It’s not universal because the recipients will be those who work in sectors where revenue has fallen 50 per cent for big companies, or 30 per cent for smaller companies, which means large sections of the community won’t get it — including, of course, government workers.

But it is a welcome, bold initiative by the government as part of a support package that now totals over 10 per cent of GDP, more than double the 2010 budget deficit of 4.2 per cent after the GFC and, in all, the biggest single budget program since World War II.

The package is likely to fall over two financial years, which could reduce the final deficit figure, but the amount calculated ignores other factors such as the amount by which government revenue will fall due to the crisis. Tax revenues, for example, will plummet.

The sectors most obviously to benefit include tourism, aviation, sport, the arts in the widest sense, hospitality and retail.

But the government has so far stopped short of shutting down the economy, and when that happens more companies will be affected, most notably in the building sector.

Harris said: “I am positively surprised by this move. The government had to do something to boost confidence and this will go some way towards that.”

Company director Sam Mostyn welcomed the policy as “a great initiative which will help keep people connected with their company.”

Economist Saul Eslake said the policy “should reduce the loss of employment, support income and increase the chance of people retaining employment when the crisis finishes”.

As with other elements of the support package, the policy was applauded across the political spectrum as the sort of bold initiative needed in this crisis.

There will be myriad loose edges to clean up and no doubt more financial carnage, but the government is to be applauded for putting together a bold package in record time that so far has avoided handouts to any particular company within a sector and instead directed support widely where it is needed most.

The trick, as noted early, will be when to turn off the tap.

A fall in the virus infection rate will be a sign that the crisis may have turned, but it will not be easy to wind back the support on offer in everything from big end of town directors free from the risk of insolvency penalties to billionaire retailers free from tenancy eviction, to basic wages for the local barista and airline worker.

In the middle of the crisis, Qantas boss Alan Joyce has won landmark support from his international pilots for his Project Sunrise, which means when the crisis ends his long-range flights to London and New York make economic sense.

In this vein, now is also the time to ask just what sort of community Australia wants to live in when the crises ends and how it will be achieved.

Mergers theory test

The ACCC will look through the present crisis in determining merger decisions, according to Rod Sims, because a competitive economy will deliver the best economy.

The theory will be put to the test as soon as Tuesday, when the ACCC is expected to rule on Bunnings’ takeover of Adelaide Power and Tools.

Sims noted the ACCC had provided temporary authorisations of agreements between competitors to help them through the crisis.

He figures this time there will be a definitive end to the crisis when infections slow, unlike the Great Depression, which ended with World War II.

Sims argues the economy will spring back to life because everyone will be keen to get back to their usual activities, but notes it is important to look through at the structure of the economy that emerges at the other end. In a speech in Sydney on Monday, he said the regulator’s efforts would be focused on the virus but this also meant looking at where companies were taking advantage of consumers.

He cited the example of petrol prices, which range up to 144c a litre in Hobart, 137c in Canberra and 134c in Brisbane. In the present environment he said prices above 130c were “inappropriate”.

Cash still king

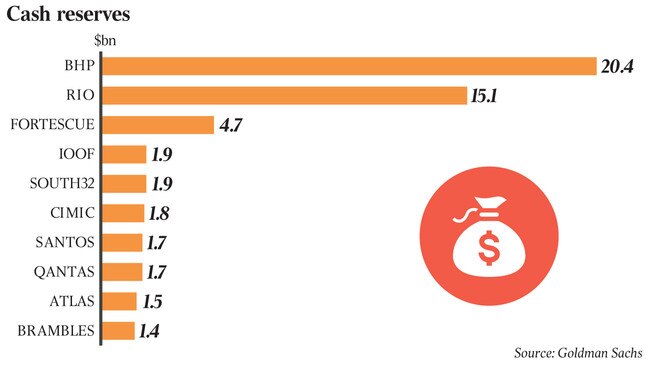

Today’s table looks at cash sitting on corporate balance sheets as at December 31, with the top 10 dominated by resources companies led by BHP with $20.4bn in cash.

This is in part due to the fact the big commodity producers were riding a prosperity wave last year with analysts expecting earnings margins this year at 39 per cent against a market average of 16.5 per cent.

The resources sector is also used to cycles as shown by BHP in 2015, with its shale oil snafu. It had net debt of $US24.4bn ($US12.8bn today), capital expenditure of $US11bn ($US8bn this year) and cash of $US6.8bn.

The company back then had progressive dividends and paid out $US6bn, which will be roughly equivalent to this year’s payout — based on 50 per cent of earnings.

China is in recovery and makes 53 per cent of the world’s steel, but that means the other 47 per cent is made in countries that are now basket cases, including India.

According to The Economist, Apple has $US207bn in cash on its books, which is more than many countries and, in theory, that means a better ability to survive the downturn.

There are myriad other measures that can be used, but this is intended more as a guide on just who will walk the magical bridge better than others.

Other industrial companies on the top 20 list include Woolworths with $1.5bn in net debt and $1bn in cash, Qantas with $1.7bn in cash and Brambles with $1.4bn.

Super pressure

Superannuation Minister Jane Hume sees some benefits in the fallout from the government decision to open superannuation books to let people get access to up to $20,000 to help them through the virus falls.

Put to one side the fact that anyone who does withdraw the money probably does themselves out of three or four times that money in the long term, smaller funds may struggle to raise the cash to pay the withdrawals.

In a speech on Monday, Hume argued that it was the smaller craft-based funds under most stress, which highlighted their lack of diversification and hence riskier investment structure.

The funds with members in sectors that suffered most through the crisis are clearly at greatest risk, and Hume noted that APRA had the power to direct funds to merge.

The likes of LUCRF with ties to the Australian Workers Union, Hostplus with hospitality workers, and Rest with retail workers, while much larger, would also see more workers under pressure.

The government has tightened the administration of the cash withdrawals, with the ATO handling the process.

Australia has taken a step towards a universal wage with the $130bn landmark wages policy unveiled on Monday that former Productivity Commission boss Peter Harris described as a “kitchen sink effort”.