Trading Day blog: live markets coverage; Telstra, energy erase ASX gains; plus analysis and opinion

Local shares take a hit as heavyweights surrender to oil uncertainty and Telstra dives to a fresh five-year low.

Welcome to the Trading Day blog for Tuesday, November 28.

Samantha Woodhilll 4.35pm: Telstra, energy reverse ASX gains

Local shares erased gains as a fresh 5-and-a-half year low in Telstra and persistent oil market uncertainty reversed a promising open.

At the close of trade, the benchmark S & P/ASX200 was down 4.473 points or 0.07 per cent at 5984.3 points. The broader All Ordinaries index was down 3.675 points or 0.06 per cent, at 6066.7 points.

Investors lost early optimism as diversified miners succumbed to a weak lead from bearish overnight oil trade, while a surprise $348m discounted block trade of Telstra shares came minutes before the stock hit a fresh 5-and-a-half year low of $3.34, recovering to close on $3.40.

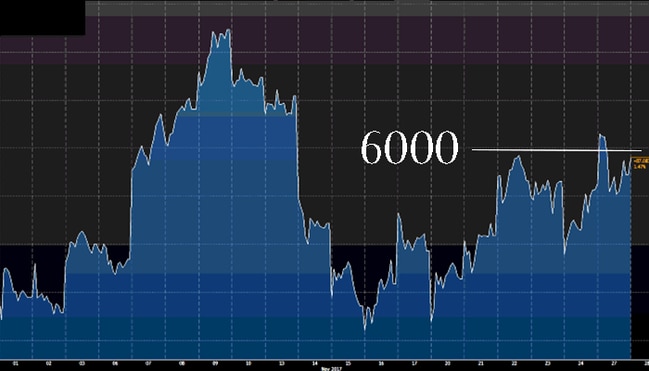

“You’ve got the major banks treading water today which makes it difficult to get the market moving,” Citibank equities sales director Karen Jorritsma.

“It sort of flirted with 6000 points earlier this morning but whenever you’ve got the heavyweights … doing nothing and BHP down, it’s going to struggle to get off the ground as a result.”

BHP fell 2.04 per cent to $27.38 along with energy producers ahead of this week’s eagerly anticipated OPEC meeting.

“Investors worried about the impact that further constraints on OPEC production would have on US shale output,” said ANZ economist and FX strategist Giulia Lavinia Specchia.

“It is believed that Russia wants language in the new agreement that would link the size of the curbs to the health of the oil market.”

Santos was dropped $2.19 per cent to $5.14 and Woodside Petroleum gave up 1.37 per cent to $31.03. Origin Energy gained 2.44 per cent to $8.80.

Andrew White 4.32pm: Origin shares jump on update

Origin Energy shares have jumped to a two-year high after it upped the output from its Eraring coal fired power station to between 15.5 and 16 terra watt hours as it rushes to capitalise on higher wholesale electricity prices.

The increased guidance, up 10 per cent on previous output, has also helped fill a gap left by the closure of the Hazelwood and Northern brown coal-fired power stations in Victoria and South Australia respectively — read more

ORG closed 2.4pc higher on $8.80

4.05pm: WATCH: Penn on Telstra reinvention

Bridget Carter 4.02pm: New Energy Solar float raises $205m

New Energy Solar has defied its critics and raised $205 million for its initial public offering.

It will now head to the market on December 8 as a company worth at least $500 million.

The book build for the deal was finalised Tuesday and saw shares priced at $1.50 each.

Some had questioned whether the business had the level of institutional support to head to the market, with it being left to rely on support from retail investors.

More to come from DataRoom

Bridget Carter 3.52pm: Soul Patts sells New Hope stake

Conglomerate Washington H Soul Pattinson has offloaded a stake of almost 10 per cent in New Hope coal with the $176 million block of shares trading before the close of market on Tuesday.

It is understood that the 80 million shares were sold at $2.20 each.

Shares are trading at around $2.33, which makes the trade in just under 10 per cent of the stock at a 5.6 per cent discount.

Brickworks, of which WHSP is the major shareholder, holds a 59.6 per cent interest in New Hope.

The trade was handled by the recently founded firm of Angus Aitken, Aitken Murray Capital Advisers.

Coal miner New Hope has a market value worth $1.978 billion.

NHC last $2.33

3.46pm: New Hope block changes hands

A $150m block of New Hope Coal shares traded hands at 3.40pm (AEDT) representing near 10 per cent of the company for $2.20/share at a 6 per cent discount to its last traded price.

Brickworks owns 59.64

NHC last $2.33

3.26pm: Discount Telstra block trades for $348m

A block of Telstra shares worth $348m changed hands at 1.52pm (AEDT) for $3.36/share, a discount to its last price of $3.40 beforehand.

Telstra’s CEO Andy Penn had moments before finished his address to the American Chamber of Commerce Conference in Sydney in which he told investors the financial impact of NBN Co’s decision to halt hybrid copper (HCF) household NBN connections will be reflected solely in the timing of payments from customers on the network.

“Financially, there’s no longer term changes,” said Mr. Penn, “but as you can imagine there’s quite a lot of complexity in the relationship between Telstra and the NBN financially, there’s disconnection payments and connection costs.”

“We’re working through the timing and the impacts ... and we’ll make a stock exchange announcement updating in relation to our guidance in the coming days.”

TLS last down 2.2 per cent on $3.38 after hitting a fresh 5-and-a-half year low of $3.34 shortly after the block trade.

3.08pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Marcus Droga — Senior Investment Advisor, Shaw and Parnters

3.05pm: Jason Steed — Managing Director, JPMorgan

3.30pm: Shane Oliver — Chief Economist and Head of Investment Strategy, AMP Capital

3.50pm: Ben Le Brun — Charles Schwab

(All times in AEST)

3.03pm: Investors to receive Telstra update

$TLS Andy Penn: We'll provide an update on our guidance in coming days (when asked about div strategy).. #ausbiz @SkyBusiness

— Ingrid Willinge (@IngridWillinge) November 28, 2017

Stephen Bartholomeusz 2.45pm: Bank inquiry is backward looking

It now appears almost inevitable that there will be a commission of inquiry, albeit perhaps not a Royal Commission, into the banks. It would probably be hopelessly optimistic to think that it might provide a better insight into the nature of the banks and their system than that provided by politicians and other bank bashers.

The politicisation of the sector, over a very lengthy period, means that there is no sense of context or perspective.

The banks are charged with profit gouging because their profits are large but with no regard to their size — the four majors have total assets of about $3.5 trillion and more than $235 billion of shareholders’ funds — or their nature and complexity.

While in absolute terms their profits, which totalled $31.5bn last financial year, might appear large, along with their average return on equity of 13.9 per cent, these are institutions that are highly-leveraged — every dollar of capital is geared about 15 times with other people’s money.

2.27pm: ASX erases gains as Telstra weighs

Australia’s S & P/ASX 200 share index has pared a 0.3pc intraday rise.

Telstra is the biggest casualty, extending losses to over 3 per cent and hitting a fresh 5-and-a-half year low of $3.34 after a discounted block changed hands for $348m in the wake of CEO Andy Penn’s address to the American Chamber of Commerce Conference in Sydney.

Meanwhile, WTI crude futures are down 0.6pc at $57.75 after falling 1.4pc Monday after OPEC Secretary General Mohammad Barkindo said OPEC’s commitment to production cuts is “unprecedented and remarkable”.

A “sell on fact” reaction to the OPEC meeting this Thursday is a risk after recent gains, particularly if cut backs aren’t extended through 2018 as expected by the market. Russia hasn’t yet backed an extension and crude oil stockpiles are falling.

“With the rhetoric not matching the logic for the first time in years, we believe that the outcome of this meeting is much more uncertain than usual,” Goldman Sachs analyst Damien Courvalin wrote Monday.

“We believe that oil prices have overshot fundamentals and that price risks are skewed to the downside into Thursday’s meeting.”

S & P/ASX 200 last down 1.3 points at 5987.4

1.44pm: Netflix 20pc of Tesltra web traffic: Penn

“Netflix accounts for 20 per cent of total traffic on our internet network,” says Telstra CEO Andy Penn speaking at the American Chamber of Conference summit in Sydney.

1.38pm: Web has lowered crime barrier: Penn

“Cyber crime is just crime, cyber espionage is just espionage. A lot of these things have become harder to manage in a digital world,” says Telstra CEO Andy Penn speaking at the American Chamber of Conference summit in Sydney.

“The internet has reduced the barrier to entry for many things and therefore its reduced the barrier to crime.”

“Don’t assume you’re 100 per cent protected. There’s a fair change every company represented by a person in this room has been [affected].”

1.35pm: Data aggregated, anonymised: Telstra’s Penn

“We keep private data private, and any way we use data is aggregated and anynoymised,” says Telstra CEO Andy Penn speaking at the American Chamber of Conference summit in Sydney.

1.30pm: 5G won’t eliminate NBN: Tesltra’s Penn

“There’s no doubt that 5G and mobile will play a bigger role, but it won’t eliminate the NBN,” says Telstra CEO Andy Penn speaking at the American Chamber of Conference summit in Sydney.

12.24pm: Stocks hold gains as Origin soars

Local shares keep their head above water, the ASX200 index 0.2 per cent higher on 6001.9 after bearishness on signals from commodity markets failed to fully materialise.

Mid-caps provide support, while heavyweight banks and miners show little conviction with both sectors swinging either side of flat.

Origin Energy surges over 3 per cent to its highest level in over 2 years as investors take kindly to its plan to capitalise on higher wholesale electricity prices by stepping up output from its Eraring power plant.

Meanwhile, the Australian dollar is little changed against its US counterpart that hit its lowest level since September overnight.

12.00pm: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Todd Kerslake from Morgans and David Novac from Wealth Wise Education guest host

12.15pm: Gerad Burg — Senior Asia Economist, NAB

12.45pm: Janu Chan — Senior Economist, St George

(All times in AEST)

11.42am: Ainsworth update causes glitch

Ainsworth Game Technology shares dipped 6pc to a 6-month low of $2.07 after a trading update.

The software developer’s first-half has been “adversely impacted” by regulatory delays in Australia, temporary margin impacts from a change in its sales mix, and lower sales in Asia.

However, Ainsworth “confidently expects” to increase its second-half pre-tax profit excluding currency impacts and will consider restarting the dividend in August 2018.

AGI last down 1.8pc at $2.19

11.28am: Cyclical over defensive, yield: Deutsche

Deutsche Bank continues to prefer cyclical over defensive and yield stocks.

“Cyclicals have better earnings revision momentum, and are on similar multiples to defensives,” Deutsche strategist Tim Baker says.

“We are underweight yield, with no exposure to telcos, infrastructure or regulated utilities.”

Note: Cyclical stocks tend to be highly correlated with economic growth, defensives counter-cynical, while yield stocks are generally considered to deliver reliable dividend streams.

`

11.13am: Origin shares jump on update

Origin Energy has reaffirmed its full-year guidance for underlying earnings to be in the range of $1.7 billion to $1.8 billion.

The energy producer and retailer said its share of gas production at the Australia Pacific liquefied natural gas project in Queensland will be between 245 and 265 petajoules, and flagged that it is targeting annual cost reductions of more than $500 million over 18 months at the joint venture.

The company also said it expects to lift electricity generation at its Eraring plant in NSW to between 15.5 and 16 terra watt hours, compared to its previous forecast of 14.6 to 15.6 TWh, as it boosts performance in response to higher wholesale electricity prices — AAP

Note: Origin remains a top late-morning performer after posting gains as much as 3 per cent.

11.03am: Miner ‘upgrade mode’ remains: Deutsche

Miners still look like a good sector to own, according to Deutsche equity strategist Tim Baker.

“The broad Asian growth cycle is in good shape, based on earnings revisions and exports,” he says, “China’s nominal growth indicators are still firm, and neutral monetary conditions should prevent much of a fall in commodity prices.”

He also notes that the resources sector remains in “upgrade mode” based on current commodity prices, and free cash flows are very strong.

Rio Tinto (RIO) and BHP remain in his model portfolio but he has removed South32 (S32).

10.55am: Stocks swing, crest over 6000

Australia’s S & P/ASX 200 share index has turned up 0.2pc to 6003.8 points after opening down 0.2pc.

Gains a broadbased with all sectors bar telcos and materials in the green, but share trading volume is about 20pc below average.

US stock index futures and crude oil futures are slightly weaker in early Asian trading.

The rise in the S & P/ASX 200 looks hard to sustain in the face of weaker offshore equities and commodities.

SWING STOCKS

+ IOOF Holdings (2.9pc), Origin Energy (2.9pc), Australian Pharma Industries (2.7pc), National Storage RENT (2.6pc)

— Gateway Lifestyle (2.3pc), Iron Mountain (2.1pc), Fortescue (2pc), Mayne Pharma (2pc), Telstra (1.5pc)

10.23am: CHART: Index head and shoulders top

Australia’s S & P/ASX 200 share index looks to be forming a head & shoulders top pattern.

The target of the pattern will be around 5795 if it breaks neckline support near 5950.

This comes after the S & P/ASX 200 hit a decade high of 6052.2 this month and daily RSI and MACD studies generated sell signals when the index subsequently fell back below 6000 points.

It also comes after two failed attempts to regain 6000 points in recent days.

While head & shoulders patterns often fail to reach their targets, the current pattern fits with the normal seasonal weakness in banks and the broader market this month.

Note that the potential target also comes in near the 100 and 200 day moving averages.

Index last flat at 5986.

10.09am: Retailers ‘tactical opportunity’: Deutsche

Deutsche Bank sees a “tactical opportunity” in buying into consumer exposure now, for two reasons.

“Firstly, these stocks are already out of favour — on our scorecard they come out as the most unpopular parts of the market,” Deutsche equity strategist Tim Baker says.

“Secondly, while households are income-poor, they’re asset rich, and that might encourage them to ramp up spending for the Christmas holiday period.

He has added JB Hi-Fi and Scentre, unweighted Woolworths and continues to hold Harvey Norman in his model portfolio.

10.02am: Commodity weight to hit ASX

Australia’s S & P/ASX 200 share index is expected to fall 0.1pc based on futures relative to fair value.

That follows a mixed close on Wall Street with the S & P 500 and the Nasdaq shying off fresh record highs.

Energy and materials proved weakest in the S & P 500 after commodity price falls.

WTI crude fell 1.4pc to $US58.11, spot iron ore fell 1pc to $US67.27 and LME copper fell 1.1pc.

BHP ADR’s equivalent close at $27.58 was 1.3pc below BHP’s close in Sydney.

Deutsche has cut banks to “neutral” from “overweight” after recent strength in the banks.

That could trigger the usual November sell-off in banks, which may also weight on the index.

After yesterday’s failure above 6000, the index could test initial support at 5951.4.

Charts show a potential head & shoulders top pattern, targeting 5790 on a break of around 5950.

Index last 5988.77

9.52am: Oroton halts trade for strategy update

Leather goods retailer Oroton has entered into a trading halt pending an announcement relating to the finalisation of its assessment of a strategic review.

ORL last 44 cents

9.45am: 6050 by year end: Deustche Bank

Deutsche Bank expects the S & P/ASX 200 to end calendar 2018 at 6050 vs. 5982 currently.

That’s well below the expected rise to 6500 forecast by Credit Suisse and Macquarie.

Deutsche equity strategist Tim Baker says the domestic economy looks mixed at best.

“Historically reliable indicators such as NAB business sentiment and employment are very strong, but we still can’t reconcile them with other measures,” he says.

“For example, earnings revisions for small industrials tend to move with business sentiment, but are currently a little below average, and despite strong jobs growth, consumer sentiment is poor, thanks to low wages growth.”

On his calculations the index is trading on a 12-month forward PE ratio of 16.1 times, resources are on 16 times, industrials are on 18.8 times and banks are on 13 times.

He has added NAB, JBH and SCG, while cutting CBA, APA and S32 from his model portfolio.

9.32am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: David Plank — Head of Australian Economics, ANZ

9.40am: Chris Weston — Chief Market Strategist, IG

9.45am: Eli Greenblat — Senior Business Reporter, The Australian

10.00am: Karen Jorritsma from Citi and Michael McCarthy from CMC Markets guest host

10.15am: Josh Littlewood — CIO, Harness Asset Managment

(All times in AEST)

9.23am: Deutche Bank plays Big Four favourites

Deutsche Bank has cut banks to “neutral” vs. “overweight” in its model portfolio.

“Revenue growth could be pressured — our lead indicator points to a slowdown in credit growth, and the benefits of repricing have largely passed,” says Deutsche equity strategist Tim Baker.

“Further, analysts have become more upbeat with more ‘buy’ ratings — that’s historically been a bad signal for subsequent performance.”

But he says valuations still look reasonable — at a 30pc discount to industrials vs. 20pc historically — and any rise in global bond yields is likely to see financials outperform, with Aussie banks likely to hitch a ride again.

Following the recent bounce, he cuts CBA and adds NAB to his model portfolio.

9.03am: Analyst rating changes

Bank sector cut to Neutral in model portfolio — Deutsche

NAB, JB Hi-Fi, Scentre added; CBA, APA Group, South32 cut from model portfolio — Deutsche

Treasury Wine Estates cut to Underperform — Credit Suisse

Motorcycle Holdings raised to Add — Morgans

Investa Office cut to Neutral — JPMorgan

IOOF Holdings raised to Overweight — JPMorgan

Dexus raised to Overweight — JPMorgan

Village Roadshow cut to Underperform — Macquarie

8.52am: BHP targets cost cuts Down Under

Robb M. Stewart writes:

BHP Billiton aims to cut costs further across its Australian mining operations, targeting another 10pc drop in unit costs over the medium term and US$1.6 billion (A$2.1bn) in additional productivity gains over the next two years.

In a presentation to investors in Adelaide on Tuesday, BHP minerals Australia president Mike Henry said large, long-life and low-cost operations in the country underpinned the resources company’s current margins and options for the future. He said the company had sustainably reduced costs over the past five years but had further to go.

The improvements are expected to come through initiatives including strengthening BHP’s maintenance capability and processes and through a global technology push, Mr. Henry said.

He added the company had a number of medium-term investment opportunities that, if approved, have average returns that could exceed 40pc and so are well placed to compete for capital within the company.

Dow Jones Newswires

Richard Gluyas 8.43am: NAB kicks off overhaul

National Australia Bank has kicked off its workplace revolution, with chief executive Andrew Thorburn starting to execute his plan to collapse the number of management layers between the bank’s senior leaders and the customer.

The simplification program, which will lead to a net reduction of 4000 jobs by the end of the 2020 financial year, began in earnest last Friday, when NAB’s 55 executive general managers were briefed about their positions — read more

NAB last $29.64

Joe Kelly 8.36am: Joyce open to Nats bank inquiry revolt

Barnaby Joyce has signalled a push by the Nationals to defy the Turnbull cabinet and embrace a banking inquiry — a move that could force an embarrassing policy backflip or risk leaving the government humiliated on the floor of parliament.

The Australian understands Mr Joyce believes the Nationals will “most likely” decide to support Queensland senator Barry O’Sullivan’s bill for a commission of inquiry at a party room meeting next week. Support for a banks probe would split the Coalition and increase pressure on Malcolm Turnbull to take ownership of an inquiry or face the prospect of Coalition MPs crossing the floor and voting with Labor and crossbench MPs.

8.27am: Oil mutes Wall St retail glee

Akane Otani and Riva Gold write:

The S & P 500 paused Monday, weighed down by a pullback in shares of energy companies.

Major indexes struggled for traction Monday, with the S & P 500 and Nasdaq giving up early gains to trade mostly lower in the second half of the session.

Shares of retailers jumped following the weekend’s holiday sales, while oil-and-gas companies fell along with U.S. crude prices.

The S & P 500 declined less than 0.1pc in recent trade. The Nasdaq Composite lost 0.1pc and the Dow Jones Industrial Average rose 25 points, or 0.1pc, to 23583.

Shares of Marathon Oil, Hess and Devon Energy lost more than 2pc apiece, while U.S. crude oil shed 1.3pc to $58.21 a barrel ahead of a meeting of major crude producers.

The Organization of the Petroleum Exporting Countries, as well as producers including Russia, is expected Thursday to discuss whether to extend output cuts that some analysts say have helped oil prices recover this year.

Meanwhile, shares of several retailers jumped, extending gains from Friday, when many department stores and brick-and-mortar outlets kicked off a weekend of major sales.

L Brands, the parent of Victoria’s Secret, rose 4.6pc, while Signet Jewelers and Gap added 1.6pc.

Dow Jones Newswires

8.14am: China elements rattle nickel

Maytaal Angel writes:

Nickel prices have fallen nearly 4 per cent, pressured by weakening demand for stainless steel in top metals consumer China, rising Chinese borrowing costs and Beijing’s regulatory crackdown on risky financing.

Chinese stocks fell sharply amid worries that rising borrowing costs will hit company profits and that fresh moves to reduce risks in the asset management industry could hit banks and millions of small investors.

“Some reports coming from China (indicate) stainless orders are weakening. Over the past couple of weeks questions from clients have gone from ‘what are the benefits of electric vehicles (for nickel)’ to ‘how bad is China’s demand’,” said Colin Hamilton, head of commodities research at BMO Capital Markets. “China produced so much stainless in the third quarter they’re having to cut back. I’d expect stainless production to be down relatively strongly in the fourth quarter,” he added — Reuters

Note: Stainless steel accounts for two thirds of nickel demand.

8.07am: Bitcoin tests market’s boundaries

Steven Russolillo and Paul Vargea write:

The price of bitcoin has surged above $US9500 for the first time, a rise of nearly 900 per cent this year that has only got faster this month.

Bitcoin rose as high as $US9732 in New York overnight (AEDT), after surpassing the $US9000 milestone over the weekend, just seven days after the digital currency hit $US8000 according to research site CoinDesk.

That marked the fastest thousand-point rally in bitcoin’s short history, surpassing the eight days it took to go from $US3000 to $US4000, and the nine days it needed to go from $US5000 to $US6000. Both of those moves occurred earlier this year.

In late-morning New York trading, bitcoin stood at $9650.27, a gain of 897 per cent on the year.

7.50am: ASX set to open flat

The Australian share market looks set to open flat with no clear lead from Wall Street which early on set fresh record highs before retreating.

At 7am (AEDT), the share price futures index was down three points, or 0.05 per cent, at 5,988.

On Wall Street, session indexes set more record highs before retreating as gains for Amazon were countered by losses in shares of chipmakers and energy companies.

By 7.14am (AEDT), the Dow Jones Industrial Average was up 0.13 per cent, the S & P 500 was down 0.04 per cent and the Nasdaq Composite had dropped 0.12 per cent.

Locally, in economic news today, the ANZ-Roy Morgan Consumer Confidence weekly survey is due out.

In equities news, Mayne Pharma’s annual general meeting is scheduled for today while Telstra chief executive Andrew Penn is slated to speak at an AmCham lunch in Sydney.

Meanwhile, the two-day Large Scale solar conference is on in Sydney.

The Australian market yesterday closed slightly higher following a late burst in buying that lifted the market out of a midday trough.

The benchmark S & P/ASX200 index rose 6.2 points, or 0.1 per cent, to 5,988.8 points.

The broader All Ordinaries index lifted 7.3 points, or 0.12 per cent, to 6,070.4 points.

AAP

7.05am: Dollar marginally higher

The Australian dollar is hardly changed against its US counterpart which again fell in the offshore session as traders braced for the resumption of deliberations on the US tax plan and the confirmation hearing for Federal Reserve governor Jerome Powell as the central bank’s next chair.

At 6.35am (AEDT), the Australian dollar was worth US76.09 cents, up marginally from US76.07 cents yesterday.

The dollar index, which measures the greenback against six rival currencies, fell 0.06 per cent to 92.724, after hitting a nine-week low of 92.496 earlier in the session.

Westpac’s Imre Speizer says while US initially were hitting fresh record highs before retreating, the US dollar slipped early on.

Commodity prices, most notably oil, also fell, he said.

“The US dollar index initially fell to a two-month low but rebounded in New York to be slightly up on the day.

“(The) AUD initially rose to 0.7645 before reversing to 0.7603, perhaps hurt by commodity price weakness overnight.” It has since crept a little higher.

But, with no major local event risk on the horizon today, Mr Speizer said he thought the local currency could slip further.

“A negative reversal overnight leaves it in a lightly bearish state on the day, targeting 0.7595 if risk sentiment remains subdued.”

The Aussie dollar is down against the yen but up against the euro.

AAP

7.00am: Energy stocks weigh on Wall St

The S & P 500 paused, weighed down by a pullback in shares of energy companies.

Major indexes struggled for traction, with the S & P 500 and Nasdaq giving up early gains to trade mostly lower in the second half of the session.

Shares of retailers jumped following the weekend’s holiday sales, while oil-and-gas companies fell along with US crude prices.

With major indexes still up double-digit percentages for 2017, some analysts said it wasn’t surprising to see the momentum in U.S. stocks falter a bit heading into year-end.

“I see the risk-reward being much more attractive in international markets,” said Crit Thomas, global market strategist at Touchstone Investments, who added that US stocks look expensive relative to their foreign counterparts.

With under two hours of trade to go the S & P 500 had declined less than 0.1 per cent. The Nasdaq Composite lost 0.1 per cent and the Dow Jones Industrial Average rose 25 points, or 0.1 per cent, to 23583.

Australian stocks are set to open steady, or slightly lower. At 7am (AEDT) the SPI futures index was down three points.

Dow Jones Newswires

6.45am: Oil falls ahead of OPEC

Oil prices fell ahead of a meeting scheduled for later this week between major crude producers, where a decision is expected on whether cuts will be extended.

The Organization of the Petroleum Exporting Countries and producers including Russia are set to meet on Thursday to discuss whether to extend cuts beyond their expiration in March. Russia’s position is considered the wildcard to the outcome.

The countries have cut output since January in an effort to drain a glut in supply.

US crude futures tumbled $US1.30, or 2.21 per cent, to $US57.65 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, fell 59 cents, or 0.92 per cent, to $US53.27 a barrel on ICE Futures Europe.

Prices surged at the end of last week amid light volumes in a shortened holiday week, but the market began to deflate Monday amid uncertainty about OPEC’s upcoming meeting.

“You’re seeing a round of profit-taking after a very thin and slow week last week,” said Donald Morton, senior vice president at Herbert J. Sims & Co., who oversees an energy trading desk.

Dow Jones

6.40am: euro weighs on European stocks

Eurozone stocks closed lower as the euro remained strong amid hopes that German Chancellor Angela Merkel is close to forming a government, dealers said.

London equities also showed losses at the closing bell as investors worried about apparently stalled Brexit talks, and a rising pound took its toll on exporters.

“European equity markets are mostly lower in afternoon action, with the euro tacking onto a recent rally to a two-month high versus the US dollar,” said analysts at the Charles Schwab brokerage.

But the continent’s equity markets were lifted off earlier lows by Wall Street posting gains approaching midday in New York thanks to upbeat signs about the holiday shopping season.

Early online shopping data suggested the “Black Friday” start to the gift-shopping season was a boon for stores, and shares in Amazon, Wal-Mart and Macy’s all rose in response.

London closed down 0.4 per cent, Frankfurt lost 0.5 per cent and Paris ended down 0.6 per cent.

AFP