There’s growing confidence that stimulus announced in 2019, which included three interest rate reductions, income tax cuts, and a fall in the dollar, has given the economy renewed zip.

And for those thinking monetary policy has no teeth when interest rates fall to ultra-low levels, this week’s December employment data proved to be compelling reading.

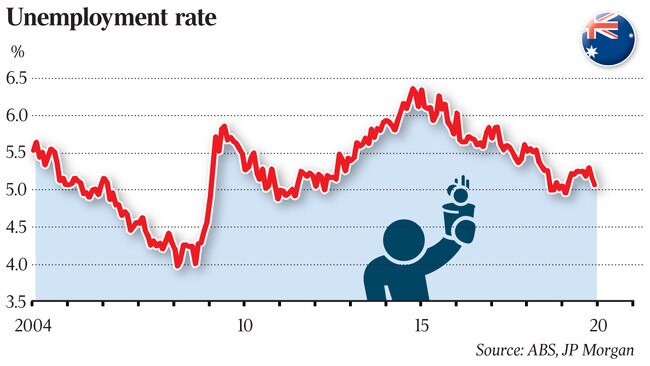

The unemployment rate fell to a 10-month low of 5.1 per cent in December, down from 5.2 per cent in November and a recent peak of 5.3 per cent in October.

The downward drift has stunned market economists, prompting many to radically rethink their forecasts for the year ahead.

There’s few things like a falling jobless rate to buoy the mood of central bankers.

If the RBA does cut its benchmark interest rate from a current record low 0.75 per cent, the move is now likely to be delayed until mid-year.

A cut at the RBA’s first policy meeting for the year on February 4 is now off the agenda.

Late last year, RBA governor Philip Lowe said the board of the central bank would need to see a material deterioration in the outlook for the economy to warrant further policy action.

Despite horrific bushfires across large swathes of the country in recent months, the flow of economic news has been, on balance, better than expected.

That’s not to say that the RBA has dismissed the fires as a threat to the economy. But the areas where they have struck aren’t regions of concentrated business activity, so the drag on growth is likely to be relatively minor.

Certainly, the fires aren’t shaping as the kind of threat that emerged in 2011, when floods across Queensland choked off coalmine production, forcing the economy to contract briefly.

The RBA will publish revised economic forecasts on February 7. These are set to indicate that damage from the fires is expected to carve just 0.1 percentage points from GDP growth in both the fourth quarter of 2019 and the first quarter of this year.

With government funds earmarked for the rebuilding of infrastructure likely to be substantial and reasonably fast-moving, the RBA will also factor in a period of recovery in the second half of the year, leaving its GDP forecasts for 2020 as a whole unaffected by the disaster. The fire season will continue until March or April, so the risk of something more severe to the economy will remain for a while yet.

There’s not expected to be anything in the new batch of economic forecasts next month to suggest the RBA will be trigger happy around interest rate cuts.

Still, the big unknown for the economy remains consumer spending. Private demand has been flat-lining, even falling on a per capita basis, crimping economic growth and starving retailers of sales.

It’s a problem that has been evident in the data since mid-2018, with record high household debt, falling house prices and soft wages growth putting a freeze on spending.

But even here the RBA is more hopeful of better times ahead.

A key central bank narrative in 2020 is likely to be one of rising certainty that consumers are using last year’s rate cuts to rapidly repair their balance sheets.

It’s a hope at the moment.

The RBA will sift coming GDP data for evidence that consumers are indeed making a comeback. If there is no improvement, the natural thing to expect then would be further rate cuts.

The RBA has faced fierce criticism that rate cuts have done little to lift the economy, and that further reductions would do more harm than good.

But with nearly all of the 75 basis points of last year’s rate cuts now passed through to mortgages, a sizeable stimulus has been rolled out to the economy, and its impact is being seen.

Bank lending data shows that many people have held their monthly home loan repayments steady, hastening debt repayment. Others are actively increasing their mortgage repayments, given the promise that rates will be held low for longer.

Despite the critics of rate cuts, balance sheet repair is clearly under way. Coupled with rising house prices and surging shares, the resulting positive wealth effects should buoy spending.

Globally, things have also improved. US-China trade tensions are back on simmer, while the vital signs of the US economy are looking better.

Throw in a strong iron ore price, and the RBA is sensing it has more time up its sleeve.

James Glynn is an economics correspondent with The Wall Street Journal in Sydney