unable to meet repayments — is “notorious for being unsuitable and consistently poor value”.

“We have found substantial evidence to suggest that a large number of Australian credit card holders are paying hundreds, if not thousands, of dollars a year for essentially worthless insurance,” Mr Paull said on Monday.

“Many policyholders are ineligible to claim some or all of the available benefits, and others are either completely unaware they have the insurance or incorrectly believe it is a requirement for obtaining a credit card.”

AAP

11.55am: US stock index futures gains encouraging

US stock index futures are encouraging today not just because they’re up. Big gains or falls in the futures in Asia are often a bad predictor of the overnight action. Gains of lesser magnitude — like the current 0.3-0.4pc — are often a better sign that Wall Street is actually going to rise. At least until the next big risk event — Tuesday’s US CPI — the air seems clear for further gains in reaction to the “Goldilocks” US jobs outcome.

S & P/ASX 200 last up 0.8pc at 6009.1.

11.45am: Rio, BlueScope surge on tariff exemption

Shares in Rio Tinto and BlueScope have jumped in morning trade as both companies emerge as the big winners from Australia’s exemption from US steel and aluminium tariffs set to come into force in a matter of weeks.

At 1125am AEDT, Rio Tinwas up 2.29 per cent at $75.49, while BlueScope was 3.33 per cent higher at $15.83.

Read Richard Gluyas’ take on why Rio and BlueScope will benefit most from Australia’s expected exemption from Donald Trump’s steel and aluminium tariffs.

11.25am: Stay with utilities, infrastructure stocks: MS

Morgan Stanley gives four reasons for investors to stay with Aussie utilities and infrastructure stocks despite the recent rise in bond yields.

It says many of those firms have a strong project pipeline that can create value, particularly Sydney Airport, APA and AusNet Services, which all have leverage to the reflation that is pushing bond yields higher.

For example, Macquarie Atlas Road’s French traffic is leveraged to economic activity and tolls often rise at a premium to CPI, APA’s contracts are generally inflation linked — notably its Wallumbilla Gladstone Pipeline revenues are linked to US CPI, the Regulated Asset Base gets inflated every year, and the WACC allowances are adjusted for prevailing yields at each reset. The investment bank also highlights the fact that all of the companies in its universe extensively hedge interest rate risk — notably Transurban, which extensively hedges all of its term debt. Furthermore, it notes that debt costs are the sum of credit margins and base rates, which have historically been inversely correlated such that debt costs are less variable than bond yields.

Finally, all-in debt costs are currently low, and many of the stocks in its universe have strong refinancing cost tailwinds ahead of them, notably Macquarie Atlas Roads and APA Group. It also notes a structural increase in demand for exposure to assets producing stable, long-term and inflation protected income, with 2013-2017 saw new global infrastructure fundraising totalling about US$288bn, supported by the global rise in defined benefit and defined contribution savings rates.

Australia’s superannuation assets are $2.6 trillion, having had a five-year compound annual growth rate of 10pc. Finally, Morgan Stanley’s US Interest Rate Strategy forecast is for US 10-year bond yields to fall back to 2pc in Q4 vs. 2.9pc now.

Bridget Carter 11.10am: Sundance raises $331m to fund US acquisition

Sundance Energy is raising $331 million through a placement and accelerated non-renounceable entitlement offer to fund the acquisition of shale gas assets in the United States.

Joint lead managers on the deal are Euroz Securities and Morgans and Aitken Murray Capital is co-lead manager.

The raising includes a $257m two tranche placement and a $74m accelerated non-renounceable entitlement offer.

Shares are being sold at 5.9c each, which is an 18.6 per cent discount to the last traded price.

The funds will be used to fund the acquisition by Sundance of certain Eagle Ford Shale properties from Pioneer Natural Resources in the US, Reliance Eagle Ford Upstream Holdings and Newpek.

Sundance is also proposing to refinance debt including a new syndicated institutional second lien term loan to raise $250m and a new syndicated reserve based lending facility with US$75.5m of undrawn capacity.

11.02am: Aristocrat faces battle on market share: MS

Aristocrat faces an uphill battle to win market in North America, according to Morgan Stanley.

The broker notes that IGT shares jumped 8 per cent after it reported 22pc YoY growth in North American replacement units and said it expects “the positive trend to continue throughout 2018” on North America Gaming OPs. IGT also said it was “confident that the positive momentum will continue in 2018 with particular strength in the 2H18”. “We believe more optimistic outlooks by IGT and SGMS could slow the pace of Aristocrat’s market share gains,” MS analyst Monique Rooney said. “Aristocrat is a high-quality growth business but cyclic, in our view. With FY18 upside largely factored in and growth to become more difficult from FY19 onwards, we find it hard to see its multiple rerating further.” Aristocrat shares are up 1.1pc at $25.00 today after hitting a record high of $25.525 in early trading

Bridget Carter 10.55am: Image Resources launches $25m placement

Image Resources has launched a $25 million placement through Euroz Securities to fund its Boonanarring mineral sands project in the North Perth Basin.

The company is offering about 250 million shares representing about 41 per cent of existing shares on issue.

Shares are being sold as part of the placement at 10c each, which is a 9.1 per cent discount to the last traded price on Friday.

Cornerstone investors include Vestpro International, which will subscribe to 10.1 per cent of Image’s total number of shares on issue and will be entitled to a board seat.

Million Up will underwrite a number of placement shares.

The funds are being raised to provide the equity component for the construction and development of the Boonanarring Project, corporate and financing costs and working capital.

The book opens today and firm bids are due by the close of business tomorrow.

10.40am: Stocks jump above 6000 points

Australia’s S & P/ASX 200 share index jumped 1.1 per cent to a two-week high of 6026.10 in early trade as the energy sector led broadbased strength after commodities surged alongside global equities. It follows strong US jobs data on Friday that beat expectations and Trump agreeing to meet North Korean leader Kim Jong Un.

Resources sector heavyweight BHP is by far the biggest driver today with a 2.5pc gain, while Newcrest is the biggest drag on the market, down 5.4pc after a tailings dam burst at Cadia, causing a shutdown and worsened production and cost guidance.

The index has regained its 50 and 100-DMA’s at 5988 and 5996. On a technical basis it could now test the downtrend line drawn from the January peak, currently at 6075. That’s also near the February rebound high at 6083.

Support from last week’s high at 5980 should now be fairly solid barring a change in the fundamental backdrop of renewed confidence in strong economic growth with minimal US wage and inflation pressure tempering the pace of Fed rate hikes.

Index last up 0.8pc 6010.8.

John Durie 10.30am: ACCC probes Seven’s TXA move

The ACCC has initiated an investigation into moves by Seven West Media to trigger a transfer of Network Ten’s share in a digital broadcast joint venture.

The potential transfer of Ten’s interest in TXA Australia was triggered when Ten went into administration in June last year.

The move led to CBS buying control of the network.

TXA was established in 1999 by the three free-to-air commercial broadcasters to handle digital transmission.

At Seven’s request TX commissioned PwC to value the company which ranged from $3 to $120 million, with Ten’s share ranging from $1 to $40 million.

Ten is opposing any transfer at the $3 valuation.

The report was finalised last month.

The ACCC is concerned about the potential for Nine and Seven to disrupt Ten’s digital broadcast and also the impact on advertisers.

The ACCC is due to release its decision on May 9.

10.15am: ACCC decision a risk for Aurizon: MS

Aurizon shareholders face a “potentially underappreciated downside” risk should the ACCC block the sale of its loss making Intermodal business, Morgan Stanley says.

While a clean exit would be positive, a statement of issues from the ACCC would see the stock continue to reflect uncertainty, and if the ACCC were to block the sale, the stock could de-rate further, Morgan Stanley analyst Rob Koh says.

“Our base case estimates incorporate a clean exit from the loss-making business — we estimate $10-15m EBIT not included in FY18 EBIT guidance of A$900-960m — and receives net proceeds of about $225m during FY18m” he says.

“We view the ultimate net proceeds as material to the AZJ investment thesis, because of the possibility of additional capital management by the company over time.”

10.05am: Trade war a risk to ‘Goldilocks’ halo

The “Goldilocks” halo over risk assets may evaporate quickly, after China’s trade minister warned “a trade war will only bring disaster…..to the global economy,” notes CMC Markets chief market strategist Michael McCarthy.

“The trade fight picked by the US President appears increasingly focused on these two largest trading blocs,” McCarthy says. “The potential for rapid escalation could constrain buying today, although a steadily increasing camp of investors who believe tariff threats are merely a bargaining tool could overrun the ramparts.”

US employment data hit a “sweet spot” on Friday night, with jobs surging while wage growth moderated, indicating an ideal higher growth, lower inflation scenario. Shares leapt and industrial commodities tracked them higher despite a stronger US dollar and futures markets point to strong opening gains in the Asia Pacific region today, but “any initial enthusiasm may ease as investors digest further trade war rhetoric.”

Also this week, China’s industrial production and retail sales data on Wednesday will speak to the growth target released last week by the People’s Political Congress, McCarthy says. And in Australia home lending numbers due tomorrow will shine light on the prospects for the besieged banking sector. The Australian dollar was a major beneficiary of Friday’s developments, lifted by stronger commodity prices.

Ben Wilmot 9.52am: McGrath in fresh profit downgrade

John McGrath’s troubled listed real estate agency has today issued another profit downgrade.

The group has generated earnings of just $720,000 in the financial year to the end of February.

The company expects to generate underlying earnings of between $5 million and $5.5m this financial year.

This will see if report actual earnings of $1m to $1.5m, after about $4m of one-off costs is taken into account.

McGrath said that new management team under the guidance of chief executive Geoff Lucas was starting to produce dividends.

Mr Lucas said that the impact of softer sales volumes had hit the company more than expected previously.

9.30am: QBE’s sum of parts highlights value: MS

Morgan Stanley’s Daniel Toohey has undertaken a sum-of-parts valuation exercise on QBE “given heightened global M & A activity.”

Its sum of parts valuation is around $12.75/share compared to Friday’s close at $9.95.

“The late stages of the cycle saw increasing M & A activity however, the passage of US tax reform alongside the somewhat ‘disappointing’ 1 Jan renewals looks to be fuelling renewed activity,” Toohey says. “In support of this we highlight AIG’s US$5.6bn acquisition of VR and AXA’s acquisition of XL.”

9.20am: Newcrest suspends Cadia gold mining

Newcrest said there was “a limited breakthrough of tailings material,” a slurry of finely ground rock, water and some benign processing reagents, when the northern tailings dam embankment burst at Cadia on Friday.

The spillover was contained in the southern tailings dam, said the miner, which added there were no injuries and that it hasn’t seen any environmental damage as a result of the collapse.

Newcrest by Saturday had fully suspended all mining and processing at the operation, 250 kilometres west of Sydney.

“While it is too early in the evaluation and recovery process for Newcrest to provide an indication of the extent to which fiscal-year 2018 production, capital and cost guidance will be impacted, this event will adversely impact guidance for fiscal-year 2018 given the contribution of Cadia to the overall outcomes of Newcrest,” said the company.

Cadia is one of Newcrest’s biggest mines, accounting for roughly one quarter of group gold production last fiscal year. Newcrest had been projecting group output of 2.4 million-2.7 million troy ounces of gold in the year through June 2018.

It said cracks had been noticed in the dam wall during a routine inspection earlier Friday and that it had stopped depositing tailings into both dams as a precaution. “No further movement of the wall has been detected since Friday night,” Newcrest said.

The miner said it is looking at possible repair options for the collapsed section of wall, and that it’s also reviewing alternative tailings locations including the old Cadia Hill open pit.

Newcrest also said it is working closely with regulators on a review of the incident.

Dow Jones

9.04am: Broker rating changes

BHP Plc raised to Buy — Investec

Oz Minerals raised to Outperform; $10.00 target vs. $9.20 previously — CLSA

Inghams cut to Neutral — UBS

Aurizon raised to Outperform — Credit Suisse

8.56am: Stocks to watch

Newcrest Mining: Newcrest has been forced to shut down its Cadia gold mine in the NSW central west — its biggest and lowest-cost mine — for three months after the wall of a tailings dam was damaged by an earthquake around the dam.

Santos, Oil Search, Woodside: Oil prices rose nearly $US2 on Friday, rebounding from two days of declines as Wall Street climbed on strong US jobs data, while investors also grew hopeful that a planned meeting between US President Donald Trump and North Korea’s Kim Jong Un could ease geopolitical tensions.

Richard Gluyas 8.35am: The winners from tariff exemption

Rio Tinto and BlueScope Steel are expected to emerge as the big winners from Australia’s exemption from US steel and aluminium tariffs set to come into force in a matter of weeks.

The nation exports $US210 million ($267.4m) in steel and $US213m in aluminium to the US each year.

Rio ships 1.4 million tonnes of aluminium to the US from Canada, while BlueScope has $US3 billion in assets and employs more than 3000 workers in the US.

The company exports Australian steel to its US businesses for further value-adding.

BlueScope chief executive Mark Vassella attributed the exemption from tariffs — 25 per cent on foreign steel and 10 per cent on foreign aluminium — to Australia’s status as a long-term ally, as well as the US benefiting from a healthy surplus in two-way trade.

“So we believe our unique position puts us in the right frame of mind for (President Donald Trump) to consider those special circumstances,” Mr Vassella said.

8.06am: Oil prices rise as mood lifts

Oil prices rose nearly $2 on Friday, rebounding from two days of declines as Wall Street climbed on strong US jobs data, while investors also grew hopeful that a planned meeting between US President Donald Trump and North Korea’s Kim Jong Un could ease geopolitical tensions.

Brent crude futures rose $US1.88 to settle at $US65.49 a barrel, a 2.96 per cent gain. Brent traded between $US63.69 and $US65.63 during the session. West Texas Intermediate (WTI) crude futures rose $US1.92 to settle at $US62.04 a barrel, a 3.19 per cent gain. US crude traded between $US60.14 and $US62.14. Oil prices extended gains in post-settlement trade, with both benchmarks up more than $US2.

Both Brent and US crude notched weekly percentage gains after weekly percentage losses last week.

Reuters

7.20am: ASX set to break through 6,000

Australian stocks are expected to open stronger after US President Donald Trump promised Australia would be exempt from its planned tariffs on steel and aluminium.

On Monday morning, the Australian share price futures index was up 57 points, or 0.96 per cent, at 6,020.

In the US on Friday, the major stocks indexes all climbed almost two per cent as February’s jobs report assuaged fears of inflation and aggressive interest rate hikes.

The Australian share market on Friday closed higher on the back of the US tariffs announcement, and possible exemptions for some countries. The benchmark S & P/ASX200 was up 20.3 points, or 0.34 per cent, at 5,963.2 points, while the broader All Ordinaries index was up 22.5 points, or 0.37 per cent, at 6,069.1 points.

In economic news on Monday, CoreLogic will release its weekly capital city home prices report.

The Australian dollar is higher after the release of strong US jobs figures and the news that there will be a summit between the leaders of the US and North Korea.

The number of jobs added the US economy jumped by 313,000 in February, the Labor Department said, its biggest increase in more than one-and-a-half years. At 7am (AEDT) on Monday, the local currency was worth US78.53 cents, up from US77.95con Friday.

AAP

7.10am: S & G mulls bank class action

A class action against Australian banks which have sold tens of millions of dollars of apparently worthless credit card insurance is being considered by a major law firm.

Slater and Gordon (SGH) is investigating the potential action for customers ranging from business people to Centrelink recipients and pensioners, arguing they may be receiving little or no benefit.

“We have found substantial evidence to suggest that a large number of Australian credit card holders are paying hundreds, if not thousands, of dollars a year for essentially worthless insurance.

AAP — read more

6.51am: Dollar shines as mood brightens

The Australian dollar is higher after the release of strong US jobs figures and the news that there will be a summit between the leaders of the US and North Korea.

At 6.35am (AEDT) on Monday, the local currency was worth US78.53 cents, up from US77.95c on Friday.

The number of jobs added the US economy jumped by 313,000 in February, the Labor Department said, its biggest increase in more than one-and-a-half years. BK Asset Management managing director of FX strategy Kathy Lien said the figures reinforced the positive momentum of the US economy, but a larger factor for the Australian dollar was the prospect of an easing of tension between North Korea and the US.

“Although the unemployment rate ticked up and average hourly earnings growth slowed, the most important takeaway is that these numbers are strong enough for the Federal Reserve to raise interest rates later this month,” she said.

AAP

6.45am: US stocks rally after jobs report

Wall Street stocks surged Friday, with the Nasdaq ending at a record following a strong US jobs report and the announcement of a summit between the US and North Korea.

However, uncertainty surrounding US President Trump’s tariffs plans and fears of a trade war kept a lid on gains in other markets, dealers said.

The tech-rich Nasdaq Composite Index jumped 1.8 per cent to 7,560.81, besting the prior record in late January by 55 points.

The gains were similar for both the Dow and S & P 500, with analysts pointing to Labor Department data that showed employers added 313,000 jobs in February, far above analyst expectations.

The closely-watched monthly US payrolls report also revealed moderating wage growth compared with the January report, mitigating concerns the Federal Reserve will speed its pace of interest rate hikes.

European bourses were mixed, with London rising 0.3 per cent and Paris winning 0.4 per cent and Frankfurt dipping 0.1 per cent.

AFP

5.15am: ASX tipped to jump at open

Australian shares look set for a positive start on Monday after US President Donald Trump promised Australia would be exempt from its planned tariffs on steel and aluminium.

Planned talks between President Trump and his North Korean counterpart Kim Jong Un are also expected to lift the mood for investors.

“When you look at the overall situation it does look very positive for our start on Monday,” Commonwealth Securities chief economist told AAP on Sunday. Australian share futures were trading 57 points higher on Sunday, after the benchmark S & P/ASX200 index rose 20.3 points, or 0.34 per cent at 5,963.2 points on Friday.

“It’s not the worse case scenario a lot of people were looking at.” President Trump tweeted on Saturday that he would not impose steel and aluminium tariffs on “the great nation of Australia”.

Australian Trade Minister Steven Ciobo insisted on Sunday there was no implicit understanding about a quid pro linking tariffs and future military promises. Among this week’s key economic data housing finance for January is due on Tuesday, alongside weekly ANZ-Roy Morgan consumer confidence figures and the monthly National Australia Bank business survey.

The monthly Westpac-Melbourne Institute consumer sentiment sentient is due on Wednesday.

There are also several speeches in Sydney by Reserve Bank top officials over the week — assistant governor (financial system) Michele Bullock on Tuesday, assistant governor (financial markets) Christopher Kent on Wednesday and deputy governor Guy Debelle on Friday.

AAP