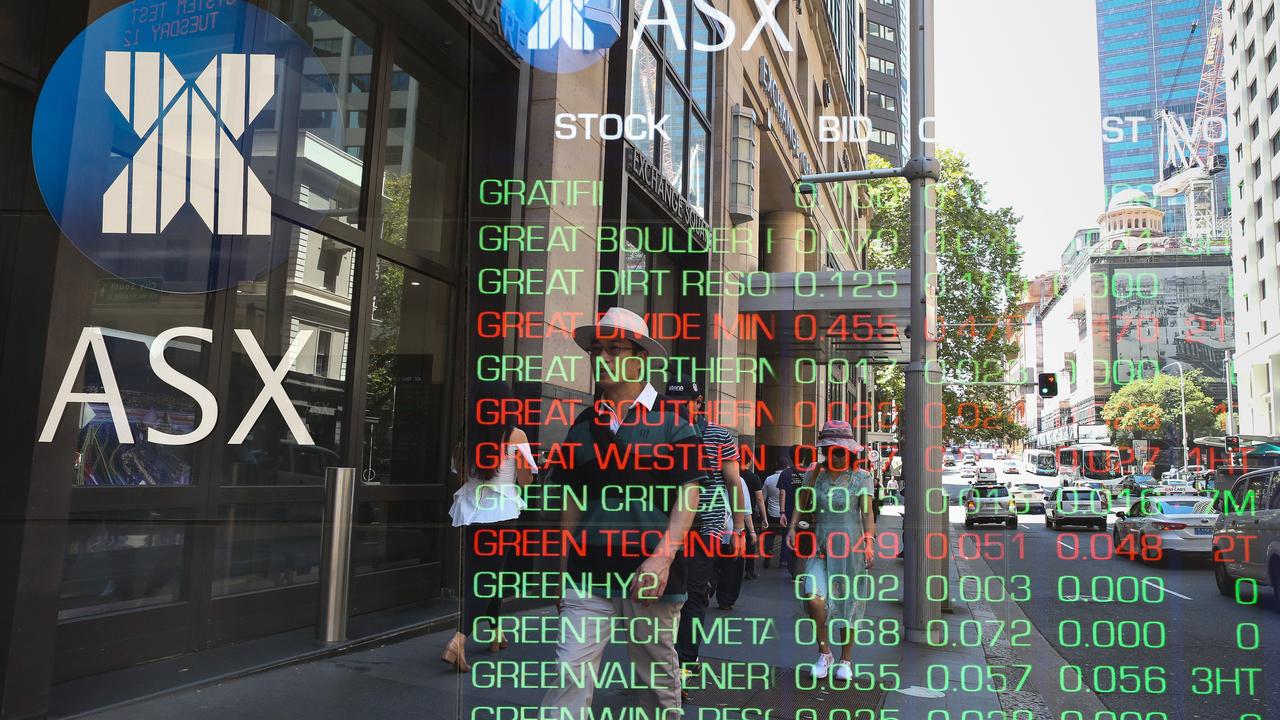

ASX 200 up for fourth day; China rate cut lifts dollar, IAG closes at three-year high

Another of rate cuts in China lifts dollar. IAG closes at three-year high. Australia sees first post-GFC bond inversion. ANZ ups rate peak after hot jobs data. DGL tanks on update.

Welcome to the Trading Day blog for Thursday, June 15. The Australian sharemarket is on its longest winning streak in more than two months after another round of interest rate cuts from China to boost its economy was enough to offset a hot jobs report locally.

The S&P/ASX 200 rose for a fourth consecutive session by 0.2 per cent, or 13.56 points to 7175.30.

Wall Street was set for a soft start this evening with futures tied to the Dow Jones and S&P 500 flat, while the Nasdaq was down 0.1 per cent.

The dollar was buying US68.20c at the close.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout