The great Trump tariff rollback

Make that a partial win for reality. The Administration agreed to scrap most of the 145% tariff Mr. Trump imposed on Chinese goods on April 2 and later. What remains is his new 10% global base-line tariff, plus the separate 20% levy putatively tied to China’s role in the fentanyl trade, for a total rate of 30%. In exchange, Beijing will reduce its retaliatory tariff to 10% from 125%. The deal is good for 90 days to start, as negotiations continue.

Investors are cheering at this border-tax reprieve, since this is a step back from mutual assured trade destruction. Dan Clifton of Strategas calculates that Mr. Trump’s trade walkbacks add up to some $300 billion in tariff relief. That’s a huge tax reprieve.

The 30% tariff is still exceptionally high for a major trading partner, but the 90-day rollback spares both sides from what looked like an impending economic crackup. U.S. consumers were facing widespread shortages, while China feared growing unemployment.

As with last week’s modest British agreement, the China deal is more surrender than Trump victory. Apart from the tariff rollback, neither side announced any broader concessions on the substantive trade issues that weigh on the U.S.-China relationship. Those include China’s barriers to American firms, especially in services such as digital and financial, and its chronic intellectual-property theft.

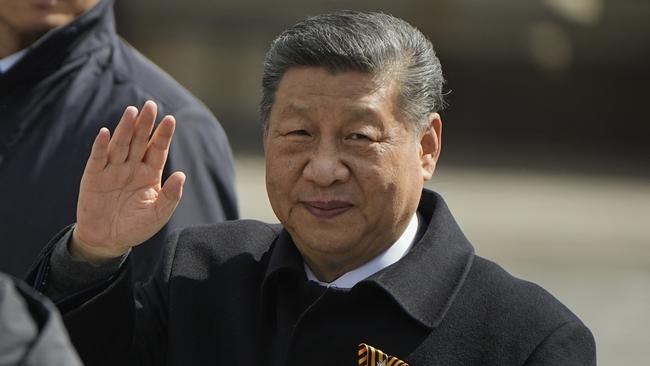

Many of these bad Chinese practices have become worse under President Xi Jinping’s strong-arm economic management. One tragedy of Mr. Trump’s shoot-America-in-the-foot-first approach is that he’s hurt his chances of rallying a united front of countries against Beijing’s mercantilism. By targeting allies with tariffs, Mr. Trump has eroded trust in America’s economic and political reliability.

Beijing now also has the benefit of concrete experience to reassure the Communist Party that Washington would struggle to impose economic sanctions in a crisis such as a Chinese blockade or invasion of Taiwan. If there’s a silver lining to the tariff fiasco, it’s the timely reminder to Congress to get serious about true military deterrence again.

Taking a step back, where are we now after nearly four months of Mr. Trump’s protectionism? The President’s concessions since his initial tariff announcements include: exemptions for goods from Canada and Mexico produced under the terms of the USMCA; a 90-day pause on his reciprocal tariffs against everyone except China; exemptions on China tariffs for iPhones and electronics; the mini-deal with the United Kingdom; and now the 90-day rollback on China tariffs.

The landing spot coming into view is a 10% global tariff, and higher (but not 145%) for China. The negotiations allegedly underway with dozens of countries while the reciprocal tariffs are paused may make some marginal headway opening markets for American firms. But so far there’s scant sign of the substantial trade deals that Mr. Trump promises.

So after weeks of market turmoil, the economy is left with higher trade costs and greater uncertainty for business, but at least a step back from Smoot-Hawley 2.0. Investors, businesses and households probably would welcome this outcome, which is considerably better than Mr. Trump’s initial plan.

But a 10% across-the-board tariff is still four times the average U.S. tariff rate before Mr. Trump took office. It keeps the door open to the economically and politically destructive special pleading for tariff breaks for well-connected industries and companies at the expense of everyone else. U.S. companies protected by high tariffs will gradually lose their competitiveness against the rest of the world.

If there’s a silver lining to this turmoil, it is that markets have forced Mr. Trump to back down from his fever dream that high tariff walls will usher in a new “golden age.” The age didn’t last two months, and it was more leaden than golden. White House aide Peter Navarro, the main architect with Mr. Trump of the Liberation Day fiasco, has been repudiated.

Mr. Trump will not want to admit it, but he started a trade war with Adam Smith and lost. He’s not the first President to learn that lesson.

Rarely has an economic policy been repudiated as soundly, and as quickly, as President Trump’s Liberation Day tariffs—and by Mr. Trump’s own hand. Witness the agreement Monday morning to scale back his punitive tariffs on China—his second major retreat in less than a week. This is a win for economic reality, and for American prosperity.