The US and China are going to economic war — and everyone will suffer

The gloves are off. The next chapter of US-China decoupling has begun. The pain will be felt everywhere.

The gloves are off. The next chapter of US-China decoupling has begun. The pain will be felt everywhere.

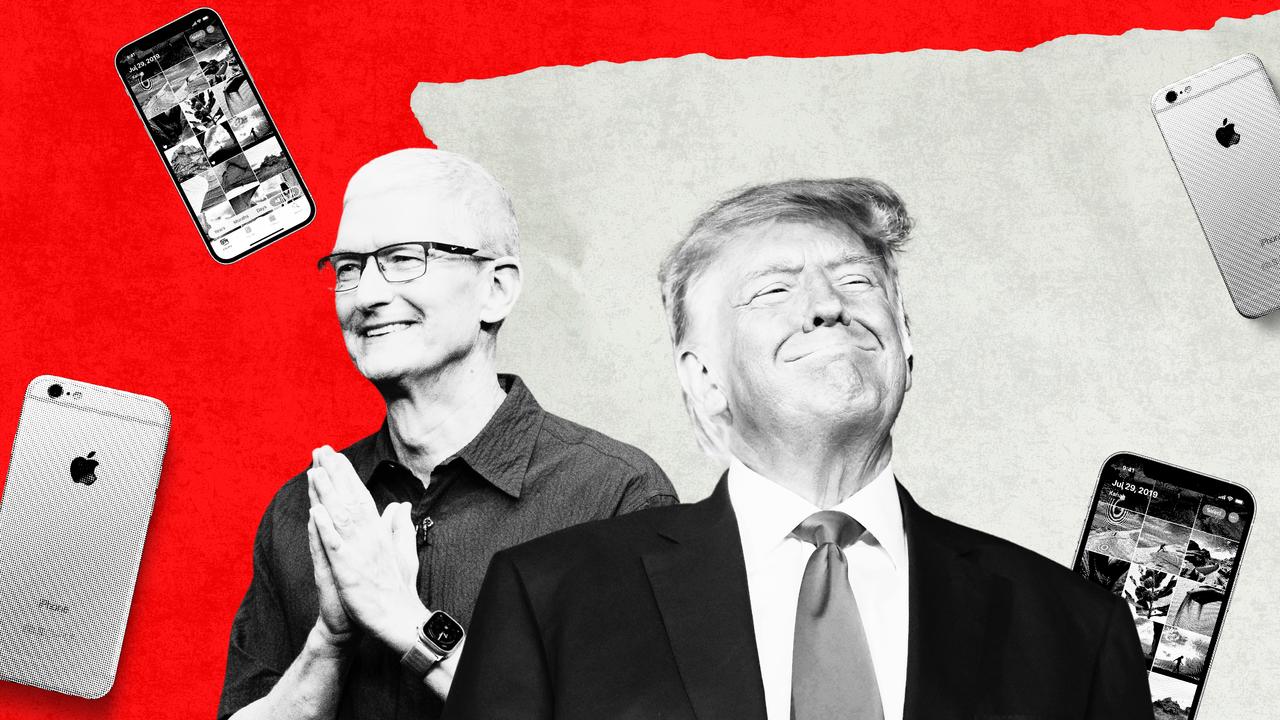

In jacking up his tariffs on China — and pausing steep duties on dozens of other nations — President Trump is pushing the world’s two biggest economic powers into a battle that will leave neither unscathed and risks tanking the global economy.

The total tariffs imposed on China in Trump’s second term now add up to 145 per cent, the White House said Thursday, while China’s blanket tariff on American goods will rise to 125 per cent on Saturday after the latest round of retaliation.

The tariffs could eventually be walked back, but already, there are signs that a portion of the $582 billion in goods trading between the two countries is grinding to a halt. US factories are cancelling orders and some Chinese manufacturers are putting workers on temporary leave. Data has shown a sharp decline in trans-Pacific ship bookings since some of the latest tariff escalations began. US stocks fell sharply Thursday as investors digested the developments.

Arlen Nercessian, a Temecula, California-based kitchen-equipment importer, messaged his Chinese agent on Wednesday to hold his latest shipment of cast-aluminium plates when he heard that Trump was pushing up tariffs — but it was too late. He said that without a deal to end hostilities between Trump and Chinese leader Xi Jinping, that order from China will be his last.

“There’s no way I’ll get any of these in the US,” he said. He might have to cut most of the company’s nine employees and contractors, switch to cheaper software and stop travelling to food shows to advertise his products “just to hunker down and survive,” he said.

While Trump says any pain in the US from tariffs will be offset by long-term gains in jobs and investment, in the near term, investment bank JPMorgan said Wednesday it is “more likely than not” that the US economy will shrink later this year.

In the 23 years since China joined the World Trade Organisation, access to its cheap manufactured products has become embedded in the consumer-focused US economy. China accounted for around 13 per cent of all US goods imports in 2024. It is a source of a wide variety of goods, including smartphones, toys and industrial parts. Entire businesses have been built around assumptions of that access, with design, marketing and distribution in the US coupled with production in China.

Many businesses had begun to adjust to a reality of higher tariffs that started during the first Trump administration. But if the new tariffs remain, they face a loss of access to Chinese production altogether — with profound changes for American consumers. Americans, already stressed from a 24 per cent rise in prices over the past five years, could end up paying even more for a smaller selection of everyday goods.

For China, meanwhile, a full-blown trade war with the US means being shut-out of the world’s biggest consumer market at a time when its economy has been leaning on exports for growth to offset a painful property bust and tepid consumer spending.

“To put it bluntly, we can only hang on for as long as we can. If we can’t hold out any longer, we’ll have to shut down the factory,” said Hong Binbin, who runs Shenzhen Jiaoyang Industrial, a maker of stuffed toys in southern China. Sales to the US account for 70 per cent to 80 per cent of the company’s revenue, Hong said, and he expects orders to stop coming in thanks to Trump’s tariffs.

Another factory, Huizhou Yihe Furniture in China’s Guangdong province, is putting its dozens of workers on leave through April 13, according to a notice seen by The Wall Street Journal, which cited “severe shock due to new trade policies.” A factory manager, surnamed Huang, confirmed the notice, which was posted Tuesday, and said he expected to extend the production halt.

The world is on course for “a disorderly economic decoupling between the world’s two largest economies,” wrote economists at Deutsche Bank in a note to clients on Thursday.

Fraught relationship

For all the angst over US-China relations in recent years, the two countries’ economies are now deeply intertwined. For more than a quarter-century, Americans have spent a big chunk of their money buying stuff made in China. The US got cheap goods, and China invested in building out its infrastructure and climbing up the development ladder.

But the relationship created enormous tensions, including lost jobs in American manufacturing towns, as well as an ever-rising trade deficit. The US exported $143.5 billion in goods to China in 2024, while $438.9 billion worth of goods went in the other direction.

Trump’s goal is to eliminate the trade deficit once and for all through tariffs, which he says will help lure more manufacturing back to the US, creating jobs at home and stanching the flow of US money to China.

“Hopefully in the near future, China will realise that the days of ripping off the USA, and other countries, is no longer sustainable or acceptable,” Trump said Wednesday.

At the same time, he gave allies and trading partners a 90-day reprieve on “reciprocal” tariffs announced on April 2, though a 10 per cent baseline tariff on virtually all imports would stay in effect — making clear that the central focus of his trade war, at least for now, is China.

So far, Beijing has hit back at each round of tariff increases from the US by raising duties on American products and targeting US companies. Chinese officials have recently discussed with some of the country’s biggest companies the feasibility of delisting their stocks from American stock exchanges as a way to limit the companies’ exposure to dollars and rising geopolitical risks, according to people familiar with the matter.

China on Wednesday issued warnings for citizens considering travelling or studying in the US, a sign Beijing wants to put pressure on America’s tourism and education sectors.

The escalating tit-for-tat actions are having severe repercussions. Financial markets have been in turmoil, with wild swings in stock, bond and currency markets.

Economists at Capital Economics said their calculations suggest exports to the US could more than halve in the years ahead, while analysts at Societe Generale said China’s exports to the US “will be largely wiped out” by Trump’s latest tariff increases.

Daily container bookings in the US-China trade route fell by a quarter since the end of March compared with last year, according to freight data platform Sonar Container Atlas. Boxship operators said some US importers have temporarily halted inbound shipments and others are storing them at customs warehouses waiting for more clarity before paying the tariffs.

Amazon.com has cancelled some vendor inventory from China after tariffs were announced, according to sellers.

Jacob Rothman, president and chief executive of Velong Enterprises, which makes grilling tools, kitchenware and home products in China, India and Cambodia sold by major retailers including Walmart and Target, said he’s lost about $10 million — and climbing — in cancelled orders for his China factory from tariffs so far, from a 2025 order book of about $160 million. He said he expects more to come.

If the trade war with China persists, Rothman said he expects he would add more design, marketing and other high-level roles in China while shrinking the factory workforce there and shifting production elsewhere, such as to India or Cambodia.

He said he can’t see the company manufacturing in the US Trump’s tough immigration policies mean he isn’t sure he could find workers, and he said he’s wary of making big investments in case the political winds change.

“Why would we invest millions of dollars into a policy that will most likely fail or change?” he said.

America’s pain

For a US economy that entered 2025 in good health, the turmoil poses serious problems.

Tariffs raise prices for imports, cutting into business and consumer spending power. The tariffs announced since January amount to a “tax increase of over $300 billion,” JPMorgan’s chief US economist Michael Feroli wrote in a research note Wednesday. Meanwhile, uncertainty over future tariffs make it harder for companies to plan ahead, weighing on business investment.

The soaring barriers on Chinese imports threaten to spoil hard-fought progress to restrain US inflation after the most recent peak, in 2022.

Although inflation came in cooler than expected in the latest data released on Thursday, if prices trend higher because of the tariffs and coincide with weaker growth, the combination would create a major challenge for Federal Reserve policymakers, since lowering interest rates to stimulate the economy risks worsening inflation.

While US hiring and economic growth have been robust, surveys point to growing pessimism. A key survey tracking US consumer sentiment fell to its lowest level since 2022 in March.

It will be difficult to unwind the trade deficit with increasingly large financial penalties for imports, economists say. Many products the US imports from China, such as electronics, are hard to replace domestically or with suppliers in other countries, said Cristian DeRitis, deputy chief economist at Moody’s.

“Shifting that production takes time and energy and comes with a cost,” DeRitis said.

‘Incredibly difficult’

The whipsawing tariff threats, walkbacks and increases are causing fits for small businesses.

Darianna Bridal & Tuxedo in Warrington, Pa., has sold 223 dresses in the past three or four months that will be subject, when they arrive, to the new Chinese tariffs.

“It will cut into our margins,” said co-owner Franco Salerno, who won’t pass on the added levies to brides who have already paid for their dresses or put down a 50 per cent deposit. “It will eat my salary up.”

Salerno and his wife Wendy spent Wednesday adjusting the shop’s cash register system to accommodate the new levies. He’s hoping that the higher prices won’t impact sales. “It’s a very emotional purchase,” he said.

“We have done everything we could to never raise our prices above their original retail value,” said Adam Fazackerley, chief operating officer and co-founder of Lay-n-Go, whose cosmetic bags and other drawstring carriers are manufactured in China and Cambodia. “That’s become incredibly difficult to do.”

Fazackerley started the Alexandria, Va., company with his wife, Amy, in 2010. The new tariffs “may be the final blow,” he said. “If we break through a $19.95 or $29.95 price point, sales would drop.”

Furniture maker Ethan Allen might raise prices on some products or adjust which items it emphasises in its marketing, CEO Farooq Kathwari said. The Danbury, Conn., company produces 75 per cent of its furniture in North America, and the rest overseas. Some floor lamps, chandeliers and other design accents come from China.

Like many American companies, Ethan Allen also sells to Chinese consumers. The brand has 40 retail locations in China, where it imports furniture made in North America. The China business is “relatively small, but tremendously impacted,” Kathwari said. “Their economy is also tough in China, plus, on top of it, they are also concerned about buying American products.”

Remaking China

For China, finding new buyers could be tough. Other countries are already bristling at a flood of Chinese imports and will be reluctant to take more. Piling more unsold goods into China’s saturated domestic market would add to already-severe deflationary pressures in its economy.

At stake in this trade war is not just China’s short-term economic performance, economists say, but its entire economic model. China’s fortunes have been built on lavish investment in factories, infrastructure and real estate and a towering export sector, a strategy that powered it into second place in the global economy.

Now, economists say, it will need to pivot to boosting consumption, or watch growth stagnate. Rebalancing China’s huge economy toward consumption means funnelling more resources to households and away from factories. In the long run, that would require far-reaching and costly reforms to build out China’s threadbare social safety net and bail out cash-strapped local governments, according to analysts.

“China’s growth model, which was spectacularly successful in recent decades, has reached its limit,” said Frederic Neumann, chief Asia economist at HSBC in Hong Kong. The bank expects the trade war to shave 1.5 to 2 percentage points off Chinese growth in the coming year — though it anticipates a much bigger hit if other countries join the US in pushing back at rising Chinese exports. The government is aiming for around 5 per cent growth in 2025.

Goldman Sachs estimates that between 10 million and 20 million jobs in Chinese factories are geared towards satisfying American consumers’ demand for homeware, toys, the latest electronic gadgets and other imported products.

One exporter, Zhu Zitong, runs a factory making plastic drums in Foshan. Zhu said three American customers have cancelled orders in the past two days. Two Chinese exporters who source products from him also told him to hold some orders until they found other buyers.

Zhu didn’t expect the trade tensions to be solved anytime soon. He said the local government in the city told him that Beijing was weighing policies to support manufacturers. He planned to gradually cease production through late next week if no new orders come in.

Wan Junhui, who works in marketing for an electronics manufacturer in Guangdong province, told the Journal last fall after Trump was elected that his company would do its best to reduce costs and help customers deal with expected tariff increases. Over the next few months, the company underwent an extensive review of everything from materials to production capacity and was able to reduce the costs of its products by around 10 per cent, he told the Journal this week.

“Unfortunately, this still falls short for consumers in the US,” said Wan, saying some customers asked for discounts of more than 30 per cent before Trump raised tariffs above 100 per cent on Chinese goods.

Order cancellations are racking up. His company has formed a special internal task force because refund requests for orders not yet shipped have been abnormally high. Sales team members are listing clients on a spreadsheet to track cancellation rates.

Despite the disruption, Hong, the stuffed-toy maker, said Beijing shouldn’t back down against the US.

“I don’t think China should compromise. After all, it’s them being unreasonable.”

Wall Street Journal

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout