What to know about China’s DeepSeek AI

The Chinese artificial-intelligence upstart has taken the business world by storm by training high-performing AI models cheaply, without the most advanced chips.

DeepSeek has Silicon Valley in awe and stocks in a frenzy.

Tech stocks sank in a broad selloff Monday after the Chinese artificial-intelligence upstart said it had trained high-performing AI models cheaply, without the most advanced chips.

Here’s what you need to know about DeepSeek:

What is DeepSeek and why am I hearing about it now?

DeepSeek is a Chinese AI company, which just a week ago launched its latest AI model, which it calls R1.

The company said the model was particularly good at problem solving, performing on par with OpenAI’s o1 reasoning model – but at a fraction of the cost per use.

A DeepSeek app is currently top in iPhone download rankings for the US.

Why are investors worried about DeepSeek?

The conventional thinking was that AI companies needed expensive, leading-edge computer chips – such as those made by Nvidia – to train the best systems.

That has justified huge spending by the biggest US tech companies, such as Alphabet and Meta Platforms, which are sometimes known as hyperscalers.

Just last week, companies including SoftBank, Oracle and OpenAI pledged to spend $500 billion to build new AI infrastructure in a venture they call Stargate.

But DeepSeek didn’t have leading-edge chips – and its models appear to be roughly on par with top US rivals on certain benchmarks that evaluate AI ability.

DeepSeek says it uses less-advanced chips, combined with innovative model-training techniques.

In addition, DeepSeek released its R1 model as open source, meaning others can pick up and adapt the model for their own use.

That will mean that other companies will be able to build on DeepSeek’s approach and potentially create other cheap AI alternatives.

Why is DeepSeek relying on cheaper technology?

It is hard for DeepSeek to buy cutting-edge chips because of US export controls, intended to hinder Chinese organisations from developing innovative AI for military purposes.

That DeepSeek appears to have been able to achieve state-of-the-art performance suggests that those export controls may be ineffective – either because US-designed chips aren’t necessary to make the best AI models, or because those chips are somehow making it to China in sufficient quantities anyway.

Who is behind DeepSeek?

Chinese hedge-fund manager Liang Wenfeng is behind DeepSeek’s development.

The business grew out of the AI research unit of his $8 billion hedge-fund firm, High-Flyer.

How good is DeepSeek?

The researchers behind DeepSeek say that they tested R1 against some of the top AI models from OpenAI – and found that it was very competitive.

Those evaluations include one developed by OpenAI itself that includes computer-programming tasks that an AI model must complete on its own, such as patching a bug in a given piece of software.

R1 performed on par with a version of OpenAI’s reasoning-focused model, called o1, and outperformed an earlier one called o1-mini.

DeepSeek published costs for using R1 that were an order of magnitude below those charged by US-based companies for their most sophisticated models.

Users on X have said they were impressed with R1’s writing and problem-solving skills but some said that the model performed worse than rivals on specific types of problem solving.

In coming weeks, more third-party testing should give a better understanding of how well R1 really performs. And users can test it out themselves, too.

Is DeepSeek a disaster for AI stocks?

Not everyone thinks DeepSeek has upended the AI-infrastructure industry.

While DeepSeek might have found a way to cut AI training costs, AI demand keeps surging, and tech companies still need more computing power, wrote Stacy Rasgon, a Bernstein semiconductor analyst.

“Is DeepSeek doomsday for AI buildouts?” Rasgon and his colleagues wrote in a report on Monday. “We don’t think so.”

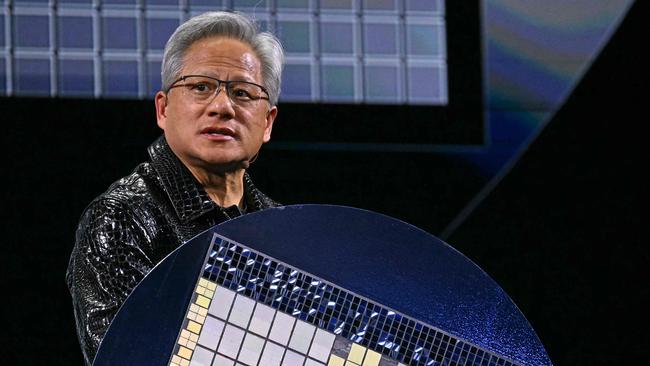

Why is Nvidia taking such a big hit?

Nvidia has been one of the biggest winners in the AI boom because its chips have almost exclusively powered the training and in many cases the day-to-day running of the most powerful existing AI models.

Nvidia – and its investors – have bet heavily that new generations of those cutting-edge chips will be necessary to develop the most powerful AI models.

DeepSeek’s success suggests that Nvidia’s lead on AI chip development may not be as big as thought, or as crucial to developing new AI models.

Who might win from the turmoil?

DeepSeek’s success building an AI model could rebalance the global playing field when it comes to AI development – and that has cheered some countries outside the US.

Government officials in France, for instance, said Monday that DeepSeek shows that agile companies with clever techniques still compete in the AI race, even if they have less money or limited access to the best AI chips.

Opportunities remain not just for China but also for Europe and other parts of the world to catch up to Silicon Valley, they argue.

“The message is that we can compete,” said an official at France’s Élysée Palace, noting that raw computing power may no longer be the determinant of who wins in AI.

“There is still a chance for alternatives.”

To be sure, DeepSeek also is a warning to other parts of the world.

French startup Mistral AI has made its name on being a smaller, more efficient competitor to US companies like OpenAI.

Now it will have to keep up with DeepSeek and others that use its models, too.

This explanatory article may be periodically updated.

The Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout