ASIC bombshell, Adore Beauty debuts, ASX ends lower after presidential debate

Australia’s share market finished slightly weaker, but mostly recovered from an intraday fall, as ASIC’s chair stepped down.

- Qantas blames border closures for $100m hit

- NAB flags further provisions

- BlueScope flags 30pc earnings rise

- Funtastic expands toy empire

That’s all from the Trading Day blog for Friday, October 23. Australian stocks closed slightly lower after Wall Street rose, and investors focused on a new US stimulus package. The Dow and S&P 500 were both up 0.5 per cent, while the Nasdaq added 0.2 per cent. Markets closely watched the final Trump-Biden debate and locally, ASIC’s chair stepped aside, Qantas held its annual meeting and NAB announced more provisions.

Paul Garvey 8.37pm: Next year could be just as tough: APRA chair Byres

Australian Prudential Regulation Authority chairman Wayne Byres has warned that 2021 could be as tough as 2020 as government stimulus starts to abate and the full financial effects of the coronavirus pandemic are felt.

Appearing before Parliament House Standing Committee on Economics on Friday, Mr Byres said the financial services watchdog would be heavily focused on the financial and operational resilience of the country’s banks, insurers and superannuation funds as the global pandemic continues to unfold.

“For the next six months we’re really dealing with an environment that while it looks to be relatively stable economically, there’s a lot of government support going into the broader economy,” Mr Byres said.

The regulator, he said, was watching closely for the impact on the finance system as that government support was scaled back.

“We‘re really preparing ourselves for what happens as the government support mechanisms start to fade or are gradually wound down, and we see the full impact of the economic impacts of the virus flowing through,” he said.

His deputy John Lonsdale told the committee that the capital and liquidity levels within the nation’s banks were very good and if anything had increased during the current period.

Robyn Ironside 6.09pm: Virgin’s board wiped clean

Virgin Australia’s board of directors has been wiped clean as the airline’s sale to Bain Capital nears completion.

A statement to the ASX by administrators Deloitte, advised that chairman Elizabeth Bryan, and directors Kenneth Dean, Judith Swales, Trevor Bourne, Marvin Tan and Sir Angus Houston had resigned, effective from October 20.

Three other directors, Raymond Gammell, Hou Wei and Kevin Xing, had not lodged formal resignations but would cease to hold office after administrators exercised their powers to replace them.

CEO Paul Scurrah, Virgin Group representative Warwick Negus and the administrators’ pick Alan Hunt, would continue as directors until the completion of the sale in November.

Deloitte also informed the ASX of its court application seeking the transfer of all shares in Virgin Australia to Bain Capital, as a condition of the $3.5bn sale.

The notice was accompanied by a 700-page independent expert’s report which found the value of the equity in Virgin Australia was nil.

5.11pm: QCoal extends Sedgman contracts

CIMIC Group’s minerals processing company, Sedgman, has been awarded two contract extensions by QCoal to continue to operate and maintain its Sonoma and Byerwen mines processing plants in Queensland.

The three-year extensions will generate revenue of $166m for Sedgman.

The agreements replace and extend Sedgman’s existing agreements at the mines, continuing CIMIC Group’s long-standing relationship with QCoal.

CIMIC Group Chief Executive Officer Juan Santamaria said: “We have a strong history of delivering consistent outcomes for QCoal, through our companies Sedgman and Thiess. Sedgman’s expertise in minerals processing and focus on maximum resource recovery will help drive even greater efficiencies at these mines.”

Sedgman Managing Director Grant Fraser said: “These contracts are testament to the partnership we have forged with QCoal over many years, and the integration of our engineering design, project delivery and operations teams.”

Sedgman undertook the engineering design, construction and commissioning of the coal handling and preparation plant at Sonoma in 2007, and has continued to optimise and expand the facility, operating it since 2007.

Sedgman delivered engineering, procurement, construction and commissioning services for a train loadout facility and processing plant at Byerwen in 2017, and the engineering, procurement, construction and commissioning of a duplication of the coal handling and processing plant in 2018, operating it since then.

4.40pm: ASX closes slightly lower

Australia’s share market finished slightly weaker but mostly recovered from an intraday fall and value stocks outperformed amid higher bond yields and oil prices.

After falling 0.4pc to an intraday low of 6148.40 amid caution before the final US presidential debate, the local market bounced alongside US futures as the debate didn’t change expectations of a Democrat sweep.

The S&P/ASX 200 finished down 0.1pc at 6167 after losing 7 points in the closing match. It was also down 0.1pc for the week but up 6pc after a stimulatory federal budget and as the RBA flagged interest rate cuts and QE next month.

The Energy, Financials, Real Estate, Utilities and Consumer Discretionary sectors outperformed, with Santos up 3,9pc, ANZ up 1.4pc, AGL up 0.4pc and Aristocrat up 2.2pc.

But the Materials, IT, Communications, Health Care, Staples and Industrials sectors lagged, with BHP down 1.3pc, NextDC down 2.7pc, Telstra down 0.7pc, Coles down 1.2pc and Brambles down 1.2pc.

NAB recovered from a minor dip following its disclosure of $642m in new provisions and impairments in its FY results next month.

CC-Amatil trading was halted pending a potential material transaction amid speculation its buying some of Asahi’s assets that it’s been forced to divest.

BlueScope rose 11pc after flagging a strong profit due to robust demand for steel in most markets.

Webjet rose 4.3pc after Morgan Stanley upgraded its rating to EqualWeight.

4.06pm: CBA forecasts dollar drop

CBA analysts say the Aussie dollar risks falling towards US68.50c in coming weeks, given it’s sensitive to the global outlook.

“The low likelihood of a pre‑election US fiscal stimulus package and the continued surge in infections in the US and Europe raise the risk the global economic recovery slows,” the analysts said.

In addition, the RBA is now widely expected to lower interest rates at its November meeting.”

The dollar was last trading slightly lower at US71.13c.

3.44pm: Blackmores co-founder steps down

Blackmores executive director and co-founder Marcus Blackmore, is stepping down from the board effective 23 October.

This was foreshadowed at the 2019 annual general meeting, the current chairman Brent Wallace will end his tenure on 27 October 2020. Anne Templeman-Jones has been appointed as chairman of the healthcare group.

Marcus Blackmore has been a director of the Company since 1973, acted as executive chairman of the board between 2009 and 2017 after which time he has remained as an executive director.

“It is now appropriate that as part of the renewal of the Board that I also move on. I have been with this company 57 years. It’s been my life. I am confident that the newly refreshed Board will support our excellent management team to achieve the strategic goals of the company. Alastair Symington is an outstanding chief executive and has surrounded himself with the best Executive Team Blackmores has ever had. At this time, it is my intention to remain a significant shareholder of Blackmores,” Mr Blackmore said.

Blackmores last traded at $62.75, down 25c.

Doug Turek 3.25pm: The new deal for asset allocation

For many years the perfect retirement portfolio was considered to be a mix of 60 per cent shares and 40 per cent bonds. The former giving you growth and the latter income and defensiveness.

At the start of this year when US Treasury bond yields broke below 2 per cent (and that was before COVID-19 arrived), Professor Jeremy Siegel, author of the investment classic Stocks for the Long Run, remarked: “We believe the old 60/40 model just won’t be able to cut it anymore.”

His concern was that low interest rates are going to persist and especially the bond part of the portfolio won’t deliver.

With US (and Australian 10-year) bond yields now below 1 per cent, I’m sure Siegel would be even more convinced.

Sadly, it is uncertain moving from 60 to 75 per cent in equities is going to get you the returns you’ve earned in the past.

Read more: The new deal for asset allocation

2.15pm: ASX bounces as US futures turn higher

Australia’s share market mostly recovered from an intraday fall as US futures turned up after the final presidential debate.

After falling as much as 0.4pc on risk aversion before the debate, the S&P/ASX 200 was in early afternoon trade down less than 0.1pc at 6168.

It came as S&P 500 futures turned up 0.1pc after falling as much as 0.3pc up until the first hour of the debate.

2.03pm: US restrictions curb Huawei revenue

Huawei Technologies posted a lower rate of revenue growth in the third quarter, as the Chinese telecom giant continues to grapple with US restrictions on its ability to buy chips and other technology.

The Shenzhen-based company said revenue in the first nine months of the year rose 9.9 per cent to 671.3 billion yuan ($US100.42 billion) compared with the same period for 2019.

Although Huawei didn’t break out results for the third quarter alone, a Wall Street Journal calculation showed revenue for the period rose 3.7 per cent, marking a slowdown in growth from the prior quarter, when revenue grew 22 per cent.

“Throughout the first three quarters of 2020, Huawei’s business results basically met expectations,” the company said in a statement.

Huawei also said its net profit margin for the first nine months was 8 per cent.

Although Huawei is privately held, it issues a limited set of unaudited figures about its business each quarter. It didn’t disclose its net income for the period, nor did it break out the performance of different business lines or geographical regions--figures it generally only discloses on a once-a-year basis.

The slowdown in revenue growth indicates that an increasingly tough set of U.S. restrictions on Huawei’s ability to source parts is starting to bite. The Trump administration last year added Huawei to an export blacklist blocking its ability to procure U.S.-sourced chips. Huawei has repeatedly denied assertions by US officials that it poses a security threat.

Australia and a growing number of European countries, including the UK and Sweden, have joined the US in blocking Huawei from their 5G network rollouts.

Dow Jones

1.58pm: Baby Bunting slumps as Toys “R” Us website revived

Shares in infant products retailer Baby Bunting have slumped 6.4 per cent at $4.47 after toy wholesaler Funtastic announced it would acquire four e-commerce websites including Toys“R”Us and Babies“R”Us.

Baby Bunting has expanded its store count and taken over several Toys “R” Us and Babies “R” Us sites in recent years after the company wound down in 2018 after administrators failed to find a buyer.

The company’s chief executive, Matt Spencer, told the market earlier this month that comparable store sales growth was at 17 per cent for the financial year so far.

Bridget Carter 1.47pm: Harmoney shares priced ahead of IPO

Harmoney has shrugged off its critics and managed to lock in enough demand to list as a business worth about $350m.

Market analysts had earlier compared the business to peer-to-peer lender Plenti, which staged a disappointing debut on the ASX following its IPO, despite insistence from the company that it was not a strong comparable.

Following a cornerstone process, Harmoney shares have been priced at $3.50 each, equating to 3.5 times its revenue for the 2020 financial year.

The size of the IPO is expected to be $92.5m, including $70m of primary capital to fund Harmoney’s growth.

Management meetings will now take place next week across Australia, New Zealand and Asia ahead of its IPO bookbuild on Thursday.

Working on the transaction is Jarden and Ord Minnett.

More to come.

Robyn Ironside 1.24pm: Qantas warning to pilots, cabin crew

antas will seek the same concessions from its pilots and cabin crew as those given to Virgin Australia as the airline strives to recover from the devastating impact of COVID-19.

CEO Alan Joyce has told the airline’s virtual AGM the “unexpected delay” in reopening state borders had cost the company $100m in the first quarter of the 2021 financial year, and would have an impact in the second quarter as well.

The losses were the direct result of border closures, which had kept a tight lid on domestic capacity.

“We had expected group domestic to be operating at about 60 per cent of pre-COVID levels by now,” Mr Joyce said.

“Instead, the continued border closures mean capacity is now below 30 per cent.”

He said the renegotiation of work agreements at Virgin Australia would have a bearing on Qantas employees, particularly if significant cost savings were achieved.

“We’ve made it clear to the unions we can’t be disadvantaged in the process,” said Mr Joyce.

“If there are concessions, we’ll expect the same considerations to be given to Jetstar and Qantas because it will be really important we maintain our competitive advantage.”

Qantas remained hopeful Queensland would open up to New South Wales in coming weeks, which would help lift domestic flying to half of pre-COVID capacity by Christmas.

Ben Wilmot 1.15pm: ASIC boss to step aside

The corporate regulator has dropped a bombshell in a parliamentary inquiry with ASIC chairman James Shipton saying he will step aside and will repay moving expenses relating to his shift into the job.

Mr Shipton told the committee he had offered to the Treasurer Josh Frydenberg to step aside pending an independent review into the expenses.

ASIC’s most senior deputy chair will take on his role while the matter is investigated. The Treasurer is considering how to fill the role.

ASIC said it was working with Treasury on the scope of the review into his expenses, which the Australian National Audit Office indicated had exceeded guidelines.

Deputy chair Daniel Crennan’s expenses relating to his move had also exceeded guidelines, the committee heard.

The ANAO’s findings were fully raised just two weeks ago and ASIC received a final management letter on Thursday, ASIC deputy chairman Karen Chester

There will be a Treasury-led independent review by an eminent person.

12.18pm: Adore Beauty surges on debut

Shares in online cosmetics business Adore Beauty are trading at over $7 on its ASX debut, up on its initial public offering price of $6.75. The stock opened at $7.40 when it started trading at midday.

Adore Beauty was founded in 2000 by Kate Morris and James Height in Melbourne. The business is now Australia’s largest pure-play online retailer of beauty and personal care products.

Adore Beauty generated $121m of revenue for the 2020 financial year.

12.06pm: Biden win favours Aussie cyclicals: Macquarie

With polls suggesting a 75pc chance of a Democrat “clean sweep” of the White House and Congress, fiscal stimulus under a Joe Biden presidency is likely to include larger government spending, which should support a rotation to cyclicals and value, according to Macquarie.

“The prospect of larger government spending under Biden should support GDP growth and inflation,” says Macquarie’s Australian equities strategist, Matthew Brooks.

“We also expect commodities to be supported from the prospect of higher infrastructure spending and more activity generally, which is positive for resource stocks.

Reflation also raises the risk of higher US bond yields, and higher discount rates could be a drag on valuations, especially for growth stocks.

We could also see a weaker USD due to the higher deficit and lack of profit repatriation, which was a tailwind after the Trump tax cuts.”

But he cautions that Biden may raise the US corporate tax rate to 28 per cent, which along with the potential for a weaker USD would be a headwind for US exposures.

While that would trim ASX Industrials EPS by about 1.3pc, it could be more than offset by the impact of higher US government spending on global growth.

But stocks with high US exposure could be impacted more by the tax hike.

Based on their US sales/earnings exposure, he estimates the FY23 EPS headwind is at least 5 per cent for Appen, Janus Henderson, Incitec Pivot, Aristocrat, James Hardie, Sims, Breville, Cochlear, News Corp and Computershare.

“Higher fiscal spending could be an offset for cyclicals, but less so for defensives,” Mr Brooks says.

Overall, he maintains that equities continue to rise in the “expansion” phase of the cycle.

Favoured value stocks in his strategy portfolio include GPT, Lendlease, Oil Search, Ampol, Worley, Seven Group, BlueScope, Telstra, Graincorp, Crown Resorts, Sydney Airport, Westpac and ANZ.

Mr Brooks prefers resources over industrials, given a positive view on commodities and the Australian dollar.

“The latter also gives us reason to prefer domestic stocks, a view that could be reinforced if Biden wins given his plan to hike corporate taxes.”

Bridget Carter 11.53am: CKI abandons Curtis Island buy

Cheung Kong Infrastructure is understood to have left the race to buy the $3.5 billion worth of infrastructure assets on offer from Shell’s Curtis Island LNG plant in Queensland.

The development sees IFM and GIP left in the competition, with final bids due Friday.

IFM has been considered the frontrunner to buy the asset since late last year when it hired advisers RBC and Lazard.

The sales process by Shell was paused at the onset of the COVID-19 crisis, but reconvened around the middle of the year.

On offer has been a 26.25 per cent stake in the infrastructure assets of Shell’s QCLNG project.

Working with CKI has been Morgan Stanley.

CKI was expected to require a highly level of certainty that it could gain approval from the Foreign Investment Review Board to buy the assets to remain in serious contention.

The successful buyer of the asset will receive a fixed annual cash income for 15 years that comes from fees for using the plant, which is not linked to the oil price, commodity prices or throughput.

The offering that is being sold through Rothschild is estimated to be worth about US$2.5bn.

Some believe that the contest will come down to what party has the cheapest cost of capital.

An ultimate competitor could be the owner Shell, given that many other companies may not be able to match its cost of capital.

For that reason, there is a chance that the energy giant could retain the assets.

11.45am: ASX dips ahead of presidential debate

Australia’s share market slipped as much as 0.4pc in cautious trading as S&P 500 futures fell 0.2pc before the final US presidential debate at midday (AEDT).

The Materials sector was weakest, with BHP down 1.1pc and Newcrest down 2.3pc.

But that was exaggerated by a 46pc fall in Iluka after the demerger of Deterra Royalties, which started trading on the ASX.

Tech stocks retreated as they did on Wall Street with NextDC down 2.4pc and Xero down 1.1pc.

BlueScope surged 11pc after predicting a solid rise in profit due to robust steel demand in most markets.

The S&P/ASX 200 was last down 0.3pc at 6157.3

Robyn Ironside 11.33am: Qantas flags $100m borders hit

Qantas chairman Richard Goyder has flagged the possibility Korea, Taiwan and Pacific island nations could be the airline’s top destinations next year, as they await for the UK and the US to reopen.

Addressing the airline’s virtual AGM, Mr Goyder said Qantas and Jetstar were keeping a close eye on markets that might open up as a result of quarantine-exempt travel bubbles, such as the one with New Zealand.

State border closures were another matter, with Mr Goyder critical of the ongoing restrictions on travel within Australia as a result of some states refusing to open up.

He pointed out that he was appearing at the AGM from Perth, due to Western Australia’s hard border stance despite very few or no cases existing in other states.

“Hopefully common sense prevails soon,” Mr Goyder said.

“This inertia doesn’t seem to be based on the actual health risk, and that seems to ignore the broader economic and social risk involved with staying shut especially as federal income support winds down.”

Qantas CEO Alan Joyce told the meeting the airline had expected to be operating at 60 per cent of pre-COVID domestic capacity by now.

“Instead the continued border closures mean capacity is now below 30 per cent,” Mr Joyce said.

The unexpected delay in borders reopening had resulted in a $100m negative impact on earnings for the first quarter of the 2021 financial year, and would have an impact on the second quarter as well, he said.

“Essentially, this is a timing issue,” Mr Joyce said. “We know the upswing will materialise--just later than planned.”

11.19am: ASX underperformance ‘may be over’

Australian sharemarket underperformance relative to global markets this year may be over as successful management of the pandemic leads to positive outlook for businesses, according to Citi.

“As the Australian economy treads the recovery path, some of the laggard domestic cyclical sectors may do better,” says Citi equity strategist, Liz Dinh.

But in her view, investors are more likely to do well over the next year with a preference towards Australian domestic cyclical exposure.

She notes that a recovering economy should benefit stocks with domestic revenue exposure. In that group Citi prefers Westpac, NAB, IAG, Mirvac and GPT.

Industrials that service Australian infrastructure and mining - like Aurizon, Downer, Monadephous and NRW Holdings - should be well positioned.

And resource sector earnings should benefit from a recovery in China.

Ms Dinh notes that the Australian market valuation is 19 times 12-months forward earnings and 17 times FY22 earnings.

Citi has a mid-2021 target of 6,200 for the S&P/ASX 200.

The index was last down 0.3pc at 6156.6.

11.15am: Tokyo stocks open higher on US gains

Tokyo stocks opened higher on Friday supported by rallies on Wall Street with investors eyeing the final US presidential election debate.

The benchmark Nikkei index advanced 0.36 per cent or 85.13 points to 23,559.40 in early trade, while the broader Topix index was up 0.37 per cent or 6.06 points at 1,625.85.

AFP

10.52am: CC Amatil may need raising: Citi

Coca-Cola Amatil could buy Kirin’s Lion Dairy flavoured milk business as well as Asahi’s Australian beer and cider assets, according to Citi.

“If both assets are purchased, the total outlay could be $600 to $1200 million, requiring an equity raising,” Citi analysts say.

“Given both equity and debt funding costs are low, an acquisition is likely to be EPS accretive by about 4-6 per cent.”

Coca-Cola Amatil is in a trading halt pending an announcement on a “material acquisition.”

10.40am: Beach jumps on first quarter result

Beach Energy shares are trading 1.1 per cent higher at $1.34 after the company flagged a “sound” start to the new financial year and a lift in quarterly revenue.

The company said it had recorded 6.8 MMboe (million barrels of oil equivalent) for the first quarter, compared to 6.5 MMboe in the same period a year ago, due to higher production from the Victorian Otway Basin and the Cooper Basin JV.

Meanwhile realised oil prices increased 38 per cent in the period, which led to a sales revenue increase of 13 per cent on the prior quarter to $361m.

“In a period when the world has been anything but normal, I’m very pleased to see a great level of stability from our diverse portfolio of production assets,” chief executive Matt Kay said.

“It was a quarter in which production met expectations, demonstrating that our team can continue to operate effectively during what has been a period of high disruption – particularly in Victoria.”

The company left its full-year production guidance unchanged.

“Sales revenue was above our forecast due to higher product pricing, with a higher than RBC forecast average gas and ethane price and a realised oil price up +38% over the quarter,” RBC analysts said.

“Beach Energy has leading Australian energy sector valuation metrics and a strong growth outlook.”

10.30am: NAB flags further remediation provisions

NAB has flagged $380m in customer-related remediation costs, which includes $245 million in discontinued wealth-related matters.

The bank also said that it had provisioned an increase of $128m in payroll remediation, as well as an impairment of property-related assets of $134m.

NAB announced the sale of its MLC Wealth business to IOOF in August. The deal remains subject to regulatory approvals.

The company said that until all customer payments have been completed, the final cost of customer-related remediation matters remains uncertain.

The bank will release its full year results on November 5.

10.23am: ASX opens flat ahead of Trump-Biden clash

Australia’s share market opened flat in mixed trading ahead of the final US presidential debate.

Falls in the Materials and IT sectors are offsetting gains in the Energy, Utilities, Communications and Financial sectors.

The four major banks rose 0.4pc - 0.7pc after US peers surged on higher bond yields amid US fiscal stimulus hopes.

Bluescope surged nearly 17pc after forecasting a rise in profit due to robust demand for steel in most markets.

Webjet rose 4.3pc after Morgan Stanley upgraded its rating to EqualWeight.

OZ Minerals rose 3.2pc after boosting its gold production guidance yesterday.

Beach Petroleum is up 1.9pc on higher oil prices.

Iluka fell 46pc after the demerger of Deterra.

10.22am: BlueScope surges on earnings update

BlueScope shares have shot up nearly 17 per cent in early trade after the steelmaker flagged a 30 per cent lift in first half earnings compared to the prior six-month period.

The company said that earnings before interest and tax was expected to be around $340m, up on the $302.4m in the prior comparable period.

“Despite the global disruption caused by COVID-19, we’ve had a solid performance from all of our operating segments for the three months to 30 September,” chief executive Mark Vassella said in a statement this morning.

BlueScope shares last up 14.6 per cent at $16.46.

10.16am: IAG shares slip after update

Shares in IAG lost ground in early trade after the company’s retiring chief executive Peter Harmer said IAG had recorded low single digit gross premium growth for the first quarter.

At 10.15am (AEST) IAG shares had dropped 1.2 per cent to $4.84.

“Our insurance profit for the quarter reflects the seasonally low incidence of natural peril events in this period, while underlying profitability has been similar to that seen in the second half of the previous financial year,” Mr Harmer said in a statement to the market ahead of IAG’s annual general meeting today.

“Within our underlying insurance margin, COVID-19-related effects have been broadly neutral in aggregate during this period, with some benefit from lower motor claims frequency offset by incremental expense and provisioning impacts.

“Despite the uncertainty confronting us, including that from COVID-19, we face the future with the confidence that we have a resilient business which is in strong financial shape, and which is well‐equipped to rise to the challenges presented by this current environment.”

Eli Greenblat 10.14am: Coca-Cola Amatil in trading halt

Beverage maker and bottler Coca-Cola Amatil has been placed into a trading halt, pending an announcement relating to a “potential material transaction”.

The bottler has been rumoured to be interested in buying Lion’s dairy and drinks business.

9.50am: What’s impressing analysts?

Mirvac Group cut to Hold: Jefferies

Star Entertainment cut to Neutral: JPMorgan

Webjet raised to Equal-Weight: Morgan Stanley

9.42am: ASX awaits Trump-Biden clash

Australia’s share market should consolidate while awaiting any reaction to the final US presidential debate from noon to 1.30pm (AEDT).

The first debate caused a 2.3pc fall in the S&P/ASX 200 as US stock index futures dived as Donald Trump lost support.

But the S&P 500 rose 0.8pc that night and as much as 6.3pc in the next two weeks as investors subsequently predicted a Democrat cleans weep.

Barring a negative reaction to the debate, the local bourse should have upside risk after proving very well supported on Thursday.

After falling as much as 1.5pc to an 8-day low of 6100.6 amid large selling, it recovered to close down just 0.3pc at 6173.8.

Thus on a daily closing basis, it confirmed the existence of support from former major resistance from June-August tops in the 6160-0.6200 area.

Some value stocks may outperform after the Energy and Financials sectors led a 0.5pc rise in the S&P 500 to 3453.5, although it remained within the recent minor down channel.

WTI crude oil rose 1.5pc to US$40.64, boosting the S&P 500 Energy sector 4.2pc amid optimism that fresh US fiscal stimulus is imminent, after House Speaker Nancy Pelosi said she and Treasury Secretary Steven Mnuchin are “just about there” on a deal.

Stimulus hopes also boosted US bond yields with the 10-year yield hitting a 5-month high of 0.868pc - testing its 200-day moving average for the first time since December 2018.

That pushed the S&P 500 Financials sector up 1.9pc with the KBW Bank index up 3.7pc.

Bridget Carter 9.40am: Funtastic expands toys empire

Australian-listed retailer Funtastic has confirmed the purchase of Toys R Us Australia and Babies R Us Australia from Louis Mittoni.

Toys R Us Australia and New Zealand is a subsidiary of the Hobby Warehouse Group, owned by Mr Mittoni.

The acquisition was first flagged by The Australian’s DataRoom column on Thursday.

In a statement to the market, Funtastic said it was also undertaking a recapitalisation where company debt would be converted into equity.

The company will also undertake a $29m equity raising through Canaccord Genuity.

9.14am: Services sector lifts PMI

The IHS Markit Flash Australia Composite purchasing managers’s index for October remained in expansion, hitting a three-month high of 53.6 from 51.1 in September.

The rise was driven by a rise in the services sector PMI to a three-month high of 53.8 from 50.8 in September.

That offset a fall in the manufacturing PMI to 54.2 from 55.4.

A rebound in both sectors saw the Composite index rise from a record low of 21.7 in April to a record high of 57.8 in July.

9.00am: Regis reaffirms production forecasts

Gold miner Regis Resources has reiterated its full-year production guidance despite unveiling a slower start to production for the new financial year.

The company said in a statement to the ASX this morning that cash flows from operations totalled $85m for the September quarter, while cash and bullion increased by $16m to $225m at the end of the quarter, up 8 per cent.

“Overall, the September quarter saw good progress on our value growth projects and while the slower start to our production year does create early pressure, we continue to consider our FY21 production guidance of between 355,000 to 380,000oz as appropriate albeit as previously noted with a stronger production weighting to the second half of the financial year,” chief executive Jim Beyer said.

“During the September quarter Regis has made a number of very positive steps progressing our value growth strategy.

“At the same time the quarter has been more challenging operationally with some short term impacts affecting our overall production for the quarter.

“Despite this, the business continued to improve safety and build its cash reserves.”

8.48am: BlueScope flags 30pc earnings rise

Steelmaker BlueScope has flagged a 30 per cent increase in earnings for the first half of the new financial year, compared to the second-half of fiscal year 2021.

The company said in an update to the market that earnings before interest and tax was expected to be around $340m, up on the $302.4m BlueScope unveiled for the comparable period, the first-half of last financial year.

“Despite the global disruption caused by COVID-19, we’ve had a solid performance from all of our operating segments for the three months to 30 September,” chief executive Mark Vassella said.

“This is a clear demonstration of the effectiveness of BlueScope’s strategy and the resilience of our asset portfolio.

“Benchmark steel spreads have improved and demand in most of our markets is robust.

“This has been supported by current strength in alterations and additions activity, demand for detached housing, rapid growth in e-commerce and logistics, and the recovery of the US automotive industry, which is a key end-market for North Star.”

Still, Mr Vassella cautioned that there was still a risk that the evolving impact of the coronavirus crisis and broader macroeconomic weakness could dampen demand.

Bridget Carter 8.32am: Link rejects Carlyle-PEP bid

Link Administration Holdings has rejected a $2.8 billion takeover bid by The Carlyle Group and Pacific Equity Partners on the basis that the offer undervalues the company.

Link now plans to explore its own opportunities for its electronic settlements business PEXA.

In a statement to the ASX Friday, Link said the bid materially undervalued the company.

It said the board had also consulted with a number of shareholders and had received feedback on the proposal.

Link said that the board’s confidence in the outlook and fundamental value in Link is underpinned by PEXA, the early progress on Link’s transformation plan, the leading markets in which it operates and the anticipated recovery.

The board was now examining structural alternatives for its portfolio, including a separation or demerger of PEXA.

It plans to share more details on the potential structural alternatives next month.

Link says PEXA is Australia’s first and only full service electronic lodgement network operator.

Its core product is the PEXA exchange, which provides integration with Land Titles Offices and State Revenue Offices, electronic lodgement services and near real time settlement of funds via the Reserve Bank of Australia.

8.17am: QBE appoints interim CEO

QBE Insurance says Richard Pryce will assume the role of interim group chief executive officer while it searches for a permanent replacement for former CEO Pat Regan.

Mr Regan left QBE suddenly last month following a complaint from a US-based female staff member and an external investigation into emails and texts sent to the employee.

The appointment of Mr Pryce, QBE’s international CEO, allows Mike Wilkins to return to his role as non-executive chairman, after he had stepped in to run the insurer.

Mr Wilkins said: “I would like to thank Richard for accepting this interim role as we conduct an extensive search for a permanent replacement. Richard is well known to employees and investors and is well respected in the insurance industry.

“Jason Harris has now commenced in the role of CEO International, giving Richard the capacity to assume this role.

”Our strategy and priorities remain unchanged and Richard provides important continuity as we execute on these.”

Mr Pryce has been with QBE since 2012 and CEO of its international business since 2019.

He will remain in the UK while in the interim CEO role and intends to retire with the appointment of a permanent CEO, QBE said.

8.05am: Intel hit by move to lower-cost laptops

Chip giant Intel Corp raised its full-year outlook even as earnings suffered as consumers gravitated to cheaper laptops and demand for datacenters softened.

The company said revenue dropped 4 per cent to $US18.3 billion after it enjoyed strong sales in the first half of the year. The company’s bottom line also suffered, with earnings per share falling to $US1.02 in the period from $US1.35 a year earlier and falling short of Wall Street’s expectation.

Intel’s shares fell more than 10pc in after-hours trading.

The company’s growth has been principally in areas where prices are lower, denting profitability, Intel Chief Financial Officer George Davis said. “We saw much stronger PC demand in the consumer and education side, which tends to be the more entry-level for PC notebooks,” he said.

Sales for the massive datacenters that companies, governments and cloud-computing operators use fell 7pc to $US5.9 billion, the company said, falling short of what analysts surveyed by FactSet forecast. Revenue for the personal-computer focused business rose 1pc to $US9.8 billion. The company’s memory division, most of which it agreed this week to sell to South Korea’s SK Hynix Inc. for $US9 billion, also reported lower sales.

Dow Jones

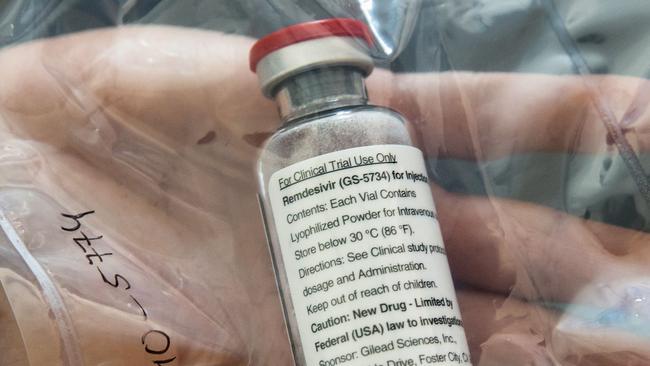

7.56am: US approves Remdesivir as Covid treatment

The US Food and Drug Administration granted full approval to the antiviral drug Remdesivir as a treatment for patients hospitalised with COVID-19, its manufacturer Gilead said, following conditional authorization granted in May.

Gilead said the authorization for the drug, sold under the brand name Veklury, was the only specific treatment for COVID-19 approved so far following a more rigorous study.

However, other treatments have received authorisation for emergency use. Gilead’s stock on the New York Stock Exchange jumped 4 per cent soon after the announcement.

AFP

7.42am: Barbie sales soar as parents cut screen time

Add Barbie to the list of the pandemic’s biggest winners.

Mattel’s flagship doll posted a 29 per cent sales increase in the third quarter, leading the toy company to 10 per cent revenue growth in the period. It was the largest quarterly increase posted by Barbie going back at least two decades, the company said.

“The brand is more relevant than ever at 62 years old,” Mattel Chief Executive Ynon Kreiz said in an interview Thursday.

After years of struggles and rising competition from other dolls, Mattel sought to reinvigorate the Barbie brand by introducing new body sizes, skin tones, hair colors and career paths. Recently, Barbie has also been boosted by hits like a “Color Reveal” product where you dip a doll into water to disclose what kind it is.

The pandemic has helped, too. Parents say they are looking for ways to entertain their children that don’t involve a screen and many are gravitating to familiar toys.

“Parents prioritize spending on their kids and look for quality, trusted products,” Mr. Kreiz said.

Dow Jones

7.30am: Americans create start-ups at record clip

Americans enduring a feeble economy and high unemployment because of the coronavirus pandemic are creating start-up companies at a record pace.

The drive is favoured by very low interest rates, banks that are eager to lend and people with money saved up -- both because no one goes out anymore and because of government stimulus aid.

“It is not as surprising as you might think,” said John Dearie of the Center for American Entrepreneurship. “People are starting new businesses because they lost their jobs. And because they have capital to start those businesses.” Around 1.6 million companies were created from July to September, by far a record, according to the Census Bureau. Never before had more than a million start-ups emerged in one quarter in America.

“The pandemic has definitely spurred interest among young people and adults to launch new businesses. The reason, we believe, is very simple. People are losing jobs,” said J.D. LaRock, the head of the Network for Teaching Entrepreneurship, which is active in 12 countries.

“And people are recognizing that the world is changing, and that there are new needs,” he said.

So people are proposing business concepts that stem from the pandemic, or finally acting on business ideas they have had for a long time but never had the opportunity or incentive to bring to fruition, said LaRock.

AFP

7.20am: ASX to open steady after US gains

Australian stocks are poised to open flat despite Wall Street posting gains after wavering over negotiations for a US stimulus package.

At about 7am (AEDT) the SPI futures index was up one point.

Yesterday, Australian stocks recovered some ground after falling sharply at the open, and closed slightly lower as global markets await the outcome of talks on US stimulus.

The Australian dollar was higher at US71.18.

Brent crude, the international benchmark for oil, rose about 1.7 per cent to US42.46c a barrel. Spot iron ore lost 0.5 per cent to $US119.75 a tonne.

7.05am: Wall St higher as investors eye stimulus talks

US stocks finished higher after wavering for much of the day as investors tracked negotiations in Washington over a fresh stimulus bill.

The S&P 500 and Dow Jones Industrial Average were both up roughly 0.5 per cent as of the close of trading. The tech-heavy Nasdaq Composite was up 0.2 per cent.

Investors have been laser-focused on the prospect of a new wave of U.S. fiscal stimulus, even as the prospects of a deal between House Democrats and Senate Republicans before the November 3 presidential election remains unlikely.

“It’s dominating the headlines, and markets are certainly still paying attention,” said Andrew Hunter, senior US economist at Capital Economics.

Investors and analysts see a new injection of stimulus as key to reviving the US economy, which is beginning to recover from its deep recession.

The number of Americans applying for unemployment benefits fell to 787,000 last week, according to data from the Labor Department, suggesting the number of layoffs are trending lower. And sales of previously owned homes in the US rose to a new 14-year high in September, the National Association of Realtors said.

Still, with the effects of the last round of stimulus fading, some investors are preparing for the economy to plateau.

“As much as the data was good, I think we may see a little bit of a short-term sag in economic momentum in the fourth quarter,” said Dave Donabedian, chief investment officer of CIBC Private Wealth Management.

Beaten-down airline and hotel chain stocks climbed. Delta Air Lines rose 4.8 per cent, and Southwest Airlines added 3.8 per cent. Airline executives said they are seeing tentative signs that consumers are traveling again, though the companies posted big losses in the third quarter.

Corporate earnings also lifted shares of individual companies. Tesla rose 2.3 per cent after the electric-car maker reported its fifth consecutive quarter of profits after years of losses.

Overseas, the pan-continental Stoxx Europe 600 fell 0.1 per cent, while the U.K.’s FTSE 100 was up 0.2 per cent after the government set additional support for companies affected by new coronavirus restrictions. Europe has been struggling with a surge of new Covid-19 cases and fresh restrictions that threaten the region’s economic rebound.

In commodity markets, Brent crude, the international benchmark for oil, rose about 1.8 per cent to $US42.47 a barrel. Gold prices dropped 1.4 per cent.

Dow Jones

6.40am: Crucial clash for Trump and Biden

President Trump and Democrat Joe Biden will have their last chance to present competing arguments side-by-side before a huge audience during their second and final debate, with the incumbent trailing in national polls and at a significant campaign cash disadvantage.

The face-off in Nashville, Tennessee, arrives after more than 45 million Americans -- roughly a third of the total presidential vote in 2016 -- already have cast ballots and with both campaigns now mostly focused on turning out their supporters and making their closing case to the few remaining undecided voters.

The session, moderated by NBC’s Kristen Welker, will include some oddities: The two men are expected to be separated by plexiglass shields because of the coronavirus pandemic, and they each will have their microphones silenced at times after their first debate featured frequent interruptions, the majority of them by Mr. Trump.

The 90-minute event at Belmont University is scheduled to begin at noon (AEDT). Six, 15-minute segments will address the topics of fighting the pandemic, American families, race relations, climate change, national security and leadership.

Dow Jones

6.01am: Gucci struggles as tourists stay home

Gucci reported a 12 per cent drop in third-quarter sales as the Italian fashion house was hit hard by the absence of tourist shoppers from Asia during the pandemic.

The results show the brand lagging other big luxury labels in the market upheaval sowed by the coronavirus. Hermès, the French brand known for its stratospherically-priced handbags, said revenue rose 4.2 per cent in the quarter, fueled by strong growth in Asia.

Louis Vuitton and Dior drove a 12 per cent sales jump in the fashion and leather goods division of LVMH Moët Hennessy Louis Vuitton SE.

Gucci is struggling because it has come to depend heavily on what was, until the pandemic, a highly-profitable strategy: selling to well-heeled shoppers, particularly the Chinese, when they travel abroad. With international travel largely locked down, brands have been forced to encourage shoppers from China and elsewhere to buy where they live.

Gucci is particularly dependent on Chinese clientele shopping in European fashion capitals such as Paris, Milan and London. It also has a large business at duty-free stores in airports. Now it is scrambling to refocus its marketing efforts for a post-pandemic world in which international tourism could take years to recover.

Gucci’s sales in Europe were down 47 per cent, a much steeper decline than Hermès, Louis Vuitton and Dior. Overall revenue was EUR2.1 billion ($US2.5 billion) for the quarter.

Dow Jones

5.20am: US stocks waver as investors eye stimulus talks

US stocks wavered between small gains and losses as investors tracked negotiations in Washington over a fresh stimulus bill.

The S&P 500 and Dow Jones Industrial Average were both up roughly 0.6 per cent in afternoon trading. The tech-heavy Nasdaq Composite was 0.2 per cent higher.

Investors have been laser-focused on the prospect of a new wave of U.S. fiscal stimulus, even as the prospects of a deal between House Democrats and Senate Republicans before the November 3 presidential election remains unlikely.

“It’s dominating the headlines, and markets are certainly still paying attention,” said Andrew Hunter, senior US economist at Capital Economics.

Investors and analysts see a new injection of stimulus as key to reviving the US economy, which is beginning to recover from its deep recession.

The number of Americans applying for unemployment benefits fell to 787,000 last week, according to data from the Labor Department, suggesting the number of lay-offs are trending lower. And sales of previously owned homes in the US rose to a new 14-year high in September, the National Association of Realtors said Thursday.

Still, with the effects of the last round of stimulus fading, some investors are preparing for the economy to plateau.

“As much as the data was good, I think we may see a little bit of a short-term sag in economic momentum in the fourth quarter,” said Dave Donabedian, chief investment officer of CIBC Private Wealth Management.

Beaten-down airline and hotel chain stocks climbed Thursday. Delta Air Lines rose 4.8 per cent, and Southwest Airlines added 3.8 per cent. Airline executives said they are seeing tentative signs that consumers are travelling again, though the companies posted big losses in the third quarter.

Investors will also be watching for any surprises when the president and Democratic nominee Joe Biden meet for the final debate before the election.

“If something big happens it could certainly be a big issue in the markets tomorrow morning,” but the likelihood is low, said Mr. Hunter of Capital Economics.

Overseas, the pan-continental Stoxx Europe 600 fell 0.1 per cent, while the U.K.’s FTSE 100 was up 0.2 per cent after the government set additional support for companies affected by new coronavirus restrictions. Europe has been struggling with a surge of new COVID-19 cases and fresh restrictions that threaten the region’s economic rebound.

In Asia, stocks fell. Japan’s Nikkei index dropped 0.7 per cent, South Korea’s Kospi fell 0.7 per cent and China’s Shanghai Composite nudged down 0.4 pe rcent.

In commodity markets, Brent crude, the international benchmark for oil, rose about 1.8 per cent to $US42.47 a barrel. Gold prices dropped 1.4 per cent.

Dow Jones Newswires

5.14am: Goldman seizing $US174m from executives

Goldman Sachs Group is seizing or withholding $US174 million from current and former executives after agreeing to a costly settlement to resolve multiple government investigations into its role in a Malaysian bribery scandal.

The Wall Street firm will cut this year’s pay to Chief Executive David Solomon and two top lieutenants, and claw back past bonuses paid to ex-CEO Lloyd Blankfein and others after it admitted on Thursday to compliance lapses in its dealings with a corrupt Malaysian investment fund.

“We must always remain open to improvement, learn from our mistakes and accept the consequences when we fail,” Mr. Solomon said in a statement.

The bank is reducing Mr. Solomon’s pay and that of Goldman President John Waldron, finance chief Stephen Scherr and Richard Gnodde, head of Goldman’s international division, by a combined $US31 million.

It is also recouping bonuses paid to Mr. Blankfein, former CFO David Viniar and a pair of executives, Michael Sherwood and Michael Evans, who oversaw some of the 1MDB dealings and have since retired. It is also in discussions to recoup money from Gary Cohn, a former executive whose future bonuses were paid out when he joined the Trump administration in 2017, a person familiar with the matter said.

Goldman on Thursday agreed to pay more than $US2.9 billion to the U.S. Justice Department and other global regulators to settle allegations that it enabled the embezzlement of billions of dollars from the fund, known as 1MDB. That is on top of the $US2.5 billion it agreed in July to pay the government of Malaysia. The penalties amount to about eight months of profits for the Wall Street firm.

Dow Jones

5.10am: Markets flat as virus cases spike

Global stock markets were steady following sharp losses the previous session, with investors spooked by a sharp rise in coronavirus cases and continued uncertainty over a pre-election stimulus package in Washington.

Oil was firmer, along with the dollar, while the pound slipped after gains made on hopes that on-off-on-again post-Brexit trade talks might finally make some progress.

Better-than-expected new US jobless benefit claims and other US data were welcomed but analysts said the underlying economic situation remained concerning and made the case for a fresh stimulus package all the more pressing.

“With fiscal relief package hopes dimming, this situation is worrisome,” Gregory Daco of Oxford Economics tweeted.

David Madden, analyst at CMC Markets UK, said that while investors expect some sort of a package eventually “there isn’t much hope that it will be achieved soon.” The deadlock in Washington over the stimulus package comes as coronavirus cases surge across the US, with many Americans already struggling and observers fearful the economy could be hit badly.

The White House has said it will agree to a $US1.9-trillion package but that is $US300 billion short of what Democrats have put forward and much more than many Republicans are willing to swallow.

Analysts said markets have been jolted also by US Director of National Intelligence John Ratcliffe’s revelations that Russia and Iran have meddled in the election run-up, sending “spoofed” emails to Americans “designed to intimidate voters, incite social unrest, and damage President Trump”.

Trump and his Democratic challenger Joe Biden face-off today with all bets off as to how it will turn out after a first debate turned into a shouting match and the second was dropped.

London closed up 0.2 per cent, Frankfurt lost 0.1 per cent and Paris was flat.

AFP

5.07am: US existing home sales boom

The US housing market continued its boom in September as existing homes sales grew 9.4 per cent from the month before, a survey said.

The 6.54 million seasonally adjusted annual rate of sales reported by the National Association of Realtors (NAR) was above expectations and 21 per cent higher than the same month in 2019, with low interest rates and the upheavals of the coronavirus pandemic fuelling a surge in home-buying.

“Home sales traditionally taper off toward the end of the year, but in September they surged beyond what we normally see during this season,” NAR Chief Economist Lawrence Yun said.

“I would attribute this jump to record-low interest rates and an abundance of buyers in the marketplace, including buyers of vacation homes given the greater flexibility to work from home.”

AFP

5.05am: Wales nationalises coronavirus-ravaged railway

The Welsh government announced that it has decided to nationalise its railways due to tumbling passenger numbers during the coronavirus pandemic.

The devolved administration’s transport authority Transport for Wales (TfW) said in a statement that it has decided to take charge of the Wales and Borders service with effect from February.

The franchise is currently operated by KeolisAmey, which was awarded a 15-year contract in 2018 and is a joint venture between French transport group Keolis and Spanish-owned firm Amey.

“The last few months have been extremely challenging for public transport in Wales and across the UK,” Welsh transport minister Ken Skates said.

“Covid has significantly impacted passenger revenues and the Welsh government has had to step in with significant support to stabilise the network and keep it running.

“We have decided to transfer day-to-day rail services to a new publicly-owned subsidiary of Transport for Wales.” The news comes on the eve of a full “firebreak” lockdown for two weeks in Wales, which is seeking to combat a soaring number of new COVID-19 infections.

AFP

5.02am: New US jobless claims drop

New claims for US jobless benefits fell to 787,000 last week, the Labor Department said, dropping below 800,000 for only the second time since the pandemic started.

The big improvement came as new applications fell 55,000, seasonally adjusted, in the week ended October 17, and total claims in the previous week were revised down by 56,000 from the original report, according to the data.

Weekly jobless claims spiked into the millions as business shutdowns began in March to stop COVID-19, and though they have since fallen the improvement had slowed in recent weeks as some government aid programs for businesses expired and the pandemic concerns continued.

Policymakers in Washington remain deadlocked after months of talks on a new stimulus bill to support the unemployed and business owners.

Even with the sharp drop last week, the number of people applying for benefits remained above the single worst week seen during the 2008-2010 global financial crisis, indicating widespread joblessness continues.

And approximately 23.2 million people were receiving benefits under all programs as of the week ended October 3, a drop of about one million from the week prior.

“With fiscal relief package hopes dimming, this situation is worrisome,” Gregory Daco of Oxford Economics tweeted.

AFP

6.00am: Coca-Cola looks to energise growth

The Coca-Cola Company said it was shaking up its product mix as part of an effort to revive sales which have been slumping during the coronavirus pandemic.

The soft drink giant reported third-quarter sales down nine per cent from a year ago to $US8.7 billion, while profits tumbled 33 per cent to $US1.7 billion.

Coca-Cola said it saw an improvement in trends versus the prior quarter, stronger sales to consumers partly offsetting the decline in sales at bars, restaurants, stadiums and other channels.

Shares rose three per cent in pre-market trade on the results. As part of its response to the pandemic, Coca-Cola said it was continuing its organisational and product changes.

It now expects to cut the number of product brands to around 200, a 50 per cent cut, phasing out some drinks like Zico coconut water and Tab diet cola. It has already shed other brands such as Odwalla juices.

AFP

5.55am: ExxonMobil chief warns of more job cuts

Global oil giant ExxonMobil will release details soon of expected job cuts in the United States and Canada, the company’s chief Darren Woods said in a letter to employees.

“As difficult as this is, I hope you understand it is critically important for the future of our company,” Woods said in a statement.

“Making the organisation more efficient and more nimble will reduce the number of required positions and, unfortunately, reduce the number of people we need,” he said in the letter that summarised the discussion at an employee forum in Houston.

Following job cuts announced for Europe and Australia, he said the company is “very close” to completing the review of operations in North America and other parts of the world.

He said the company is wrestling with the “devastating impact” of the pandemic that caused a severe drop in demand for energy: oil demand dropped 20 per cent amid a collapse in travel.

And despite cost cutting measures the company still faces “significant headwinds.” ExxonMobil, which employs 75,000 workers worldwide, has suffered a sharp decline in value that accelerated during the pandemic, and was recently overtaken on Wall Street by renewable energy firm NextEra.

AFP

4.45am: American Airlines reports $US2.4bn loss

American Airlines said its earnings plunged 73 per cent in the third quarter amid the collapse in air travel during the coronavirus pandemic, causing a loss of $US2.4 billion, which was not as bad as analysts expected.

The company, which recently laid off 19,000 workers after Washington policymakers failed to renew funding to support airlines, said it reduced the rate at which it burns cash to $US44 million a day in the July to September period, compared to $US58 million daily average in the second quarter.

Another 20,000 employees took early retirement or long term leave as American, like other airlines, struggled to survive.

“During the third quarter, we took action to reduce our costs, strengthen our financial position, and ensure our customers return to travel with confidence, said American CEO Doug Parker said in a statement, calling the pandemic “the most challenging time in our industry’s history.”

AFP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout