The move comes as a conga line of business representatives is knocking on doors in Canberra seeking a range of help packages with appeals from AFL clubs to the top listed companies seeking some relief.

It also comes as big business has shown a commendable concern for staff and customers for the obvious self-interest that it needs both to prosper long term.

The extraordinary goodwill highlighted by job sharing between the airlines with excess staff and those businesses like Telstra and supermarkets who need workers was in part smashed by the public spat between Qantas and Virgin. It was sparked by reports that Virgin was seeking government aid by way of debt convertible into equity which sent Qantas boss Alan Joyce into an unseemly and unfortunate intervention on Sky News.

The competitor spat highlights the risks involved as governments and businesses attempt to chart a course to keep as many companies as possible in shape to help speed up the post health crisis revival.

The GFC was a crisis for financial markets and affected businesses, but the coronavirus is a crisis facing the entire community, which explains the extraordinary attention focus aimed at mitigating its impact.

Business and government are (airlines aside) working well together and so far the packages led by the RBA are finding support through welcome economy-wide measures. It remains to be seen when the full details of the government’s plan emerge if that principle is maintained.

Business is working on the assumption that the coronavirus health impact will peak in May to June and hopefully will then slow allowing commerce to resume.

The argument is it is better if companies concentrate on how to get through the next few months so they can quickly recover rather than worry about regulations and insolvency laws which apply big penalties on directors when they trade insolvent.

PWC insolvency guru Ian Carson told The Weekend Australian that “the vast majority of directors are honest and just want to see their companies survive and prosper”. Regulatory relief is needed in the economy, even excluding the impact of the virus and the insolvency push may well spark a longer-term debate about the need for a debtor-based scheme like Chapter 11 bankruptcy rules in the US rather than the Australian creditor-based laws that put the banks in charge of the business.

Most directors think they would do a better job of running the company than the bank. But that is a longer-term debate and the issue is today.

AFL clubs earn their primary income from crowds turning up to games plus their share of the TV gate and, in some cases, poker machines and member revenues. Now, crowds are banned and the other two are potentially up in the air which leaves some clubs in real trouble.

The government is due to unveil more stimulus measures this weekend including an 80 per cent government-backed loan to help businesses survive. The insolvency changes may be included in the package.

Others are pushing for an extension of the fair employment guarantee from companies in receivership to those in voluntary administration. This extends government-backed wages for those workers who lose their jobs.

The aim of any suspension of the insolvency rules and other regulatory changes is to free managers to focus on how the company can survive long term.

The concept is sound, but the bottom line is that outside basic survival most businesses and consumers would prefer not to take on new debt and as much as the banks will welcome government backing, they know only too well this comes with strings attached.

The big banks have sung from the rooftops what good corporate citizens they are being in providing interest payment holidays and they too would prefer their customers to survive rather than fail.

The banks are doing their bit to help the economy through innovative packages supporting customers, but let us not forget that is also helping the banks as well.

ANZ with a 15-basis-point cut was the only bank that passed on any of the 25-basis-point cut in official interests by the RBA.

The RBA package was designed to help reduce funding overall by targeting a low yield in three-year notes that took shape on Friday with the three-year yield at 30 basis points and the 10-year at 1.18 per cent.

Big business is showing its colours as the engine of the economy and the banks and the likes of Telstra have won welcome plaudits for agreeing to moratoriums on debtors, which may swing the government towards a more benign view of business.

Telstra agreed to suspend its staff reductions, which was not such a grand claim when you consider 6300 or 78 per cent of the jobs are already gone, and it too stood up with promises to suspend penalties for financially troubled customers. It is talking to Qantas and others to fill some of the 1000 vacancies it is trying to fill to meet present needs, which mirrors the company-to-company contact between the big supermarkets and the airlines offering jobs to workers who are stood down.

McInnes calls shot

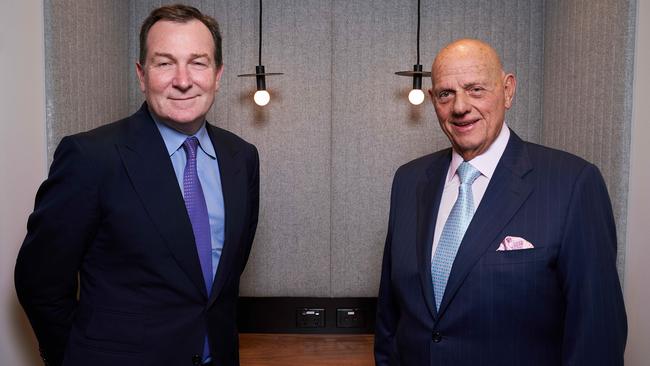

Mark McInnes at Premier Investments is heading into the mayhem in extraordinarily good shape thanks to a stunning past six months where he has achieved the rare combination of a 7.6 per cent increase in sales to $732.1m while also reducing costs.

McInnes has managed to reduce the per cent of sales taken by labour costs from 23.1 per cent to 22.3 per cent while rental costs have fallen from 17.1 per cent to 15.9 per cent. Thanks to a predominance of short-term leases for his stores, he is in the position where 70 per cent of stores have either leases expiring or held over, meaning they are being negotiated now.

Most landlords heading into the storm are desperate to keep rental income flowing so, on paper, McInnes has the bargaining high hand.

The increase in staff productivity appears to come from more encouragement for staff who can cross-sell so the pair of pyjamas from Peter Alexander is sold with other items.

Staff are on sales incentives so they are weighted towards multiple sales. Online sales are up 28.4 per cent and now account for 14 per cent of total sales but better still at profit margins above the group average at 17 per cent.

In Australia, online sales come from the same wholly owned warehouse in the Melbourne suburb of Truganina, which means costs are kept under better control. McInnes has been a retailer for 32 years and is at the top of his game at just the right time given the worst market conditions.

Josh Frydenberg is considering the radical move of temporarily suspending the operation of the insolvency laws for six months to help boost business confidence in managing companies heading into the health crisis peak in the middle of the year.