Trading Day: live markets coverage; ASX cheers Aussie tech export; plus analysis and opinion

Local shares close higher after global growth hopes were given a leg up by the progression of key US tax reform.

Welcome to Trading Day for Friday, October 20.

Samantha Woodhill 4.25pm: Stock lift amid fresh US tax hope

The local sharemarket closed up at a fresh five-month high with gains broadly spread across all sectors, after the US Senate approved a budget resolution, signalling support for tax reform.

The benchmark S & P/ASX200 was up 10.9 points, or 0.18 per cent, at 5,907 points, while the broader All Ordinaries index rose 8.8 points, or 0.15 per cent, to 5,968.6 points.

The S & P/ASX 200 has now risen 4.5 per cent over the past 11 sessions, the strongest 11-day gain since Donald Trump was elected US president last November.

In financials, NAB edged up 0.25 per cent to $32.46. Commonwealth Bank added 0.29 per cent to $78.97. Westpac gained 0.18 per cent to $33.51, while ANZ slid 0.03 per cent to $30.59.

Iron ore miners booked modest gains despite a sharp fall in the price of iron ore, with ANZ analysts said a pledge by Chinese President Xi to continue to constrain speculation in the housing market weighed on prices.

The spot price lost 1.84 per cent to $US60.88, according to the Metal Bulletin.

BHP ticked up 0.45 per cent to $26.68, Rio Tinto edged 0.09 per cent lower to $69.06, while Fortescue lifted 1.65 per cent to $4.93.

4.00pm: Atlassian stock hits record

US-listed Australian software company Atlassian easily beat earnings expectations with a quarterly report, sending shares to prices the company has never seen in regular trading.

Atlassian reported a first-quarter net loss of $US14 million, or 6 cents a share, on revenue of $US193.8 million, up from $US136.8 million in the same quarter a year ago.

After adjusting for stock-based compensation and other effects, Atlassian claimed profit of 12 cents a share, up from 10 cents a share a year ago. Analysts on average expected adjusted earnings of 9 cents a share on sales of $US185.8 million, according to FactSet.

After closing with a 1.1 per cent gain at $US40.25, shares gained more than 5 per cent in after-hours trading, topping $US42. The stock has never surpassed $US41 in a regular trading session, and set a closing high at $US40.39 last week.

Dow Jones

3.31pm: Power price hit may run deeper

Higher electricity and gas prices have the market’s full attention ahead of inflation data due next week, energy and utilities investors rampantly piecing through the Federal government’s new power policy direction for sticking points.

Headline consumer prices are to have risen at 2 per cent in the third quarter (on the same period a year prior) according to NAB’s Tapas Strickland, the economist keeping a keen eye on potential flow-on effects — or that on core inflation — of a recent hike in wholesale power costs on the core measure that typically strips them out.

“There is the risk that higher electricity prices could have second round effects,” says Mr. Strickland, “it will be important to monitor whether firms have the pricing power to pass such cost rises on to their buyers.”

NAB’s core inflation forecast for the period is also 2 per cent year-on-year.

Alongside a surplus of vegetables — mainly tomatoes, broccoli, beans and zucchini’s — the war waging in the supermarket space is keeping consumer prices down, according to Westpac economist Justin Smirk, grocery giants eating into margins amid record low wage growth.

“This is a soft update as outside of electricity, gas and dwelling purchases it is hard to find any signs of broader inflationary pressure with many consumer goods captive to a competitive deflationary cycle,” says Mr. Smirk alongside his headline (1.9pc) and core (1.8pc) forecasts.

Third-quarter Consumer Price Index (inflation) data due from the Australian Bureau of Statistics Wednesday next week at 11.30am (AEDT).

Paul Garvey 3.20pm: Minnows soar as Tanzania paves path

A breakthrough in negotiations between gold giant Barrick and the government of Tanzania has put a rocket under the share prices of some of the ASX stocks exploring in the southern African nation.

Shares in the Craig Williams-chaired OreCorp surged by 40 per cent this morning before the company halted trading in its shares, while Cradle Mining shares are up almost 21 per cent in early afternoon trade.

The run came as Barrick and the Tanzanian government announced a settlement of their ongoing fight over alleged unpaid taxes. Under the agreement, Barrick and its African subsidiary Acacia Mining will pay Tanzania $US300 million and Tanzania will take a 16 per cent stake in Acacia’s three Tanzanian gold mines.

Back in July, Tanzania served Acacia with a $US190 billion bill for unpaid taxes, penalties and interest for evading taxes and under-declaring exports.

The fight with Barrick and Acacia inspired the harsh new mining legislation that smashed the ASX-listed Tanzanian plays earlier this year. In that instance, the ASX intervened and forced around a dozen Tanzanian explorers into trading halts while they clarified the impact of the new measures, which included higher taxes and an effective nationalisation of a part-interest in all mineral projects.

While it is not immediately clear what if anything the Barrick-Tanzania settlement will mean for those wider changes, investors appear willing to bet that OreCorp and Cradle now face a brighter future.

ORR last up 30pc at $0.20, CXX last up 20.1pc at $0.14

3.00pm: #1-4: AGL bull case in new energy era

AGL Energy appears to be a net beneficiary of the Federal Government’s newly announced National Energy Guarantee, says Citi, upgrading the stock to “buy” and raising its 12-month target price on the stock 5 per cent to $26.88.

The NEG requires energy retailers to have a benchmark level of electricity on hand contractually and has slowed the pace of downward wholesale price pressure from renewables penetration, according to Citi analysts, both from which AGL investors can glean material upside.

While the devil is in the yet-to-be-released policy detail, Citi stays on the front foot and has formulated four reasons for an AGL bull case given the current power state-of-play.

1: “Its coal fleet benefits from retailers being incentivised to contract capacity from the most reliable and low cost generators.”

2: “As the emissions target becomes more onerous, the storage and firming capacity, which comprise AGL’s growth plans, becomes increasingly valuable.”

3: “AGL’s vertical integration allows it to always contract the best terms from its own generation.”

4: “Renewables penetration in the NEM may be slower, protracting the pace of our forecast wholesale price decline.”

Bloomberg’s consensus analyst ratings currently lists 5 buy, 3 neutral and 1 sell rating(s) on the stock.

AGL last up 1.9 per cent on $24.88

Elizabeth Redman 2.55pm: Property’s 55-year boom ending: UBS

Australia’s 55-year housing boom is ending because the long-term benefit of lower interest rates is likely over, although a housing crash is unlikely, according to UBS.

The research comes after Australian house prices soared 6556 per cent over the 55 years to 2016, marking a world record for the longest upswing, on Bank for International Settlements data.

Housing price growth averaged 8.1 per cent per year in that period and prices doubled every nine years.

But the “forever boom” is ending and prices are set to be flatter in future with growth of between 0 and 3 per cent in 2018, UBS economists George Tharenou and Carlos Cacho wrote in a note to clients.

More to come.

Michael Roddan 2.40pm: CBA rewarded execs amid allegations

The competence of Commonwealth Bank chairman Catherine Livingstone, one of Australia’s most influential businesswomen, has been heavily questioned by a parliamentary inquiry after she admitted to signing off on bonuses for bank executives while knowing the lender breached anti-money laundering legislation more than 53,000 times.

Appearing at the House of Representatives committee inquiry into the major banks, Ms Livingstone stood by her decision to sign off on CBA’s 2016 financial year remuneration report which gave an “above target” strength rating to matters of risk management. At the time, Ms Livingstone was not yet chairman of the bank but was a member of the board that signed off on the report — read more

CBA last up 0.3 per cent at $78.97

2.26pm: Risk assets soar on US budget progress

US budget progress through the Senate has boosted risk assets at the expense of safe havens today.

US S & P 500 futures rose 0.4pc and Australia’s S & P/ASX 200 share index jumped 0.5pc to a 5.5-month high of 5924.9 in anticipation of gains on Wall Street.

US 10-year bond yields rose 4 basis points to 2.36pc amid increased expectations of US tax cuts after the Senate passed the FY18 Budget.

But spot gold fell 0.5pc to $US1283.90 as the US dollar index rose 0.3pc and increased prospects of US fiscal stimulus reduced the risk of a stock market correction.

The S & P/ASX 200 has now risen 4.6pc in 11 days, the strongest rise in an equivalent time since the start of the “Trump bump” 11 months ago.

A test of major chart resistance may be possible next week if the index closes above 5900 today and Wall Street rises further.

But a rise to 6000 would push the forward PE ratio up to 16.25 times, near two-decade highs around 16.8.

Unless earnings forecasts are revised up, the index will look expensive near 6000 points, particularly given upside risk for interest rates.

2.14pm: Retail to stay threadbare: Morgans

Industry feedback suggests retail trading conditions have softened since August, says Morgans.

“This will likely play out in the form of some benign trading updates during the upcoming AGM season,” the broker says.

“With Amazon’s upcoming entry, we expect trading multiples will be broadly capped.”

“Additionally, any top-line or margin wins short term by domestic retailers will likely be retained/reinvested in order to provide additional protection medium-long term.”

It says this creates a “fairly benign outlook for the listed retailers” and has cut Domino’s, Adairs and Beacon Lighting to “hold”.

Samantha Woodhill 2.10pm: Clime funds base creeps higher

Clime Investment Management increased its funds under management by $158 million in the first quarter, the asset manager revealed in its quarterly update.

Gross balances and agreed mandates, which includes individually managed accounts, Clime Capital Limited and managed funds, stood at approximately $758 million in the September quarter, up from $600 million in the corresponding quarter of last year and $584m the quarter previous.

Clime also confirmed that after the recent 1.5 cent fully franked final dividend, the company has around $10 million in liquid capital.

In the fourth quarter of 2017, gross balances and agreed mandates totalled $584m.

The company also announced that it has appointed a head of private wealth do drive services to “wholesale and sophisticated clients”.

“This appointment is in line with our commitment to provide diversified asset offerings,” Clime said in a statement to the ASX.

CAM last $0.86

1.53pm: Dollar sinks as Trump tax progresses

The Australian dollar falls 0.6 per cent against its US counterpart to US78.36 in afternoon trade as investors rally behind the greenback after the US senate progressed the Trump administration’s proposed tax reforms.

More to come.

12.30pm: Woodside overly generous: Macquarie

Macquarie has cut Woodside to “underperform” vs. “neutral” after its production report showed weaker than expected production, sales and revenue, driven by maintenance and lower-than-expected pricing.

“We feel an inflection point has been reached where it is clear that WPL’s safety net is slipping away,” the broker says.

“Pluto’s foundation contracts, the bedrock of WPL’s earnings, have already shown weakness from medium-term contracts renewals, and we see a substantial risk ahead for the foundation contract repricing.”

“On top of this is the ongoing uncertainty regarding NWS’ future, lacklustre results in Myanmar, and the legal challenge in Senegal.”

“With this in mind, we question if an 80 per cent payout ratio — above the stated 50 per cent minimum — is the appropriate policy.”

“Though we have no concerns regarding liquidity, we question if it is capital better allocated to acquiring/finding, and developing new opportunities.”

Macquarie has also lowered its target price to $28.10 vs. $29.00.

WPL last 0.6 per cent at $29.08

Matt Chambers 12.05pm: BT Group backs Jan du Plessis

British telecommunications giant BT Group has thrown its support behind incoming chairman, and departing Rio Tinto chairman, Jan du Plessis, in the wake of US fraud charges against the miner and former chief executive Tom Albanese.

This week’s fraud charges over the delay of a write down of Mozambique coking coal assets, which came with a record fine from British corporate regulators, are the latest in a mounting pile of governance issues swirling around Rio and its board — read more

RIO last down 0.9pc at $8.50

Michael Roddan 11.39am: Handle ATMs with care: NAB

National Australia Bank chief executive Andrew Thorburn has become the latest big four bank boss to stress the role of risk committees in preventing the launch of smart ATMs that don’t comply with anti-money laundering legislation.

Appearing at the House of Representatives review of the major banks in Canberra, Mr Thorburn told MPs that NAB’s introduction of the intelligent deposit machines with a limit of $5000 was “a matter of balancing risk with convenience”.

11.20am: Apple hit by China watch glitch

Apple has another headache in China: this time with its latest watch.

For the first time, the Apple Watch can have an independent cellular connection, allowing people to use it to make voice calls, send and receive text and data even if the watch isn’t wirelessly connected to an iPhone.

But in China, the feature was abruptly cut off for new subscribers, without explanation, after a brief availability with one telecom company.

News of the suspension helped send Apple shares down 2.4 per cent — read more

Dow Jones Newswries

11.05am: Stocks drop as oil sours mood

Rebecca Gredley writes:

The Australian share market has started lower with a dip in oil prices weighing on the local energy sector, as Wall Street closed flat after a dip in technology shares.

At 10.30am (AEDT) on Friday, the benchmark S & P/ASX200 index was down 19.7 points, or 0.33 per cent, at 5,876.4 points, while the broader All Ordinaries index was down 20 points, also 0.34 per cent, at 5,939.8 points.

In futures trading, the SPI200 futures contract was down 21 points, or 0.36 per cent, at 5,857 points.

The big four banks were all trading lower, as the chief executives of National Australia Bank and Commonwealth Bank faced a parliamentary inquiry on Friday. Oil prices fell more than one per cent overnight after four days of gains, seeing the energy sector trading lower after open on Friday.

Woodside Petroleum was down 1.4 per cent, to $28.83, Oil Search fell 1.5 per cent, at $7.04, Santos was down 2.2 per cent to $4.19 and Origin Energy dipped 1.3 per cent to $7.46.

AAP

10.50am: Kiwi markets register political shock

Jonathon Underhill writes:

The New Zealand dollar fell as much as 2 per cent on Friday and the benchmark stock index dropped more than 1 per cent as the certainty of a three-term National government, under which the economy grew and equities rallied, was replaced by a coalition that may prove fractious and unconventional.

The kiwi dollar fell as low as US70.07c from 71.29c before the announcement on the new government Thursday.

The S & P/NZX 50 Index fell 1.1 per cent to 8037.39, the lowest in almost two weeks, and swap rates fell in the wake of Winston Peters and his NZ First Party’s decision to team up with Labour and the Greens.

“We’ve had a long period of certainty,” said Greg Smith, head of research at Fat Prophets.

“The economy has been very strong and the stock market has been incredibly strong during that time. You know what you get with the status quo. Now we’ve suddenly got a three-way coalition. That’s been problematic in other countries. ‘‘You’ve got two parties that don’t see eye-to-eye in the Greens and NZ First. And you’ve got a younger leader as PM in combination with an elder statesman as well.” The stock market sell-off was broadbased.

AAP

9.53am: ASX eyes hit to commodities

Australia’s S & P/ASX 200 share index is expected down 0.3pc after commodity price falls.

Spot iron ore fell 2.9pc to $US60.8, WTI crude fell 1.4pc to $US51.29, LME zinc fell 1pc and copper slipped 0.3pc

BHP ADR’s equivalent close at $US26.39 was a 0.6pc discount to yesterday’s BHP close in Sydney.

However, the S & P 500 recovered steadily to close up 0.1pc at a fresh record closing high of 2562.1.

The Nasdaq fell 0.3pc because of a 2.4pc fall in Apple.

But a majority of S & P 500 sectors rose.

Still, the S & P/ASX 200 is due for a pause after rising 4.3pc in 10 days.

S & P/ASX 200 last 5890.1

9.30am: Macquarie Atlas names new CEO

Macquarie Atlas Roads says chief Peter Trent will step down from the role effective February next year and Macquarie’s now infrastructure arm CEO James Hooke will succeed him.

MQA last $5.68

9.22am: Time to swoop on Crown: Morningstar

Crown has been upgraded to “accumulate” from “hold” by Morningstar analysts.

The stock has fallen over 7 per cent in two sessions after allegations surfaced the casino operator had rigged pokie machines to enable banned continuous play and had encouraged money laundering activities.

“We view Crown Resorts as a high-quality company offering both a defensive earnings quality and an attractive growth profile,” Morngingstar maintains.

“The Crown Sydney development will be a key source of growth, leveraging both the rapidly growing Chinese middle class and Australia’s attractiveness as a tourist destination.”

Morning star analysts pitch $13.50 as fair value for Crown stock, 16 cents above the highest level it has reached over the last 12-months.

CWN last $10.92

9.08am: Analyst rating changes

AGL Energy raised to Buy — Citi

Santos cut to Neutral — JPMorgan

Sandfire to Hold — Canaccord

Crown raised to Buy — Morningstar

Australian Pharmaceutical Industries raised to Neutral — Credit Suisse

Ausdrilll raised to Buy — Deutsche Bank

Adairs cut to Hold — Morgans

Woodside Petroleum cut to Underperform — Macquarie

Beacon Lighting cut to Hold — Morgans

Domino’s cut to Hold — Morgans

Adam Creighton 9.00am: China faces a ‘Minsky Moment’

“Housing is for living, not for punting,” said Chinese President Xi Jinping during his 3½ hour speech at the twice-a-decade Communist Party Congress this week.

Clearly, he wouldn’t stand a chance in Australian politics, where borrowing to punt on houses is sacrosanct. But he doesn’t have to worry about getting votes. And Chinese households and businesses have taken to borrowing with a vengeance, in any case.

Chinese household and business debt combined, as a share of GDP, has reached the same level as Japan’s in the early 1990s, when its bubble spectacularly burst.

John Durie 8.44am: Waislitz ups Select Harvests holding

Alex Waislitz’s Thorney Holdings has increased its stake in Select Harvests from 5.2 to 7.7 per cent after snaring 25 per cent of the recent $65 million placement totalling 10.7 million securities.

The placement earlier this month came after the company disclosed JP Morgan-advised Abu Dhabi sovereign fund, Mubadala had proposed a conditional offer at $5.85/share for the company last month.

The proposal was rejected by the board.

The equity raising has reduced gearing in the company from 37.6 per cent to 12.3 per cent.

Select (SHV) closed yesterday at $4.87 a share below the suggested bid price but above the $4.20 a share placement price.

8.35am: ASX to open down

The Australian share market looks set to open lower following an overnight dip in oil prices and a weak lead from Wall Street, where markets were weighed down by tech stocks before recovering in late trade.

At 7am (AEDT) on Friday, the local share price futures index was down 19 points, or 0.32 per cent, at 5,859.

Tech companies pulled US stocks back in late trade after reports in Taiwan suggested Apple was cutting orders for its iPhone 8 due to low sales. A slide in crude oil prices also pulled down energy stocks, which could follow suit on the ASX.

In local news today, the chief executives of National Australia Bank and Commonwealth Bank will make their latest appearances before MPs in Canberra.

Ansell and insurer IAG hold their annual general meetings.

AAP

Damon Kitney 8.20am: UBS banks on equal agenda

Anne Anderson will never forget her early days on the fixed income desk in the Sydney offices of global investment bank UBS.

“I remember being told that women could not wear pants. This was in 1993!” she tells today’s edition of The Deal magazine.

Fast forward almost a quarter of a century, and Anderson reckons she has delivered a cool $500 million to the bank, leading its Asia-Pacific fixed-income division and growing the business to over $30 billion in direct assets under management in the Asia-Pacific.

Matt Chambers 8.15am: BHP board shake up looms

New BHP Billiton chairman Ken MacKenzie, in his first BHP annual general meeting, has strongly backed chief executive Andrew Mackenzie but indicated a board shake up is looming at the world’s biggest miner.

In statements that will be seen as a rejection of speculation there was management change on the way at BHP, Mr MacKenzie told BHP’s London AGM on Thursday that his chief executive, Mr Mackenzie, and his team had set BHP up for future success in the past five years.

“During this time, BHP has become simpler ... more efficient ... more disciplined ... and stronger,” Mr MacKenzie said.

“Andrew, I look forward to working with you and your management team as you drive these outcomes even further” — read more

BHP last $26.56

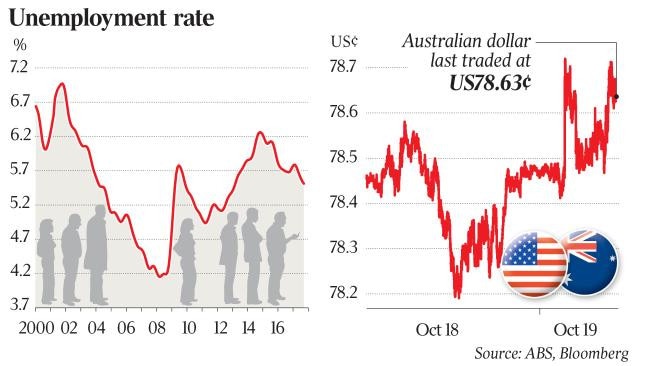

8.06am: Rate rise firms on jobs growth

David Rogers and Sarah-Jane Tasker write:

A further strengthening of Australia’s labour market has backed official forecasts of faster economic growth, reinforcing economists’ expectations that wages growth will recover enough to allow the Reserve Bank to consider lifting interest rates from a record low next year.

The surprise jobs boom came as signs of improving business confidence continued, with business conditions ticking up last quarter, according to the latest National Australia Bank survey.

Conditions, measured by sales and profitability, remained upbeat in the last quarter and the near-term and long-term outlook had strengthened, NAB said.

NAB group chief economist Alan Oster said the figures pointed to an improving economy.

“A positive byproduct of that has been solid outcomes for hiring intentions and capex plans for the year ahead,” he said.

7.40am: Kiwi slumps on new government

The New Zealand dollar has fallen about 2 per cent to a five-month low after NZ First opted to form a coalition with Labour, bringing in a government that has vowed to reduce migration, potentially putting a brake on one of the nation’s economic drivers.

The New Zealand dollar was trading at US70.08 cents at 6.30am (AEDT), from US71.29c yesterday, before the announcement on the new government.

The new coalition, with Labour leader Jacinda Adern as prime minister, is yet to name cabinet ministers or set out its policy priorities but financial markets have already weakened the New Zealand dollar on speculation the new government may borrow and spend more, curb migration, tweak the Reserve Bank Act and may raise the minimum wage.

AAP

7.10am: Dow recovers, edges higher.

US stocks stalled overnight as a stream of earnings and other company news swung shares.

Major indexes fell at the open, and the Dow Jones Industrial Average was down more than 100 points at its session low before the blue-chip index recovered toward the close.

The Dow industrials added 5 points, or less than 0.1 per cent, to 23,163, a day after closing above 23,000 for the first time. Declines in index heavyweights including Apple and Goldman Sachs Group kept pressure on the Dow for most of the session.

The S & P 500 gained less than 0.1 per cent and the Nasdaq Composite lost 0.3 per cent.

Australian stocks looked set to open lower, however. At 7.10am (AEDT) the SPI futures index was down 19 points.

On Wall Street, Apple fell 2.4 per cent following reports that a new cellular feature on the Apple Watch was disabled in China. Boeing fell 0.4 per cent and Goldman shed 0.8 per cent.

Shares of Verizon Communications helped mitigate the Dow’s declines, jumping 1.2 per cent after the company said it gained wireless subscribers in the latest quarter. Travellers added 2.4 per cent.

Elsewhere, shares of eBay fell 1.8 per cent after the online marketplace lowered its annual profit outlook for a second consecutive quarter.

Alcoa shares fell 2.5 per cent after the manufacturer of aluminium and bauxite products reported earnings that missed analysts’ estimates.

As investors broadly shied away from assets they consider to be relatively risky, government bonds strengthened, with the yield on the benchmark 10-year US Treasury note falling to 2.323 per cent, compared with 2.339 per cent yesterday. Yields fall as bond prices rise.

Dow Jones Newswires

6.55am: Aussie dollar gains

The Australian dollar has gained yet more ground against the US dollar after a drop in the local unemployment rate.

At 6.30am (AEDT), the local currency was worth US78.62 cents, up from US78.45c yesterday.

The Australian dollar continued to benefit from yesterday’s data that showed unemployment falling to its lowest level in more than three years in September. The Aussie also hit a 17-month high against the New Zealand dollar after Jacinda Arden surprised the market with her general election win.

BK Asset Management managing director of FX strategy Kathy Lien said the Aussie dollar had benefited from money flowing out of New Zealand, and was one of the few currencies to outperform the greenback.

“The labour market continues to be one of the country’s primary areas of strength,” Ms Lien said.

AAP

6.45am: Iron ore slides

The price of iron ore has slipped again, falling 3.4 per cent to $US59.60 overnight, according to The Steel Index.

6.40am: World stocks slip from record highs

Global stock markets ended a record-breaking run as corporate earnings, economic data and political woes cast doubt on the rally’s sustainability, dealers said.

Europe’s stock markets slid in response to Spain’s escalating political crisis, while investors awaited news from an EU summit where Brexit will once again be the focus of attention.

The Madrid stock exchange underperformed its European peers, as banking stocks dropped sharply, but weakness also extended into the industrial sector.

Wall Street was lower approaching midday in New York after a new highest reached yesterday, but remained comfortably above the key 23,000 level it breached this week for the first time.

“Mixed global economic and earnings data, along with lingering political and monetary policy concerns are conspiring to stymie the rally,” said analysts at the Charles Schwab brokerage.

European stock markets were “firmly on the back foot as a raft of company report earnings missed expectations, while investors await the next steps with respect to the constitutional crisis in Spain and today’s EU summit in Brussels”, noted Michael Hewson, chief market analyst at CMC Markets UK.

Spain said it would press ahead with suspending Catalonia’s autonomy after the region’s leader warned he may declare independence, heralding an unprecedented escalation of the country’s worst political crisis in decades.

Traders were looking also to Brussels, as EU President Donald Tusk warned Britain not to expect any breakthrough in Brexit negotiations at a European summit starting overnight, saying London needed to come up with more concrete proposals.

Leaders of the other 27 EU members meeting in Brussels through to tonight (AEDT) are set to postpone until at least December a decision on whether enough progress has been made in talks to move on to discussing Britain and the EU’s future relationship.

More cracks have been appearing in Britain’s economy, and data Thursday showed that retail sales fell more than expected in September, against a backdrop of rising inflation largely caused by a Brexit-hit pound.

London closed down 0.3 per cent, Frankfurt ended 0.4 per cent lower and Paris was down 0.3 per cent.

AFP