Trading Day: live markets coverage; A2 Milk slumps on Nestle hit; plus analysis and opinion

Shares in A2 Milk fall as much as 9pc after Nestle confirmed it is launching its own A2 infant formula in China.

That’s it from us for the Trading Day blog for Wednesday, March 28. Join us again tomorrow for all your local and global markets news.

S amantha Bailey 4.15pm: Stocks finish in the red

The local sharemarket finished the session firmly lower after a weak lead from Wall Street and as global geopolitical tensions continue to weigh on investor sentiment.

At the close of trade, the benchmark S & P/ASX200 had lowered 42.8 points, or 0.73 per cent, to 5789.5 points. The broader All Ordinaries index had fallen 44.54 points, or 0.75 per cent, to 5899.199 points.

It came after technology companies dragged Wall Street lower in the wake of the Facebook privacy scandal overnight, but the FTSE ended its session higher.

CommSec market analyst Steven Daghlian said the local bourse appeared to be following Wall Street back and forth, from daily gains to daily losses, this week.

“That volatility is probably going to continue,” he said.

“I think the concerns about trade between the US and China are still there, and there’s been a focus on Chinese officials meeting with the North Korean leader in recent days. The Trump administration is still saying it’s considering a crackdown on Chinese investments on some US technologies as well.

“There hasn’t really been anything in the way of economic news out today to really influence markets here or in the region for that matter, and that’s pretty much going to be the case for the rest of the week.”

The major miners fell on the back of a weaker iron ore price.

BHP lost 1.1 per cent to $28.67 while Rio Tinto lowered 1.04 per cent to $73.39. Fortescue tumbled 4.59 per cent to $4.37.

“Iron ore prices were also weaker, despite steel prices rebounding,” said ANZ FX research head Daniel Been.

“Steel rebar futures in China rose as much as 2 per cent as the concerns over a trade war eased.

“However, this didn’t flow through into the iron ore market, with traders reluctant to aggressively bid for cargoes amid a healthy level of inventories at the steel mill level.”

In financials, ANZ shed 1.13 per cent to $27.10 while NAB weakened 0.84 per cent to $28.40. Commonwealth Bank slipped 0.79 per cent to $71.86 while Westpac softened 0.42 to $28.58.

The energy sector lost ground after the price of oil fell on Tuesday night.

Oil Search fell 1.77 per cent to $7.23 while Santos drooped 1.16 per cent to $5.13. Origin Energy was cut by 0.9 per cent to $8.85 and Woodside Petroleum edged 0.88 per cent lower to $29.24.

“Crude oil prices fell sharply as the market returned its focus back to US crude oil stockpiles,” Mr Been said.

“A Bloomberg survey shows the market is now expecting a rise of 850,000 barrels last week ahead of the EIA report on Wednesday.

“This is despite OPEC continuing to point to falling inventories elsewhere around the world.”

A2 Milk plunged 7.52 per cent to $12.06, after Nestle confirmed it has launched an infant formula product competition with A2’s formula product.

Fund manager Blue Sky went into a trading halt after a report by short-selling hedge fund Glaucus Research sent its shares plummeting as much as 16 per cent. Glaucus said it believes Blue Sky is “significantly overstating” its fee earning assets under management. The stock last traded down 9 per cent at $10.40.

Elsewhere, construction company Watpac was unchanged at 75 cents, despite issuing a profit downgrade as a result of two lost tenders in its already flailing mining business.

The Australian dollar was trading slightly higher at 76.90 cents in late trade.

3.30pm: Asian stocks fall on tech weakness

Asian stock markets were in the red Wednesday as tech stocks extended losses following sell-offs of their US peers overnight.

Investors are selling technology-related shares on concern governments might tighten their scrutiny over Facebook after it was revealed that users’ data was shared with a consulting firm affiliated with President Donald Trump.

Japan’s Nikkei 225 sank 1.8 per cent to 20,936.59 and South Korea’s Kospi slid 1.3 per cent to 2,419.89. Hong Kong’s Hang Seng index fell 1.4 per cent to 30,350.64, while China’s Shanghai Composite Index dropped 1.1 per cent to 3,131.48.

Stocks in Taiwan, Singapore and other Southeast Asian countries also fell.

Investors cut their holdings of Asian tech stocks after a series of incidents sent their U.S. peers lower again. One of those cases is a report that authorities will investigate a fatal crash that involved a Tesla electric SUV equipped with a semi-autonomous control system. In Asia, Samsung Electronics Co. fell 2 per cent and Sony Corp. lost 2.4 per cent. Softbank Group Corp. slumped 3.6 per cent. Tencent Holdings Ltd. was down 2.6 per cent.

3.15pm: A2 Milk slumps on Nestle formula move

Shares in A2 Milk have slumped as much as 9pc after Nestle confirmed it is launching its own A2 infant formula in China.

Shares were last down 6.8pc at $12.17 after falling 9pc to 3-week low of $11.86 in early trading.

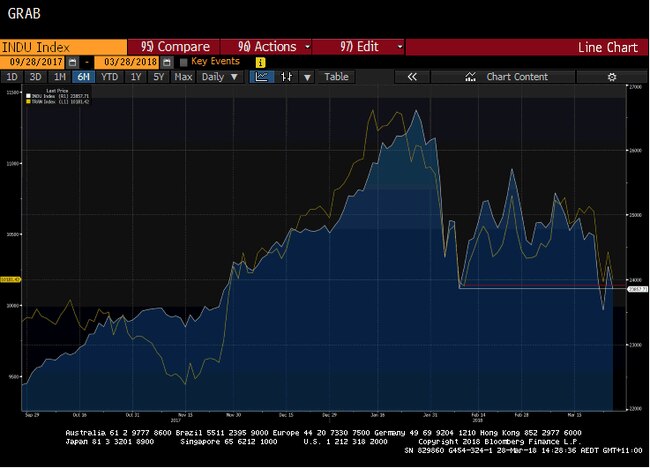

2.53pm: US shares near major sell signals — charts

The US sharemarket is close to forming a major sell signal according to Dow Theory. It’s also close to breaking major support lines from 200-day moving averages.

If the Dow Jones Transportation Average closes below its Feb. 9 low on a daily closing basis, at 10136.61 — 0.3 per cent below Tuesday’s close — the Dow Theory Sell Signal will be triggered.

With the Dow Jones Industrial Average having already broken the equivalent low at 23,860.46, the final step would be a break down in the DJTA.

According to Charles H. Dow — founder of the Wall Street Journal and the father of modern technical analysis — the stock market averages need to “confirm” each other.

The DJIA has already formed a major downtrend in peaks and troughs and needs to be confirmed by a major downtrend in the DJTA, which is considered a leading indicator of the economy.

The other major concern is the S & P 500 is falling back toward it’s 200-DMA at 2587 after a “sucker” bounce on Monday — the strongest rise in 2.5 years.

The DJIA is also nearing its 200-DMA and the February intraday lows on both indexes will be viewed as “last ditch” support.

Samantha Bailey 2.30pm: Billabong shareholders approve takeover

Shareholders in struggling surfwear brand Billabong have voted strongly in favour the proposed acquisition by US company Boardriders, owned by private equity giant Oaktree.

Boardriders, which owns the Quicksilver and Roxy surf brands as well as DC shoes, made a bid for the company in January, offering $1 per share in cash by scheme of arrangement.

Shortly before the shareholder meeting Boardriders increased the bid to $1.05 per share.

Billabong, which has a $228m term loan maturing in September 2019, booked a first-half loss in February, citing weakness in the Asia-Pacific and European markets.

Announcing the deal, Billabong’s board unanimously recommended that shareholders vote in favour of the scheme, saying it was in the interest of shareholders as the company faces ongoing financial risk.

“The board considers that it will become necessary for Billabong to materially reduce debt if it is to continue with its current strategy which, given the company’s existing high debt levels is expected to require asset sales or a dilutive equity raising,” chairman Ian Pollard told shareholders in January.

“While Billabong has made significant operational progress in recent years, the board is also mindful of the fact that, in the absence of the scheme, Billabong shareholders face ongoing risks and uncertainties associated with the business.”

Eli Greenblat 2.05pm: ASIC had concerns over Myer intangibles valuation

The corporate regulator has publicly acknowledged that it had approached troubled department store Myer about the $1 billion in value on its books of its goodwill and brand name intangibles before the retailer last week booked $524.5 million in impairments last week when it released its interim result.

The Australian Securities and Investments Commission this afternoon said in a statement it notes the decision by Myer last week to write down the value of its goodwill and brand name intangible assets by $515 million in its financial report for the half-year ended 27 January 2018.

“ASIC had raised concerns on the value of these assets in Myer’s financial report for the full-year ended 29 July 2017, including the reasonableness and supportability of the cash flow forecasts used in testing the assets for impairment,’’ the regulator said in a statement.

“Myer has stated that it adopted lower cash flow forecasts in making the 27 January 2018 write down in the value of its assets. Myer also referred to the deterioration in trading during the first half of the 2018 financial year.

“ ASIC calls on preparers to focus on the quality of financial report information, the impairment of non-financial assets remains a focus in ASIC’s surveillance of financial reports.”

Last week Myer unveiled its biggest loss in its more than 100 years of operating, reporting a half-year loss of $476.22 million as more than half a billion dollars in restructuring costs and impairments of its goodwill sank the retailer into losses.

Myer booked $6.5 million in restructuring and redundancy costs, $7.24 million in store exit costs and a massive impairment of $524.5 million against the value of the goodwill on its books.

The value of its goodwill had been a contentious issue for some time and was raised by major shareholder Solomon Lew when his representatives battled the Myer board at its AGM last year. At the AGM, which officials from ASIC also attended, Mr Lew’s Premier Investments peppered the board with questions over the threat to its banking covenants if it was required to book a sizeable writedown of its goodwill.

At the time Myer said it was constantly testing the valuations of its goodwill and other intangible assets.

Myer did not breach its banking covenants as feared when it posted its half-year result and included the large impairments, but moved dangerously close to the edge of those loan agreements.

1.45pm: A2 Milk drops on Nestle competition

Shares in A2 Milk have fallen sharply in intraday trading after a report that global food and dairy giant Nestle has launched an infant formula products that uses the A2 beta-casein protein, the same protein that is the mainstay of A2 Milk’s products.

The New Zealand Herald said Nestle has launched the A2 product under the brand Illuma and that it is already available in China.

A2 Milk shares were 64 cents, or 4.9 per cent, lower at $12.40 at 1226 AEST, after going as low as $11.86.

1.25pm: Blue Sky halted after share plunge

Blue Sky Alternative Investments has been placed in a trading halt to “review and respond” to the short selling recommendation by Glaucus Research which has pummelled their shares today.

Blue Sky shares were last down 9pc at $10.40 after earlier diving 16pc to a 7-month lwo of $9.41.

12.40pm: Blue Sky in second-biggest fall on record

Blue Sky Alternative Investments’ share price is heading for its second-worst day on record after the Glaucus short selling recommendation.

Blue Sky shares have plunged 16 per cent to a 7-month low of $9.61.

Its biggest ever fall was on December 4, 2013 when it closed down 18.4 per cent.

Share trading volume of 8.69 million shares is about 11 times the 20-DMA.

12.30pm: Miners, banks drag on market

Australian shares have regained some ground but remain lower at midday following heavy overnight falls on Wall Street.

The benchmark S & P/ASX200 index, which had been down as much as 0.87 per cent, was 0.56 per cent lower at 5,799.6 points at 1200 AEDT on Wednesday. The broader All Ordinaries index was down 0.58 per cent at 5,898.3 points, with industrials and property trusts the only sectors showing gains. The materials sector was down 0.85 per cent following falls in the price of copper and iron ore, with BHP Billiton down 0.62 per cent to $28.81 and Fortescue Metals falling 4.04 per cent to $4.395.

Rio Tinto shares sank 0.31 per cent to $73.93 despite increased hopes of a shareholder windfall after the resources giant completed its exit from Australian coal with the $2.25 billion sale of its interest in Queensland’s Kestrel underground mine.

The big four banks were trading between 0.48 and 0.82 lower, with ANZ Bank the worst performer, down 22.5 cents at $27.185.

Technology stocks mimicked Facebook-led falls in the US, with WiseTech Global dropping 49 cents, or 4.62 per cent to $10.11.

The tech-heavy Nasdaq Composite dropped 2.93 per cent to 7008.81 overnight, the Dow Jones Industrial Average fell 1.43 per cent to 23,857.71, and the S & P 500 lost 1.73 per cent to 2612.62.

Energy stocks sank as oil prices remained flat, pulled in opposite directions by strong global crude output and talk of a possible disruption to Middle East supply.

Woodside Petroleum fell 1.31 per cent to $29.115, Santos declined 0.58 per cent to $5.16, and Oil Search was trading 1.77 per cent lower at $7.23. The Australian dollar continued its slide against its US counterpart, dragged down by the commodity price falls.

At 1200 AEDT, the local currency was worth 76.92 US cents, down from 77.30 US cents on Tuesday.

Dana McCauley 12.15pm: Seven dumps Yahoo7 stake

Seven has dumped its stake in Yahoo7, ending months of speculation about the future of its joint venture with Verizon subsidiary Oath.

It comes a month after Yahoo7 announced a spate of redundancies in a bizarrely-worded press release, and will result in further cuts — including chief executive Ed Harrison, chief financial officer Penny Diamantakiou, chief technology officer Paul Russell and product director Mark Robinson.

Oath’s head of Asia-Pacfic Rose Tsou said in a statement: “Simplifying our structure in Australia and New Zealand is a big moment for Oath and our advertising and publisher partners.

“We see a huge amount of opportunity for growth through our global house of brands and technology platforms.”

Insiders say Oath, created last year when Verizon acquired Yahoo, has a preferred approach of stripping back local content and relying heavily on syndicated Yahoo content run across its international editions.

12.05pm: Blue Sky in free fall

Blue Sky Alternative Investments shares are in free fall after the short-selling recommendation from Glaucus Research.

The share price has abruptly fallen 14 per cent to a 7-month low of $9.85.

11.50am: Glaucus flags Blue Sky as short sell

Glaucus Research — which famously called out the sandalwood company TFS (which became Quintis) in 2017 — has now flagged Blue Sky Alternative Investments as a short sell.

It says Blue Sky’s fee-earning assets under management are overstated and its revenues are unsustainable, according to a report on its website today.

Glaucus says it has a short position in Blue Sky and says it’s worth $2.66 at most versus Tuesday’s close at $11.43.

Blue Sky last down 2 per cent at $11.23.

Samantha Bailey 11.20am: Avanco to give Oz ‘resilience, choice’: CEO

Oz Minerals chief executive Andrew Cole has told Sky News Business that the company’s bid to acquire Avanco would provide Oz with a strong portfolio of opportunities into the future.

“When you add Avanco into [our] portfolio, we will have really strong optionality at every piece of our portfolio and I think as a resources company, having that sort of optionality is very powerful and very important,” Mr Cole said.

“It will give us resilience and it will give us choice.”

The Adelaide copper miner made a $444 million play for Avanco Resources yesterday, in a deal which could provide four new Brazilian mines for Oz in the next six years.

Oz Minerals, which operates a mine at Prominent Hill in South Australia, could have seven mines in operation within six years under the deal.

“The value we’ve put on the table for Avanco I think is a fair representation of the value today and I think there’s tremendous upside in the portfolio that they’ve got,” Mr Cole said.

“The Avanco acquisition is about 16 per cent of Oz’s market capitalisation so in terms of risk for Oz Minerals, it’s a relatively small capitalisation of our company so I think there’s a lot more upside in Avanco than is currently being captured in the valuation for Avanco today.”

10.55am: Buybacks likely for Rio shareholders: UBS

UBS expects Rio Tinto to give cash back to shareholders via on and off-market buybacks following the sale of its Kestral coal mine for an “impressive price”.

Rio Tinto announced earlier today it had sold its entire stake in the Kestrel coal mine in Queensland to a consortium comprising of private equity manager EMR Capital and Indonesian coal company Adaro Energy for $US2.25 billion.

“Rio’s options post-sale are to pay down debt, invest in growth, or give the cash back to shareholders,” the analysts, led by Glyn Lawcock said.

“Mgmt indicated with FY17 results that there is no need to further reduce net debt, M & A is too expensive & capex will remain $5.5-6.0bn until 2020; as a result, we expect proceeds (when received) to be returned to shareholders via an on- and offmarket buybacks.”

The analysts also say Rio could raise a further $3 billion from disposals this year, including its Pacific Aluminium unit, its stake in the Iron Ore Company of Canada (IOC) and its stake in the Grasberg Copper mine in Indonesia.

UBS has a Buy rating on Rio Tinto, with a target price of $90. Rio Tinto was last down 0.53 per cent at $73.76.

Eli Greenblat 10.40am: Supermarket wars headed for ceasefire

The decade-long supermarket price wars, which have been a boon for bargain-hungry shoppers but a costly expense for retailers, could be creeping towards a cease fire and it all could come down to the price of a BBQ chicken.

A few weeks ago, according to a Wall Street bank, Coles tested the market by lifting the price in a number of regional supermarkets of those handy BBQ chickens that are inserted into carry bags and placed under in-store warmers by $1, with Woolworths quickly following the price rise by matching it.

In some kind of strange retail chicken dance, Coles then rolled out the $1 price rise nationwide and again Woolworths matched it.

To shoppers it doesn’t seem to have made much difference and gone without little commentary, but for Bank of America Merrill Lynch analyst David Errington it is cause for optimism that the “race to the bottom” on prices — that has seen Woolworths and Coles aggressively slash prices in a prolonged price war — could be at an end as rational pricing returns to the supermarket sector.

He views the 12 per cent price hike for BBQ chickens as forming part of an “industry changing event” that will put an end to the constant price wars that have severely eroded supermarket profitability as customers prepare for a return on some modest price inflation in the $90 billion grocery sector.

“Australian food retailers show they don’t “hate” money,’’ Mr Errington said in a note to clients this morning.

“We believe the margins in the Australian supermarket industry have fallen too aggressively in the past 2 years, and that all participants are likely to allow price inflation to modestly return after a lengthy period of deflation.’’

And it is at the BBQ chicken station that the two combatants could meet and call a truce — metaphorically that is, without any collusion which would be illegal.

Samantha Bailey 10.30am: Watpac tips FY loss, flags mining asset sale

Construction company Watpac has warned it will likely swing to a full-year loss as it flagged the potential sale of its mining assets.

The company’s board told the ASX this morning it will now undertake a comprehensive review of its already flailing mining business, which Watpac warned in its first-half results would be a key risk to the group’s profitability.

The profit downgrade follows to unsuccessful tenders on two major mining projects and after the company was removed from the All Ordinaries index in a quarterly reshuffle.

Watpac is now expecting to book an underlying net loss before tax, which strips out one-off items, of between $3 million and $5m, compared to the underlying net profit after tax of $1.1m for the 2017 financial year.

The company booked a statutory loss of $31.4m for the full year last year.

Watpac told shareholders that despite the “disappointing” performance of the mining business, its construction and civil businesses are profitable and will likely to contribute positively to the underlying fiscal year 2018 result.

It comes as major shareholder BESIX, a Belgian construction group, looks to acquire 50 per cent of the shares held by each of the other Watpac shareholders for $0.92 cash per share.

“BESIX has confirmed that this latest earnings guidance update will not have an impact on the Proposal,” the company said.

At about 10.20am (AEDT) Watpac shares were unchanged at 75 cents.

10.20am: Stocks fall at open

The Australian share market has opened lower, weighed down by losses in mining stocks consumer stocks and health care, and after Wall Street suffered a late fall.

At 1012 AEDT on Wednesday, the benchmark S & P/ASX200 index was down 26.8 points, or 0.46 per cent, at 5,805.5, while the broader All Ordinaries index was down 27.4 points, or 0.46 per cent, at 5916.3 points.

In futures trading, the share price futures index was down 31 points, or 0.53 per cent, at 5,787 points.

AAP

John Durie 10.10am: ACCC delays Saputo-MG decision

The ACCC has delayed its decision on Saputo’s undertaking to clear its proposed $1.3 billion acquisition of Murray Goulburn until April 4.

The ACCC has said it will only clear the deal if Saputo sells the one billion litre MG Koroit processing plant.

The decision was due tomorrow but the ACCC said it needed more time to test the proposal.

Murray Goulburn has said it will keep its proposed unit holders meeting on April 5 even though it is uncertain whether a buyer will be known by next Thursday.

Potential bidders include a range of Chinese buyers, Bega and the Midfield-Louis Dreyfus consortium.

Any ACCC approval is likely to come with a commitment from Saputo to continue supplying the plant for a set period to allow the new buyer time to settle milk supply.

But given Saputo is the vendor some argue it is conflicted in deciding just who should buy the plant given the buyer will eventually be a competitor.

An independent adviser should be installed to run the sales process, according to some bidders.

Questions are also raised about just what MG unit holders will be voting on next week given they are unlikely to know who will be buying the Koroit plant.

Ben Wilmot 9.55am: Denny takes major interest in McGrath

The NSW central coast’s leading property developer, Tony Denny, last night emerged as a substantial shareholder in John McGrath’s listed real estate agency, with the cashed-up businessman taking a position ahead of the company unveiling a turnaround strategy.

Mr Denny, who shot to prominence three years ago with a $320 million fortune after selling his Europe-based AAA Motor Group, has been quietly amassing his stake as McGrath shares have slumped.

The former used-car tycoon has built up a 5.05 per cent stake in the real estate agency after picking up 7.2 million shares this month as they hovered around the 40c mark.

Although his company has labelled his buying as passive investment, it will give him a say in the company’s direction as he sits behind only Mr McGrath, who has 26 per cent, Shane Smollen, with close to 9 per cent, and institutions Perpetual and Argo.

The remainder of the McGrath register is relatively tightly held.

9.30am: Genting tipped for Sky City casino

Genting Group out of Malaysia or an Australian property developer are being tipped as the most likely buyer of Sky City Entertainment’s Darwin Casino, as investment bank Goldman Sachs continues to weigh options for the venue on behalf of its listed owners.

The casino, based in the Northern Territory capital, has been unofficially on the market for some time, and Sky City Entertainment said yesterday during its investor day presentations in Auckland that Goldman Sachs would test interest from selected parties, and that if a sale could be concluded at the right price with the right buyer, proceeds would be used to repay debt and fund short-term strategic growth initiatives.

Market talk suggests the most likely acquirer would be Genting Group, and should it not acquire the casino, the next move could involve selling the site to a property developer and retaining a management agreement to operate the casino.

Bridget Carter, Scott Murdoch

9.25am: Rio completes exit from coal

Rio Tinto has completed its exit from Australian coal with the $2.25 billion sale of its 80 per cent stake in Queensland’s Kestrel underground mine. The mining giant on Wednesday said it has agreed to sell its stake to private equity manager EMR Capital and Indonesian coal firm Adaro.

The sale is expected to be completed in the second half of 2018 and takes the value of Rio Tinto’s Australian coal divestments in the past month to $4.15 billion.

Rio Tinto last month said it was selling two Queensland coal projects to global mining giant Glencore for $1.7 billion, and its stake in an undeveloped project to Whitehaven Coal for $200 million.

Rio Tinto chief executive Jean-Sebastien Jacques said the funds raised would be used for “general corporate purposes”, without giving further details. “The sale of Kestrel, together with the announced divestments of Hail Creek and our undeveloped coal projects, delivers exceptional value to our shareholders and will leave our portfolio stronger and more focused on delivering the highest returns through targeted allocation of capital,” Mr Jacques said. “I would like to thank the many people at Rio Tinto and the communities where we operate, whose hard work and commitment has contributed to the success of the coal business over many years.”

AAP

9.20am: Stocks to watch

BHP Billiton, Rio Tinto, Fortescue — Iron ore prices have fallen $US5 in the past two weeks, down to $US 65.17 in Singapore on Tuesday.

Northern Star, Newcrest, Evolution — Gold prices fell on Tuesday after hitting a near six-week high as the US dollar rose and risk appetite revived in global financial markets, but the precious metal remained underpinned by an array of geopolitical tensions.

AAP

9.10am: Broker rating changes

South32 upgraded to Outperform — Macquarie

Whitehaven Coal upgraded to Outperform — Macquarie

Orocobre upgraded to Outperform — Macquarie

Japara Healthcare upgraded to Underperform — CLSA

Apollo Tourism & Leisure upgraded to Add — Morgans

Fortescue price target cut to $4.70 from $5.15. Underperform rating maintained — CLSA

Fortescue downgraded to Sell at Citi

Sandfire Downgraded to Sell at UBS

Northern Star Downgraded to Sell at UBS

CSR Upgraded to Equal-weight at Morgan Stanley

OZ Minerals Upgraded to Hold at Canaccord

88 Energy Cut to Neutral at Hartleys Ltd

News Corp changed to Sell from Not Rated — UBS

8.45am: Copper lifts on trade talks

Copper prices rose on Tuesday after reports of behind-the-scenes talks between the US and China fuelled hopes that a trade war could be averted and sparked a global stock market recovery, but a strengthening dollar limited gains.

Benchmark copper on the London Metal Exchange closed up 0.7 per cent at $US6,649 a tonne, after touching a three-and-a-half-month low on Monday.

“Copper is trying to react to the improved sentiment in the stock market (and) reduced fears about global trade tensions,” said Saxo Bank analyst Ole Hansen. But he said prices were unlikely to rally far.

“With inventories on the rise, the market lukewarm about the near-term prospects for Chinese demand and the speculative community having sliced their longs to the lowest in a couple of years, there’s not much of an appetite (for copper) right now.”

Reuters

8.25am: Gold slides after hitting near 6-week high

Gold prices fell on Tuesday after hitting a near six-week high as the US dollar rose and risk appetite revived in global financial markets, but the precious metal remained underpinned by an array of geopolitical tensions. The US dollar rose versus a basket of major currencies, as returning risk appetite dented investor appetite for the greenback. A stronger US dollar makes US dollar-priced gold costlier for non-US investors.

Stock markets jumped in response to reports the US and China were negotiating to avert a trade war, denting gold’s appeal as a safe haven, but fell in late trade.

“There’s going to be a few months of talks before uncertainty around the global trade situation can be erased, and in the meantime gold will at times benefit,” said Simona Gambarini, commodities economist at Capital Economics. “In the short term we definitely see gains (for gold).” Spot gold dropped 0.7 per cent at $US1,343.84 per ounce in afternoon trade, after touching $US1,356.66, its highest since February 16.

US gold April futures settled down $US13, or 1 per cent, at $US1,342 per ounce.

Underpinning gold, Moscow said on Tuesday it would respond harshly to a US decision to expel 60 Russian diplomats over a nerve agent attack on a former Russian spy in Britain, but was still open to strategic stability talks with Washington.

Meanwhile, spot silver lost 0.7 per cent at $US16.54 per ounce after hitting a near three-week high of $US16.80.

Reuters

7.35am: Tech sell-off hits US stocks

Wall Street was back on shaky ground overnight, with huge declines in technology shares leaving major stock indices sharply lower.

The tech-rich Nasdaq Composite Index dropped 2.9 per cent to 7,008.81. The Dow Jones Industrial Average fell 1.4 per cent to 23,857.71, while the broadbased S & P 500 shed 1.7 per cent 2,612.62.

Analysts pointed to a cascade of negative stories surrounding leading technology names, including Facebook, Tesla Motors and Twitter.

“You’ve got large cap tech that led this downdraft,” said Art Hogan, chief market strategist at Wunderlich Securities.

“Once this market starts in a direction like this, you’re not going to see anybody step in and catch a falling knife.”

Overnight losses set the market back on the red after yesterday’s brief surge.

Stocks also fell sharply on Thursday and Friday on worries about President Donald Trump’s trade policies, but those fears have receded somewhat in the last couple of days.

Facebook dropped 4.9 per cent as the social media company continued to face scrutiny over a customer data scandal. Chief executive Mark Zuckerberg turned down a request by British lawmakers to appear in parliament but reportedly agreed to testify at a US congressional hearing.

Tesla slumped 8.2 per cent after the National Transportation Safety Board announced it was investigating a fatal crash last week involving a Tesla automobile in California.

Twitter dived 12.0 per cent after a report from Citron Research warned the company was vulnerable to a regulatory crackdown over its data privacy policies. Citron is known for placing bets on stock price falls.

Google parent Alphabet sank 4.6 per cent after a US appeals court revived Oracle’s lawsuit alleging that Google owed billions of dollars in damages over the search engine company’s use of Java programming language in its Android smartphone operating system. Oracle lost 2.4 per cent.

AFP

7.15am: ASX to open weaker

The Australian share market is expected to open much lower after Wall Street suffered a heavy fall in late as trade tensions started to play on people minds again.

At 7am (AEDT), the Australian share price futures index was down 60 points, or one per cent, at 5,758.

In the US, stock gave up early gains, after US officials asked China to cut tariffs on imported cars, allow foreign majority ownership of financial services firms and buy more US-made semiconductors in negotiations to avoid a US-China trade war.

Australian shares yesterday closed higher, led by the big miners. The benchmark S & P/ASX200 closed up 41.8 points, or 0.72 per cent, at 5,832.3 points, while the broader All Ordinaries index was up 42.3 points, or 0.72 per cent, at 5,943.7 points.

AAP

7.10am: Rio sells Kestrel coal mine

Shares in Rio Tinto rose overnight after the company said that it has sold its entire stake in the Kestrel coal mine in Queensland for $US2.25 billion.

The dual-listed mining company (RIO) said it sold all of its 80 per cent stake in the Kestrel mine to a consortium comprising of private equity manager EMR Capital and Indonesian coal company Adaro Energy.

7.05am: Aussie follows Wall St lower

The Australian dollar is lower as the major US stocks index suffer heavy falls, weighed down by tech stocks.

