Xi Jinping flexes China’s trade muscle with visit to rare earths hub

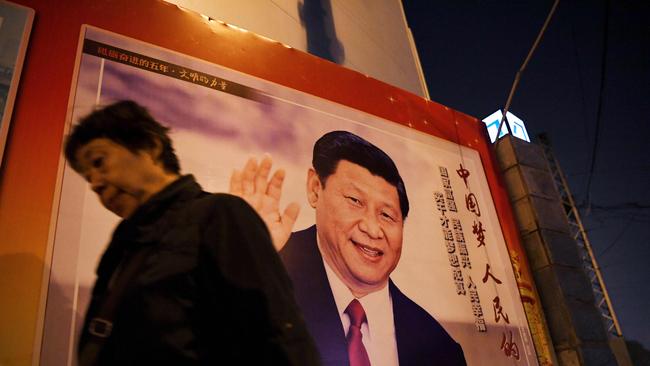

In a message to the US, China’s President has visited a rare-earths region with his top trade negotiator.

President Xi Jinping pinpointed a source of leverage his government has over high-technology industries critical to the US economy, touring a region of China that calls itself a rare-earths kingdom with his top trade negotiator.

Mr Xi’s visit this week to one of the world’s largest suppliers of rare earths — natural elements used for wind turbines, electric cars and jet fighters — is a reminder of the world’s dependence on China for their production.

“It sends the message: ‘Keep in mind we have the ability to affect the production of many major products in the United States,’” said Anthony Marchese, chairman of Texas Mineral Resources Corp, which hopes to produce rare earth elements near El Paso. “To the people who follow the industry, to the Trump administration, they see the symbolism,” he said.

China’s state media said Mr Xi’s trip to the southern province of Jiangxi provided an opportunity to learn about the rare-earths industry. Other comments were more pointed: One headline on an article circulated on social media referred to Jiangxi’s rare earths as a “trade trump card.” Tensions between Washington and Beijing over trade and technology have intensified in the past week after the Trump administration said it would make it illegal to supply some US technology to Chinese telecommunications equipment maker Huawei Technologies Co. Beijing criticised the move as “bullying.” On his tour, Mr Xi was shown on state television on Monday accompanied by his emissary to the trade talks with the US, Liu He. Stock prices of companies associated with the industry soared in China in anticipation of a potential increase in prices of the materials.

Beijing exerts critical influence on the supply of rare-earth materials. The 17 elements have hi-tech uses: neodymium for permanent magnets in mobile phones, terbium in LED lights and dysprosium used to cool nuclear rods, for example. Though the minerals are found in abundance in many parts of the world, processing them into materials is often highly polluting, sometimes releasing radioactivity. China holds that production chain.

The US last year imported about $US160 million ($230m) in basic rare-earth materials, mostly from China, for use as catalysts and in glass and ceramic making, according to figures from the US Geological Survey. That figure doesn’t include micromotors, electronics and other products made in China that incorporate the elements.

Chinese Foreign Ministry spokesman Lu Kang sidestepped questions of what Mr Xi’s visit symbolised, saying, “It is normal that the top leader investigates relevant industrial policies. I hope everyone can interpret it correctly. Don’t make too many associations with it.” Visiting the same area Mr Xi toured, former leader Deng Xiaoping in 1992 compared China’s role in the rare-earth sector with the Middle East’s production of oil. Few paid attention until 2010 when, in an attempt to centralise control of the mining, production and trade of rare earths, Beijing sharply curtailed exports, sending prices surging 10-fold. Coming amid a flare-up in political tensions with Tokyo, some politicians in Japan accused Beijing of seeking to damage its electronics business. Hillary Clinton, then the US secretary of state, said China’s move was a “wake-up call” to risks of China’s near monopoly on global supply.

As trade resumed and prices cooled over the next few years, would-be miners from Greenland to Wyoming folded. Companies like Toyota Motor Co., General Electric Co. and United Technologies Corp. later touted technology breakthroughs that didn’t require rare earths. Intel Corp.’s website says its Altera chips don’t use rare earths, but it uses a “minute amount of cerium” for wafer processing and that particular rare-earth material is plentiful.

China’s dominance only grew. More important than China’s mining of the elements was the ability of its factories to turn rare earth into useful intermediate materials, including metals and magnets, via the environmentally damaging processes that other countries shunned. Other Chinese companies sprang up to apply the metals and magnets to more sophisticated items like micromotors, further entrenching China’s rare-earth ecosystem.

The US’s primary mine, Mountain Pass, once the world’s largest producer, began to ship materials it dug from California’s Mojave Desert to China for the chemical processing needed to make them into usable metals.

The US defence establishment, which cites the need for rare earths in night-vision equipment and gyroscopes in jets, has continued to issue reports calling attention to China’s dominance, a concern echoed by the Trump administration. In February 2018, the Department of the Interior listed rare earths as a stand-alone category on a draft list of 35 critical minerals. “The United States is heavily reliant on imports of certain mineral commodities that are vital to the Nation’s security and economic prosperity,” it said.

On Monday, Mr Xi visited JL MAG Rare-Earth Co., in the Jiangxi city of Ganzhou, which boasts half the world’s so-called heavy rare earths. JL Mag is a significant producer of magnets using rare-earth elements “and sells a lot of magnets into the USA. and Europe,” said Gareth Hatch, managing director of U.K. consulting firm Strategic Materials Advisors Ltd.

The company’s financial reports and marketing materials don’t name US companies on a customer list that includes European, Japanese and Chinese auto and machine makers. But a lengthy shot of a Tesla Inc. vehicle appears near the end of a video introduction about the company as it says it aims to be the top global brand in high-end neodymium magnets. “The application prospects are very broad,” JL Mag says in the corporate video.

JL Mag, which registered a distribution office in Delaware in December, didn’t respond to requests for comment.

Tesla, which is building a plant in Shanghai, has been supplied with magnets by Chinese producer Beijing Zhongke Sanhuan High-Tech Co. since 2016, that company has said in the past. Tesla didn’t respond to questions about whether it also uses other magnet suppliers.

Texas Mineral Resources’ Mr Marchese wants the US government to set a buy-American clause for the Defence Department, which he says would spur investment in processing rare earths into the metals and magnets now made in China.

Anticipating that rare earths could figure into the trade spat, US chemical group Blue Line Corp. and Lynas Corp., an Australian producer of rare earths, recently proposed building a processing operation for the industry in Texas, which would be the first so-called separation plant in the US

Trefor Moss and Chunying Zhang contributed to this article.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout