Trading Day: live markets coverage; CBA buoys ASX above 6000; plus analysis and opinion

The local sharemarket seals its second consecutive close above 6000 as buyers rallied on a strong CBA profit result.

And that’s the Trading Day blog for Wednesday, November 8.

Samantha Woodhill 4.23pm: CBA buoys ASX above 6000

The local share market ended the session slightly higher and above 6000 for the second day in a row, as a strong Commonwealth Bank update saw financials drive the market higher.

The benchmark S&P/ASX200 was up 2 points on 6016.3 points, while the broader All Ordinaries index rose 1.7 points to 6089.1 points by the close.

CBA shares added 2.7 per cent to $80.27 after it booked $2.65 billion in cash profit for the three months through September, up from $2.4bn last year. The local bourse was buoyant off the back of the strong result, Citi Bank equities sales director Karen Jorritsma said.

“The market has responded very well to that today,” she said.

“The income growth number looked very solid, they’ve actually built enough capital to offset the dividend they recently dropped out and the quarter one capital position looks very good.

“They continue like all the other banks to do well on the back of their credit cycle being at a low point.”

Westpac edged up 0.3 per cent to $32.74 and National Australia Bank fell 0.2 per cent to $31.65. ANZ put on 0.3 per cent to $30.10.

4.01pm: Loan write-off wave buoys CBA: Macquarie

A “solid” 1Q18 result from CBA was underpinned by improving margins on mortgage repricing, as well as a lower impairment charge, which is a consistent theme across the sector, according to Macquarie Equities.`

“While underlying earnings of about $3.9 billion are broadly in line with expectations we note that elevated expense growth in 1Q18 was impacted by CBA’s decision to take provisions for future project costs that are expected to be incurred from various regulatory and compliance issues,” Macquarie analysts say. “This suggests that expense trends should moderate in 2Q18 and CBA is well placed to beat underlying earnings consensus expectations in 1H18. Similar to peers, CBA’s credit quality and capital trends were favourable in the quarter.”

In their view the near-term risks associated with operational disruptions or larger-than-expected fines are broadly reflected in the current valuation.

They note that CBA is trading on about 13.9 times 12-month forward EPS versus a sector average of 13.4 times.

“With supportive operational trends we expect to see share-price support,” Macquarie adds.

The broker has a “neutral” rating and $78.00 target on CBA.

In late trade, CBA shares are 2.7 per cent higher, or over $3bn healthier in market capitalisation terms at a fresh 3-month highs of $80.30.

3.43pm: CBA revenue growth ‘best in class’: Citi

Citi has upgraded Commonwealth Bank to “neutral” from “sell” following its first-quarter update released earlier today.

CBA’s $2.65bn first-quarter cash earnings on a run-rate basis beat Citi’s $5.14bn first-half forecast, while its net interest margin over the period faced off with slowing volume growth to help deliver “best-in-class” revenue growth of 4 per cent, according to the investment bank’s analysts.

“Despite having to atone for regulatory and compliance weaknesses, the bank looks to be in good shape to do so with enough capital momentum to absorb any likely penalty,” say the analysts.

In late trade, CBA shares are 2.7 per cent higher, or over $3bn healthier in market capitalisation terms at a fresh 3-month highs of $80.30.

3.20pm: Fruition talk as Costa hits fresh highs

Shares in fruit and vegetable producer Costa Group continue a run of all time record highs today up to $6.95, ripe in the view of the market leading up to its annual general meeting next week.

Costa grabbed investors attention after it splashed $68m earlier in the week to fill out its now 90 per cent stake of Morrocan joint venture African Blue, The Australian’s DataRoom revealing speculation it may deliver an earnings upgrade at the key shareholder event in Melbourne.

“Valuation is not cheap,” says Macquarie after it upgraded the stock to “outperform” earlier this week, “but we expect positive earnings momentum to continue to drive the stock higher.”

While also seeing “upside” risk to guidance, Goldman Sachs analysts remain cautious and list price deflation as a key risk.

“Although we remain positive on the company’s fundamentals, we see limited upside from current levels,” say Goldman analysts.

CGC last up 3.5 per cent on $3.95

Read: Wesfarmer’s Coles counts cost of supermarket price war, writes Stephen Bartholomeusz

Richard Gluyas 2.47pm: AI not all cut and paste, finds NAB

National Australia Bank’s openness about the rise of the machines in financial services is in stark contrast to the caution of its Sydney rivals after less-than-stellar industry returns from early investment in a digital labour force.

While artificial intelligence and machine learning are key board agenda items, with research indicating the potential to save about 30 per cent of administration costs by as early as 2018, the dollar benefits yielded so far have failed to live up to the hype.

Eli Greenblat 2.28pm: Lew’s pronged Myer resurrection plan

Retail billionaire Solomon Lew has issued a seven point plan to resurrect Myer performance and earnings, while also lashing back at incomig Myer chairman Garry Hounsell for claiming he was keeping secret the names of three independent directors he had proposed should join the Myer board to support its turnaround.

Injecting even more heat into the war of words, Premier Investments said Mr Hounsell needed to “stop lying to his shareholders’’ and accused the former Qantas director of ‘’peddling” falsehoods.

In a statement this afternoon, the latest in a daily slanging match between Mr Lew and Mr Hounsell, the billionaire’s fashion conglomerate Premier Investments has revealed that in a meeting between the two combatants, Mr Lew named Premier Investments directors Terry McCartney and Tim Antonie and chief investment officer of Abacus Property Group, Steven Sewell.

Mr Lew’s Premier Investments also didn’t miss an opportunity to aim a punch at Mr Hounsell, taking a personal swipe at his wine business, as well as his choice of Julie Ann Morrison as a new director for Myer given her questionable retail experience — read more

MYR last down 1.4 per cent on 73 cents

2.19pm: CBA hoists ASX into the black

Australia’s S&P/ASX 200 share index has turned slightly positive amid a surge in CBA after its trading update.

That follows an opening fall of 0.3pc as global equities and commodities retreated slightly.

Banks may support the overall market or push it a bit higher until Friday, when ANZ trades ex-dividend.

CBA shares trade 2.5 per cent higher at $80.17, stacking on over $3bn in market capitalisation and might even get a couple of upgrades overnight based on the commentary so far.

On the charts, after breaking above its 100-DMA at $79.14 earlier, CBA could test its 200-DMA at $81.20 tomorrow.

However, CBA may take much longer to break the downtrend line drawn from the April peak, currently at $82.06.

Index last up 4 points on 6018.8.

2.02pm: Fortescue board taps dual deputies

Iron ore miner Fortescue Metals Group has appointed two of its directors as deputies to chairman Andrew Forrest.

Mark Barnaba, who also sits on the board of the Reserve Bank of Australia, will be a deputy chairman, along with Sharon Warburton, who is also the chair of the Northern Australia Infrastructure Facility.

The world’s fourth biggest iron ore exporter is currently searching for a replacement for chief executive and managing director Nev Power, who will step down in February — AAP

FMG last 2.6 per cent higher on $4.90

1.36pm: Nufarm to acquire FMC European assets

Nufarm has entered into a $US90m deal to buy a European cereal broadleaf herbicide portfolio from FMC Corporation.

The assets are expected to be earnings-per-share accretive and initially contribute net sales of approximately $30m, or approximately $15 million in EBITDA terms over the 2019 financial year according to Nurfarm.

The purchase will be funded by existing debt facilities.

NUF last $8.84 in a trading halt.

12.55pm: James Hardie in European buy

Building materials supplier James Hardie has agreed to buy Europe’s biggest fibre gypsum board manufacturer as it looks to expand presence in the region’s affluent construction market.

The ASX-listed company will buy the German-based parent of Fermacell GmbH in an all-cash transaction worth €473 million ($738 million), with the deal expected to close in the last quarter of its 2018 fiscal year. James Hardie will fund the acquisition through debt financing. Fermacell holds more than 70 per cent share in Europe’s fibre gypsum board market and also produces cement-bonded boards.

The acquisition will diversify James Hardie’s geographic, product and end-market portfolio, chief executive Louis Gries said — read more

JHX last $18.93

12.34pm: ‘Solid’ result from CBA: Citi

Commonwealth Bank’s $2.65bn first-quarter cash earnings beat Citi’s $2.6bn estimate, the investment bank pitching CBA’s update earlier this morning as “another solid result”.

First-quarter revenue growth of 4 per cent impressed Citi analysts, while 4 per cent expenses growth they attributed to regulatory cost provisioning,

“Proforma capital [came in at] 10.8pc if you include for life insurance sale — so in a strong position,” say Citi analysts.

CBA last up 1.6 per cent on $79.46

12.14pm: ASX200 tests 6000 resolve

The local sharemarket falls to trade either side of the 6000 mark, failing to follow on yesterday’s stellar Melbourne Cup day run that saw it break the key level for the first time since the Global Financial Crisis.

The S&P/ASX200 index last traded down 0.1 per cent on 6007.3 after touching 5997 briefly in early trade.

Resource stocks BHP (-1.4pc) and Rio (-1.1pc) take a hit after the spot price of key domestic underlying commodity iron ore fell to $US62.66/tonne, while the price of crude oil halts its run of successive two-and-a-half year highs to trade near $US63.55/barrel as global markets edge closer to pricing in supply fears amid a recent anti-corruption push in Saudi Arabia.

CBA adds 2 per cent, or $2.8 billion in market capitalisation as it looks to close out its biggest rise in two months in the wake of its first-quarter update, while Telstra shares ebb slightly after the telco said it will refund NBN customers provided slower-than-agreed speeds and that it may have contravened Australian Consumer Law.

SWING STOCKS

+ Westfield (3.1pc), Orocobre (2.4pc), Costa Group (2.2pc), Ausnet Services (1.5pc)

— Orica (4.2pc), Ardent Leisure (3.7pc), a2 Milk (3.4pc), Seven West Media (3.2pc), Nine Entertainment (2.5pc)

52 WEEK-RECORDS

Highs:

Worley Parsons: $15.48

Blackmores: $165.48

Costa Group: $6.87

Ausnet Services: $1.82

Lows:

HT&E: $1.61

Fletcher Building: $6.25

Trade Me Group: $3.82

Seven West Media: 60c

12.10pm: CBA results ‘a beat’: CLSA

Commonwealth Bank’s $2.65bn first-quarter cash earnings beat $2.54bn consensus estimates, according to CLSA’s Brian Johnson.

Results benefited from strong revenue backed by higher margins and healthier insurance income as the second-half FY17 effects of Cyclone Debbie dwindle, according to Mr. Johnson, however questions remain at the brokerage over the bank’s underlying cost growth.

“[The result] contrasts to Westpac’s where there were misses on revenues, expenses and reduced overlays,” says Mr. Johnson.

“Regardless of AUSTRAC, CBA is the premium ROE Australian bank.”

CBA last up 1.6 per cent on $79.46

12.06pm: CBA result ‘quite good’: Regal Funds

CBA’s 1Q18 result was “quite good” according to Omkar Joshi at Regal Funds Management.

He says CBA’s unaudited cash profit of $2.65bn was 4pc above expectations and 1pc above on a pre-provision profits basis.

“Low bad debt [provisions] were again the feature but still a good result even without it,” Joshi says.

CBA shares last up 1.6pc at $79.46

Ben Butler 11.58am: Westpac BBSW case scope widens

The corporate regulator’s rate-rigging case against Westpac has strengthened this morning after a judge allowed it to broaden its case beyond what the bank understood it had to meet.

Federal Court judge Jonathan Beach said the Australian Securities and Investments Commission had made a mistake in its pleadings.

“In my view it is appropriate to give ASIC an opportunity to correct this issue,” Justice Beach said.

He said Westpac had failed to establish it would suffer any forensic disadvantage if ASIC was allowed to amend its case.

There would be greater prejudice to the public interest if he refused ASIC’s application than there would be prejudice to Westpac by allowing it, he said — read more

WBC last $32.64

11.52am: Virgin Australia held privatisation talks

Virgin Australia says it has held discussions about privatisation, however it is yet to reach any outcome to report to the market at this stage — read more

VAH last 19 cents.

11.29am: Westpac vows levy agitation

Westpac says it will keep fighting to remove the federal government bank levy.

Chairman Lindsay Maxsted says the levy is a “highly inefficient and distortive tax” that places an impost on a small number of Australia’s largest taxpayers, adding that Westpac and its shareholders must “continue to agitate for its removal”.

“It discriminates against Australian banks relative to global peers and it has impacted the value of your investment and the investments of millions of superannuation holders across Australia,” Mr Maxsted said in Westpac’s annual report — AAP

WBC last $32.65

11.00am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

NOW: Live cross — Morgans

11.15am: Ric Spooner — CMC Markets

11.45am: Martin Crabb — Shaw and Parnters

12.00pm: Henry Jennings from MarcusToday guest hosts

12.00pm: Greg McKenna — AxiTrader, Ben Le Brun — OptionsXpress

12.15pm: James King — Currency Analyst, AFEX Australia

12.45pm: Paul Dales — Chief Economist. Capital Economics

10.40am: James Gerrish — Senior Advisor, Shaw and Parnters

(All times in AEST)

Samantha Woodhill 10.38pm: Ardent CEO Simon Kelly resigns

Ardent Leisure Group CEO Simon Kelly has resigned, effective immediately, after just five months in the role.

The shock move comes as the entertainment group said it was trading broadly in line with earnings expectations for the year.

The former Nine Entertainment finance chief took on the CEO role on June 9, replacing Deborah Thomas, who left after a two-year stint that was marred by the tragic deaths of four people at the company’s Dreamworld theme park last year — read more

AAD last down 3.2 per cent on $1.82

Supratim Adhikari 9.58am: Tesltra concedes on NBN speeds

Telstra has agreed to compensate around 42,000 customers after failing to provide them speeds promised to them over the National Broadband Network (NBN), with the incumbent telco admitting that it may have contravened the Australian Consumer Law.

The Australian Competition and Consumer Commission (ACCC) said on Wednesday that Telstra’s measures will include offering refunds to customers, the option to change speed plans, and exit from contracts without paying a fee.

It added that the bulk of the affected customers are on the NBN fibre to the node (FTTN) or fibre to the building (FTTB) footprint — read more

TLS last $3.47

Simon Benson 9.45am: ‘Marooned on our own tax island’

The full rollout of the Turnbull government’s company tax plan will deliver a $30 billion revenue return to the federal budget, effectively halving the claimed total cost of the policy, according to an official Treasury report to be released today.

The report also warns that Australia could suffer a “permanent reduction in the level of GDP and real wages” if it fails to respond to the changing global tax environment — fuelled by Donald Trump’s renewed push to cut the US rate to 20 per cent.

9.38am: ASX eyes CBA support over 6000 mark

Australia’s S&P/ASX 200 should be supported by stronger-than-expected results from CBA.

The index was expected to open down 0.3pc based on overnight futures relative to estimated fair value.

But CBA’s 1Q18 unaudited $2.65bn cash profit beat the $2.54b consensus by about 4.3pc, according to CLSA’s Brian Johnson.

The quality was mixed, with stronger revenue driven by higher margin, but a loan loss charge of $198m vs. $296m expected.

If the index somehow manages to close above 6000 again today it would be very positive on a technical basis.

China’s monthly trade data at 1.30pm (AEDT) could have some bearing on the resources sector today.

The fall in futures follows flat-to-negative leads from Wall Street, moderate falls in European equities and commodities.

While the S&P 500 was flat, the volatility index started to bounce from the record closing-basis low it hit on Friday.

LME copper fell 2.2pc and Brent crude oil fell 1.1pc to $US63.55 after hitting a 2 year high of $US64.27 on Monday.

More importantly, spot iron ore fell 1.1pc to $US62.66/tonne after surging 5.8pc on Monday, though coking coal rose 1.2pc to $US182.75.

Partly offsetting the weakness in commodities, AUD/USD fell to a 4-month closing-basis low of 0.7645.

BHP ADR’s equivalent close at $28.23 was a 1.8 per cent discount to BHP’s Australian close yesterday.

Index last up 1pc at $6014.3

9.32am: Ardent CEO Simon Kelly resigns

Ardent Leisure Group chief executive Simon Kelly has resigned, with CFEO Geoff Richardson to assume the role on an interim basis — read more

AAD last $1.88

9.25am: The Trading Day ahead

Join the conversation with our Trading Day experts for breaking news and analysis in financial markets here and on Sky News Business (Ch: 602)

9.30am: Chris Weston — Chief Market Strategist, IG

9.45am: Kaz Sangha — CMC Markets

10.00pm: Julia Lee from Bell Direct and John Milroy from Ord Minnett

10.00pm: Evan Lucas — The Lucas Report, Martin Lakos — Macuqarie

10.40pm: Sally Auld — Chief Economist, JPMorgan

(All times in AEST)

9.20am: Snap crackles, then bursts 20pc on Wall St

Georgia Wells writes:

Snap. said its quarterly loss more than tripled, disappointing Wall Street again as it failed to significantly grow the number of people using its app daily or the amount of money advertisers are spending to reach those users.

For its third straight quarterly earnings report as a publicly traded company, it failed to live up to Wall Street’s forecasts for revenue. Snap, the parent company of the messaging app Snapchat, said revenue in the third quarter rose 62 per cent to $US207.9 million ($A272.08m). Analysts polled by FactSet expected $US236.9 million in revenue.

Shares were down 18 per cent in after-hours trading — read more

Dow Jones Newswires

David Swan 9.13am: Uber boss details new direction

Uber’s new CEO has outlined the ridesharing company’s new ‘cultural norms’, as he looks to steer Uber in a new direction after years of scandals and toxic workplace culture.

Dara Khosrowshahi, who took the reins at Uber after the company’s founder and former boss Travis Kalanick resigned amid claims of sexual harassment at the company, said he’s spent his first few months in the new job “dealing with a few firefights”, and has settled on a new set of norms for the controversial tech disrupter.

Admitting Uber’s value of ‘toe stepping’ — a concept in which employees were encouraged to share ideas openly — was “too often used as an excuse for being an asshole”, Uber under Mr Khosrowshahi is geared towards “doing the right thing.”

Matt Chambers 9.08am: Gladstone cashes in on gas spike

Gladstone’s big gas export plants pumped out LNG at near record rates last month, drawing gas from as far as Victoria to take advantage of resurgent LNG spot prices, despite major maintenance works.

The situation, combined with rising oil prices, has helped send Origin (ORG) and Santos (STO) shares to two and one-year highs, respectively.

8.56am: Analyst rating changes

Independence Group cut to Hold — Global Mining Research

Platinum Asset Management cut to Sell — Morningstar

Orica cut to Sell — Citi

8.43am: Inside the Myer pressure cooker

Will Glasgow and Christine Lacy write:

Sure the springtime weather was cooler than a polar bear’s toenail, but there was a spark to Melbourne Cup 2017.

Things seemed noticeably sunny inside Richard Umbers’ Myer marquee.

Was it radiating from Umbers’ vibrant check suit? Or Rebecca Judd’s borderline fluoro pink frock?

Or was it the afterglow of incoming Myer chairman Garry Hounsell’s explosive claim, made in a letter to shareholders the day before, that he had been sounded out by the retailer’s billionaire nemesis Solomon Lew to chair Premier Investments?

Lew said the claims were a “lie and a fabrication’’.

But Hounsell, along with his wife Julie, wasn’t impressed with that response.

“I’m speaking to my lawyers,” Hounsell told us.

Read more from Margin Call

8.36am: CBA lifts first-quarter profit

Commonwealth Bank says it booked a first-quarter statutory net profit of $2.8bn and a 6 per cent increase in cash earnings on the same period a year prior to $2.7bn, both on an unaudited basis.

Net interest margin was “higher” on the same basis due to asset repricing and reduced liquid asset balances, though the rise was partially offset by the impact of the bank levy, higher funding costs and competition.

The bank’s CET1 capital ratio came in at 10.1 per cent by the end of the period, 55 basis points higher than that at June 17.

“Obviously the net interest margins fed through to a brighter result,” says OptionsXpress’ Ben Le Brun — read more

CBA last $78.20

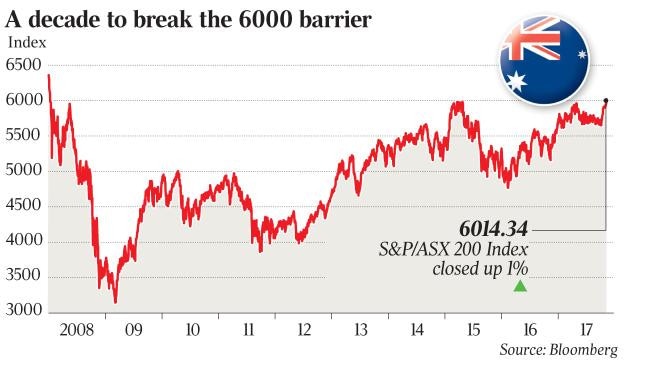

8.19am: Surge to 6000 puts GFC to rest

Australia’s sharemarket has surged past 6000 points, hitting its highest level since the global financial crisis as rising commodity prices turbocharged an end-of-year rally driven by record highs in global equities.

After trading sideways for the past 2½ years, the benchmark S&P/ASX 200 finally broke above its 2015 high yesterday, rising 1 per cent to 6014.3 points, its highest daily close in almost 10 years.

The latest gains finally draw a line under the financial crisis that was triggered by the collapse of US investment bank Lehman Brothers in late September 2008, an event that threatened to bring down the global financial system.

The strongest one-day rise in the local bourse for the past four weeks came as the Wall Street benchmark, the S&P 500, hit a fresh record high after political uncertainty caused by a corruption crackdown in Saudi Arabia pushed the price of Brent crude oil up 3.5 per cent to a 2½-year high of $US64.27. Iron ore also rebounded overnight on Monday, helping local shares.

While many global markets from Wall Street to Tokyo have hit record highs in recent weeks, the local market has lagged behind. The local share index hit the all-time high of 6828.7 in November 2007.

7.54am: ASX set to follow Wall St lower

The Australian market looks set to open lower after US stocks lost a little ground in offshore trade after some disappointing company earnings reports. At 0700 AEDT on Wednesday, the share price futures index was down 27 points, or 0.45 per cent, at 5,974.

In the US, stocks dipped after a disappointing profit forecast from Priceline and as investors fretted that a Republican plan to cut corporate taxes could be watered down.

Locally, no major economic news is expected on Wednesday.

In equities news, Commonwealth Bank is expected to provide a first quarter trading update, while Fortescue Metals, Sims Metal Management, Virgin Australia and Domino’s Pizza have annual general meetings scheduled.

AAP

7.50am: Oil prices pull back from 2-yr highs

Oil prices edged lower on Tuesday, as some of the geopolitical fears that took crude to a two-year high faded.

Light, sweet crude for December delivery fell 15 cents, or 0.3 per cent, to $57.20 a barrel on the New York Mercantile Exchange. Brent, the global benchmark, lost 58 cents, or 0.9 per cent, to $63.69 a barrel.

On Monday, oil prices jumped to heights not seen since 2015 after Saudi Arabian Crown Prince Mohammed bin Salman had more than five dozen princes, ministers and prominent businessmen detained in an effort to tackle alleged corruption in the kingdom.

7.35am: US oil stockpiles tipped to fall

US crude oil stocks are expected to show a decrease in data due Wednesday from the Department of Energy, according to a survey of analysts and traders by The Wall Street Journal.

Estimates from 12 analysts and traders surveyed showed US oil inventories are projected to have decreased by 2.1 million barrels, on average, in the week ended Nov. 3.

Two analysts expect stockpiles to rise and 10 expect them to fall. Forecasts range from a decrease of 5 million barrels to an increase of 2 million barrels.

The closely watched survey from the Energy Information Administration is due at 10:30am. EST Wednesday.

Gasoline stockpiles are expected to fall 1.8 million barrels on average, according to analysts. Eleven analysts expect them to fall and one expects no change. Estimates range from a decline of 3.2 million to no change.

Dow Jones

7.15am: Public trust in Fed is critical: Yellen

Federal Reserve Chair Janet Yellen says the Fed’s effectiveness critically depends on the nation’s confidence that the central bank is acting only in the public’s interest.

On Tuesday, Yellen said it is important for Fed officials to “demonstrate our ethical standards in ways that leave little room for doubt”. Yellen’s remarks came at a ceremony where she and former Fed chairman Ben Bernanke were honoured with this year’s Paul H Douglas Award for Ethics in Government, named for the late Illinois senator.

Yellen and Bernanke were recognised for their efforts to increase transparency at the historically secretive Federal Reserve.

Yellen’s comments were her first public remarks since President Donald Trump announced last week that he was bypassing her and nominating Fed board member Jerome Powell as the next Fed chairman.

AAP

Read more

7.00am: US stocks slide as financials weigh

US stocks are lower in afternoon trade as banks and consumer-focused companies slide.

Online travel companies TripAdvisor and Priceline slumped on Tuesday after TripAdvisor reported weak revenue and Priceline’s quarterly forecast disappointed investors. TripAdvisor tumbled 18 per cent and Priceline lost 12 per cent.

Stocks that pay large dividends, like real estate companies, fared better. Shopping mall operator GGP rose 8.2 per cent.

Smaller, domestically-focused companies fell sharply. The Russell 200 index sank 1.4 per cent.

The Standard & Poor’s 500 index fell 4 points, or 0.2 per cent to 2,586. The Dow Jones industrial average lost 47 points, or 0.2 per cent, to 23,500. The Nasdaq composite fell 30 points, or 0.5 per cent, to 6,755. All three indexes finished at record highs Monday.

AAP