Coonan grilled at Crown inquiry, ASX negative in afternoon trading

Australia’s share market drifted sideways before turning down decisively as US stock index futures faded after early gains.

That’s all from the Trading Day blog for Friday, October 16. The S&P/ASX 200 fell as much as 0.7pc to a 3-day low of 6165 before closing down 33.5 points, or 0.5pc, at 6176.8. Still, it rose 1.2pc for the week after surging 5.4pc during budget week, its best one-week gain in six months. The index is up 6.2 per cent for the month after shedding 4pc during the September pullback in global markets.

Ben Wilmot 7.11pm: Changes proposed at Investec

The Investec Australia Property Fund has put up a proposal to internalise its management and buy the rights to an Investec Bank opportunistic vehicle.

The internally-run property group will be dual listed on the Australian Securities Exchange and the Johannesburg Stock Exchange.

The new group will pay $40m to the Investec Group to acquire the management rights of the listed fund, which has a $1bn office and industrial portfolio, as well as the management rights of the TAP Fund, which will be seeded with $30m.

The proposal is subject to the approval of unitholders at the extraordinary general meeting on November 17.

A committee comprising the independent directors Richard Longes, Sally Herman, Hugh Martin and Georgina Lynch, will consider the proposal.

Independent expert Deloitte Corporate Finance Pty Limited said the deal was fair and reasonable and in the best interests of unitholders.

Jared Lynch 7.03pm: Shareholders line up for small buinsess

Australia’s big four banks and the Morrison government will become shareholders in a raft of small and medium-sized businesses after tipping in $100m each to create a half a billion dollar “future fund” for the sector.

The Australian Business Growth Fund — which also includes $20m contributions from Macquarie Bank and HSBC, bringing the total to $540m — is aimed at providing fresh capital injections into SMEs to help catapult the country out of its coronavirus-fuelled recession.

The fund will target investment yields of up to 20 per cent, with former NAB executive Anthony Healy as its chief executive and former Tasmanian premier Will Hodgman as chair. The fund will be available to SMEs generating annual revenue of $2m to $100m and a track record of three consecutive years of revenue growth and profitability.

Mr Healy said the Business Growth Fund (BGF) was similar to other funds overseas and would involve taking minority stakes of 10-40 per cent in businesses to help deliver growth and more jobs as the country recovered from the COVID-19 pandemic.

“We are looking to back the owner and management team of the business, and secondly it’s long-term — most private equity funds are in and out in three, four or five years. We have a time horizon of up to 10 years,” Mr Healy said.

“We will also be building a talent network, which will be able to bring expertise and advice and capability to support small and medium-sized business owners.”

John Durie 6.22pm: Corporate Australia’s Covid responses

Corporate Australia has impressed itself with its ability to operate through the pandemic, with chief executives working overtime to keep the business ticking over, but it is also more than ready to return to what will be considered normal.

ANZ’s Shayne Elliott like others has worked overtime to keep up communications and interest with weekly chats, bringing in guests like sports stars Todd Woodbridge, St Kilda’s Jack Billings and staffer and Melbourne AFLW star Meg Downie.

He has also brought along Coca-Cola Amatil’s boss Alison Watkins, professional gamer son Elliott, and tailored his weekly webcasts for a younger audience during school holidays.

JB Hi-Fi’s Richard Murray has hired 75 SUVs and 25 high top vans to help Melbourne staff get orders out the door to customers, and Coles’ Steven Cain has the gym at his store support centre (also known as head office) running online classes.

It’s a communications task that is well practised and has its positive side, with hierarchy being broken down and all layers of the office getting to speak to one another on equal terms.

BHP’s Mike Henry notes: “I’m actually finding that the deliberateness of needing to look out for one another has created stronger connections and trust in some relationships.”

As Pact’s Ruffy Geminder says: “We are humans — not machines”, by which he meant he missed the ability to sit in face-to-face meetings.

KPMG chair Alison Kitchen says: “As chair, I find I must work really hard to watch and pick up on the physical cues and be quite directional in engaging participants.”

EY’s Tony Johnson says Zoom works just fine but not so well for sensitive issues where you want to read how people are reacting.

Bridget Carter 5.39pm: Hipages to list at up to $318.5m

The float of hipages has been met with overwhelming demand, as the group prepares to carry out its book build for its initial public offering on Monday.

The online trade services platform has brought forward its book build to Monday, with fund managers told on Friday through a book message that demand for its IPO has exceeded its offer size at the top end of its $2.05 to $2.45 per share price range.

Working on the float is Goldman Sachs, with the group to list with a market value of between $266.5m and $318.5m after undertaking a cornerstone process.

Hipages is looking to raise between $89.1m to $100.4m, with $40m in primary proceeds and $49.1m to $60.1m in secondary proceeds.

News Corp, publisher of The Australian, which owns 30.1 per cent of the online platform, will own 25.4 per cent once it is listed, while chief executive and co-founder Robert Sharon-Zipser will reduce his stake from 10.3 per cent to 6.5 per cent.

Its management roadshow started on Monday.

The bookbuild was to be held on October 22 and the prospectus will be lodged on October 23, with shares to trade on a normal basis on November 16.

The attraction by fund managers to the business is that 90 per cent of its revenue is recurring.

The IPO funds will be used for expansion amid rising demand for home improvements and related services.

Started in 2004, hipages has 36,000 paying trade services in Australia on its platform and will focus on gaining additional scale in the domestic market, which has about 257,000 trade businesses, for about two years before expanding offshore.

It is understood hipages booked revenue of about $50m, growing at about 20 per cent per annum, and underlying earnings of close to $4m in the 2020 financial year.

Comparables are other online classified advertisers such as Carsales, REA Group and Seek.

It recently secured a three-year contract with the NSW Education Department with an option to extend for two years.

Earlier, analysts at Goldman Sachs valued the business at between $280m to $370m.

Bridget Carter 5.20pm: Hipages bookbuild brought forward

Hipages has brought forward its book build to Monday, with demand for its IPO exceeding its offer size at the top end of its $2.05 to $2.45 per share price range.

4.30pm: ASX falls at the close

Australia’s share market drifted sideways before turning down decisively as US stock index futures faded after early gains.

The S&P/ASX 200 fell as much as 0.7pc to a 3-day low of 6165 before closing down 33.5 points, or 0.5pc, at 6176.8.

Still, it rose 1.2pc for the week after surging 5.4pc during budget week, its best one-week gain in six months.

The index is up 6.2pc for the month after shedding 4pc during the September pullback in global markets.

While buoyed on Thursday by RBA Governor Lowe’s clear signals of imminent policy easing it wasn’t enough to keep the share market rising on Friday.

The index appeared to succumb to frustration about the slow pace of easing of coronavirus restrictions in Victoria.]

The Real Estate sector dived 2pc, with GPT down 4.7pc, and Transurban lost 2.7pc.

Banks and resources also lost ground with Westpac down 0.6pc and BHP down 1.4pc.

But Macquarie rose 1.3pc, Afterpay gained 1.8pc and Medibank Private rose 3pc after an upgrade by Morgan Stanley.

The Australian dollar was 0.27pc weaker against the US dollar trading around US70.75c by the close of the ASX session.

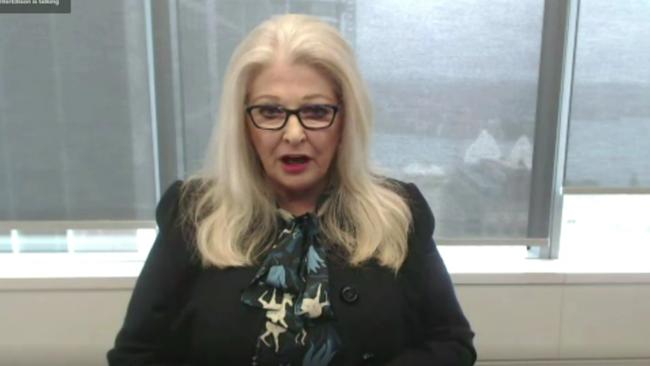

Lachlan Moffet Gray 3.45pm: Coonan questioned on internal investigation

Ms Sharp has displayed board minutes from June of 2019 and asked Ms Coonan whether at that stage the board was concerned over the lack of information flow from management.

Ms Coonan confirmed that was correct and Ms Sharp displayed the earlier discussed email from former board member Geoff Dixon to company secretary Mary Manos where the board requested John Alexander ask Barry Felstead for an explanation about what had occurred in China based on a draft report from the VCGLR on the issue.

“Did you ever get that explanation?” Ms Sharp asked.

“Certainly not within the purview of this note and I think it all went into a different mode with Mr Murphy haven taken the draft report back to the VCGLR,” Ms Coonan said.

Ms Sharp then asked Ms Coonan if she was aware that the media claimed to have received thousands of internal crown documents, and whether she turned her mind to the fact that the allegations were in part based on internal documents.

“I think that must have escaped me, Ms Sharp, and I was really more focused on the allegations that were made,” she replied.

Ms Sharp then asked Ms Coonan if she thought she approached the official rebuttal to the media allegations with the appropriate caution.

“It depends what you mean by caution, caution is one element to take into account when as a body of men and woman, and directors, you have a ferocious attack on the reputation and standing on the company you’re responsible for,” she said.

Ms Sharp then asked whether it was true that CLO Joshua Preston and Australian resorts Barry Felstead were tasked with investigating the media allegations, which Ms Coonan said it was.

Ms Sharp then asked whether Ms Coonan ever turned her mind to the thought that in effect, Mr Felstead was asked to investigate his own conduct - especially since the board was separately awaiting explanations from Mr Felstead.

Ms Coonan said that was no reason Mr Felstead could not conduct this investigation “fulsomely,” but conceded that with hindsight, asking someone in risk to investigate the allegation could have been beneficial.

3.42pm: Rock oyster supplier to IPO

Sydney rock oyster supplier East 33 has announced it will IPO and list on the ASX, as it touted plans to become one of Australia’s largest rock oyster suppliers.

The company said that on completion of the initial public offering, its board would include directors Philip Corne and Kara Hurry Walker, who have both previously worked for global luxury group LVMH, as well as founder of China’s largest privately-owned integrated aquatic port, Mr Xingqi Gao.

East 33 said it had also established marketing collaborations with Moet Hennessy, part of the LVMH.

East 33’s co-founder and Executive Chairman, James Garton, said:

“We are proud to be part of the transformation of the Sydney Rock Oyster industry,” co-founder and executive chairman James Garton said.

“This unique oyster has been enjoyed in Australia for more than 150 years and we look forward to deploying the skills of our farmers to showcase it to the world.

The Sydney rock oyster should be our native version of French Champagne or Beluga Caviar.”

Lachlan Moffet Gray 3.25pm: International VIPs an, ‘important component’: Coonan

Counsel assisting Naomi Sharp is now asking Crown chairman Helen Coonan about her knowledge of the regulatory regimes governing casinos, and the opinion the regulators have towards the high risk of money laundering within casinos.

Ms Sharp asked Ms Coonan if she has and has had an understanding of anti-money-laundering compliance.

“I think I’ve got a good understanding of AML and a good understanding of the risks the legislation contemplates and through the operation of the casino I’ve certainly been aware of the risks of money laundering,” she replied.

Ms Sharp is now asking about Crown’s decade long JV with Melco in Macau, and asked Ms Coonan if she understood the regulatory regime in Macau.

“(It’s) Not as significant as my understanding of the Australian jurisdictions, but I had an idea of the regulation and the steps taken to deal with junkets (in Macau),” Ms Coonan replied.

Ms Sharp asked how long Ms Coonan has been aware of the risks surrounding junkets in Macau, and Ms Coonan said it was sometime after she was appointed a director in 2011.

“But I don’t think I was ever aware of the fact that junkets have a background in organised crime - I knew they had a risk of organised crime,” she said.

Ms Sharp asked Ms Coonan if she had training in anti money laundering compliance.

“Yes, as an advisor to JP Morgan I regularly do quite detailed courses on AML and I have directed in recent weeks that each director on the board complete the Crown AML course,” she said.

Ms Sharp then turned into establishing the importance of VIP international players to Crown, and in particular, the Barangaroo casino in Sydney.

After being shown materials from over the past decade that record James Packer’s ambition to increase VIP patronage, Ms Coonan agreed it was an “important component” of the Barangaroo venture.

Ms Sharp then displayed an advertisement Crown placed in October of 2017 containing a message from then chair John Alexander that accuses Andrew Wilkie MP of trying to “smear” the company through a series of allegations.

Ms Coonan said the board probably approved the advertisement.

Ms Sharp then noted that the regulator later fined Crown $300,000 for modifying 17 gaming machines, which was one of Mr Wiklie’s allegations.

“Did that experience in placing an ad in fairly strident terms which later was found to have effectively overstated the matter...give you any inkling that you needed to take some caution before taking out full-page advertisements rejecting allegations in the media?”

“It could have given pause for thought if it had come to mind,” Ms Coonan said.

3.10pm: NZ retailer to pay back wage subsidies

ASX-listed New Zealand retail chain Briscoe Group says it will repay the $11.5m it received in wage subsidies and reinstate its dividend after it experienced strong sales through its third quarter.

Announcing it would pay out about $20m in dividends for the first half of the financial year, chairman Rosanne Meo said recent trading performance has given the board confidence.

“None of us imagined we would be in such a strong position when New Zealand went into lockdown on 25 March,” Ms Meo said in a statement to the ASX.

“Our immediate response at this time was to cancel the $28 million dividend due to all shareholders and undertake a commitment to our staff to keep their jobs and protect their families.

“We also want to thank our shareholders for their patience in relation to the cancellation of our earlier dividend.”

Ms Meo said that the board would continue to closely monitor the trading environment ahead.

“Unlike other companies Briscoe Group has not made people redundant or closed stores,” she said.

“We pride ourselves with having a strong balance sheet so we can continue to expand our economic footprint with new store openings which will inevitably lead to the creation of jobs.

“In that regard the company is playing its part in helping rebuild New Zealand.”

2.55pm: ASX drops to 2-day low

Australia’s S&P/ASX 200 share index fell 0.3pc to a two-day low of 6176.5 as S&P 500 futures pared a 0.3pc intraday gain in the Asian session.

All sectors bar Tech and Consumer Discretionary are now in the red, with Real Estate leading a fairly broad-based fall.

Among major stocks, Macquarie is up 1.2pc and CSL has recovered a bit to be down 0.7pc, but BHP is down 1.5pc, Transurban is down 2pc, Westpac is down 1pc, Rio Tinto is down 1.2pc, Scentre is down 3.3pc and Mirvac is off 4.4pc.

Lachlan Moffet Gray 2.47pm: Coonan looking to ‘renew’ Crown board

Crown chairman Helen Coonan has told a NSW inquiry into Crown’s suitability to hold a casino license in the state that she is looking to “renew” the board of the embattled company and is talking to some current directors about their exit plans.

Questioned by Counsel assisting Adam Bell about whether she agreed with James Packer’s testimony at the inquiry last week that going forward the Crown board should be more “independent” of his holding company Consolidated Press Holdings, Ms Coonan said:

“I think that’s a fair reflection of the way which we need to go forward.”

When Mr Bell questioned how that could be achieved, Ms Coonan said the process was already underway.

“I think we need to go through a very fulsome exercise of looking at the right framework for independence, that includes longevity through independence of thought and ability to bring skills to bear on the board,” she said.

“I’ve commenced conversation with some directors relating to an orderly process for them to leave the board and to get on some more independent directors.”

Mr Bell asked Ms Coonan whether she was familiar with the Star casino’s stipulation that no more than one shareholder can hold 10 per cent in the company, hinting at the fact that Crown could do the same and force James Packer to sell down his 36 per cent shareholding.

“I think that’s a very difficult question - I think whilst the shareholding is there, it’s certainly my duty as chair and the broader duty of the board to properly manage that relationship, to properly manage the relationship with the nominee directors...I would not really want to opine on divestment or a timeframe for it,” Ms Coonan replied.

Commissioner Patrica Bergin asked whether Ms Coonan ever had any conversations over a concern Stanley Ho may have had an interest in Melco when the deal was announced last year.

Ms Coonan said that she thought someone mentioned the potential of modifying the agreement with the NSW gaming regulator to prepare for that possibility.

Counsel assisting Adam Bell has stepped down and Naomi Sharp is now asking questions.

Lachlan Moffet Gray 2.28pm: Coonan questioned on Packer protocol

The inquiry has resumed and Counsel assisting Adam Bell has asked Crown chair Helen Coonan why she chose to review a shareholder protocol that allowed James Packer to receive information about the company on demand.

“I basically wanted to make sure that the information that I assumed was being provided was being provided in accordance with the protocol, and so what I did was ask MinterEllison to review it to ensure it was still fit for purpose,” Ms Coonan said.

“After we reviewed it at the board there were a few instances of what I’d call ad-hoc email and communications that I thought may not have, not so much have accorded with the protocol, but I thought it needed to be a bit tighter and if there were communications they needed to be better understood and provided properly in that context.”

Ms Coonan said she asked company secretary Mary Manos to write to people entitled to share information under the protocol and remind them of her obligations.

She also said she identified a few “ad-hoc” instances but they were not “nefarious.”

“It wasn’t anything that looked nefarious or out of order...nothing like confidential information that could really be a detriment,” she clarified.

Mr Bell asked her if she knew Mr Demetriou provided information under the protocol, and Ms Coonan said she recalled he was identified generically.

He then asked if she discovered that Mr Packer was communicating “requests” to board members despite having no right to do so.

“I think that was identified either at that time or slightly earlier,” Ms Coonan said.

Mr Bell then displayed an email to former board member Geoff Dixon in May of last year after the Melco transaction was announced where Ms Coonan asks if a board member should be conveyed to discuss “governance issues.”

Mr Bell asked if one of those issues the fact that Mr Johnston hadn’t informed the board about the transaction prior to its announcement.

“Yes, I thought it would have been helpful if we had known, or appropriate if we had known,” Ms Coonan replied.

An email from that same day from Mary Manos to executive chairman to John Alexander included a reference to independent directors wanting to meet separately to CPH-aligned directors to discuss the transaction.

Ms Coonan said that she was concerned about what the transaction would do to the license to operate Barangaroo - even though she didn’t specifically know if Dr Stanley Ho, father of Melco head, Lawrence Ho, had an interest in Melco.

The agreement with NSW to operate Barangaroo forbids shares in Crown falling into an entity associated with Dr Ho - and it was later revealed the now deceased Dr Ho held an interest in Melco through a shell company and family trust.

“I do recall asking her - because I didn’t know about Mr Ho, that is Mr Ho senior, but I was concerned about potential regulatory ramifications of the transaction,” Ms Coonan said, later clarifying

However, at a board meeting 12 days later there was no such meeting, but there may have been “independent conversations,” Ms Coonan said.

2.25pm: Aussie Broadband gains on ASX debut

Shares in telco Aussie Broadband have surged more than 80 per cent after the company started trading on the ASX today at $1 a share.

At 2.20pm (AEST), shares were trading at $1.89 each.

“This day marks the beginning of the next phase of our journey,” the company’s managing director Phillip Britt said in a statement to the market this morning.

“Our business has grown strongly over the past three years due to our reputation for providing high quality internet at home, business and enterprise levels, along with our transparent customer service to ensure our customers have a seamless end to end experience.”

The listing followed a $40m in its IPO, which the company said was strongly oversubscribed.

The company formed in 2008 and provides NBN plans to homes and small businesses.

Lachlan Moffet Gray 1.10pm: Coonan defends Crown’s Johnston

Crown chairman Helen Coonan has mounted a strong vote of confidence in Crown board member and CPH executive Michael Johnston when asked if she still had confidence in him due despite his failure to inform the wider boards of risks to staff in China.

“The answer to that Mr Bell is yes,” Ms Coonan said, before clarifying her statement.

“If he is no longer acting under the controlling shareholder agreement, he’s no longer getting information under the services agreement or providing services in an executive capacity, and he’s no longer wearing a lot of hats - that is he’s not involved in some, perhaps you might say, executive matters to do with the operation of Crown, he is a very, very fine, diligent and dedicated board director who I think can continue to make a good contribution with those adjustments.”

Mr Bell then asked why she would say that given he failed to inform the board of a critical situation developing in China.

“I do think that’s a lapse, none of us are perfect, but I think in terms of his general contribution to the board, I value it, I’ve worked very closely with him.

“He is a very, very, fine diligent and dedicated board member....”

Mr Bell then produced Crown’s security trading policy, dated from December of 2018.

“Do you agree it’s important that there’s absolute clarity as to when directors and officers of Crown resorts can trade in shares in Crown resorts and when they can’t?” Mr Johnston asked.

Ms Coonan agreed.

Mr Bell then pointed to a part of the policy which says the stipulations of the policy extend to entities “managed by a Crown director or are directly or indirectly controlled by a Crown director.”

Mr Bell then said that former CFO Ken Barton told the inquiry he provided financially sensitive information to Mr Johnston in May 2019 while Mr Johnston denied the information was financially sensitive.

The inquiry then adjourned for lunch, but it is likely Mr Bell is trying to establish that Mr Johnston potentially violated Crown’s security trading policy - undermining Ms Coonan’s strong support of the man.

The inquiry will continue at 2pm.

Lachlan Moffet Gray 12.45pm: Coonan pleads ignorance on Packer

Counsel assisting Adam Bell has asked Helen Coonan whether she knew why James Packer resigned from the Crown board in 2015.

“I really didn’t know, I didn’t have a conversation with Mr Packer at the time,” she replied.

Mr Bell then displayed an ASX media release in relation to Mr Packer stepping down as a director and highlighted quotes from Mr Packer where he claims he is stepping down to take up new roles with the company working overseas.

Mr Bell then asked Ms Coonan if she was ever aware that James Packer made threats to a businessman in the context of a discussion on the privatisation of Crown.

“No,” she replied.

Mr Bell then asked if Robert Rankin ever informed her of the incident.

“No.”

Mr Bell then asked if she came aware of the incident prior to its revelation last week during Mr Packer’s appearance at the inquiry.

“No...But I did know there were times where he wasn’t well,” she said.

This is the first substantive time the incident has been discussed at the inquiry since it’s revelation last week, where Mr Packer said his behaviour was “shameful,” and pinned it on his bipolar disorder.

Mr Bell then displayed a board minutes that contained a discussion of a situation with Hellman and Freeman.

“I don’t think there was very much information about Hellman and Freeman other than potentially, as I recall, as an equity investor,” Ms Coonan said.

He then pointed to other parts of the minutes about the establishment of a services agreement with Mr Packer, and how Robert Rankin said that CPH-aligned executives did not want to execute the agreement, “given the current process with Hellman and Freeman”.

Mr Bell asked if Crown was happy to continue with the agreement with Mr Packer.

“I think so and I think it was just deferred from this meeting,” Ms Coonan said.

This services agreement has been discussed in the inquiry previously - it would have seen Mr Packer receive $11.5m a year to promote Crown to VIP clients.

Mr Bell asked if Ms Coonan was informed that Mr Packer was suffering an illness at the time, but Ms Coonan said she wasn’t, only that she understood he was unwell at times.

Mr Bell then asked Ms Coonan when the last time she spoke to Mr Rankin was.

“Not since he left the board,” she replied.

Robert Rankin left the Crown board in 2017.

Commissioner Bergin interjected to ask Ms Coonan whether she knew Mr Rankin suggested that management should be on “high alert” for the potential of staff arrests in China.

Ms Coonan said she wasn’t aware.

Mr Bell then moved to discussing the controversial services agreement between Crown and Mr Packer’s company, Consolidated Press Holdings.

The agreement allows CPH executives to be paid to provide services to Crown and allows confidential information about Crown to be provided to CPH.

Crown directors have unanimously justified the agreement as merely formalising an arrangement that already existed, given the position of CPH executives on the Crown board over the years, but Commissioner Patricia Bergin has criticised it explicitly.

Mr Bell also mentioned the controlling shareholder protocol which allowed Mr Packer to receive confidential company information despite no longer sitting on the Crown board.

Ms Coonan mentioned the protocol had recently been reviewed in “about June.”

“I had recently had the controlling shareholder protocol this year because it came to my attention that it may have been used ad-hoc,” she said.

Ms Coonan said that she was aware of the protocol when it was formed in 2018 and expected information would be shared “in the confines of this agreement,” but didn’t have specific knowledge about the information flow.

Mr Bell mentioned how Michael Johnston gave information to Mr Packer under this agreement on Crown’s financial forecasts at a time when Mr Packer was negotiating the sale of 19.9 per cent of his Crown shares to Melco, a Hong Kong gaming company.

Mr Johnston, being a CPH executive and a Crown director, should have notified the Crown board of a conflict of interest, but didn’t.

Ms Coonan said the board was set to decide the future of the protocol at a board meeting this Wednesday.

“I’ve directed that information flows cease pending consideration by the board at a board meeting that I think is scheduled on Wednesday, because I want to be thoroughly comfortable with what these documents do,” she said.

“It may be that some provision of information may be appropriate.”

Lachlan Moffet Gray 12.28pm: Crown ad ‘should have been softened’

Crown chairman Helen Coonan has been questioned about the company’s response to critical media coverage by 60 Minutes.

Displaying a transcript of the 60 Minutes program, Mr Bell read a section that states China’s impending crackdown on foreign gambling promoters was clearly broadcast prior to the arrest of Crown staff.

He also displayed an associated article that made a similar statement and asked Ms Coonan whether she was aware the media alleged that Crown ought to have known the risk of promoting gambling in China.

“I am aware of that allegation, yes,” Ms Coonan said.

Mr Bell also showed extracts from media reports detailing how Crown went out of their way to continue their operations in China by instructing staff to falsely claim they weren’t working in China when questioned.

Mr Bell then displayed the official Crown board rebuttal to the media reports, which describes them as a “deceitful campaign.”

The statement was released to the ASX and as a full-page ad in many newspapers.

Mr Bell noted that Ms Coonan, before signing on to this advertised rebuttal, expressed concern to then executive Michael Johnston about the failure in the risk management processes.

“Do you agree, given the circumstances, to acknowledge that you and your colleagues did have concerns that warning signs weren’t escalated to the board

“I just don’t think we could have got it into the ad, Mr Bell,” Ms Coonan said, saying the ad was more focused on rebutting the contention that Crown “deliberately broke the law in China.”

Mr Bell asked whether Ms Coonan would have re-worded the ad in hindsight.

“To be perfectly honest with you, I think the language should have been softened,” she said, although she added that the views of the board were “sincerely held” at the time, even if the views were based on a “misplaced reliance” on incorrect information supplied by management.

Lachlan Moffet Gray 12.14pm: Coonan quizzed on China arrests

The inquiry has resumed and Counsel assisting Adam Bell is nailing down Ms Coonan’s position on the arrest of 19 Crown employees in China in 2016.

Mr Bell asked Ms Coonan if she could give an explanation for the events as James Packer and other executives were unable to during their evidence.

“The root cause of that is pretty obvious, and that is people tried to manage on the ground, and they probably missed the political and social changes in China and probably put over-reliance on legal advice,” Ms Coonan said.

Mr Bell then displayed an email from former board member Geoff Dixon to company secretary Mary Manos on the 10th of July last year, in reference to a board meeting the prior month.

At the meeting a draft report to the board about the China arrests indicated that there were failures in Crown’s risk management process, and Mr Dixon’s email said that board members present expressed concern at this fact.

Ms Coonan said she was one of the members who expressed concern and said she was one of the members present who, according to the email, requested executive chairman John Alexander get Barry Felstead to speak to the document at the next meeting and explain what happened at the time.

“I think we were very interested to know what Mr Felstead’s explanation was,” Ms Coonan said.

Mr Bell then asked Ms Coonan if she watched the 60 Minutes program in July last year that made allegations against Crown and read associated articles.

Ms Coonan said she watched the programme and read most of the associated articles.

12.04pm: ASX steady at noon

Australia’s share was little changed at midday after a modest intraday fall.

After falling 0.3pc to an intraday low of 6192.5, the S&P/ASX 200 rose slightly to intraday high of 6212.7 before easing back to 6206.

Volume was 26 per cent above the 20-day moving average after settlements related to Thursday’s expiry of October equity options.

Support on the dip was consistent with a 0.3pc rise in S&P 500 futures, after a strong intraday bounce on Wall Street overnight amid renewed hope of additional fiscal stimulus.

Gains in Consumer Discretionary, Financials and Consumer Staples sectors offset falls in the Real Estate, Health Care, Industrials, Energy and Communications sectors.

Among the major stocks, CSL fell 0.9pc, BHP fell 0.6pc and Transurban lost 1.2pc, while the four major banks rose 0.3-0.6pc, Fortescue rose 1.1pc

Unibail-Rodamco-Westfield surged 13pc as dissident shareholders called for a breakup.

Medibank Private was up 3.8pc after Morgan Stanley upgraded to Overweight.

11.49am: RBA sends easing signal: Westpac

Westpac chief economist Bill Evans says the policy easing signal in RBA Governor Philip Lowe’s speech yesterday was “about as strong as you can get that he is planning to ease policy at the next Board meeting on November 3rd”.

In his speech, Dr Lowe noted that: “As the economy opens up…. it is reasonable to expect that further monetary easing would get more traction than was the case earlier”.

Mr Evans says his recent forecast that cuts in the RBA’s key policy rates (cash, 3-year bond and Term Funding Facility) and the Exchange Settlement Account rate to 0.10pc from 0.25pc “now look fairly safe”.

And his expectation that the RBA will announce its commitment to support the whole yield curve by announcing its intention to further expand its balance sheet by purchasing Australian and semi-government bonds in the 5-10 year maturity range “now looks consistent with the Governor’s increased emphasis on the need to be ‘competitive’ with other central banks on its use of the balance sheet”, according to Mr Evans.d

Lachlan Moffet Gray 11.45am: Coonan unaware of questioning by Chinese police

Mr Bell is continuing to quiz Ms Coonan on her knowledge of the risk to Crown staff in China prior to their ultimate arrest in October in 2016.

Despite numerous Crown executives being aware of the Chinese government’s growing hostility towards foreign gambling promoters, the issue was never raised at board level and Ms Coonan said it demonstrated a failure of risk management and company culture.

“There was a tendency to try to manage all these things on the ground, as we now know,” she said.

Mr Bell has also noted that in 2015 Crown decided to remove its logo from the tail of the company’s private jets when transferring VIP clients from China to Australia, but Ms Coonan said she did not know about this.

“Plainly these matters should have been escalated,” she said.

Ms Coonan also said that she didn’t know prior to the arrest of staff in China that Chinese police had questioned a staff member in Wuhan and required a letter from Crown to corroborate the employee’s statement.

Mr Bell said that Barry Felstead knew about the questioning of the staff, and only told one board member by email: Michael Johnston, who did not tell any other board member.

But Mr Felstead did not tell CEO Rowen Craigie, his direct superior, and Mr Bell asked Ms Coonan if that meant the proper lines of reporting had been “compromised” and that Crown’s risk management process had failed.

Ms Coonan agreed and said that if the wider board had been aware, she assumed that the operation in China might have been aborted.

Commissioner Patrica Bergin also noted that Crown emails about the incident at the time indicate that someone “informed on the company” by telling the Wuhan police that Crown was organising gambling tours.

Ms Coonan agreed it was a concern and the inquiry adjourned for a 10 minute break.

Perry Williams 11.40am: ‘Too soon’ for Boral to offload US buisness: JP Morgan

Boral would struggle to sell its entire North American business in the near term despite major investors pushing for the building materials supplier to offload the division, JP Morgan said.

New boss Zlatko Todorcevski will reveal the results of a company-wide review by the end of October which may call for the sale of its US division following shareholder angst about its poor performance since Boral paid $3.5bn for Headwaters in 2016.

However, a full sale may be a step too far according to the broker with its flyash assets potentially problematic should Joe Biden win the US presidency.

“We believe it would be too soon to announce significant divestments in North America at management’s review outcome later this month,” JP Morgan analyst Brook Campbell-Crawford said.

“While a supportive demand backdrop could enhance the appeal of some of Boral’s North American businesses, structural challenges in fly ash - which could accelerate under a Biden presidency if elements of the Green New Deal are implemented - may be an issue for acquirers.”

Boral’s US division has a $2.6bn valuation based on an enterprise value to earnings before interest and tax multiple of 14.1 times. That remains well below funds employed for the division of $3.8bn as of June 30, 2020.

Lachlan Moffet Gray 11.15am: Crown’s resort boss to step down

Crown chairman Helen Coonan has told the inquiry that Crown’s CEO of Australian Resorts Barry Felstead will leave the company by year’s end.

After being presented with evidence that Mr Felstead knew that Crown’s staff in China were expressing fears about their safety prior to their arrest in 2016, Ms Coonan was asked by Counsel assisting Adam Bell if she still had confidence in Mr Felstead.

“Well I have to tell you that Mr Felstead’s current position is now redundant,” Ms Coonan answered.

“Mr Felstead was getting very near to wishing to retire, I think recent events have escalated his desire to do that and he’ll part with the company around the end of the year.”

The inquiry is continuing with Commissioner Patricia Bergin pressing Ms Coonan on why Crown has not conducted a comprehensive review of its issues when former board member Ben Brazil pushed for it years ago.

Ms Coonan said the board was “constrained” by legal advice preventing a review due to a class action in process against Crown.

“This has been teased out in various processes. And as I mentioned to you a little earlier, on legal advice, the Crown Board hasn’t initiated a round-up-inquiry, but it may not be done yet, Mr Bell, there’s a lot of water to flow under the bridge yet,” Ms Coonan said.

Coonan ‘didn’t think’ of potential China risk

Earlier, Mr Bell has asked whether Ms Coonan relied on management assurance that Crown had legal advice supporting their activities in China before signing the public rebuttal to allegations of negligence raised in media reports last year.

“Yes, I relied on the, in this particular respect, relied on the internal memorandum,” Ms Coonan said.

Mr Bell then displayed a 2015 email from Crown’s man in China Michael Chen to an external Beijing lawyer, wherein Mr Chen asks whether Crown should look at moving staff off the mainland due to growing government hostility towards gambling promoters.

The lawyer replies it would be a good idea to have key employees “tentatively” working outside China, like Hong Kong.

Ms Coonan said she was not aware of the exchange at the time and most likely learnt that Crown received legal advice along those lines through the inquiry.

She agreed that the fact advice of this nature was being sought required board attention.

Mr Bell asked Ms Coonan if there had been changes in the legal department to ensure a similar event does not occur in the future.

“I am aware that there has been quite a bit of changeover in the legal department,” Ms Coonan replied.

Mr Bell asked Ms Coonan if she ever turned her mind to the widely understood fact that there was a potential for arbitrary action on the part of the Chinese government towards Crown staff, prior to their ultimate arrest.

“No,” Ms Coonan replied.

10.39am: Tyro jumps on Bendigo deal

Shares in payments platform Tyro have lifted in early trade following an announcement it had signed a 10-year partnership with Bendigo Bank.

The deal will mean more than 26,000 Tyro terminals will be deployed its terminal fleet to just above 89,000 terminals.

Tyro said that gross profit share from the deal – after gross profit share to Bendigo Bank and before operating costs – would be about $19 million in fiscal year 2022.

“The alliance with Bendigo Bank is an exciting combination of Australia’s fifth biggest retail bank with the fifth largest merchant acquiring bank,” Tyro chief executive Robbie Cooke said.

“Partnering with Bendigo Bank will see Tyro’s leading proprietary payments platform made available to Bendigo Bank’s current and future business customers – giving them access to more features, more payment options and seamless integrations to more than 300 point of sale systems.

“Tyro will deploy its payments expertise to Bendigo Bank’s business customers, with Bendigo Bank continuing to provide all other banking services to these customers under a long-term, collaborative and strategic alliance.

“This is a great example of two customer focused Australian organisations coming together to provide better solutions for Australian businesses through a partnering of capability and expertise.”

Tyro shares last up 5.1 per cent at $4.12.

Lachlan Moffet Gray 10.35am: Coonan unaware of China offices

Counsel assisting Adam Bell has now displayed a briefing paper that management provided the board prior to the board signing a public rebuttal to allegations of negligence raised by media reports in respect to their operations in China.

The paper advises the board that Crown made a conscious decision not to open an office in China, but Mr Bell asked Ms Coonan whether she was aware that the Crown staff operated out of an office rented in the name of two employees, for which the company reimbursed them.

Rowen Cragie earlier told the inquiry offices were operated to avoid detection, and James Packer told the inquiry the office was never ticked off by him.

Ms Coonan said she was not aware of these offices.

“My understanding is that at all times the operations in China were considered to be legal by the operatives that were there,” Ms Coonan said, defying the implication Crown staff were acting unethically.

“If they thought they were acting legally i’m not sure you could necessarily draw the fact that they were not acting ethically,” she said.

Mr Bell asked Ms Coonan that given other casinos applied for a licence to operate from the Chinese government and conducted offices openly, would she accept that Crown increased the risk to their staff by not doing the same.

“If there was some divergence from whatever the practice or requirements were at the time, obviously that would increase some of the scrutiny...but it’s difficult for me because I don’t really know what those people thought, or what they were doing at the time,” she said.

She agreed that the issue of the Chinese offices should have been raised with the risk committee at the time.

Counsel assisting Adam Bell has displayed to Helen Coonan an email chain from June 2012 where a Crown international business manager proposes upgrading a Crown office in Guangzhou as the current office is in a residential building subject to random checks from Chinese authorities.

A response from Crown staff member in China Jason O’Connor enquiries as to whether legal advice has been sought for making such a move, while legal staff deliberated how to complete a move that better “legitimises” Crown’s operations.

Mr Bell pointed out that a move to another office was not completed until 2015 and that Mr O’Connor previously told the inquiry that the existence of this unofficial office was not a secret at Crown.

Ms Coonan said there was clearly a “failure of execution of the risk management framework,” but denied there was any problem with the framework itself.

Mr Bell asked whether an internal inquiry as to how this could have happened occurred.

“After the China arrests the board received legal advice not to pursue an inquiry at that time and that related to other proceedings and in subsequent years, there have been a lot of inquiries,” Ms Coonan said.

“I think we are getting to the state now where there have probably been five lots of inquiries into these unfortunate events.”

Moving on, Mr Bell noted that Ms Coonan earlier claimed that after the 2015 arrest of some gambling promoters in Korea, Mike Johnston told Ms Coonan that the arrests related to currency controls and that Crown’s staff in China did not face the same risks of arrest.

Mr Bell asked Ms Coonan whether Mr Johnston portrayed that advice in the context of a growing crackdown by the Chinese government on foreign gambling promoters.

“No I don’t think it was that extensive, and from recollection I might not have known about the Korean arrests,” Ms Coonan said, adding that Mr Johnston said legal advice proving his position had been obtained.

Ms Coonan said she checked with then company secretary Michael Neilson as to the efficacy of that advice, and was reassured it was solid.

Ms Coonan said she was not aware of the growing hostility of the Chinese government towards foreign gambling promoters at the time.

10.25am: Stocks open steady

Australia’s share market has been mostly flat in mixed trading so far Friday.

The S&P/ASX 200 was down 0.1pc at 6205 after 30 minutes of trading.

S&P 500 futures have risen 0.2pc after the US benchmark mostly recovered from a 1.4pc intraday fall amid renewed hope of US fiscal stimulus.

Gains in the Energy, Consumer Discretionary, Financials and Communications offset falls in the Real Estate, Health Care, Materials and Utilities sectors.

Beach Petroleum rose 2.5pc, IDP Education bounced 3.4pc, Medibank Private rose 4.2pc after Morgan Stanley upgraded, while Dexus fell 1.9pc, CSL lost 1.3pc, BHP fell 0.9pc and AGL lost 0.4pc.

Unibail bucked the property sector selloff, surging 15pc as dissident shareholders called for a breakup.

Lachlan Moffet Gray 10.20am: Coonan questioned on China arrests

The NSW Crown casino inquiry has resumed with Counsel Assisting Adam Bell taking the stand to question Crown chairman Helen Coonan.

Mr Bell began his line of questioning as he did with other board members to give evidence before the committee, by displaying Crown employee guidelines from 2008 that state the business must at all time conduct its affairs legally and ethically.

He also displayed the board’s charter and the ASX’s principles on corporate governance and risk, questioning Ms Coonan if she at all times expected Crown board members to act in accordance with them.

“That’s the expectation, yes, Mr Bell,” Ms Coonan said.

Mr Bell also got Ms Coonan to agree that it was ultimately the board that was responsible for setting Crown’s risk appetite for operations in China prior to the October 2016 of 19 Crown staff for illegally promoting gambling, as well as the idea that a board must hold management to account generally.

A 2017 speech by the ASIC Commissioner was also produced, and a section emphasising the importance of a company board in setting company culture was read.

Mr Bell then proceeded to ask Ms Coonan if she was aware that Crown had staff in China prior to their arrest.

“I think the answer to that is yes, but the precise nature of their engagement, I’m not sure,” Ms Coonan replied, adding that she understood they had a “promotional role” but she didn’t know specifically that they were engaged in filing Visa applications and collecting debts.

Ms Coonan also said she read no legal advice prior to the arrest about the legality of their activities, and did not know that Crown had no permission from the Chinese government to advertise their activities, or that Crown could have applied for permission.

Crown management at the time interpreted legal advice they received in such a manner that if Crown did not establish an office, their activities would technically be legal.

Ms Coonan said she was never made aware that Crown’s activities turned on that interpretation.

10am: What’s impressing analysts

Alumina raised to Positive: Evans & Partners

Ansell raised to Overweight: JPMorgan

Audinate raised to Outperform: Credit Suisse

Eagers cut to Neutral: JPMorgan

Eagers price target raised 30pc to $13; Buy rating kept: UBS

GUD Holdings raised to Buy: Citi

Medibank Private raised to Overweight: Morgan Stanley

Stockland cut to Sell: Morningstar

Telstra raised to Buy: New Street Research

Nick Evans 9.56am: Rio facing shareholder class action

Outgoing Rio Tinto boss Jean-Sebastien Jacques faces fresh problems as the Rio board searches for a successor, with both the company and its chief executive facing a class-action suit in the US alleging they made “materially false and misleading statements” about cost blowouts at the Oyu Tolgoi mine in Mongolia.

The class-action lawsuit was filed in the US earlier this week by shareholders of Rio and its partner in Oyu Tolgoi, Turquoise Hill, and names Mr Jacques and Rio copper boss Arnaud Soirat, as well as other senior executives of both companies.

It alleges the companies failed to disclose troubles at Oyu Tolgoi that have led to a $US1.9bn blowout in the cost of the underground expansion of the mine, and delays in its construction of about two years.Rio said on Friday the suit is “without merit”.

The news comes as shipments from Rio’s flagship Pilbara iron ore operations sank in the September quarter as the company dealt with the fallout from the destruction of 46,000 year old heritage sites at Juukan Gorge, and conducted major maintenance on its Cape Lambert shipping berths.

Rio shipped 82.1 million tonnes of iron ore in the period, down 5 per cent against the June quarter, and down the same amount from the September quarter of 2019.

9.46am: ASX set to dip at open

Australia’s share market should remain well supported on dips before the weekend.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open down 0.2pc at 6197.9.

But there are reasons to believe it will find support from former strong resistance near 6200.

Speculation of RBA rate cuts and quantitative easing intensified after Philip Lowe’s speech, sending the index up to a fresh seven-month high of 6233.4 on Thursday.

On the charts, it convincingly broke above resistance from June, July, August highs in the 6160-6199 area, closing up 0.5pc at 6210.3.

Thursday’s rise may have caught some traders short near the old resistance level.

The key to whether it now sustains the break above 6200 will partly rest with how the ASX200 Banks index reacts to its 200-day moving average near 5955.4.

Banks’ economic risk was reduced by the budget and could be further reduced by the start of an RBA QE program that props up asset prices.

The KBW Bank index rose 1.7pc overnight and while the S&P 500 lost 0.2pc, it mostly reversed a 1.4pc intraday fall linked to an unexpected surge in US jobless claims and 2.5pc dive in the Euro Stoxx 50 amid the worsening pandemic in Europe.

Wall Street trimmed losses as House Speaker Nancy Pelosi told Democrats that a Covid-19 relief package won’t wait until January, prompting her to schedule another call with Treasury Secretary Steven Mnuchin, while President Donald Trump he’d go over $US1.8tn in stimulus.

In commodities, spot iron ore fell 0.7pc to $US118.90 and Brent crude fell 0.4pc to $US40.96, while gold was flat and copper and nickel rose 0.5pc. BHP ADR’s equivalent close at $36.53 was a 0.7pc discount to BHP’s Sydney close.

AUD/USD is probing support from its 100-day moving average at 0.7097 amid expected RBA QE, but could bounce if US lawmakers agree on immediate fiscal stimulus.

Lachlan Moffet Gray 9.40am: Coonan to front Crown inquiry

The NSW Independent Liquor and Gaming Authority’s inquiry into the suitability of Crown Resorts to hold a casino licence in the state resumes this morning.

Current Crown chairman and former Liberal senator Helen Coonan will be giving evidence today.

Having been a member of the board since 2011 and chair since January of this year, Ms Coonan’s evidence will be the second most consequential on the recommendations inquiry Commissioner Patricia Bergin will make to the NSW government regarding Crown’s licence to operate the Barangaroo Casino, after James Packer.

It is likely the Counsel assisting’s line of inquiry will focus on Ms Coonan’s knowledge of the risks Crown staff faced in China prior to their arrest in 2016, as well as her knowledge of the risks associated with “junkets” - gambling promoters - and of anti-money-laundering regulations.

It is also expected that Ms Coonan will be scrutinised on her plans to rectify the many deficiencies in Crown’s risk management processes, with her answers certain to shape her own future at the company.

The inquiry will begin at 10am.

Ben Packham 9.25am: China warned over cotton move

Trade Minister Simon Birmingham has warned China against taking “discriminatory actions” against Australian cotton suppliers, saying the government would treat any unauthorised trade ban “very seriously”.

In the latest shot in the growing trade war between the countries, cotton growers say Chinese authorities are urging the Asian powerhouse’s spinning mills not to use the Australian fibre.

Unlike China’s bans on Australian beef, barley and wine, Beijing’s alleged targeting of Australian cotton is outside official channels, and much harder to prove.

Senator Birmingham said the government was working closely with the cotton industry to clarify the situation.

“China should rule out any use of discriminatory actions against Australian cotton producers. Impeding the ability of producers to compete on a level-playing field could constitute a potential breach of China’s international undertakings, which would be taken very seriously by Australia,” he said.

“Our cotton exporters have worked hard to win contracts and establish themselves as reliable suppliers of high quality cotton in the Chinese market, which is an important input for many Chinese businesses.”

Agriculture Minister David Littleproud, who like Senator Birmingham has been unable to speak to his Chinese counterpart to discuss recent trade tensions, urged China to treat Australia fairly and with respect.

“You can only resolve differences by having your hand out and being prepared to have that conversation,” he said.

“We are showing leadership as an Australian government and are prepared to have that conversation and to have that dialogue.

We are a good global citizen and we will continue to do that, we just asked to be respected in return and listen to, so that any misunderstanding can be explained.”

Ben Wilmot 9.20am: Unibail-Rodamco under pressure to break up

French company Unibail-Rodamco-Westfield is facing a shareholder revolt over its plans to undertake a €3.5bn rights issue with dissident shareholders calling for a company break up.

The mall company has been slugged by the coronavirus crisis and last month unveiled the plans for the raising as part of a broader €9bn turnaround plan, including asset sales.

But French billionaire Xavier Niel, allied with Unibail’s former chief executive Leon Bressler, is urging shareholders to vote against the planned rights issue.

They are leading an investor group with a combined 4.1 per cent stake and need more than 35 per cent of voters to oppose the rights issue for it to be called off.

They have dubbed the rights issue “a misguided act by a management team that remains prisoner of its failed strategy that started with the acquisition of Westfield.”

The dissidents said buying the international Westfield shopping mall empire, in a $32bn deal struck by Sir Frank Lowy as he exited the industry in 2018, was to blame for Unibail’s heavy debt burden. Mr Bressler proposed selling the US portfolio - made up of Westfield centres in New York and other key cities - and using proceeds to slash debt.

Unibail shares closed up 13.8 per cent overnight and their secondary units could follow suit on the ASX on Friday.

The company said it would engage in a constructive and open dialogue with its shareholders. But its supervisory board said it “expresses its strong disagreement with these proposals, which add significant uncertainty and risk in the current complex environment”.

The board reiterated its commitment to the existing turnaround scheme, calling it a comprehensive and well-calibrated plan, which resulted from “an in-depth review of the group’s strategic options”.

8.45am: Rio unveils lower ore production

Rio says its Pilbara operations are returning to almost normal operating conditions with rosters back at pre-COVID-19 settings, as it revealed third quarter iron ore production was down 1 per cent on the same period last year.

A recovery in planned maintenance activity led to 5 per cent lower iron ore shipments for the period.

“We have delivered a good operational performance across most of our assets catching up on planned maintenance activity, particularly in iron ore, and continuing to adapt to new operating conditions as we learn to live with COVID-19,” chief executive J-S Jacques said.

“Rio Tinto has shown great resilience through challenging conditions and will continue to prioritise the health and safety of our employees, contractors and communities.”

8.43am: New Hope to cut corporate headcount

Queensland-based miner New Hope says it plans to make up to 75pc of its corporate office redundant by the end of November as part of a significant restructure, which will see the majority of executive positions removed.

The company said in a statement this morning that it had offered voluntary redundancies to employees in its corporate headquarters, as it targets a more streamlined management structure.

“With the ongoing uncertainty around approvals for New Acland we have had to refocus and put the business in the best position to go forward,” chief executive Reinhold Schmidt said.

“We have had to make some extremely difficult decisions but, in reality, even if we were granted approvals for Stage 3 today, we are in for a tough couple of years as we ramp up again.”

8.30am: Beacon Lighting boasts bumper first quarter

Retailer Beacon Lighting says that trading conditions have been supportive of the lighting and fan product categories, as it unveiled a first quarter net profit after tax figure of $8.4m, up from $2.2m the same period a year ago.

Group sales increased 24.3 per cent while online sales had lifted 156 per cent.

The company flagged a “successful year” in 2021, that despite the uncertainty caused by the coronavirus crisis.

“During these difficult times we have been able to provide our customers across Australia with a safe and rewarding shopping experience in our stores and online,” chief executive Glen Robinson said.

“We are seeing many customers investing in their home as they spend more time at home working and studying.

“Thanks to the support of our customers and the commitment of our team members, the Group has been able to achieve these strong results.”

Eli Greenblat 7.58am: Threat to Christmas stock eases: Woolies

Woolworths chief executive Brad Banducci says he is “relatively comfortable” with the ability for the supermarket giant to have enough stock on the shelves for Christmas, despite restrictions on its operations in Victoria caused by coronavirus lockdowns.

Previously Woolworths, as well as other supermarkets, warned there could be some food shortages because of the workplace restrictions placed on their distribution centres and warehouses that limited the number of workers on site and threatened a bottleneck in supply chains.

Speaking on ABC Radio National on Friday morning, Mr Banducci said the recent easing of those workplace restrictions should help beef up the supply chain and ensure enough stock was available at Christmas where consumer demand is expected to be highly elevated.

“Look, it has been a very productive couple of months working with industry and the Victorian government to ensure we can get the product right for Christmas and so that side of things from where we stand at the moment we feel very, relatively comfortable.”

But he said the real issue was the mental health of its team in Victoria, as all people in the state went through the prolonged stage 4 restrictions and lockdowns.

Mr Banducci also confirmed Woolworths would not take advantage of the wage subsidy being offered to employers taking on younger workers under the JobMaker program, saying that Woolworths supported the spirit of the program but that it “would look inappropriate, opportunistic” if Woolworths chose to participate.

Woolworths is planning to hire 15,000 team members to help with the Christmas rush, he said.

7.49am: Cotton industry ‘disappointed’ by China changes

The cotton industry says it is working to understand China’s changes to export conditions which appear to show mills being discouraged to use Australian cotton.

“It has become clear to our industry that the National Development Reform Commission in China has recently been discouraging their country’s spinning mills from using Australian cotton,” said a joint statement by Adam Kay, CEO of Cotton Australia and Michael O’Rielley, chair of the Australian Cotton Shippers Association.

“Our industry is working with the Australian government, including the Trade and Agriculture ministers’ offices, to investigate the situation and fully understand what is going on.

“To now learn of these changes for Australian cotton exports to China is disappointing, particularly after we have enjoyed such a mutually beneficial relationship with the country over many years.”

The industry said it would work with Canberra to “respectfully and meaningfully engage with China to find a resolution”.

7.20am: ASX tipped to dip at open

Australian stocks are set to open slightly lower after global markets were hit by tightening coronavirus lockdowns in Europe and a weakening jobs picture in the US.

At around 7am (AEDT) the SPI futures index was down 13 points, or about 0.2 per cent.

On Thursday, Australian stocks closed higher following a speech by the RBA’s Philip Lowe which flagged a November rate cut.

The Australian dollar was down at US70.93.

Brent-crude futures, the global benchmark of oil prices, ended the day down 0.4 per cent at $US43.16 a barrel, after earlier falling as much as 4.1 per cent.

Spot iron ore lost 0.7 per cent to $US118.90 a tonne.

7.12am: US business urges Trump to withdraw diversity order

More than 150 business and nonprofit groups, including the US Chamber of Commerce, are asking President Trump to withdraw his executive order that puts a limit on some diversity training.

In a letter sent to the White House, the groups said that the order creates confusion, leads to unnecessary investigations and hinders employers from combating workplace discrimination.

The group said the order “is already having a broadly chilling effect on legitimate” diversity training and its ambiguity could lead to unwarranted complaints and investigations.

The executive order, issued on September 22, prohibits federal agencies, companies with federal contracts and recipients of federal grants from participating in training that “promotes race or sex-stereotyping or scapegoating.”

The Trump administration threatens to suspend or cancel federal contracts with companies that violate the order.

Dow Jones Newswires

7.05am: US stocks edge lower on Covid, jobs

Stocks pared losses, but ended slightly lower as tightening coronavirus lockdowns in Europe and a weakening jobs picture in the US cast a shadow on markets.

Investors pulled back from the big technology stocks that have pushed the market higher, leaving major indexes with a third consecutive day of declines.

The S&P 500 fell 0.2 per cent, dragged lower by the communication services, health care and technology sectors. The Dow Jones Industrial Average slipped less than 0.1 per cent, or about 18 points, and the tech-heavy Nasdaq Composite slid 0.5 per cent.

The pullback followed losses overseas, with the pan-continental Stoxx Europe 600 down 2.1 per cent as governments hurried to impose lockdown measures to halt the spread of Covid-19. In Asia, Hong Kong’s Hang Seng retreated 2.1 per cent.

Uncertainty surrounding the coming elections and the on-again, off-again stimulus talks, as well as risks of a second wave of coronavirus infections, have left many investors sitting on the sidelines.

“The back and forth on the pre-election stimulus program has gone from a lot of optimism to a lot of pessimism,” said Jim McCormick, global head of desk strategy at Natwest Markets. “And we are seeing setbacks on the vaccine and a general pessimism about the worsening Covid situation in Europe.”

Fresh data suggested that persistent layoffs are holding back the economic recovery. New applications for unemployment benefits rose last week to the highest level since late August, with claims increasing to 898,000.

Markets are also reflecting investors’ reluctance to make any large bets until after the election, when the risk of contested results has been eliminated, said Mr. McCormick.

London became the latest European capital to tighten lockdown measures, with restrictions set to come into force this weekend. On Wednesday, France declared a state of emergency and imposed a nightly curfew for the Paris region and eight other metropolitan areas across the country.

The new measures threatened to imperil Europe’s fragile recovery, said Altaf Kassam, EMEA head of investment strategy and research at State Street Global Advisors.

The deadlock between the White House and Congress over any additional government spending appeared to become more entrenched. Treasury Secretary Steven Mnuchin played down the chances of a pre-election breakthrough and House Speaker Nancy Pelosi said major disagreements had yet to be resolved.

Dow Jones Newswires

5.15am: Wall St drops on rising COVID-19, economic risks

US stocks dropped as tightening coronavirus lockdowns in Europe and a weakening jobs picture in the US cast a shadow on markets.

In US afternoon trade the S&P 500 was down 0.6 per cent, and the Dow Jones Industrial Average slipped 0.1 per cent. The tech-heavy Nasdaq Composite slid 0.7 per cent.

The declines followed losses overseas, with the pan-continental Stoxx Europe 600 down 2.1 per cent as governments hurried to impose lockdown measures to halt the spread of COVID-19. In Asia, Hong Kong’s Hang Seng retreated 2.1 per cent.

Uncertainty surrounding the coming elections and the on-again, off-again stimulus talks, as well as risks of a second wave of coronavirus infections, have left many investors sitting on the sidelines.

“The back and forth on the pre-election stimulus program has gone from a lot of optimism to a lot of pessimism,” said Jim McCormick, global head of desk strategy at Natwest Markets. “And we are seeing setbacks on the vaccine and a general pessimism about the worsening Covid situation in Europe.”

Fresh data suggested that persistent lay-offs are holding back the economic recovery. New applications for unemployment benefits rose last week to the highest level since late August, with claims increasing to 898,000.

“This has been one of the biggest flies in the ointment, if you will, about the economic recovery that we’ve seen,” said Jeff Schulze, investment strategist at ClearBridge Investments. “The labour market is still continuing to move forward, it’s just not in a fast enough manner to appease all investors.”

Markets are also reflecting investors’ reluctance to make any large bets until after the election, when the risk of contested results has been eliminated, said Mr McCormick.

Former Vice President Joe Biden holds an 11-point lead over President Trump with less than three weeks to go before Election Day, according to the latest Wall Street Journal/NBC News poll. Despite Mr. Biden’s lead, uncertainty about a surprise on election night is keeping investors cautious.

London became the latest European capital to tighten lockdown measures, with restrictions set to come into force this weekend. On Wednesday, France declared a state of emergency and imposed a nightly curfew for the Paris region and eight other metropolitan areas across the country.

The new measures threatened to imperil Europe’s fragile recovery, said Altaf Kassam, EMEA head of investment strategy and research at State Street Global Advisors.

The deadlock between the White House and Congress over any additional government spending appeared to become more entrenched. Treasury Secretary Steven Mnuchin played down the chances of a pre-election breakthrough and House Speaker Nancy Pelosi said major disagreements had yet to be resolved.

Dow Jones Newswires

5.15am: Fashion and leather lift LVMH

French luxury goods giant LVMH said a sales rebound in fashion and leather goods had lifted third quarter sales to limit fallout from the COVID-19 pandemic.

LVMH noted a “significant improvement” as fashion and leather limited a fall in revenue to seven per cent on an organic basis after the virus had wreaked havoc in the first half of the year.

Sales came in at almost 12 billion euros ($US14 billion) for the quarter, above expectations of between 11.7 and 11.4 billion euros.

“Since the start of the year, LVMH has demonstrated good resilience in an economic environment severely disrupted by the serious health crisis that led to the suspension of international travel and the closure of the Group’s stores and manufacturing sites in most countries over a period of several months,” the company said in a statement.

“The encouraging signs of recovery observed in June for several of the Group’s activities were confirmed in the third quarter in all regions, notably in the United States, and in Asia, which once again grew over the period.” Fashion and leather sales rose 12 per cent on the third quarter of 2019, in marked contrast to perfumes, watches and jewellery and selective retailing, which all recorded falls.

The world’s leading luxury products group said it recorded revenue of 30.3 billion euros for January-September, down 21 per cent.

AFP

5.10am: Italian business chief sentenced for fraud

The head of Italian defence firm Leonardo, Alessandro Profumo, was sentenced to six years in prison for fraud related to when he headed the troubled lender Banca Monte dei Paschi di Siena (BMPS).

The court found Profumo guilty of market rigging and false accounting at BMPS in the first half of 2015, fined him 2.5 million euros ($US3.1 million), and prohibited him from managing a company for two years.

The bank’s former director general Fabrizio Viola was sentenced to the same penalties, while the BMPS itself was fined 800,000 euros.

Both men, who were additionally barred from public office for five years and from heading a company for two years, remain free pending an appeal.

Sources for their defence team told financial wire agency Radiocor the verdict would likely not have repercussions on Profumo’s continued stewardship of Leonardo, given it is not definitive.

AFP

5.07am: EU proposes Brexit talks next week

Chief EU Brexit negotiator Michel Barnier said he had invited his British counterpart to resume trade talks next week, despite Prime Minister Boris Johnson’s threat to walk away.

“And as of tomorrow I will be speaking with my counterpart David Frost. On Monday we’ll be in London for the full week, including the weekend if necessary. The following week in Brussels,” Barnier said.

“That’s what I have proposed to the British team to negotiate in the short space of time still left to us, so that we can negotiate this agreement through to the end of October, so that we have the agreement that we want, that the member states want.”

AFP

5.05am: Stocks plunge on virus restrictions, US jobs data

Global markets plunged with investor sentiment hammered by fears that tighter coronavirus restrictions could derail a tentative economic recovery.

In London, equities closed 1.7 per cent lower after the UK government announced the British capital faces more stringent coronavirus restrictions as case numbers rise.

Paris suffered a drop of more than 2.0 per cent after the French government announced a curfew for the capital and eight other cities -- covering almost a third of the country’s population -- for as long as six weeks.

And Frankfurt stocks lost 2.5 per cent after Germany also ramped up COVID-19 restrictions, while the EU’s disease control agency labelled more than half of the bloc’s member states as red zones in a new map to guide member states’ decisions on travel restrictions.

Across the Atlantic, Wall Street sentiment was not helped by Labor Department data showing new applications for US jobless benefits rose to a seven-week high of 898,000 last.

The increase of 53,000 from the prior week was the sharpest rise in seasonally-adjusted initial claims in two months as the United States attempts to recover from mass lay-offs caused by virus-related business shutdowns earlier this year.

The Dow and the tech heavy Nasdaq had fallen around 1.0 per cent two hours into trading with Apple and Tesla notably losing ground.

Asian markets had earlier also closed well deep in the red.

“Renewed health concerns and tighter restrictions around Europe are hammering stocks,” said CMC Markets analyst David Madden.

“Dealers are dumping stocks for fear that economic activity will drop off because of the tighter restrictions in various parts of Europe.” “The latest restrictions are likely to hamper Europe’s economic recovery -- which was already running out of steam before the health woes ramped up again,” said Madden.

Oil prices also faltered, losing more than three per cent.

AFP

5.00am: New US jobless claims rise sharply

New applications for US jobless benefits rose unexpectedly last week to 898,000, the Labor Department said.

The 53,000 increase from the prior week was the sharpest rise in seasonally adjusted initial claims since the week of August 15, as the United States attempts to recover from mass lay-offs caused by business shutdowns earlier this year to stop COVID-19.

The jump brought the levels of initial claims back to where they were in late August, and remained above the single worst week of the 2008-2010 global financial crisis, the last economic downturn.

Another 372,891 people also filed claims for benefits under a special program to help workers not normally eligible for benefits and who lost their jobs due to the pandemic, about 91,000 less than the week prior, according to the unadjusted figures.

The report comes amid an ongoing impasse in Washington over passing more aid to the beleaguered US economy, with Democrats and Republicans still unable to agree on a new stimulus package after the expiration of key measures of the $US2.2 trillion CARES Act passed in March.

AFP

4.55am: Stimulus deal ‘hard’ before election

Getting a new stimulus spending package approved by Congress is unlikely before the November 3 presidential election but negotiations will continue nonetheless, US Treasury Secretary Steven Mnuchin said.

Lawmakers have tried fruitlessly for months to reach an agreement on a follow-up to the $US2.2 trillion CARES Act after key provisions of that rescue measure expired, depriving unemployed workers of needed support and sparking mass lay-offs by US airlines.

Talks resumed in recent weeks but with the election drawing ever nearer and Democrats and Republicans still arguing over how much to spend and in what form, Mnuchin acknowledged the talks are facing tough odds.

“A deal would be hard to get done before the election, but we’re going to keep trying,” Mnuchin said in an interview on CNBC. “So, I don’t want to say that it’s not likely, it’s just there are significant issues.” Democratic House Speaker Nancy Pelosi late Wednesday spoke on MSNBC and said the sides would not be talking if they didn’t really want to reach an agreement, but insisted on a “clear plan to crush the virus” as well as funds for education and to protect worker safety.

Major Wall Street indices sunk into the red over the past days as traders began realising new economic stimulus may not come any time soon. The Dow was 0.7 per cent lower in early trading.

AFP

4.50am: French, Dutch push EU to limit tech giants

France and the Netherlands jointly urged EU regulators to limit the power of Silicon Valley giants like Google and Facebook, and break them up if necessary.

Firms such as these as well as Amazon and Apple have immense power over companies wishing to access consumers using their platforms and concerns have grown about how they use it.