Toy industry: Funtastic back in profit after debt restructure

The company said it was beginning to see the benefits of a refinancing that sliced $35 million from debt.

Investors in toy wholesaler Funtastic had a rare dose of good news after the company swung to a first-half profit from a loss in the same period last year.

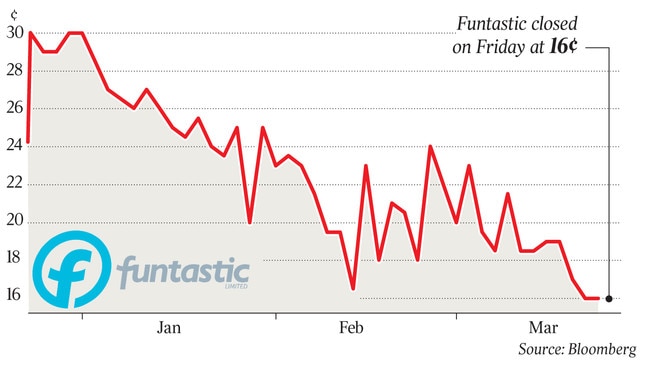

The positive numbers, mostly on debt restructuring, prompted shares to surge almost 9 per cent on Friday.

Unveiling a net profit of $35.4 million, up from a $4.3m loss in the first-half last year, the company said it was beginning to see the benefits of its strategic initiatives, including a refinancing that sliced $35m from debt.

Even so, first-half revenue was down 31 per cent to $28m. The company, which has the distribution rights to the Razor toy scooter, did not declare an interim dividend.

It comes amid a challenging retail environment that has claimed a number of brands, including Oroton, Herringbone and Rhodes & Beckett, and the latest victim, US toy retailer Toys ‘R’ Us, has announced it would likely liquidate in Australia.

Since 2013 Funtastic has hit its shareholders with a string of damaging profit warnings — racking up an average of one earnings warning a year between 2010 and 2013 due to a number of disappointing toy launches and acquisitions, especially in the confectionery category.

It once had licences for the most powerful toy brands in the world under its control, including Thomas the Tank Engine, The Wiggles, Ben 10, Bob the Builder and Bratz, and a shareholder base the envy of any small-cap company that included investors like Gerry Harvey, Alex Waislitz, Lachlan Murdoch and the Mathieson family.

It was one of the hottest stocks on the market a decade ago, as its must-have toys flooded the shelves of Australia’s leading retailers and its share price boomed.

Funtastic shareholders last year knocked back a proposal to delist the company from the ASX, in a bid by the board to save on listing fees.

It still pushed ahead with the debt restructure and in September undertook a capital raising of $8.2m.

For the period ending January 31, operating costs fell 32.3 per cent. Funtastic said its continued efforts to improve working capital resulted in a reduction in inventory, which lowered warehouse costs.

“The company expects to see continued performance improvements driven by a number of new products, expansion of its e-commerce opportunities, confectionery and apparel categories resulting in better margins and lower fixed operating costs,” Funtastic said.

“The company is now clearly focused on its four core business streams of toys and plush, apparel, tech and confectionery,” Funtastic said in a statement.