Trading Day: ASX up as travel-related stocks gain

S&P/ASX 200 closes higher as travel-related stocks gain and miners fall, and RBA boss tips unemployment to drop.

- Building approvals smash estimates

- Bunnings property owner posts profit

- Amcor upgrades outlook, launches new buyback

That’s all from the Trading Day blog for Wednesday, February 3. Australian stocks surged to an 11-month high after global markets continued to rally, and the price of oil jumped. On Wall Street the S&P 500 rose 1.4 per cent and the Dow and Nasdaq both gained 1.6 per cent. Locally, RBA governor Philip Lowe has delivered a speech on the year ahead.

James Kirby 7.14pm: House price bounce gets built in

New housing data clearly shows house prices - but not apartment prices - are set to rebound.

The latest residential building approval numbers, tagged as “incredible” by CBA’s economics unit, certainly justify some of the surprising optimism we heard from the major banks last year when the market still looked weak.

The stand out figure is the level of new approvals for free standing houses. House approvals in December bounced ahead by 14.9 per cent but apartment approvals only limped along by 2.5 per cent.

Higher approvals are expected to lead to higher prices for residential property in the near term.

If so, then current forecasts of a 10 per cent increase across the board in dwelling prices for the coming year appear feasible (CBA’s own forecast is 8 per cent).

On a yearly basis, the figures are even more dramatic - approvals for detached houses are up 55 per cent.

Eli Greenblat 6.54pm: Australian wine exports crushed by Chinese tariffs

China’s punishing tariffs on Australian wine launched last year as part of a wider political and trade dispute between Beijing and Canberra have had a deadening impact on exports, with Australian wine sold into China slumping by 98 per cent in the first month the tariffs were applied.

Following the release of export data that illustrated the damage wrought by 200 per cent-plus tariffs inflicted by China, Wine Australia chief executive Andreas Clark said that in December 2020 only $4m worth of Australian wine was sold to China, compared with $173m in December 2019.

The massive dive is expected to continue into 2021, robbing Australia of a wine market once worth more than $1bn a year but now almost worthless, and leaving industry insiders pessimistic that other markets such as North America and the UK can buy enough wine to repair the damage.

Perry Williams 6.30pm: Amcor cashes in on working from home

Global packaging giant Amcor continues to cash in on the new COVID world order, with working from home driving demand for consumer products.

Amcor lifted its profit guidance for the 2021 financial year after delivering a 6 per cent rise in interim earnings boosted by strong food and beverage growth as millions of consumers in North America and Europe remain in lockdown a year after the pandemic first hit.

Ready made meals, juices, coffee and pet food products using Amcor packaging have helped drive earnings for the company, which traces its origins to establishing Victoria’s first paper mill on the banks of the Yarra River in the 1860s.

Amcor runs 230 packaging factories spanning more than 40 countries and said the pandemic had worsened in many of its markets during the last three months of 2020.

“We saw a pick-up in COVID impacts in the second quarter of our fiscal year, particularly in Europe and North America,” chief executive Ron Delia said.

“The complexity and challenges of operating in that environment became much more pronounced and much more difficult to navigate. There has been pockets of the business that have benefited from at-home consumption, including beverage (products) in North America.”

Cliona O’Dowd 5.24pm: UniSuper lending stock to short-sellers again

UniSuper has quietly reinstated the stock lending program it shut down in early 2020 when markets went into panic mode over the coronavirus pandemic.

The $90bn industry super fund, which manages the savings of university staff, brought back the program, which lends stock to short-sellers, late last year, a UniSuper spokesperson confirmed to The Australian.

“We reinstated (the program) in the fourth quarter last year when we were suitably comfortable that the market was back to normal,” UniSuper chief investment officer John Pearce said.

In a move that enraged hedge funds at the time, the super fund, one of Australia’s largest, last March instructed its custodian to suspend its stock lending program effective immediately and recalled all shares on loan.

Hedge funds rely on stock lending programs to bet against companies: these funds borrow the shares from investors and sell them in the hope of buying back the stock at a later date at a lower price. The hedge funds then pocket the difference.

“In a normally functioning market we’re comfortable lending our shares as we genuinely believe that it adds to market efficiency,” Mr Pearce said at the time.

“The ability to short-sell adds to liquidity and price discovery in an orderly market. However, we are now in a market gripped by panic and we believe that restricting the ability to short-sell is in the best interest of promoting a more orderly market.”

Elise Shaw 5.06pm: $A inches higher; no RBA speech impact: CBA

The Australian dollar inched higher against the US dollar towards 0.7615, notes Commonwealth Bank’s Global Markets Research team.

“AUD was not impacted by RBA governor Philip Lowe’s speech, despite governor Lowe discussing exchange rates. He noted that the AUD was lower than it would have been otherwise because of the RBA’s bond‑purchase program. He also said it was premature to discuss withdrawing stimulus, especially in the context of other central bank’s accommodative monetary policy settings.

“In our view, the RBA’s extended QE program is unlikely to push AUD/USD down much unless the interest rate spread with the US is comfortably below 0.0%. Indeed, longer‑term Australian bond yields have already given up yesterday’s modest falls. As mentioned previously, commodity prices are the major driver of fair value. The risks to commodity prices, particularly iron ore, are tilting down, raising the spectre of further falls in AUD in the near term,” the CBA team said.

4.42pm: ASX ends up 0.9% after 11-month high

Australia’s sharemarket surged to a fresh 11-month high as a jump in Alphabet added to strong leads from Wall Street, but profit taking left the index just shy of an 11-month high on a daily closing basis.

The S&P/ASX 200 rose as much as 1.3pc to 6852.9 - highest since 26 February - after the S&P 500 rose 1.4pc and S&P 500 futures rose as much as 0.5pc with Alphabet up about 7pc in afterhours trading after its quarterly report.

But after peaking just before a predictably dovish speech from RBA governor Philip Lowe at the National Press Club, the index closed up 0.9pc at 6824.6, after losing 15 points in the closing single price auction.

Profit taking was to be expected after a very strong 5.2 per cent rebound from a 2-month low of 6517.2 this week.

But Wall Street may be back on an upward path after recent hedge fund related derisking and a “maximum dovish” RBA should help the local share market outlook.

The “revision ratio” of ASX 200 earnings estimates is positive and a strong earnings season may not yet be fully priced in, although the faltering iron ore price and China’s liquidity drain pose risks.

Virgin Money surged 15pc after its trading update, Corporate Travel rose 6.4pc as Ord Minnett upgraded, Carsales rose 6.3pc as Goldman Sachs upgraded and Flight Centre jumped 4.9pc as Macquarie boosted its target price.

Amcor gained 4.5pc after raising its FY21 earnings guidance and Credit Corp rose 4.7pc on target price upgrades.

Real Estate was the strongest sector with Goodman up 2.6pc and Stockland up 4.4pc.

Banks were also strong with the four majors up 1.2-1.9pc notwithstanding some profit taking today.

Afterpay turned down 1.6pc on UK regulatory jitters after an early rise as Macquarie boosted its target price 44pc to $140.

Iron ore miners were the main drags with BHP down 2.2pc after the spot price fell 4.4pc to $US149.55 a tonne.

Vale’s results tonight will be key for iron ore miners.

Eli Greenblat 4.12pm: DJs to close flagship Wellington NZ store

David Jones will close its flagship store in Wellington, New Zealand, as it incorporates a new strategy for the upmarket department store. The second store in Auckland will remain open.

A spokesman for David Jones said in line with its retail network strategy, David Jones has made the decision to close the Wellington store in June 2022.

“As the retail sector continues to transform, including the accelerated shift to online, the optimisation of our retail network – through investment in our digital and physical channels, a focus on right-sizing and where necessary, consolidation of our physical footprint – is critical to meeting the changing needs of our customers,” the spokesman said.

“David Jones remains committed to serving our customers in New Zealand and, in addition to our Newmarket store in Auckland, we look forward to introducing David Jones online to all our New Zealand customers in the second half of 2022, closely following the closure of our Wellington store.”

The spokesman said the department store remained committed to the strong, ongoing performance and growth of its Newmarket store in Auckland.

“The decision to close our Wellington store has not been made lightly and we sincerely thank our customers and our team for their support and commitment over the past four and a half years.”

Ben Wilmot 3.52pm: Kuwaitis put $200m city hotel portfolio on the block

Kuwaiti-controlled Action Hotels Group has listed its three Melbourne properties for sale in the first major hotel portfolio offer of the year with hopes of reaping more than $200m.

CBRE Hotels’ Michael Simpson, Wayne Bunz and Scott Callow will sell the Accor-managed assets, including the Novotel Melbourne South Wharf. The portfolio also includes the 155-room Ibis Glen Waverley and the 73-room Ibis Budget Melbourne Airport Hotel.

The Action Hotel Group assets will be available separately or in-one-line and have a total of 575 guest rooms. It is being billed as the first of a number of hotel assets to hit the market.

The campaign follows last year’s $180m portfolio sale of 17 Ibis-branded hotels to Iris Capital.

3.33pm: ASX bounces strongly late afternoon

Australia’s sharemarket bounced strongly late afternoon after an intraday dip from a fresh 11-month high. The S&P/ASX 200 rose more than 20 points in 15 minutes, jumping around 6820 to 6842.6, after a 1.3pc intraday surge to 6852.9 points - highest since Feb 26th.

ASX200 volume 16pc above the 20-day average isn’t large considering today’s moves.

Today’s close relative to the previous 11-month peak at 6832.6 (or 6824.7 on a daily close basis may be key for momentum. After a very strong 5.2 per cent rebound from a 2-month low of 6517.2 this week, a strong close today would be impressive.

However, some profit taking wouldn’t be overly surprising.

The ASX200 was last up 1.1pc at 6838.3.

David Ross 3.25pm: Mozo snapped up by UK-listed media company

Financial comparison site Mozo has been snapped by London stock exchange listed media company Future Plc.

One of Australia’s leading comparison sites Mozo has been operating in Sydney for over a decade, turning over $11m in revenue in 2020.

The deal opens the way to Australia for Future, giving the business a price comparison revenue stream and looks set to boost Mozo’s reach due to additional resourcing.

Future is one of the world’s larger specialised media companies, reportedly reaching one in three adults in the UK and US.

The business owns a swathe of online sites and magazines in the business and consumer space.

Future CEO Zillah Byng-Thorne said she was “delighted” with the buyout of Mozo.

“We are seeing the increasing convergence of content and price comparison and this acquisition supports our global growth ambition in this area,” she said.

Jared Lynch 2.35pm: Starpharma safe sex antiviral to fight Covid

A antiviral product used in condoms to ensure safe sex is being deployed to fight COVID-19 in Europe.

Melbourne-based biotech Starpharma is ramping up manufacturing of its Viraleze nasal spray - which it says studies have shown is 99.99 per cent effective against COVID-19 - in anticipation of receiving approval from European regulators.

Chief executive Jackie Fairley says the product has been used for the past five years in two Starpharma products - an antiviral condom and a gel for the treatment and prevention of bacterial vaginosis. It is already approved for use in more than 40 countries for those applications..

Dr Fairley said the company was planning to launch the product in Europe and the UK, where coronavirus has killed more than 700,000 people, in March.

“Our European regulatory submission has been completed and undergoing final review ahead of submission shortly,” Dr Fairley said.

“Initial launch batches of Viraleze are currently being manufactured to support rapid rollout following approval.”

Starpharma shares were trading 1.6 per cent higher at $1.62 in early afternoon trade on Wednesday compared with a 1 per cent gain across the broader share market.

Dr Fairley said the spray stops infection when applied to cells before and after exposure to the virus.

“The product can be used in a wide variety of risk situations. If you are about to walk into the supermarket, you would use it.

“The same on public transport or getting on a plane. Elevators are a prime example of where it is difficult to socially distance – and likewise at restaurants and bars where masks can be removed.”

COVID-19 infects human cells by using the characteristic spike proteins to attach to proteins on the surface of human cells. Dr Fairley said the spray works by blocking the interaction between viral spike proteins and human cell proteins, preventing infection.

“The product can be used in a wide variety of risk situations,” Dr Fairley said.

“If you are about to walk into the supermarket, you would use it. The same on public transport or getting on a plane. Elevators are a prime example of where it is difficult to socially distance – and likewise at restaurants and bars where masks can be removed.”

John Shine, president of the Australian Academy of Science and former CSL chairman, said such products were needed, given vaccines did not prevent transmission of COVID-19.

“Vaccinated individuals will be protected from the worst of COVID-19 but will not be protected from becoming infected,” Professor Shine said. “None of the vaccines that have been approved for use have demonstrated that they can stop transmission.”

Perry Williams 1.20pm: Refining industry still struggling: Exxon

ExxonMobil has issued a downbeat assessment of the refining industry as it weighs a decision on the future of its Altona refinery in Melbourne.

The US energy giant operates Altona, one of only three refineries still operating in Australia, but has signalled doubts over its future with the facility trading at a loss.

The company told The Australian on January 27 it is still weighing up a government assistance package and has made no decisions over Altona.

Exxon chief executive Darren Woods said the global refining industry was still struggling.

“If you look at the industry as a whole across the globe, where margins are at, it’s not a sustainable position just because of the losses that are accruing,” Mr Woods told investors after its fourth quarter earnings call.

“These are commodity businesses and if you take a price that goes below the marginal cost of supply, it’s going to end up costing the industry as a whole and eventually players will rationalise and drop out. And that for as long as I’ve been in the Downstream, that business has been long supply and it’s a slow process to rationalise, particularly as more refineries come on out in Asia.”

The refining sector should pick up later in 2021.

“My expectation is the second half of the year will look a lot better than the first half, but exactly where we end up on that bar, I think it’s tough to tell.”

BP announced plans in October to close its Kwinana oil refinery in WA, blaming regional oversupply and low margins.

Lachlan Moffet Gray 1.20pm: Jobs recovery ahead: RBA’s Lowe

Reserve Bank Governor Philip Lowe denied he is disappointed in the government’s plans to end the JobKeeper wage subsidy this year.

“I think when JobKeeper ends there will be some job shedding...but that’s going to take place in the context of an economy that’s otherwise recovering,” Dr Lowe said.

“Am I disappointed that the government is stopping the JobKeeper program? No. The government made it clear it was a temporary program.”

Dr Lowe said “the unemployment rate has come down a lot quicker than we thought” and “our sense is that job creation is going to continue”, but noted that the scenario is something of an unknown.

“It’s possible that it could go the other way, but our central scenario is that we will continue to recover.”

1.15pm: PBoC liquidity drain continues

China’s central bank has continued to drain liquidity from its financial system, potentially causing further underperformance from China’s stock market.

The PBoC offered just CNY100bn ($20bn) of cash while CNY180bn of seven-day funds matured Wednesday.

The Shanghai Composite was down 0.3pc in early trading and was down 2.4pc since January 2, while the S&P 500 was down 0.4pc.

It comes after the PBoC also drained cash from the system last week, driving overnight interbank borrowing costs sharply higher at a time of heightened speculation in China’s housing and financial markets.

The concern is that a tightening of liquidity could be exacerbated by heightened demand for cash in the Lunar New Year period - when the PBoC normally adds cash - though celebrations may be damped by the pandemic.

Bloomberg estimates the PBOC needs to provide more than CNY1.5 trillion of liquidity to stabilise money markets around the break.

Lachlan Moffet Gray 1.10pm: RBA denies central bank rates ‘war’

RBA Governor Philip Lowe has denied that global central banks are in a “cold war” over interest rate cuts, saying they are reacting rationally in the context of their own interests.

“Every month I am meeting with the governors of other central banks and we discuss this issue,” Dr Lowe said, adding that if one bank begins a quantitative easing program, another will follow to keep their currency competitive.

“No one wants to see in the current environment their exchange rate go up,” he said.

“Are we going to be doing this for years? I hope not, I don’t expect we will need to be doing this for years.”

Dr Lowe also waved away concerns of an asset or housing price bubble.

“The national house price index today is where it was four years ago,” he said.

“The capital city price index is lower than it was four years ago....And the equity market we aren’t even back to where we are at the beginning of last year.”

Dr Lowe did however say the RBA would be watching home lending to ensure lending standards do not drop.

Dr Lowe did not allow himself to be drawn on a question relating to the Craig Kelly controversy, but did say he gets his medical advice from his doctor and advised others to do the same.

“I’m not a big youtuber or social media person,” he said.

Dr Lowe was asked whether he tells his children to prepare for a lower living standard in the future due to growing government debt.

“No, I certainly don’t prepare them to have lower living standards than I have...I talk to them about opportunity and technology,” Dr Lowe said.

He said that the most important priorities for growing living standards are “developing technologies and developing human capital,” adding that “what comes out of the ground” will not shape the Australian economy in the future like it did in the past.

Dr Lowe said human capital and the resilience of Australians will help drive up interest rates over the next decade as the economy and wage growth increases.

Bridget Carter 1.08pm: Westpac poised to sell auto loan portfolio

Westpac is understood to be about to finally fire the starting gun on the sale of its $10 billion dealer finance and auto loan portfolio, with Morgan Stanley currently lining up bidders.

It is understood that prospective suitors are currently signing non-disclosure agreements being handed out by Westpac’s adviser, Morgan Stanley, ahead of receiving information memorandums for the sale, which could reap the Australian bank between $1bn and $2bn in proceeds, according to estimates.

More to come.

Lachlan Moffet Gray 1.06pm: Lowe declines to advise on wage growth

RBA Governor Dr Philip Lowe has been asked whether he should advise the government to do more to help wage growth and address the balance of power in the labour market.

“No, I am not going to provide the government with advice...on that issue,” Dr Lowe said, adding that the RBA’s role was to use monetary policy to support wage growth.

“Before the pandemic we were seeing some tightness in the labour market,” he said.

Dr Lowe was also asked whether the government’s policy of linking public sector wage increases to private wage increases was detrimental to overall wage growth.

“It depends which way you think the causation runs here,” Dr Lowe said.

“My aspiration is for both public and private sector wages to be growing faster than they are.”

Dr Lowe was also asked whether a contractionary budget this year may impact the economic recovery.

“It’s not my business to kind of be commenting on hypotheticals,” Dr Lowe said, adding that he hoped the government would remain flexible and continue an expansive fiscal response if needed.

Ticky Fullerton 12.40pm: Microsoft willing to accept media laws

Microsoft says it would sign up to the federal government’s proposed news media bargaining code, in the clearest break from its rivals Google and Facebook to date.

Microsoft chief executive Satya Nadella spoke to Scott Morrison and Communications Minister Paul Fletcher last week and said he “fully supports” the proposed code, the company said.

“The code reasonably attempts to address the bargaining power imbalance between digital platforms and Australian news businesses,” Microsoft president Brad Smith said.

“While Microsoft is not subject to the legislation currently pending, we’d be willing to live by these rules if the government designates us.”

Both Google and Facebook are aggressively lobbying against the code, which would force the two technology giants to negotiate with Australian publishers over payment for content.

Google, in particular, has threatened to remove its search engine from Australia if the bargaining code is legislated – most recently it experimented with removing local news from search results.

Patrick Commins 12.35pm: Unemployment could drop below 5pc: RBA’s Lowe

Reserve Bank governor Philip Lowe says the unemployment rate could fall below 5 per cent by the second half of next year if the post-COVID economic recovery proves stronger than anticipated in the central bank’s updated set of estimates.

Speaking at the National Press Club in Canberra, Dr Lowe’s comments came a day after unveiling a further $100bn in monetary policy support to bolstering growth and committing to keep rates at 0.1 per cent until 2024 “at the earliest”.

“The cash rate will be maintained at 10 basis points for as long as is necessary,” Dr Lowe said on Wednesday.

He said the “economic downturn was not as deep as was initially feared and the bounce-back has been earlier and stronger than we were expecting”.

The RBA now expects, in its base case, that the jobless rate will drop from 6.6 per cent to 6 per cent by the end of this year, and to 5.5 per cent by the close of 2022.

But in his speech the governor detailed an “upside scenario”. In this scenario, the pandemic remains well contained, “with a strong pick-up in consumer and business confidence propelling a stronger self-sustaining recovery, especially given the large amount of monetary and fiscal stimulus that is in place”.

“In the upside scenario, the unemployment rate falls faster to be a bit below 5 per cent in the second half of next year.”

12.30pm: Private business investment lagging: RBA

RBA Governor Lowe laments that “we are yet to see the same signs of a recovery in private investment that we have witnessed in household spending.”

Dr Lowe tells the National Press Club “an increase in private business investment is not only needed to support the economic recovery but also to build the productive capital stock that is needed for our future,”

“So this too is an issue we are watching carefully.” But “investment is nonetheless expected to pick up as uncertainty recedes and demand increases.”

12.30pm: RBA ‘monitoring lending standards closely’

RBA Governor Lowe says the RBA will be “monitoring lending standards closely” as “housing prices rise again”.

“We would be concerned if there were to be a deterioration in these standards, but there are few signs of this at the moment,” Dr Lowe tells The National Press Club.

12.30pm: Consumer spending risks ‘in both directions’

RBA Governor Philip Lowe warns that there are risks to the central bank’s forecasts on consumer spending in both directions.

“On the downside, further bad news on the health front could see additional restrictions on activity and a renewed desire to save” he tells the National Press Club.

“And on the upside, positive news on health and jobs could see people seek to catch up on spending and run down their extra saving buffers quickly.

So we are watching this area carefully.”

12.30pm: QE to stop ‘unwelcome’ $A rise: Lowe

RBA Governor Lowe claims QE “has worked” because it has “helped to lower interest rates and has meant that the Australian dollar is lower than it otherwise would have been.”

In his National Press Club speech, Dr Lowe says Tuesday’s decision to extend QE was based on the RBA’s consideration of the effectiveness of its bond purchases, the decisions of other central banks, and “most importantly” the outlook for inflation and jobs.

“In terms of other central banks, most have recently announced extensions of their bond purchase programs, many running until at least the end of this year,” he says.

“Given this, if we were to cease bond purchases in April, it is likely that there would be unwelcome upward pressure on the exchange rate.”

12.30pm: ‘Possible’ inflation won’t meet target by 2024: Lowe

RBA Governor Lowe offers a dovish tweak to his already-dovish policy outlook.

In his National Press Club speech the Governor concedes the RBA’s inflation target may not be met by 2024.

“Before increasing the cash rate, the board wants to see inflation sustainably within the 2 to 3 per cent target range,” he says.

“Meeting this condition will require a tighter labour market and stronger wages growth than we are currently forecasting.

It is difficult to determine exactly when this condition might be met but, based on the outlook I have discussed today, we do not expect it to be before 2024, and it is possible that it will be later than this.”

So the message is: interest rates are going to be low for quite a while yet.”

12.15pm: ASX up 1.1pc before RBA speech

Australia’s sharemarket surged before an important speech by RBA Governor Lowe at 12.30pm (AEDT).

The S&P/ASX 200 was up 1.1pc at 6837.4 after hitting an 11-month high of 6852.9.

After strong gains on Wall Street, the index got an additional boost from a surge in US futures.

S&P 500 futures rose 0.4pc and NASDAQ futures climbed 0.5pc, with Alphabet up 7pc in afterhours trading after its results.

Virgin Money surged 15pc after its results, Credit Corp rose 6.2pc on broker target price upgrades, Amcor jumped 5.5pc on improved FY21 earnings guidance and Carsales surged 5.5pc after Goldman upgraded.

Banks were strong with the four majors up 1.9-2.2pc after Morgan Stanley flagged a lift in dividend payouts starting with CBA ‘s results next week.

Real estate was the strongest sector with Goodman, Scentre and Stockland up over 2pc.

Miners dragged, with South32 down 4.3pc and BHP down 2pc on the iron ore price pullback.

Adam Creighton 11.50am: House approvals strong: ABS

Builders have shrugged off uncertainty about the economy and population growth, pushing the number of approvals of new houses and apartments to a record high.

The total number of new dwelling approved for construction increased for the sixth consecutive month in December, rising to more than 19,537 - almost 11 per cent higher than November and 23 per cent higher than December in 2019.

“Private house approvals were strong across the country, with Victoria, South Australia and Western Australia hitting record highs in seasonally adjusted terms. Federal and state housing stimulus measures, along with record low interest rates have contributed to strong demand for detached dwellings,” said Daniel Rossi, Director of Construction Statistics at the ABS.

“Despite the uncertainty experienced by developers and households during 2020, the total number of dwellings approved in the calendar year was 4.8 per cent higher than in 2019,” he said.

The announcement by the ABS comes amid news of rising house prices and surging demand for home loans, especially among first home buyers, that have prompted concerns the Reserve Bank series of interest rate cuts could reignite the property market.

11.35am: Building approvals smash estimates

Australia’s December building approvals data have smashed market expectations.

Building approvals rose 10.9pc month-on- month.

Bloomberg’s consensus estimate was for a 3pc rise.

It’s the fastest pace of growth in this volatile series since a 16.8pc rise in September.

Private sector building approvals rose 15.8pc in December after rising 6.1pc in November.

It comes amid record low interest rates, quantitative easing and unprecedented fiscal support.

Uptake of first-home-owner grants has been much greater than expected.

11.36am: ASX hits fresh 11-month high

Australia’s sharemarket has surged to a fresh 11-month high in the first 1.5 hours of trading on Wednesday.

The S&P/ASX 200 rose 71 points or 1.1pc to 6833.9 points, exceeding a previous 11-month peak of 6832.6 reached last week.

It comes amid a resurgence in the US share market this week after the recent retail-driven short squeeze forced derisking by hedge funds.

And it follows a “maximum dovish” RBA statement yesterday. RBA Governor Lowe will speak on “The Year Ahead” at the National Press Club from 12.30pm (AEDT).

Perry Williams 11.30am: QIC snaps up US Enwave business

Queensland asset manager QIC has scooped up the US business of North American power company Enwave Energy after its competitor IFM Investors jointly bought Enwave’s Canadian operations for $C2.8bn ($2.9bn).

QIC - whose clients include Australia’s largest superannuation funds controlling $730bn of retirement savings - teamed up with the privately run financial services player Ullico for the US buyout.

Enwave serves 340 clients and operates across eight states, providing energy solutions to 400 buildings including universities, school districts and hospitals.

“Our sector centric, thematic-based investment strategy targets distributed energy and sustainability, and Enwave Energy US is well positioned to take advantage of this growing market, leveraging its leading position in green energy and its demonstrated credentials operating North America’s largest thermal ice storage facility in Chicago and executing in Denver on the largest sewer heat recovery system in North America,” QIC’s Ross Israel said. The deal price was not disclosed.

IFM partnered with Ontario Teachers’ Pension Plan Board on Wednesday to acquire Enwave’s Canadian operations, with each investor to hold a 50 per cent stake.

Enwave is a low-carbon energy business that provides cooling and heating solutions to over 320 customers across a range of sectors in Canada.

Jared Lynch 11.20am: Tabcorp lotteries ‘could be worth $10bn’

Tabcorp’s lotteries business could be worth more than its current entire market capitalisation, with Citi analysts valuing the division at $10bn.

The embattled gambling group has become a target of several takeover offers looking to snap up its poor performing wagering division - which Citi has valued up to $3bn - and spin off its lotteries business.

London-listed Entain, the Ladbrokes owner, is actively courting Tabcorp as part of its efforts to become Australia’s betting king. Meanwhile big private equity firms have been circling Tabcorp, with two consortiums in hot pursuit, both keen to strike a deal that would result in renowned digital betting pioneer Matthew Tripp heading the company.

Meanwhile, Credit Suisse analysts have counted US casino corporates, major media, wagering and gaming companies as well as private equity firms in the mix of possible suitors - with the company’s share price rocketing to $5.20 - a three year high. Since Monday, its shares have surged from $3.95 to $4.56.

Citi analyst Bryan Raymond said it was an “opportune time” for Tabcorp’s new chairman Steven Gregg, who replaced Paula Dwyer last month, and whoever replaces long-serving chief executive David Attenborough, who announced his impending departure last July.

“This is an opportune time to consider a demerger or sale of the wagering business, in our view, given the new chairman and soon to be appointed chief executive,” Mr Raymond wrote in a note to investors.

Mr Raymond valued the lotteries business at $10bn or 16 times FY22 EBITDA. This compares with Tabcorp’s current market capitalisation of $9.88bn. He said this would unlock value with has failed to materialise since Tabcorp’s $11bn merger with Tatts in 2017.

David Ross 11.15am: Westpac loses High Court battle over BT switch

Westpac has lost its High Court battle with ASIC over the bank’s campaign to get customers to switch into its BT Super product.

The High Court dismissed the bank’s appeal in a judgment released on Wednesday.

ASIC had taken issue with Westpac’s outbound letters and calls to customers, alleging it constituted personal advice to customers.

The court found Westpac had provided personal advice in the campaign which netted BT Super $640mm in customer superannuation balances.

The regulator had also provided the court 15 case studies which it argued reflected personal advice to customers, resulting in breaches of the law.

ASIC’s victory helps clarify the dividing line between personal and general advice and closes a loophole long exploited by banks in selling in-house superannuation products.

Westpac had earlier lost a Federal Court challenge 3-0 in October 2019 in a string of court battles over its tactic of superannuation selling.

The bank had initially won a 2018 case against ASIC, which cleared the bank.

Perry Williams 10.37am: Amcor shares higher after upgrade

Amcor surged by as much as 7.4 per cent to a five-week high in early trading after upgrading its 2021 earnings guidance and delivering interim results ahead of expectations.

Citi highlighted the strong performance from its rigids plastic packaging unit which saw sales growth of 10 per cent and volumes 6 per cent higher.

A jump in earnings per share guidance to 10-14 per cent for 2021 also easily outstripped consensus at 11.5 per cent.

“Bemis synergies, lower overheads and interest costs contributed to better earnings alongside solid organic growth,” Citi analyst Craig Woolford said.

Amcor shares last up 6.7 per cent to $15.35.

10.30am: ASX hits five-day high in early trade

Australia’s share market hit a five-day high in early trading on bullish offshore leads and a “maximum dovish” RBA yesterday.

The S&P/ASX 200 was up 0.8pc at 6819.7, with Energy, Communications, Real Estate, Technology, Financials, Industrials and Health Care.

Alphabet rose 7pc in afterhours trading, pointing to a further rise in Wall Street tonight.

Among heavyweights, Amcor rose 6.6pc after upgrading its FY21 guidance.

Virgin Money surged 11pc after its results.

Carsales rose 5pc after Goldman Sachs upgraded.

Credit Corp added 5pc as brokers increased their targets

Banks are strong with the four majors up 1.2-1.5pc.

But BHP is down 2.4pc after spot iron ore dived 4.4pc to a seven-week low of $US149.455.

10.09am: CBA should favour dividends over buybacks: MS

Morgan Stanley’s Richard Wiles expects CBA to raise its interim dividend to $1.55 per share - above Bloomberg’s consensus of $1.35 - but not launch any share buyback in its 1H21 result next Wednesday.

“More importantly, we believe CBA should consider using its surplus capital to support a higher medium-term payout ratio rather than undertaking buybacks,” he says.

Mr Wiles notes that strong capital and provisioning, the Australian economy’s “resilient re-opening” and the lifting of APRA’s dividend restrictions provide CBA with a number of capital management options.

For FY21, he sees a full year dividend of 330 cents per share based on a payout ratio of 72pc, and a resumption of CBA’s historic 1H/2H skew of about 45/55pc in the full year dividend, with an interim dividend of 155c or 47pc of his FY21 estimate.

But in the near term, he expects CBA to adopt a conservative approach to capital, meaning that it will not announce a buyback at the 1H21 result and it could adopt a more pronounced 1H/2H skew of about 40/60 per cent.

While the major banks have healthy capital ratios, Mr Wiles sees six pre-conditions for buybacks, which are unlikely to be met this year.

In his view, banks could create more value for shareholders by targeting a higher “sustainable” medium-term payout ratio rather than undertaking buybacks.

He notes that CBA’s target dividend payout ratio range is still 70-80pc, but its FY21E “excess” capital of about $6bn could be used to add more than $1bn to the annual dividend for several years.

“All else equal, this implies a 10 percentage point increase in the payout ratio and an annual dividend which is about 50c or ~10-15 per cent higher than our base case in FY22and FY23,” Mr Wiles says.

“If viewed as sustainable in the medium-term, we think investors could be prepared to capitalise this higher dividend.”

Lachlan Moffet Gray 10.03am: Myanmar Metals extends trading halt

Myanmar Metals has requested a suspension of trading of its securities until February 10 at the latest pending an update on the impact of the political situation in the country on the company’s projects.

It comes after the company entered a voluntary trading halt on February 1 following the military coup.

The Australian reported today that Myanmar Metals holds mining interests in the country’s Shan State, which is home to ethnic separatist groups that have been battling the now resurgent military on and off over the past decades.

Bridget Carter 10.04am: Blackstone eyed Tabcorp wagering arm

Private equity fund Blackstone is understood to have been in talks to buy Tabcorp’s $3 billion wagering arm as part of a proposal that may have seen renowned digital betting pioneer Matthew Tripp run the business, according to sources.

It comes after London-listed global betting firm Entain, which owns Ladbrokes, confirmed Tuesday night it had lodged a takeover proposal for Tabcorp’s wagering business, which would involve a break up the Australian $9bn gambling giant.

It is also understood that overseas pension funds, such as those out of Canada, have also been circling the $9 billion Australian listed betting company, while sources say that Ladbrokes’ major rival, Flutter Entertainment, which owns Sportsbet and comprises the merged Paddy Power and Betfair entities, will likely now consider its options with respect to the Tabcorp wagering arm.

However, some question whether Flutter would face opposition from the Australian Competition and Consumer Commission.

The Australian reported late last year that two consortiums have been hot pursuit, both keen to strike a deal that would result in former BetEasy boss Matthew Tripp, heading the company.

One party was said to be eager to bid for the entire Tabcorp business in a deal that may be worth $9bn.

The other group was interested in only the TAB wagering business, potentially valuing the unit at up to $3bn.

It is now understood that the group interested in the wagering arm is Blackstone.

DataRoom reported Tuesday that Blackstone was considered a logical suitor for the business after revealing that Tabcorp had received a breakup proposal for the company about two weeks ago that involved the buyer taking the company’s wagering arm.

Ben Wilmot 10.02am: Dexus trust wins tenants at Freeman Central project

Property group Dexus has won two major logistics tenants at the Freeman Central development in Richlands, Queensland, as companies lock in more space along the east coast to capitalise on a rise in e-commerce.

Dexus secured the built to lease commitments for warehouse and office facilities across 22,200sq m at Freeman Central, resulting in 65 per cent of the estate’s first stage being leased at completion.

Third-party logistics operator, ACR Supply Partners, has taken 12,200sq m, enabling expansion into Queensland to service its growing e-commerce customer base. James Lane also took 10,000sq m, supporting its 27 home furnishing retail stores.

Dexus Australian Logistics Trust acquired the large nine hectare industrial development site in Richlands in April.

Lachlan Moffet Gray 9.53am: Tabcorp wagering spinoff gets Citi tick

Citi analysts believe the time is right for Tabcorp to spin off its underperforming wagering arm from its lucrative lottery arm given the recent renewal of the company’s executive team, with a new chair and incoming CEO.

The analysts believe a fair purchase price for the wagering business would be around $3bn, including a control premium, with the value of the segment falling around $2.3bn.

A new buyer could rebase the wagering business by reinvesting in customer offers and systems while rationalising the retail footprint of TAB’s physical betting shops.

Synergy opportunities also exist, the analysts said, although this would likely face ACCC and FIRB approval.

The new slimmed-down TAB would then be free to unlock the true value of its lotteries business, which the analysts value at $10bn, compared to Tabcorp’s market cap of $9.8bn.

“While very early in the process, the prospect of an exit from wagering and gaming services looks appealing, given a standalone lotteries business would be considered among the highest quality defensive businesses in Australia,” they said.

Ben Wilmot 9.50am: Bunnings property owner turns in $144m half

BWP Trust, the country’s largest listed owner of Bunnings warehouses, says it is well positioned in the COVID-19 environment, with its $2.6bn portfolio riding the home renovation boom.

The trust, which receives most of its income from Bunnings and other national large format retailers, which are performing well during the pandemic, is benefiting from the re-rating of its properties as investors chase the complexes for safe income streams.

BWP said rent reviews were expected to contribute incrementally to property income in this half and there are 41 leases to be reviewed to the CPI or by a fixed percentage increase during the period. There are also 19 market rent reviews of Bunnings warehouses that are being finalised.

The trust said demand for Bunnings warehouse properties is expected to remain relatively stable in the near-term given the current low interest rate environment and the strength of the Bunnings covenant.

But it said this financial year’s distribution would be similar to the ordinary distribution paid last year, with capital profits being used to support the distribution as necessary.

BWP said the distribution may be reviewed if COVID-19 impacts were more severe or prolonged than anticipated.

BWP turned in a first half profit of $144m, which included $87.1m of unrealised gains in its portfolio. It paid an interim distribution of 9.02c per unit in line with last year.

It had like-for-like rental growth of 2 per cent in calendar 2020 and a weighted average lease expiry of 4.3 years. The company is geared at just 17.8 per cent and had a weighted average cost of debt of 3.2 per cent per annum.

BWP made rent abatements of just $403,868 to tenants impacted by the COVID-19 shutdowns during the half.

The trust sold the ex-Bunnings Warehouse property at Underwood in Queensland for $16 and also agreed to sell a former Bunnings property at Mindarie in WA.

9.46am: Afterpay target raised 44pc: Macquarie

Macquarie Equities has raised its Afterpay target price 44pc to $140, but stays “Neutral” after the broker’s Wei Sim assumed research coverage from David Leung

“Afterpay is trading at 25 times one-year forward enterprise-value-to-sales - a premium to peers and historical valuations,” Ms Sim says.

“This may be justified by its strong growth, however the catalysts to justify material further upside from current levels are unclear to us.”

Lachlan Moffet Gray 9.33am: ‘No Myanmar threat to Woodside’

Analysts at Macquarie believe the political situation in Myanmar is unlikely to impact Woodside’s valuation, joining Credit Suisse in prescribing little value to the offshore oil drills in the country.

“Woodside just very recently commenced a 3-well drilling campaign in deep-water Myanmar,” the Macquarie analysts said.

“In response to the recent military coup, WPL management comments it is monitoring the situation, considering how the drilling may be impacted, and preparing a forward plan.

“We do not attribute any value to the A6 deep-water gas development or the exploration acreage.”

9.15am: ASX may hit 11-month high

Australia’s share market may hit an 11-month high today.

A daily close above last week’s close at 6832.6 may induce more buying on a technical view.

That could induce a test of the record high at 7197.2 within weeks as long as Wall Street holds up.

Overnight futures relative to fair value imply the S&P/ASX 200 will open up 0.8pc at 6817.

But Alphabet is up 7pc and Amazon is up 1.8pc in afterhours trading after both reported after the US close.

This points to a rise in US futures which may cause a bigger-than-expected rise in the Australian market, potentially led by tech stocks.

Dovish yet optimistic comments from RBA Governor Lowe in his National Press Club speech on “The Year Ahead” from 12.30pm (AEDT) may help shares.

The local share market may also see a further reaction to the RBA’s implied extension yesterday of its yield curve control through 2024 and confirmation to another $100bn QE program at the current pace of $5bn a week.

AUD/USD is now struggling to stay above its 50-DMA at 0.7605 after Tuesday’s RBA policy statement - described as “maximum dovish” by UBS.

Despite a late pullback from a 5-day high of 3843.09, the S&P 500 closed up 1.4pc at 3826.3 points.

A record 60pc fall in GameStop and 8.5pc fall in spot silver (CME raised margins by 18%) will ease pressure on hedge funds to reduce global risk exposure.

The S&P 500 Financials sector was strongest but WTI crude oil futures rose 2.8pc to $US55.04.

But BHP ADR’s equivalent close at $44.30 was a 1.8% discount to BHP’s Sydney close.

Spot iron ore fell 4.4pc to $US149.55 to be down 15pc from a 9-year high of $176 in mid-December.

The S&P/ASX 200 rose 1.5pc to 6762.6 on Tuesday.

Eli Greenblat 9.09am: China tariffs hit wine exports

Australian wine exports are showing the early signs of punishing China tariffs, with exports slowing in the 12 months to December 2020, decreasing by 1 per cent in value to $2.89 billion.

According to Wine Australia’s latest export report released on Wednesday there was a 0.5 per cent increase in volume to 747 million litres (83 million 9-litre case equivalents) and a 1 per cent decline in average price to $3.87 per litre free on board (FOB).

Wine Australia Chief Executive Officer Andreas Clark said that despite the COVID-19 pandemic, exports hit a record year-on-year value of $3.1 billion reached in 2007.

Mr Clark said that there had been a sharp increase in exports from August to October, primarily to mainland China and the United Kingdom, while the decline in November and December was predominantly in exports to China.

Exports to mainland China were immediately down following the imposition of the temporary tariffs in November. The sharp decline in export volumes and value in the final two months of the year saw the overall value for 2020 decline by 14 per cent to $1.01 billion and volume drop by 29 per cent to 96 million litres (10.7 million 9-litre case equivalents).

It was expected that exports to China would remain low in coming months affecting total export numbers during 2021.

In late 2020 Beijing hit Australia’s $45 billion wine industry with a tariff of more than 200 per cent from that threatens to cripple exports to its biggest overseas market.

According to Wine Australia exports to Mainland China were down 14 per cent to $1.01 billion, sales to the United Kingdom were up 29 per cent to $456 million and exports to the United States was up 4 per cent to $434 million.

Lachlan Moffet Gray 8.41am: Afterpay welcomes UK payments report

Afterpay has welcomed the findings of a British report into how the burgeoning buy now, pay later sector should be regulated, saying it supports proportional regulation for the emerging market.

The Woolard Report, published by the UK’s Financial Conduct Authority, has recommended bringing BNPL firms under a specialised regulatory regime “as a matter of urgency” due to their currently unregulated status.

The report warns that one in ten major UK bank customers using a BNPL platform is in arrears - and says regulation is needed to prevent the problem from growing.

In a statement, Afterpay’s British brand Clearpay said it would work with the regulator and other authorities “to create the applicable regulation of the sector.”

“It has always been Clearpay’s view that consumers will be best served by products designed with strong safeguards and appropriate industry regulation with oversight from the FCA,” the company said.

Perry Williams 8.40am: Amcor upgrades profit outlook

Global packaging giant Amcor has lifted its profit guidance for the 2021 financial year after delivering a six per cent rise in interim earnings driven by strong food and beverage growth.

Amcor upgraded its outlook for adjusted earnings per share growth to 10-14 per cent in constant currency terms from 7-12 per cent previously.

It delivered a six per cent lift in earnings before interest and tax to $US743m from $US699m, in line with estimates.

Net income on a GAAP basis lifted 10 per cent to $US522m and noted annual free cash flow of $US1bn.

Its flexibles unit, which drives the bulk of earnings, saw 2 per cent growth on the same period last year driven by food, pet food and beverage sales but offset by some healthcare markets due to reduced elective surgery and less prescriptions. Rigid packaging grew by six per cent on the prior period.

“Amcor delivered strong financial results ahead of our expectations for the first half and we have raised the outlook for the full year as our teams continue to demonstrate resilience and outstanding execution,” Amcor chief executive Ron Delia said.

The company declared a quarterly dividend of US11.75c, slightly higher than last year’s US11.5c payout.

Amcor shares in the US were 5.7 per cent higher in after-hours trading.

Amcor runs 250 packaging factories spanning more than 40 countries and spent $US6.8bn buying out a main rival, Bemis, in 2018 to boost its global clout.

8.33am: Google rides ad recovery to record revenue

Google rode a surge in online holiday spending to record revenue in the fourth quarter, even though it disclosed for the first time continued losses in its closely watched cloud division.

The internet titan’s earnings reflected a continuing recovery in global ad spending that took a hit in early 2020 when people paused travel plans and other purchases in response to the coronavirus pandemic.

Google parent Alphabet posted a record $US56.9 billion revenue, up from $US43.2 billion a year ago. The company’s advertising units pulled in $US46.2 billion, up nearly 22pc from a year earlier. Analysts had forecast $US52.7 billion in revenue, including $US42.3 billion from advertising, according to FactSet.

Alphabet’s profit also rose, to $US15.7 billion, from $US9.3 billion a year ago. Analysts had expected $US11.9 billion.

Google also revealed details about the costs of its cloud division for the first time. While that unit brought in $US3.8 billion in revenue, overall it lost $US1.2 billion in the fourth quarter. This announcement will enable investors to better compare the results of Google’s cloud business with those of Amazon.com Inc. and Microsoft Corp.

Dow Jones Newswires

8.25am: ASX set for strong start

Australian stocks are poised for a strong opening, as global markets continued to rally, and oil prices jumped.

At about 8am (AEDT) the SPI futures index was up 57 points, or 0.8 per cent.

It follows a rise of 1.5 per cent on the ASX yesterday.

The Australian dollar is lower at US75.85.

Brent oil rose 2.0 per cent to $US57.46 a barrel, while spot iron ore sank 3.8 per cent to $US150.10 a tonne.

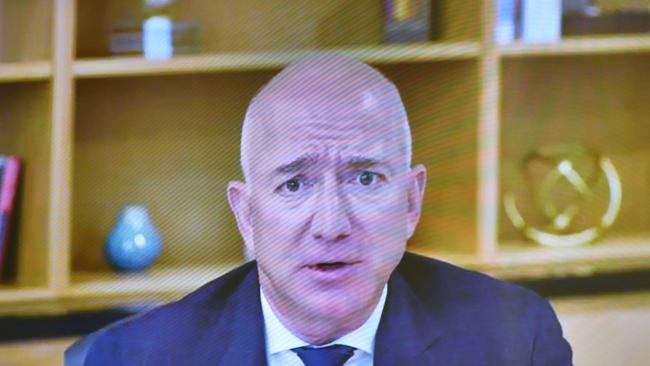

8.20am: Bezos to step down as CEO of Amazon

Amazon founder Jeff Bezos said he would give up his role as chief executive of the tech and e-commerce giant this year as the company reported a surge in profit and revenue in the holiday quarter.

The company said Andy Jassy, who heads Amazon Web Services, would take over as CEO in the third quarter.

The announcement came as Amazon reported a blowout holiday quarter with profits more than doubling to $US7.2 billion and revenue jumping 44 per cent to $US125.6 billion.

Few companies have seen growth take off like Amazon during the global health crisis. The explosion in online shopping vaulted the company’s sales to record figures as the e-commerce sector grew by around 50pc throughout last year, according to some analysts.

Amazon sales for all of 2020 rose 37pc year-over-year to $US380.06 billion and are expected to advance again this year.

AFP, Dow Jones

8.19am: What’s impressing analysts today?

BHP PLC cut to Sell: Liberum

BHP AU cut to Neutral: Credit Suisse

Bega Cheese cut to Sell: Morningstar

Carsales.com raised to Buy: GS

Deterra raised to Outperform: CS

Fortescue raised to Outperform: CS

Infomedia started at Positive: Evans & Partners

Perenti raised to Buy: Jefferies

Platinum Asset cut to Sell: Morningstar

Rio Tinto PLC raised to Outperform: CS

Star Entertainment raised to Overweight: JPM

Tabcorp cut to Neutral: CS

Western Areas cut to Neutral: CS

Afterpay target price raised 44pc to $140; Neutral rating kept: Macquarie

8.02am: Wall Street posts solid gains

US stocks rose, signalling that major indexes may extend this week’s gains ahead of earnings from technology giants Amazon.com and Google parent Alphabet.

The S&P 500 rose 1.4pc as of the close of trading in New York, a day after the broad stocks gauge posted its biggest one-day advance since November. The Dow Jones Industrial Average gained 1.6pc, as did the technology-heavy Nasdaq Composite Index.

For the fifth straight trading day, stocks at the center of a social media frenzy -- led by GameStop -- did the opposite of the Dow industrials.

Shares of GameStop tumbled about 60pc, wiping out the gains from the past week. AMC Entertainment Holdings declined about 40%. Express, Naked Brand, BlackBerry and headphones-maker Koss retreated.

Silver prices also slid after their steep ascent Monday, when online investors set their sights on the metals market and spurred the metal to its biggest one-day advance in over a decade. Futures for the metal were off more than 9.4pc after CME Group’s Comex exchange responded to the volatility by raising margin requirements.

Otherwise, stock markets have steadied globally this week after a choppy January, when the Reddit-fueled trading frenzy, signs of a slowdown in the U.S. economy, and concerns about the pace of the vaccine rollout and new coronavirus variants weighed on share prices. Investor sentiment has been lifted by robust earnings reports from large-cap companies, as well as a decline in coronavirus cases in the U.S. and several other major economies.

“The vaccine rollout is continuing to pick up steam, it looks like, for at least the time being, the [coronavirus] surge isn’t just continuing, and the earnings have been good,” said Tim Courtney, chief investment officer of Exencial Wealth Advisors. “So in terms of what the markets wanted to see, it’s pretty much gotten the news it wanted so far.”

Investors are closely following discussions around another round of coronavirus relief in Washington. A group of Senate Republicans on Monday outlined their roughly $US618 billion offer, including a round of $US1000 direct cheques for many adults. The proposal omits measures favoured by many Democrats, such as aid for state and local governments and a plan to raise the federal minimum wage to $US15 an hour.

The pan-continental Stoxx Europe 600 rose 1.3pc, led higher by shares in French companies as well as makers of cars and car parts.

Dow Jones

7.36am: IFM Investors in Canada energy deal

Australia’s IFM Investors and Canada’s Ontario Teachers’ Pension Plan Board have jointly acquired Canadian energy operations owned by Enwave Energy Corporation for $C2.8bn.

IFM Investors and Ontario Teachers’ will retain the Enwave brand and each will own 50 per cent of the company.

Enwave is an low-carbon energy business that provides cooling and heating solutions to over 320 customers across a range of sectors in Canada.

“Enwave will be an attractive addition to our infrastructure portfolio. Its delivery of essential district energy services, providing investors with highly defensive, utility-like exposure coupled with leading sustainability attributes, will help IFM Investors deliver on our purpose to protect and grow the long-term retirement savings of working people,” said Kyle Mangini, Global Head of Infrastructure at IFM Investors.

IFM Investors is owned by Australian pension funds and has $US106bn under management.

7.33am: GameStop traders turn on new members

Longtime members of the Reddit forum that was the launch pad for the GameStop frenzy are lashing out at the group’s millions of new users, asking whether they can be trusted and accusing them of working for hedge funds.

WallStreetBets has been hit by bots that question some of the members’ investing initiatives and pitch commission-free brokerage accounts, according to a Wall Street Journal analysis of the posts.

Messages that promote stocks that don’t have large short positions -- where traders sell borrowed securities betting the price will be lower when they buy it back -- are blasted by members as being controlled by moneyed interests to sap momentum from the GameStop bet.

Longtime followers have reacted to the deluge of new content by asking moderators to ban new users or take additional steps to limit where they appear. “Seriously, the 6 million new users have f -- this place up,” one user wrote Monday. “New users are coming here to screw us,” a Wednesday post read.

Longtime members say the site, while always boisterous, now has more of a mob mentality. At least 180 posts submitted in January discussed new users or threads along with variations of the word “ban” and other terms describing account restrictions, up from 14 in December, according to the Journal’s analysis.

Dow Jones

7.15am: BHP disaster claim appeal to UK Court of Appeal

Victims of an iron ore tailings dam disaster in Brazil say they will go to Britain’s Court of Appeal in a bid to have their $9bn lawsuit against BHP heard in England.

In November, a British judge struck out a damages claim lodged on behalf of 200,000 Brazilians affected by the Samarco dam disaster in 2015, which killed 19 and polluted waterways.

British-domiciled BHP Group, which co-owns the mine with Vale, said the judge’s ruling reinforced its view the victims should pursue their claims in Brazil.

However the claimants still believe they can establish jurisdiction in England, and will go to the UK Court of Appeal in the hope of “holding BHP to account”.

The claimants argue that redress achieved in Brazil has been inadequate, with BHP largely protected from legal consequences to date.

5.10am: Dow rises ahead of Amazon, Alphabet earnings

US stocks rose, signalling that major indexes may extend this week’s gains ahead of earnings from technology giants Amazon.com and Google parent Alphabet.

The S&P 500 rose 1.7pc, a day after the broad stocks gauge posted its biggest one-day advance since November. The Dow Jones Industrial Average gained 2.00pc, and the technology-heavy Nasdaq Composite Index climbed roughly 1.6pc.

For the fifth straight trading day, stocks at the centre of a social media frenzy -- led by GameStop -- did the opposite of the Dow industrials.

Shares of GameStop tumbled 49pc. That wiped out the gains from the past week but keeps the video game company up about 500pc for the year.

Silver prices also slid after their steep ascent Monday, when online investors set their sights on the metals market and spurred the metal to its biggest one-day advance in over a decade. Futures for the metal fell 8.8pc on Tuesday after CME Group’s Comex exchange responded to the volatility by raising margin requirements.

Otherwise though, stock markets have steadied globally this week after a choppy January, when the Reddit-fuelled trading frenzy, signs of a slowdown in the U.S. economy, and concerns about the pace of the vaccine rollout and new coronavirus variants weighed on share prices. Investor sentiment has been lifted by robust earnings reports from large-cap companies, as well as a decline in coronavirus cases in the U.S. and several other major economies.

Investors will parse quarterly earnings from Amazon.com and Alphabet after markets close. Shares of giant tech companies have continued to power the broader market in 2021, pushing the Nasdaq Composite up 5pc so far this year.

Shares rallied in overseas markets. The pan-continental Stoxx Europe 600 rose 1.3pc, led higher by shares in French companies as well as makers of cars and car parts. In London, silver miner Fresnillo dropped 4.8pc.

Elsewhere in commodities, Brent-crude futures, the benchmark in international energy markets, rose about 2.5pc to $US57.76 a barrel.

Dow Jones Newswires

5.07am: Trading apps buckle under deluge

Many trading platforms and online brokers are struggling to cope with the flood of new users and spike in transaction volumes.

Freetrade, a London-based commission-free trading platform, had so many people trying to buy stocks on its platform on Friday that its foreign-exchange partner’s bank cut its processing capacity by 95pc. The app’s users couldn’t buy most US stocks until Monday.

“It was the volume of orders. If we had opened the markets as normal, people would have had orders queuing into the middle of the day on Saturday,” said Adam Dodds, founder of Freetrade. “It was impossible for us to do it.”

E*Trade, which was acquired by Morgan Stanley in October, had over 3,000 people report problems such as slow order executions on Monday afternoon, according to Downdetector, a website that tracks outages. E*Trade didn’t immediately respond to a request for comment.

Retail trading has surged in the first month of 2021 as extraordinary moves by stocks such as GameStop attracted hordes of new investors. In the month of January, U.S. off-exchange stock trading volumes were above the entire U.S. stock market’s average trading volume for 2019, according to research by Piper Sandler.

Dow Jones

5.05am: Tesla to recall 135,000 vehicles over computer issue

Tesla will recall nearly 135,000 cars to repair a computer memory failure that could pose a safety risk, US regulators said on Tuesday.

The electric car manufacturer notified the US National Highway Traffic Safety Administration (NHTSA) of the massive recall over the problem affecting the cars’ touchscreen that could cause a loss of some features.

The recall covers the 2012 to 2018 Model S sedans and the 2016 to 2018 Model X SUVs equipped with a NVIDIA Tegra 3 processor, Tesla said in its notification to NHTSA.

When the flash memory in the touchscreen reaches the end of its useful life, it “can cause failures of the centre display software components, and may indirectly cause loss of the rearview camera display, defrost/defog control settings and exterior turn signal lighting,” the manufacturer said.

AFP

5.00am: Oil hits one-year peak on US storm

A snowstorm pushed oil prices to pre-pandemic levels as global stocks extended rallies on hopes for more US fiscal stimulus.

Silver prices sank by 7.8 per cent to $US26.78 per ounce meanwhile, having spiked the previous day to an eight-year peak on chatroom-driven demand.

Stock indices fired up as investors got back in the saddle after last week’s global rout and snapped up bargain shares.

“The new month continues to be good to equities, which have thrown off their late January despair and staged an impressive bounce from the lows of last week,” remarked IG analyst Chris Beauchamp.

Oil prices surged on the back of upbeat market sentiment and a snowstorm that socked the northeastern United States.

US benchmark West Texas Intermediate oil soared to one-year high around $US54.91 per barrel, while Brent North Sea crude hit $US57.70, a level last reached nearly a year ago.

“Oil prices powered higher... lifted in part by the positive sentiment returning to equity markets, but mostly because of frigid weather sweeping the United States, pushing up the demand for heating,” said OANDA analyst Jeffrey Halley.

Elsewhere, fears about the social media-led retail investor battle with Wall Street hedge funds that undermined sentiment last week appeared to be abating.

In Europe, London closed up 0.8 per cent, Frankfurt added 1.6 per cent and Paris surged 1.9 per cent.

AFP

4.58am: Amazon unveils ‘nature-infused’ design for new HQ

Amazon unveiled what it called a “nature-infused” design for the second phase of its second headquarters, being developed just outside Washington.

The centrepiece of the new Arlington, Virginia, development to be called “PenPlace” will be a double-helix building surrounded by landscaped gardens with plants native to the region.

The design unveiled is the latest part of Amazon’s $US2.5 billion “HQ2” which will become a second headquarters for the technology and e-commerce giant based in Seattle, Washington.

“The Helix at our Arlington headquarters will offer a variety of alternative work environments for Amazon employees amid lush gardens and flourishing trees native to the region,” the company’s global real estate and facilities vice president John Schoettler said in a statement.

“A true double helix in shape and structure, this unique building will feature two walkable paths of landscaped terrain that will spiral up the outside of the building, featuring plantings you may find on a hike in the Blue Ridge Mountains of Virginia.” Amazon said it would include an artist-in-residence program to be hosted within the Helix that would allow local artists to showcase their work.

AFP

4.55am: Profits jump for Alibaba

Chinese e-commerce giant Alibaba saw profits jump over the last three months of 2020 as economic activity returned in China and online spending continued apace.

In the third quarter of its staggered fiscal year, the Wall Street-listed group reported a profit of 79 billion yuan ($US12.2 billion) on Tuesday, up 52 per cent year-on-year.

That came after a fall of 60 per cent in the previous quarter. Sales for the period was up 37 per cent year on year to 221.1 billion yuan -- outstripping the estimates of analysts polled by financial agency Bloomberg, who forecast a 33 per cent increase in revenue.

“Thanks to the rapid recovery of China’s economy, Alibaba had another very healthy quarter,” group CEO Daniel Zhang said in a statement

AFP

4.50am: Ferrari vows to roar back in 2021

Italian luxury car maker Ferrari said it expected sales and margins to bounce back in 2021, following a year marked by a production hiatus due to coronavirus.

Ferrari said it expects to post full-year 2021 revenues of 4.3 billion euros ($US5.18 billion), up 24 per cent from the 3.46 billion it posted last year, as lower deliveries due to a seven-week production suspension took its toll on results.

The company delivered 9,119 cars worldwide in 2020, down 10 per cent. Analysts, on average, had been expecting 2021 revenues of 3.45 billion euros, according to Factset.

Full-year net profit fell 13 per cent to 609 million euros in 2020, beating estimates, but reversed course in the fourth quarter, jumping by 58 per cent as deliveries picked up.

AFP

4.42am: Exxon Mobil reports 2020 loss of $US22.4bn

Exxon Mobil closed the books on a terrible 2020, reporting losses in the fourth-quarter and for the full year in the wake of lower oil prices with COVID-19.

The big US oil company reported a fourth-quarter loss of $US20.7 billion following huge write-offs. That took the company’s loss for all of 2020 to $US22.4 billion, compared with $US14.3 billion in profits in 2019.

The energy giant unveiled new cost-cutting efforts, a new low-carbon business unit and a new board member that it said would position it for the future.

“The past year presented the most challenging market conditions Exxon Mobil has ever experienced,” said Chief Executive Darren Woods, adding that the company responded “decisively” in ways that will position it for the long term.

AFP

4.40am: Pfizer expects $US15bn in 2021 sales for vaccine

Sales of the COVID-19 vaccine developed by Pfizer and BioNTech could reach up to $US15 billion in 2021 and go higher if Pfizer signs additional supply contracts, Pfizer said.

The projections came as Pfizer reported fourth-quarter and full-year profits and released forecasts for 2021. Pfizer projected full-year 2021 sales of between $US44.4 to $US46.4 billion, excluding sales for the COVID-19 vaccine.

The forecast reflects “a continued recovery in macroeconomic and healthcare activity throughout 2021 as more of the population becomes vaccinated against COVID-19,” Pfizer said.

“These assumptions are guided by the trajectory of current infection rates in many parts of the world and the expected timeline for broad access to effective vaccines.” Pfizer reported fourth-quarter net income of $US594 million, compared with a loss of $US337 million in the year-ago period.

For all of 2020, Pfizer reported profits of $US9.6 billion, down 41.4 per cent from 2019, with revenues up two per cent to $US41.9 billion.

Pfizer’s fourth-quarter revenues included $US154 million in sales of the COVID-19 vaccine.

AFP