ASX gives up 8-day high as uncertainty looms

Shares bounced from daily lows but a late blow from a pause in Melbourne elective surgery added to weakness in health shares.

- Second jobless wave looms: ANZ

- Jobless rate lifts to 7.4pc

- Visy buys O-I in $1bn deal

- Helloworld raising $50m

That’s all from the Trading Day blog for Thursday, July 16. In a yoyo session for shares, the benchmark hit 8-day highs early but finished down 0.69pc after weakness in tech and health stocks.

Locally, ABS data showed unemployment of 7.4pc, the highest since 1998, while Chinese GDP data surprised to the upside.

8.50pm Charlie Peel Excavation begins on Adani Carmichael mine

A year after the approval of the Carmichael mine, Adani has started digging towards a seam expected to yield up to 10 million tonnes of thermal coal a year.

Excavation of the open cut mine in the Galilee Basin in central Queensland began late last week with the removal of rock above the coal deposit.

Adani says the first coal from the $2bn mine, approved in June last year, will be exported in 2021 through its port at Abbot Point, north of Bowen in the Whitsunday region.

The construction milestone comes after the surprise resignation last week of chief executive Lucas Dow, who has been replaced by former BHP executive David Boshoff.

In a statement on Thursday, Mr Boshoff announced the digging of the mine pit and said the company was “on track” to meet its export target. “It’s great to see our big new gear, the Liebherr R 996B excavator and CAT 796 dump trucks, hard at work,” he said.

“In time, they will reach the coal seam then we will be excavating coal as we need to remove around four cubic metres of rock for every tonne of coal we mine.”

8.30pm China data surprises on the upside

China has become the first major economy to return to growth since the coronavirus started sweeping across the world.

On Thursday, China said its economy grew 3.2 per cent from a year earlier in the second quarter as authorities benefited from an aggressive campaign to eradicate the virus within its borders.

In sequential terms, China’s second-quarter growth in GDP represented a 11.5 per cent rebound from the first three months of the year, according to data released by Beijing’s National Bureau of Statistics. For the first six months of the year, China’s economy contracted just 1.6 per cent compared with the first half of 2019.

The growth figure for the second quarter beat a median estimate from economists for 2.6 per cent growth and was at the top end of an unusually wide range of forecasts, from a contraction of 3.1 per cent to growth of 3.5 per cent. It followed a historic 6.8 per cent contraction in the first three months of the year, when Beijing shut down the country in late January as the coronavirus spread across China from the central city of Wuhan.

“The national economy overcame the adverse impact of the epidemic in the first half gradually and demonstrated a momentum of restorative growth and gradual recovery,” the statistics bureau reported.

The second-quarter recovery followed a string of data points that suggested China’s economy had turned a corner. Manufacturing surveys have shown a steady recovery in sentiment over the past three months. And China said this week that exports and imports had returned to growth in June for the first time since the outbreak.

The Wall Street Journal

7.59pm David Swan Telstra’s price hikes under attack

Telstra has come under fire for increasing its mobile plan prices at a time when Australian families are doing it tough because of the COVID-19 pandemic.

Earlier this month, Australia’s biggest telco lifted prices on all of its plans by between $5 and $15 a month, a move it said was because of the company’s extra investment in 5G networks.

Telstra’s new plans mean a customer will have to spend a minimum of $65 a month to access 5G services, up from $50.

The telco said customers would get more data under the revamped offerings, but Telsyte analyst Foad Fadaghi questioned whether consumers really needed more mobile data, given so many people were staying at home during the pandemic.

He said customers often wanted to spend less, not more, particularly during a pandemic.

“With economic headwinds, some consumers will be looking to consolidate their spend if their data caps are starting to far exceed their regular or irregular usage,” he said. “Telsyte research shows although data usage is growing, data allowances are growing much faster. The average data utilisation rate in a given month … was 30 per cent in 2019, down from 41 per cent in 2018 and 50 per cent in 2017.”

7.32pm Perry Williams Woodside on LNG spot weakness

Woodside Petroleum has highlighted the weakness of the LNG spot market after revealing it sold nearly half of its LNG in the June quarter at a price nearly two-thirds less than the amount received for its contracted gas sales.

Analysts expressed surprise on Wednesday after Woodside said second quarter LNG prices for volumes produced by facilities including Pluto and the North West Shelf fell steeply to $US5 per million BTU from $US8.10 per million BTU in the previous three months.

Woodside said the 38 per cent price fall was due to customers taking less on a contracted basis, forcing it to sell more in the weak spot market which is suffering from over-supply and tepid demand.

Nearly half or 46 per cent of Woodside’s LNG was sold at an average spot price of just $US2.6mbtu compared with 13 per cent sold on the spot market in the first quarter, Woodside said after market close Thursday.

That contrasts with the remaining 54 per cent offloaded on a contracted basis at an average price of $US7mbtu, accounting for 76 per cent of its LNG revenue in the three month period.

The high percentage of spot sales was influenced by “challenging market conditions” with five LNG cargoes not wanted by contracted buyers while an extra three cargoes were produced as its plants ran at full capacity with supplies placed with casual buyers.

Some contracted buyers may have given little warning of their plans to Woodside, Citi noted, when they invoked an industry clause known as downward quantity tolerances or DQT where buyers can trim agreed tonnes without paying extra charges.

“We understand customers generally exercised DQT, meaning a larger amount of Woodside’s LNG book was sold into a very soft market. Further, some DQT can be exercised days before a cargo is lifted, leaving Woodside little time to place volume into spot,” Citi analyst James Byrne said.

Woodside fell 1.43 per cent to $20.66.

7.10pm Lisa Allen, Ben Wilmot i-Prosperity goes into voluntary administration

One of the most active investors in the Australian hotel industry with around $1bn worth of deals in play, both locally and in the US, entered voluntary administration on Thursday night.

The move is a major blow to the struggling hotel investment sector given Michael Gu’s i-Prosperity Pty Ltd group, a major financial advisory firm for Asian investors, was one of the sector’s largest and most active investors.

It controls the five-star Pullman on the Park near the Melbourne Cricket Ground as well as a major development site at 333 Kent Street, Sydney, according to its website.

Thirteen entities associated with the i-Prosperity Group, which bills itself as a funds management and investment group, have been caught up in the voluntary administration including i-Prosperity Pty Ltd, i-Prosperity Group Holdings and Cornerstone Capital Investment Group.

“Our urgent focus is on stabilising the i-Prosperity Group and commencing a full and thorough investigation into its affairs, including certain court proceedings that remain on foot,” said voluntary administrator and Cor Cordis Partner Barry Wight in a statement on Thursday night.

“It remains too early to determine whether a viable restructure plan can be developed, but we look forward to working closely with the i-Prosperity Group’s stakeholders over the coming weeks,” Mr Wight said.

6.59pm Nick Evans, Ben Packham Barrick Gold ramps rhetoric over Porgera

Barrick Gold boss Mark Bristow has ramped up the company’s rhetoric over the loss of its Porgera gold mine in Papua New Guinea, blasting Prime Minister James Marape refusal to renew its lease in a letter delivered ahead of the company’s decision to restrict power supplies to communities around the mine.

The PNG government refused to renew the mining licence at Porgera in April, putting in doubt the future of the multi-billion dollar mine, owned jointly by Barrick and China’s Zijin Mining.

Barrick has challenged the decision in the PNG courts, and last week flagged taking the dispute to the World Bank’s International Centre for Settlement of Investment Disputes – where it last year won a $US5.8bn ruling against Pakistan’s government after a protracted dispute over control of the Reko Diq copper deposit.

On Thursday, the PNG company that operates the mine said the lack of revenue from the mine meant it would be forced to restrict local power supplies, formerly delivered free to local communities, to 12 hours of supply a day. The company said it would “do its utmost” to maintain 24 hour power to the local hospital.

In a letter sent on Wednesday, seen by The Australian, the Barrick boss described Mr Marape’s decision to strip Barrick and partner Zijin Mining of the rights to Porgera as precisely the opposite of a ‘legitimate government process’, and told the PNG Prime Minister the action in the World Bank’s ICSID would damage the country’s international reputation if it did not negotiate a settlement.

In the letter, Mr Bristow referenced a heated text exchange between Mr Marape and Ilua Temu, executive director of the joint venture, saying he was “stunned” at Mr Marape’s apparent lack of concern over the future of Porgera.

6.43pm: Samantha Bailey Medibank fined $5m over rejected claims

The Federal Court has ordered Medibank Private to pay $5m in penalties for denying claims that customers were covered for.

The health insurer’s fully owned ahm Health Insurance business incorrectly rejected at least 1396 enquiries or claims for joint investigations or reconstruction procedures on ahm “lite” or “boost” policies.

“Medibank’s false statements to consumers were a serious breach of our consumer law,” ACCC chairman Rod Sims said.

6.27pm: Jared Lynch Call centre scrips speed up tracing

Three US states, including Florida, are using cloud technology from a Melbourne company as part of their tracing efforts to combat COVID-19 as the number of new American infections soars to an average of 62,000 a day.

But Panviva’s platform, which uses call centre scripts to eliminate the need for extensive training and equips tracers with the necessary information to identify the sources of infections, is yet to be introduced in Australia as Victoria and NSW scramble with a fresh spike.

The need to roll out tracing quickly is rising, with Victorian health authorities yet to identify the source of 790 COVID-19 cases, including 458 in the fortnight to Wednesday.

Panviva chief executive Ted Gannan said the company aggregated the essential information that tracers needed to know when interviewing people infected with COVID-19, enabling them to swiftly identify other contacts.

The company provides call centre software for Westpac, ANZ, Medibank, Foxtel and Telstra as well as other bluechip companies and recently pivoted to COVID-19 tracing in the US.

6.00pm: Lisa Allen Helloworld shuts stores, raises capital

The grim spectre of at least two years worth of international travel restrictions, coupled with substantially reduced cash flows, has prompted about 5 per cent of Helloworld’s 2500 retail travel agents across Australia and New Zealand to close as the company announced a fully underwritten $50m equity raising on Thursday.

Helloworld Travel chief executive and managing director Andrew Burnes said the prolonged travel restrictions into at least 2021, coupled with total transaction values reduced to about 10 per cent of normal levels, had prompted the decision to raise equity.

“We do not anticipate a return to significant air capacity and travel until the first or second quarters of the 2022 financial year,” Helloworld told the ASX.

5.28pm: Jared Lynch Recce Pharma shares surge

Shares in Recce Pharma have surged more than 26 per cent after a US-based respiratory treatment company selected two of its drugs to help combat COVID-19 infections.

The two drugs, Recce 327 and Recce 539 are the same compounds that the CSIRO is also studying as part of its coronavirus fight.

US-based Path BioAnalytics will study those compounds as part of its research into SARS-CoV-2, the virus which causes the COVID infection. Preliminary data is expected in September and Recce will retain all intellectual property rights.

Recce 327 is a broad-spectrum synthetic antibiotic used to treat blood infections and sepsis, while Recce 529 is a synthetic polymer formulation to treat infections. Following the news of the US partnership on Thursday afternoon, Recce shares jumped 24 per cent to $1.42, against a broader sharemarket drop of 0.95 per cent.

“The current pandemic underscores the need for more effective treatment approaches to prevent infectious diseases,” Recce chairman John Prendergast said.

Recce shares jumped 26.6 per cent to $1.45 by the close, against a broader sharemarket drop of 0.7 per cent.

4.39pm: Breville, Zip lead decliners

A rally in appliance maker Breville yesterday was swiftly reversed today, the stock topping the list of the worst performers by the close.

It comes as consumer discretionary stocks slipped by 0.7pc, joining the broader sell-off as only industrials and communications stocks held on to gains.

Buy now, pay later player Zip also felt the brunt of selling – down for a third consecutive session with a 9.6pc loss to $5.94.

Here’s the biggest movers at the close:

4.12pm: Health drag hits ASX

Shares bounced from daily lows in the closing match, but still finished lower for the day as health care and tech stocks took a hit.

Despite strong offshore leads and a lift to 8-day highs early, the benchmark ASX200 finished the session lower by 42 points or 0.69 per cent to 6010.9.

Weakness in the major miners weighed on the index, but a late blow from the pause on elective surgery in Melbourne dealt the final blow to health stocks.

CSL fell 2.1pc, as Ramsay reversed by 0.6pc and Fisher and Paykel lost 3.3pc.

Rachel Baxendale 4.02pm: Melbourne elective surgery paused

The Andrews government has moved to pause all Category Three elective surgery in Metropolitan Melbourne, as hospitals grapple with rising numbers of COVID-19 patients and quarantined healthcare workers.

Health Minister Jenny Mikakos said the move was aimed at ensuring sufficient spare beds and workforce capacity, amid 2128 known active coronavirus cases – 1686 more than a fortnight ago.

More urgent elective surgery will also be reduced to no more than 50 per cent of usual activity across all public hospitals and 75 per cent in private hospitals, enabling private hospitals to continue to take on public category one (emergency) and urgent category two surgery.

There will be no changes to elective surgery in regional Victoria.

Ramsay Health last traded up 0.6pc to $63.23.

Follow the latest at our live blog

3.44pm: Offshore investors rush for $17bn bond

The government’s $17bn bond issued earlier this week had a “huge step up in offshore participation”, according to Westpac.

Crunching the numbers on the issuance, head of rates strategy Damien McColough notes an offshore allocation of 45.2pc – “even striking across the entire suite of previous syndications”.

“It shows that despite historically low yields, Australia continues to provide a high yielding, highly rated opportunity for the global investor.”

Asian demand accounted for 28pc of the issue, while domestic demand was 55pc.

“We think the syndication was a good result and provides further confidence in the market’s ability to absorb large supply.”

Bridget Carter 3.32pm: BWX raising oversubscribed

DataRoom | Beauty products provider BWX has closed the book for its $40m equity raising through Macquarie Capital and Bell Potter after receiving strong demand.

A book message sent to investors said: “Demand for the placement substantially exceeds the available stock”.

The timing for the book to be closed was brought forward to 2.30pm, investors were told.

Shares were sold at $3.40 each, a 7.10 per cent discount to the last traded share price of $3.66.

Net proceeds of the Offer will be used to fund the construction of a new manufacturing facility and support office, provide funding for growth, enhance financial flexibility and strengthen the Issuer’s balance sheet.

Bridget Carter 3.31pm: Crescent hires BofA for pathology sale

DataRoom | Crescent Capital has hired Bank of America as it officially places its Australian Clinical Labs business up for sale.

It comes after the private equity firm was in negotiations to sell the operation to Healius last year. However, while talks occurred between both groups, a transaction never happened.

ACL comprises Healthscope’s former pathology assets and also the operations formerly owned by St John of God and Perth Pathology and is set to sell for a price worth hundreds of millions of dollars.

Among parties that may take a look are BGH Capital, while Healius may once again cast its eye over the operation.

Sonic Healthcare – a dominant industry player – is expected to be precluded from being involved in a transaction due to competition concerns.

3.24pm: Lockdown to trim Telstra earnings: GS

Goldman Sachs has cut its earnings forecasts for Telstra given the lockdown in Melbourne, but notes the stock is still a Buy given the ultra-low rate environment.

Analysts let by Kane Hannan revise Telstra’s earnings lower by 3pc for FY21, reflecting ongoing travel restrictions, extended Melbourne support measures and further delays in redundancies in its productivity program.

They forecast FY21 earnings to decline 4pc to $7.14bn, before a 6pc recovering to $7.55bn.

“In an uncertain, low-rate environment, we see telco infrastructure as highly attractive,” Mr Hannan says, adding its estimates for Telstra’s InfraCo valuation were around $38bn or 14x FY23 earnings.

TLS last traded flat at $3.47.

Samantha Bailey 3.08pm: Medibank fined $5m for false statements

The Federal Court has ordered Medibank Private to pay $5m in penalties for denying claims that customers were in fact covered for.

The health insurer incorrectly rejected at least 1,396 inquiries or claims for joint investigations or joint reconstruction procedures on ahm “lite” or “boost” policies.

“Medibank’s false statements to consumers were a serious breach of our consumer law,” ACCC Chair Rod Sims said.

“These representations were made for more than five years in many cases, and affected hundreds of customers who were denied the cover they were entitled to under their existing Medibank policies for joint procedures that they required.

“Some Medibank policy holders incurred extra out of pocket expenses for major medical procedures, some delayed having these joint procedures and managed their pain, while others ‘upgraded’ their Medibank policies at an additional cost when they didn’t have to.”

Medibank reported the conduct to the consumer watchdog in August 2018 and has since notified about 130,000 current and former policy holders, inviting them to make a complaint or seek compensation.

The company has now paid more than $775,000 in compensation to 175 affected members, including some who unnecessarily upgraded their policies.

MPL shares last down 1.7pc to $2.93.

Perry Williams 2.53pm: Third of Aussie LNG exports delayed

More than a third of Australian LNG exports in June suffered delays being shipped to buyers in Asia amid a supply glut and low prices while export revenues plunged by nearly a quarter last month, consultancy EnergyQuest said.

Some 33 of the 85 gas export cargoes from Australia were delayed with ships either remaining at port or going round in circles before reaching their destination compared with 41 delayed cargoes in May.

LNG export revenue fell 23 per cent to $2.87bn in June from $3.74bn in May with income down 17 per cent on the same period a year ago.

“The decrease in revenue is a result of the lower export volumes seen during June and a lower lagged oil price,” EnergyQuest said. “Revenues are now showing signs of the falling oil price.”

Woodside Petroleum revealed on Wednesday the price of LNG produced by facilities including Pluto and the North West Shelf fell to $US5 per million BTU, from $US8.10 per million BTU in the first quarter as it was forced to sell more supplies on the weaker spot market as buyers limited volumes taken on a contract basis.

Rocky territory for a swag of Australia’s top commodities including LNG over the short-term will ultimately cut earnings over the next two years, estimates from the federal government’s commodity forecaster show.

Australia’s LNG revenues are set to plummet by 26 per cent to $34.9bn in 2020-21 from $47.4bn this year as the biggest oil crash in a generation flows through to contract prices for the fossil fuel.

LNG, which typically has a three month lag before reflecting changes to crude prices, is trading at record low prices on Asian spot market and large Australian producers are expected to be forced into cuts when buyers re-open negotiations or contracts come up for renewal.

Government forecasters had previously predicted LNG exports would fall to $44bn in 2020-21 from $49bn in the current financial year, although the estimates were made before the worst of the crude slump and a global economic slowdown from the health pandemic.

Read more: Woodside to delay Scarborough, Browse

2.30pm: Rebound in hours worked encouraging

With issues around the definition of unemployment clouding the headline figures, NAB notes that today’s lift in hours worked is a positive for hopes of a recovery.

Hours worked across the labour market rose by 4pc, but are still down “a very sizeable” 6.8pc from pre-virus levels in March.

Markets economist Kaixin Owyong notes that the data shows a two-thirds recovery from the 10pc drop-off.

“This reflects both the rise in employment and a fall in the number of people who had been stood down; 62,000 fewer people worked zero hours in June,” she notes.

“Alongside the bounce in jobs, these data are an encouraging signs that the labour market rebounded solidly once the virus was contained and restrictions were eased and should be able to do so again.”

Read more: End of early super worries retailers

1.59pm: Second jobless wave looms: ANZ

ANZ economists have warned of further weakness to come in the nation’s employment data, warning the hit could spread wider than just the lockdowns metro Melbourne.

Senior economist Catherine Birch attributes Australia’s “effective management of the first wave” as helping to fuel a rebound in employment, but notes the reversal to come from Stage 3 restrictions in Melbourne.

“Metropolitan Melbourne and Mitchell Shire together account for an estimated 21pc of national employment, so the new lockdown will set the labour market recovery back in Q3,” she writes.

“While Melbourne workers will feel the worst of it, regional Victoria will also be affected, and the nationwide recovery is likely be slower, as consumer and business confidence is undermined, demand is more fragile and businesses more cautious about hiring.”

AUDUSD last down 0.24pc to US69.90c.

Australia’s #unemployment rate rose to 7.4% in June (highest since 1998), despite the increase in employment, as #participation jumped to 64.0%. But many who have lost work since March remain outside the labour force and aren’t counted as unemployed. #ausecon @cfbirch pic.twitter.com/He9xKk1cwD

— ANZ_Research (@ANZ_Research) July 16, 2020

1.45pm: Signs of early, modest jobs recovery

June jobs data shows signs of an early and modest recovery, according to RBC, though it warns today’s release is more backward looking than usual with Victoria’s lockdown postdating the survey.

Chief economist Su-Lin Ong writes that details in the data were consistent with the opening up of the economy, with the movement of people in the workforce has shifted to more people entering for the first time in a few months, especially those in the 15 to 24 year old age bracket.

“While the worst is likely behind us in terms of job shedding, recouping jobs lost will be a long process, especially if growth is modest as we anticipate,” she says.

“The leading indicators of employment suggest that momentum has already eased and the Victorian developments will add to that. We remain with our base case for a further rise in the unemployment rate to 8-8.5pc by year end with only modest progress in 2021 with the unemployment rate likely to still be around 7pc by year end.”

Read more: Australia’s jobless rate lifts to 7.4pc

Eli Greenblat 1.22pm: Beacon rallies as light demand runs hot

Shares in lighting retailer Beacon Lighting rose almost 10 per cent after it said it was expecting strong sales and profit growth of 38.5 per cent for the year thanks to a boom in online sales.

In a trading update to the market, Beacon said based on the unaudited sales result during fiscal 2020 it would book sales of around $252m, representing sales growth of roughly 2.6 per cent. Sales growth is forecast at 7.2 per cent and online sales growth of 50.6 per cent.

Beacon said it was set to record a net profit of around $22m, reflecting profit growth of circa 38.5 per cent.

“Despite the disruptive times over the second half the group has been able to achieve outstanding results,” chief executive Glen Robinson said.

“These results would not have been possible if it was not for our adaptable and resilient team at Beacon Lighting and the continued support of our valued customers.

BLX shares last up 7.8pc to $1.11.

1.14pm: Part-time job lift signals recovery: JPM

While the headline jobless figure for June was higher than expected, JP Morgan global market strategist Kerry Craig notes that the lift in jobs created is encouraging.

He notes that the 210,000 jobs gained was almost entirely driven by an increase in part time employment.

“Full time jobs declined in the same period. This isn’t usually an optimal mix however it does reflect an economy getting back on its feet as employers start to re-employ back part-time staff,” Mr Craig says.

“The number of jobs gained was decent, but so too was the rise in the participation rate. As the lockdown ended in many states, workers have re-entered the labour force as they seek jobs, pushing the unemployment rate higher.”

Improvement in the underemployment and under-utilisation rate was also cause for optimism, but the unemployment rate will get worse before it gets better, he added, noting a likely increase the data as the participation rate increases.

Read more: Australia’s jobless rate lifts to 7.4pc

1.02pm: Mining pullback dents rally

Local shares have given up all of an early 0.4pc jump to trade down by 0.7pc at lunch, as tech and health stocks tumble.

Despite hope early that shares could hit five-week highs, the benchmark has succumbed to negativity, down 41 points or 0.67pc to 6012.2 at lunch.

Heavyweight miners BHP and Rio Tinto are doing a lot of the damage – down around 1.2pc – alongside a turn lower in the major banks.

Hope of a vaccine is lifting travel-related names including a 2.2pc jump in Qantas and 1pc lift in Flight Centre.

Here’s the biggest movers at lunch:

12.38pm: China demand still weak: Innes

While China’s headline GDP figure for the June quarter was positive, AxiCorp’s Stephen Innes warns the demand side weakness is still worrying.

China reported industrial production growth of 4.8pc year-on-year, but retail sales were weak with a 1.8pc drop.

“Second quarter data shows that it’s easier for China to normalise the supply side of the economy with industrial production, than the demand side with retail sales after the COVID-19 shock,” he writes.

“No matter how much stimulus and fiscal sugar you try to entice consumers with, they will not leave their apartment and go on a spending spree until they feel confident the landscape is virus-free.”

AUDUSD last down 0.3pc to US69.86c.

12.33pm: UBS trims overweight rating on banks

UBS quantitative analyst Pieter Stoltz has trimmed his Overweight stance on banks the broker’s model Australian share portfolio.

“We think equities are likely to be supported by further positive economic data releases in Q3 but see downside risk for equities in Q4 due to a potential fiscal cliff,” he says.

“Therefore, in this update we remain overweight cyclical sectors, including Discretionary Retail, General Industrials and Banks, but are watching the sign posts outlined in the link above for when to rotate toward more defensive positioning.

“Overall, ultra-low rates mean we are tilting towards Growth – High PE – over Value – Low PE – while still being overweight cyclicals.”

Mr Stoltz added CSR and APA Group while taking a negative stance on ASX given earnings headwinds that it sees building in FY21.

The big four banks are all trading in the green at midday.

12.08pm: Perpetual clocks $400m in outflows

Investors seem to have to have given up on Perpetual at exactly the wrong time.

Australia’s biggest hedge fund reported fourth quarter outflows of $400m, even as funds under management (FUM) rose 33pc to $28.4m, although some of that was due to the Trillium acquisition, which is now 20pc of FUM.

FUM excluding Trillium rose 1.4bn to $22.8bn in June, mainly due to mark-to-market adjustments as equity markets recovered some of their Market quarter gains.

Unrealised gains on financial assets for the quarter were $7.7m compared to the $6.6m unrealised losses reported in the March quarter, giving $0.9m of unrealised FY gains.

As part of cost cutting started in April, effective July 1 the Perpetual Chairman and CEO have agreed to a 20pc reduction in fees/base salary for a six-month period.

Perpetual’s Board and Executive team have agreed to a 10pc reduction in fees/base salary for a six-month period. There will also be no cash bonus in FY20 for the Group Executive team.

PPT last traded up 2.8pc to $31.81.

12.02pm: China GDP rises 3.2pc

China’s economic growth for the June quarter beat expectations, rising by 3.2pc versus consensus of 2.2pc, according to the latest release.

Year-to-date GDP is down by 1.6pc, up from a -6.8pc read last quarter.

The Chinese commerce department also reported a 4.8pc jump in industrial production for June, versus the same time last year, paring year-to-date losses to -1.3pc.

The lift seems to be supporting the ASX, with shares fighting to flat at noon.

BREAKING: China's GDP grows 3.2% in the second quarter, defying a global slump https://t.co/rVZjol9eAk pic.twitter.com/xwLi4cA5Mz

— Bloomberg Next China (@next_china) July 16, 2020

11.52am: Ausbil lifts bank exposure

Ausbil’s Paul Xiradis has given a ringing endorsement of Australian bank shares.

“If you are optimistic about Australian and New Zealand economic recovery, and we are, you have to be comfortable with the banks,” he says.

He notes that banks are provisioning for an economy with far higher unemployment, more negative economic growth and a slower recovery than has been evident, but still predicts “the depths of the downturn are not going to be anywhere near as bad as initially expected”.

“The recovery is not going to take as long as was expected. If this remains the case, it is a fantastic opportunity for investors to reweight back into the banks.”

He reveals that Ausbil increased its exposure to banks through the COVID-19 selldown, and is now the most overweight on the sector that it has been for a number of years.

“This is on the basis that we think earnings will exceed expectations, bad and doubtful debts may not be nearly as bad as the market has been pricing, and if that is the case, they have strong balance sheets, and banks will return to paying an ongoing sustainable dividend, albeit at a lower payout ratio,” he adds.

“All of a sudden, the banks have become a pretty attractive proposition, and the market is still underweight, so the set up is for the banks to trade up as we move into the second half of 2020.”

Patrick Commins 11.33am: Jobless rate lifts to 7.4pc

Australia’s unemployment rate lifted to 7.4 per cent in June, from 7.1 per cent in the prior month, official labour force statistics show.

That’s greater than the 7.3pc expected by economists.

Employment jumped by 210,800 in the month, representing only a fraction of the 835,000 plunge in the number of employed over April and May as measures taken to suppress the spread of COVID-19 forced the closure of large segments of the economy. But the lift was greater than consensus of a 100,000 increase.

Interestingly, all the jobs were part time, whereas full time jobs fell 38,100 according to the ABS.

The Australian Bureau of Statistics seasonally adjusted figures showed the workforce participation rate climbed 1.3 percentage points to 64 per cent in June, after dropping by 3.1 percentage points across April and May.

A larger pool of those working or looking for work explained the lift in the jobless rate despite the boost to employment.

AUD/USD slipped from 0.7008 to 0.6990 after the data were released.

Read more: Jobless rate lifts to 7.4pc

ABS Aust jobs data for June: +211k, > expected & recouping 24% of the jobs lost to May.

— Shane Oliver (@ShaneOliverAMP) July 16, 2020

But participation also rose as people who had given up looking for work came back into the workforce (partly as the looking for work requirement returned for JobSeeker) pushing unemp to 7.4% pic.twitter.com/EndaTYmdI0

Bridget Carter 11.11am: Melb Airport seeking McGrath Nicol advice

DataRoom | Melbourne Airport has emerged as the airport that has been seeking advice from McGrath Nicol to handle the impact from the COVID-19 disruptions.

It comes after DataRoom reported on Thursday that the insolvency firm was working with either the Sydney or Melbourne Airport.

Melbourne Airport is owned by AMP Capital, IFM, Deutsche, The Future Fund and Morrison & Co and is considered to have a very conservative capital structure with enough reserves to withstand another 12 months of COVID-19-related challenges, say sources.

An airport spokesperson said that McGrath Nicol provided the airport with discrete advice on certain issues from time to time, but it was not related to the solvency of the airport or its operations.

Airports have been seeking assistance in recent months on negotiating with lenders, as the return of a large air traffic volume looks increasingly slim in the short term with a second major COVID-19 community outbreak in Victoria and also signs of the virus in southwest Sydney.

McGrath Nicol is also likely to be offering advice on how to handle the collapse of Virgin Australia, which is soon to be bought by private equity firm Bain Capital. At least one of the airports is an unsecured creditor.

11.09am: Dollar, shares sink as COVID cases jump

A soaring coronavirus case count in Victoria and now NSW is hitting the Australian dollar and shares.

AUD/USD fell 0.2pc to an intraday low of 0.6993 and the ASX200 fell 0.2pc to an intraday low of 6037.6 after early gains.

As well as news of more than 300 new cases of COVID-19 cases in Victoria, NSW reported 10 new cases in the past day.

Also weighing on the market risk appetite today is a 0.4pc fall in S&P 500 futures.

Read more: High alert over young Crossroads pubgoer

Samantha Bailey 10.56am: Helloworld flags provisions as it raises $50m

Travel agency chain Helloworld is raising $50m as it flags impairments from COVID-19 to come in its full-year results next month.

The company said it expected total transaction values to remain at around 10 per cent of previous levels until September, and then progressively increase as state borders reopen and a potential trans-Tasman bubble opens.

Still, Helloworld said it was “well placed” to capitalise on the disruption of the global travel industry and that it expected to continue to gain market share and drive cost efficiencies after the closure of its Manila and Mumbai offices, as well as the divestment its US wholesale operation.

Helloworld also said it would continue to support its travel agents and brokers through what it said was a challenging period, including by suspending all franchisee and marketing fees.

The fully underwritten equity raising is comprised of a $27.1m institutional placement and a $22.9m entitlement offer, hoped to provide liquidity to help the company manage travel restrictions, expected to persist into 2021.

The raise will result in the issue of 30.303 million new fully paid ordinary shares in Helloworld, representing approximately 24.3 per cent of existing shares on issue.

Shares are offered at $1.65 per share – a 16pc discount to their last close price of $1.97.

10.48am: ASX gives back gains

Shares have reversed early strength, pulling into the red in the first hour as miners and tech stocks drop.

The benchmark ASX200 hit an 8-day high early, but is now lower by 6 points or 0.1pc to 6046.6.

Weakness in the major miners is doing a lot of the damage – along with a 0.5pc slip in CSL.

Perry Williams 10.34am: Iberdrola waives 50pc acceptance clause

Spanish bidder Iberdrola has dropped a minimum 50.1 per cent acceptance condition for its $856m Infigen Energy takeover offer.

Iberdrola is in pole position after boosting its cash bid to 89c a share and receiving FIRB approval but has only secured 24 per cent of Infigen’s register with its offer to date.

Its bid was made unconditional on Thursday with the minimum acceptance condition waived, meaning Infigen shareholders will receive cash within five business days if they sell out.

Rival suitor UAC Energy had previously topped up its bid to 86c a share.

Infigen recommended shareholders accept Iberdrola’s offer in a statement to the ASX on Thursday.

Iberdrola’s initial 86c bid was recommended by Infigen’s board on June 17 after the two companies held talks over the last year, spoiling an existing $777m offer from UAC lobbed on June 3. It boosted its offer to 89c after UAC matched the 86c bid.

The Spanish-listed utility, the largest wind power producer in the world, has told The Australian it would look to replicate its global integrated strategy in Australia, suggesting it may target a bigger chunk of the electricity market should its Infigen deal prove successful.

IFN last traded down 0.5pc at 92c.

Read more: Spanish push for bigger slice of Australia’s power pie

Bridget Carter 10.20am: BWX raising $40m

DataRoom | Beauty brand owner BWX is raising $40m through Macquarie Capital and Bell Potter.

Shares are being sold at $3.40 each, a 7.10 per cent discount to the last traded share price of $3.66.

Net proceeds of the Offer will be used to fund the construction of a new manufacturing facility and support office, provide funding for growth, enhance financial flexibility and strengthen the Issuer’s balance sheet.

10.12am: Miners trim ASX gains

Shares are edging higher early, though much more subdued than the 1pc jump that had been anticipated by overnight futures.

At the open, the benchmark ASX200 is higher by 25 points or 0.4 per cent to 6078, an eight day high for the market.

Consumer staples and health care are the key detractors, while tech pushes higher and banks outperform.

Commonwealth Bank is up 0.7pc, NAB by 1pc, Westpac higher by 0.8pc and ANZ by 1pc.

Vaccine hopes boosted a number of stocks hurt most by COVID-19, with Flight Centre up 5pc, Webjet up 4.7pc and Qantas up 3pc.

Also in that group, Domain rose 2pc, Premier Investments rose 2.7pc at Super Retail rose 2.4pc.

Samantha Bailey 10.02am: Lockdowns need a better system: Business Council

Business Council of Australia chief executive Jennifer Westacott has warned of serious economic consequences if Australia doesn’t get better at managing COVID-19 lockdowns.

“We are in for a long-haul,” she told Fran Kelly on ABC’s RN Breakfast this morning.

“We have to get a better system for managing these lockdowns so that the community knows the rules, business knows the rules, and we can try and make sure that we can open up as much of the economy as we can.

“We’ve got to try and make sure this suppression strategy works effectively.”

Her comments come after the government announced a $2.5bn “JobTrainer” package this morning, to save apprentices and re-skill young workers who have lost their jobs as a result of the coronavirus crisis.

“I haven’t seen all the detail yet but this is exactly, and you and I have talked about this quite a few times, this is exactly what we’ve been calling for,” Ms Westacott said.

Read more: PM’s rescue package for young workers

9.48am: ASX headed to five-week high

Australia’s share market is set for five-week highs after offshore markets surged on vaccine hopes despite worsening coronavirus news.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open up 1pc at a 5-week high of 6113.4.

The S&P 500 closed up 0.9pc at 3226.6 after hitting 3238.3 intraday – the highest since Feb 25 – and briefly turning positive year to date.

Industrials, Energy, Financials, Materials and Health Care stocks led gains while Utilities, Consumer Staples, Communications, Consumer Discretionary, Real Estate and IT underperformed.

In Europe, the Euro Stoxx 50 rose 1.7pc and the FTSE1000 gained 1.8pc with biotech AstraZeneca surging after the Telegraph said an Oxford-AstraZeneca vaccine made antibodies and T-cells with no major side effects.

Crude oil helped the Energy sector with WTI up 2.3pc to $41.20 as US inventories fell the most since December, even though OPEC+ confirmed its intention to taper supply cuts in August.

President Trump ruled out additional sanctions on top Chinese officials for now as he doesn’t want to further escalate tensions with Beijing. But US Secretary of State Pompeo later said the US will impose visa restrictions on some employees of Huawei over the Chinese Communist Party’s human rights abuses, including against Muslims and other minorities.

Locally, the NSW government is moving towards a further tightening of COVID-19 restrictions for at-risk businesses, a pre-emptive measure designed to quell infection rates in the community and limit future outbreaks.

Today sees the release of domestic employment data for June at 11.30am with the market expecting a 7.3pc jobless rate and a 100,000 rise in jobs.

China releases 2Q GDP and monthly economic activity data for June at 1200pm

9.32am: French exec joins CSL board

French biotech executive Pascal Soriot has been tapped for the board of CSL, set to join from next month.

Mr Soriot is the current chief executive of AstraZeneca, a British-Swedish multinational headquartered in Cambridge which has been described as one of the frontrunners in the worldwide hunt for a COVID-19 vaccine.

“His deep experience in both established and emerging markets complements CSL’s global footprint and the values he has displayed in leading AstraZeneca will support CSL’s values and purpose to deliver for patients,” chairman Brian McNamee said.

Before joining AstraZeneca in 2012, Mr Soriot was chief operating officer of Roche’s pharmaceutical division.

9.27am: What’s on the broker radar?

- Capricorn Metals cut to Hold – Canaccord

- Iluka cut to Hold – Morningstar

- Origin Energy cut to Hold – Morgans

- Paradigm Biopharma cut to Speculative Hold – Bell Potter

- Regis Resources cut to Hold – Canaccord

- Sandfire Resources cut to Hold – Morningstar

- Saracen Minerals cut to Hold – Canaccord

- Southern Cross cut to Neutral – Macquarie

- Whispir cut to Hold – Ord Minnett

- Whitehaven raised to Buy – Shaw and Partners

- Woodside cut to Neutral – Citi

Bridget Carter 9.13am: Helloworld raising $50m

DataRoom | Helloworld is raising $50m of equity through Ord Minnett.

Shares are being sold at $1.65 each, a 16 per cent discount to the last closing price.

The travel group will raise $27m through a placement and $23m through an entitlement offer to create balance sheet flexibility amid an uncertain trading environment.

More to come

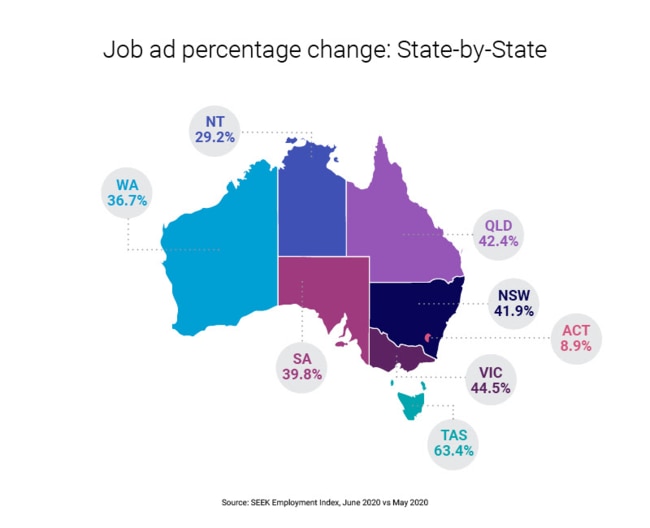

9.10am: Hospitality, tradies driving rebound: Seek

A lift in job vacancies for hospitality workers and tradies is supporting a rebound in the labour market, according to the latest Seek survey.

Job ads on the site rose by 41.5pc in June from the previous month, with the greatest contributor an 80pc jump in hospitality and tourism jobs, followed by a 51pc lift in trades and services.

The new lockdown in Victoria is set to weigh on the state’s job prospects however, warned managing director Kendra Banks.

“June employment data showed positive job ad growth for all states and territories. New South Wales job ad volumes were up 41.9pc in June when compared to May, and we saw more opportunities for jobseekers in the Sydney metropolitan area and surrounding regions than we have seen for some time.

“While June was the second month of continuous month-on-month job ad growth for the nation, the recent restrictions in Victoria have meant that we’re seeing job ad volumes begin to slow in the state.”

Eli Greenblat 8.49am: Michael Hill digital sales treble

Jewellery retailer Michael Hill is riding a wave of booming online sales during the coronavirus pandemic, with its digital sales for the fourth quarter up 193 per cent to new highs.

In a trading update issued Thursday morning, the jewellery chain said it had experienced a robust return to trade in the quarter as its stores began a staggered reopening with like for like store sales down 4.1 per cent for the period against the same time last year.

But much like other retailers, Michael Hill has witnessed a massive leap in the performance of its online sales as consumers stay home, or are forced to stay home, and shun going to crowded shopping centres in the wake of COVID-19.

The trading update reported that its flagship Australian arm had posted an 8.1 per cent fall in sales for the quarter, New Zealand sales were down 10.9 per cent and sales in Canada up 38.1 per cent as store closures, reopenings and online traffic produced a volatile revenue performance.

John Stensholt 8.20am: Visy in $1bn deal

Billionaire Anthony Pratt’s paper manufacturing and recycling giant Visy will pay almost $1bn to acquire the Australian and New Zealand glass making business of Owens Illinois (O-I).

The deal, which is expected to be completed by the end of July, is one of the biggest manufacturing acquisitions by a locally owned business in Australian business history.

O-I is the largest manufacturer of glass bottles and containers in Australia and New Zealand with factories in Sydney, Melbourne, Brisbane, Adelaide and Auckland.

Visy – which is owned by Mr Pratt and his two sisters Heloise Waislitz and Fiona Geminder – is already one of the world’s largest privately owned recycling and packaging companies.

Visy will employ 7200 people in Australia and New Zealand post the acquisition.

7.40am: American Airlines may stand down 25,000

American Airlines shares dipped 2pc in after-hours trading after it sent notices to 25,000 workers – about one-fifth of its workforce – about potential furloughs as the airline copes with what it calls slackening demand for air travel during the pandemic.

American, which is prohibited from slashing jobs or pay rates through to September 30 under terms of $US25 billion in federal payroll support, also urged employees to take buyout and early retirement packages before being forced to cut their jobs.

The airline, which reported an 80pc plunge in June revenue, says it will be overstaffed by 20,000 when federal aid expires on October 1.

Earlier this month, United Airlines Holdings warned its workers it could furlough 36,000 of them and likely move to lay-offs in August, the Wall Street Journal reported. United had 96,000 employees as of December.

Dow Jones

7.38am: Gates, Bezos Twitter ‘hacked’

The Twitter accounts of billionaires Bill Gates, Jeff Bezos and Elon Musk and technology companies including Apple and Uber Technologies appear to have been hacked, the latest instance in which users with millions of followers have been compromised on the social- media platform.

The accounts of Mr Musk, Mr Gates, Mr Bezos, Apple and others posted similar messages requesting money be sent to their cryptocurrency accounts. The messages received thousands of likes before they were taken down.

The accounts of the bitcoin and Ripple cryptocurrencies posted similar messages, along with popular cryptocurrency exchanges like Coinbase.

The breach is the latest in a series of security failures that Twitter has experienced in recent years. Last August, Twitter’s chief executive Jack Dorsey’s personal account was compromised and used to send erratic and racist tweets.

In 2017, a number of prominent accounts were hacked and used to convey pro-Turkish messages. Representatives for Twitter didn’t immediately respond to requests for comment.

Dow Jones Newswires

7.20am: Michael Hill in ‘robust’ return

Jeweller Michael Hill says it has emerged “leaner and stronger” after shutdowns forced by the coronavirus pandemic.

In a quarterly trading result, the ASX and NZ-listed jeweller said same-store sales were down 4.1 per cent compared to the prior year.

As stores closed and staff were stood down before a staggered reopening, online sales boomed, rising 193 per cent.

Fourth quarter margins were up 200 bps against prior year, to deliver flat profit dollars for the quarter on an adjusted same-store sales basis.

Adjusted same-stores sales for the full year were up by 2.7 per cent.

“Michael Hill has emerged from the pause in store trading as a leaner, stronger and more focused business,” said Michael Hill CEO Daniel Bracken.

Eleven “underperforming” stores were permanently closed during the quarter – seven of them in Australia.

6.50am: Alcoa reports falling demand

Alcoa Corp said customers pulled back on so-called value-added aluminium products during the second quarter versus the first as the COVID-19 pandemic crimped economies around the world.

As a result, during the latest quarter, the company shifted to producing lower-priced, commodity grade ingot, Alcoa said.

The aluminium maker reported a loss of $US197 million, or $US1.06 a share, narrower than its loss of $US402 million, or $US2.17 a share, for the second quarter last year.

Following adjustments, the company reported a loss of 2 cents a share, compared with a loss of 1 cent a share on that metric a year ago.

Last week, Alcoa predicted adjusted earnings on a per-share basis would range from break-even to loss of 8 cents.

Revenue fell to $US2.15 billion for the quarter from $US2.71 billion the year earlier.

Alcoa’s joint venture partner in Australia, Alcan, said last week it was facing a $1bn tax battle.

6.20am: ASX tipped for higher start

Australian stocks are set to open higher after gains on Wall Street fuelled by signs of progress on a coronavirus vaccine and some better-than-expected earnings results.

Shortly after 6am (AEST), the SPI futures was up 21 points. or 0.3 per cent.

On Wednesday, Australian stocks rallied 1.9pc to a two-week high amid COVID-19 vaccine optimism and a jump in the price of iron ore.

The Australian dollar has broken through the US70c mark, and at about 6am (AEST) was at US70.04c, up from US69.95c at 4pm yesterday.

6.10am: Promising vaccine study lifts Wall St

The Dow Jones Industrial Average logged a fourth straight day of gains after investors got several doses of good news.

Signs of progress toward a coronavirus vaccine by Moderna propelled most corners of the stock market higher. Goldman Sachs Group added to the advance after reporting one of its best quarters by revenue ever. Apple won a key court case in Europe, and economic figures on industrial production surprised to the upside.

That all pushed the blue-chip index up 0.9 per cent and the S&P 500 rose 0.9 per cent. The Nasdaq Composite advanced 0.6 per cent following a series of swings in technology stocks.

Most of the gains followed the release of a new study suggesting Moderna had reached a breakthrough with its coronavirus vaccine, setting the stage for a larger trial at the end of this month. Cruise-ship operators, airliners and other stocks sensitive to the coronavirus crisis mostly led the stock market higher. Shares of Moderna rose 6.9 per cent.

“Every time we get some sort of positive news on the vaccine front, then understandably markets benefit from that,” said Paul Jackson, head of asset-allocation research at Invesco. “The way it’s looking at the moment, it really looks as though a vaccine is the only hope. This thing is not going away.”

Some better-than-expected earnings results also boosted stock prices. Goldman Sachs shocked Wall Street by reporting a $US2.4 billion profit last quarter, more than double the expectation of forecasters and bucking the lacklustre results revealed by JPMorgan Chase, Citigroup and other banks. US Bancorp also topped expectations for the last quarter.

Apple had contributed to the session’s earlier gains after the tech giant won a major legal battle with the European Union. The bloc’s second-highest court sided with the U.S. company over a EUR13 billion ($US14.8 billion) tax bill that EU antitrust officials had said the U.S. company owed to Ireland. Shares rose 0.7 per cent.

Overseas, the Stoxx Europe 600 rose 1.8 per cent, with gains for airline and cruise-line stocks. China’s Shanghai Composite Index fell 1.6 per cent and Hong Kong’s Hang Seng closed largely flat after President Trump authorised sanctions targeting Chinese officials who crack down on the rights of Hong Kong.

Dow Jones Newswires

5.45am: Countries ‘waking up’ to Huawei

A growing number of countries are recognising the threat to data privacy from using mobile technology from the Chinese giant Huawei, and are likely to shun the company when building out their 5G networks, the top US security Adviser said.

“Each country is going to make their decisions for their own country, but I think there’s a growing recognition everywhere that Huawei is a problem,” National Security Adviser Robert O’Brien told journalists in Paris.

His comments came after three days of talks with counterparts from France, Italy, Germany, the Netherlands and Britain, which surprised many on Tuesday by banning Huawei entirely from its 5G rollout.

“Europe is awakening to the threat of China,” O’Brien said, citing the country’s aggressive moves against Hong Kong as well as India in recent weeks as Western nations grapple with the coronavirus pandemic.

Despite months of US pressure, other European nations have only imposed limits on using Huawei equipment for 5G or declined to do so, in part over fears of angering a major economic power.

Washington believes Huawei gear could give Chinese authorities a back door into networks that would allow it not only to spy on government secrets but also sweep up vast amounts of personal data.

Australia has banned Huawei from its 5G rollout.

AFP

5.40: Fiat, PSA name merged company

Fiat Chrysler and Peugeot Citroen said they had agreed to call the group formed by their mega-merger “Stellantis”.

The tie-up, which was announced at the end of October and is to be finalised early next year, will create the world’s fourth-largest automaker.

In a joint statement, the two automakers said naming the future company was “a major step as they move towards the completion of their 50:50 merger”.

The name is rooted “in the Latin verb ‘stello’ meaning ‘to brighten with stars’”, according to the statement.

“It draws inspiration from this new and ambitious alignment of storeyed automotive brands,” it said.

The next step would be the unveiling of a logo for Stellantis.

AFP

5.35am: Markets boosted by vaccine hopes

Global stock markets got a shot in the arm from hopes for a coronavirus vaccine, with the outlook for more US financial stimulus adding to the brighter mood.

Optimism was sparked by US biotech firm Moderna saying the final stage of human trials for a COVID-19 vaccine would start at the end of the month, after a report said first stage tests had been a success.

The news follows an announcement from Pfizer and BioNTech that two of four candidates for treatment had received “Fast Track” designation from US officials.

“It goes without saying that a vaccine will be the gamechanger in the pandemic, the thing that will allow life to return to normal and businesses and households to thrive once again,” said Craig Erlam, analyst at the Oanda trading group.

“So it’s hardly surprising that investors get a little excited when the results of these trials emerge, even those in the early stages.”

European markets were as much as two per cent higher at the close, outperforming the Dow on Wall Street which had retreated from opening gains by the late New York morning.

London and Frankfurt both gained 1.8 per cent, while Paris rose 2.0 per cent.

Providing added support were signs that the US might add to its stimulus after reports said top Republicans were reconsidering their opposition to it.

Trillions of dollars pledged by the US and other governments and central banks around the world have been a key driver of the rally in stock markets from their March lows – but one that is weighing on the US currency.

Strong US industrial output numbers released shortly before the New York opening bell added to the better mood on trading floors.

On the corporate front, Apple shares rose after a European court handed the company a big win against the EU Commission, cancelling an order for Apple to repay Ireland 13 billion euros ($US15 billion) in back taxes.

Goldman Sachs shares were up after the bank beat earnings forecasts, a day after JP Morgan also outperformed expectations.

Oil prices rose, defying doubts about OPEC’s willingness to maintain all its recent production cuts for much longer.

AFP

5.32am: Walmart to require face masks

Walmart announced that it would require shoppers to wear face masks, joining an increasing number of businesses in mandating the protection amid the latest spike in US coronavirus cases.

The world’s biggest retailer, which had previously encouraged masks on consumers but not required them, said the mandate would take effect July 20.

That will give the company time to post signage and train “health ambassadors” to facilitate the process of requiring an item that has been a cultural flashpoint in the United States throughout the country’s struggle with COVID-19.

AFP

5.30am: Ice cream maker drops ‘Eskimo’ name

A Danish ice cream maker said it would remove the name “Eskimo” from one of its products in case it offended Inuit and other Arctic people.

Hansens Is said it had opposed changing the name of its Eskimo ice lolly but after careful consideration had decided to choose a more suitable name.

The firm said there was now more information and debate “around the derogatory treatment and inequality towards minorities and indigenous people”.

The term Eskimo, used to refer to indigenous people from all over the Arctic, started being criticised by some of the 140,000 indigenous people of the Arctic region in 1970s.

Aaja Chemnitz Larsen, one of two politicians representing Greenland in the Danish parliament, pointed out that the term meant “eater of raw meat” – although this theory is the subject of debate.

“Eskimo has a pejorative meaning for many Greenlanders. So I think it is only natural to show this level of respect for us,” she told Danish news agency Ritzau.

AFP

5.27am: US industrial output jumps

American industry saw a rebound in June as businesses began to reopen amid the coronavirus pandemic, with total output jumping by 5.4 per cent compared to May, the Federal Reserve said.

But for the April-June quarter, which included the worst of the COVID-19 outbreak so far, industrial production collapsed at an annual rate of 42.6 per cent, “its largest quarterly decrease since the industrial sector retrenched after World War II,” the Fed said.

Manufacturing surged 7.2 per cent last month, but mining, including oil and gas production, fell 2.9 per cent.

AFP

5.25am: Goldman profits top estimates

A blowout performance in trading and underwriting lifted Goldman Sachs’ revenues in the second quarter as it reported flat earnings compared with the year-ago period.

Profits came in at $US2.2 billion, translating into $US6.26 per share, much better than the $US3.78 expected by analysts.

Revenues surged 41 per cent to $US13.3 billion.

Goldman’s markets division benefited from volatility amid the upheaval caused by the coronavirus shutdowns and aggressive stimulus measures by central banks. The equity and fixed income, currency and commodities trading both notched multi-year records.

The investment bank also scored record quarterly net revenue in both equity and debt underwriting as its corporate clients sought to raise funds to ensure adequate liquidity.

Goldman set aside $1.6 billion for bad wholesale and consumer loans in the wake of the downturn due to COVID-19.

That marks a sharp increase from the year-ago level, but is still much lower than the reserves taken by JPMorgan Chase and other large banks on Tuesday.

Those banks have much larger retail banking operations and are vulnerable to losses in case of defaults on credit cards, car loans and other consumer items.

AFP

5.20am: Burberry cuts jobs as sales slide

Burberry is to cut 500 jobs after global coronavirus lockdowns sparked a sales collapse, the British luxury fashion group said.

Sales tanked 45 per cent to £257 million ($US322 million) in the company’s first quarter, or 13 weeks to June, from a year earlier, Burberry said in a trading update that sent its share price sliding.

Burberry, which generates a large chunk of its turnover from big-spending tourists, including in airports, has been hit hard by the COVID-19 outbreak that shut shops and grounded planes worldwide – but it has seen a turnaround in key market China.

AFP

5.15am: Apple wins EU court battle

A European court annulled an EU order that Apple repay Ireland 13 billion euros ($US15 billion) in back taxes, in a major legal setback for Brussels.

The commission’s historic ruling against Apple was delivered in August 2016 by Competition Commissioner Margrethe Vestager in a shock decision that put Europe on the map as a scourge of Silicon Valley.

The iPhone-maker and Ireland had appealed the order, which Apple CEO Tim Cook slammed at the time as “total political crap”.

Vestager was derided as Europe’s “tax lady” by US President Donald Trump because of the case, as well as a series of antitrust fines she imposed on Google.

The clear cut decision by the EU’s general court could now face another appeal at the top European Court of Justice, with a decision expected no earlier than 2021, but Vestager initially said only that Brussels was studying the Judgement.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout