US Fed dims outlook on tariff uncertainty

The US central bank has held rates steady and downgraded economic forecasts after Donald Trump’s tariff blitz.

The Federal Reserve extended its wait-and-see posture on interest rates while marking up its forecasts for inflation and revising down its outlook for growth and employment this year.

The central bank held steady its benchmark federal-funds rate at around 4.3 per cent at its policy meeting as it assesses how a blitz of policy changes — on trade, immigration, spending, and taxes — by the Trump administration could reshape the economic outlook. Consumer sentiment has slumped in recent weeks amid headlines on federal cutbacks and higher tariffs.

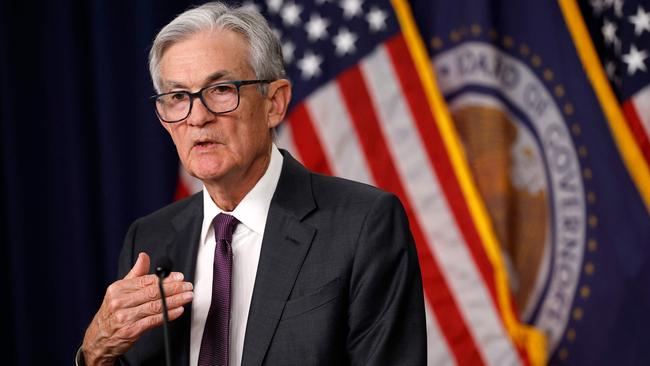

“We think it’s a good time for us to await for further clarity,” Fed Chair Jerome Powell said at a news conference Wednesday.

Investors were heartened Powell didn’t signal a more aggressive stance toward potential tariff-related price hikes. The Dow Jones Industrial Average rose 0.9 per cent, or about 380 points. The S&P 500 and the Nasdaq Composite rose more than 1 per cent each.

New economic projections showed 11 of 19 policymakers expect the Fed to cut rates at least twice this year, a narrower majority than the 15 officials who had pencilled in at least two cuts in December.

Officials indicated they expected inflation to rise this year to 2.7 per cent, from 2.5 per cent in January. “That’s really due to the tariffs coming in,” Powell said. Progress bringing down inflation “is probably delayed for the time being.”

For now, those projections showed officials think price growth will slow in 2026 and 2027, meaning they don’t see a reason to set rates differently than they did before the tariffs. “It can be the case that it’s appropriate sometimes to look through inflation if it’s going to go away quickly without action by us,” Powell said. “And that can be the case in the case of tariff inflation.”

Policymakers also said they expect gross domestic product growth of 1.7 per cent in 2025, down from their December projections of 2.1 per cent.

Fed officials tried to strike a balancing act last year. Inflation has made considerable progress toward their target, reaching 2.5 per cent in January from 5.5 per cent two years earlier.

Officials wanted to prevent the aggressive rate increases they made in 2022-23 from unnecessarily slowing down economic activity as price and wage growth cooled, and they cut rates by 1 percentage point between September and December last year. But they also don’t want to undo recent progress on inflation.

The Trump administration has charged ahead with a mix of policies that makes it harder to forecast growth and inflation. Deregulation and steps to reduce energy prices could boost growth and allow inflation to continue to cool.

Recent economic data paint a mixed picture. Spending has slowed but hiring has held steady. The unemployment rate stood at 4.1 per cent in February.

“The economy is still pretty good. Employment is still holding up. But we now have, over the last six weeks, instituted just this enormous amount of uncertainty that everybody is talking about,” said Frank Sorrentino, chief executive at ConnectOne Bank in Englewood Cliffs, N.J., which has $US9.9bn in assets.

He said loan demand appears to have slowed as a result of policy-driven uncertainty. “We’ll figure our way through it, but people can’t decide whether to start or stop, slow down or speed up. It just makes it very, very difficult for businesses to function in an effective way,” said Sorrentino.

Prices of goods, excluding food and energy items, declined in most months last year, contributing meaningfully to a slowdown in inflation over that time. But they have turned higher recently.

The Fed risks being put “in an increasingly difficult spot because on the one hand, you have signs the labour market is slowing even though a lot of this data is not going to show up immediately in the employment report,” said Michael Reid, senior US economist at RBC Capital Markets. On the other hand, tariffs could result in higher inflation readings for the rest of the year.

A combination of stagnant growth and higher prices — sometimes called stagflation — could make it harder for the Fed to cut interest rates this year to pre-empt any slowdown.

How Fed officials respond could turn largely on whether businesses and consumers expect higher prices to persist, because central bankers believe those expectations can be self-fulfilling.

If workers, landlords and business owners expect inflation to stay elevated, they will order their financial decisions in ways that could sustain higher prices.

Some surveys that attempt to measure consumers’ inflation expectations have increased or shown much greater uncertainty about the outlook for inflation recently.

In conversations with his clients, Sorrentino said he worries about an inflationary psychology taking hold in the economy even if tariffs raise prices only on a one-off basis.

“By themselves, tariffs are not necessarily inflationary, but the thought of all of these tariffs — everyone seems to equate that with inflation,” he said. “I think people are frontrunning some of that a bit and they’re starting to think about, ‘Hey, I got to charge more for whatever it is I do.’”

Separately, the central bank approved plans to slow the reduction of its $US6.8 trillion asset portfolio. Beginning in April, the Fed will allow $US5bn in Treasury securities to mature every month without reinvesting the proceeds into new securities, down from the current pace of $US25bn. Fed governor Christopher Waller dissented against the decision.

Powell characterised the decision as a “common sense” way to avoid shrinking the portfolio in a way that could lead to sharp dislocations in money markets in the months ahead.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout