Trading Day blog: live markets coverage, plus analysis and opinion

The ASX200 rises amid subsiding caution as resource stocks feel the heat of mixed commodity trade.

Welcome to the Trading Day blog for Monday, September 11.

04.35pm: Banks drive stocks higher

The Australian share market closed higher than expected in a surprise turnaround, following flat leads from Wall Street on Friday.

Global equity futures were up, driven by lessening global risk aversion, after North Korea held off plans to launch another ballistic missile; Hurricane Irma proved weaker than expected and China’s latest inflation data exceeded expectations.

Australia’s S & P/ASX 200 share index closed up 0.7 per cent at 5713.1 amid reduced risk aversion in global markets.

Banks were the biggest contributors to the strength, rising between 1.4 and 2.2 per cent.

“It’s all about switching from safe havens to risk assets today,” said IG chief market strategist Chris Weston. “And after a large period of underperformance, financials are firing on all cylinders.”

It comes after a cautious week for the markets last week when North Korea tested its biggest intercontinental ballistic missile, and the second major hurricane this month hit the US.

Macquarie Group jumped 3 per cent to $85.15 after reiterating its guidance for fiscal 2018 earnings in line with the last year.

Elsewhere, Tabcorp rose 2.7 per cent to $4.16 after independent expert Grant Samuel said the proposed $11bn Tatts Group merger is in the best interests of Tatts shareholders.

Mr Weston said Monday’s rally in equities was also driven by market positioning and expectations.

“We went into the weekend expecting further missile tests in North Korea so people bought the Japanese yen, gold and US Treasury bonds. There was also an expectation that Hurricane Irma would cost insurers about $US200 billion but we are looking at numbers significantly lower than that.

He said there appeared to be a belief in global markets that fixed income assets have become “too pessimistic”. In his view, bond yields are now likely to move up and the curve likely to steepen, helping the outlook for the bank’s interest rate margins.

US 10-year Treasury bond yields rose 4 basis points to 2.09 per cent in Asian trading as demand for safe-haven investments moderated. The global benchmark bond yield hit a 10-month low of 2.01 per cent last week as risk aversion flared and expectations of more US interest rate hikes declined.

The materials sector was the only declining group, with falls in gold and copper miners dominating, Sandfire Resources dropped 2.85 per cent and Independence Group fell 4.33 per cent.

Deutsche Bank said copper market signals have turned negative after prices rose as much 18 per cent to $US310 a pound since July, according to Deutsche Bank. LME copper fell 3.2 per cent on Friday.

“The near-term indicators for copper now appear less positive, especially falling premiums, widening scrap discounts, and a sharp increase in the CFTC speculative position,” Deutsche Bank analysts said.

Oz Minerals was among the firm’s key “sell” calls.

While concern about North Korea’s belligerence this year may linger this week, Mr Weston said the sanctions initiated by China since the nuclear test were also a positive sign.

“People are not going to suddenly unwind all their hedges, but you’ve seen China place sanctions on financial transactions with North Korea and that’s good because the markets are more concerned about the US relationship with China rather than any chance of military conflict at this point.”

“The other thing we need to remember is that China’s PPI — at 6.3 per cent year on year — suggests that other countries may be underpricing inflation risks as well.”

“Every healthy share market should have rotation and that’s what we’re seeing with commodities leading us higher, then a second tailwind from inflation, with financials benefiting from that.”

“What we’re seeing is a very healthy share market.”

“The thematic that’s driving us higher is markets underpricing inflation.”

Samantha Woodhill

04.20pm: Centuria takes stake in rival Propertylink

Centuria Capital is seeking to advance its “friendly” plans for rival property fund manager Propertylink after taking a 17 per cent stake in the company.

The investment managers that sold shares to Centuria and its listed industrial trust are now showing their hands.

Salt Funds Management today disclosed it sold around half of its stake in Propertylink and further notices are expected from other shareholders.

Other players on the register include Credit Suisse, Perpetual, Colonial and BT Investment Management and they are likely to be influential as the company’s future is decided.

Centuria Capital said on Friday it had taken control of a 17 per cent stake in the industrial real estate and funds specialist but painted the move as friendly.

Propertylink said that it was “open to discussions” to determine if any strategic initiatives proposed would be in the best interest of its investors.

Centuria took a 9.3 per cent direct interest in Propertylink for $53m and its listed industrial fund, Centuria Industrial REIT, acquired another 7.7 per cent stake in the company.

One option would be for Centuria to buy the Propertylink funds business and its listed industrial trust to take carriage of the industrial assets.

Ben Wilmot

02.25pm: RBA to hike before inflation reaches midpoint — NAB

The RBA is likely to start hiking rates before inflation reaches the middle of its 2-3pc band, similar to the way the BOC has hiked in recent months, according to NAB.

“We find that economic performance in Canada has been considerably stronger than in Australia over the past 9-12 months, with strength in Canadian GDP, retail sales and consumer confidence,” says Ivan Colhoun, NAB’s Chief Economist, Markets.

“That said, the Bank of Canada’s move was also driven in part by the desire to remove some of the stimulatory policy setting currently in place in Canada. Such a stimulatory setting is also in place in Australia and in the broadest sense, the global monetary policy cycle is turning, with the Fed and BoC raising rates, and ECB beginning to talk about tapering its QE program.”

“It is our expectation that the RBA would also begin to remove accommodation before Australian inflation is back at the midpoint of the inflation target and before all the spare capacity in the labour market has been reduced.”

02.00pm: Citi backs inflation pick-up amid global recovery

Citi equity strategists are backing an inflation pick-up as global economic recovery strengthens.

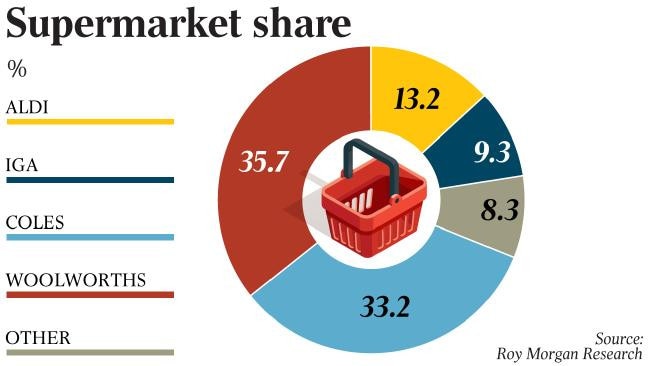

Notwithstanding uncertainty over China’s policy outlook the feel that diminishing excess capacity will ultimately lift inflation globally. Consequently they are more wary of a rise in bond yields than a sell-off in commodities, and still favour the resource sector over the yield-sensitive areas. “Elsewhere, with the domestic economy somewhat in its own cycle, and housing and business investment not as in synch with trends internationally — due to the earlier mining investment boom — growth doesn’t look like seeing as much of an upswing, encouraging us to curtail exposure to the banks and other local cyclical stocks, and still prefer some of the larger

sectors where profitability seems to be slowly improving — insurance and supermarkets.”

01.40pm: S & P/ASX 200 up 0.9pc as risk aversion abates

Australia’s S & P/ASX 200 share index is up 0.9pc at 5722.7 amid lessening risk aversion in global markets. The index is currently heading for its best one-day rise in more than four weeks.

S & P 500 futures are pointing to a solid 0.5pc rise as Hurricane Irma wasn’t as bad as feared and North Korea didn’t test any more ICBM’s over the weekend. Japan’s Nikkei 225 is up 1.4pc, strongest in the region, as Japanese yen has retreated after hitting a 10-month high on Friday.

Elsewhere in Asia, South Korea and Hong Kong are up 0.8pc while China is up about 0.1pc.

Spot gold is down about 0.7pc reflecting lessening demand for safe havens.

But industrial commodities have recovered a bit with LME copper up 0.3pc and WTI crude up 0.7pc. Dalian iron ore futures are down about 2.1pc after falling about 3.9pc on Friday night.

12.45pm: Dacian Gold gets Outperform rating from RBC

Higher Western Australia’s gold royalties hasn’t deterred RBC Capital Markets from initiating research on Dacian Gold with an ‘outperform’ recommendation.

Dacian, which is constructing its Mt Morgans gold project near Laverton, is a “low-risk development play with additional upside and corporate appeal”, says RBC analyst Paul Hissey.

He models Mt Morgans to produce 200,000 ounces per annum at an all-in sustaining cost of less than $1,000 per ounce, giving it plenty of headroom to absorb last week’s $20 per oz gold royalty hike by the WA government. Moreover, he sees parallels between Dacian and fellow gold developer Gold Road, which last year struck a deal to sell a half-stake in its Gruyere gold discovery to international heavyweight Gold Fields.

“We could see Dacian as having similar alternatives, given the scale, location and future optionality of its assets,” Mr Hissey says. “Dacian provides a similar analog, in a market where larger producers are typically ex-growth, with declining resources but are flush with cash.”

Mt Morgans sits a short distance from Gold Fields’ Granny Smith and Wallaby gold mines and AngloGold Ashanti’s Sunrise Dam mine. RBC has an initial price target on Dacian of $3.00 a share. The stock was trading at $2.21 at the time of writing.

11.45am: Dodgy home loans on the rise — UBS

Dodgy home loans are on the rise in Australia, posing risks for banks and headaches for regulators.

A UBS survey of 907 Australians who took a mortgage in the past 12 months found that just 67 per cent said their application was completely factual and accurate versus 72 per cent a year ago.

By channel, the level fell to 61 vs. 68 per cent for brokers and to 75 vs. 78 per cent for bank branches. For NAB, the level fell to 62 per cent and for ANZ it fell to 55 per cent.

And while APRA has again clamped down on risky lending this year, 46 per cent said it was easier to get a mortgage compared to 17 per cent who said it was harder than previous experiences.

Equally disturbing from a policy standpoint is the fact that Respondents also said there has been no increase in the amount of supporting documentation and verification required.

“Despite recent macroprudential policies, the findings of this survey and the fact that mortgage approvals remain at record levels implies that there is little evidence mortgage underwriting standards have been tightened through the eyes of the consumer,” UBS analyst Jonathan Mott says.

Given the rising level of misstatement over multiple years, he estimates banks now have about $500 billion of factually inaccurate mortgages or “liar loans” on their books. The term was used in the US during the Financial Crisis for mortgages where documentation was not accurate.

“While household debt levels, elevated house prices and subdued income growth are well known, these finding suggest mortgagors are more stretched than the banks believe, implying losses in a downturn could be larger than the banks anticipate,” Mr Mott says. “We are underweight Australian banks and are very cautious the medium term outlook.”

11.15am: Citi sees hefty BHP shale potential

An exit of US Onshore oil & gas could lift BHP’s valuation by $10 a share, according to Citi.

It assumes a $US6bn sale price and that the proceeds are used to reduce debt.

Citi’s Clarke Wilkins says BHP’s plan to sell US Onshore is “a positive step in both unlocking value but also giving the company a pathway to create value.”

He keeps his “neutral” rating and $26.00 target price.

BHP last down 2.5pc at $26.61

Samantha Woodhill 11.00am: Origin splashes $190m on gas deal

Origin Energy has announced it has entered into a $190m deal with Benaris, enabling Lattice Energy to acquire Benaris’ 27.77 per cent stake in the Otway Gas Project Joint Venture, increasing Lattice Energy’s interest in the project from 67.23 per cent to 95 per cent.

The deal is set to simplify the ownership structure of the joint venture, ahead of Origin’s plans to offload Lattice Energy, Origin’s non-core oil and gas assets business unit.

The acquisition is expected to be completed when Lattice Energy is divested and will include the 29.23 per cent interest Benaris has in T/30P Exploration Joint Venture and VIC/P43 Exploration Joint Venture — read more

ORG last up 0.5pc at $7.79

10.45am: Copper streak losing lustre: Deutsche Bank

Copper market signals have turned negative after prices rose as much 18pc to $US310 a pound since July, according to Deutsche Bank.

“The near-term indicators for copper now appear less positive, especially falling premia, widening scrap discounts, and a sharp increase in the CFTC speculative position,” Deutsche Bank analysts say.

“Thus we now see greater downside risk to for copper prices near-term.” They note that miners have begun approving more brownfield growth projects, a trend they expect this to continue over the next 18 months as copper miners start to take a more aggressive approach.

“However, we expect M & A could also come back into focus along with new approaches to tackling high capital intensities.”

Oz Minerals is among the firm’s key “sell” calls.

LME copper fell 3.2pc on Friday.

10.40am: Platinum teeters on top shelf: Macquarie

Platinum Asset Management shares are overvalued after rising 42pc to $6.01 since May, says Macquarie.

“Inflows of about $100m in August and material outperformance of the International Fund, are not sufficient to justify the current valuation,” the broker says.

Macquarie has reiterated its “underperform” rating and $5.92 target price, noting that an acceleration in net inflows supported by the recent strong relative performance and the potential for performance fee income is a risk to its view.

PTM last up 0.3pc at $6.02.

10.35am: ASX200 ticks higher as caution eases

Australia’s S & P/ASX 200 share index rose 0.4pc to 5696.5 early amid lessening concern about North Korea and Hurricane Irma.

Health care, consumer discretionary, IT and financials are strongest, while materials are down amid weaker commodity prices.

Macquarie is a standout, up 2.4pc after reconfirming its earnings guidance.

OZ Minerals is among the worst performers after LME copper fell 3.2pc.

BHP is down 2.1pc, in line with its ADR’s, despite stronger-than-expected China inflation data.

The index looks hemmed into a 5645-5735 range with downside risk on the charts.

Index last up 0.5 per cent at 5700.

Greg Brown 10.30am: AGL jumps as Liddell stoush heats up

AGL Energy shares jumped 0.8 per cent at the open to $25.00 and near a one-month high as the stoush between it and the federal government over the fate of the Liddell power station in the NSW Hunter Valley takes its latest turn.

Barnaby Joyce says he witnessed AGL chief executive Andy Vesey say the energy giant was prepared to sell the Liddell Power Station in the NSW Hunter Valley.

The Deputy Prime Minister said he was in a meeting with Malcolm Turnbull and Scott Morrison when the AGL chief said he would be willing to sell the coal power plant.

Mr Vesey said last week AGL planned to shut the plant down in 2022 and the company had no plans to sell — more to come

AGL Energy last 0.8 per cent at $24.97

10.20am: Logical ‘bite’ for Amcor: Macquarie

A $US4.3bn ($5.4bn) bid for Bemis could be a “big bite” for Amcor that would require a large equity raising but “the logic makes sense”, according to Macquarie.

The broker notes that Bemis is the biggest player in US flexibles and AMC has a clear strategy to lift its current 3pc market share of US flexibles, given BMS has 10-15pc.

Macquarie says there would be significant cost synergies in resin sourcing, overheads, SG & A and procurement. Revenue synergies would also be likely given AMC would be able to provide unrivalled global flexible packaging supply, pull through relationships into the US from other jurisdictions and leverage GMS relationships.

AMC said in response to press speculation on Friday that it continually reviews opportunities.

AMC last down 1.7pc at $15.45

10.15am: Macquarie shares leap 3pc at open

Macquarie shares jump as much as 3.5 per cent at the open to $85.65 after it flagged a rise in profit for the first half of the fiscal year on the back of stronger performance fees.

Macquarie said it continued to expect its net profit for the full-year will be broadly in line with the prior year, but the strength in fees meant its first-half profit was set to be up year-over-year and in line with the final six months of the previous fiscal year — read more

MQG last up 2.3pc at $84.66

9.58am: Macquarie sees steady FY18

Macquarie has reiterated its FY18 guidance at the CLSA Investor’s Forum today.

As a result of stronger performance fees now anticipated to be recognised in the first half, the 1H18 result is expected to be up on 1H17 and broadly in line with 2H17.

The investment bank continues to expect FY18 result broadly in line with FY17.

MQG shares are trading below Bloomberg’s consensus target price by the most since Jun. 2016.

MQG last $82.70.

9.55am: ASX200 to firm as risk aversion eases

S & P/ASX 200 should trade firmly today amid less a lessening of risk aversion in global markets.

North Korea didn’t test missiles on Foundation Day as feared and Hurricane Irma was only Category 3 and missed Miami.

Reflecting these developments, spot gold fell as much as 0.8pc to $US1335.03 and USD/JPY rose 0.6pc to JPY108.47 in early trading.

A weaker Japanese yen is a plus for Japan’s share market and gains there could rub off on regional share markets.

Additionally, China’s share market and metal prices may react positively to above-consensus China inflation data released Saturday.

SPI 200 futures had pointed to a flat open but the index might now see gains early this week.

Resources may underperform initially, with BHP ADR’s close at $26.68 equivalent to a 2.2pc fall in BHP.

Spot iron ore fell 1.7pc to $US74.36 on Friday and Dalian iron ore futures fell 3.9pc.

Similarly, the LME metals index fell 2.5pc as LME copper fell 3.2pc on Friday.

And WTI crude declined 3.3pc to $US47.48 before rebounding 0.5pc this morning.

But overall the index has as chance to surprise on the upside today.

Still, the charts will remain bearish this week while the index remains below 5734.9 with an emerging headwinds factors weighing on sentiment, according to CMC chief market strategist Michael McCarthy.

“Plunging industrial commodity prices point to a rough start to the trading week for Australian investors,” said Mr. McCarthy, “however a still buoyant Australian dollar means that international support for the Australia 200 index is unlikely.”

Index last 5672.6

Matt Chambers 9.40am: Nickel miner pins hope on electric cars

Independence Group is already starting to field inquiries from electric vehicle battery manufacturers interested in getting their hands on additional supplies of nickel.

Independence managing director Peter Bradford said the Perth-based company, which formally opened its new $456 million Nova nickel mine in southern Western Australia on Friday, had brought the mine on line at a time of growing investor interest in the impact of electric vehicles on demand for base metals such as nickel.

Eli Greenblat 9.35am: Suppliers served Aldi pot roast

German discount supermarket Aldi is plumping its corporate and social responsibility credentials by demanding its Australian suppliers sign up to rigorous ethical sourcing programs and auditing regimes, as it works on shaping community views that the chain is more than just about bargain basement prices.

The pitch to its own suppliers to sharpen their corporate social responsibility systems is viewed by industry experts as part of Aldi’s global initiative for the next five years that covers all of its regional operations, including Australia, and covers issues such as store modernisation, new private label strategy, local sourcing and ethical sourcing by its suppliers.

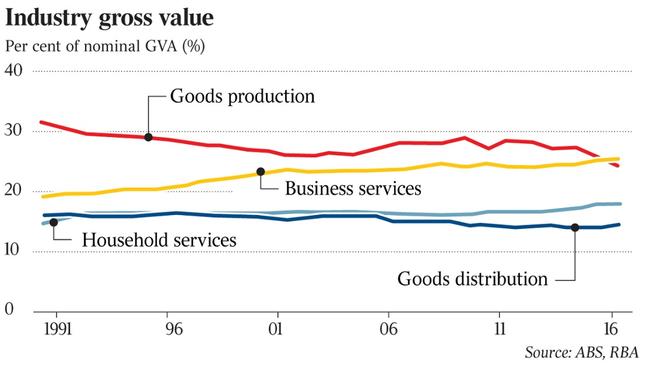

9.30am: Treasury banks on services growth

Both Treasury and the Reserve Bank are looking to the services sector and business services in particular to drive Australia’s productivity and growth once new production generated by the resources boom matures.

The two peak economic institutions have a new focus on the economics of firms and sectors as they try to come to grips with the nature of structural change in the economy.

The strength of services sectors has been behind the dynamism of the economies of Sydney and Melbourne, which have now been driving Australia’s economic growth over the past five years as resource construction comes to an end, dragging down the economies of the mining states.

9.00am: Tabcorp sets date for Tatts completion

Tabcorp expects to complete its $11 billion mega merger with gaming rival Tatts on November 1.

The betting and gaming giant says it is confident of completing the deal, with Tatts shareholders scheduled to vote on the scheme of arrangement on October 18, before a second court hearing into the merger six days later. “With substantially all pre-implementation regulatory approvals now in place, we look forward to continuing to work with Tatts to successfully complete the transaction,” Tabcorp chairman Paula Dwyer said in a statement on Monday — AAP

TAH last $4.05

Damon Kitney 8.40am: Don’t pigeonhole firms: Stevens

Former Reserve Bank governor Glenn Stevens has lamented the “pigeonholing’’ of big business in the economic reform debate, which he believes has too often condemned its contributions to being viewed as simply “self-serving’’.

Speaking to The Australian, Mr Stevens said he struggled with being similarly “pigeonholed’’ in the decade he ran the RBA.

“To be honest the difficulty that the business community faces at least in part is that it struggles to articulate for policy positions that it genuinely believes are pro-growth and mean higher living standards for the country, without sounding as though it just wants a tax cut,’’ he said.

Sarah-Jane Tasker 8.40am: Insurers call for radical surgery

Australia’s top health insurers have put aside competitive rivalries to unite to push for healthcare reform, warning regulation is fuelling perverse incentives in the system and adding to affordability pressures.

The sector’s leaders, covering about 80 per cent of insured Australians, debated industry issues at a roundtable discussion hosted by The Australian, as pressure on the sector intensifies with consumers ditching cover because of affordability concerns.

Private Healthcare Australia’s chairman, and HBF’s recent managing director, Rob Bransby said insurers didn’t have too many levers left to pull to address affordability concerns.

7.37am: Stocks tipped to open flat

The Australian market looks set to open fractionally in the red, after Wall Street closed mainly lower as investors brace for Hurricane Irma, close on the heels of devastating Harvey.

At 7am (AEST), the share price futures index was down two points, or 0.04 per cent, at 5,667.

In the US, the S & P 500 has ended slightly lower as investors braced for potential damage from Hurricane Irma as it moved towards Florida, while a decline in big tech names like Apple and Facebook pushed the Nasdaq down more sharply.

The Dow eked out a gain, helped by a 4.0 per cent rise in shares of insurer Travelers, and the Dow Jones US Insurance Index rose 2.1 per cent, recouping some losses after coming under pressure recently as the southern US braced for another powerful storm closely on the heels of Hurricane Harvey. The Dow Jones Industrial Average rose 0.06 per cent, the S & P 500 lost 0.15 per cent and the Nasdaq Composite dropped 0.59 per cent.

Locally, in economic news on Monday, the CoreLogic capital city house prices survey for the week just ended is due out. No major equities news is expected.

The Australian market on Friday fell, while the Aussie dollar gained sharply on strong housing data and a weaker greenback.

The benchmark S & P/ASX200 index lost 17.3 points or 0.3 per cent, to 5,672.6 points.

The broader All Ordinaries index was down 14.4 points, or 0.25 per cent, at 5,739.4 points.

Meanwhile, the Australian dollar has slipped against a weakened greenback. The local currency was trading at US80.56 cents at 7am (AEST), from US81c on Friday.

AAP

7.12am: Dollar eases against greenback

The Australian dollar is almost half a cent lower against its US counterpart, falling back from its US81c of Friday, despite the greenback itself weakening.

At 6.35am (AEST), the Australian dollar was worth US80.58c, down from US81c on Friday.

Reduced expectations for another US Federal Reserve interest rate rise this year helped drive down the US dollar to its lowest in more than two-and-a-half years on Friday, with stubbornly weak inflation continuing to surprise Fed policymakers.

New York Fed president William Dudley did not repeat an assertion from three weeks ago that he expects to raise rates once more this year, in a speech on Thursday, and an agreement in Congress to push the US debt ceiling to December, both hit the greenback.

Concerns over the impending short-term impact of Hurricane Irma on the US economy also weighed, analysts said.

Against a basket of other major currencies, the US dollar index was down 0.38 per cent after touching a low of 91.011, its weakest since January 2015. The Aussie dollar is also lower against the yen and the euro.

AAP

6.35am: Wall St snaps winning streak

US stocks notched weekly declines, with severe weather and continuing tension between the US and North Korea driving some of the biggest moves.

Shares of financial companies rose Friday but posted their worst week in months as banks and insurers slid.

The Dow Jones Industrial Average edged up 13.01 points, or less than 0.1 per cent, Friday to 21,797.79. The S & P 500 slipped 3.67 points, or 0.1 per cent, to 2,461.43 and the Nasdaq Composite fell 37.68 points, or 0.6 per cent, to 6,360.19, weighed down by declines in tech shares. All three indexes posted weekly declines, snapping two-week winning streaks.

Insurance companies have been under pressure due to fallout from Hurricane Harvey and as Hurricane Irma has battered several Caribbean islands, threatening further damage as it approached Florida.

Dow Jones Newswires

6.28am: Copper takes a hit

Copper prices posted their largest one-day decline in four months Friday after data was released showing Chinese copper imports were flat in August from the previous month.

Copper for December delivery closed down 3.2 per cent at $US3.0415 a pound on the Comex division of the New York Mercantile Exchange, the most actively traded copper contract’s worst day since May 3. The industrial metal had risen in eight straight weeks-its longest such streak in more than a decade-to its highest level in almost three years, but ended that streak Friday following weakness from the world’s largest copper consumer.

Dow Jones

6.23am: Irma buffets US oil prices

Oil prices tumbled, as uncertainty gripped the market over the potential impact of Hurricane Irma.

Light, sweet crude for October delivery lost $1.61, or 3.3 per cent, to $47.48 a barrel on the New York Mercantile Exchange, its biggest one-day loss since July 5. Brent, the global benchmark, fell 71 cents, or 1.3 per cent, to $53.78 a barrel.

While damage done in Florida will have less of an impact on energy infrastructure and refineries than in Houston, the prospect of a storm that travels up the east coast ignited some fears of further disruptions to refiners in that area. Analysts also expect to weigh on consumer demand for fuel.

“It’s such a questionable story,” said Bob Yawger, director of the futures division at Mizuho Securities USA. Market participants “don’t want to be long at the end of this day.”

Dow Jones

5.35am: Former JBS chairman surrenders

Joesley Batista, the former chairman of meat packing giant JBS, has turned himself over to Brazil’s legal authorities after the country’s Supreme Court approved his arrest for allegedly reneging on the terms of a plea-bargain agreement.

High court Justice Edson Fachin approved the arrest following a request from Attorney-General Rodrigo Janot, according to documents made public on Sunday.

In his decision, Mr. Fachin said there are multiple indications that Mr. Batista is “part of an organisation dedicated to the systematic practice of crimes against the public administration and money laundering” and agreed to partially suspend some legal benefits that had been granted to him, making his arrest possible.

Mr. Batista and other JBS executives signed the plea deal in April after admitting to paying millions of dollars in bribes to nearly 2,000 Brazilian officials over at least the past decade. The controversial agreement granted them immunity for their criminal acts in return for their full co-operation with legal authorities.

Dow Jones