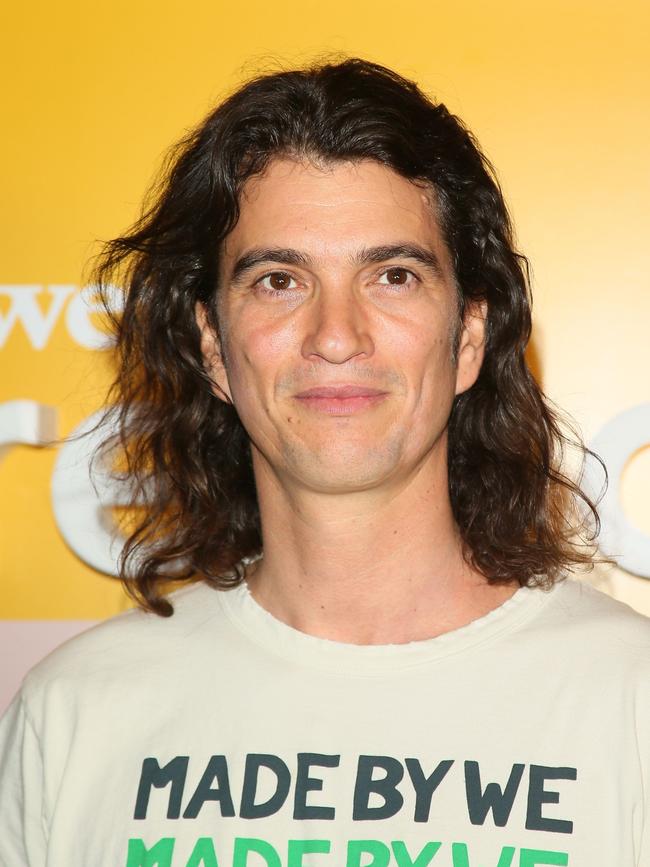

WeWork co-founder Adam Neumann becoming an apartments mogul

Entities of co-working entrepreneur Adam Neumann have bought more than $US1bn in apartments stakes, reportedly to ‘shake up rental housing’ for young professionals.

Adam Neumann, who built office co-working giant WeWork before resigning as chief executive when his fortunes soured, has a new business venture under way: apartment landlord.

Entities tied to Mr Neumann have been quietly acquiring majority stakes in more than 4000 apartments valued at more than $US1bn in Miami, Atlanta, Nashville, Tenn., Fort Lauderdale, Fla., and other US cities, according to court, property and corporate records and people familiar with the transactions. Many of these investments occurred within the past year.

Mr Neumann has told friends and associates of his ambitions to build a company that would shake up the rental-housing industry, say people familiar with the matter.

Exactly how he plans to accomplish this goal couldn’t be learned, and his investments so far have largely been in traditional apartment buildings. Mr Neumann has said he wants to create a widely recognisable apartment brand stocked with amenities, according to a person who was part of these conversations. His Nashville property, the 268-unit Stacks on Main, features a saltwater pool, a dog park and valet trash pick-up, according to the building’s website.

Mr Neumann is hoping to appeal to the same sort of young professionals he lured to hundreds of co-working office spaces when he was chief executive at WeWork, said those people familiar with the matter. His flexible office space was renowned for offerings such as free craft beer and fruit water.

D.J. Mauch, a partner in Mr Neumann’s family office, said: “Since the spring of 2020, we have been excited about multifamily apartment living in vibrant cities where a new generation of young people increasingly are choosing to live, the kind of cities that are redefining the future of living. We’re excited to play a role in that future.”

Mr Neumann has also invested in a number of start-ups, according to a person familiar with the matter.

Mr Neumann co-founded WeWork in 2010 and raised more than $US10bn for a business once valued at $US47bn, persuading investors to value it as a tech company despite its real-estate roots. He also launched WeLive, planned as a network of buildings where people can rent rooms in shared, furnished apartments. The company opened apartment buildings in New York and Virginia, but WeWork closed WeLive after Mr Neumann’s departure.

The 42-year-old entrepreneur left the company in late 2019 after plans for an initial public offering of stock fell through amid concerns over his management style and heavy losses. WeWork, now publicly traded, has a market capitalisation of about $US7bn. That valuation is more in line with real-estate companies than fast-growing tech firms.

Mr Neumann became rich working at WeWork, and is using his own funds toward buying stakes in the apartment buildings, according to a person familiar with the matter. When Mr Neumann served as CEO, he and his co-founder sold a total of more than $US500m of stock, largely at higher share prices than today, according to documents and people familiar with the sales. To encourage Mr Neumann to give up his control of the company, WeWork majority owner SoftBank Group paid him nearly $US200m for consulting and other fees and bought $US578m of shares from him, according to WeWork securities filings.

Mr Neumann helped fuel the US co-working craze through his company’s rapid expansion. At one point, WeWork occupied more Manhattan office space than any other company. But he is following the crowd in the already hot apartment business.

The sector has experienced rising investor interest since the start of the Covid-19 pandemic, particularly in the booming Sunbelt. Rents are surging in many cities alongside rising household incomes and housing shortages that analysts say are unlikely to disappear soon. Cities such as Nashville and Miami are also attracting migrants from the Northeast seeking warmer weather, less-costly housing and lower taxes.

In 2020, Mr Neumann acquired a major stake in Alfred Club Inc., a company that provides concierge services such as picking up and dropping off groceries and laundry in residential buildings.

His real-estate holdings, which include two apartment buildings in Atlanta, are mostly recently built properties with more than 200 units and lots of common amenities.

In Fort Lauderdale, an entity tied to Mr Neumann owns Society Las Olas, according to court records. The 639-unit apartment building includes a co-working space, a putting green and a barber shop, according to the developer’s website.

In downtown Miami, Mr Neumann recently signed a contract to buy a majority stake in the 444-unit Caoba apartment tower, valuing the property at roughly $US200m, according to a person familiar with the matter. An entity tied to Mr Neumann also owns the nearby 387-unit Yard 8 apartment building, court records show.

Mr Neumann has also invested in suburban apartments, where demand has grown as remote workers leave crowded city centres in search of more space. He holds stakes in a building in Decatur, Ga., according to public records, and another in Norwalk, Conn., said a person familiar with the matter.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout