Volatility trading: the market tactic driving stocks haywire

Markets were once dominated by bulls and bears. These days, another animal is on the rise.

Markets were once dominated by bulls who thought stocks would go up and bears who thought they would go down. These days, another animal is on the rise. It doesn’t much care what stocks do, as long as they do something.

These investors are focused on volatility, the amount of movement in prices over time. In recent years, volatility has gone from a specialty of derivatives traders to a vehicle for trading in its own right. Investors big and small are wagering hundreds of billions of dollars on volatility, including by betting directly on the moves of measures like the S&P 500, shares of individual companies or oil prices.

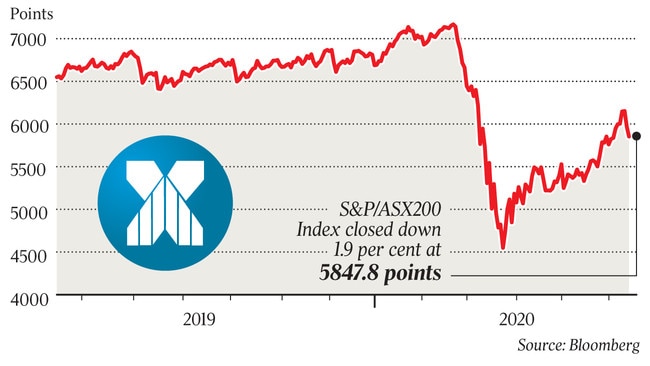

The pandemic has cemented its arrival, luring fresh cash and interest as stock swings jumped to new levels. Since then, big moves in stocks — both up and down, including a drop of more than 1,800 points in the Dow Jones Industrial Average on Thursday — have provided traders with ample opportunity to profit.

Volatility trading has grown so big that trading on expected market moves can itself move markets. Bets on lower volatility can spur a cycle that magnifies periods of calm. At other times, the strategies can worsen downturns once they begin.

Tools used to trade volatility, such as options, have flourished, with contracts tied to trillions of dollars’ worth of stocks changing hands in any given week, according to data provider Trade Alert.

“It started out as a metric,” said Devesh Shah, who first helped make the widely watched volatility gauge, the Cboe Volatility Index, or VIX, tradeable in 2004 while he was at Goldman Sachs Group Inc, before retiring as a partner. “Now … the genie is out of the bag and volatility is everywhere.” Today’s economic uncertainty means that volatility trading, and therefore also volatility itself, is likely to stay elevated as investors seek to either protect themselves from it, or, increasingly, to make money from it.

“I don’t think there’s ever been a time when there’s so much uncertainty, ” said Paul Britton, founder of Capstone Investment Advisors LLC, one of the biggest investment firms specialising in trading volatility, managing roughly $7 billion. “That is typically good for volatility practitioners. Uncertainty is our friend.” Tactics tracking volatility range from extremely risky to relatively innocuous. Some trade volatility itself, tapping derivatives tied to the VIX or using options to express whether market swings will shrink or swell. Sophisticated investors have long used esoteric tools called variance swaps, which can set them up for explosive gains — or losses — based on whether stocks crash or soar.

More than a trillion dollars’ worth of derivatives bets tied to the VIX have changed hands this year, according to Cboe Global Markets data, more than quadruple the figure a decade ago.

Funds sitting in volatility exchange-traded products rose to a high of almost $12 billion, according to FactSet data, and trading volumes for many surged to a record during the recent tumult. At times this year, a volatility product was among the most popular exchange-traded products in the entire U.S. stock market.

This year, assets under management for hedge funds trading volatility hit a record $19.4 billion, according to industry tracker Hedge Fund Research, more than double the amount a decade ago. Such strategies have attracted big investors like the $395 billion California Public Employees’ Retirement System, the largest public pension plan in the U.S., and the Virginia Retirement System.

In other strategies, volatility is used as a metric driving buying and selling decisions. About $330 billion is invested in volatility-control funds, up from $123 billion in 2010, according to estimates from Joseph Becker, a director at Milliman Financial Risk Management.

The business of volatility took off after the financial crisis, as exchange operators and bankers devised new, and risky, ways to trade it. The first exchange-traded product tied to the VIX — known as Wall Street’s “fear gauge” — was introduced in 2009, shortly after markets around the world collapsed.

After the last recession, a fear of steep stock losses that can wipe out a retirement portfolio spurred a rush into products promising to rise when markets are tumbling. The ensuing decade of ultralow interest rates led investors into increasingly creative tactics to juice returns and generate steady income.

One of the strategies at Mr. Britton’s firm, Capstone, that involves betting on the differences in swings between the broader stock market and individual shares has returned 12% through May, according to a person familiar with the matter. Its flagship volatility strategy has returned 2%. By comparison, the S&P 500 was down 5%, including dividends, for the same period.

Another Capstone strategy, designed to trade violent swings in the stock market during crises, has returned 220% through May, this person said. These events are referred to as “tail risks,” events with a statistically minute probability of occurring.

The returns this year are in part thanks to a bet in January that investors weren’t fully grasping the giant risk that the coronavirus posed to the world. As the virus spread through China and U.S. stocks hovered near records, Mr. Britton flagged the danger at a weekly meeting with his investment committee in New York.

“I would say: ‘Visualise CNN running a story where a healthy mother of two from the Midwest dies from the coronavirus … and visualise what that means to the market,’” Mr. Britton said. “That’s going to be playing for 72 hours, non-stop, on loop.” The firm started buying inexpensive options and hedges tied to the VIX, the person familiar with the matter said, contracts that would pay out handsomely as major U.S. indexes began tumbling in late February, abruptly ending the nearly 11-year bull market for stocks.

It’s a sharp shift from recent years when bets flourished that markets would remain calm. Mr. Britton once addressed a room full of fellow volatility hedge-fund managers at his annual conference, the Global Volatility Summit, donning a red cap with the words “Make Vol Great Again” stitched on its front in white letters. It was March 2017, shortly after President Trump’s inauguration, when calm swept through markets and stocks soared.

Many attendees of those summits say volatility is an asset class of its own, akin to stocks and bonds as a must-have in a portfolio. Mr. Britton says investors need to look to different strategies that will generate returns in times of market turmoil, with bond yields near record lows.

Similarly, Ernie Chan launched his tail-risk strategy after taking severe losses trading currencies in the wake of the 2011 downgrade of U.S. Treasurys.

That event roiled markets and wiped out about a third of his firm’s assets at the time. He thought a volatility-focused strategy would shield his firm, QTS Capital Management, from taking another brutal loss. Its trading program, which kicks in under certain conditions, often goes quiet for long periods before a burst of activity.

Mr. Chan was on a cruise ship between Florida and the Bahamas in February when his cellphone was inundated with messages. After months of inactivity, the program was trading in a frenzy. “It’s almost like a pandemic prediction system,” said Mr. Chan. “It detected that something is not going well in the world and it started to let us trade.” Based in Ontario, Canada, while his business partner has been sheltering from the pandemic on one of New Zealand’s remote islands, Mr. Chan considers the firm, which oversees about $29 million in its tail-risk strategy, crisis-proof. March, the most volatile month in the stock market’s history, was its best month ever.

Tail-risk volatility strategies followed by industry tracker Eurekahedge have returned 57% this year through March.

In recent years, many pointed to the popular trade of betting against volatility as part of the reason markets were so placid. Investors big and small turned to selling options in a bid that markets would stay tame. Dealers at banks or market-making firms who were the end buyers of these options contracts often hedge themselves in the stock market, buying into falling markets and selling into rising markets.

At other times, the trades have been blamed for exacerbating instability. “The exposure in these derivatives is so significant now that it’s often the tail wagging the dog,” said Cem Karsan, a senior managing partner at volatility hedge fund Aegea Capital Managements LLC, which oversees about $250 million. “It’s definitely a structural change in how markets work.” This was on display in February 2018, during what became known as “volmageddon,” when two volatility exchange-traded products collapsed during a bout of turbulence, and again in March of this year. Some said options hedging activity was exacerbating stock swings. This activity can also help drive swings in the last half-hour of the trading day, when stocks are prone to out-size moves, according to research from Barclays PLC.

Mr. Chan says hedging by options traders and buying and selling by exchange-traded funds can drive stock moves, particularly at the end of the day. That gives him an opportunity to make money from the wild intraday swings.

Like other traders, Mr. Karsan says the distortions create opportunities for him to buy and sell derivatives, taking advantage of minuscule price discrepancies.

Access to exchange-traded funds have made it easy for individuals like Dennis Murphy to join the trades. After the former immigration officer received a pin congratulating him for 25 years of government service, he quit out of dissatisfaction with his career. He initially tried his hand at trading stocks around earnings releases but didn’t have much luck.

“Then a friend of mine told me, ‘Hey, did you ever look at these things called ETFs?’ ” Mr. Murphy said. “I didn’t know what an ETF was. I have no financial background.” (MORE TO FOLLOW) Dow Jones Newswires June 12, 2020 12:06 ET (16:06 GMT) Copyright (c) 2020 Dow Jones & Company, Inc.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout