Sam Bankman-Fried jury hears duelling narratives as fraud trial begins

What the prosecution calls crimes in meltdown of crypto exchange FTX, the defence describes as mistakes.

The long-awaited criminal trial of FTX founder Sam Bankman-Fried kicked off Wednesday (Thursday AEST) with the defence and prosecution clashing over whether the fallen crypto leader was a deeply flawed company manager or the architect of one of the biggest financial frauds in US history.

In opening statements, Assistant US Attorney Thane Rehn told a Manhattan jury of nine women and three men that Bankman-Fried was on top of the world a year ago, living in a $US30 million ($47m) penthouse, flying on private jets and hobnobbing with NFL great Tom Brady and former president Bill Clinton.

“He had wealth. He had power. He had influence,” Rehn said. “But all of that – all of it – was built on lies.”

Mark Cohen, a lawyer for Bankman-Fried, told jurors that the government was falsely portraying his client as a cartoonish villain when in reality he was a “math nerd who didn’t drink or party” and acted in good faith in building his crypto exchange in the emerging cryptocurrency space.

“As a result, some things got overlooked,” Cohen said.

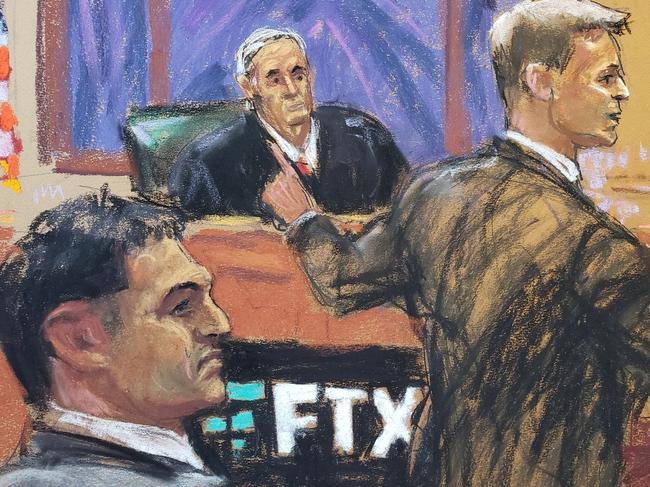

The 31-year-old Bankman-Fried, wearing a gray suit and sporting a trim haircut, quietly sat between his lawyers, at times typing on a laptop, clasping his hands and glancing at the jury, which includes a retired corrections officer, a librarian and a physician assistant.

His parents watched from nearby seats, sitting behind courtroom sketch artists intently drawing their son. He faces seven criminal counts, including fraud and conspiracy charges.

The trial, which could last six weeks, marks a once-in-a-generation financial fraud case that pits the one-time darling of crypto against a US attorney’s office that has sought to position itself as the sheriff of a frontier industry.

The proceedings promise to shed new light on the meteoric rise of FTX – which swept up athletes, models and politicians – and its implosion in November, when customers discovered that billions of dollars in investments had disappeared.

Rehn told the jury that Bankman-Fried stole at least $US10 billion from thousands of FTX customers while defrauding lenders and investors in the company’s sister hedge fund, Alameda Research. Bankman-Fried used the stolen money to buy lavish beachfront property in the Bahamas, make political donations to curry influence in Washington and cover risky bets by Alameda, the prosecutor said.

Key to the fraud was Alameda, to which Bankman-Fried secretly sent money that customers understood to be safely kept at FTX, he said. Bankman-Fried named his on-and-off girlfriend Caroline Ellison as head of Alameda, while he actually controlled the shots, Rehn said. Ellison, he said, would testify that she stole money alongside Bankman-Fried.

Bankman-Fried sought to cover his tracks, directing the creation of false financial statements, backdating contracts and lying to Congress about the safety of customer money, he said.

Cohen said the prosecution had built its case on hindsight. The business relationships between FTX and Alameda were legitimate, and Bankman-Fried didn’t conceal transactions between the companies, he said. The Bahamas properties were used to attract and house FTX employees, and the celebrity commercials were to build a business, he said.

“It’s not a crime to try to get Tom Brady to go on ads for your company, ” Cohen said.

A series of market shocks in 2022 affected the entire crypto world, Cohen said. As the crisis escalated in November, customers suddenly sought billions in withdrawals, and Bankman-Fried took reasonable measures to address the problem, he said.

“This was a frenetic time and the plane was going into the very eye of the storm,” Cohen said.

Before FTX’s collapse, Bankman-Fried garnered media attention as a shaggy-haired boy genius who wanted to make as much money as possible to solve society’s problems. As a top political donor, he captivated Washington lawmakers and won accolades as a trustworthy figure pushing for legislation to clarify the rules around crypto. Celebrities and professional athletes, including Brady, model Gisele Bündchen and comedian Larry David, signed on to promote FTX as a safe and easy way to buy and trade digital currency.

The stakes for both sides are high. If convicted, Bankman-Fried likely faces decades in prison. The parties never engaged in plea discussions, and a deal was never on the table, a prosecutor said in court this week.

Manhattan US Attorney Damian Williams, who sat in the courtroom’s front row alongside his top staff, has aggressively pursued indictments against alleged bad actors in crypto over the past two years. But Bankman-Fried is by far his biggest target, and a loss could raise broad questions about the Justice Department’s ability to police new financial markets.

Williams announced an indictment against the FTX founder a month after the company filed for bankruptcy. Bankman-Fried’s lawyers have said prosecutors rushed to indict him and got their facts wrong.

Three former members of Bankman-Fried’s inner circle, including Ellison, are expected to testify against him. The three previously pleaded guilty to fraud and other offences and are co-operating with the government. Cohen told the jury that the trio’s co-operation loomed over their testimony.

“Are they spinning things that Sam said and did at the time that are good faith business decisions that they themselves were fine with?” Cohen asked.

Adam Yedidia, a college friend of Bankman-Fried, testified Wednesday afternoon that he worked as a software developer at FTX and lived in a penthouse apartment in the Bahamas with Bankman-Fried and eight other people. Yedidia, who said he was given immunity by prosecutors, told jurors that he quit his job in November 2022 when he learned that Alameda had been using FTX customer deposits to pay back creditors. His testimony will continue when the trial resumes Thursday morning.

Before Yedidia took the stand Wednesday, an FTX customer told jurors how he lost more than $US100,000 when the exchange collapsed.

Bankman-Fried hasn’t said whether he plans to testify in his own defence. In court this week, US District Judge Lewis Kaplan, who is presiding over the trial, told the defendant that he could take the stand even if his defence attorneys advised against it.

“If you want to testify, you will be permitted to do so, regardless of whatever advice you have received,” the judge said.

The Wall Street Journal