At 6.35am (AEDT), the local currency was worth US76.78 cents, down from US77.30 cents yesterday.

After enjoying some gains yesterday, Wall Street resumed its slide that started last week, on the back of nervousness over a possible trade war between China and the US.

AAP

6.45am: Wall St in late sell-off

US stocks slid in afternoon trade, pressured by further declines in technology and financial shares.

The Dow Jones Industrial Average had swung between small gains and losses for much of the session before turning firmly lower in the final hour of trading as losses accelerated in the tech sector.

In late trade the blue-chip index fell 432 points, or 1.8 per cent, to 23,770, while the S & P 500 slipped 2.1 per cent, and the tech-focused Nasdaq Composite declined 3.3 per cent. Earlier in the session, the Dow had risen as much as 243 points.

Australian shares are set for an opening slide. At 6.55am (AEDT) the SPI futures index was down 57 points.

On Wall Street the S & P 500’s technology sector dropped 3.4 per cent, suffering the biggest losses of the index’s 11 major segments. Nvidia, which has made a broad push to bring its computing platform into self-driving cars, was the worst performer in the broad index after the chip company said it would temporarily halt testing of its driverless technology on public roads following the fatal crash of an Uber Technologies autonomous vehicle. Nvidia shares fell 9.4 per cent.

Meanwhile, shares of Facebook declined 5.2 per cent as chief executive Mark Zuckerberg said he expects he will have to testify about the social media company’s privacy and data-use standards. Facebook shares are down 15 per cent this month over concerns about its handling of user data.

Pressure in the tech sector spilt over into the broader market last week when the Dow and S & P 500 dropped nearly 6 per cent to log their biggest weekly declines since October 2008.

Bank shares also came under fresh selling pressure.

The KBW Nasdaq Bank Index of large lenders fell 2.8 per cent, on course for its third decline in five trading sessions, as a fresh wave of buying in government bonds sent the yield on the 10-year Treasury note to its lowest settlement since early February. Lower interest rates tend to hurt banks by weighing on their net interest margins, a key measure of lending profitability.

Ryan Detrick, senior market strategist for LPL Financial, said the recent downturn in the market could be a chance for investors to buy the dip.

“The bottom line is still the tariffs are a near-term worry, sure, but the global economy’s still on really firm footing,” he said.

European stocks rebounded, with the Stoxx Europe 600 closing up 1.2 per cent, ending a four-day losing period, which came amid rising tensions between multiple EU nations and Russia.

The upbeat trading in Europe echoed the sharp resurgence in equities markets in Asia-Pacific.

That recovery began yesterday as the US and China appeared to soften their stances over trade, after tensions between the two superpowers ratcheted up last week.

The friction was soothed by news that the two countries were in talks to improve U.S. access to Chinese markets.

Dow Jones

6.40am: Stocks rebound as trade fears recede

Stock markets rose as fading fears of a US-China trade war prompted fresh buying in Europe and pushed Wall Street higher in early trade.

“US stocks are adding to yesterday’s sharp recovery in early action, with trade war concerns between China and the US appearing to continue to cool,” Charles Schwab consultants said.

Investors were “buoyed” by a “softening trade stance”, senior market analyst Craig Erlam of OANDA said.

Donald Trump last week imposed tariffs on some $60 billion of Chinese imports over the “theft” of intellectual property.

This week, nerves were soothed as it emerged that high-level talks had been taking place between the world’s top two economies to find an agreement.

Jasper Lawler, head of research at London Capital Group, said the ongoing rebound went some way towards unwinding losses “from one of the worst weeks in recent years for stock markets”.

But he cautioned investors “not to get too excited” because “huge up-days do not typically happen in a strong market”.

Instead, this looked like a “dead cat bounce”, Lawler said.

In Europe, takeover activity boosted sentiment — with shares in GlaxoSmithKline jumping after the British drugs giant agreed to buy Novartis’ stake in the pair’s consumer healthcare joint venture for $13 billion (10.4 billion euros).

London closed up 1.5 per cent, Frankfurt ended 1.6 per cent higher and Paris finished 1.0 per cent higher.

Earlier, Asia also performed well, with Tokyo closing higher thanks to a drop in the yen against the dollar, as traders shifted out of assets considered safe in times of uncertainty and turmoil.

Seoul rose 0.6 per cent and the won climbed more than one per cent against the dollar on speculation Kim had visited China — in what would have been his first trip outside North Korea since assuming power at the end of 2011.

AFP