Why big investors are cautious on coronavirus cure

As drug firms race to discover treatments for the coronavirus, big investment firms are placing cautious bets on likely winners.

As drug companies race to discover treatments for the new coronavirus, big investment firms are placing cautious bets on likely winners.

Hedge funds and venture capital firms are growing more confident researchers will develop effective drugs to fight the pandemic. Yet successful efforts that could help millions — or even billions — of people might not result in big profits for shareholders, the investors argue. Some are even placing bearish wagers on pharmaceutical companies they believe are attracting excessive excitement over their progress on COVID-19 treatments.

“Most of the stock prices don’t bear semblance to reality,” said Joseph Edelman, who runs Perceptive Advisors, a $US4.2bn ($6.5bn) New York healthcare hedge fund, which is focused on what it sees as the disconnect between the price of stocks like drug company Gilead Sciences and their potential profits from any treatment or vaccine.

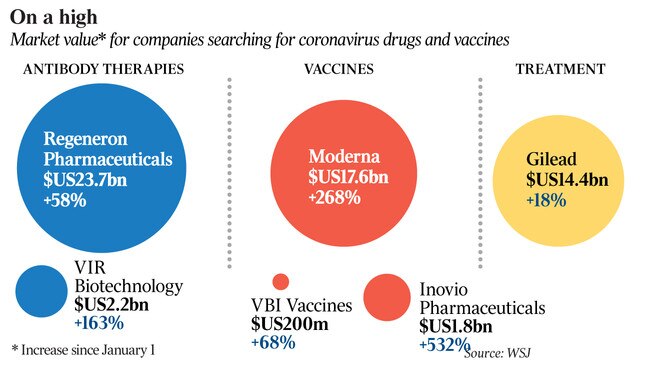

Gilead stock is up 18.9 per cent this year, thanks to remdesivir, an antiviral drug administered intravenously that shortens the recovery time of hospitalised COVID-19 patients, according to recent data.

It’s always hard anticipating successful drugs, but those wagering on coronavirus treatments face unique challenges. Some of the most innovative and promising approaches are wholly unproven.

Companies are competing with foreign nations and not-for-profit organisations determined to achieve their own breakthroughs. Successful drugs or vaccines may run into pricing, manufacturing and distribution difficulties.

Among the issues investors are struggling with: can COVID-19 treatments help those sick while also protecting individuals against the virus, or will that require different drugs? Will vaccines render treatments less necessary? Will governments allow companies to charge high enough prices to generate sizeable profits?

Larry Robbins, who runs healthcare hedge fund Glenview Capital Management, is avoiding bets on possible coronavirus treatments, partly because he expects researchers to find a vaccine, limiting the need for even the most effective treatments.

“We are all cheering for a treatment on a humanitarian level, but as an investor, you have to believe a treatment works, and that sales last long enough for it to have a material impact on a company,” he said.

Gilead is among the stocks that has investors thinking twice. The company expects to manufacture more than a million treatment courses of remdesivir by the end of this year, and the drug could have billions of dollars in new annual sales, investors say. If Gilead can develop an inhaled version of the drug or other alternatives to receiving it intravenously, its popularity could increase, bullish investors argue.

But Gilead has promised to donate 1.5 million doses of COVID-19 treatments to hospitals free of charge, and the price it would charge thereafter is unclear, raising questions about eventual profits. In the past, Gilead has been criticised for placing high prices on its HIV and hepatitis treatments. It may feel pressure to keep a lid on remdesivir’s cost — especially given President Donald Trump’s past public criticism of drug prices.

If Gilead charges about $US4000 per course, as some investors predict, that would result in $US4bn ($6.2bn) of revenue for a million patients. That figure would be well below Gilead’s $US14.6bn of added market value this year — without taking into consideration the drug’s development costs, estimated to be about $US1bn, a figure that would reduce any profits.

Some investors are not yet convinced of remdesivir’s efficacy. “Even if the drug has only a modest effect, people will still prescribe it, but Gilead won’t make a lot of money,” said Dr Joseph Lawler, who runs hedge fund JFL Capital Management, which is shorting, or betting against, Gilead.

A Gilead spokesman said the company had not yet set a price for remdesivir. “At this time, we are focused on ensuring access to remdesivir through our donation,” he says. “Post-donation, we are committed to making remdesivir both accessible and affordable to governments and patients around the world.”

Some investors are focusing on treatments that may help those who are sick but also can prevent people from getting the virus. These investors are betting on therapies that use antibody proteins generated by the body’s immune system. Regeneron Pharmaceuticals, a leader in antibody therapies, is using a “monoclonal” antibody approach, where scientists select the most powerful antibodies from recovered coronavirus patients — or, in the case of Regeneron, from mice that have been given human immune systems — clone them, and turn them into drugs.

Regeneron plans clinical trials soon and is preparing to manufacture hundreds of thousands of doses each month.

Moderna has attracted the most excitement among vaccine makers, sending its stock soaring 230 per cent this year, as it moves closer to human trials. Its strategy is to produce a vaccine using the virus’s genetic sequence, rather than its actual genetic material. It uses programmed material, called messenger RNA, or mRNA, with the goal of directing a patient’s immune system to produce antibodies to the coronavirus.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout