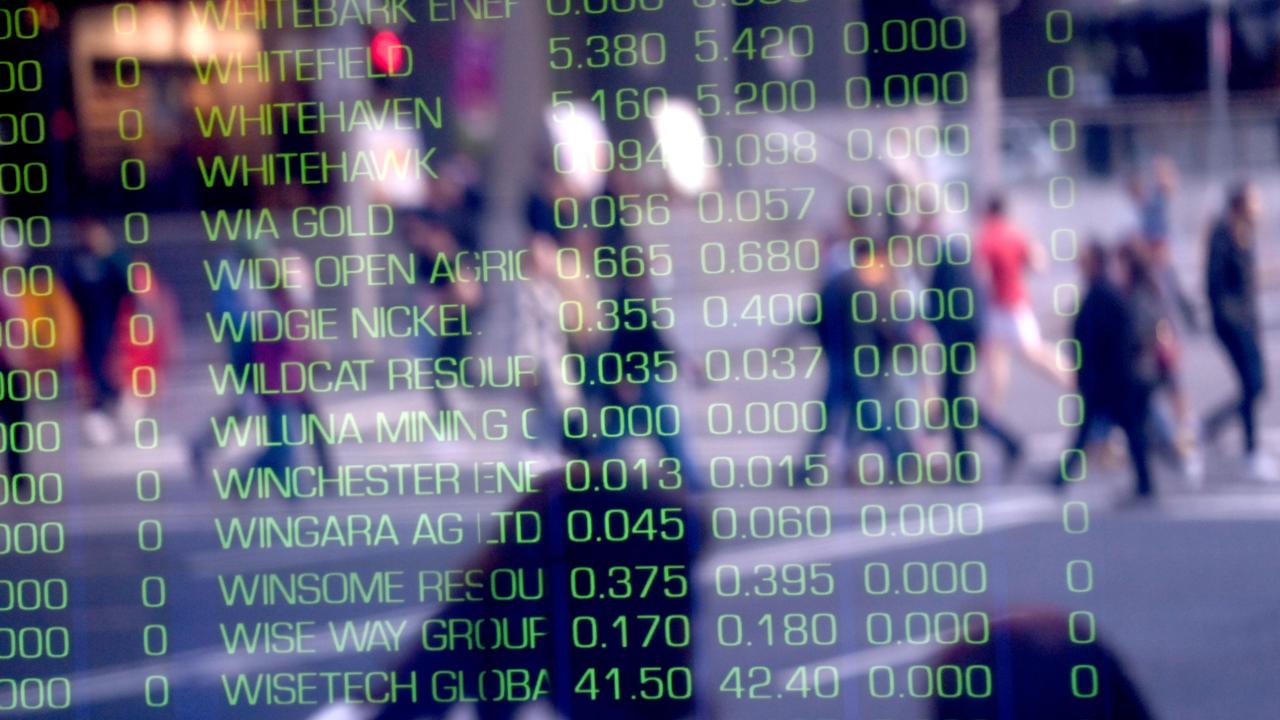

Shares gain $38bn in value, $A drops as Westpac tips Oct cut

Australia’s share market ended a 4-day losing streak with its best day in 9 weeks, adding $38bn of market capitalisation.

- Qantas ends Wallabies sponsorship

- Westpac tips October rate cut

- Kathmandu profit smashed 86%

- Nufarm swings to heavy loss

That’s all from Trading Day for Wednesday, September 23.

Australia’s share market ended a 4-day losing streak with its best day in 9 weeks, adding $38bn of market capitalisation.

The S&P/ASX 200 share index finished up 140 points, or 2.4pc, at a 4-day high close of 5923.90 points after hitting an intraday high of 5933.3.

The market got a boost from Westpac’s call for the RBA to cut rates in October. Disappointment with Tesla’s Battery Day conference knocked its shares and Aussie lithium miners, but S&P 500 futures are holding up after the House approved stopgap funding measures. Locally, Kathmandu reported a big hit to full-year profit and Nufarm has swung to a full-year loss.

David Swan 8.32pm: NBN moves ‘give certainty’

The telco industry rallied behind the NBN shake-up on Wednesday, with Telstra and smaller providers alike declaring the $4.5bn upgrade would provide much-needed certainty for a sector struggling with profitability and competitive tensions.

NBN Co and the government announced on Wednesday that 8 million households would be granted access to ultra-fast internet speeds under a major multi-year upgrade program.

NBN Co chief executive Stephen Rue told The Australian the pandemic had accelerated changes in the economy that were already under way, necessitating the speed boosts.

A Telstra spokesman said the telco was pleased to see that its customers could access the higher speeds they now needed.

He said Telstra had been calling for more certainty on the network’s upgrade path, particularly given the increase in demand due to COVID-19.

“The importance of this upgrade has only been reinforced by COVID and working and studying from home,” he said. “On the matter of pricing, we continue to encourage NBN to eliminate the CVC charge, which is essentially an excess data charge and will act as a disincentive for customers to access the higher speeds offered by the technology upgrade.”

Vocus Retail chief executive Antony de Jong said the “on-demand” fibre upgrade approach was a welcome one, given customers who were willing to pay more for faster broadband speeds would be able to achieve them. He agreed with Telstra that CVC needed a rethink.

Damon Kitney 7.12pm: Billionaire Bob Ingham dies

It is known as the Ingham mansion, a Spanish, ranch-style, single-storey home complete with pool and tennis court set on eight hectares of land on Old Kurrajong Road in the western Sydney suburb of Casula.

Billionaire chicken farmer, racehorse breeder and entrepreneur Robert Ingham – who was simply known as “Bob” from an early age – lived there for more than eight decades until his death this week at the age of 88.

His family confirmed he passed away on Tuesday surrounded by his loved ones.

Richard Gluyas 6.24pm: Wesfarmers ‘ambitious’ emissions agenda

Wesfarmers has committed to an ambitious net zero emissions agenda across its diversified businesses, citing heightened expectations from the group’s shareholders and staff.

The group announced a net zero target for its retail operations, including Bunnings, Kmart and Officeworks, by 2030, with its chemicals, energy and fertilisers businesses set an aspirational goal of 2050, recognising that technological advances were needed.

As in the past, the targets cover Scope 1 and 2 emissions, from both owned or controlled sources and purchased energy.

Managing director Rob Scott said Wesfarmers was well-positioned to contribute to the global objective of net zero emissions by 2050, in line with the Paris Agreement.

“Wesfarmers has, for many years, managed its businesses with deep carbon awareness, and we take responsibility for improving the energy efficiency of our operations, transitioning to renewable power, investing in new technologies and working with our suppliers and customers to help them do the same,” Mr Scott said.

Helen Trinca 5.43pm: PwC to pay COVID one-off ‘thank you’

The big four accounting firm PwC will pay all staff a one-off “COVID-19” payment as it puts this year’s salary cuts and redundancies behind it.

The firm emailed staff on Wednesday afternoon to say that the payment would be made across all businesses and “enabling functions” on December 15.

As well, promotions that had earlier been flagged as delayed until next year, will instead go ahead next month and in November.

No details were available on the quantum or percentage of the payment.

PwC chief executive Tom Seymour said that the one-off was a “thank you to our people for their hard work and commitment during what has been a very challenging period”.

The positive news for PwC staff comes against a background of significant cost-cutting imposed across all four firms this year as the pandemic devastated the business sector with a flow on effect to the firms’ audit and consulting operations.

Patrick Commins 4.56pm: RBA has ‘not done enough’: Paul Keating

Paul Keating has slammed the Reserve Bank, saying its “indolence” and obsession with monetary policy orthodoxy has led to an “incremental” approach that has not done enough to support the nation through its worst downturn since the 1930s.

In an extraordinary attack on the country’s most revered economic institution, the former Prime Minister in a statement damned the central bank’s “indolence” through the COVID-19 crisis, accusing it of being “way behind the curve in supporting the government in its budgetary funding measures”.

“As history has shown, when a real crisis is upon us the RBA is invariably late to the party,” Mr Keating wrote. “And so it is again.”

4.34pm: ASX +2.4%; best day in 9 weeks

Australia’s share market ended a 4-day losing streak with its best day in 9 weeks, adding $38bn of market capitalisation.

The S&P/ASX 200 share index finished up 140 points or 2.4pc at a 4-day high close of 5923.90 points after hitting an intraday high of 5933.3.

After plumbing at a 3-month low of 5763.2 on Tuesday, the index responded to a strong rebound on Wall Street and growing speculation of an October rate cut and quantitative easing by the RBA.

The Industrials, Health Care, Consumer Discretionary, Staples, Utilities, Tech sectors outperformed along with economic reopening trades as Melbourne remained on track to ease some restrictions next week.

In large caps, CSL rose 3.8pc, NAB rose 2.8pc, Transurban rose 4.9pc, Woolworths gained 3.8pc, Aristocrat rose 5.1pc, Sydney Airport gained 4.9pc, Brambles jumped 3.6pc and Cochlear gained 4.2pc.

Miners lagged with Fortescue up just 0.7pc despite an upgrade by Citi, as iron ore futures fell 2pc following a fall in the spot price overnight.

The Australian dollar was 0.6pc weaker against the US dollar trading at US71.28c by the close of the ASX session.

4.10pm: Economic reopening trades surge

Economic reopening trades in the share market have surged today as Melbourne remains on track for some easing of coronavirus restrictions on Monday.

Among stocks that would benefit from an easing of lockdowns in Victoria in particular, Transurban is up 4.9pc, NAB is up 2.9pc , Sydney Airport is up 4.4pc, Qantas is up 4.2pc and REA Group is up 5.4pc.

Other outperforming stocks linked to the Victorian economy include Bendigo Bank, Flight Centre, Star Entertainment, Carsales.com, AP Eagers, Viva Energy, Webjet, Tabcorp, Ampol and ARB.

The S&P/ASX 200 is having its best day in two months, with a 2.6pc rise to a 4-day high of 5933.3 ahead of the close.

Perry Williams 4pm: Greens call on Vic govt to upgrade Portland aluminium smelter

The Victorian Greens have renewed a call for the state government to tip in $50m to upgrade the struggling Portland aluminium smelter into a reverse battery powered by renewable energy.

A power sharing plan devised by AGL Energy has fallen through, raising fresh concern over the future of the facility amid fears owner Alcoa could be forced to shut its doors as early as next year.

AGL supplies Portland from its Loy Yang A coal plant in Victoria’s Latrobe Valley but the Greens have called for the government to instead invest in up to 10 new renewable projects to supply its needs.

“Victorian taxpayers currently subsidise Alcoa’s energy use to the tune of $50m a year. But what if, instead, the Victorian Government helped turn the Portland smelter into a giant battery and run on clean energy? Smelters around the world do it and we could too,” Victorian Greens acting leader Ellen Sandell said.

“With the AGL energy deal falling through, the smelter and its 1,500 workers are in need of a lifeline, and turning the smelter into a giant battery would be a win for workers, Portland and our climate.”

Portland accounts for 10 per cent of Victoria’s demand and there are concerns its closure could also accelerate the exit of EnergyAustralia’s Yallourn coal plant.

3.30pm: Shares remain strong in final hour

Australian shares remain strong in the final “hour of power”.

The S&P/ASX 200 is up 2.2pc at 5913 after hitting a 3-day high of 5919.6.

The index is set to end a four-day losing streak with its best day in 2 months.

The Industrials and Health Care sectors have wrestled the lead from Consumer Staples and Technology, with Brambles up 3.4pc and CSL up 3.8pc with the A$ down 0.6pc today.

3.00pm: TD Securities calls October RBA cut

TD Securities has also joined the October RBA rate cut bandwagon.

Senior APAC rates strategist, Prashant Newnaha notes that the RBA has indicated every month since July that it does not rule out changes to its mid-March package if conditions warranted. And while he suspected the RBA’s balance of risks may have shifted on receipt of the September statement, the Minutes of that meeting didn’t strongly confirm that.

But he argues that Governor Lowe expressed low confidence on hitting its unemployment and inflation targets in August and Deputy Governor Debelle cemented this on Tuesday.

“We now expect the RBA to act at next month’s meeting,” he says.

“None of the options the RBA detailed to ease policy further are optimal.

However RBA bond purchases out along the curve, cutting the 3yr target yield from 25bps to 10bps and the TFF rate to 10bps is what the RBA is likely to deliver in unison.”

2.50pm: Strong demand for record bond sale

The Australian Office of Financial Management has set a new record for the amount of funds raised from the bond market in one issue.

The $25bn tranche of the new September 21, 2026 Treasury Bond was priced at a yield to maturity of 0.47pc. The issue was 2.6 times covered at the clearing price with $66.1bn of bids, according to the AOFM and the price was 100.177 basis points over BBSW.

ANZ, BofA, DB and JPM were joint-lead managers.

It’s the AOFM’s sixth syndicated Treasury bond sales since the onset of the coronavirus crisis.

In April, it raised $13bn, $19bn in April, $17bn in May, $15bn in July and $21bn in August.

2.45pm: Wesfarmers CEO handed bumper pay packet

Wesfarmers chief executive Rob Scott received a pay packet worth $7.76 million for the 2020 financial year, up from $6.75m in 2019.

Mr Scott forwent his cash bonus and had his take home salary shaved by about $14,000 to nearly $2.34m.

But he still received more than $5m in shares, compared to $3.9m the prior year, after his 2016 share based payments vested.

Wesfarmers posted a 69.2 per cent fall in full-year profit to $1.697 billion for 2020 as it reworked its operations, but net profit from continuing operations lifted 8.2 per cent for the period.

The company was not eligible for JobKeeper but did receive about $40m in wage subsidies outside of Australia.

2.40pm: ASIC extends COVID-19 capital raising relief

The Australian Securities and Investments Commission has extended the temporary relief for certain capital raisings and financial advice as the uncertain impact of the coronavirus crisis continues.

ASIC said the relief will mean that companies can continue to raise capital in a quicker and less costly way without undermining investor protection, in measures that were originally announced in March.

The corporate watchdog will also extend the financial advice relief and the no-action position for superannuation trustees, which aims to provide customers with affordable and timely financial advice through the COVID-19 pandemic.

2.35pm: AUD/USD targets 0.7000

AUD/USD fell 0.8pc to a 6-week low of 0.7117 on RBA cut speculation and USD strength.

With the 50-day moving average breaking this week and a Head & Shoulders top pattern now play, expect a further 1.7pc fall to the 100-day moving average and Head & Shoulders target near 70 cents in the near term.

A similar technical setup on the US dollar index suggests it’s poised to rise a further 1.5pc to 95.65 in the short term.

NAB and Westpac are likely to lower their A$ targets after predicting rate cuts and full-blown QE by the RBA at its board meeting next month.

US dollar strength and commodity price weakness shows global markets are risk averse.

Dalian iron ore futures are down 2.2pc, LME copper is down 0.5pc and Brent crude oil is down 0.7pc this afternoon.

2.30pm: Bunnings, Kmart target net zero emissions by 2030

Wesfarmers is targeting net zero Scope 1 and 2 emissions by 2030 for its Bunnings, Kmart and Officeworks businesses, the company said in its annual report released today.

Meanwhile the company’s chemicals, energy and fertilisers businesses and Coregas, which have a greater challenge to abate emissions, are targeting a net zero Scope 1 and 2 emissions by 2050.

“Wesfarmers has, for many years, managed its businesses with deep carbon awareness, and we take responsibility for improving the energy efficiency of our operations, transitioning to renewable power, investing in new technologies and working with our suppliers and customers to help them do the same,” managing director Rob Scott said.

“Today, we have announced clearer, more ambitious commitments, including net zero targets or aspirations for all our businesses.”

2.20pm: ASX +2.1%; best day in 2 months

Australia shares are having its best day in two months, with the S&P/ASX 200 rising 2.1pc to a 3-day high of 5909.3. Apart from the overnight bounce on Wall Street, the market is reacting positively to heightened speculation of fiscal and monetary policy easing next month.

The futures-implied chance of the RBA cutting the cash rate at its 6th October board meeting rose from 68pc to 87pc after Westpac chief economist Bill Evans predicted rate cuts plus the start of full-blown QE in October.

The S&P/ASX 200 may shy off its 100-day moving average at 5904 before a possible fall on Wall Street, given that the rising US dollar suggests global markets remain risk averse.

Perry Williams 2pm: Qld govt ‘incentive’ extends the life of Glencore copper smelter

Mining giant Glencore will extend the life of its Mount Isa copper smelter and Townsville refinery until at least 2025 after the Queensland government agreed to make a one-off payment to secure the future of the industrial facilities.

Glencore had blamed “high fixed costs”, including power prices, for the uncertainty surrounding the future of its smelter and refinery ahead of a decision over whether to proceed with rebricking the Mount Isa smelter at a cost of about $40m.

However, the government’s “one-off incentive” included in its North Queensland Recovery Plan was enough for Glencore to commit $500m of investment to continue operating the copper smelter and refinery for a further three years out to 2025.

“This incentive will partially mitigate the negative costs of continuing these assets which face high fixed costs and struggle to compete internationally,” Glencore said in a statement on Wednesday. “We recognise these metallurgical assets are an import part of the North Queensland economy and part of a broader supply chain which supports thousands of jobs.”

Any decision to close the smelter would have significant knock-on effects for the Mount Isa mining district and may have threatened up to 1000 jobs.

1.40pm: RBA may cut “even sooner”: RBC

RBC chief economist Su-Lin Ong sticks to her call for the RBA to cut its official cash rate, 3-year bond yield target and term funding facility rate in 1Q21 rather than next month as a number of economists now expect and the futures market has priced as an 86pc chance.

“Renewed labour market weakness and easier global policy settings in the first half of 2021 will be the likely triggers, with the trajectory of the currency also an important factor,” she says. While “intensified market speculation of earlier easing could force the RBA to deliver even sooner” she maintains RBA is a “reluctant player in the unconventional policy space”.

While a separate bond buying program of longer-duration bonds remains an option “this would be a significant step for the RBA, which has, thus far, been reluctant to buy more bonds than necessary with yields already historically low”.

“We think the odds of a 5–10yr bond purchases program have risen to about 40 per cent, but it is not our base case and would probably demand a weaker domestic and global outlook.”

12.45pm: RBA to cut in October: BetaShares

Betashares’ chief economist David Bassanese has joined the rapidly growing minority of economists predicting rate cuts at next month’s policy meeting.

He says RBA deputy governor Guy Debelle appeared open to cutting the cash and 3-year bond rate targets to 0.1pc at his speech on monetary policy and the economy on Tuesday.

“To my mind, further monetary rate cuts will do little to actually provide further stimulus to the economy at this stage, and risks creating further distortions in asset prices – such as housing and shares,” Mr Bassanese says. “But the RBA probably feels it needs to be seen to be doing something to support business and consumer confidence at this delicate stage of the economic recovery, particularly given the setback caused by Melbourne’s return to lockdown.”

He also says the RBA is also likely becoming uncomfortable with the strength in the Australia dollar, particularly as other global central banks – such as the Bank of England and Reserve Bank of New Zealand – have toyed with the idea of negative interest rates, and the US Federal Reserve has also recently pledged to keep interest rates at near-zero levels for possibly several more years, and which in turn has forced the European Central Bank to canvass possible further monetary stimulus to avoid undue strength in the Euro.

“In short, the global central bank currency war – where each is competing to have a cheap currency via very low interest rates – continues, and the RBA likely feels it has no choice but to enter the fray,” Mr Bassanese says. “A rate cut next October 6th RBA Board meeting would also complement likely further fiscal stimulus to be announced in the October 6 Federal Budget. It will be a “Team Australia” week of coordinated policy stimulus.”

Patrick Commins 12.20pm: Retail turnover down in August

Retail trade suffered a sharp reversal in August, as a collapse in spending in locked-down Victoria led declines across the country.

Monthly turnover dropped 4.2 per cent to $29.4bn, according to preliminary and seasonally adjusted figures from the Australian Bureau of Statistics, bringing a three month retail rebound to an abrupt end.

Despite the reversal in August, retail spending remained 6.9 per cent higher than a year before, the ABS figures showed.

Victoria’s second wave of virus cases and associated restrictions drove a 12.6 per cent plunge in spending in the state, with “large falls across all industries except food retailing”, ABS director of quarterly economy wide surveys Ben James said.

“Stage 3 and 4 restrictions saw many businesses unable to trade from their physical stores in August,” Mr James said.

But the pullback in spending was not just restricted to Victoria, with retail turnover across the rest of the country falling 1.5 per cent in August versus July. Most states and territories recorded falls, the ABS said.

The data revealed Australians are winding back their purchases of household goods, but spending remained well above levels of a year prior.

Clothing, footwear and personal accessory retailing, department stores, and cafes, restaurants and takeaway food services, had large falls, the ABS said, while food retailing recorded a small fall.

Joyce Moullakis 12.10pm: Plenti shares drop on debut

Plenti’s shares have tumbled in early trading on its ASX debut, as investors were rattled by how the car finance and energy lender would navigate COVID-19 loan loss challenges.

Carsales.com-backed Plenti - formerly RateSetter Australia - saw its shares slide 24 per cent to $1.27 in the first 45 minutes of ASX trading on Wednesday, down sharply from a listing price of $1.66. The stock had slumped as low as $1.26, despite the S&P/ASX200 opening stronger.

Plenti is targeting growth in digital car and personal loans and financing for renewable energy. As part of the listing process, the company rebranded to Plenti and gave notice in August to sever a licence agreement with RateSetter UK.

Plenti chief executive Daniel Foggo said against the backdrop of COVID-19 the group remained focused on lower-risk prime borrowers.

He said the number of Plenti customers that had entered loan repayment pauses was tracking at about half of its peers.

“We are clearly shifting our loan book from just personal loans to increasingly automotive and renewable (energy) loans, and from a credit perspective even over the last six months it (loan portfolio) continues to get more robust,” Mr Foggo said in an interview.

“This (IPO) was all about raising new capital to further accelerate our growth, and we’ve moved to deliberately change our funding mix over tine from exclusively a peer-to-peer funding model... to now really diversified.”

Plenti’s prospectus showed that while its credit losses were less than 1.75 per cent, that reflected a blended average where problem personal loans were much higher in number than car and energy finance.

Plenti remains loss-making as it seeks to scale up and gain greater market share in its target segments. In an ASX update on Wednesday the company said it continued to “trade well” since lodging its prospectus last month.

12.00pm: Rate cut prediction fuels ASX

Westpac’s prediction of an October rate cut and possible quantitative easing by the RBA helped fuel a surge in the Australian share market along with falls in the Australian dollar and bond yields. The S&P/ASX 200 was up 1.9pc at a 3-day high of 5893.4 points at midday - on track to break a 4-day losing streak as the US market did overnight.

The AUD/USD was down 0.4pc at 0.7140 after hitting a 6-week low of 0.7128 and Australia’s 10-year bond yield was down 4.5bp at 0.79pc after hitting a 5-month low of 0.773.

After a strong bounce on Wall Street overnight, S&P 500 futures were little changed after the House approved a stopgap funding measure, while Nasdaq futures were down 0.3pc with Tesla down 6.8pc after-hours on disappointment with its Battery Day conference which also hit lithium miners. Galaxy fell 9pc and Orocobre and Pilbara Minerals fell more than 5pc.

The Consumer Discretionary sector led broad gains in the Australian market with Wesfarmers up 2.6pc on the RBA rate cut speculation and Aristocrat up 4.6pc after Citi boosted its target price and Afterpay up 4.1pc following overnight gains in US Tech stocks.

Fortescue Metals rose 1.7pc after Citi upgraded to Buy, while major banks rose about 2pc as investors bet that more fiscal and monetary policy stimulus would help the economy, though RBA rate cuts could hurt margins.

Robyn Ironside 11.15am: Qantas lifts after ending Wallabies sponsorship

Qantas has announced it will end its 30-year partnership with Rugby Australia as part of a major overhaul of the airline’s sponsorship arrangements.

Other tie-ups with Cricket Australia, the Football Federation of Australia, Australian Olympic Committee and Paralympics Australia will continue, but on a “non-cash basis”.

Qantas stressed the decision to cut ties with Rugby Australia and the Wallabies was not related to last year’s controversy over player Israel Folau.

Qantas shares last up 2.8 per cent at $3.88.

11.00am: Westpac predicts RBA rate cut

The Australian dollar dived from 0.7175 to a 6-week low of 0.7130 and the S&P/ASX 200 extended its rise to be up 1.7pc at a 3-day high of 5883.5 and the 10-year government bond yield dropped 7 basis points to a 5-month low of 0.773pc after Westpac chief economist Bill Evans predicted the RBA will cut rates at its 6th October meeting.

“We now expect the RBA to cut the overnight cash rate to 10 basis points; to adopt a 10 basis point three year bond target; and to adjust the rate on any new drawdowns of the Term Funding Facility to 10 basis points,” Mr Evans says.

“The Bank is also likely to reduce the rate which the Bank pays on Exchange Settlement Account balances from 10 basis points to 1 basis point.”

He says RBA Deputy Governor Guy Debelle in his speech yesterday “gave a fairly clear hint that the Board is set to cut the cash rate and other key policy rates at its October Board meeting.”

Mr Evans also says the RBA is likely to extend its objectives for bond purchases to include general support for the Australian and semi government yield curves in the five to ten year maturity range.

“It is likely to leave this commitment open ended at this stage,” he says.

“The theme is likely to be, as we saw in March, a Team Australia moment where the Reserve Bank is directly supporting a bold Federal Budget.

The prospect of the RBA “sitting back” to assess the Budget, which has been seen as the “norm” in previous years is not appropriate for these unique times.”

10.55am: Lithium miners disappointed by TSLA

Lithium stocks have been hit by investor disappointment over Tesla’s highly promoted “Battery Day”. Galaxy Metals fell 6.9pc to $1.36, Orocobre fell 3.8pc to $2.675 and Pilbara Minerals fell 4.7pc to $0.375.

It comes after Tesla’s “mind-blowing” announcement flagged by CEO Elon Musk was just a plan to make a fully autonomous electric car for US25,000 ($34,000) in about 3 years time.

Investors in Australian lithium miners were hoping for announcements of projects to boost lithium demand but Tesla now has its own lithium mine in Nevada.

After falling 5.6pc in regular trading Telsa shares are down 6.8pc in after-hours trading, pushing Nasdaq futures down 0.5pc.

10.45am: Iron ore slumps below $US120 a tonne

The spot iron ore price shed 2.5 per cent to $117 as steel margins in China came under pressure on the back of elevated steel stockpiles and disappointing consumption growth.

“China is the largest and most critical consumer of mining commodities, accounting for between 40 and 60 per cent of metal and iron ore demand,” said Commonwealth Bank mining and commodities research director Vivek Dhar.

“While China’s industrial demand weakened during China’s lockdown period, the success it achieved at flattening its rate of infections meant that China was one of the first countries to meaningfully relax restrictions.

“Demand has improved markedly in China since bottoming in February, given that industrial production, a good proxy for commodity demand, is now above pre-COVID levels.”

The spot price for the steelmaking ingredient was up around $US130 a tonne last week.

Melissa Yeo 10.30am: Myer won’t replace retiring directors

Myer directors Lyndsey Cattermole and Julie Ann Morrison will retire from the board at its upcoming AGM, not to be replaced in a bid to reduce board costs.

Chairman Garry Hounsell said he had been considering the size of the board “for some time”, as profits at the department store have taken a beating.

It comes after the board and management team elected to forgo their director fees from May to June, in light of staff cuts across the business as its stores were shuttered.

Adding to the cost saving measures, Mr Hounsell said he would take a $50,000 pay cut to a $250,000 annual salary, and non-executive directors would have their pay cut from $120,000 to $100,000.

The cuts are the third reduction to chairman and non-executive director fees since FY18, and are set to stay in place for at least two years.

“The decision to forego Director fees for a period in April, and to receive reduced fees during May and June were absolutely appropriate and today’s announcement of a smaller Board, reflects the size of the business, our ongoing focus on costs and the current operating environment,” Mr Hounsell said.

10.20am: ASX +1.4% after US bounce

Australia’s S&P/ASX 200 rose 1.4pc to a 2-day high of 5865.3 after the US ended a 4-day losing streak. The Australian market is now set to end its first four-day losing streak since April. A 5.6pc after-hours fall in Tesla - amid disappointment with its “Battery Day” announcements has pushed Nasdaq futures down 0.4pc. But S&P 500 futures are up 0.1pc at this stage, underpinning the current bounce in the Australian share market.

All Australian shares market sectors are in the green, led by Tech, after a surge in Amazon and other major Tech stocks drove the US share market higher.

Among local Tech stocks, Zip Co is up 4.8pc and Afterpay is up 3.8pc.

Aristocrat is up 4.4pc after Citi boosted its price target.

Fortescue Metals is up 1.8pc after Citi upgraded to Buy.

Banks are bouncing back with the four majors up more than 1pc.

Kathmandu shares fell 8.1pc after its results before halving the decline.

10.13am: Unis could unlock property value

Australian universities might sell their real estate holdings for funding options with the sector poised to lose as much as $16bn in revenue until 2023, according to brokerage UBS.

Analysis by UBS of 10 large universities highlights $25bn of real estate on balance sheets, which could be sold to RIETS in sale and leaseback deals. This includes $17.3b of buildings, $5.3b of land and $2b of properties under construction.

“To maintain their investment in research and innovation, their existing real estate holdings are likely to be considered as funding options,” UBS analysts led by Grant McCasker said in a note to clients.

“Universities may look at potential sale and lease of existing buildings but also monetise their land holdings while partnering with developers”.

Recent examples include Charter Hall partnering with Western Sydney University at Westmead and La Trobe University seeking development partners for their $5b University City of the Future project.

9.55am: Fortescue raised to Buy: Citi

Citi’s Paul McTaggart raised Fortescue Metals to Buy from Neutral based on valuation.

He says that with China’s Golden Week approaching and steel profits under pressure, China’s mills may well moderate production and defer some iron ore purchases.

In the past week the iron price has softened from above US$130 to $US123 a tonne.

“Investor nervousness is high with some concerned that China steel production is set for a sustained downward correction,” Mr McTaggart says.

But he thinks a near-term respite for China mill margins will be modest and won’t last.

“World ex China steel production is now starting to recover and will add meaningfully to demand for both met coal and iron ore as steel production rates normalise,” he says.

“While there might be a seasonal slowdown in China iron ore demand in the Dec-Feb winter period, China lead indicators point to ongoing strength in seasonally adjusted steel demand.” Citi’s recently turned more constructive on Chinese steel demand for the next three years based on a projected continuation of credit easing and China’s heavier reliance on domestic investment for GDP growth with property, infrastructure and automotive sectors remaining key pillars for China’s growth. Citi’s Fortescue target remains unchanged at $18.50 a share.

9.45am: What’s impressing analysts?

- Chalice Gold cut to Speculative Hold: Bell Potter

- Fortescue Metals raised to Buy: Citi

- Inghams raised to Buy: Morningstar

- Mineral Resources started at Neutral, $26 price target: GS

- Qube raised to Buy: Jefferies

- Newcrest raised to Neutral: Macquarie

- Aristocrat price target raised 15pc to $34.60: Citi

- New Hope price target cut 19pc to $1.30: Citi

- Treasury Wines cut to Neutral/High Risk; price target cut 21pc to $10.05: Citi

9.35am: ASX expected +1.2% on US bounce

Australian shares are expected to bounce significantly after a rebound on Wall Street. Overnight futures relative to fair value suggest the S&P/ASX 200 index will open up 1.2pc at a two-day high of 5853 after falling 0.7pc to a 3-month low close of 5784.07 on Tuesday.

If it closes higher today it will snap a 4-day losing streak - its first since April.

The Australian market may start to outperform as speculation of fiscal and monetary stimulus builds before the RBA meeting and federal budget on 6th October.

The US market snapped 4-day losing streaks on the S&P 500 and the Nasdaq, with gains of 1.1pc and 1.7pc respectively. But while the US tech sector started to bounce on Monday, there were no real fundamental drivers for the turnaround. European markets were mostly flat as the resurgence of coronavirus saw the UK increase restrictions on movement for 6 months.

Apart from growth worries from coronavirus in Europe and the US, continuing global share market negatives include US dollar strength, expectations of quarter end selling of equities, weak seasonal factors, US fiscal and monetary policy hiatus and political uncertainty.

US share market volume was below average, though it was also light at the June trough.

Amazon surged 5.7pc after Bernstein upgraded to Outperform, while Microsoft, Facebook, Alphabet and PayPal rose more than 2pc.

US banks remained weak with the KBW Bank index down 2.3pc.

The Energy, Financials and Health Care sectors fell and the Materials sector rose just 0.2pc.

BHP ADR’s suggest the resources sector heavyweight will open up 0.6pc at $36.90.

Spot iron ore fell 2.4pc to a six-week low of $US116.70 and spot gold fell 0.5pc, while copper rose 1.5pc, Brent crude rose 0.6pc

AUD/USD hit a 1-month low of 0.7155 as the US dollar index hit a 6-week high.

David Ross 9.28am: Fletcher spruiks NBN funding model

Communications minister Paul Fletcher has spruiked the move from the NBN to borrow $3.5bn on commercial markets to fund upgrades to the fibre optic network.

Some have criticised the move as being a consequence of the government’s failure to stick with the original plans developed under Labor.

But Mr Fletcher, speaking on ABC News Breakfast, said the upgrade was all part of the plan.

“With the volume rollout now largely completed, now there’s the opportunity to move to the next stage and this is very much consistent with what we said back in 2013, with our strategic review of the NBN,” he said.

“If we’d stuck with Labor’s plan, it would have been almost 5 million fewer homes. But, secondly, what this now allows is for more homes to be able to, should they choose to, order a higher-speed service.”

Mr Fletcher, who was previously infrastructure minister, rejected suggestions he knew or should have known about the deal highlighted in the recent auditor general report that saw taxpayers pay ten times the amount recommended for land acquired for the Western Sydney airport.

“The report is critical of the department for concealing information, not just from the minister but, indeed, from senior officials of the department itself,” he said.

“The Auditor-General, I think, has rightly identified that the department did not do the right thing. And the information that was provided to senior officials of the department was inadequate, by less senior officials, let alone what was provided to the minister.”

9.10am: ‘High expectations’, says Kogan

Online retailer Kogan.com says it has “high expectations” for its business and “we fully expect the current growth trajectory to continue well into financial year 2021”.

The comments in the company’s annual report follows Kogan growing its customer base to just under 2.2m in the 12 months to June 2020.

At the same time the company recently unveiled a 55.9 per cent increase in net profit after tax to $26.8m.

The company’s remuneration report shows Ruslan Kogan, the co-founder and chief executive officer, was last financial year paid $594,000, up from $439,000 a year earlier after the payment of a $101,000 bonus.

Ruslan Kogan has a 15 per cent stake in Kogan.com.

KGN shares last traded at $20.08, giving it a market capitalisation of a little over $2bn.

8.49am: Nufarm swings to heavy loss

Chemical fertiliser company Nufarm has swung to a full-year loss for the 12 months through July 31, posting a net loss attributable to members and after material items of $456m compared to a net profit of $38.3m in the prior period.

Underlying earnings before interest, tax, depreciation and amortisation from continuing operations fell to $235.8m, down 21.4 per cent on the prior year.

“Our earnings performance in 2020 was disappointing,” said chief executive Greg Hunt.

“While good momentum was generated in most regions in the second half of the year, weaker earnings from the North American business in the first half and a decline in European and Seed Technologies earnings resulted in underlying EBITDA from continuing operations declining by 21 per cent.”

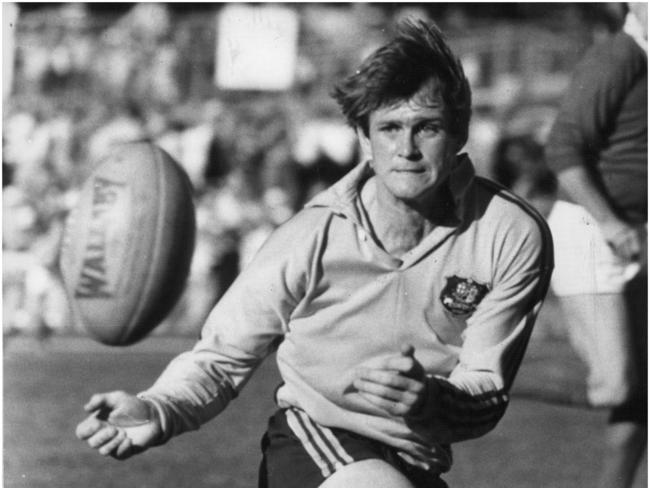

Chris Jenkins 8.26am: Hawker joins Westpac board

Westpac has announced the appointment of former IAG CEO and rugby international Michael Hawker to its board. Mr Hawker will take up the position in November. The move marks a return to Westpac for Mr Hawker, who was group executive for business and consumer banking between 1998 and 2001.

Meanwhile Allison Deans, who has been on the Westpac board since 2014, would be retiring as s director, the bank said in an ASX statement.

In its executive ranks, earlier this week Westpac announced that Chris de Bruin would be the new head of its consumer banking division.

Chris Jenkins 7.50am: Kathmandu profit smashed 86%

Adventure gear group Kathmandu has seen its annual net profit fall 86 per cent to just $NZ8.1m as the coronavirus pandemic smashed on its retail and wholesale operations around the world.

The result, which included nine months of the group’s ownership of surf group Rip Curl, included total revenue of $NZ801.5m, up 48.7 per cent on 2019.

Kathmandu will not pay a final dividend.

Kathmandu said its Rip Curl business had been most affected by the pandemic, with an estimated sales impact of $NZ70m.

Like many retailers, Kathmandu reported that the pandemic has brought about a strong lift in online sales, which climbed 63 per cent to $NZ106.4m in the year to the end of July.

CEO Xavier Simonet said sales had rebounded strongly in Australia and New Zealand since lockdown conditions had begun to ease.

7.01am: Brexit cost warning

A “no-deal” Brexit could be three times more costly to Britain’s economy in the long term than the coronavirus outbreak, a new study published Tuesday warned.

The think-tank UK in a Changing Europe said the political and economic effects of the pandemic were likely to mitigate or hide that of failing to secure a trade agreement with the EU.

But in the short term, the lack of a new formal trading relationship with Brussels would be bad news for economic recovery and larger than the health crisis in the long term.

The think-tank, which collaborated with the London School of Economics, said Brexit would hit growth in the coming years more than if the UK had opted to remain in the bloc.

“The claim that the economic impacts of COVID-19 dwarf those of Brexit is almost certainly correct in the short term,” its authors wrote.

“Not even the most pessimistic scenarios suggest that a no-deal Brexit would lead to a fall in output comparable to that seen in the second quarter of 2020.

“However – assuming a reasonably strong recovery, and that government policies succeed in avoiding persistent mass unemployment – in the long run, Brexit is likely to be more significant.

“Our modelling with LSE of the impact of a no-deal Brexit suggests that the total cost to the UK economy over the longer term will be two to three times as large as that implied by the Bank of England’s forecast for the impact of COVID-19.” The study estimated that the negative impact on gross domestic product would be 5.7 per cent over the next 15 years compared with the current level, while GDP was forecast to take a 2.1-per cent hit from COVID-19.

The projections come despite a lack of clarity about the overall repercussions from the pandemic, and as a second wave of infections hits Europe.

AFP

6.36am: US stocks snap losing streak

US stocks closed higher, snapping a four-day losing streak for two of the three major indexes, as investors attempted to look past rising coronavirus case counts around the world and intensifying political tensions in Washington.

The Dow Jones Industrial Average added 140 points or 0.5% to close near 27,287, according to preliminary closing figures, while the S&P 500 finished near 3,316, up 34 points or 1.1%. The Nasdaq Composite index jumped 185 points, 1.7%, and finished trading near 10,964.

Federal Reserve policymakers on Tuesday repeated calls for Congress to enact additional aid to help the economy, and Treasury Secretary Steven Mnuchin said the White House was interested in reaching a deal with politicians.

Shares of Amazon.com Inc. (AMZN) bounced more than 5% higher after an analyst price-target increase.

Dow Jones

6.34am: Nike profit lifts

Nike Inc. posted a higher profit in the fiscal first quarter on lower expenses but sales slipped as its wholesale business and Nike-owned stores were affected by the coronavirus pandemic.

The Beaverton, Ore.-based company said profit was $1.52 billion, or 95 cents a share, for the quarter ended Aug. 31, up from $1.37 billion, or 86 cents a share, a year earlier. Analysts were expecting earnings of 42 cents a share, according to a FactSet poll.

Sales were $10.59 billion, a roughly 1% decrease from a year earlier. Analysts were looking for $9.13 billion. Nike’s direct sales rose 12% to $3.7 billion. Digital sales surged 82%.

“Despite a majority of stores open in the quarter, we continue to experience year-over-year declines in physical retail traffic across the marketplace due to COVID-19 impacts and safety related measures, offset partially by higher conversion rates,” Nike said.

The company reduced selling and administrative expenses, demand creation expenses and operating overhead expenses compared with last year.

Dow Jones

6.23am: US headed for strong rebound: Mnuchin

The United States is set for a strong economic rebound in the third quarter but additional government spending is still needed, Treasury Secretary Steven Mnuchin said on Tuesday.

The comments came as Mnuchin testified along with Federal Reserve Chair Jerome Powell before the House Financial Services Committee amid a continuing impasse in Washington over how much to spend to revitalise the US economy as it struggles with the COVID-19 downturn.

“I believe we will see tremendous growth in the third quarter fuelled by strong retail sales, housing starts, home sales, manufacturing growth and increased business activity,” Mnuchin said.

“America is in the midst of the fastest economic recovery from any crisis in the US,” he added.

However Mnuchin acknowledged that “some industries particularly hard bit by the pandemic require additional relief,” citing tourism and restaurants, among others.

The United States saw GDP plunge by a historic 31.7 per cent annualised in the second quarter, but growth is expected to rebound sharply thanks to states’ moves to resume business even as COVID-19 remains rife.

Facing business shutdowns that caused mass lay-offs, Congress passed the $2.2 trillion CARES Act in March, which included a program of loans and grants for small firms as well as extra weekly payments to the unemployed.

However those provisions have expired, and Democratic and Republican politicians in Washington have yet to reach an agreement on another bill, with a $500 billion measure blocked by Democrats in the Senate earlier this month.

During the hearing, Powell repeated that the US economy may need more support, noting the stimulus checks and expanded unemployment payments provided under the CARES Act helped recover three-quarters of household spending lost due to the pandemic.

About half of the 22 million people laid-off in March and April have returned to work, and for those still unemployed, the recovery “will go faster for those people … if it’s all of government working together,” Powell said.

White House economic advisor Larry Kudlow had on Monday suggested the US economic recovery was strong enough that additional spending may not be needed, but on Tuesday moderated that stance, telling CNBC, “I don’t think … recovery depends on the package, but I do think a targeted package could be a great help.” Mnuchin echoed those comments, telling House politicians President Donald Trump’s administration was still ready to pass another bill, and supported sending out a second round of stimulus checks.

“The president and I remain committed to providing support for American workers and business,” he said. “I believe a targeted package is still needed and the administration is ready to reach a bipartisan agreement.”

6.15am: China makes green pledge

The United States is set for a strong economic rebound in the third quarter but additional government spending is still needed, Treasury Secretary Steven Mnuchin said on Tuesday.

The comments came as Mnuchin testified along with Federal Reserve Chair Jerome Powell before the House Financial Services Committee amid a continuing impasse in Washington over how much to spend to revitalise the US economy as it struggles with the COVID-19 downturn.

“I believe we will see tremendous growth in the third quarter fuelled by strong retail sales, housing starts, home sales, manufacturing growth and increased business activity,” Mnuchin said.

“America is in the midst of the fastest economic recovery from any crisis in the US,” he added.

However Mnuchin acknowledged that “some industries particularly hard bit by the pandemic require additional relief,” citing tourism and restaurants, among others.

The United States saw GDP plunge by a historic 31.7 per cent annualised in the second quarter, but growth is expected to rebound sharply thanks to states’ moves to resume business even as COVID-19 remains rife.

Facing business shutdowns that caused mass lay-offs, Congress passed the $2.2 trillion CARES Act in March, which included a program of loans and grants for small firms as well as extra weekly payments to the unemployed.

However those provisions have expired, and Democratic and Republican politicians in Washington have yet to reach an agreement on another bill, with a $500 billion measure blocked by Democrats in the Senate earlier this month.

During the hearing, Powell repeated that the US economy may need more support, noting the stimulus checks and expanded unemployment payments provided under the CARES Act helped recover three-quarters of household spending lost due to the pandemic.

About half of the 22 million people laid-off in March and April have returned to work, and for those still unemployed, the recovery “will go faster for those people … if it’s all of government working together,” Powell said.

White House economic advisor Larry Kudlow had on Monday suggested the US economic recovery was strong enough that additional spending may not be needed, but on Tuesday moderated that stance, telling CNBC, “I don’t think … recovery depends on the package, but I do think a targeted package could be a great help.” Mnuchin echoed those comments, telling House politicians President Donald Trump’s administration was still ready to pass another bill, and supported sending out a second round of stimulus checks.

“The president and I remain committed to providing support for American workers and business,” he said. “I believe a targeted package is still needed and the administration is ready to reach a bipartisan agreement.”

6.08am: Shake-up for India’s Tata

The largest minority shareholder in India’s massive Tata group announced late Tuesday that it would exit the conglomerate, ending a bitter years-long battle following the ouster of former Tata chairman Cyrus Mistry.

The decision by the Shapoorji Pallonji (SP) Group, of which Mistry is the managing director, will likely pave the way for holding company Tata Sons to buy the 18.4 per cent stake and boost its control of the salt-to-steel behemoth.

Mistry was axed as chairman of Tata Sons in 2016 as group patriarch Ratan Tata set about eradicating his influence in the 150-year-old conglomerate.

The two companies are mired in a protracted legal fight, with Tata Sons recently securing a court order banning the SP Group from using its stake to raise funds.

“Tata Sons has amplified its institutional efforts to suppress and inflict irreparable harm on the SP Group, in the midst of a global crisis triggered by the COVID Pandemic,” the construction firm said in a statement.

“Today, it is with a heavy heart that the Mistry family believes that a separation of interests would best serve all stakeholders,” it added.

The move ends a seven-decade-long relationship between the two companies that descended into acrimony following the removal of Mistry from the helm of Tata Sons.

“This is a statement of divorce and basically (the SP group) is telling Tata group that they have the right of first refusal and can buy their shares”, Ajit Sharma, a Supreme Court lawyer and expert in company law, told AFP.

Mistry became a Tata Sons director in 2006 and succeeded Ratan Tata, then 75, as chairman in 2012.

But ties quickly deteriorated, with Tata taking interim charge following Mistry’s dismissal as the pair engaged in bitter public mudslinging, including accusations of corporate malfeasance.

Mistry also dragged Tata Sons to India’s National Company Law Tribunal, claiming that he was unfairly sacked as the world-renowned group descended into turmoil and its global reputation took a hit.

Tata, which was founded under British colonial rule, operates in more than 100 countries. It owns Britain’s Tetley Tea and Jaguar Land Rover, and the Anglo-Dutch steel firm Corus.

6.05am: US home prices lift

US existing home prices shot higher in August amid surging demand as more consumers sought housing to adapt to working from home, a survey released Tuesday said.

That put the squeeze on inventory, which continued to dip as median prices climbed after breaching the $300,000 level for the first time ever in July.

The National Association of Realtors (NAR) said sales rose 2.4 per cent from July to a seasonally adjusted annual rate of six million, in line with analysts’ expectations and the highest level since 2006.

Existing home sales took a dive earlier this year as the coronavirus pandemic snarled business across the country. August was the third straight month of growth, boosted by the shift to work-from-home by many professions, as well as the Federal Reserve’s move to keep interest rates low.

“Home sales continue to amaze, and there are plenty of buyers in the pipeline ready to enter the market,” NAR chief economist Lawrence Yun said, adding “further gains in sales are likely for the remainder of the year” due to low interest rates and increased rehiring of laid-off workers.

Growth was seen in all regions, with the Northeast, home to the worst initial COVID-19 outbreak, climbing the most at 13.8 per cent. Overall, sales last month were 10.5 per cent higher than August 2019.

However total inventory declined 0.7 percentage points from July to 1.49 million units and unsold inventory sits at a three-month supply, compared with a four-month supply a year earlier.

Median home prices jumped 11.4 per cent from a year earlier to $310,600, and Joel Kan of the Mortgage Bankers Association warned that gain “is far above income growth and threatens overall affordability – especially for first-time buyers.” “It’s clear that more inventory is needed to keep home prices from rising too quickly,” he said.

Even with mortgage rates at low levels, Ian Shepherdson of Pantheon Macroeconomics predicted reticent bankers would take some of the wind out of the housing market’s sails in the last months of the year.

“Tightening of lending standards in recent months appears already to be crimping applications, so sales likely will peak around the year-end,” he said