Lenders take 2pc hit as retailers JB Hi-Fi, Harvey Norman rally

JB Hi-Fi soared to a record high and helped Harvey Norman higher, while Bendigo Bank took a hit after weak results.

- Earnings beats, misses evenly matched: JP Morgan

- Ampol details $682m servo spin-off

- Lynas to raise $425m

- JB Hi-Fi defies gloom with profit lift

That’s all from the Trading Day blog for Monday, August 17. Australian stocks fell 0.8 per cent by the close of trade, led by more than 2pc losses in the major banks, with results sharply in focus after JB Hi-Fi boosted profits and its final dividend, while Bendigo Bank fell short of expectations.

BlueScope, Lendlease, Kogan, Altium and GWA were among other companies releasing results, with mixed reaction.

James Kirby 8.19pm: Time for a CSL share split

It’s time to split the shares in biotech giant CSL.

With its role in COVID vaccines making headlines and results due this week, the company has rarely been so important to the local market yet its $281 shares are woefully out of kilter with other blue chips.

The impulse to split is running hot on Wall Street where the world’s biggest company Apple did a 4-for-1 split and triggered a 20 per cent share price rise.

In its ongoing battle against Commonwealth Bank to be the biggest Australian listed company, the blood products group has some catching up to do when it comes to shareholder representation. CBA — at $70.76 — is held by around five times as many investors as CSL. The bank has 880,000 shareholders and CSL has about 160,000 on the books.

In fact, CSL does not have any other ASX market leader anywhere near its price — which has regularly breached $300 — the closest would be Cochlear at $198.

Could a split happen? The company does not rule out such a move, though CSL said there were no plans to split at present.

Nevertheless, CSL has led the market with a share split previously — back in 2007 the company did a 3-for-1 split, a move its CEO at the time (now chairman) Brian McNamee described as a move to “improve the affordability and liquidity of the company shares for retail shareholders”.

Technically, a share split should not mean any change in the fundamentals of a stock. After all if you have $2000 worth of CSL and the board was to sign off on a 2-for-1 split you would still have $2000 worth of stock.

David Rogers 7.48pm: Dividends surprise so far

Dividends have been a key upside surprise of the August reporting season, albeit Bendigo Bank’s decision to defer its final dividend injected a note of caution before trading updates from Westpac and ANZ this week.

Bendigo Bank — which is heavily exposed to the lockdowns in Melbourne — also undershot earnings estimates, exceeded cost estimates, disappointed on capital generation and couldn’t give earnings guidance, pushing its shares down 6.6 per cent, while Westpac, ANZ and NAB fell between 2.3 and 2.6 per cent.

The S&P/ASX 200 share index fell 0.8 per cent to 6076.4 points, dragged down by the financial sector.

However, there were plenty of positive share price reactions to results, with Beach Energy up 6.1 per cent, JB Hi-Fi up 4.8 per cent to a record high close of $49.60 and BlueScope up 2.3 per cent.

For the ASX 200, the August reporting period is 25 per cent complete by number and 39 per cent by market capitalisation as of Monday. By Friday, the picture will be clear as 65 per cent of the top 200 companies or 80 per cent by market cap will have reported.

So far, corporate outlooks and earnings per share revisions have been on the whole disappointing.

Robym Ironside 6.59pm: Virgin bondholders bid fails

A bid by bondholders to disrupt the sale of Virgin Australia has been shot down by the Federal Court, in a move welcomed by prospective new owners Bain Capital.

Two key bondholders, Broad Peak Investment Advisers and Tor Investment Management, had sought court orders to allow their proposal for the airline to be put to creditors for a vote.

The firms were hoping their deed of company arrangement (DOCA) would be preferred by creditors over that of Bain Capital, handing them a better return on their investment in the airline.

Their barrister, Ian Jackman, argued his clients were lawfully entitled to propose an alternative DOCA and have it voted on by creditors at the next meeting on September 4.

But the barrister for the administrators, Dr Ruth Higgins, said there was a binding deal between Deloitte and Bain Capital that made the bondholders’ bid futile.

“There is a not a circumstance in the procedures as we understand it for the bondholders’ DOCA to be voted on at that second meeting and we want to avoid the impression that could occur,” Dr Higgins told the court.

Damon Kitney 6.19pm: Crown ‘failed’ on China risks

The Australian boss of the James Packer-backed Crown Resorts has admitted he failed to properly alert the risk committee of the company’s board of directors about the dangers faced by Crown’s China-based staff, following a Chinese government crackdown in 2015 on foreign casinos marketing to its citizens.

Under examination at a public inquiry on Monday reviewing the events leading up to the spectacular arrest of Crown’s staff in China in October 2016, the casino giant’s Australian Resorts chief executive Barry Felstead was repeatedly questioned about his knowledge of warnings by the company’s former China strategy architect, then president of international marketing Michael Chen, about the crackdown.

On one occasion Mr Chen warned Mr Felstead and a number of senior Crown executives in an email about the concerns being expressed by Crown’s staff on the ground about their safety, 18 months before 19 employees were jailed.

John Stensholt 5.10pm: Property outlook ‘grim’: Triguboff

How the rich invest | Even at 87, billionaire Harry Triguboff says he has not missed a single day of work during the COVID-19 pandemic.

Neither have staff members at the Sydney CBD office of his apartment giant Meriton, though Triguboff has been as hands-on with the business as ever during its more than six-decade history.

But Triguboff, who has steered his business through recessions and economic downturns, and survived the early to mid-1970s credit crunch that almost forced him to sell Meriton, admits the coronavirus has been his biggest challenge yet as borders close and workers lose their jobs.

“The future is very grim. We cannot survive without people — the migrants — coming to this country,” Triguboff says. “It is rubbish. We have never had these types of problems before.

“The other problem will be unemployment. It will be very hard for people. So we have to adjust as a country. We have to look at migration again, the (international) students must come again, too.”

As revealed by The Australian this month, Triguboff — the owner of 20 serviced apartment towers in the eastern states — stopped construction of a new complex he was building in the Melbourne CBD as the city entered stage-four lockdown.

4.37pm: JB Hi-Fi leads retail outperformance

The pace of earnings releases stepped up a notch on Monday, with releases from more than 10 listed groups including closely watched tech retailers JB Hi-Fi and Kogan.

Both stocks soared to record highs in opening trade, but by the close were trading in opposite directions. JB Hi-Fi reported a boosted profit and dividend, sending shares higher by 4.8 per cent to $49.60 at the close, while Kogan slipped 6.1 per cent to $20.51 even as it near doubled its dividend.

While still yet to report its own results, momentum in the sector lifted Harvey Norman shares by 2.9 per cent to $4.22, aided further by a JP Morgan upgrade.

Across the rest of the releases, Bendigo Bank fell short of expectations with a 27 per cent slump in cash earnings and deferral of its dividend, prompting shares to slide by 6.6 per cent to $6.54.

Here’s the biggest movers at the close:

4.12pm: Bank reversal drives ASX losses

Banks led a move lower on the local market on Monday, trimming gains after a 2 per cent jump last week.

At its worst, the ASX200 fell down 1.1 per cent to a one-week low, but by the close was down a more muted 50 points or 0.81 per cent to 6076.4.

On the All Ords, shares fell by 43 points or 0.69 per cent to 6218.5.

3.17pm: Japan economy shrinks by record 7.8pc

Japan’s economy shrank a record 7.8 per cent in the April-June quarter, the worst contraction in the nation’s modern history, data showed Monday, as the coronavirus deepens the country’s economic woes.

The contraction from the previous quarter was slightly worse than expectations but is still significantly less severe than declines seen in many other industrial economies.

Still, it is the worst economic contraction for Japan since comparable data became available in 1980, eclipsing the brutal impact of the 2008 global financial crisis.

And some analysts labelled it the worst fall since data began to be compiled in 1955, though a change in calculation methods in 1980 makes the comparison complicated.

It was the third straight quarter of negative growth, confirming a deepening recession for Japan, and raising the prospect that the government will consider pumping further stimulus into the economy.

AFP

3.03pm: Cromwell, ARA battle fires up

The bitter takeover battle between property investor Cromwell and major shareholder ARA has stepped up once again, with ARA today calling for an extraordinary general meeting for a third time.

ARA has been pushing for its nominees, including influential businessman Gary Weiss, to be elected to the Cromwell board for over 10 months.

In its latest retort, Cromwell called on shareholders to “stop ARA’s takeover by stealth”, stressing its record in blocking the ARA vote in the previous two meetings.

“ARA’s intention to seize control of Cromwell has been revealed and, just as Cromwell has stated all along, ARA’s intentions equate to a takeover by stealth via a hostile and opportunistic proportional offer that undervalues Cromwell and denies Cromwell securityholders the ability to realise their full investment in Cromwell and the control premium to which they are entitled to receive for handing effective control of Cromwell to ARA,” Cromwell said.

“Unlike ARA, Cromwell has robust governance and a proven track record of strong performance, successfully outperforming all ARA-managed listed REITs over the long term.”

CMW last traded down 3.4pc to 86.5c.

Read more: Cromwell gets into Euro logistics as takeover simmers

2.50pm: Hydrix reports first heart device implants

Biotech developer Hydrix has reported the first supply and implant of its AngelMed Guardian heart attack warning device.

The listed group said this afternoon that four of its devices had been successfully implanted to patients in Singapore last week through an early access scheme, each of which had now been discharged from hospital.

The implant is a milestone for the group in the Asia Pacific after acquiring a seven-year distribution agreement for eight countries earlier this year.

Hydrix said it was exploring opportunities for implants under Australia’s early access scheme, saying there was potential for local implants in the December quarter.

HYD shares are surging on the news, last up 197pc to 26.5c.

2.17pm: Shanghai outperforms on PBoC boost

A bigger-than-expected medium-term lending facility from the PBoC has caused an outsized rise in the Shanghai Composite today.

The index is up 2.3pc at 3436.3 points - on track for its best day in 4-weeks - after the PBoC added CNY700bn via a 1-year MLF, substantially more than CNY550bn maturing this month, while keeping the MLF rate on hold, after a 20bp cut in April which preceded a cut in the benchmark prime lending rate.

“Stock markets are always in a better place when more money is concerned whether fiscal or monetary it matters little to stock market investors,” notes AxiCorp chief global markets strategist, Stephen Innes.

The increased liquidity injection helped lift S&P 500 futures as much as 0.4pc, with help from US-China trade talk optimism - after China committed to increase oil purchases from the US - as well as ongoing expectations that a US fiscal deal will happen in the next few weeks, he adds.

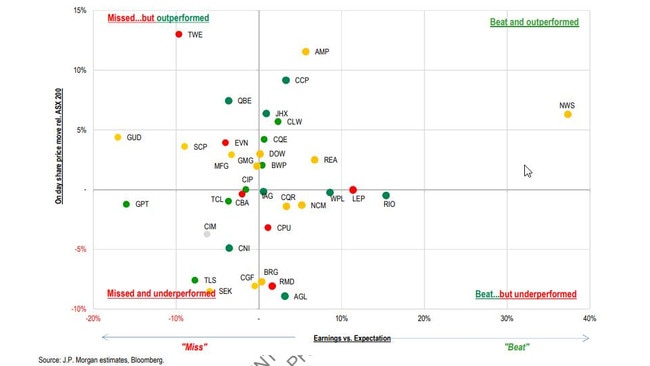

2.05pm: Beats, misses evenly matched: JPM

Reflecting on the first week of reporting season, JP Morgan notes an even split between beats and misses but that earnings revisions are in “downgrade mode”.

Analyst Jason Steed writes that the resurgence of retailers is a key thematic, especially as retail REITs and Myer remain under “considerable pressure”.

But when it comes to revisions, he says that downgraders are outnumbering upgraders by nearly 2:1, driven by industrials, utilities and communications.

He notes an evenly matched 33pc split between beats and misses for the results released to Friday, but says its too early to draw much of a conclusion as yet.

“Over 30pc of the companies that have reported so far have had their ‘fears realised’,” he notes.

“There was ‘undue pessimism’ for 11 companites in the week prior to results, and 20pc of the companies experienced ‘false hope’ as their on-day share prices moves disappointed.

“The lowest proportion of our coverge had their ‘hopes realised’ at just 17pc with post-results performance that was in-line with market expectations.”

Bridget Carter 1.45pm: Are Kogan founders selling again?

DataRoom | Speculation is mounting that another block trade by Kogan’s founders could be imminent.

It comes after the online marketplace posted a 55.l9 per cent lift in its full year net profit to $26.8m due to booming online sales.

While shares were down more than 5 per cent in Monday’s trade, Kogan’s market value has soared since the COVID-19 pandemic and is now about $2.3bn.

Its founders, Ruslan Kogan and David Shafer, sold shares in 2018 through investment bank Citi.

The pair had about 42 per cent of the listed business and that sale of just under 7 per cent of the stock took their interest down to about 35 per cent at that time.

Then, shares were sold at $6.41 each.

Some suspect that Canaccord and UBS could be on the ticket this time around.

Read more: Online makes Kogan a Covid winner

1.19pm: Zicom surges on surgical mask pivot

Specialist equipment manufacturer Zicom has as much as quadrupled its market value intraday, after announcing a pivot to surgical mask production.

The group said it had spent the past three months leveraging its in-house engineering skills and extra manpower during partial COVID-19 lockdowns to design and build its own production line to manufacture masks.

It said an initial run had the capacity to produce 3 million surgical masks in a month on a full production run.

While the company had started the project as a corporate social responsibility exercise, it said it now saw greater long-term feasibility.

“We have decided to develop and potentially expand in this new business and related personal protective equipment,” it said in a statement.

“We focus on high quality surgical masks to provide protection to healthcare personnel and the general public. This differentiates us from ordinary face masks being sold widely.”

ZGL shares last traded up 122pc to 10c, after soaring to heights of 18.5c.

Bridget Carter 1.16pm: John Laing suitors search for partners

DataRoom | Parties shortlisted to buy John Laing’s Australian renewable assets are believed to be searching for equity partners to join forces for an acquisition.

Apparently, approaches have been made around the market by the groups in the final mix to determine if others want to tip in funds to acquire the wind farms.

One possible scenario is a break-up, where assets are sold off individually in the Macquarie Capital-advised process.

The infrastructure investors shortlisted for the John Laing wind farms are believed to be First Sentier Investors, advised by JPMorgan, ICG and Federation Asset Management, which already owns the Kiata Wind Farm in Victoria with John Laing through its Windlab business.

Some believe that Neoen, advised by PwC is unlikely to remain a contender, despite earlier being in the mix.

The bidders are now vying for a smaller portfolio after John Laing opted to exclude solar assets in its Australian business, such as the Sunraysia Solar Farm and the Finley solar project, both in NSW.

Read more: John Laing assets race heats up

Bridget Carter 1.14pm: Quadrant locks in roadshow for Adore Beauty

DataRoom | Quadrant private equity’s online cosmetics business Adore Beauty will start management meetings with institutional investors in the first week of September.

It is understood that meetings for its non-deal roadshow are being booked in with institutional investors this week.

Fund managers are believed to be eagerly awaiting details about the private equity-backed operation that was founded by Kate Morris.

Quadrant’s pitch to investors will be that demand will remain strong for Adore Beauty’s skin-care products and make-up, with well-known brands such as Calvin Klein, Clinique, L’Oreal, Revlon and Lancome.

This is as the brands that are being sold online when shoppers are avoiding malls due to the COVID-19 pandemic.

Working on a potential float of the operation is UBS and Morgan Stanley.

1.01pm: ASX bounces off one-week low

Australia’s sharemarket has bounced off a one-week low amid a slight improvement in the global risk appetite this morning.

The S&P/ASX 200 is down 0.6pc at 6088.7 after falling 1.1pc to 6059.2.

The modest intraday bounce comes as S&P 500 futures lift by 0.4pc, the Australian dollar rises by 0.3pc, WTI crude oil futures rise 1pc and the Shanghai Composite gain 1.4pc.

While the S&P 500 shied off its falling 200-day moving average at 6180 last week, it hasn’t seen any decisive pullback from this important resistance level.

Here’s the biggest movers at half-time:

Ben Wilmot 12.57pm: Unibail reaffirms credit position

Unibail-Rodamco-Westfield, the French company that bought the international Westfield mall empire in 2018 in a $32bn deal, has been forced to issue a statement on recent market rumours in relation to a potential rights issue.

The company, that has a secondary listing on the ASX, has been hard hit by the coronavirus crisis with malls in Europe and the US subject to strict rules, prompting expectations of heavy write downs.

But the company said it had €12.7bn of cash and undrawn credit facilities at its disposal and had already reacted to the COVID-19 pandemic by strengthening its liquidity and balance sheet.

The mall owner has cancelled its second dividend instalment, deferred non-essential capital expenditures, cut back its development pipeline and sold five French shopping centres.

It said deleveraging was a priority and it intends to sell €4bn of assets in the next couple of years, on top of the €4.8bn of disposals completed since June 30, 2018.

But it added that its supervisory and management board continue to weigh the merits of all potential strategies to strengthen its financial profile in line with their respective fiduciary duties. “However, no decision has been made yet on any of the available additional deleveraging options,” Unibail said.

URW last down 5.3pc to $3.60.

Read more: Unibail warns of ‘unpredented’ retail challenges

12.22pm: Harvey Norman rides higher on JB results

Strong competitors are providing uplift for Harvey Norman shares, ahead of the release of its its own earnings results at the end of the month.

The electronics and furniture retailer is trading higher by 4.4pc at midday to $4.28 off the back of outperformance in JB Hi-Fi after it reported 12.2pc comparable sales growth.

Recall that its shares had a similar reaction to Nick Scali’s upbeat earnings release at the start of the month.

An upgrade from JP Morgan could also be helping shares as analyst Shaun Cousins writes retail was a key beneficiary of lower spending in other consumption categories.

“With furniture and bedding estimated to be 30pc of sales, following years of strong sales, Harvey Norman has greater exposure to the housing sector than JB Hi-Fi or Super Retail Group,” Mr Cousins writes.

“Harvey Norman has a history of maring expansion (and contraction), providing greater leverage.”

Read more: JB Hi-Fi delivers bumper profit, dividend

12.13pm: Couche-Tard likely to return for Ampol: RBC

Deal talks between Ampol and French suitor Couche-Tard were abandoned due to COVID-19, but the two are likely to resume negotiations even as Ampol spins off its service station sites in a new property trust.

According to RBC analyst Gordon Ramsay, the new property plans “unlock a portion of the hidden value of the Ampol convenience retail sites” and “increases potential for Ampol to deliver incremental growth and returns”.

“Couche-Tard also continues to view Ampol as a strong strategic fit for its business and an important potential component of its Asian growth strategy, and hence we think there remains a strong likelihood of a resumption in deal talks once more certainty is apparent in the economic outlook,” Mr Ramsay says.

He notes the company intends to use the $612m proceeds to pay down its debt - estimating its debt to earnings ratio to come down to 1.75x - while the company has previously noted any capital return would be considered when debt is less than 1.5x.

ALD last down 3.6pc to $28.76.

11.37am: Melbourne exposure to hit Bendigo: Macq

Macquarie Equities keeps its Underperform rating and $6.25 price target on Bendigo Bank after its FY20 results, saying that: “given challenging operating conditions in the low rate environment and a higher exposure to the Melbourne lockdown than peers, we find it difficult to justify Bendigo’s current valuation”.

It notes that underlying 2H cash profit was 12pc below the consensus estimate, costs were higher than expected, capital generation below its estimate and the dividend was deferred due a challenging earnings outlook and COVID uncertainty.

“We see further risk to dividend sustainability and have dividend cuts in our forecast going forward,” the broker warns.

BEN last down 6.5pc to $6.55.

Eli Greenblat 11.31am: G-Star administrators fail to find buyer

Voluntary administrators for youth fashion and apparel company G-Star RAW, which lurched into voluntary administration in May, have failed to find a buyer for the retailer and will close all its stores with the loss of 200 jobs.

Justin Walsh, Sam Freeman and Stewart McCallum of EY were appointed as voluntary administrators of G-Star Australia on May 15, with the retailer one of the first victims of the emerging COVID-19 pandemic earlier this year.

“Despite an extensive marketing program no buyer was identified for company’s business. As a consequence, all of the company’s stores have now been closed. This resulted in approximately 200 job losses,’’ EY said in a statement on Monday morning.

The administrator said G-Star RAW was a globally recognised brand but in the current uncertainty it wasnt able to secure a buyer as concerns grow about the future strength of the nation’s retail sector.

“The fact that no party was able to buy the business reflects the high level on uncertainty regarding the future prospects for the retail sector in Australia.”

Read more: G-Star succumbs to coronavirus hit

11.21am: JB Hi-Fi still a ‘Sell’ despite records

Above-consensus results for JB Hi-Fi are helping its shares to lift to new records of $51.33 in morning trade.

It comes as the retailer reported underlying EPS of $2.632, beating the consensus estimate by 4.6pc while DPS beat by 9.5pc and July like-for-like sales rose 44.2pc.

Still, Macquarie Equities says it is concerned about the outlook – While noting that the overall result was ahead of expectations and July 2020 comparisons are well above market expectations, “near-term risks to discretionary spend are high in our view and the impressive comps likely cannot be maintained throughout the year”.

Citi’s Bryan Raymond expects JB Hi-Fi’s strong start to FY21 to generate consensus upgrades of 5 per cent or more. But he has kept his Sell rating and $42 price target, which is 16pc below the current price, cautioning that stock shortages may present a sales risk to first half sales.

On the positive side the lack of incremental costs required to drive the strong sales result was surprising, The Good Guys beat his earnings estimate by 4pc, and JB Hi-Fi swung to $252 million of net cash, from $320 million of net debt in FY19, driven by very strong EBITDA growth, a reduction in capex and a much lower inventory position.

But a 25bp gross margin contraction at the group level in the second half was surprising given the lack of promotional activity in the period and inventory fell 16pc on year as inventory days fell to 48 days versus 58 days in FY19.

JBH last at $49.79, while peer Harvey Norman joins the rally with a 4.3 per cent lift to $4.28.

Read more: JB Hi-Fi delivers bumper profit, dividend

Bridget Carter 11.12am: Charter Hall paid more than tipped, analysts

DataRoom | Charter Hall’s acquisition of a $682m stake in the Ampol petrol stations with partner GIC has been well received by some analysts, who say the price paid is less than expected.

They also add that it reinforces the view that Charter Hall will not need to raise equity, given that the listed company will only invest $34m of its own capital for the transaction with its capital partner, the Singapore sovereign wealth fund GIC, offering up the remainder.

Earlier, the expectation was that the 49 per cent interest in the portfolio that Charter Hall was in negotiations to buy would have been worth about $1bn.

But this transaction values the entire portfolio of 203 petrol stations at $1.4bn with a yield of 5.5 per cent.

The leases expire between 11 and 22 years and the properties will be held in an unlisted property trust.

11.07am: Early moves after today’s results

Shares are lower across all sectors after the first hour as the benchmark ASX trades down by 0.9pc.

With results in focus, here’s how today’s releases are being traded:

| COMPANY | % CHANGE | LAST TRADED |

| JB Hi-Fi | 5.26 | $49.82 |

| Altium | 3.47 | $34.63 |

| BlueScope | 0 | $12.07 |

| Lendlease | -0.69 | $11.44 |

| Kogan | -3.85 | $21.01 |

| Bendigo and Adelaide Bank | -5.36 | $6.62 |

| GWA Group | -10.15 | $2.48 |

Lilly Vitorovich 11.02am: WPP refinances ahead of results

WPP AUNZ has become the latest company within the embattled media sector to negotiate its $420m debt facilities with its banks, just days ahead of the advertising group’s interim results.

As part of WPP’s renewal and extension of its debt facilities with four banks, its $270m three-year term facility has been extended to August 2023 from June 2021.

Its $150m rolling annual working capital facility has also been extended by two months to August 2021. It had been extended in May, but the company wanted all its debt facilities to run to August, thus the two month extension.

WPP CEO Jens Monsees says the extension “proactively reduces financial risk in our business and provides stability and flexibility to drive growth”.

“Through this challenging economic and operating environment, we have taken a

conservative approach to our financial position.”

WPP’s announcement comes just weeks after Seven West Media, the media company controlled by billionaire Kerry Stokes, renegotiated the terms of its $750m debt facilities with its bankers.

Outdoor ad group oOh!media in late March raised $167m to pay down its $354.5m debt pile and amended its debt arrangements to provide “extra headroom” during the crisis.

WPP last traded down 3pc to 32c.

10.45am: Second round super withdrawals top 1.1m

Those tapping into their super accounts are going back for a larger slice, according to the latest data from APRA.

The regulator this morning said $31.1bn had been withdrawn from the super pool to August 9, with more than 1.1 million now tapping the scheme twice.

APRA said the initial program had attracted 3 million Aussies, with withdrawals averaging $7402, rising to an average application of $8487 for those going back for more.

Applications in the surveyed week were 50/50 split between initial and repeat application – totalling 88,000.

10.15am: Banks, tech lead ASX loss

Shares are firmly lower in early trade, with losses led by the financial and tech sectors as investors weigh up the latest earnings releases.

At the open, the benchmark ASX200 is lower by 41 points or 0.67 per cent to 6085.2.

The major banks are lagging – NAB down by 2pc, Commonwealth Bank by 0.8pc, ANZ off by 1.1pc and Westpac losing 1.3pc – but the worst hit is Bendigo and Adelaide Bank, off by 4.7pc after its full-year cash profit missed consensus by almost 4pc.

On the plus side, JB Hi-Fi is rising by 4pc, while CSL adds 0.8pc and Mesoblast is up by 2.6pc.

10.13am: BlueScope result ‘broadly positive’: JPM

JPM analyst Lyndon Fagan says BlueScope’s FY20 result was “in line, with outlook comments broadly positive regarding volume”.

Australian Steel Products were “ahead of our estimate with the key feature being slightly higher domestic volumes”.

He also notes that North Star expansion will now be ramping up by the June 2022 half – 6 months earlier than he assumed, with full production expected in 18 months.

BSL last down 2pc to $11.83.

Read more: BlueScope profit slumps 90pc

David Ross 9.54am: Australians paying too much for gas, says ACCC

Australian gas on the east coast is selling for almost double the price it is being exported for, a new report reveals.

An interim report from the Australian Competition and Consumer Commission shows Australian domestic customers were slugged between $8 and $11 per gigajoule (GJ) in late 2019 and early 2020.

This was compared to LNG export prices which were fetching below $6/GJ since early 2020.

“The ACCC is very concerned with the widening gap between domestic and export parity prices, which will have an inevitable impact on Australia’s industrial sector during what is already a difficult economic period,” ACCC Chair Rod Sims said.

The regulator notes the danger of gas shortages across the east coast market and recommends the Commonwealth Government Heads of Agreement with LNG producers be renewed beyond 2020.

9.46am: What’s on the broker radar?

- Harvey Norman raised to Overweight – JP Morgan

- Metcash raised to Outperform – Credit Suisse

- NAB cut to Underperform – Jefferies

- Navigator Global raised to Buy – Ord Minnett

- Telstra cut to Netural – JP Morgan

9.41am: ASX to drop 0.8pc

Australia’s share market is expected to open down based on offshore leads but results are in focus as earnings season accelerates this week.

Overnight futures relative to fair value suggested the S&P/ASX 200 will open down 0.8pc at a two-day low of 6077 points after the S&P 500 stalled near record highs.

S&P 500 futures and the Australian dollar have risen as much as 0.2pc in early trading in what may be a slight positive reaction to the indefinite delay of a 6-month review of US-China trade talks.

But over the weekend, US President Trump ordered that Chinese-owned ByteDance sell its video-sharing app Tik Tok within 90 days and the Commerce Department said it was ending a temporary waiver for US firms to do business with Huawei.

Mr Trump also hinted that he is looking at taking action against other Chinese tech giants, such as Alibaba, and the risk for the market is that he ratchets up tensions further into November’s election.

Meanwhile, the rate of increase in coronavirus cases in Australia fell to 292 in the past 24 hours, with 282 in VIC, albeit with 25 news deaths, while trends in Europe and NZ worsened.

9.36am: Platinum appoints Strapp as chairman

Platinum has announced Guy Strapp as its new chairman as co-founder and largest co-shareholder Kerr Neilson also takes a step away from the fund, leaving his role as analyst at the end of the month.

Mr Neilson had been in the analyst position for the past two years after stepping down as the fund’s chief.

In a notice this morning, Platinum said Mr Neilson would leave the role on August 31, but would remain as a non-executive director.

”The trouble with high performance investing is that it requires total immersion; it is all consuming of one’s time,” Mr Neilson says.

“Working from home has softened me up and caused me to ponder wider social issues. Having seen the team grow and mature over the years, I am confident in their ability to meet clients’ high expectations.”

In addition, Michael Cole is set to retire as chairman of the board after the group’s AGM in September, to be replaced by Guy Strapp.

PTM last traded at $3.86.

Ben Wilmot 9.30am: Charter Hall snares Ampol sites

Listed property funds manager Charter Hall Group has set up a major partnership with GIC, Singapore’s sovereign wealth fund, to acquire a 49 per cent stake in a new trust which will own 203 Ampol service stations across Australia.

The Ampol portfolio will have initial lease terms ranging from 11 through to 22 years, a 19.2 year weighted lease term and 10 year initial option terms, plus multiple five year options thereafter.

The properties will be subject to CPI annual rent reviews, with minimum 2 per cent and maximum 5 per cent increases per annum.

Charter Hall will have a 5 per cent in the new partnership or about $34m.

“This off market transaction follows regular dialogue with the Ampol team over the past 2 years and reinforces our confidence in the convenience retail sector,” Charter Hall CEO David Harrison said.

The company said its extension of its 15-year relationship with GIC, with which it owns office towers including Chifley Tower, grew their multisector relationship.

Cliona O’Dowd 9.20am: Bendigo Bank profit slumps 27pc

Bendigo Bank has deferred its final dividend and says it is unable to provide meaningful guidance for fiscal 2021 due to challenging market conditions as it posted a 27 per cent slump in cash profit to $301.7m for the 12 months through June.

The result was below analyst estimates for cash earnings to come in at $313m for the year.

Handing down the result, Bendigo chief executive Marnie Baker said COVID-19, record low interest rates and investment costs required to support its strategy to reshape the business had dragged on earnings.

“We expect market conditions to remain challenging and because of this we are unable to provide meaningful guidance for FY21. We continue to focus on maintaining a strong and resilient balance sheet supported by our growth and clear transformation strategy,” she said.

“We’re observing how COVID-19 is changing the world and considering how we can use this to shape the future of work and continuously improve as leaders in customer experience.”

Total income over the 12 months rose slightly to $1.61bn, while lending, at record levels and above system growth, increased 5.1 per cent to $65.3bn, driven by strong residential lending growth of 9.4 per cent, 3.6 times system.

BEN last traded at $7.00.

Eli Greenblat 9.17am: Kogan dividend jumps as sales soar

Online marketplace Kogan.com has posted a 55.9 per cent gain in full-year net profit to $26.8m as booming online sales saw its full-year revenue rise by 13.5 per cent to $497.9m.

The retailer said the increase in revenue for the period was driven by growth in its exclusive brands products.

Kogan.com booked profit before tax of $38.85m, up 66 per cent, and included unrealised foreign exchange losses of $1.4m in 2020 compared to a loss of $200,000 in 2019.

The retailer also booked a provision for estimated penalties and costs associated with a cost of a court case launched by the Australian Competition and Consumer Commission of $700,000. In July a court ruled that a promotion held by Kogan.com was false or misleading.

Kogan.com declared a final dividend of 13.5 cents per share, almost double the 8.2 cents per share paid out in the final dividend for 2019, and is payable on October 19.

KGN last traded at an all-time high of $21.84.

Read more: Kogan ‘misled shoppers’ in promo

9.07am: Ampol spins off servo sites

Ampol is set to spin off 203 of its freehold convenience retail sites and sell a 49 stake to a consortium of Charter Hall and GIC.

In the deal announced this morning, Ampol will establish an unlisted property trust with the two real estate groups, and receive $682m for the sale of a 49pc stake, representing a weighted average capitalisation of 5.5pc.

The deal values the entire portfolio of service stations at $1.4bn, with $77m in rental payments to be paid from Ampol in the first year.

Ampol said the proceeds of the deal of $612m after taxes and other costs will be used to initially reduce leverage.

8.54am: Lynas to raise $425m

Lynas Corporation has announced a fully underwritten equity raising to raise about $425 million to fund Lynas “2025 foundation” projects.

The raising is by way of a fully underwritten one 1 for 7.7 pro-rata accelerated non-renounceable entitlement offer and institutional placement.

New shares will be issued at $2.30 per share, representing a 11.9 per cent discount

to last close.

Proceeds from the equity raising will be used to fund major projects expected to be delivered in 2023 that are essential steps towards the Lynas 2025 growth vision, including a planned Kalgoorlie are earth processing facility, and associated upgrades at its Malaysia plant.

8.50am: Altium profit down 42pc

Altium Ltd’s full-year profit fell 42pc as the coronavirus hit expected demand for its circuit board software, and the Australian company said the pandemic could push back the time frame for its long-term revenue target.

Altium reported a net profit of $US30.9 million for the 12 months through June, down from $US52.9 million a year earlier. Altium said pretax profit rose 12pc but it was hit by a larger tax expense including a one-time impact of $US16.4 million due to a restructuring in the U.S.

Revenue rose 10pc to $US189.1 million, missing the $US200 million aspirational target the company acknowledged was out of reach back in May.

Chief Executive Aram Mirkazemi said the effects of the pandemic might mean Altium needs an additional 6-12 months to hit its 2025 revenue target of $US500 million.

The directors declared a final dividend of 19 cents a security, compared with 18 cents for the same period a year earlier, for a full-year payout of 39 cents. Its fiscal 2019 total payout was 34 cents.

Dow Jones Newswires

8.47am: Beach profit drops 13pc

Beach Energy Ltd. said its annual net profit fell by 13 per cent, reflecting the impact of a steep drop in oil prices that led many of its peers to take hefty impairment charges against assets.

Beach said it made a net profit of $500.8 million in the 12 months through June, down from $577.3 million in the same period a year earlier.

Directors of the company declared a final dividend of 1.0 cent a share, in line with the payout a year earlier.

Underlying net profit, which strips out one-time items including unrealised hedging movements and gains on assets sales, was 18 per cent lower at $461.0 million.

Beach produced 26.74 million barrels of oil equivalent in fiscal 2020, up 2 per cent on proforma output for the previous year, but was slugged by weaker energy prices as a battle for market share between Saudi Arabia and Russia heaped further pressure on an oil market already sagging due to coronavirus. Brent ended last week at $US44.80/bbl, and is down 32pc since the start of January.

Dow Jones Newswires

Samantha Bailey 8.44am: GWA feels building weakness

GWA Group has flagged weak construction market conditions through fiscal year 2021 as the bathroom fittings maker unveiled a slump in full-year profits.

The company booked net profit after tax down 53 per cent to $43.89 million and declared a final dividend of 3.5 cents per share fully franked. The company received more than $1 million in JobKeeper payments in response to the coronavirus crisis.

“In a very challenging year, with significant uncertainty and a strong focus on the health and wellbeing of our people, GWA delivered a disciplined result in fiscal year 2020,” chief executive Tim Salt said.

“Our top line was significantly impacted by lower construction activity, merchant destocking in the first half, and the impact of the COVID-19 pandemic and lower than expected merchant restocking in the last quarter of the year.”

While the company said that trading through July has been slightly ahead of the same period a year ago, market conditions are expected to remain challenging due to the uncertainty created by the COVID-19 pandemic and exacerbated by the outbreak in Victoria.

Eli Greenblat 8.40am: JB Hi-Fi defies gloom with profit lift

JB Hi-Fi has kicked off earnings season for the nation’s biggest retailers with a 21 per cent lift in full-year net profit to $302.3 million, in line with guidance provided by the company in June, with sales through July and August booming by as much as 40 per cent.

The bumper result, coming amid a slowing economy and the impact of the COVID-19 pandemic, has also allowed JB Hi-Fi to lift its final dividend by almost 80 per cent.

The consumer electronics giant on Monday reported sales for fiscal 2020 up 11.6 per cent to $7.9 billion, slightly ahead of guidance of $7.86bn, with underlying earnings up 30.5 per cent to $486.5m.

The company declared a final dividend of 90 cents per share, up 76.5 per cent, to give it a total 2020 dividend up 33.1 per cent to $1.89 per share.

JB Hi-Fi said its Australian arm grew sales by 12.5 per cent to $5.32bn, ahead of guidance of $5.26bn, with like for like sales up by 12.2 per cent. JB Hi-Fi New Zealand sales were down 5.7 per cent to $NZ222.8m as closures across the country because of COVID-19 dented its performance.

Its The Good Guys business saw sales rise by 11.2 per cent to $2.39bn, in line with guidance provided to the market in June, as like for like sales rose 10.8 per cent.

JB Hi-Fi said in July Australian like for like sales were up 44.2 per cent, JB Hi-Fi New Zealand up 9.1 per cent and The Good Guys sales up 40.4 per cent.

The retailer said there was strong sales momentum into August, especially online as Melbourne faced shut downs, but the retailer would not be giving sales guidance for 2021 given the uncertainty around COVID-19.

Read more: JB Hi-Fi delivers bumper profit, dividend

8.32am: Lynas in halt before raise

Rare earths company Lynas has requested a trading halt ahead of a planned capital raising.

8.20am: Lendlease slumps to loss

Lendlease Group said it made an annual net loss, as it absorbed costs tied to the exit of its engineering business and the impact of the coronavirus pandemic.

Lendlease reported a net loss of $310 million for the 12 months through June, compared to a $467 million profit a year earlier.

Directors declared a final distribution from the Lendlease Trust of 3.3 cents a share, with no dividend from the company.

Lendlease said conditions deteriorated significantly in the second half of its fiscal year, with delays experienced in converting development opportunities across the company’s urbanisation pipeline. Also, Lendlease’s communities business experienced weak trading conditions.

“In construction, the impact was greater in our international regions, particularly in cities where mandated shutdowns were implemented,” Lendlease said. “This included lower productivity, projects being put on hold and delays in the commencement or securing of new projects.”

Lendlease reiterated that the restructuring cost to exit the engineering business was expected to be at the top end of the previously guided $450 million-$550 million range, and would mostly be accounted for in fiscal 2020. It expects the sale to complete shortly with a $160 million price tag, payable in instalments during fiscal 2021.

Dow Jones Newswires

8.05am: Chris Lynch joins Westpac board

Westpac has announced the appointment of Chris Lynch to the bank’s board.

Mr Lynch’s last executive position was as CFO of Rio Tinto. Earlier, he was CEO of

Transurban and held a number of senior executive positions at BHP.

7.55am: BlueScope profit plunges 91pc

BlueScope Steel reported a 91pc fall in annual net profit, as it felt the sting of weaker steel spreads and ebbing demand in some key markets during the coronavirus pandemic.

BlueScope said it made a net profit of $96.5 million in the 12 months through June, down from $1.02 billion in the same period a year earlier. The result was also dragged down by a $197.0 million impairment charge against its New Zealand and Pacific Steel segment.

The steelmaker’s annual underlying earnings before interest and tax was down 58 per cent at $564.0 million, roughly in line with revised guidance of around $560 million provided in mid-July.

Directors declared a final dividend of 8 cents a share, in line with the payout a year ago.

BlueScope faced disruptions in key markets during the second half of its fiscal year, including a national shutdown in Malaysia and the temporary idling of some auto manufacturing in the US as authorities battled to suppress the coronavirus.

On Monday, BlueScope said steel spreads in North America and Asia are currently below averages in the second half of the just-ended fiscal year. Still, the company said its North Star facility in Delta, Ohio, is dispatching near full capacity.

“There is a high level of uncertainty in the current environment given the risks of COVID-19 events which could disrupt demand, supply chains and operations, combined with broader macroeconomic weakness dampening demand,” said BlueScope, adding it wasn’t able to provide specific underlying Ebit guidance for the first half of fiscal 2021.

BlueScope said its buyback program would remain on hold “until there is a demonstrable improvement in business conditions”.

Dow Jones Newswires

6.20am: ASX to open solidly lower

Australian stocks are set to open firmly lower after a tepid session on Wall Street on Friday, and ahead of a busy week for profit results.

The SPI futures index was this morning down 58 points, or around one per cent.

Ahead, the earnings season hits top gear, with investors bracing for some disappointment when it comes to profit guidance, although results so far have been better than expected when it comes to matching estimates.

More than two-thirds of S&P/ASX 300 companies are scheduled to release accounts this week, including BHP, Coles, CSL, Lendlease, Suncorp and Wesfarmers.

Of the string of profit results over the past two weeks some 31 per cent of earnings have beaten expectations, 46 per cent have matched earnings estimates, while 22 per cent have disappointed the market, according to calculations by Richard Coppleson, an institutional trader with Bell Potter.

The earnings results come against a backdrop of a rising Australian sharemarket and stronger global markets, improving Victorian coronavirus trends and a better-than-expected start to the August reporting season. The S&P/ASX 200 share index is just 22 points off its post-March closing peak of 6148 points.

However there’s a sting in the tail, with brokerage Macquarie Equities seeing more downgrades than upgrades.

On Friday, the ASX finished higher by 0.6 per cent to cap a 2 per cent weekly rally

Also this week, the Reserve Bank and the US Federal Reserve release the minutes of their latest meetings. Markets will be looking to the Fed for signals on more stimulus.

The Australian dollar is higher at US71.70c.

5.35am: New private capital giant

A former affiliate of private-equity firm TPG has amassed one of the biggest pools of private capital on record as investors seek opportunity from the economic uncertainty unleashed by the coronavirus pandemic.

Sixth Street Partners has brought in $US10 billion for its flagship fund, a nine-year-old vehicle known as Tao, since it was reopened to new investment in April, according to people familiar with the matter. It now totals $US22.5 billion and the firm has told investors it would cap the fund at around $US24 billion at the end of September.

That would put it just behind the record-breaking private-equity funds Blackstone Group Inc. and Apollo Global Management Inc. finished raising in 2019 and 2017, which came in at $US26 billion and $US24.7 billion, respectively. It would rival the EUR21.3 billion (worth about $23.9 billion at the closing date) buyout fund CVC Capital Partners completed this summer.

All that cash streaming in has brought to more than $US2 trillion the amount firms have raised to invest across global private markets, including equity and debt, according to advisory firm Hamilton Lane Inc. Expensive markets made that challenging in recent years, but now many investors are hoping that the pandemic will create a fresh wave of opportunities.

Sixth Street is the former credit arm of TPG. It was founded in 2009 by 10 partners, many of whom worked together under Chief Executive Alan Waxman in Goldman Sachs Group Inc.’s special-situations group, which has wide leeway to invest wherever it sees an opportunity.

Sixth Street has historically kept a low profile but that might be changing as the firm, which formally separated from TPG in May and now has about $US48 billion in assets, prepares to invest its newly bolstered war chest during an unprecedented economic crisis.

Dow Jones

5.25am: EU urges Turkey to halt gas hunt

The European Union urged Turkey to halt its exploration for gas in a disputed area of the eastern Mediterranean “immediately”, in a crisis that has stoked tensions with other countries in the region.

The call came after Ankara said it planned to extend its controversial search by drilling off the southwestern coast of Cyprus from next week.

Turkey’s actions in the eastern Mediterranean have put it at loggerheads with its uneasy NATO ally Greece and the rest of the EU, with France announcing last week it would bolster its presence in the region in support of Athens.

Brussels has repeatedly called on Ankara to halt energy exploration off Cyprus, arguing that the drilling is illegal because it infringes on the island’s exclusive economic zone.

Turkey’s latest announcement “regrettably fuels further tensions and insecurity in the Eastern Mediterranean”, EU foreign policy chief Josep Borrell said in a statement.

“This action runs counter and undermines efforts to resume dialogue and negotiations, and to pursue immediate de-escalation, which is the only path towards stability and lasting solutions, as reiterated by EU foreign ministers last Friday,” he said.

“I call on the Turkish authorities to end these activities immediately and to engage fully and in good faith in a broad dialogue with the European Union.”

AFP

5.20am: Wall Street recap

Wall Street stocks finished a positive week on a tepid note, ending little changed following mixed data on US retail sales and industrial production.

The Dow Jones Industrial Average ended the session up 0.1 per cent at 27,931.02, concluding a winning week for the blue-chip index and the other two major US stock indices.

The broadbased S&P 500 was essentially flat at 3,372.85, while the tech-rich Nasdaq Composite Index shed 0.2 per cent to 11,019.30.

Retail sales increased 1.2 per cent last month compared to June, a more modest rise than economists had been expecting, held down by a decline in auto sales, according to government data.

Industrial production rose 3.0 per cent in July, the third consecutive monthly increase but a slower gain than in June, the Federal Reserve said.

Despite the mediocre data and broad expectations that unemployment will remain at high levels for some time as the US struggles to contain the coronavirus, the S&P 500 and Nasdaq stand near all-time highs.

“The recovery in equity markets has been stunning, partly reflecting the huge amount of stimulus that has been unleashed,” said a note in Oxford Economics.

“However, a further deterioration in the health situation or the absence of additional fiscal support are two key downside risks that are likely not fully discounted.” The Oxford Economics note warned that Washington’s failure to approve a new stimulus package “will minimise chances of a sustained economic rebound.”

President Donald Trump told reporters Friday he remains steadfast in opposing a spending package that would include help for ailing cities and states.

“They want $US1 trillion to go to their friends doing a bad job running certain cities and states that are doing very badly,” Trump said, adding that Democrats are to blame for the impasse.

AFP