Trading Day: ASX up 1% on CSL, BHP, CBA gains

Australia’s share market closed 1pc higher with gains from heavyweights CSL, BHP and CBA before the FOMC meeting.

That’s all from the Trading Day blog for Wednesday, September 16. Australia’s share market closed 1pc higher with gains from heavyweights CSL, BHP and CBA coming before the FOMC meeting. Wall Street had been positive overnight. The Nasdaq closed up 1.2 per cent, the S&P 500 added 0.5 per cent and the Dow Jones Industrial Average was flat. US futures were trading in positive territory as the ASX closed.

8.37pm: Don’t confuse China trade with security

The head of Scott Morrison’s manufacturing taskforce has called on the government to adopt a less confrontational public approach to dealing with China, saying it would be a mistake to confuse Australia’s “economic interests” with its “security interests”.

Andrew Liveris, former chief executive of global giant Dow Chemical, during a speech at the National Press Club in Canberra also told energy investors to stop “whingeing” about the threat of government intervention.

He said $4 a gigajoule for gas on the east coast remained a viable target, despite producers rejecting the price as unrealistic.

Amid what experts say is a low point in the political relationship between Australia and our largest trading partner, Mr Liveris advocated for Australia to conduct sensitive discussions around political and security matters in private. “China is a really good listener and they have a culture where saving face matters, so you don’t want to embarrass (them),” he said. “You have to be very careful with how you say things, and what you say.

“When we confuse mercantile interests with what are issues of principle, that’s when we get into trouble. We need to keep diplomatic channels wide open, to speak frankly and to speak our mind in private with China’s government about what we believe, what our standards are, what our values are.

At the same time, we need to keep the flow of trade moving between our two countries. Both of these things can and must be kept in balance.”

As diplomatic relations plumb new lows, the trading relationship has reached new peaks, with more of Australia’s exports than ever flowing to China.

7.50pm: Market feels ‘very fully valued’: Tony James, Blackstone

In an exclusive interview, CNBC’s Sri Jegarajah and Martin Soong interviewed Tony James, executive vice-chairman, Blackstone Group, who said: “I think the consensus is we should have more stimulus. I think both parties want more stimulus, the White House certainly wants more stimulus, if nothing else for the election. But absent stimulus, I think the Fed’s gonna feel more pressure to move. Now, short rates are already near zero, so the concern would be that eventually we get some inflation and that would affect long rates. So yes, in a nutshell, I think in the absence of stimulus, the Fed, keeping that yield curve at the long end down, is helpful.

“The market feels very fully valued. In my opinion, it’s a little ahead of itself, but I think it’s supply and demand, as I say capital continues to run in there. There’s also a little bit of a fear of missing out, a little FOMO in there, where everyone’s made a lot of money in the market this year and people are piling in. And so I think in the short term, those, you’ll continue to have that momentum.

“Long term, though I think the market will feel very full over a sort of 10, five to 10-year horizon. I think this could be a lost decade in terms of equity appreciation, both because at some point we’ll have interest rates normalizing somewhat, or at best stopping further decline on the one hand, and then there’s plenty of headwinds for corporate earnings, there’s higher taxes, their operating cost because of COVID are up, their supply chains are going to be less efficient, deglobalization will hurt productivity, state and local employment will be under pressure because of the deficits.

“All of that will be economic headwinds for companies, so I think you can have disappointing long-term earnings growth with multiples coming in a little bit. And I could see anemic equity returns over the next five to 10 years.”

7.33pm: Rio Tinto called out on board diversity

When asked if Rio Tinto was part of the Canada Pension Plan portfolio and whether it would be reviewing its holdings in an exclusive interview with CNBC’s Sri Jegarajah and Martin Soong, Mark Machin, CEO and president of the Canada Pension Plan Investment Board, replied: “I’m sure it is. And I have to, I’d have to check. I would imagine we have some nominal holding in one of our passive indices. But it’s not a very direct position, I know that for sure. But I can check in a few minutes and tell you exactly how much we own. But it’ll be somewhere in one of the major global equity indices that we have in our passive portfolio. And I’m sure that soon we’ll be engaging with them.

“I say we actively engage, and we will, for example, I mean, I’ll take up a related issue, which is gender diversity. So, we strongly believe that diversity on boards is correlated with long term investment returns. And we’ve done our own internal quantitative analysis on several thousand securities controlling all other factors. And we’ve shown that’s the case. In addition, we’ve done analysis on 100 external studies and shown that’s the case. So, it’s quantitatively based. So, three years ago, we started voting against boards in Canada that didn’t have women on the board. And that along with a lot of other efforts has had an impact on the number of women on boards in Canada. There’s no major company now that doesn’t have a woman on the board in Canada. And two years ago, we put that out. We continue to engage with companies around the world to push this theme. And we will vote, and we will engage, and we will have active dialogue with companies about why this makes sense. And we hope that we and others will have an impact because ultimately it will impact long term returns.”

7.18pm: Bill Gates’s dad dies

William H. Gates II, who raised a precocious and headstrong young man known as Bill Gates and later helped the co-founder of Microsoft Corp. give away his billions, died Monday at his beach home on Hood Canal in Washington state, the family said. He was 94 years old and had Alzheimer’s disease.

Mr Gates Senior helped found what became K&L Gates, an international law firm, but was far better known as the father of a billionaire software pioneer. He was often asked whether he was “the real Bill Gates.”

Searching for a new mission after his wife, Mary Gates, died of cancer in 1994, he volunteered to help his son deal with increasingly frequent requests for donations. He later became co-chair of the Bill & Melinda Gates Foundation, which has spent $53.8 billion over the past 20 years on its humanitarian missions, including the eradication of malaria and the provision of vaccines to children in poor countries.

Bill Gates posted a tribute to both of his parents on his blog. “I knew their love and support were unconditional,” he wrote, “even when we clashed in my teenage years. I am sure that’s one of the reasons why I felt comfortable taking some big risks when I was young, like leaving college to start Microsoft with Paul Allen. I knew they would be in my corner even if I failed.”

The Wall Street Journal

John Stensholt 7.04pm: Rugby union’s saviour could be Nine and Stan

Rugby union may get a financial lifeline from an unusual and potentially groundbreaking source: Nine Network and its online streaming service Stan.

Nine is understood to have entered discussions with Rugby Australia about a potential broadcast deal that would see Wallabies matches telecast on Nine’s free-to-air channel and Super Rugby games mostly or only shown on Stan.

The move would be a first for Australian sport to find a home on a streaming video on demand service, the likes of Netflix and Amazon Prime on a global basis and Stan domestically have mostly focused on movies and comedy or drama series.

While discussions are ongoing the sticking point is exactly what Nine or any of its rivals would be bidding for, given uncertainty over the future structure of Super Rugby.

It is also unlikely that Nine, which already has extensive NRL and tennis commitments, would shell out tens of millions of dollars annually on rugby.

Lilly Vitorovich 6.49pm: Nine Network returns to reality

Nine Network is looking to a string of reality shows including Celebrity Apprentice with Lord Alan Sugar, Beauty and the Geek, Married At First Sight, plus family-friendly programs to attract viewers next year.

Chief sales officer Michael Stephenson said Nine would deliver “new, fresh and innovative shows” as the free-to-air TV broadcaster looks to extend its TV ratings lead and grow its broadcast video-on-demand service, 9Now.

At its first virtual upfront event to unveil its 2021 program line-up to advertisers and media buyers on Wednesday afternoon, Nine announced that Lord Sugar will host the local version of Celebrity Apprentice, featuring personal trainer Michelle Bridges, radio host Michael ‘Wippa’ Wipfli and gymnast Olivia Vivian.

Bridget Carter 6.23pm: JC Flowers looks at AMP

US-based private equity firm JC Flowers is understood to be circling the wealth operations of AMP.

It comes after the New York private equity firm made attempts earlier to buy the MLC wealth management business from the National Australia Bank before the business was sold to IOOF last month for $1.4bn.

For MLC, JC Flowers was advised by JPMorgan, but it is understood the American bank is not aiding its latest efforts to assess the AMP operations.

JC Flowers is run by the former Westpac boss David Morgan and was founded in 2001 by billionaire and former Goldman Sachs partner J.Christopher Flowers.

As of 2017, the business had invested more than $US15bn ($20.5bn) in capital.

It has bid for a number of high profile portfolios in the past, including Sallie Mae, offering about $US25bn amid the global financial crisis in 2007, troubled British lender Northern Rock, Friends Provident and Bear Stearns.

While it has considered various targets in Australia, it is yet to make a major acquisition.

Perry Williams 5.45pm: BHP, Fortescue reject heritage ban

BHP and Fortescue Metals Group have rejected shareholder demands for a moratorium on disturbing Australian cultural heritage sites in the wake of the Rio Tinto scandal, arguing that agreeing to such a move would disempower traditional owner groups and damage the economy.

The two resources giants, Rio’s chief iron ore rivals in the Pilbara, were asked by the Australasian Centre for Corporate Responsibility to adopt a moratorium on mining that would “disturb, destroy or desecrate” Australian heritage sites in a bid to avoid a repeat of Rio’s Juukan Gorge destruction.

However, both companies rejected the request ahead of their annual general meetings and said it would set a dangerous precedent.

BHP, which is due to appear on Thursday at the inquiry into Rio’s destruction of the Juukan Gorge caves, said it was particularly concerned the move would override agreements between the miner and traditional owners without their consultation or agreement.

“This has the unintended consequence of disempowering traditional owner groups to manage their cultural heritage consistent with the principle of self-determination,” BHP’s board said in an AGM notice.

“No matter how well intentioned, the board cannot recommend a vote in favour of a resolution that would have this effect. Nor can the board support a resolution that could have the effect of setting a precedent for such outcomes in the resources sector more broadly.”

4.24pm: ASX up 1pc on CSL, BHP, CBA gains

Australia’s share market rose the most in a week with positive contributions from all sectors.

The S&P/ASX 200 index closed up 61.3 points or 1pc at 5956.1 after rising as much as 1.1pc to a peak of 5958.5 in the final hour of trading.

It came after the US market rose for a third consecutive day, amid better-than-expected economic data from China and the US.

Heavyweights including CSL, BHP and CBA made the biggest positive contributions with gains of 1.5pc, 1.3pc and 0.7pc respectively.

But the banking sector underperformed for a second day running, with ANZ down 0.5pc and NAB losing 0.2pc.

Tech was the strongest sector as it was in the US, with Afterpay up 4pc and Zero up 2pc.

Seek rose a solid 9.6pc on a report that Alibaba was in talks to invest in online jobs classifieds company, Zhaopin.

The FOMC meets at 4am AEST, with investors also watching for BoE, BoJ and OPEC meetings on Thursday.

The Australian dollar was 0.14pc stronger against the US dollar trading at US73.12c by the close of the ASX session.

4.03pm: Contrarian trade still positive: BofA Survey

BofA’s Global Fund Manager Survey remains positive for global equities on a contrarian basis.

According to the survey of 199 participants managing $US601bn ($823) of assets, the BofA Global FMS Cash Rule rose to 4.8 per cent from 4.5pc. BofA says that means investors should stay long equities.

BofA’s Cash Rule says buy equities when cash is above 4.5pc and sell when cash is below 3.5pc.

Its Bull & Bear indicator remained at a “neutral” 3.9pc, whereas below 2.0 gives a buy Investors should buy global equities when it falls below 2.0 and sell when it rises above 8.0, according to BofA.

Chief investment strategist, Michael Hartnett says these indicators of fund manager positioning suggest the S&P 500 will stay in the 3300-3600 range that has held since early August, and cyclical rotation is in its infancy. Interestingly, 58pc of investors said “it’s a bull market”, up from 25pc in May.

For the first time since Feb more investors (49pc) said the global economy is in an early-cycle phase rather than recession (37pc) and a net 84pc said global growth will be higher in next 12 months.

And a record 80pc said long US Tech and growth stocks is the most “crowded trade”.

2.55pm: Rebalancing flow “problematic” for equities: JPM

A deterioration in equity market liquidity this month makes large quarter-end rebalancing flows more problematic for equity markets at a time when investors also face the risk of disappointment on monetary and fiscal policy and the risk of an indecisive election outcome, according to JPMorgan.

While the equity market rebound over the past week is consistent with the idea that the “froth” from the extreme positions of momentum traders in Nasdaq had been largely cleared by early last week, “this does not mean that is all clear for equity markets going forward”, says JPM’s head of global quantitative and derivatives strategy, Nikolaos Panigirtzoglou.

Starting with the FOMC outcome, markets are about to face three main risks over the coming weeks: policy disappointment, negative quarterly rebalancing flows and a close US election.

Mr Panigirtzoglou expects around $US200bn ($275bn) of negative rebalancing flow by entities that tend to rebalance on a quarterly basis, such as US defined benefit pension plans, the Norwegian oil fund, and the Japanese government pension plan.

“This is the most negative rebalancing flow since the virus crisis,” he says.

“In our opinion, this negative rebalancing flow becomes even more problematic given this month’s sharp decline in equity market depth.”

2.46pm: Seek jumps on Zhaopin discussions

Job classifieds company Seek has told the market that its Chinese employment platform, Zhaopin, is holding discussions with a number of parties to assess whether the introduction of new investors could better support its long-term growth aspirations.

The announcement comes on the back of media reports that suggested e-commerce giant Alibaba is looking to invest hundreds of millions of dollars in the recruitment site.

Seek shares are up 9.3 per cent at $20.90.

Elise Shaw 2.26pm: Used vehicle prices up 25%

CommSec chief economist Craig James gives us three indicators and says there are three encouraging stories: New home sales have soared over the past three months under the influence of the HomeBuilder scheme. Used vehicle prices have soared in response to higher demand and lower stock levels. Home prices continue to hold up, supported by bank lending and low interest rates.

“Up to May, Sydney and Melbourne home prices led the way higher alongside Hobart. Now Sydney and Melbourne prices are correcting and it’s the turn of Brisbane and Adelaide to drive national home prices higher. While the jobless rate has risen, interest rates are at generational lows and banks continue to lend,” James says.

The surprise packet is the used vehicle market. “Most car owners expect to see the value of their vehicles eroding over time. But in the COVID-19 era, prices for second-hand vehicles are rising. Aussies are more cautious about using public transport. As a result, people are holding on to their vehicles and more people are looking to purchase an extra vehicle. So demand is up, supply is down and prices are up. Overlaid is the fact that global vehicle production has fallen in the past six months, supporting both new and used vehicle prices. Super-low interest rates are also keeping car financing costs down.

Data analytics firm, Datium Insights, provides a weekly report on the used vehicle market. In the week to September 14, used vehicle prices rose by 3.4pc after lifting 1.6pc in the previous week.

In August, used vehicle prices were up 25pc over the year according to the Datium Insights - Moody’s Analytics Used Vehicle Price Index.

The authors of the report noted: “Demand for wholesale used vehicles was robust last month. The Datium Insights - Moody’s Analytics Used Vehicle Price Index increased 25pc on a year-ago basis in August. This is the highest rate for a series that goes back to 1999. Car prices rose 22.9pc while truck prices increased 32.1pc. Vehicle retention value, measured as price/MSRP, rose 25.2pc compared with the same month last year, with the car component increasing 21.6pc and the truck component increasing 29.4pc.”

In the latest week SUV (+3.6pc) and Light Commercials (+3.4pc) drove increases in used vehicle prices.

Datium Insights reports that the supply of vehicles fell 4.1pc over the week to September 14 and that “stock remains considerably low”.

“Investors have a raft of relatively new indicators to watch to get a sense of how individual sectors and companies are faring, as well as the broader economy,” says James. “The Reserve Bank, governments and both regional and major banks are playing key roles in supporting economic recovery. However, there is still some way to go.”

1.55pm: ASX hits 5-day high; +1.1%

The S&P/ASX 200 rose as much as 1.1pc to a 5-day high of 5957.5.

The bigger-than-expected intraday rise came as S&P 500 futures swung from -0.3pc to +0.3pc.

S&P/ASX 200 volume improved to be slightly above average for this time of day.

The mood was helped by a further 1.7pc rise in WTI crude to a 6-day high of $US38.91 after better than expected China and US economic data in the past 24 hours combined with the shut-in of 20pc of Gulf Coast oil production. And the PBoC’s strongest yuan fixing in 29 months backed the possibility of further US dollar weakness and commodity price strength.

But while the Australian dollar rose 0.3pc to 0.7321, the US dollar index was little changed, Dalian iron ore futures fell 2.1pc and copper futures rose just 0.2pc.

Still, the persistent downtrend in USD/CNH shows no sign of abating,” says AxiCorp chief global markets strategist, Stephen Innes.

“It has been a solid start to the week for equity markets with gains across the board in Asia spilling over to the rest of the world, driven by China’s economic exceptionalism, which should continue to support commodities and selective cyclical equities as well as underpin broader risk,” he says.

1.30pm: Reliance boss plugs into bonus

Reliance Worldwide chief executive Heath Sharp received a bump in his total pay packet for the 2020 financial year after he was awarded a cash bonus worth nearly $270,000.

Mr Sharp’s pay packet lifted from just over $3m in 2019 to more than $3.4m in fiscal year 2020.

Last month, the plumbing company unveiled a 5 per cent lift in net sales for the full-year but net profit after tax dropped 32.7 per cent to $89.4m.

12.55pm: Fed to seeks to offer reassurance

Armed with a new interest rate strategy, the Federal Reserve will seek to reassure the US economy rattled by the coronavirus downturn as it wraps up its policy meeting tonight (AEST).

The two-day event concludes amid a renewed push by a top lawmaker in Washington to agree on an additional spending bill to prop up the economy following a historic collapse in GDP in the second quarter and data showing a worryingly high rate of new layoffs.

The United States is home to the world’s worst coronavirus outbreak with more than 194,000 deaths, and in the pandemic’s opening days the Fed slashed its benchmark lending rate to near-zero and rolled out trillions of dollars in liquidity lines to keep markets functioning.

But the continued fiscal support that Fed officials -- including Chair Jerome Powell -- say the world’s largest economy needs to weather the downturn has yet to be approved, and with nowhere to go on interest rates, economists predict the policy-setting Federal Open Market Committee (FOMC) will rather attempt show they are doing their part.

“America’s central bank is likely to emphasise a decidedly low rate outlook for years to come to help nurse the world’s biggest economy back to health after a record contraction,” said Joe Manimbo, senior market analyst at Western Union Business Solutions, referring to the second quarter when the business shutdowns caused GDP to collapse by a record 31.7 per cent annualised.

AFP

John Durie 12.40pm: BAML lifts Woolies price target

BAML has lifted its price target for Woolworths to over $50 a share based on better-than-expected sales growth and a 10 per cent increase in earnings tipped this financial year.

Woolworths earnings fell slightly last financial year.

Comparable store sales growth of 12 per cent in the last quarter edged out rival Coles but online growth was the star, up 43 per cent in the last year to around 5.5 per cent of total sales.

BAML analyst David Errington said COVID had caused some delays for Coles, which is using UK retailer Ocado to build its online fulfilment.

Outperformance is expected in part because the peak of the COVID costs are now behind the company.

Woolworths’ costs ran at two per cent of sales against 1.5 per cent at Coles.

Errington said the retailer had also declared that it had now caught up with Coles in terms of store refurbishments and upgrades, which meant a period in which capital expenditure ran at two times depreciation compared with Coles at one times.

Chief executive Brad Banducci received no short term incentives last year due to the staff underpayment issues.

This wasn’t an issue on his potential pay because earnings went backwards.

But after spending up last year earnings will grow this year which also benefits Banducci’s pay cheque.

Jared Lynch 12.32pm: Star gets JobKeeper, pays bonuses

Casino group Star Entertainment has paid its top executives $1.4m in bonuses after it put its hand out for $130m in taxpayer cash to fund the wages of almost 7000 staff it stood down in April.

The company opted to pay out its short-term incentive payments in the form of deferred equity this year to “preserve cash” during the COVID-19 pandemic.

Chief executive Matt Bekier received $829,872 in deferred equity on top of his $1.56m base salary, taking his total remuneration to $2.36m. Three other executives shared in the remainder of the $1.4m in bonuses.

But Mr Bekier’s could have received more. He agreed to a 40 per cent pay cut, while non-executive directors took a 50 per cent cut to their fees.

Star’s remuneration committee chair Sally Pitkin said while the group did not hit its STI target, the board decided to pay STI bonuses in the form of deferred equity, which is subject to a one year retention restriction because the group was performing ahead of budget before the COVID-19 pandemic struck.

“The group did not achieve the financial gateway under the STI, however, the Board has decided to exercise its discretion to make limited equity awards under the FY20 STI,” Ms Pitkin said in the group’s annual report.

Lachlan Moffet Gray 11.52am: Super funds post positive returns

Super funds are defying the broader economic malaise and continuing to grow, with a new report from Chant West showing that funds recorded positive growth in the second month of the financial new year.

The report, which measures the comparative growth of differently classed super assets, shows that the median growth-orientated fund returned 1.7 per cent over August, bringing the total return for the 2021 financial year to 2.7 per cent.

It means that the median growth fund has recovered 9.5 per cent of the 12 per cent that was lost in February and March when the growing coronavirus crisis spooked global markets and sent the ASX 200 crashing to a yearly low of 4546 points.

Most Australians are invested in a growth orientated fund, which have a 61-80 per cent exposure to growth assets.

Chant West Senior Investment manager Mano Mohankumar said the subsequent rebound of global markets was behind the turnaround in the fortunes of growth funds, as was generally resilient portfolio construction.

“Listed share markets, which are the main drivers of growth fund performance, had a terrific month in August,” Mr Mohankumar said. “Australian shares returned 3 per cent, while international shares surged 5.8 per cent in hedged terms.

“However, the appreciation of the Australian dollar (up from US$0.72 to US$0.74) reduced that gain to 2.9 per cent unhedged terms. “

11.50am: ASX up 0.7pc on light volume

Australia’s share market has sustained most of an initial positive reaction to US market gains.

Shortly before midday the S&P/ASX 200 index was up 0.7pc at 5935 after surging 0.9pc to a four-day high of 5947.3. Tech leads, as it did overnight with Afterpay up 2.5pc, Appen up 2.8pc and Nearmap up 7.2pc.

Heavyweights including BHP, CSL and Rio Tinto are generating much of the strength with gains of more than 1pc.

Seek is up 10pc after The Information reported that Alibaba Group is in talks to invest hundreds of millions of dollars in online jobs classified company, Zhaopin.

The utilities, financials and energy sectors are in the red.

In a bad sign for the index, the major banks are markedly underperforming for a second-day.

Amid tough outlook for loan growth and bad debts, CBA is up 0.1pc, while Westpac is down 0.3pc, NAB is down 0.4pc and ANZ is down 0.8pc.

Volume is very light for a Wednesday - 21 per cent below average - suggesting the early rise was driven more by a lack of selling than strong buying.

The sideways drift since the open reflects investor caution before the outcome of the FOMC meeting at 4am AEST Thursday.

The Fed is the main event but domestic jobs data and BoJ, BoE and OPEC meetings are also due Thursday.

Stuart Condie 11.20am: Kogan.com’s marketing spend helps: RBC

Kogan.com’s reinvestment of record sales revenue into marketing is a positive indicator for future sales, RBC Capital Markets says. Kogan’s gross sales for August were more than twice those of a year earlier, and marketing costs hit a monthly record the same month. The bank views the online retailer’s decision to spend on growing customer numbers as a strength due to the high engagement rates of Kogan customers. RBC last published an outperform rating on Kogan.com with a $22.00 target price. Shares are up 4.3pc at $20.06.

11.15am: Super funds rebound continues: Chant West

Super funds have continued their bright start to the new financial year with the median growth fund with 61 to 80 per cent in growth assets up 1.7pc in August, according to Chant West.

After losing 12pc over February and March, the median growth fund has since returned an impressive 9.5pc on the back of the surprisingly sharp share market rally.

For the 2020-21 financial year to date, the median fund is up 2.7pc.

“Over the first half of September we’ve seen signs of that rally wavering along with increased volatility, which doesn’t come as a surprise given the level of economic and political uncertainty,” says Chant West senior investment research manager, Mano Mohankumar.

“However, super fund members should take comfort in that fact that they’re invested in well-diversified portfolios that have proved to be resilient in the face of external shocks.”

Over 3, 5, 7, 10 and 15 years, all Chant West risk categories have met their typical long-term return objectives, he says.

11.07am: Upgrades expected on Viva, Ampol

Morgan Stanley’s Adam Martin tells clients to expect consensus upgrades on Viva Energy and Ampol.

With retail margins in 2H20 continuing to outperform our forecasts, and with volumes likely recovering in late 2020 as Victoria comes out of lockdown, Mr Martin says the setup for 2021 “remains interesting”.

He notes that retail fuel margins of 18c/L for July, 17c/L for August and 21c/L for September “remain well above the 2019 average margin of 14c/L.

Hee sees more leverage for Viva from higher margins, since the Australian fuel package announced this week of about $60m for each refinery represents about 30pc of Viva’s FY21 net profit versus 13pc for Ampol.

And every 1c/L movement in retail margins equates to about 12pc movement in net profit for Viva versus 7pc for Ampol.

Mr Martin also notes that retail fuel margins have compensated for lower volumes in 2020.

Viva’s retail fuel gross margin rose 25pc and Ampol’s rose 16pc in the first half of 2020 year on year despite volumes falling 9pc and 16pc respectively.

Meanwhile from a demand perspective, public transport “remains stagnant and continues to be challenged”.

Viva was last up 1.6pc at $1.61. ALD last down 1.2pc at $23.23.

11.00am: NZ expects longer pandemic hit

The coronavirus pandemic will drag on growth for longer than previously forecast, New Zealand’s Treasury Department said, though the near-term hit to the economy is likely less severe than feared.

The government’s budget update, required because national elections will be held in October, forecasts economic growth to average 2.8pc a year over five years, compared with the previous forecast of 3.9pc.

“The medium-term outlook has deteriorated,” the Treasury said. The effects of the coronavirus pandemic are now expected to be more persistent and the global economic outlook has worsened, it said.

The Treasury predicts unemployment to peak at 7.8pc in the first quarter of 2022, lower than the previous forecast of a peak of 9.8pc this year, indicating that temporary government wage subsidies have prevented some job losses. But unemployment will likely remain above 7.0pc into 2023 and won’t decline below 5.0pc until 2027, the department said.

The forecasts assume New Zealand’s border remains closed throughout 2021 and the government spends $NZ58.5 billion on measures specifically in response to the pandemic.

Dow Jones Newswires

Robyn Ironside 10.54am: Homecoming passenger cap raised

Deputy Prime Minister Michael McCormack has announced an increase in the number of Australians allowed to return home from 4000 a week to 6000.

He said New South Wales, Queensland and Western Australia would each be asked to take an extra 500 returning travellers a week.

South Australia would be asked to accept an additional 360 and Mr McCormack said he also wanted to know how many travellers Tasmania, the Northern Territory and the ACT could handle.

Victoria would remain exempt due to its ongoing COVID crisis.

“We want more Australians to come home and every capital city airport has the capacity to do just that,” Mr McCormack said.

He encouraged Queensland to consider allowing some of those travellers to return and quarantine on the Gold Coast and in Cairns.

“There are plenty of empty hotel rooms in these capital cities and I want them filled with returning Australians,”

State premiers and chief ministers had been written to today, in an effort to increase the numbers of returning travellers.

An estimated 30,000 Australians currently overseas had registered their interest in returning home.

“It’s been a very difficult situation for some trying to get home and we acknowledge that,” said Mr McCormack.

10.53am: Institutions bolster Tabcorp raising

Tabcorp Holdings is turning to institutional investors to make up the shortfall of the retail leg of its capital raising.

The wagering giant raised $131.4m selling shares at $3.31 each, representing the final stage of Tabcorp’s entitlement offer.

The retail component of the entitlement offer raised gross proceeds of $230 million from the issue of 71 million new shares at an issue price of $3.25.

Together with the institutional component of the entitlement offer, which closed on August 21, Tabcorp has now raised approximately $600m.

The proceeds of the entitlement offer will be used to pay down existing drawn bank debt facilities and will strengthen Tabcorp’s balance sheet.

Bridget Carter 10.45am: DJs properties may sell for $700m

Bidders for the David Jones properties in central Sydney and Melbourne are expected to be shortlisted by the end of this week.

The understanding is that so far, the greatest interest from prospective buyers has been for the flagship Sydney store on Elizabeth Street, with offers said to be around $400m to $500m.

A challenge for any prospective buyer of the Melbourne store has been conducting due diligence, with the city being in lockdown for many weeks due to the coronavirus outbreak.

Expectations are that the entire portfolio could sell for about $700m.

However, the question is whether that will be enough to cover David Jones’ debts, said to be around $750m.

So far, among the groups that have shown interest are understood to have been Charter Hall, Shaun Bonett’s Precision Group and Scentre Group.

10.39am: Why Macquarie likes JB Hi-Fi

Macquarie analysts have flagged upside risk to JB Hi-Fi’s sales and earnings as new 5G handsets and console launches create a product buzz heading into the Christmas period.

In a note to clients this morning, the analysts upgraded their recommendation on the stock to outperform, saying there were five reasons they liked JB Hi-Fi shares:

1. Redirected travel spend they said was likely to provide a consistently higher spending base, with spending levels likely to remain elevated for the remainder of the calendar year as service consumption remains constrained;

2. New product releases are expected to support Black Friday and Christmas sales, including 5G devices and the new Xbox;

3. The company’s online sales offering had improved, with the analysts citing industry feedback which suggested online sales in Victoria were providing a “meaningful offset” to the lost sales from bricks and mortar stores;

4. They noted continual improvement in relevant store offerings, including JB Hi-Fi’s newly renovated World Square Store; and

5. The fact that JB Hi-Fi was trading 15 per cent below its PE ratio relative to industrial stocks.

10.30am: Tokyo opens lower ahead of Fed

Tokyo shares opened lower as investors shied away from major moves ahead of a Federal Reserve decision, and with Prime Minister Shinzo Abe’s successor preparing to take office.

The benchmark Nikkei 225 index fell 0.10 per cent, or 23.73 points, to 23,431.16 while the broader Topix index lost 0.18 per cent, or 2.91 points, to 1,637.93.

Dow Jones

10.20am: ASX opens higher after US tech-led gains

Australia’s S&P/ASX share index rose 0.9pc to a 4-day high of 5947.3, matching expectations based on futures after Wall Street rose for a third day running.

As was the case on Wall Street, the tech sector led gains with Afterpay and Appen up more than 3pc in early trading.

The heavyweight materials sector was the biggest contributor to strength, with BHP up 1.6pc and Rio Tinto up 2pc despite a fall in iron ore prices.

Banks were underperforming for a second day running, with NAB down 0.4pc.

Seek surged 9pc after The Information reported that Alibaba Group is in talks to invest hundreds of millions of dollars in online jobs classified company, Zhaopin.

S&P 500 futures are down 0.2pc, potentially trimming gains in Australian shares.

10.15am: ByteDance to keep majority TikTok stake

China’s ByteDance would retain a majority ownership stake in its TikTok app unit as part of a proposal being reviewed by national-security regulators, with an eye toward settling the high-profile deal by a deadline Sunday, according to a person familiar with the situation.

The proposal includes Oracle Corp.’s bid to become TikTok’s U.S. technology partner as part of an effort to address the administration’s national-security concerns surrounding the Chinese-owned video-sharing app.

The Committee on Foreign Investment in the U.S., which includes officials from the Treasury, State, Commerce and other departments, reviewed the deal late Tuesday afternoon but didn’t make a recommendation, according to an official familiar with the matter.

The deal would make Oracle the U.S. technology partner of TikTok, while allowing TikTok’s parent company, Beijing-based ByteDance Ltd., to retain a majority ownership stake, according to the person familiar with the deal. TikTok’s global business would also become a company based in the U.S. that will remain a unit of ByteDance, the person said, adding that Oracle would take a minority stake in that company.

President Trump told reporters at the White House earlier Tuesday that his administration would make a decision on the pending deal “pretty soon,” adding that he has “high respect” for Oracle Chairman Larry Ellison.

Dow Jones

10.07am: Lithium market ‘bottoming’

The lithium and battery metals worm continues to turn ahead of potential catalysts from Tesla’s Battery Day next week.

Canaccord’s Reg Spencer notes that lithium prices have continued to fall year to date with the impact of COVID-19 on downstream demand exacerbating high inventory levels and continued market surpluses. Sustained low prices have resulted in significant cuts and delays to planned capacity additions, and he sees the market entering a “bottoming phase” with a recovery in pricing “possible” in 2021.

While he remains wary of “the potential for some false starts in the near term”, Mr Spencer says a slowly improving outlook for prices should see some positive sentiment return to lithium equities.

He keeps his positive medium-to-longer term view, with preferences for companies with lower cost operations, likes Orocobre and Galaxy Metals.

Mr Spencer upgrades Pilbara Minerals to Hold and boosts his price target for the company 75pc to $0.35.

He also lifts his target for Galaxy 15pc to $1.50.

9.55am: What’s impressing analysts?

JB Hi-Fi raised to Outperform: Macquarie

CBA price target lowered 6pc to $73.50: Bell Potter

Challenger raised to Outperform: Credit Suisse

Citadel Group cut to Hold: Bell Potter

Laserbond started at Buy; $0.90 price target: Canaccord

Lendlease resumed at Equal-Weight: Morgan Stanley

Pilbara Minerals raised to Hold: Canaccord

9.34am: Kogan enjoys customer boom

Kogan.com grew its active customer base by 152,000 through August to more than 2.46 million, in what was the biggest monthly increase in the company’s history.

In a market update this morning, Kogan.com said its gross profit grew by more than 165 per cent year on year, while gross sales lifted more than 117 per cent.

The company said it would provide a further business update at its annual general meeting in November.

9.30am: Facebook facing antitrust challenge to power

The US Federal Trade Commission is preparing a possible antitrust lawsuit against Facebook that it could file by the end of the year, according to people familiar with the matter, in a case that would challenge the company’s dominant position in social media.

The case preparations come after the FTC has spent more than a year investigating concerns that Facebook has been using its powerful market position to stifle competition, part of a broader effort by US antitrust authorities to examine the conduct of a handful of dominant tech companies.

No final decision has been made on whether to sue Facebook, people familiar with the matter said, and the commission doesn’t always bring cases even when it is making preparations to do so, such as when it decided against filing an antitrust complaint against Google in 2013 after a lengthy investigation.

Facebook is still in the process of making its case to the commission, even as the probe has been progressing into its late stages, and recent efforts by FTC staff have included taking testimony from CEO Mark Zuckerberg, something the commission didn’t do during a prior probe of the company’s privacy practices. That matter resulted in a record-breaking $5 billion settlement.

Dow Jones

Robyn Ironside 9.28am: Changes possible on flight caps

Deputy Prime Minister Michael McCormack will deliver an update on international flight caps on Wednesday after weeks of pressure from airlines and Australians stuck overseas to allow more people to come home.

Currently no more than 4000 people a week are permitted to arrive in the country and go into mandatory hotel quarantine for a fortnight in Sydney, Brisbane, Adelaide and Perth.

The caps have seen airlines limit seats to only first class travellers paying as much as $15,000 for a fare.

In the first week of September 140 flights from overseas landed in Australia with the capacity to carry 30,000 people.

But the caps meant only 4000 seats were filled despite 23,000 Australians registering their interest with the Department of Foreign Affairs and Trade to return home.

Last week Qatar Airways CEO Akbar Al Baker questioned why the government was not filling three, four and five-star hotels with returning travellers based on what they were willing to pay for quarantine.

And on Tuesday Melbourne Airport CEO Lyell Strambi said it was time to allow overseas arrivals to again quarantine in the city, under the supervision of the Department of Corrections.

9.25am: ASX bounce may disappoint

A third-straight day of gains on Wall Street is expected to boost Australia’s share market.

However it may disappoint before key events including the outcome of the FOMC meeting.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open up 0.9pc at a 4-day high of 5948. That follows a 0.5pc rise in the S&P 500 and a 1.2pc gain in the Nasdaq following stronger than expected US economic data.

But while Tech led gains with the NYFANG+ index up 2.6pc, Financials, Energy, Consumer Staples, Industrials and Health Care underperformed.

Citi fell 6.9pc on risk management regulatory concerns, while JPM fell 3.1pc on a lower full-year net interest income forecast. Caterpillar fell 3.2pc as July sales disappointed.

Moreover, the S&P 500 and Nasdaq now face resistance from the top of their recent consolidation band, while a lack of new fiscal or monetary stimulus, month-end rebalancing needs and a tight election race give downside risks. US stock index futures are down slightly.

BHP ADR’s suggest the resources heavyweight will open up 1.1pc at $37.92 but while WTI crude rose 2.7pc to $US38.28 as Hurricane Sally forced about 20pc of oil production to be shut down in the Gulf Coast, spot iron ore fell 1.5pc to $128.55.

A new 3.5pc low for the S&P/ASX 200 Banks index yesterday was a bad sign for the overall market, particularly since the money wasn’t switched to resources.

As well as the FOMC outcome at 4am Thursday, the BoJ, BoE and OPEC are due to meet and Australia’s August jobs data are due.

8.50am: QBE ponders UK insurance ruling

QBE is considering its next move after the British High Court ruled in favour of the insurance company on two of three coronavirus policy wordings.

In a statement to the market this morning, QBE said was considering options to appeal a third decision, where the court ruled in favour of the insureds.

The insurer said that based on the claims affected by the UK Financial Conduct Authority test case, it estimates its UK business interruption claims exposure is around $170m before recoveries under its catastrophe reinsurance protections.

The UK Financial Conduct Authority undertook a test case to resolve issues around the interpretation of business interruption policy wordings, looking at whether they responded to COVID-19 and related government mandated nationwide lockdowns.

8.06am: State Street hit over reporting breach

US-owned investment management giant State Street Bank and Trust Company has been fined $1.24m by AUSTRAC for failing to report international funds transfers.

The anti-money laundering regulator said it has reasonable grounds to believe that State Street contravened a designated infringement notice provision under the Anti-Money Laundering and Counter-Terrorism Financing Act.

AUSTRAC alleges that the US bank contravened the act 99 times prior to July 2020.

Under section 45 of the Act, registered financial institutions including banks and credit unions must report such transactions within 10 business days of sending or receiving the instruction.

The financial crime agency says it is working with State Street to address compliance issues with its reporting systems and controls.

State Street is the world’s largest custodian bank.

Commonwealth Bank paid a $700m penalty in 2018 for breaches of the same laws.

David Ross 8.02am: Gas vital for emissions: Liveris

The architect of the federal government’s gas plan, former Dow Chemical chief Andrew Liveris, says gas is integral to ensuring a low or no emissions future and to allow Australia to meet its Paris targets.

“We do have to have a future of net-zero and a future that minimises carbon. We need a transition in an affordable way,” he said.

“You can’t get 100pc of renewables at a reliable price.”

Mr Liveris, speaking on Radio National, said Australia had significant amounts of gas it wasn’t bringing to market and switching over to gas from coal could see emissions intensity cut by 40 per cent.

“Our consumers are paying higher prices than they are in Tokyo, that’s a travesty,” he said.

“The transition pathway has to be technology and fact-based not emotion-based, we’ve got to tip the carbon out of the air you’ve got to get it out of the smokestacks.”

He said criticism of the government’s plan as interventionist misunderstood the role of the state in creating markets.

“Governments function when they create frameworks and rules to allow markets to function, You don’t have a travel business without airports,” he said.

“You’ve got to create the framework to create the mechanism for markets to form, we have failed to create that mechanism until yesterday.”

Mr Liveris will speak further on the plan at the National Press Club today.

David Ross 7.30am: Gas plan to ‘create confusion’

Atlassian co-CEO and co-founder Mike Cannon-Brookes says Scott Morrison’s gas plan would only go to further distorting the energy market and goes against expert advice.

He said the suggestion the government would finance gas and energy projects if the market failed to act would only reinforce inaction.

Most people who were going to do something are going to sit aside saying I’m going to wait for the government,” Mr Cannon-Brookes said.

“If you want to create market confusion that’s the best way to do it.”

“This intervention will drive up energy prices for consumers. It will lock in that gas plant for another 40 years. This is not the cheapest long term plan for our grid at all.”

Mr Cannon-Brookes’ remarks come after he yesterday said he would consider developing an option to replace the ageing Liddel coal-fired power station in NSW.

The software billionaire has already worked on several energy projects including a major battery storage plant in South Australia.

“Parts of this bundle are good, the extra transmission will bring on far more renewables to our grid in a stable and sensitive way,” he said.

“We need to be clear about what we are trying to solve, I don’t think the solution is gas.”

“The chief scientist has been very clear we need to keep the existing gas generation we have running for their lives.

“He is absolutely against any new gas extraction as being incompatible with our Paris emission goals.”

6.20am: ASX to open higher

Australian stocks are tipped for a stronger start after gains on Wall Street, where the rally in tech shares continued.

Around 6am (AEST) the SPI futures index was up 44 points, or 0.7 per cent.

Yesterday, the S&P/ASX 200 share index slipped 0.1pc to 5894.80 in quiet trading by the close of trading, while the Aussie dollar was stronger after the release of RBA minutes

The Australian dollar was higher at US73.04.

Brent oil was up 2.3 per cent at $US40.53 a barrel, and spot iron ore was down 1.5 per cent to $US128.55.

6.10am: US stocks rise as tech rally extends

US stocks closed higher as technology shares recouped some of their recent losses.

The S&P 500 added 0.5 per cent, and the tech-heavy Nasdaq Composite climbed 1.2 per cent as of the close of trading. The Dow Jones Industrial Average hovered around the flatline at 27994.42.

The S&P and Nasdaq built on gains from Monday after sustaining big losses earlier in the month. Investors endured volatile trading sessions as the big tech stocks pulling the market steadily higher suddenly pulled back. Those stocks appear to have stabilised in recent sessions.

Tech shares climbed, extending the previous day’s rally.

Looking ahead, investors face uncertainties about the spread of the coronavirus, efforts to produce a vaccine, the pace of economic recovery and the outcome of the coming US elections. But many analysts believe stocks have room to rise.

“Right now, it looks to us like the economy’s going to be improving. They’re keeping interest rates low. And so it’s still a favourable environment for stocks, especially growth companies,” said Tom Plumb, president and portfolio manager at Plumb Funds.

A wave of multibillion-dollar deals emerging earlier this week from well-known tech companies have helped boost stock benchmarks, underscoring the outsize role of giant firms in US equity markets.

“There’s been exuberance in the tech sector and valuations are high, but M&A means some people think there’s still some assets that aren’t overvalued, they may actually be undervalued,” said Ludovic Subran, chief economist at Allianz. “M&A can be perceived as a sign of undervaluation” and some people will be buying.

Earlier, key economic statistics showed that China’s economic recovery accelerated in August. Retail sales in the Asian nation returned to pre-coronavirus levels with their first month of growth this year. Other major indicators, including factory production, investment and property activity, all gathered pace, signalling a strong rebound for the world’s second-largest economy.

The Shanghai Composite Index closed up 0.5 per cent, and Hong Kong’s Hang Seng index rose 0.4 per cent.

In Europe, the pan-continental Stoxx Europe 600 rose 0.7 per cent from an anticipated boost in Chinese demand for European goods.

Dow Jones Newswires

5.55am: US probes Nikola over mislead claims

The Justice Department has joined U.S. securities regulators in examining allegations that electric-truck start-up Nikola Corp. misled investors by making exaggerated claims about its technology, according to people familiar with the matter.

The Justice Department’s inquiry is being handled by the Manhattan U.S. attorney’s office, working in concert with the Securities and Exchange Commission, which has initiated its own examination of the claims about Nikola, the people said.

Specifically, federal prosecutors are probing allegations that Nikola, a maker of electric and hydrogen-powered semi-trucks that listed publicly in June, misrepresented progress it made in developing key technology core to releasing new models, the people said.

Dow Jones

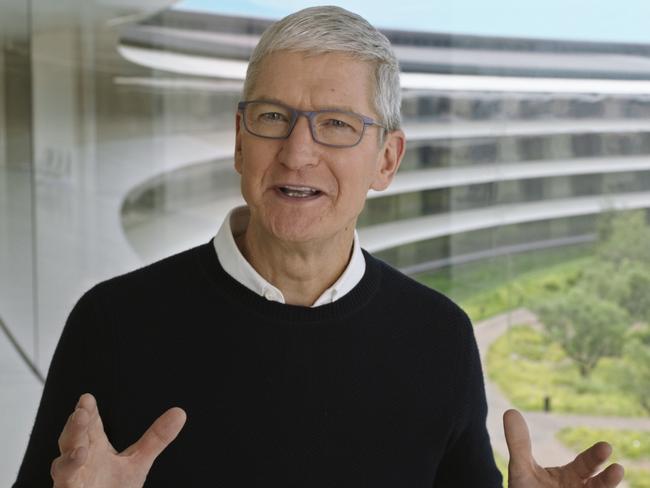

5.47am: Apple unveils new watch, iPad

Apple showed off its latest smartwatch with faster computing power and an ability to measure blood oxygen as well as updated iPads as interest rises in such devices among homebound users looking for help tracking exercise and logging hours of remote work and learning.

Instead of Chief Executive Tim Cook unveiling the company’s latest flagship iPhone as he has done every September since 2012, Apple showed its Watch Series 6, starting at $US399, and a new mid-tier offering called Watch SE, with fewer abilities than the high-end version and starting at $US279.

The company also revealed an updated iPad Air, starting at $US599, with a new touch-ID button on the side that unlocks the screen and faster computing power.

The latest smartphone is expected to be revealed next month after COVID-19-related delays pushed back production.

Analysts such as Thomas Husson from Forrester Research Inc. say not having to tout the iPhone will let Apple showcase products that might get less attention in a normal year. “I think it will highlight the fact that this is an ecosystem of devices,” he said. “They all fit together.”

Illustrating how Apple is working to expand further into digital services, the company announced a streaming fitness service called Fitness+. The $US9.99-a-month service is connected to the company’s watch, aiming to help users track and improve their performance. Fitness+ also offers virtual workout classes with videos on the iPhone or television.

The company also detailed a new bundling of digital subscriptions dubbed Apple One as it works to bolster its software business beyond the iPhone, which makes up about 50pc of sales. The new bundle starts at $US14.95 a month and includes Apple Music, TV, Arcade and iCloud storage.

Dow Jones

5.44am: Oil prices rise

Oil prices rose, clawing back some of their losses from recent weeks, with US hurricane season limiting supply from the Gulf of Mexico.

U.S. crude futures rose 2.7pc to $US38.28 a barrel, paring some of this month’s losses that have dragged oil down from its highest level since early March in the low $US40s a barrel. Prices started the year above $US60, then briefly tumbled below $0 in April with the coronavirus eroding demand. Brent crude, the global gauge of prices, advanced 2.3pc to $US40.53 a barrel.

The International Energy Agency said precautionary shut-ins prompted by Hurricane Laura cut U.S. supply by 400,000 barrels a day in August. Meanwhile, it now expects global oil demand to contract in the last three months of the year by 5 million barrels a day -- some 600,000 barrels a day deeper than forecast last month.

Dow Jones

5.40am: Kraft sells cheese brands to Lactalis

French dairy company Lactalis reached a deal to acquire several leading cheese brands from US food giant Kraft Heinz for $US3.2 billion, the companies announced.

Lactalis, which sells cheese under the President brand, will acquire several Kraft brands in the United States, including Cracker Barrel, Breakstone’s, Polly-O and Athenos.

The two companies will also partner to develop the license for some products under the Kraft and Velveeta brands. But Kraft will retain Philadelphia Cream Cheese and Velveeta Processed Cheese, among other products, it said in a press release.

AFP

5.38am: Virus cost global tourism $US460bn to June

The coronavirus crisis cost the global tourism sector $US460 billion in lost revenue during the first six months of 2020 as the number of people travelling plunged, the UN said.

Revenue lost between January and June amounted to “around five times the loss in international tourism receipts recorded in 2009 amid the global economic and financial crisis,” the Madrid-based World Tourism Organization said in a statement.

International tourist arrivals fell by 440 million during the period, or 65 per cent, with Asia, the first region to feel the impact of COVID-19, seeing the steepest decline, it added.

“This represents an unprecedented decrease, as countries around the world closed their borders and introduced travel restrictions in response to the pandemic,” the Tourism Organization said.

AFP

5.35am: US Fed begins meeting

The Federal Reserve’s rate-setting committee began meeting, a central bank spokeswoman said, while a top lawmaker signalled a new push to get stimulus for the battered US economy through Congress.

Talks between Democrats and Republicans in Washington on a new bill to aid both workers and businesses hit by the coronavirus downturn have stalled for weeks, even as central bank officials including Fed Chair Jerome Powell repeatedly emphasised that the economy needs more support.

The Fed cut its lending rate to near-zero as the devastating business shutdowns to stop the virus’s spread began in March, and there is practically no chance of that changing as the Federal Open Market Committee (FOMC) begins its two-day meeting.

Analysts are instead watching for further details on the bank’s new inflation targeting strategy, which will keep interest rates lower for longer in a bid to maximise employment, or perhaps comments from Powell on the outlook for the economic recovery.

AFP

5.30am: European markets advance

Positive economic data from Europe prodded the continent’s stock markets higher, while momentum from Monday’s vaccine optimism and big-name deal making kept Wall Street buoyant.

Lower-than-feared British unemployment, at 4.1 per cent in the second quarter, and German investor confidence at a level last seen in May 2000 both brightened investors’ moods in Europe.

London’s FTSE 100 closed up 1.3 per cent, the Frankfurt DAX 30 gained 0.2 per cent and France’s CAC 40 added 0.3 per cent.

The upward moves in Europe were driven both by “data and following yesterday’s solid US advance,” Charles Schwab analysts commented.

But “the risk of a ‘no-deal’ Brexit and the potential economic harm that accompanies it increased” after the British government’s move to tear up parts of a hard-fought Brexit deal signed with Brussels early this year, in a re-run of past disagreements over Northern Ireland.

Legislation putting the move into effect passed its first reading in parliament Monday night.

Upbeat Chinese figures on retail sales and industrial output had earlier driven Asian stock markets higher.

The euro fell against both the dollar and sterling, which continued its recovery after diving last week on Brexit woes.

Meanwhile financial players can expect further support from the US central bank tomorrow.

“The Fed will be unable to be optimistic about the recovery until they see how the economy performs when the second wave of the coronavirus hits,” paving the way for policymakers to keep economic stimulus in place, Moya said.

Fed chief Jerome Powell “will likely reiterate the need for Congress to do more” to support the US economy, he added, with President Donald Trump’s son-in-law and senior adviser Jared Kushner saying any new fiscal package may have to wait until after the November 3 presidential election.

AFP

5.28am: US sees lukewarm industrial production

US industrial production continued to recover from the COVID-19 downturn in August but its pace was slowed by bad weather and a pullback in car manufacturing, the Federal Reserve said.

Production rose 0.4 per cent last month, well below the 3.5 per cent gain seen in July and 7.3 per cent below its level in February, before the pandemic, the Fed said.

Hurricane Laura and Tropical Storm Marco brought temporary shutdowns to oil and gas production in the southern United States, causing mining production to fall 2.5 per cent in the month.

Durable and non-durable manufacturing saw slowing growth compared to July, with motor vehicles and parts declining 3.7 per cent. All told, industrial production was 7.7 per cent lower than August 2019, while capacity rose 0.3 points to 71.4 per cent, slightly below expectations.

Manufacturing has been clawing back ground lost when business shutdowns to stop the spread of coronavirus began in mid-March, which saw industrial production sink by 12.9 per cent in April before returning to positive territory in the months since.

“The rebound continues, but at a slowing pace,” Ian Shepherdson of Pantheon Macroeconomic said.

AFP

5.25am: WTO faults US over China tariffs

The World Trade Organisation upheld a complaint by China over additional duties slapped by the Trump administration on some $US250 billion worth of Chinese goods, sparking outrage in Washington.

A panel of experts set up by WTO’s Dispute Settlement Body ruled the tariffs “inconsistent” with global trade rules, and recommended that the United States “bring its measures into conformity with its obligations”.

US Trade Representative Robert Lighthizer slammed the decision, saying it proved the WTO, which has long faced searing US criticism, “is completely inadequate to stop China’s harmful technology practices.”

“The Trump Administration will not let China use the WTO to take advantage of American workers, businesses, farmers, and ranchers,” he said in a statement.

Chinese state media Global Times meanwhile hailed the ruling and said in a tweet it hoped the US would respect it and “take pragmatic actions to meet China and other WTO members halfway to enable a stable and healthy development of the global economy.”

The panel was created in January last year to review US President Donald Trump’s decision to hit China with tariffs on a quarter of a trillion dollars’ worth of goods.

The tariffs imposed in 2018 marked the beginning of the trade war between the world’s two largest economies.

Tuesday’s announcement marks one of the first in a series of anticipated panel rulings over complaints filed by a long line of countries over Trump’s decision to slap them with steep tariffs on steel and aluminium imports.

AFP

5.20am: Klarna tops $US10bn in valuation

Swedish payment solutions provider Klarna said it had raised $US650 million (547 million euros) in a funding round, putting the estimated value of the company past $US10 billion for the first time.

Launched in 2005, Klarna now offers an app which provides consumers with an easy platform to shop with retailers, automatically giving them four months to pay for purchases and offering plenty of promotions.

Klarna also offers businesses online payment solutions for their proper sites, handling both credit card payments and invoices.

Klarna’s app has more than 12 million monthly users worldwide and the firm says it has over 200,000 retail partners.

According the company, the new “post money valuation of $US10.65 billion” means Klarna is the highest valued fintech firm in Europe, and fourth worldwide.

Currently operating in 17 countries, the company employs some 3500 people.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout