CSL, BHP weigh on ASX as dollar extends gains

The Aussie dollar is climbing toward US72c, shrugging off a 1.3pc slide in the sharemarket as commodities surge.

- CSL, BHP drag on shares

- Retail sales lift 2.4pc

- Beach Energy expects profit miss

- Fire, floods drag QBE to first-half loss

That’s all from the Trading Day blog for Wednesday, July 22. Shares lost 1.3pc to reverse Tuesday’s solid 2.6pc jump, led by a reversal in CSL and BHP as risk sentiment took a hit from a blow out in virus cases in Victoria.

The Aussie dollar continued higher after setting new 15-month highs while preliminary retail sales figures showed a rise of 2.4pc in June, and QBE lifted despite warning of heavy losses to come in the first half.

US futures suggest a slip to come overnight.

8.57pm: Eli Greenblat Bouncing Baby Bunting blooming

Shares in infant clothing, homewares and equipment retailer Baby Bunting bounced more than 11 per cent after it confirmed its dominant position in the specialist baby goods sector by forecasting full-year net profit to rise by as much as 35 per cent as its twin engines of store sales and online sales powered up.

In a trading update on Wednesday, Baby Bunting said it expected pro-forma earnings before interest, tax, depreciation and amortisation for fiscal 2020 of between $33m and $34m, reflecting growth of between 22 per cent to 25 per cent.

Pro-forma net profit after tax for the year of between $18.5m and $19.5m would see growth of between 29 per cent and 35 per cent but still below previous guidance of profit as high as $22m. Statutory net profit after tax would be between $9.5m to $10.5m, from $11.6m in 2019.

The earnings update was upbeat compared with its more cautious trading update in March, when the coronavirus pandemic first took hold in Australia, and represented an acceleration of its strong store and online sales in guidance provided to the market in May.

Baby Bunting shares lifted more than 11 per cent on the profit forecast and later closed up 35c, or 11.11 per cent, at $3.50. They have more than doubled from lows of just over $1.50 in March.

7.58pm: Chris Griffith Call for Apple fix on COVIDSafe app

Government Services Minister Stuart Robert has fired a barb at Apple over the COVIDSafe contact tracing app. He says the US tech giant could “fix” an issue “tomorrow” involving locked iPhones not picking up all Bluetooth signals from similar iPhones.

The COVIDSafe app has been downloaded about 6.7 million times and is designed to help trace the contacts of a person with COVID-19. The app uses Bluetooth to discover and record the encrypted IDs of other phones nearby so they can be traced later if necessary.

Speaking on Sky News Australia, Mr Robert said a phone’s ability to detect the Bluetooth signal from nearby phones varied from handset to handset. “It varies from handset to handset, from operating system to operating system, and from Android to Google,” he told Sky News.

6.51pm: Lachlan Moffet Gray Jumbo farewell from flying kangaroo

On Wednesday, a socially distanced crowd of 150 people gathered in the cavernous space of Qantas hanger 96 at Sydney Airport, to witness the abdication of the last queen of the skies.

For 49 of Qantas’s 100 years the Boeing 747 Jumbo jet has been synonymous with the image of the flying kangaroo, becoming the plane on which many Australians experienced their first international flight and a welcome sign at airports for travel-weary Australians returning home from the far-flung corners of the world.

The first delivery of the 747 – the a-200 series – was taken in 1971 at a modern-day equivalent cost of $1.5bn, a record breaking and daring investment for Qantas at a time when supersonic passenger jets like the Concorde were thought to be the future of air travel.

And off it goes ... job done #747farewell https://t.co/CsH8EZTR4T pic.twitter.com/g2zPRQvsR0

— Lisa Millar (@LisaMillar) July 22, 2020

The jet soon proved the doubters wrong, with its fuel economy and large passenger size making air travel economical for the average Australian while setting numerous world records, such as flying the first non-stop commercial flight from London to Sydney in 1989.

Such was the jet’s popularity that over the past 49 years, Qantas has operated a total of 65 747s – including a stint between 1979 and 1985 when the fleet was composed entirely of the jumbo.

But as aviation technology advanced, Qantas progressively upgraded its fleet with the final six 747s set to be retired at the end of the year – before the coronavirus pandemic brought forward their retirement to the depths of a plane graveyard in California’s Mojave Desert.

Speaking in front of the final 747 – part of the 400 series — Qantas CEO Alan Joyce paid tribute to the aircraft that “overcame the tyranny of distance” to open up the world to Australia.

“We’re here today to say farewell to the queen of the skies,” Mr Joyce said.

“We’re saying farewell to an aircraft that I think that has changed the world of aviation, an aircraft that has changed Qantas, an aircraft that has changed Australia.”

Mr Joyce said the 747 had played an integral part in the highs of Australia – ferrying hundreds of Olympic medals, sporting trophies, visiting dignitaries and even the Pope and the Queen into the country – but it was also witness to the lows, flying numerous rescue missions, most recently out of Wuhan.

“When Australians needed our help, this aircraft was the first aircraft, because of its reliability,” Mr Joyce said.

“It goes back as far as 1974 when the aircraft evacuated 674 Australians out of Darwin – still the record for the amount of people that were every flown on a 747.”

5.57pm: James Kirby Rush to ‘fix’ home mortgage

Australians have rushed to “fix” their mortgage rates during the pandemic crisis with the portion deciding to lock in rates at current levels nearly tripling to a record-breaking 40 per cent, Commonwealth Bank has reported.

The extraordinary shift in borrowing patterns at the nation’s largest home lender is expected to be matched across the sector as fixed rates are often lower than variable rates at present.

With rates at record lows, many homeowners are clearly seeking security in knowing in advance how much they will have to pay each month in the years ahead.

Meanwhile, the banks are able to keep the fixed rates at very low levels thanks to emergency monetary policy settings from the Reserve Bank of Australia that are funding our banking system.

“It’s more than a spike in fixed rate applications,” says Stephen Halmarick, chief economist at the Commonwealth Bank. “It’s deeper than that - there is an expectation that monetary policy will be at these settings for some time to come.”

Australian investors and home owners traditionally used variable rates, which historically had lower headline rates and allowed borrowers to pay off the loan faster if their financial situation improved.

But the long decline in interest rates experienced in the local market has prompted a major shift which brings the Australian system into line with overseas markets, such as the US and continental Europe, where long-term fixed rates are more common.

Fixed rate investors were still running at just 14 per cent of all borrowers as recently as early March.

4.29pm: Resolute leads, Inghams lags

Gold miner Resolute led the market’s best performers on Wednesday as traders turned to safe haven gold and silver asset to shield against the virus uncertainty.

As the market gave back gains, Resolute jumped by 12.9 per cent to $1.40 – cheering commentary from Citi suggesting that record high gold prices are just “a matter of time”.

Similarly, Silver Lake added 3.7 per cent to $2.53.

On the flip side, Mesoblast, Pro Medicus and PolyNovo felt the pressure of a rising dollar and shift away from health stocks, while Inghams dropped 5 per cent after closing a facility in Melbourne’s North due to several COVID-19 cases.

Here’s the biggest movers at the close:

4.11pm: ASX drops 1.3pc in heavyweight reversal

A stark reversal in market sentiment wiped 1.3 per cent from the ASX, as CSL and BHP dived.

At the close, the ASX200 was down 81 points or 1.32 per cent to 6075.1.

All sectors bar energy finished deeply in the red, led by a health and tech drop. BHP lost 3.4 per cent to $37.50 while CSL fell 3.6pc to $282.72.

3.16pm: Inghams facility closed in COVID scare

Chicken producer Ingham’s has temporarily closed its Victorian processing plant after five employees tested positive for COVID-19.

The group said this afternoon that its Thomastown Further Processing Plant had been temporarily closed, with all employees requested to self-isolate at home.

Ingham’s said it would be “working with its customers to minimise supply chain disruptions and to ensure that Ingham’s products remain available to consumers around Australia”.

While the site in Melbourne’s North is closed, Ingham’s said the rest of its sites across Australia remained operational.

ING last traded down 4.4pc to $3.39.

3.02pm: Lion One jumps on Fiji gold find

Dual-listed gold explorer Lion One Metals is cheering a fresh find at its Fijian gold mine, with shares up as much as 49pc.

The miner, also listed on the Toronto stock market, this afternoon said it had encountered visible gold in 1cm veins, at a depth of 583m, while drilling at its project on the Viti Levu island in Fiji.

“A network of veins, each measuring a few mm up to two cm wide, has been intercepted, some displaying coarse clots of visible gold particularly those at a depth of approximately 583m,” the company said.

“Drilling of this hole will continue to it is planned termination at 1,000m once it has passed across the entire feeder target.

“Core drilled to date is currently being logged and will soon be sawed, sampled, and assayed.”

LLO shares hit $2.60, and last traded up 35pc to $2.35.

2.56pm: ASX erasing Tuesday outperformance

The local share slide is picking up pace in afternoon trade, with the benchmark now down 1.5pc near daily lows.

The Health Care and IT sectors have continued to lead the retreat with CSL down 3.7pc and Afterpay down 3.4pc after surging Tuesday.

But other big drags include a 3.4pc fall in BHP after Citi downgraded, a 2.2pc fall in Wesfarmers, a 0.8pc fall in CBA and a 2.5pc fall in Transurban.

Apart from banks, some domestically-sensitive stocks have reacted badly to Victoria’s record number of new coronavirus cases.

Among them, Qantas is down 3.4pc, Seek is down 3.1pc, Domain is down 2pc and Star Entertainment is down 1.8pc

Joyce Moullakis 2.51pm: ANZ underwriter agreement key in ACCC trial

The competition regulator is more focused on ANZ’s $2.5bn capital raising underwriting agreement from 2015 in proving a landmark cartel against it and investment banks managing the deal, over witness evidence.

The Australian Competition and Consumer Commission’s Marcus Bezzi stressed in pre-trial hearings on Wednesday the regulator had examined a number of areas including whether the banks’ arrangements were a joint venture and if the parties were in competition.

“The underwriting agreement was a really important piece of evidence, probably more important than anything that was said by the witnesses,” Mr Bezzi, the ACCC’s executive general manager of specialised enforcement, said.

“The material that we had gave us confidence.”

The ACCC and Director of Public Prosecutions are pursuing criminal charges against ANZ, Citigroup and Deutsche Bank and six current and former executives over how they managed a 2015 sale of surplus shares not taken up in a $2.5bn raising. The regulator alleges the banks acted as a cartel and is drawing on evidence supplied from JPMorgan, a fellow bank on the deal.

2.38pm: ASIC won’t review Westpac lending case

Financial regulator ASIC says it won’t seek special leave to appeal to the High Court in the Westpac ‘responsible lending’ matter – also known as the Wagu and Shiraz case given the example raised in court of personal spending.

The move follows the full Federal Court’s 2-1 decision to reject ASIC’s earlier appeal.

“While it would have been open to ASIC to seek special leave to appeal to the High Court to obtain a ruling on the construction of the statute, ASIC is mindful of the impact of the additional time required to resolve this matter in the current challenging economic circumstances,” the regulator says.

ASIC said it will review its updated regulatory guidance and will consider what implications the Federal Court decision has for that guidance.

“Any reform of the National Consumer Credit Protection Act (National Credit Act) to clarify further the enforcement of those principles is ultimately a matter for the Federal Government and parliament,” ASIC noted.

The decision is a small relief for Westpac which won’t have to mount a challenge to the case again.

Read more: Westpac claims ‘wagyu and shiraz’ win

2.33pm: All Trades QLD collapses

One of the nation’s biggest commercial employer of apprentices and trainees, the privately held All Trades Queensland has collapsed.

John Park and Joanne Dunn from FTI Consulting have been appointed as voluntary administrators of the Brisbane-based company.

FTI Consulting’s Mr Park said the administrators will seek to administer the affairs of the company in a way that maximises the chances of its business continuing.

“The Administrators are mindful that ATQ is a major commercial employer of apprentices and trainees in Australia and plays an important role in developing the careers of many trades people,” Mr Park said in a statement.

“Our aim is to maximise the prospects of the business continuing via a market trade sale or recapitalisation through a Deed of Company Arrangement,” he said.

The Administrators will conduct an independent assessment of the financial position and ongoing viability of ATQ. The Administrators intend to work with ATQ management and staff in continuing to trade the business while the review takes place.

2.20pm: Global markets far from euphoria: BofA

Global financial markets remain “far from euphoria”, according to Bank of America.

On a contrarian basis, this is a sign that the “risk-on” rally can continue.

“Global Equity Risk-Love continues to dwell in the neutral zone, now in the 43rd percentile of its history since 1987, after recovering from peak panic in March,” says BofA’s head of APAC and global EM strategy, Ajay Singh Kapur.

“Narrower spreads, lower put-call ratios and stock-to-stock correlations, and subsiding volatilities were some of the more conspicuous moves among the drivers of the Global Equity Risk-Love, two-thirds of which come from Developed Markets and one-thirds from Emerging Markets. He notes that the Global Risk-Love reading is aligned with BofA’s gauge of global cross asset risk, the Bull & Bear Indicator, now at 3.0 and fairly distant from the worryingly bullish levels above 8.0.

And the BofA Fund Manager Survey Cash Indicator, at 4.9 per cent this month, was also mildly higher than the prior 10-year average level of 4.7 per cent, “implying that investment managers have preserved some dry powder instead of going all out.”

“It is worth remembering that sentiment indicators are constructed to be contrarian only at the extremes, while they suggest going with the flow for readings in between,’ Mr Singh Kapur says.

1.43pm: Retail data shows ‘new normal’: ANZ

ANZ has described the latest retail sales data as evidence of “the new normal” where elevated retail spending replaces any travel or entertainment purchases.

After early June data showed a 2.4pc jump in sales, ANZ notes that its own data indicates expenditure is likely to be similar in the current month.

Data from the bank for the week to July 18 showed strong year-on-year household spending continued into July, with electronics up 66pc, furniture up 50pc and homewares up 30pc.

Melbourne’s lockdown was pulling social spend lower however, with national dining spend down 3.4pc – thanks to a 24pc drop in Melbourne.

Read more: Lockdown lift got spending going

1.17pm: Death rate above average: ABS

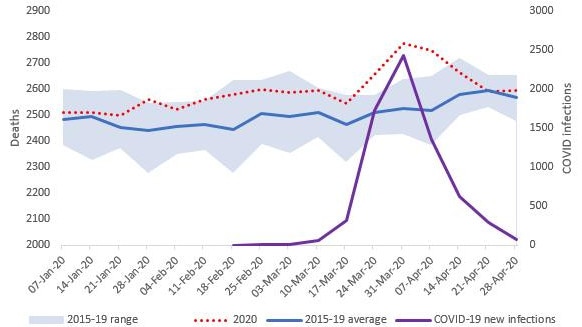

Deaths in April were higher than average, according to the latest data from the ABS, continuing a pattern evident since March.

The national statistics bureau today reported 44,000 doctor certified deaths between January and April this year, higher than an average of 42,500 over the previous five years.

While coronavirus hogs the headlines, the ABS said it was deaths from pneumonia which were higher than historic averages, with diabetes deaths also higher than expected.

Director of mortality statistics James Eynstone-Hinkins noted that deaths from mid-March to mid-April “exceeded historic averages by more than 700”, but had settled back to trend levels for the remainder of April.

A graph of deaths for the period shows a spike in deaths coincided with the peak number of COVID-19 infections in mid-March.

1.01pm: CSL, BHP drag on shares

Yesterday’s optimism is a distant memory as shares slide by 1.1pc in Wednesday’s trade.

At 1pm, the benchmark ASX200 is off by 69 points or 1.12pc to 6087.3.

The biggest drag is from heavyweights BHP, lower by 3.3pc, and CSL which is slipping by 3.2pc.

QBE is bucking the negativity with a 1.7pc boost despite warning of a near $1bn loss for the first half.

Here’s the biggest movers at 1pm:

12.43pm: BHP at fair value: Citi

BHP shares have run to fair value levels and while June quarter production was in line with estimates, FY21 output will be softer, says Citi.

After the mining heavyweight yesterday handed down its quarterly results, analyst Paul McTaggart noted that production was better than expected in copper and iron ore, but weaker in metallurgical and energy coal and petroleum.

Adding to that, he says a 25pc lift in BHP shares over the past three months has them at “fair value levels”.

He revised lower his profit expectations by 10pc to $9.1bn given FY20 production and financial impacts, and trimmed FY21/22 EPS by 11pc and 6pc respectively.

BHP is one of the biggest weights on the index at 1pm, last down 3.2pc to $37.55.

David Ross 12.17pm: Viva jumps 7pc on AFM purchase

Gym owner Viva Leisure is acquiring Australian Fitness Management, the master franchisor of 197 Plus Fitness gyms, in a deal worth as much as $20m.

The $18m deal, with an additional $2m subject to performance, is expected to be sealed by August 31, on the condition of a restructuring of AFM’s existing lease and sublease arrangements.

AFM offers Viva a line into India and New Zealand, with four and three gyms in those countries respectively, which Viva chief Harry Konstantinou said opened up significant opportunities.

“Viva sees that as an opportunity to grow franchises in NZ as well as corporate owned enterprises,” he said.

The acquisition is on a pro-forma earnings of 8x or a net profit of 12x and will be funded through existing cash reserves after the group tapped the market for $25m just last month.

AFM generates $100m in annual revenues from its almost 175,000 members – the merger to take Viva’s memberships to over 270,000, making it the third largest by membership or fourth largest by network.

VVA shares last traded up 7.3pc to $2.51.

Read more: Viva Leisure raising $25m

11.38am: Retail sales lift 2.4pc

Early retail sales data for June shows a 2.4pc rise from May, settling after sharp swings during and after the first wave of national lockdowns.

As compared to June 2019, retail sales were up by 8.2pc however, showing a lift in spending as shopping centres and restaurants reopened.

“Rises in June 2020 were led by cafes, restaurants and takeaway food services, and clothing, footwear and personal accessory retailing,” ABS said.

“While some restrictions on trade remained in June, many businesses in these industries saw a full month of trade, having been closed for the first week of May 2020. Turnover in these industries remained below the levels of June 2019.”

A lift in supermarket sales, in part due to panic buying by Melbourne shoppers in late June, helped to offset a slip in liquor sales.

AUDUSD flat at US71.28c.

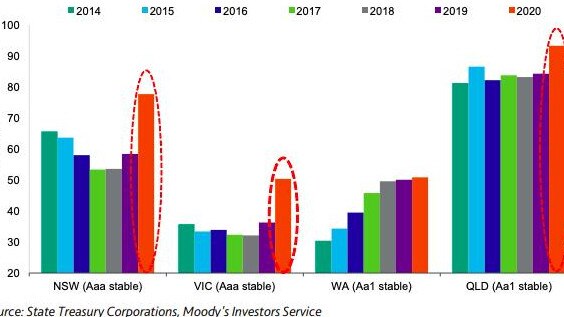

Patrick Commins 11.33am: State debt surges $50bn: Moody’s

Australia’s state debt burden has surged $53bn in just six months, global ratings agency Moody’s has said, as state leaders joined the Commonwealth in committing to massive spending initiatives to soften the economic blow from the COVID-19 crisis.

As Josh Frydenberg braced the country for an “eye-watering” debt and deficit figures in tomorrow’s federal budget update, Moody’s analysts said they expect “a material deterioration in budgetary outcomes for all states in 2020 and 2021”.

The debt burden is rising for all states (except Western Australia thanks to booming commodity prices), with average debt as a percentage of state revenues increasing from 103 per cent in 2019-20 to 120 per cent in 2022-23.

NSW and Victoria are responsible for around 70 per cent of the increased debt in 2020.

The new report from Moody’s said that despite the surge in debt, “we expect states to maintain their resolve to contain spending and implement additional budgetary redress measures once the outbreak has been addressed”.

11.09am: Travel takes knock from Vic virus tally

Local shares are falling further as Victoria announces a record 484 new coronavirus cases on Wednesday.

The S&P/ASX 200 is down 1pc at 6092 after falling an additional 20 points on this news.

Domestic cyclicals were worst hit as they are exposed most to the prospect of more restrictions due to the worsening outbreak, Qantas fell 3.2pc, Crown fell 3.2pc, Webjet fell 1.6pc, Flight Centre fell 1.3pc, Tabcorp fell 1.2pc and CBA lost 0.5pc.

The Australian dollar also retreated, falling from a 0.7145 to 0.7123 intraday.

10.44am: Yesterday’s winners lead today’s slip

Australia’s S&P/ASX 200 share index is falling 0.8pc to 6109, with tech and healthcare switching from winners yesterday to losers today, in line with offshore moves.

CSL is down 2.6pc, Mesoblast down 6.2pc, Afterpay down 3.3pc and Xero down 3.5pc.

But BHP is the single biggest drag on the market, falling by 3pc after Citi downgraded its rating to Neutral and Morgans Financial cut to Hold.

Rio Tinto and Fortescue are coming off on the back of BHP even after spot iron ore rose 2.4pc to $US108.26 and Dalian iron ore futures rose 2.2pc overnight.

OZ Minerals rose 4.5pc to a 6-year high of $13.56 after boosting its copper output guidance.

Energy stocks are also surging with Santos and Oil Search up more than 3pc after Brent crude oil rose 2.4pc to $US44.32.

Banks are still enjoying the afterglow of extended fiscal stimulus with the four majors up 0.2-1.2pc.

Ben Wilmot 10.36am: AMP rocked as Hourigan jumps ship

Funds manager AMP Capital has been rocked by the departure of global property chief Carmel Hourigan who has left the company to head Charter Hall’s office unit.

The move will see the property veteran step into the role of chief executive of Charter Hall’s Office arm, with a mandate to expand the listed group’s $20bn office holdings.

But her exit will shake AMP Capital which has a $29bn property funds empire and puts a spotlight on the controversial appointment of infrastructure boss Boe Pahari as AMP Capital chief executive.

AMP Capital has been under siege since the decision to appoint Boe Pahari as head of AMP Capital effective July 1 replacing the highly regarded Adam Tindall

Responding to media reports, the company has confirmed Pahari was appointed despite a $500,000 fine for a past sexual harassment complaint back in 2017.

10.28am: Iberdrola lifts Infigen bid, with conditions

Infigen’s Spanish suitor Iberdrola has lifted its bid for the group for a third time, offering 92c per share, but only if it receives an additional 13pc acceptances by the end of the month.

The tug of war between Iberdrola and rival bidder UAC has been ongoing for the past several months, but the latest offer trumps UAC’s 86c per share bid and puts Iberdrola firmly in the lead.

Iberdrola says the addition 13pc would give it a total relevant interest of 37.28pc, including 4.28pc already received from acceptances under the offer.

Infigen directors have unanimously recommended the offer, saying they intent to accept the deal, in the absence of any superior offer.

IFN last traded up 1.66pc to 92c.

Read more: Infigen battle not over yet, says Ords

10.13am: Health, tech drag ASX lower

Shares are shying off the four-month highs hit yesterday, pulling lower by 0.7pc in early trade as health and tech stocks drag.

At the open, the ASX200 is off by 42 points or 0.69 per cent to 6114.

BHP is a key detractor, down 3pc, while QBE adds 1.1pc despite warning of a first-half loss.

The major banks are all trading in the green again, ANZ leading the pack with a 0.6pc lift.

10.07am: Baby Bunting tips 35pc profit jump

Retailer Baby Bunting says it expects to report profit growth as much as 35 per cent for the full year, as the group’s essential nature saw it remain open through the coronavirus lockdowns.

In audited results released to the market this morning, Baby Bunting said earnings were expected between $33m and $34m, up 22pc to 25pc on the previous year, while profit was expected at between $18.5m and $19.5m.

Sales grew by 12pc to $405m as online sales lifted by 39pc – now making up 14.5pc of total sales for the year.

“As the ongoing restrictions in Melbourne and surrounding areas indicate, COVID-19 is likely to have an impact into FY21 in ways that may be unexpected,” chief Matt Spencer said.

“I am confident that our business can respond to new challenges as we did in the second half of FY20. To date, trading in FY21 has continued to be positive.”

BBN last traded at $3.15.

9.49am: Downer raises $339m

Downer shares will return to trade this morning, after the group raised $339m in an institutional entitlement offer.

The group today said its $3.75 per share offer had been strongly supported by institutional shareholders, with a take-up rate of approximately 97pc of eligible shareholders.

“Proceeds of the Entitlement Offer will be used to strengthen Downer’s balance sheet, support the acquisition of the remaining shares in Spotless and provide flexibility for continued investment in Downer’s core Urban Services business,” chief Grant Fenn said.

“We believe the strong support for the Institutional Entitlement Offer is an endorsement of the actions we are taking to make our business more competitive and allow us to drive improved returns going forward.”

DOW last traded at $4.26.

9.44am: ASX likely supported on dips

Australia’s share market should be well supported on dips amid an improving global risk appetite.

Overnight futures relative to fair value suggest the S&P/ASX 200 will open down 0.3pc after surging 2.6pc to a 6156.3 points on Tuesday.

That follows an intraday pullback in the US share market which left the S&P 500 up 0.2pc at 3257.3 and the Nasdaq down 0.8pc at 10680.4.

But while gold rose 1.3pc as the US dollar index fell 0.8pc, indicators of global risk appetite mostly improved.

The Australian dollar rose 1.6pc to a 15-month high close of US71.28c after the extension of fiscal stimulus in Australia while the Euro rose 0.7pc to a 21-month high close of 1.1527 after agreement on the EUR750bn EU Rescue Fund.

Meanwhile the VIX volatility index hit an almost 7-week low of 23.61pc, remaining below its 200-day moving average for a third day.

While the coronavirus pandemic may be worsening, vaccine hopes are high, and US politicians still have time to agree on a $US1tn fiscal boost before their August break.

9.36am: Silver rally has further to run: CBA

Gold is most commonly associated with safe haven demand, but silver too has been on a run of late, surging to the highest level since March 2014.

Commonwealth Bank resources analyst Vivek Dhar notes that silver is benefiting from haven demand and long term US real yields, along with industrial demand hopes.

“Some in the market estimate that industrial demand accounts for as high as ~85pc of total silver consumption,” he notes.

“Photovoltaics (~10pc of total silver demand) look particularly promising as a number of economies, particularly Europe, look to deploy “green” stimulus in response to COVID‑19.”

Supply disruptions have also helped silver prices higher, with estimates that 66pc of global production of the precious metal was on hold due to COVID-19 lockdowns, the most of any commodity.

“The silver‑gold price ratio gives context to the surge in silver prices. The silver‑gold price ratio bottomed at 0.79pc in mid‑March, marking the lowest ratio in at least 20 years,” Mr Dhar adds.

“Even as silver prices have surged higher, the silver‑gold price ratio is still well short of the long‑term average of ~1.5pc. We think that means that a sustained rally in silver can continue, particularly when demand hopes and supply concerns are added to the mix.”

9.14am: What’s on the broker radar?

- BHP cut to Neutral – Citi

- BHP cut to Hold – Morgans

- Credit Corp raised to Overweight – JP Morgan

- Perseus cut to Underperform – Credit Suisse

- Saracen Minerals cut to Hold – Argonaut

- Saracen Minerals cut to Sell – EL & C Baillieu

9.04am: Boeing 737 MAX not back until 2021

Boeing Co’s 737 MAX isn’t likely to resume widespread passenger flights until early next year — nearly two months beyond previous expectations — due to another regulatory delay, according to US government and industry officials.

That means the jets are expected to be grounded at least as long under the plane maker’s chief executive, David Calhoun, as under his predecessor, Dennis Muilenburg, who was ousted at the end of 2019 following repeated delays in getting the plane back into service.

The latest timeline, these officials said, anticipates the Federal Aviation Administration won’t finish work to lift its March 2019 grounding order until late October or early November, because the agency has decided to ask for public comments before finalising software and hardware changes. Regulators overseas could take days or weeks longer to concur in those decisions.

Completing pilot training and maintenance checks — and obtaining final FAA approval for those tasks for individual airlines — is expected to stretch well into December, according to the officials. Only then will the MAX — responsible for two fatal crashes that took 346 lives — be ready to return to commercial service.

Dow Jones

8.58am: Beach Energy expects profit miss

Beach Energy said its annual profit would be slightly below expectations, largely due to weak prices of oil and liquids coupled with the impact of the coronavirus pandemic on production.

Beach said underlying earnings before interest, tax, depreciation and amortisation in the year through June would be marginally below earlier guidance of $1.175 billion ($US838 million), without being more specific.

Production in its fiscal fourth quarter totalled 6.84 million barrels of oil equivalent, which brought annual output to 26.74 million barrels. That was up 2 per cent on proforma production for the previous year, but represented a 1 per cent miss to guidance.

Beach said the pandemic had impacted the pace of new Western Flank well connections and gas demand during the fourth quarter.

“Beach ended FY20 with $50 million net cash and has access to $500 million in liquidity, meaning our balance sheet remains rock solid,” said chief executive Matt Kay.

Dow Jones Newswires

Samantha Bailey 8.48am: QBE flags first-half loss

Insurer QBE has flagged a first-half loss due to the impact of COVID-19 and an increase in catastrophe claims for the period.

In a market update, QBE said it expected to book an after tax loss of around $US750m when it unveils its interim results next month.

QBE said COVID-19 related costs were expected to be around $US600m pre-tax, in trade credit and LMI, as well as in casualty landlords’ insurance and other classes.

Australia’s devastating bushfire season and east coast hailstorm activity also meant that catastrophe claims lifted to $US310m from $US180m in the first-half a year ago. That figure was significantly higher than the company’s $US250m catastrophe allowance.

The company also said it suffered a net investment loss of around $US125m during the period as a result of extreme investment market volatility.

8.48am: Oz Minerals lifts guidance

Oz Minerals raised its guidance for copper and gold production in the year through December after overcoming disruption from the coronavirus pandemic to deliver a strong first-half performance.

Oz Minerals said it now expects to produce between 88,000 and 105,000 tonnes of copper this year, up from prior guidance for output of 83,000-100,000 tonnes. The miner also expects to produce 227,000-249,000 troy ounces of gold, above a prior forecast for 207,000-234,000 ounces.

Oz Minerals reported copper production of 24,577 tonnes in the three months through June, which is the company’s fiscal second quarter. Gold output totalled 68,740 ounces, led by production from its Prominent Hill mine in South Australia state.

Management said all-in sustaining costs averaged US$0.505/lb in the second quarter, sharply down on costs of US$0.749/lb in the previous three years. As a result, Oz Minerals said it’s now targeting all-in sustaining costs of US$0.70-US$0.85/lb.

Dow Jones Newswires

8.45am: What’s impressing analysts?

BHP PLC Cut to Neutral: Citi

Credit Corp raised to Overweight: JPMorgan

Perseus cut to Underperform: Credit Suisse

Saracen Mineral cut to Hold: Argonaut Securities;

Saracen Mineral cut to Sell: Baillieu

Perseus cut to Underperform: Macquarie

Silver Lake Resources raised to Outperform: Macquarie

7.45am: Virus crisis to get worse: Trump

A sombre President Donald Trump warned that the coronavirus crisis in the United States is likely to “get worse before it gets better.”

“Some areas of our country are doing very well,” Trump said at his first formal White House virus briefing since the end of April. “Others are doing less well,” the president said. “It will probably unfortunately get worse before it gets better.”

He said there had been a “a concerning rise in (virus) cases in many parts of our South.” Trump urged Americans to wear face masks to help prevent the spread of the highly contagious virus which has left more than 141,000 people dead in the United States.

“We are asking everybody that when you are not able to socially distance, wear a mask,” he said. “Whether you like the mask or not, they have an impact. They will have an effect and we need everything we can get.”

Trump said the goal is “not merely to manage the pandemic but to end it.” “The vaccines are coming and they’re coming a lot sooner than anyone thought possible,” he said.

Trump also repeated his assertion that the virus “will disappear.” “It will disappear,” he said.

AFP

6.20am: ASX set to fall, buck global trend

Australian stocks are set for a solid fall in early trade despite advances on global markets, and after yesterday posting their highest close since early March.

At about 6am (AEST), the SPI futures index was down 64 points, or 1.1 per cent.

US and European stocks mostly gained overnight, boosted by a new EU fiscal stimulus package and earnings result.

Oil prices rose more than 2 per cent and gold gained 1.2 per cent.

Aided by an extension to government wage support, Australia’s S&P/ASX 200 share index yesterday surged 2.6 per cent to 6156.3 points — its highest close since early March.

At 6am (AEST) the Australian dollar was sharply higher at US71.23c, up from US70.16c at 4pm yesterday.

Spot iron ore prices were up 1.5 per cent to $US111.15c.

6.15am: Dow ends higher

The Dow Jones Industrial Average rose, with energy prices and stocks rallying after a new fiscal stimulus package from the European Union provided new hope for fighting the pandemic’s economic fallout.

The blue-chip average gained 0.6 per cent, while the S&P 500 rose 0.2 per cent. The Nasdaq Composite slipped 0.8 per cent, a day after a closing at a record.

Major oil companies Exxon Mobil rose about 5 per cent and Chevron climbed 7.1 per cent to boost the Dow industrials. Chevron on Monday had struck a $US5 billion deal to acquire Noble Energy, saying the deal would help it combat the downturn.

The rally carried Brent crude up 2.3 per cent, pushing it above $US42 a barrel for the first time since early March when prices plunged amid a pricing war between Saudi Arabia and Russia. US oil rose 2.3 per cent.

Boosting confidence included some better-than-expected earnings from major US companies and the rising expectations that increased government stimulus around the world would ease the effects of the coronavirus shutdowns.

The European Union reached a historic pact that signalled greater unification and spending across its members. The bloc agreed on terms for a EUR1.8 trillion ($US2.06 trillion) spending plan.

The pan-continental Stoxx Europe 600 rose 0.3 per cent, paring earlier gains, to its highest close since early March.

“Having an agreement on fiscal co-ordination in a time of crisis … probably gives Europe a level of stability it has lacked,” said David Kelly, chief global strategist at J.P. Morgan Asset Management. “That really is a big deal.”

In the U.S., there are other signs Washington is also moving toward another round of stimulus, though Republicans and Democrats remain split on key issues.

Meanwhile, a busy week of US earnings gave some other signs of confidence.

Earnings for S&P 500 companies are still expected to register a fall of roughly 44% from a year ago, according to analysts polled by FactSet. A wave of expected reports throughout the week, including from big names such as Amazon.com, Microsoft, and American Express, will shed further light on the economic views of business leaders.

Gold prices continued to climb, rising 1.2 per cent to $US1838.30 per troy ounce. Investors are buying the metal as a haven asset and to hedge against potential inflation as central banks continue to pump money into the system, according to Luc Filip, head of private banking investments at SYZ Private Banking.

“It’s almost a no-brainer, let’s buy some gold to hedge when there’s many uncertainties still,” Mr. Filip said.

In Asia, most major equity benchmarks ended the day with muted gains. Hong Kong’s Hang Seng index was among the biggest gainers after it rallied over 2pc. Japan’s Nikkei 225 rose 0.7pc.

Dow Jones Newswires

5.58am: Year-end target for vaccine

A coronavirus vaccine being developed by the University of Oxford and AstraZeneca should be available globally “at cost price” by year end, the firm’s director general said.

“Our objective is to bring the vaccine to everybody, (and) equally to do so on a not-for-profit basis so we shall be providing the vaccine at cost price,” Pascal Soriot told RTL radio.

“At cost price that will be about 2.5 euros ($2.8) per unit. “We hope to be able to produce a vaccine by the end of the year … perhaps a little earlier if all goes well” on the back of phase three results expected in the autumn, Soriot added in an interview.

Early results of a closely watched Phase 1/2 trial published this week in The Lancet suggest the vaccine candidate is safe and induces an immune response.

US group Johnson & Johnson has also vowed to deliver a vaccine at “non-profit” pricing.

In contrast rivals Pfizer, Merck and Moderna confirmed Tuesday to US politicians they would not sell vaccine at cost.

AFP

5.55am: Oil futures higher

Oil futures climbed, with US and global benchmark prices marking their highest finish since March, after the European Union reached a deal on a coronavirus aid package, easing concerns about energy demand.

Meanwhile, analysts expect Wednesday’s Energy Information Administration to report a second straight weekly decline in U.S. crude inventories. On average, analysts polled by S&P Global Platts expect the EIA to report a fall of 1.9 million barrels in crude supplies for the week ended July 17.

August West Texas Intermediate oil rose $US1.15, or 2.8pc, to settle at $US41.96 a barrel on the New York Mercantile Exchange on its expiration day. September WTI crude, which is now the front-month contract, settled at $US41.92, up $1, or 2.4pc.

Global benchmark Brent was up 2.4 per cent to $US44.32.

5.50am: Immuron in coronavirus advance

Australia’s Immuron said a component called IMM-124E that is used to manufacture the company’s digestive-health supplements showed promise neutralising the new coronavirus in laboratory tests.

The preclinical trials signal that the drug component could be useful in inhibiting the virus in the gastrointestinal tract, Immuron said.

The ASX-listed pharmaceutical companies American depositary shares later rose 39 per cent to $US14.50.

The Melbourne-based company reported the results of a study in which samples of SARS-CoV-2, the virus that causes COVID-19, were placed in the presence of IMM-124E. Concentrations of IMM-124E between 40 and 160 micrograms per millilitre prevented 90pc of viral replication, according to Immuron.

Inhibiting coronavirus in the gastrointestinal tract would be helpful if fecal-oral transmission of SARS-CoV-2 is prevalent, Immuron said. The company said current research on that question is inconclusive.

Immuron typically uses IMM-124E to produce Travelan and Protectyn, over-the-counter digestive supplements.

Dow Jones Newswires

5.45am: Pompeo urges world to stand up to China

US Secretary of State Mike Pompeo urged “the entire world” to stand up to China but denied forcing Britain’s hand in its decision to ban the communist superpower’s private telecoms giant Huawei.

Pompeo met Prime Minister Boris Johnson in the heat of an emerging crisis in relations between London and Beijing over everything from China’s treatment of Hong Kong to its persecution of more than one million ethnic Uighurs and other mostly Muslim minorities.

The top US diplomat used a press conference with his UK opposite number Dominic Raab to air a host of grievances President Donald Trump’s administration had built up against Beijing.

He accused China of engaging in “a cover-up and co-opting” the World Health Organisation by allegedly suppressing early details of the “preventable” coronavirus pandemic that has killed more than 610,000 people globally.

The Chinese Communist Party’s “exploitation of this disaster to further its own interest has been disgraceful”, he said.

Pompeo also castigated China for claiming disputed areas of the South China Sea “you have no lawful claim to” and trying to “threaten and bully” its neighbours.

AFP

5.40am: Markets rise on vaccine hopes, EU deal

Global stock markets rose on promising results from two clinical coronavirus vaccine trials, and after EU leaders finally clinched a landmark 750-billion-euro stimulus deal.

“A combination of vaccine optimism and fiscal stimulus is boosting the mood,” City Index analyst Fiona Cincotta said.

“Encouraging results … in addition to EU leaders agreeing to a 750-billion-euro recovery fund, is overshadowing rising tension between the UK and China — and soaring COVID-19 numbers in California.”

The clinical studies provided a much-needed shot in the arm for investors, who have been put on edge by spikes in new infections around the world, causing a months-long surge across equities to stumble.

The European Union finally reached a stimulus agreement after four days of haggling.

“Deal!” tweeted EU Council Chief Charles Michel, whose job was to guide the talks over more than 90 hours.

The package sends tens of billions of euros to countries hardest hit by the virus, most notably heavily-indebted Spain and Italy that had lobbied hard for a major gesture from their EU partners.

London closed up 0.1 per cent, Frankfurt rose 1.0 per cent and Paris added 0.2 per cent.

AFP

5.32am: Virus smashes Spain’s bars, restaurants

Devastated by the loss of customers during the virus crisis, around 40,000 bars, hotels and restaurants in Spain have permanently closed, the hotel and catering industry said.

The figure amounts to 13 per cent of such establishments in Spain, a country in which tourism plays a major role in the economy, and where the population tends to eat out very often, Spain’s hostelry federation said.

By the end of the year, that figure is expected to rise to 65,000 — or 20 per cent of the total.

“It confirms our worst-case scenario,” said José Luis Izuel, head of Hosteleria de Espana, at a press conference.

AFP

5.30am: Swiss watch exports dive

Swiss watch exports plunged again in June, an industry body said, though there were early signs of a potential uptick thanks to renewed demand from China.

In April, exports plummeted by an annualised 81.3 per cent, and were followed in May by an impressive decline of 67.9 per cent as global sales took a time out amid the coronavirus pandemic.

In June, exports were still off by 35.1 per cent compared with June 2019, the Federation of the Swiss Watch Industry said in a statement, at 1.1 billion Swiss francs (1.0 billion euros, $1.14 billion).

But, “as the first country to fall victim to the pandemic and therefore the first to recover, China saw a very sharp increase in demand for Swiss watches,” the statement noted.

In June, exports of Swiss watches to China were in fact 47.7 per cent higher than during the same month a year earlier.

AFP

5.25am: LinkedIn to cut 960 jobs

Professional social network LinkedIn said it was cutting 960 jobs, or six per cent of its workforce, as the global pandemic has hit demand for its paid recruitment services.

The COVID-19 outbreak “is having a sustained impact on the demand for hiring,” said Ryan Roslansky, chief executive of the Microsoft-owned platform.

As a result, “there are roles that are no longer needed as we adjust to the reduced demand in our internal hiring and for our talent products globally.”

The move comes amid surging joblessness during the pandemic-induced economic slump, even though many technology firms have weathered the crisis and even boosted employment.

LinkedIn said it added new features to help job seekers and businesses during the pandemic, and made recruitment tools free for those fighting the pandemic.

It also pledged to help 25 million people worldwide acquire new skills. But LinkedIn’s Talent Solutions business, aimed at helping companies recruit, “continues to be impacted as fewer companies, including ours, need to hire at the same volume they did previously.”

AFP

5.20am: Coca-Cola results hit

Coca-Cola reported a steep drop in second-quarter profits due to a big decline in away-from-home consumption, especially at the height of the coronavirus lockdowns.

The results underscored the soda maker’s reliance for sales on sporting events, movie theatres and entertainment — economic segments that have been battered by social distancing protocols instituted to address COVID-19.

Net income came in at $US1.8 billion, down 32 per cent, behind a 28 per cent decline in sales to $US7.2 billion.

Coca-Cola expects the second quarter to be “the most severely impacted” period of 2020, “the ultimate impact on full year 2020 results is unknown,” the company said.

Like many other large companies, Coca-Cola withdrew its annual forecast this spring amid the upheaval of the COVID-19 shutdowns.

The company did not restore a projection in its second-quarter earnings statement, a sign of continued uncertainty as large markets including the United States continue to battle outbreaks.

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout