Trading Day: live markets coverage; ASX levers up on global growth; plus analysis and opinion

The ASX reverses early gains, while Telstra investors take top of the podium as the telco’s rural edge persereves.

Welcome to Trading Day for Monday, October 23.

Samantha Woodhill 4.21pm: Stocks fall under heavyweight drag

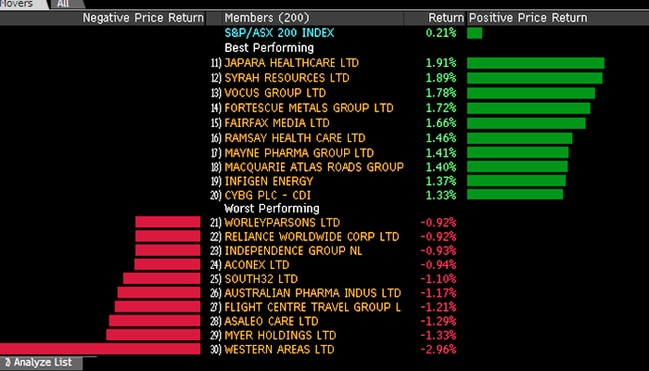

The local share market ended the session slightly lower, as declines in the two largest stocks, BHP and Commonwealth Bank, dragged on the bourse.

The benchmark S & P/ASX200 was down 12.988 points, or 0.22 per cent, at 5894.0 points, while the broader All Ordinaries index was down 15.30 points, or 0.26 per cent, at 5807.30 points.

IG chief market strategist Chris Weston said the macroeconomic backdrop is still positive despite the dip, saying investors are waiting for a new catalyst to drive the market forward.

“Ultimately, we’ve had a good run, we are just seeing some profit taking. That’s all it is,” he said.

“There’s nothing more to it than that, nothing’s changed, everything still looks quite positive, we’ve just had a really good run and at some stage people are going to take a bit off the table, you need new news to fuel the beast.”

In financials, NAB edged up 0.34 per cent to $32.57, Commonwealth Bank lost 0.35 per cent to $78.69, Westpac lowered 0.30 per cent to $33.41, and ANZ edged 0.16 per cent downward to $30.54.

BHP lost 0.71 per cent to $26.49 while Rio Tinto ticked up 0.29 per cent to $69.26.

The Australian dollar was trading at US78.25c in late trade.

4.10pm: Valuations not yet flashing red: Macquarie

The valuation of Australian shares is not yet flashing a warning sign, according to Macquarie.

The broker says this month’s rise in the ASX300 to 15.3x to 15.8x earnings-per-share (EPS) forecasts for the next 12-months is at the upper end of the 10-year median at 15.4x.

However, Macquarie notes that is “simply back in line with the average when measured over the past three years and still below the high reached in early 2015 and mid 2016”.

It says a broadening of performance adds to the sustainability of the domestic rally and in part helps to de-risk market internals, particularly given the valuation dispersion remains close to a record level of 6 PE points.

“We continue to see signs that the rally is supported by improving economic /earnings fundamentals (with) global growth is at its highest level since 2010 and earnings growth continues to pick up across the US, Europe and Japan.

But it cautions that the rise in bond yields should not be so easily overlooked and the window for the strong cyclic upside in markets is relatively short with a Fed rate hike priced as a near certainty in December.

Moreover the potential for Australian long bond yields to finish the year above 3.00 per cent is rising.

“This will keep rate-sensitive areas under relative performance pressure even if the market track higher,” Macquarie adds.

The broker says banks are the best way to leverage US growth developments alongside US housing exposure via Boral and James Hardlie.

It also favours global industrial exposure with Amcor, CSL, Cochlear and Incitec.

It keeps its “underweight” rating on REIT’s, Telco’s and Utilities.

Cliona O’Dowd 4.00pm: APRA lashes banks on lending

Australian Prudential Regulation Authority chairman Wayne Byres says measures to cool the country’s hot property market are working, as he delivered a blistering rebuke to the nation’s bankers for eroding lending standards over the past decade.

Delivering the keynote speech at COBA 2017, Mr Byres also cautioned that the regulator’s restrictions, while temporary, would only be lifted when banks improve home loan standards over a sustained period.

3.45pm: Loan shift poses bank profit risk: Moody’s

The profitability of Australian banks is at risk from “intense” loan competition, according to Moody’s, holding its “stable” rating on the sector.

Repricing new and existing mortgages has strengthened capital positions of big banks, however it could spur sector competition and squeeze margins, the ratings agency says.

“Australian banks have raised interest rates charged on some of their existing loans, which will support net interest margins into next year,” says Moody’s

“This situation, together with low bad debt charges and efficiency gains, will enable the banks to maintain their healthy profits.”

“However, profit growth could be pressured by intense competition for lending assets and moderate loan growth.”

The ratings agency downgraded Australian banks earlier this year to ‘Aaa stable’, citing “rising tail risks in the domestic housing sector”, major lenders since uniformly increasing their capital reserves and winding down exposure to new interest-only loans in accordance with the prudential regulator’s new “unquestionably strong” standards

On system stability, Moody’s says its 2018 GDP forecast of 2.8 per cent is supportive, and while housing market-related risk remains high, it isn’t likely to “significantly undermine” the banking sector over the next 12-18 months.

Greg Brown 3.14pm: ‘A mistake’: Turnbull’s NBN admission

Malcolm Turnbull says it was a “big mistake” to set up a new government company to roll out the National Broadband Network while conceding there was a “reasonable question mark” over whether taxpayers would ever see a return from the project.

The Prime Minister attacked Labor for the “calamitous train wreck of a project” and said he “had to play the hand of cards I was dealt” when he gained control of the project as communications minister in 2013.

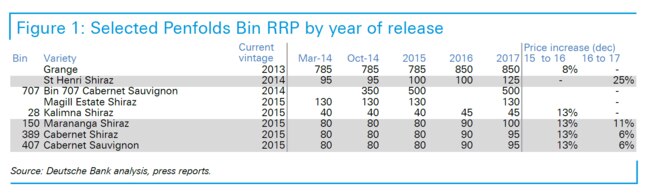

Eli Greenblat 2.58pm: Grange quaffers’ bitter China beef

It’s not just households facing bill shock when they open their latest electricity or gas bills, with quaffers, drinkers and collectors of the iconic Penfolds Grange collection being forced to swallow steadily increasing prices to secure a bottle of favourite Penfolds brand as they compete with insatiable demand from China and other keen buyers overseas.

And in what might send shockwaves through the Penfolds’ Australian fanbase, it appears the allocation of the iconic Grange has been tilted further to Asia’s favour and possibly reducing the supply to local markets.

Last week Penfolds released its 2017 Bin collection, including the 63rd consecutive release of the powerhouse flagship Grange, with prices generally increasing across the board for the labels that are sold alongside the Grange such as St Henri Shiraz and Bin 398 — more to come

Sarah-Jane Tasker 2.40pm: Health cover’s poor prognosis

Australia’s health insurers are less defensive than perceived, analysts warn, with recent reforms unlikely to fix long-term affordability issues or underlying claims inflation.

Morgan Stanley’s Daniel Toohey has also warned that switching and downgrading health insurance policies showed no signs of abating.

Mr Toohey, in a report on a survey on health insurance, highlighted that 56,000 people under the age of 30 year had dropped out of the system in 2017. He said that reversing declining participation likely demanded “value”, not “discounts” — read more

Note: Medibank Private last (-)1.1pc, NHF last +0.3pc.

Supratim Adhikari 2.24pm: ACCC eases Telstra tension

Telstra can finally breathe a sigh of relief with the Australian Competition and Consumer Commission unconvinced that declaring domestic roaming is the antidote to poor mobile services in rural Australia.

The prospect of Vodafone Australia and TPG Telecom roaming on its multi-billion dollar mobile network had spooked Telstra’s shareholders, especially in light of the pressure the business is already under. However, the ACCC’s final decision on the issue will give Telstra some comfort and the telco’s shares (TLS) prove the best ASX top ten performer in late trade, 1.1 per cent higher at $3.56.

“The ACCC’s inquiry found that declaration would likely not lead to lower prices or better coverage or quality of services for regional Australians,” ACCC chairman Rod Sims said.

But it’s not all plain sailing just yet, there’s the issue of a court case that Vodafone has filed against the ACCC, which could potentially counteract the regulator’s final decision.

Meanwhile, Mr Sims has flagged moves to make it easier for Telstra’s rivals to get their mobile equipment on Telstra’s towers.

Dana McCauley 2.20pm: Ten takeover gets FIRB approval

The Foreign Investment Review Board has approved Ten’s sale to CBS, leaving just the court approval of the transfer of company shares to finalise the takeover.

Ten Network Holdings announced to the market this afternoon that the FIRB had advised the Commonwealth it had no objection to its acquisition by the US broadcaster on Wednesday, October 18.

The approval, needed for a foreign-owned company to buy an Australian business, was expected.

A Supreme Court hearing beginning on October 31, and expected to run over two to three days, is the final hurdle for the deal — read more

TEN last $0.16 in trading halt

1.54pm: Japanese equities rally on Abe victory

Ese Ereriene writes:

Japanese equities led broad strength across Asia-Pacific markets on Monday, with a landslide election victory for Japan’s ruling party sending the Nikkei on course to a record 15th-straight session of gains.

Prime Minister Shinzo Abe’s coalition government retained the crucial two-thirds majority in Sunday’s election, securing a third term and putting him on track to become the longest-serving Japanese leader.

While polls had largely been in Mr. Abe’s favour, his win raises investor hopes of continued market-friendly economic and monetary policies.

“Abe’s victory confirms his loose policy-mix style and may entice foreign investors back to the market,” said Frank Benzimra, head of Asia equity strategy at Société Générale, reiterating his advice for investors to pick companies with high capital-expenditure plans.

The Nikkei Stock Average was up 1.1pc early in Asia trading, aided by further declines in the yen, which helped the country’s export-focused stocks. The Japanese currency was down 0.4pc against the U.S. dollar.

1.40pm: ASX edges back toward flat

The local sharemarket edges back toward flat, the S & P/ASX200 index reversing early gains of up to 0.3 per cent to trade just 3.3 points above its starting mark of 5907.

Banks and miners appear to be avoiding most of the heavyweight selling, while Wesfarmers and Woolies both hit new intraday lows in lunchtime trade.

Telstra shares hold onto early gains of up to 1.6 per cent after the competition watchdog confirmed its decision not to allow competitors access to its rural network.

After surging at the open by as much as 5 per cent, Vocus tracks price action in the broader sharemarket to sit just 1 per cent in the black at $2.84 after it announced the planned sale of its NZ business.

Meanwhile, the local currency climbs its way out of earlier losses as its US counterpart loses steam to US0.03 cents above flat on US78.20 cents.

Ben Butler 1.20pm: NAB in rate-rig settlement talks

NAB is in talks to settle a lawsuit in which the corporate regulator has accused it of rigging key interest rate benchmark the BBSW.

The talks, which have been underway for days, are continuing today after the case was adjourned this morning because the ANZ has settled similar allegations against it.

It is believed a deal between NAB and the Australian Securities and Investments Commission is close.

If a deal is struck, this would leave Westpac, which is so far holding the hardest line of the three banks, alone to defend itself against ASIC’s lawsuit — more to come.

NAB last up 0.6pc on $32.66

12.55pm: FIRB approves CBS-Ten takeover bid

The Foreign Investment Review Board says it has no objections to a potential takeover of Ten Network by US giant CBS, according to a release to the ASX.

TEN last $0.16 in trading halt.

Eli Greenblat 12.40pm: Myer’s CEO pay cut to $1.7m

Myer chief executive Richard Umbers took a slight pay cut in 2017, with his total remuneration slipping to $1.744 million from $1.896 million in 2016, as the department store operator booked its worst profit result since its sharemarket float.

It comes as major shareholder Solomon Lew prepares to attack Myer over its performance at the retailer’s upcoming annual general meeting — read more

MYR last down 1.3pc on $0.73

12.14pm: Treasury safe China brand hunger bet?

Morgan Stanley likes exposure to a good bottle of Grange, betting thirst for Treasury Wine’s portfolio in China is yet to be quenched with a 2-5 per cent increase in its forecast range for the bottler’s FY18-20 earnings.

“Wine Australia indicates that growth in Australian exports to China accelerated to +56pc on a MAT basis in Sept. vs. +44pc to June,” says Morgan Stanley.

“Higher price point wine remains the driver with growth per litre at A$30-50 +121pc, A$50-100 +79pc, A$100-200 +178pc and >A$200 +101pc over the same period.”

Keeping in mind it’s flagship vintage, Morgan Stanley asks the question: could Treasury be considered a ‘luxury’ company? If so, here are some recent comments from peers:

“Very solid double digit in value led by strong trends in Continental China, in particular”: Remy Cointreau

“Confirmed recovery in China for all qualities … numbersare still extremely solid in Q2 (in China)”: LVMH

“China very quickly is having a stellar year ... in the last quarter the business doubled”: Diageo

“Improvement in China”: Prada

“Return to growth of China, which we hadn’t seen since FY13”: Pernod Ricard

“The 4Q results came largely from terrific strengths in China”: Estee Lauder

The investment bank holds an “overweight” rating and $16.00 12-month price target on Treasury, its earnings prospects justification for a premium on peers over and above the 13 per cent Treasury currently holds according to its estimates.

Analysts currently peg 4 buy ratings, 5 hold and 4 sell ratings on Treasury shares, according to Bloomberg’s consensus estimates.

TWE last up 0.2pc at $15.05

Ben Butler 11.32am: ANZ eyes near $50m rate rig settlement

The ANZ has settled rate-rigging allegations brought against it by the corporate regulator by admitting wrongdoing and agreeing to pay a penalty believed to be around $50m.

Its deal, struck late last night after marathon talks, increases pressure on the other two banks accused of misconduct, NAB and Westpac, to strike settlements of their own with the Australian Securities and Investments Commission.

Those that fail to settle face an eight-week trial in the Federal Court.

It is believed that the terms of the deal between ANZ and ASIC provide some protection for the bank against its admission of wrongdoing being used against it in class action proceedings while at the same time preserving the penalty provisions of the law under which the regulator brought its action.

An ANZ spokesman declined to comment while ASIC representatives could not be reached this morning — read more

ANZ last $30.61

11.25am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Daniel Hynes — Senior Commodity Strategist, ANZ

11.45am: Live cross — Shaw and Parnters

12.00pm: Joe Mayger — Lake house Capital

12.15pm: James King — Currency Analyst, AFEX Australia

12.45pm: Steven Walters — Chief Economist, AICD

1.00pm: Ben Le Brun — OptionsXpress

(All times in AEST)

Damon Kitney 10.58am: Crown recovers, Packer cools on Japan

Crown shares (CWN) lift as much as 1.3 per cent in early trade to $11.15 after James Packer played down the prospects of Crown Resorts pushing for a casino licence in Japan, and warned there is risk the company is overcapitalising on its flagship $2.4 billion Crown Sydney casino project after spending too much on its Perth and Melbourne properties.

In an interview with The Australian, ahead of Crown’s AGM this Thursday, Mr Packer said he did not want its management “distracted” by writing a big cheque to participate in a competitive bidding process to build a casino resort in Japan.

Crown has been looking at investing in a casino licence if it becomes available in the Japanese city of Yokohama, which the company believes has similarities to the Melbourne market — read more

10.40am: ASX extends winning streak

Local shares post opening gains as the S & P/ASX200 index lifts 0.3 per cent to 5923.9.

Investors take the lead on US growth options as all major banks except for a steady CBA lift between 0.2-0.4 per cent, while Macquarie’s preferred US housing market exposure James Hardie lifts over 1 per cent and Boral trades 0.6 per cent higher.

Miners trade mixed despite the higher price of spot iron ore, BHP drops 0.6 per cent and Rio Tinto adds 0.4 per cent.

Vocus shares rose as much as 5 per cent at the open as investors leapt in on the telco’s decision to prepare its NZ business for a FY18 sale. The stock has since pared most of the opening gains to trade just shy of 2 per cent in the black at $2.86.

Early ASX200 swing stocks below:

Ben Butler 10.23am: ANZ settles ASIC rate-rigging case

ANZ has settled rate-rigging allegations brought against it by the corporate regulator, leaving the other two banks accused of misconduct, NAB and Westpac, to fight on in the Federal Court.

Counsel for ASIC told the court that the agreement needed to be documented and asked for all the cases to be stood down for 48 hours to enable the documents to be completed.

Justice Jonathan Beach said he was willing to grant the time.

He said it might cause difficulties for the other cases but there was no reason why the cases against the other two banks could not go ahead on Wednesday morning — read more

ANZ last $30.59

10.10am: ASX to keep pace on growth hopes

Australia’s S & P/ASX 200 is expected to rise again Monday with IG tipping a 0.2pc opening gain.

This follows 0.5pc rise gain in the S & P 500 to a fresh record high on Friday after the US House approved the FY18 budget.

The news was out in local trading on Friday but the S & P/ASX 200 only rose 0.2pc on Friday.

Potential US stimulus from expected US tax cuts is obviously more positive for the US market, but also good for the global economy and the interest rate outlook.

Banks are the best way to leverage US growth developments alongside US housing exposure via Boral and James Hardie, Macquarie says.

BHP ADR’s equivalent close at $26.40 points to a 1.1pc rise in BHP after spot iron ore rose 2.6pc to $US62.46.

Also, note that S & P 500 futures are up almost 0.1 in early Asian trading.

On the charts, the S & P/ASX 200 has minor resistance from the May 11 peak at 5922.5.

The year’s high at 5956.5 is stronger resistance before the major level at 6000 points.

Friday’s low at 5868.6 is the first level of support before former resistance at 5836.4.

Index last 5906.98

Samantha Woodhill 10.00am: Oil veteran to replace Santos chair

Santos has announced Keith Spence will replace outgoing chairman Peter Coates when he steps down from the role in February.

Mr Spence has retired from his role on the board of Oil Search (OSH) to take on the position. Oil Search chairman Rick Lee confirmed in an ASX statement this morning that Oil Search is now searching for a replacement board member and thanked Mr Spence for his service over the past five years.

“His knowledge of, and career experience in, the oil and gas sector, strong professional and technical capability and focus on safety and operational excellence has been invaluable to the Oil Search board in fulfilling our various duties and responsibilities,” he said — read more

STO last $4.26

9.55am: Myer chief’s pay falls to $1.7m

Myer boss Richard Umbers has received a $1.7 million pay package, down slightly from the $1.9 million awarded the previous year.

Mr Umbers earnt a base salary of $1.2 million in the year to July 29, bringing his take home cheque to $1.4 million, excluding share based payments, Myer’s annual report shows.

The retailer has maintained its short-term incentives model — that no awards are paid unless a minimum net profit is achieved — but has altered its long-term incentives plan to one that “reflects the ongoing nature of our business evolution” — AAP

MYR last $0.75

Greg Brown 9.40am: Corporate crackdown looms

The Turnbull government is considering tripling corporate penalties and forcing companies that break the law to forgo turnover or profit.

The government is today expected to release a review from an independent taskforce that will recommend giving the Australian Securities and Investments Commission more powers to crack down on corporate crime.

The report recommends increasing corporate penalties from $1 million to $3m, while forcing bigger companies to forgo a percentage of their earnings if they engage in misconduct.

Financial Services Minister Kelly O’Dwyer will say later today that a strong penalty framework is “crucial” to improving outcomes for consumers and investors.

“The taskforce process will help to ensure that ASIC has the right tools to combat corporate and financial sector misconduct and to protect consumers,” Ms O’Dwyer said in a draft release obtained by The Australian.

9.37am: ACCC rules on mobile roaming

The competition watchdog has decided not to declare domestic mobile roaming, confirming a draft decision made in May.

However, the Australian Competition and Consumer Commission says it has identified a range of regulatory and policy measures that could improve inadequate mobile phone coverage and poor quality of service in regional Australia.

The ACCC said in deciding whether to declare a service, it must be satisfied that declaration would promote the long-term interests of end-users.

“The ACCC’s inquiry found that declaration would likely not lead to lower prices or better coverage or quality of services for regional Australians,” ACCC Chairman Rod Sims said.

Bridget Carter 9.19am: David Lang grabs KKR lead role

David Lang is joining KKR’s Australian team.

Mr. Lang joins from Pamplona Capital Management, a US$10 billion global private equity fund where he was a partner and founding member.

KKR said in a statement that he has 20 years of industry experience from consumer staples and retail, to industrials and infrastructure.

His appointment follows the departure of Ed Bostock, who was hired by Wesfarmers after leading the KKR Australian operations

More to come.

9.10am: Gold falls out of favour

Gold prices have fallen after the US Senate approved a budget blueprint that paves the way for tax cuts, causing stocks, the dollar and bond yields to rise. The Republican-controlled Senate voted by 51-to-49 late on Thursday for the measure, clearing a hurdle for tax cuts that would add up to $US1.5 trillion to the federal deficit over the next decade.

Investors betting on faster economic growth as a result bought riskier assets while bond holders reduced their positions on worries that inflation and federal borrowing could rise.

Spot gold was down 0.77 per cent at $US1,279.44 an ounce by 2.41pm Friday EDT (5.41am Saturday AEDT), down about 1.9 per cent on the week.

US gold futures for December delivery settled down $US9.50, or 0.7 per cent, at $US1,280.50 per ounce, 1.8 per cent lower on the week.

Reuters

9.04am: Macquarie Atlas push to axe Macquarie

Bridget Carter and Scott Murdoch write:

Shareholders at Macquarie Atlas Roads are believed to be considering an extraordinary general meeting to dump Macquarie Group as its manager after becoming weary of paying what they believe are exorbitant fees to control the $3.7 billion global owner of toll roads.

The move comes after the shock announcement of the departure of Peter Trent on Friday. Mr Trent was said to be in the US when the announcement was made by Macquarie that he would be replaced in February by James Hooke, who has run Macquarie Infrastructure Corporation in the US.

MQA last $5.72

Matt Chambers 9.00am: Oils not well: $4.5bn loss

The huge impact of the OPEC oil cartel’s battle with US shale producers has been starkly revealed in a national industry survey that says Australia’s oil and gas industry logged a combined 2015-16 underlying net loss (excluding writedowns) of $4.5 billion.

The results of the Australian Petroleum Production & Exploration Association’s 29th annual survey, to be released today, show the biggest, and only the second, net loss since the survey started in 1987-88.

8.55am: Analyst rating changes

Woodside raised to Buy — Shaw & Partners

Ramsay Health Care initiated at Outperform, $74.50 target — Macquarie

HealthScope initiated at Neutral, $2 target — Macquarie

Huon initiated at Buy — Goldman Sachs

8.50am: Vocus readies NZ arm sale

Vocus says it is preparing to sell its New Zealand assets, targeting closure at the end of FY18.

The arm generated revenue of A$323m in FY17 compared with the Australian Enterprise and Wholesale arm ($764.6m) and Australian Consumer division ($795.1m).

Alongside the announcement, Vocus maintained FY18 guidance including a $1.9-2bn revenue range, $370-390m earnings (EBITDA) range and underlying net profit between $140-150m.

VOC last $2.81

8.42am: Suncorp in $250m capital raising

Suncorp has announced a $250 million capital raising comprised of convertible debt notes.

“Suncorp’s capital position will be further strengthened by the Capital Notes 2 Offer and is a key part of our ongoing funding and capital management strategy,” said Suncorp CFO Steve Johnson to the ASX.

The announcement comes shortly after the insurer announced an overhaul of its senior ranks including the departure of its insurance head Anthony Day.

Sun last $13.67

Andrew White 8.28am: Banks in court over rate rig case

A landmark case against three of the big four banks over interest rate rigging will get under way in the Federal Court in Melbourne this morning after mediation and talks with the corporate regulator failed to reach a settlement.

Westpac, ANZ and National Australia Bank are facing a raft of separate allegations that they manipulated the bank bill swap rate (BBSW), a key interest rate benchmark used widely as a reference rate for business lending and investment, in order to boost their own profits.

Damon Kitney 8.23am: Packer hedges his bets in Japan

James Packer has played down the prospects of Crown Resorts pushing for a casino licence in Japan, and warned there is risk the company is overcapitalising on its flagship $2.4 billion Crown Sydney casino project after spending too much on its Perth and Melbourne properties.

In an interview with The Australian, ahead of Crown’s AGM this Thursday, Mr Packer said he did not want its management “distracted” by writing a big cheque to participate in a competitive bidding process to build a casino resort in Japan — read more

CWN last $11.01

7.40am: Stocks set to edge higher

The Australian market looks set to open just fractionally higher after a solid rise in Wall Street’s last session, amid optimism that US president Donald Trump’s tax plan had moved a little closer to becoming reality.

At 7am (AEDT), the share price futures index was up five points, or 0.08 per cent, at 5,895.

In the US, the Senate late Thursday approved a 2018 budget blueprint that could pave the way for Republicans to pursue a tax-cut package without Democratic support.

The S & P index of financials, which are expected to benefit from the administration’s proposed policies, rose 1.2 per cent.

The Dow Jones Industrial Average rose 0.71 per cent, the S & P 500 gained 0.51 per cent and the Nasdaq Composite added 0.36 per cent to 6,629.05.

Locally, in economic news on Monday, the CommSec state of the states report is realised and the CoreLogic capital city house prices survey for the week just ended is due out.

In equities news, Atlas Iron and Super Retail Group have their annual general meetings.

The Australian market on Friday closed at its highest level since May this year as the improved potential for US tax cuts and a turnaround in iron ore futures lifted sentiment.

The benchmark S & P/ASX200 index rose 10.9 points, or 0.18 per cent, to 5,907 points.

The broader All Ordinaries index lifted 8.8 points, or 0.15 per cent, to 5,968.6 points.

AAP

7.00am: Dollar lower

The Australian dollar has slipped against its US counterpart, which strengthened on increased optimism for US President Donald Trump’s tax reform plan after the US Senate approved a budget blueprint.

At 6.35am (AEDT), the Australian dollar was worth US78.17 cents, down from US78.45 cents on Friday.

US Republican Senator Rand Paul appeared to back the administration’s sweeping tax cut plan, saying he was “all in” for massive tax cuts, even as the Senate passed a key budget measure without his support one day earlier, Reuters said.

The dollar index, tracking the greenback against a basket of major currencies, rose 0.49 per cent, its biggest daily gain in a month.

Bets that Trump’s planned tax cuts, infrastructure spending and other pro- business measures would push up growth and inflation had been behind a reflation trade that propelled the US dollar to 14-year highs earlier this year.

Meanwhile, the Aussie dollar is higher against the yen and fractionally up against the euro.

AAP

6.50am: ASX set to lift at open

Australian stocks looks set for a positive start after Wall Street hit record closing highs on Friday, and after the local market hit its highest level since May.

“I suspect the market will open up, the US moved higher on Friday as did Europe,” AMP Capital’s chief economist Shane Oliver said.

At 7am (AEDT) the SPI futures index was up 5 points.

US stocks were boosted after the US Senate passed a budget resolution that lifted hopes of tax-cut reform moving forward.

The Dow registered a sixth week of gains, while the S & P 500 was up 0.9 per cent for the week and the Nasdaq added 0.4 per cent.

Dr Oliver said investors had been waiting all year to see if the reforms would go ahead in the US.

“It’s starting to happen, and it does provide confidence tax reform is on track,” he said.

Globally share markets and investors like tax cuts, so Dr Oliver suspects the reforms would provide a boost to the US and global economies. He said the unrest in Spain with Catalonia pushing for independence was not having any significant impact on the markets.

“It seems to be an internal Spanish issue, it hasn’t really had any impact,” Dr Oliver said.

Locally, the Australian share markets closed on Friday at its highest level since May. The benchmark S & P/ASX200 index was up 10.9 points, or 0.18 per cent, at 5,907 points, with most sectors making gains.

Investors will look to inflation readings this week. On Wednesday the Australian Bureau of Statistics releases the inflation report for the September quarter. Dr Oliver suspects it will show an annual rise of around two per cent for the year so far, which is likely to signal interest rates will remain on hold for the foreseeable future.

AAP