The X Factor of the year: markets defying recession fears

Nearly three decades on, the exercise of picking the surprise factor of the year remains as unpredictable as ever.

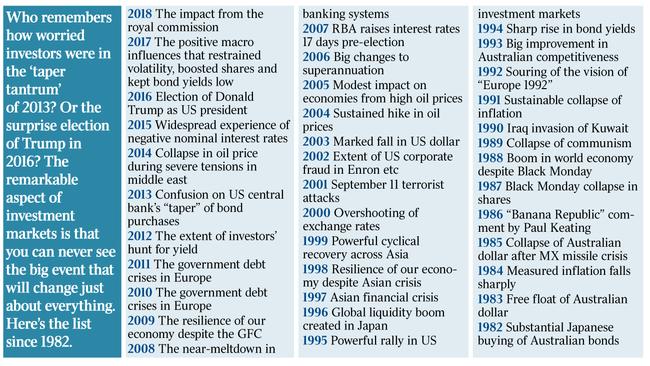

I suggested the unexpected surge in Japanese buying of Australian bonds was the X factor of investment markets for 1982. Since then, identifying the surprise factor each year has become an obsession of mine, even an addiction.

In 2007, The Australian gave it a new name: The X factor.

X factors in investment markets are the major influences that had not generally predicted or allowed for but which turn up and have powerful influences on investment markets. The pick of each harvest is the X factor for that year.

To be a fan of the X factor, as I am, doesn’t preclude taking a view on where the economy, shares, interest rates, property and exchange rates seem to be headed. Rather, it’s a reminder that investors need also to allow for the uncertainty and surprises that are inevitable. Diversification and awareness of risk are important to successful investing.

The X factor in any year can be negative, as it was in the near-meltdown of the global banking system in 2008, the terrorist attacks in 2001, the sovereign debt crisis across Europe in 2010 and 2011, and the immediate impact of the royal commission into banking and finance in 2018.

Or the X factor can be positive, as it was in 2009 with the resilience of our economy following the global financial crisis, the marked drop in trend inflation in 1991, and the strong growth in the world economy in 1988, despite the collapse of share prices (of 25 per cent in 25 minutes) on October 21, 1987.

Sometimes, the impact of an X factor is felt for many years afterwards — as happened after the free float of the Australian dollar in 1983 (still the best move in economic policy in Australia over the post-war years), and after the hunt for yield that started in 2012.

The list of contenders for the 2019 X factor is long and varied. It includes, in no special order:

● Continuation of the 10-year old US economic upswing, despite the recent weakness in US manufacturing and in business capital spending.

● Australian interest rates remaining well below equivalent US rates, without the Australian dollar plunging.

● Extreme drought conditions in eastern Australia.

● Prolonged riots in Hong Kong.

● Brexit’s many complexities.

● The generally unexpected outcome of the Australian election on May 18.

● Strong growth in job numbers in the US and Australia, despite modest/ weak GDP growth.

● The marked escalation in the tariff and technology wars, with uncertainty on whether an effective truce can be framed.

● The expanding range of worrying geo-political risks.

● Strong gains in share prices, despite recurring expectations of an imminent and deep global recession.

● The widening spread of negative nominal interest rates in Europe and Japan.

● The return of fears China will experience a hard landing.

●Australia’s unexpected moves towards a balanced budget and to record a current account surplus.

● The build-up of views the US and Australia will follow Europe and Japan in adopting “unorthodox” monetary policies.

● Signs of recovery in median house prices in Sydney and Melbourne.

In my view, the X factor for 2019 has been the strength of sharemarkets, despite widespread and recurring fears on the part of many investors and commentators of an imminent and deep global recession.

Next year will also have its share of surprises in investment markets from which the annual X factor for 2020 can be chosen. But let’s not try to predict it, as it wouldn’t then be the X factor.

To all who read this column, good health, good humour, and good investing.

Don Stammer is an adviser to Stanford Brown Financial Adviser. The views are his alone. For further information on the X Factor files feel free to contact at don.stammer@gmail.com

Twenty eight years ago, I made an off-the-cuff comment that seemed to resonate with the two or three investors present.